New research suggests a sudden surge in crypto investment firms taking an interest in payments and privacy-focused altcoin Dash.

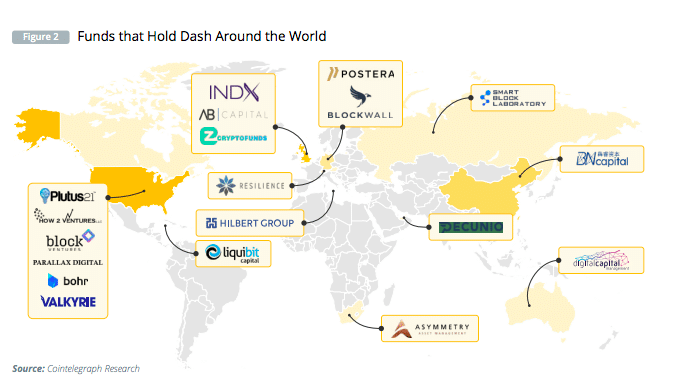

A new report from Cointelegraph Research found that out of 200 crypto funds surveyed, 19 funds hold Dash, and over 40 funds plan to invest in Dash in the next 12 months.

The 19 funds that hold Dash include Digital Capital Management, Liquibit Limited, BN Capital, Postera Capital, Blockwall Capital, Hilbert Capital, Smart Block Laboratory, Asymmetry Asset Management, Resilience AG, Pecun.io, All Blue Capital, INDX Capital, EZCAMG, Plutus21Capital, How2Ventures, Block Ventures, Parallax Digital, and Bohr Arbitrage Crypto Fund.

According to the report, the funds holding Dash all gave similar answers as to why.

“The Dash community is actively trying to become a medium of exchange. Real-world use drives organic demand for the asset as opposed to only speculative demand associated with many other cryptocurrencies. As one respondent succinctly stated, ‘Bitcoin is digital gold and Dash is digital cash.’”

Cointelegraph Research

Cointelegraph ResearchThe report also notes that Dash is held in many trusts, including the Valkyrie Dash Trust, which aims to get an annual yield of 2.5%–4% via staking.

"Dash is a well-known, respected name in the payments space in many areas of the world, and has an engaged, loyal following," said Valkyrie Investments CEO Leah Wald. "One of our goals at Valkyrie is to enable those underserved by traditional financial firms to have access to financial services, and expanding investment into the Dash ecosystem is part of that mission."

The researchers highlight the need for a high-throughput, fast, low-cost system as blockchains scale higher, and this is something institutions may have their eye on as well, even if the timing is still unclear.

“As more people adopt cryptocurrencies, more transactions need to be processed per second,” they said, adding “More traffic on a blockchain network often leads to increased transaction fees. The 2017 bull market increased on-chain transaction volume and led to an increase in transaction fees in Bitcoin and Ethereum.”

DASH, which outperformed BTC in 2021 by about 10%, was created in 2014 to focus on the “digital cash” aspect of the Bitcoin whitepaper. It features InstantSend, which lets users transfer DASH without waiting for the transaction to be confirmed on the Dash blockchain by sending the crypto to “Masternodes” that lock the funds before recording them in the next block.

Dash’s PrivateSend allows users to send transactions with a built-in mixer that can obfuscate the transaction without the need for a traditional mixer like Tornado or Blender.

Over the last few years, Dash has faded a bit into the “legacy coin” category, but the latest research could suggest a potential trend change.