As Bitcoin was breaking new records in the past 3 days, large financial exchanges are attempting to get in on the action.

We have previously reported that the CME will be launching derivative futures in December. The effect of this was a rapid acceleration in the price of Bitcoin from below $6,000.

Yet, according to a report, NASDAQ the second largest stock exchange in the world, also wants to get in on the action. They are reportedly looking to launch Bitcoin futures contracts next year.

This would allow for more investors to bet on the price of Bitcoin through the futures derivative contracts. Moreover, the name brand value that is attached to the NASDAQ exchange could further entrench Bitcoin in the public sphere.

Turning Tides

One thing that most people will agree is that Bitcoin has no doubt earned its stripes this year and has become impossible to ignore.

There has also been a great deal of interest in cryptocurrncies from large institutional investors and hedge funds. These investors do not want to miss the ongoing technological wave.

These plans by the CME and NASDAQ to introduce futures also follow a string of other companies that have offered similar derivative instruments. Earlier this year, a company called Ledger X has started offering Bitcoin OTC options.

There are also other companies that are planning to launch their own derivative offerings. For example, Cantor Fitzgerlad which is a large broker that owns an exchange, has also said that they will be offering Bitcoin futures in 2018.

Stabilising Forces?

One thing that Bitocin is well known for are its immense price swings. Hence, many may wonder the prudence of offering instruments that allow for taking much larger positions in Bitcoin with leverage.

Although derivatives and futures are indeed risky instruments, many economists think of them as a certain stabilising force. They will allow all of the Bitcoin investors to hedge their risk which reduces overall volatility.

Similarly, offering institutional investors an opportunity to hedge their positions will mean that more of them will feel comfortable investing in Bitcoin.

As more large market participants enter the Bitcoin ecosystem, so too will liquidity increase and the associated calming effects that this will have on the Bitcoin market.

Reaction to Announcement

Although Bitcoin derivatives have been available at other exchanges such as Bitmex and IQ Option, the announcements of these futures had more weight.

Yesterday was yet another wild day in the rough and tumble of the Bitcoin markets. The price of Bitcoin rallied past $10,000 in the morning and upon the news raced through the $11,000 level.

As most of the major news organisations reported the news, this was most likely the impetus that drove Bitcoin through the $11,000 level.

However, towards the end of the trading day there appeared to be a great deal of profit taking as Bitcoin retraced back below the $10,000 and fell towards $9,000.

Large institutional funds or "smart money" immediately picked up the coins at the relatively attractive level and drove the price back above $10,000.

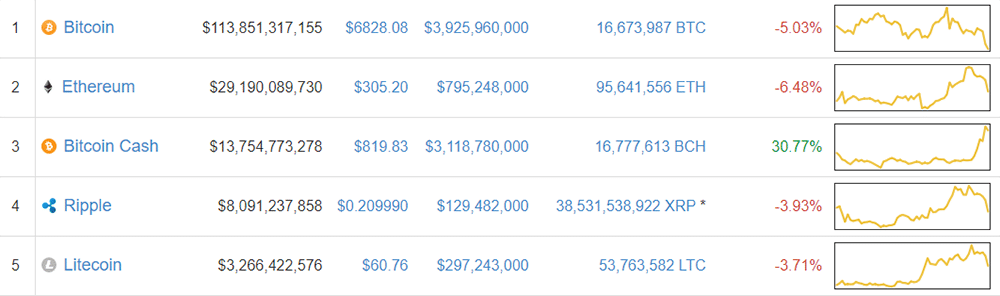

Image via Coinmarketcap

This price action does indeed illustrate the immense volatility that is present in the market. One can only wonder how a deep and liquid futures and options market may have stabilised the "whip-saw" trading.