Ripple, the banking themed cryptocurrency that was the talk of the town just recently has announced that they will be working with a multinational Spanish bank, the Santander group.

Together, the two will create a mobile app that is designed to allow for personal, instant cross-border payments. What's interesting to note is that this new app will not in any way make use of cryptocurrency, such as Ripples own native XRP. Instead, it uses a Ripple technology known as xCurrent.

Ripple targets the banking industry

Many cryptocurrencies attempt to exist fully outside of the traditional banking sector or act as alternatives for banks. Ripple, on the other hand, is marketing itself as a product to be used almost exclusively by banks. As such, it has kept its public communications highly conservative, and it has done its best to maintain a highly corporate facade.

Ripple recently hit all-time highs of nearly 3 dollars each, which gave it one of the highest market caps in all of cryptocurrency. The market has since cooled off and Ripple prices for XRP are averaging under a dollar.

This means the currency dropped by more than two thirds in just a month or so. One major revelation that caused a big portion of the drop off was that currently, no bank is using XRP.

Ripple claimed that it would be attempting to use its XRP tokens as a means of moving money in between banks. So far, it would appear that no bank is using XRP just yet. That may be changing though. As the Santander Group moves to join Ripple, it could encourage other banks to give them a second look.

Santander Group to use xCurrent

The Santander Group has been working with Ripple and had its own employees testing the new app for the last 18 months. The app seems to have worked with Apple Pay and is intended to be a personal payment network. It does not appear to be for bank to bank transfers, which has been the major selling point of XRP since its launch.

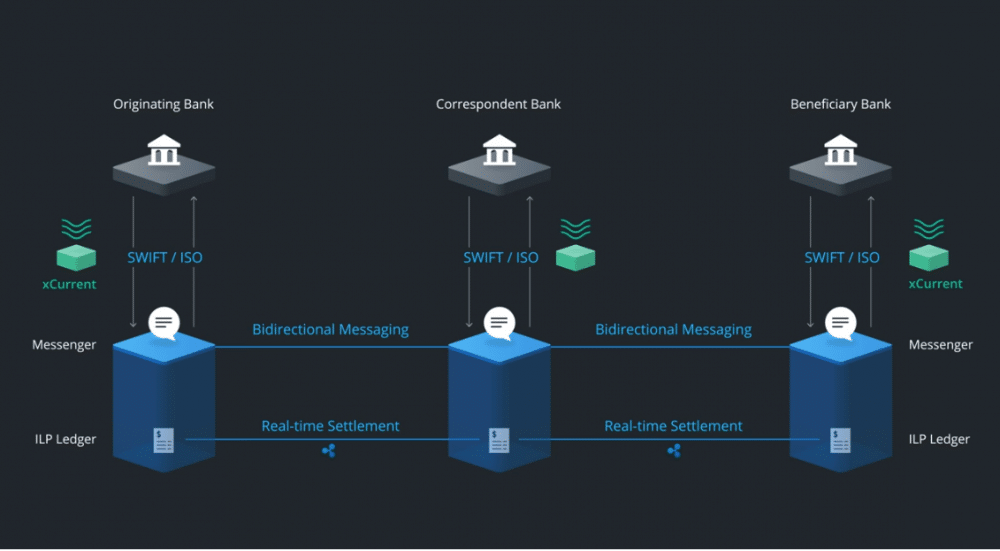

What is xCurrent? It is apparently a type of protocol that does not use cryptocurrency at all. According to an official YouTube video, xCurrent does use cryptographic technology but does not use any token exchanges. The system allows for relatively instant transfers to occur across several banks. It could hypothetically lead to cheaper and faster cross-border payments.

Image via Ripple.com

This, however, may not turn out to be particularly exciting for end-users.

Today, there already a number of mobile cross-border payment apps that operate near instantly and without fees. Some examples include Venmo and Square's Cash app. Additionally, as Santander Bank is not making use of XRP, this development may not significantly affect the adoption of, and consequently the prices of, XRP units.

It is possible though, that this development could cause other banks to have greater trust in Ripple, and may eventually lead one of them to adopt or incorporate XRP into their process somehow. That is yet to be seen, however.