If anyone has been paying attention to the price of Ripple, Bitcoin Cash, Monero and Litecoin in recent days, they would have noticed the incredible rise in some of these currency's prices. Indeed, the bullish run seems to be continuing as Litecoin just broke the $60 level overnight and Monero has just passed $160.

There appears to be only one factor that is driving this rally in these coins and it has to do with South Korea. A number of South Korean exchanges have started to allow traders to trade on these pairs and these traders are not holding back.

Indeed, this appears to be quite similar to the movements that were driving these pairs in recent weeks when Japan was making moves to institute particular rules that would govern digital currencies.

LiteCoin

Litecoin has been on quite an impressive run over the past week culminating with the meteoric rise over the the past 24 hours. It briefly reached above $60 in overnight trading. Although having slightly retracted to current levels, this is still a 35% rise in the currency over the week.

Taking a look at the volume of Litecoin over the past few days on CoinMarketCap we can see that Bithump the South Korean exchange was responsible for over 20 percent of the volume. Adding to this we also saw volume out of Chinese exchanges OKCoin and Huobi Pro with combined volume of 33%.

Monero

Monero, the privacy concious cryptocurrency, had one of the most impressive rallies this weekend. The price of the currency hit all time highs when it started being offered on these exchanges.

This caps off a really impressive past week for Monero as the currency has nearly tripled since exchange trading began. If you take a look at the below image you can see the immense rally of the currencies that coincided with periods of increasing volume.

Ripple

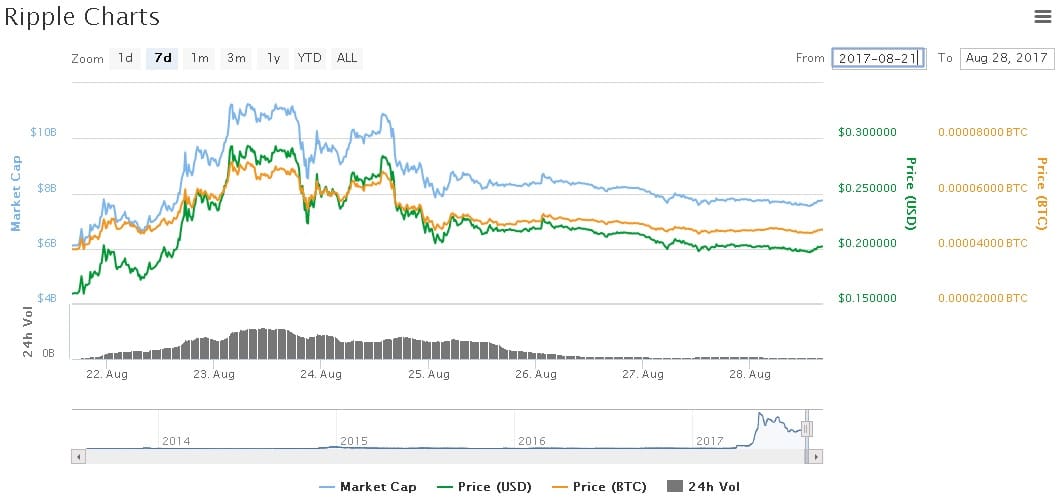

Another currency that has seen increasing volatility and interest due to a South Korean listing is that of Ripple (XRP). The price almost doubled over a very short time frame almost reaching the $0.30 price level.

Although there were some rumours that they may be a partnership with the currency and Alibaba, there is no doubt that the massive South Korean volume was the main driver. In fact, over 70% of the trading volume on XRP was done in the South Korean markets.

In order to understand this meteoric increase in volume appropriately, XRP volume was about $200m in the week before trading in a range of about 0.15 to 0.18. In this past week, Ripple volume exceeded $2.25bn which was almost 40 times the volume low point of the previous week.

Bitcoin Cash

The Bitcoin Altcoin, Bitcoin Cash (BCH) also grabbed the attention of South Korean traders. Indeed, the recent spike in the price of BCH seemed to be highly correlated to that of the South Korean volume as well.

As the price of BCH approached the $1,000 mark, the total volume that was dominated by South Korean trading was over 56%. This was all in the BitHump, Coinone and Korbit exchanges. As a benchmark of this outsized impact, these exchanges comprised of only 6% of total Bitcoin (BTC) volume in the same period.

However, it appears as some of the initial euphoria surrounding the currency was short lived as it moved back to the $600 level with volumes tapering off.

More to Come?

It is clear that South Korean traders are currently having an outsized impact on the newest crypto Altcoins. This is similar to the impact that Chinese traders had on the price of Bitcoin and Ethereum a few years ago.

There is a certain type of allure that comes with trading a new crypto currency that drives South Korean traders to make fast and decisive purchases. Hence, the astute crypto trader would want to take note of the next Altcoins that are lined up for a listing. Could IOTA and NEO also make an entrance? Keep an eye on the exchange announcements.