Many may be slightly relieved that the contentious hardfork to increase the blocksize limit was averted, broader questions around scaling now need to be answered. Many of the concerns that were present before the fork have raised their head again.

One of the most important of these was the transaction scalability of the network. At the time of writing, there are about 128,000 unconfirmed transactions. Similarly, the average transaction fee on the network spiked this weekend as a result of this.

One of the suggestions in order to bring a reasonable scaling solution was the increase of the block size. The "Big Blockers" were of the view that full blocks caused by the increasing demand were a cause of the delay. They contended that this was as a result of the 1MB limit.

Given that this was thrown out of the window with the failure of SegWit2X, another solution is in order. Hence, one of the most relevant suggestions at this time is the lightning network.

What is the Lightning Network?

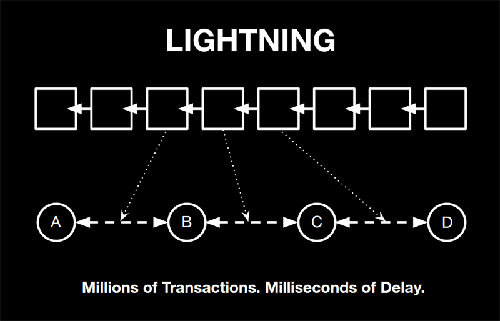

Quite simply, the lightning network was a smart contract script that would have been implemented on the Bitcoin network. It would allow for the creation of private payment channels between a particular person and all of the other people that they have transacted with. Apart from this, they would also have a channel open to the Bitcoin blockchain.

Hence, users on the network would be allowed to transact on their own private channels. All of these payments between them would not have to be recorded on the blockchain as it currently is. Only once the final transaction outcome has been determined would it have been added to the chain.

This would have the result of decreasing the amount of transactions that miners would have to verify on the blockchain. This Peer-to-Peer transaction solution will make the transactions on the network faster and much more affordable.

In order for the Lightning Network to be effectively introduced, the Bitcoin network needed to fix the problem it had with transaction malleability. This problem was effectively blocking the roll-out of the lightning network.

However, it was through introduction of support for segregated witness transactions (SegWit) that laid the groundwork for the lightning network. This was implemented in September this year and is slowly gaining momentum as more companies / wallets support the transactions.

SegWit formed part of the New York agreement where a number of companies and miners agreed that it could be implemented as long as there was an increase of the block size to 2MB three months later. Given that the agreement has collapsed, SegWit transactions and the lightning network are the main contenders.

How the Network Speeds it Up

The lightning network will allow for transactions to be verified immediately and at the same time. Moreover, the use of time locks secured with a multisig address means that payments occur instantly. Hence, "uncomfirmed" transaction wait times could become a thing of the past.

The hope is that with the lightning network, payments can scale markedly and allow Bitcoin to become a true medium of exchange for online commerce. One of the reasons that vendors have still stuck with major credit card processors is the speed with which these transactions can occur. This is something that could now change with these instant transactions.

Moreover, unlike with card transactions, the payment is P2P which means that it is completed directly between you and the other party. There will be no third party bank or processor that needs to facilitate the transactions.

Competing Altcoins at the Gates

It is quite important that these scaling solutions are implemented rather soon. This is because there are a number of altcoins that are already processing transactions very quickly and with minimal fees. This is perhaps one of the reasons that Bitcoin cash had a metoric rise over the weekend.

Many of the "Big Blockers" in the Bitcoin community decided to move their BTC holdings into BCH as they viewed that the 8mb block limit would provide them all the space they needed for the coming transactions.

Other cryptocurrencies such as Ethereum, Dash and Litecoin are able to process transactions in a much more efficient way. Moreover, Ethereum is also working on development of the Raiden network which is an off chain scaling solution not that much more different from the lightning network.

Yet, these competing ecosystems can be viewed in a positive light as it will provide further impetus for the Bitcoin community to solve the scaling crisis.

Featured Image via Fotolia