Automated trading bots have become increasingly popular among traders in recent years, and it is easy to understand why. Who doesn’t dream of a life where you are kicking back on a beach, relaxing and sipping Piña Coladas as an army of trading bots set to work, making you money? In fact, that may be just what brought you to this review.

While trading bots are unlikely to turn you into a millionaire overnight, and they are far from money printing machines, crypto trading bots have become highly valuable assistants for many skilled traders in the crypto space, with platforms like 3Commas being one of the top places for crypto bots.

In this 3Commas guide, we will give you a brief overview of what the platform has to offer, the pricing plans, some of the 3Commas trading bots available, and everything you need to know to determine if the 3Commas crypto bot platform is right for you.

Review Summary

3Commas offers a large number of automated trading tools, bots, and advanced settings for manual traders. The team behind the project set out with the aim of creating tools that help traders minimize their risks while maximizing their profits.

Recent severe security blunders have called the reputation of 3Commas into question and has left crypto traders seeking alternatives.

The Key Features of 3Commas are:

- Functionality- The platform interface provides significantly more robust tools and settings for trade management than what is available on crypto exchanges. It offers traders a simple-to-use and intuitive interface with useful data and analytics regarding trading performance and history.

- Technology- Automated trading takes place via an API integration with cryptocurrency exchanges. The bots are able to trade 24/7 and there are tools to scan multiple charts, searching and executing trade setups on a trader’s behalf.

- Huge range of tools- There is a large range of trading tools for both automated and manual trading strategies. Users can create, analyse, backtest, demo test, and copy portfolios of other traders. There are over 30 indicators and 90 candle patterns available for different strategies.

- Support- The platform offers substantial self-help and FAQ articles to help traders and customer support is available 24/7 in multiple languages.

3Commas Platform Summary

| Headquarters: | Estonia |

| Year Established: | 2017 |

| Regulation: | N/A |

| Security: | Poor |

| Beginner-Friendly? | No |

| KYC/AML Verification: | None |

| What Trading Pairs Can be Automated? | 3Commas trade strategies can be deployed on any chart and any pair |

| Supported Exchanges/Platforms | Binance, KuCoin, Coinbase, Bybit, OKX, KuCoin, Crypto.com, Tradingview, and more. See 3Commas Supported Exchanges for a full list. |

What is 3Commas?

3Commas is a cloud-based trading terminal software. It is not an exchange where you can buy and sell crypto, but the 3Commas software provides an interface that integrates and syncs with crypto exchanges that already have a charting platform and order functionality available.

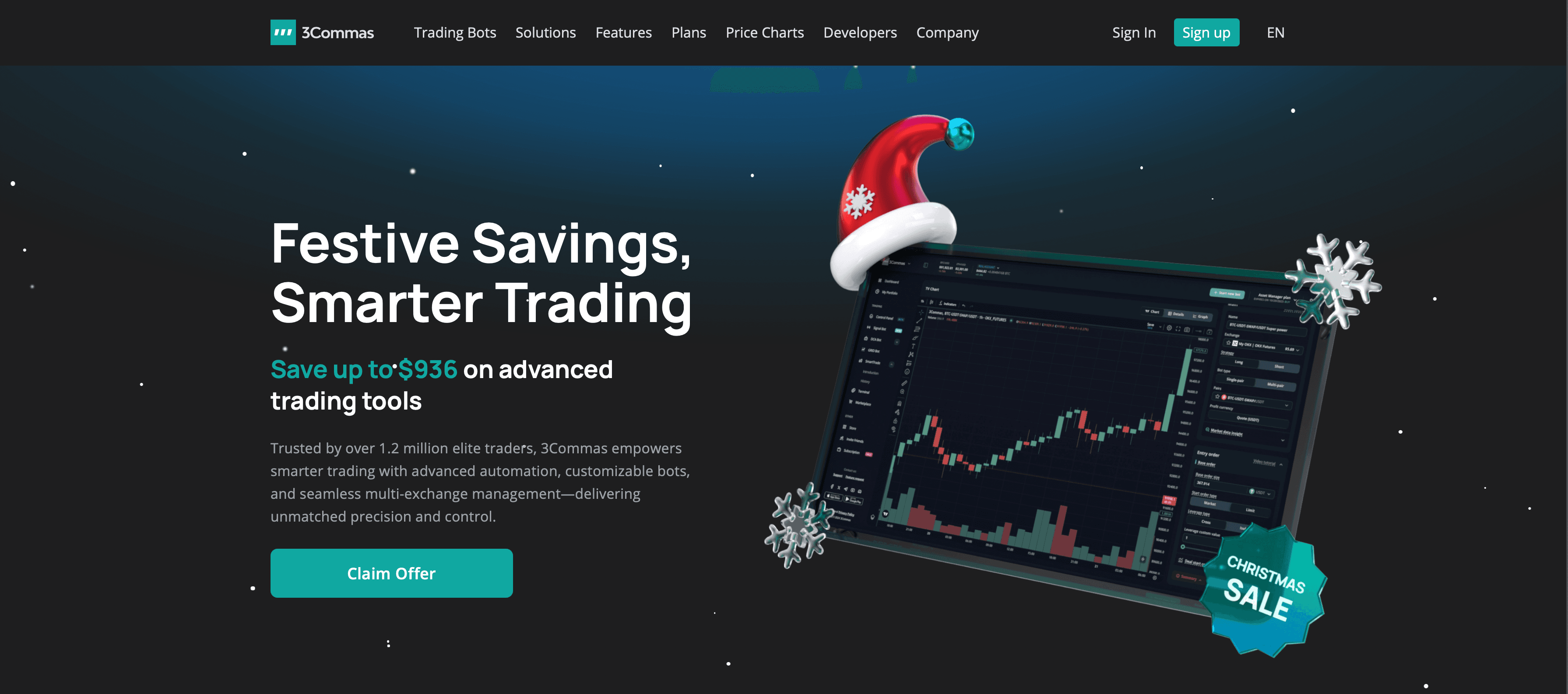

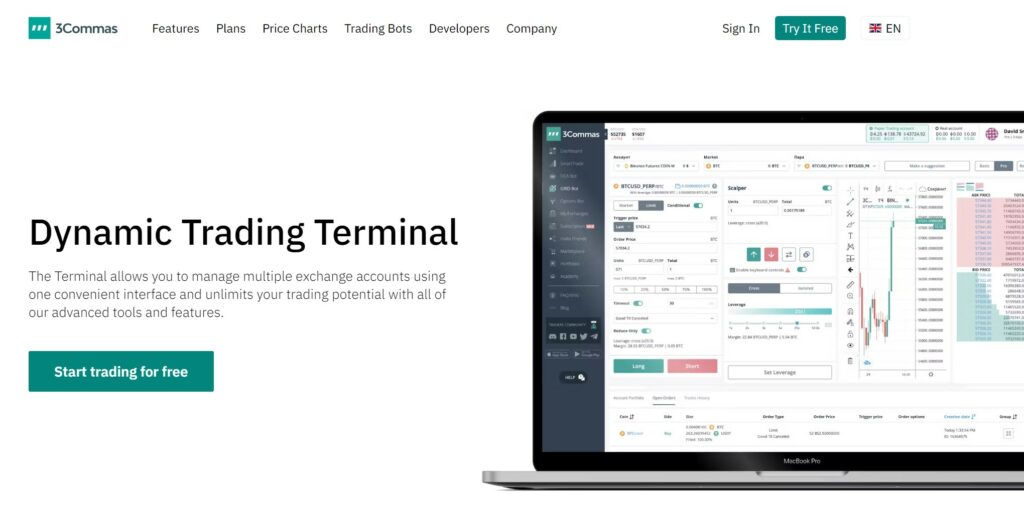

A Look at the 3Commas Homepage

A Look at the 3Commas Homepage3Commas trading bots can connect to crypto exchanges like Binance, OKX, Bybit and more, and provide traders with a more advanced level of functionality for manual traders, or automated strategies and copy trading for traders who are looking to put their trading on autopilot.

Trading on cryptocurrency exchanges has the following drawbacks:

- Lack of automation.

- Lack of notifications.

- Inability to monitor different exchanges.

- Traders need to actively monitor charts looking for trade setups and monitor open positions.

- Lack of advanced order management settings with less effective stop loss and take profit settings.

The four primary benefits of 3Commas are:

- Better profit and risk management- With advanced settings not supported natively on exchanges, traders have access to a plethora of features which provide traders with tools to help them better manage their risk and lock in profits. These settings will be covered later on.

- Trade automation- 3Commas has multiple bots and strategies available for traders to customize or select pre-built options to help them automate their trading activities.

- Trade 24/7- Automated trading strategies can be deployed on multiple different charts and trade at all hours of the day, potentially increasing a trader’s efficiency and profitability.

- Copy portfolios- Traders can choose to copy other traders’ portfolios or bots, which can help with diversifying risk, enhancing profits, and learning from other traders and strategies.

3Commas is a popular platform for traders interested in trading bots or who need more advanced trading functionality. The platform has multiple features needed to enhance the trading experience while maximizing profits, minimizing risks, and making it possible for traders to not have to stay glued to their charts constantly looking for trade setups and babysitting open positions.

Some of the Benefits of 3Commas

Some of the Benefits of 3Commas3Commas trading bots can help execute buy and sell orders on your behalf based either on your pre-determined criteria, or the bots can run on full autopilot by utilizing artificial intelligence. The platform is also perfect for copy trading and for traders who want more control over their trade settings or who trade on more than one exchange as everything can be managed through the 3Commas interface.

If you are interested in exploring trading bots further and finding 3Commas alternatives, we have a detailed article highlighting the Top Crypto Bots where we cover some of the best platforms for automated crypto trading.

Guy also has a great video on crypto bots below:

3Commas Key Features

In this next section, we will cover the key products and features of the platform

Demo Trading Accounts

An important feature of 3Commas that should 1,000% be utilized and taken advantage of is the ability to do what is known as demo account trading.

This area of the site allows traders to test out strategies and practice bots on demo accounts without risking live funds. I cannot recommend this enough as it is common knowledge that the majority of traders who use trading bots lose money due to inexperience. They fail to work on mastering the trader's mindset and demo accounts do not get utilized enough. Often, traders are too impatient to practice and just want to jump in right away thinking they can start making money from day one.

Prior to my time at the Coin Bureau, I was an active day trader for years and actually worked for a company alongside other traders and computer science graduates where we designed and tested hundreds of trading bots, so I’ve been around the automated trading block a time or two and can bring you this warning from personal first-hand experience:

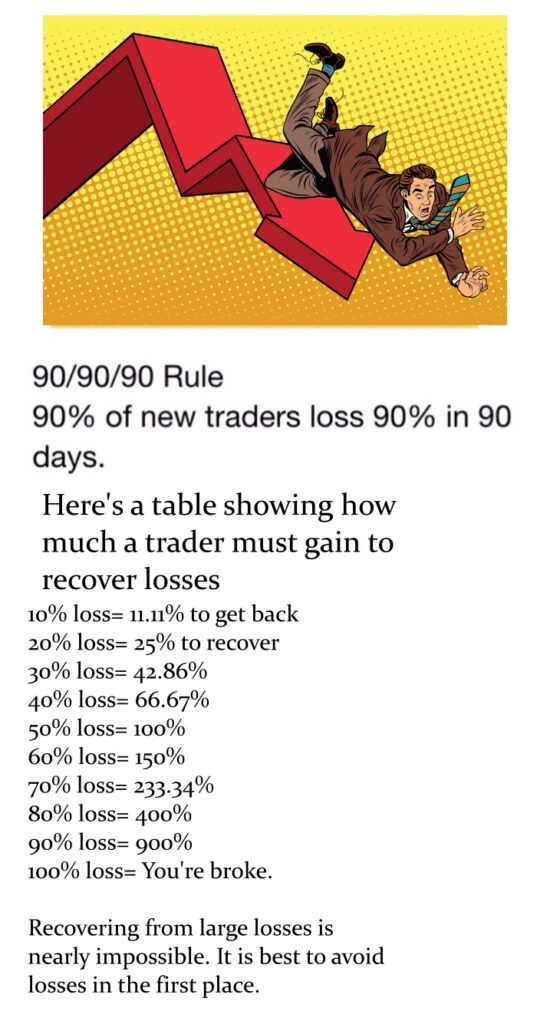

Warning ⚠️: Over 90% of inexperienced traders who use automated trading bots lose money. It is important to understand that no automated trading strategy can be successfully deployed in all market conditions. Trading bots are static and rule-based, while markets are dynamic, volatile and unpredictable. Professional traders have different strategies to deploy for different market conditions, and no one strategy, like the one followed by a trading bot, can be consistently profitable in all market conditions.

Trading bots are tools best used by experienced traders who know the appropriate market conditions in which to run a bot and have already developed manual profitable trading strategies.

Some of the Features and Benefits of 3Commas

Some of the Features and Benefits of 3CommasSo, with that warning out of the way, please be sure to test out any new strategy or bot on a demo account first. A good rule of thumb is to test out your strategy or bot for 2-3 months and if you manage to make a profit at the end of 3 months, then you can consider trying your strategy out with live funds and never risk more funds in a trading account than you can afford to lose.

If you need further convincing that trading and automated bots are extremely dangerous, check out TradingView’s article on the 90-90-90 rule. It has been historically shown that 90% of traders lose more than 90% of their funds in their first 90 days of trading, hence why I recommend trading demo accounts for your first 2-3 months.

Image via Shutterstock

Image via ShutterstockI harp on about this as I’ve known hundreds of traders who have lost everything by blowing accounts and I don’t want to see that happen to any of you who may be reading this article. Please don’t contribute to the 90-90-90 statistic. To help you overcome the high failure rate, read our in-depth crypto trading psychology article written by an experienced trader.

One last point to make before I stop sounding like your panicking mother on your first day of kindergarten is to keep the following realization in the back of your mind before chasing unrealistically high ROIs as novice traders tend to do:

The highest-paid and most successful hedge fund and portfolio managers in the world make on average between 8-15% per year. Warren Buffet, often considered the greatest investor of all time, shoots for around 20-30% per annum. These people live, eat, and breathe the markets, as well as have access to insider information and data not available to retail investors. The best portfolio managers get paid millions to consistently earn that amount.

This is What a Professional Trading Setup Looks Like. If These Guys Get Paid Millions to Make 10-20% Per Year, Be Sure You Have Realistic Expectations of Profit. Image via Shutterstock

This is What a Professional Trading Setup Looks Like. If These Guys Get Paid Millions to Make 10-20% Per Year, Be Sure You Have Realistic Expectations of Profit. Image via ShutterstockIf fully automated bots were able to consistently outperform professional trader's results, everyone would be using them. We would all be millionaires and these people would have no jobs. Just something to consider to keep your expectations realistic.

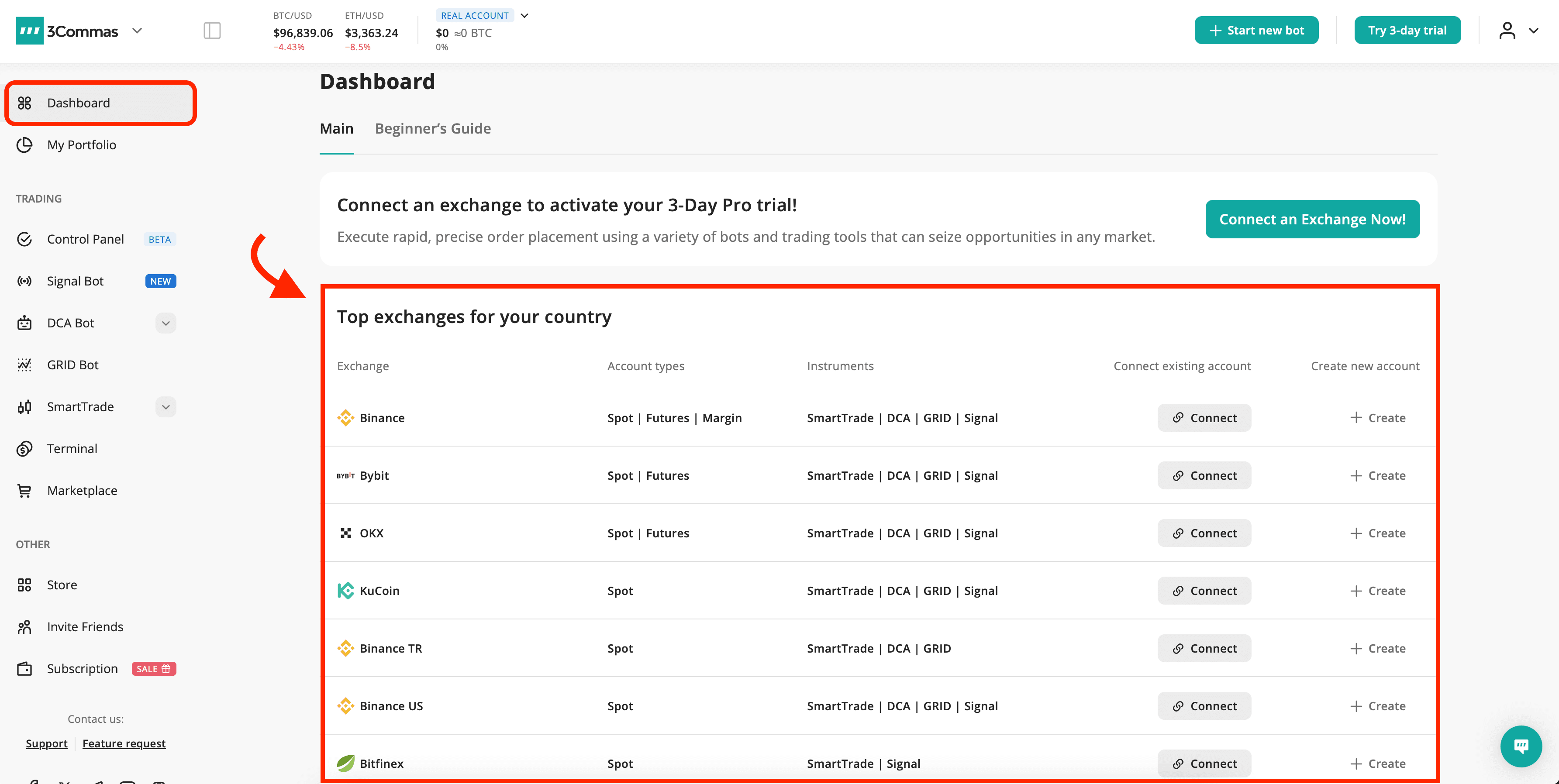

Connect Exchange APIs

Before you get started doing anything with 3Commas, you will need to link your exchange account to the 3Commas platform. Basically, you need to give 3Commas access to your trading account and provide it with permission to execute trades on your behalf.

This is useful even for traders who do not want to use automated bots as they can execute trades across multiple different exchanges all from within one interface.

The process to connect the APIs will vary depending on what exchange you use, but, for most exchanges, you will simply navigate to the Dashboard.

Once there, you can choose the exchanges you would like to connect your account with and enter the required credentials to link the two platforms.

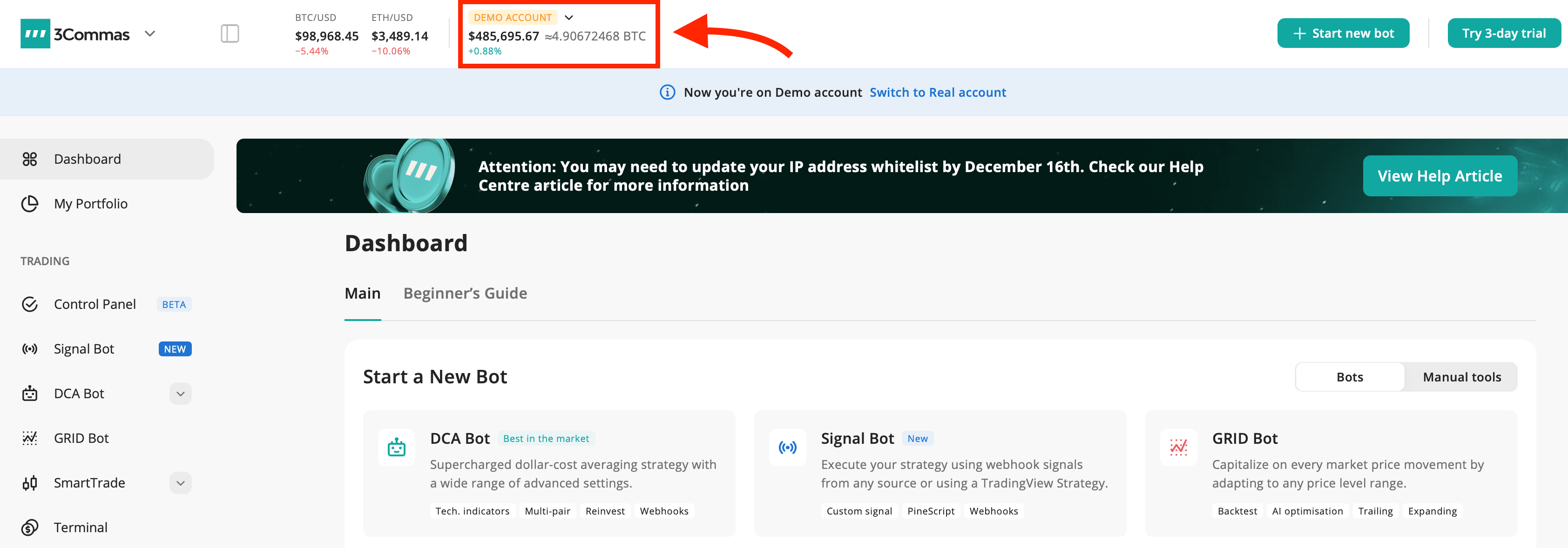

3Commas Dashboard

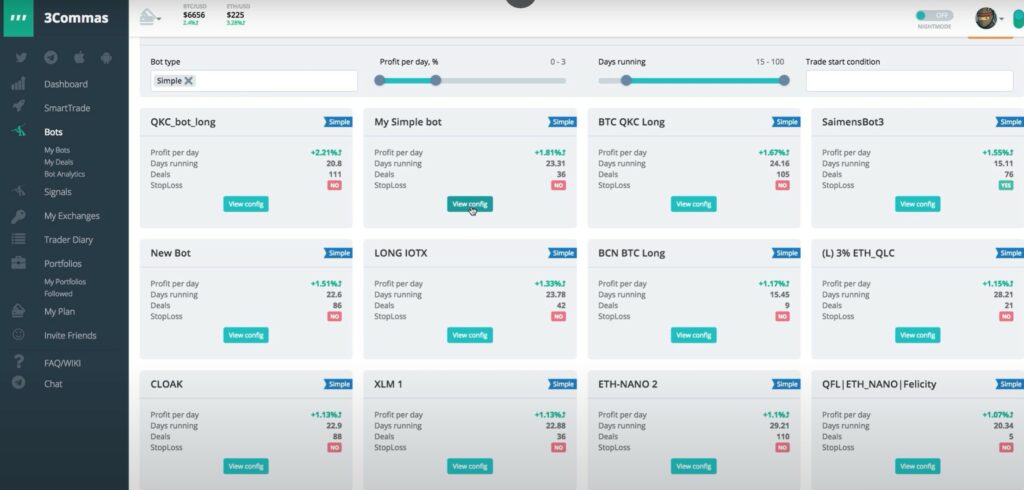

3Commas DashboardAutomated Trading and Trading Bots

3Commas trading bots are the primary attractor to the platform and have been incredibly successful in onboarding over 220,000 users. The bots on 3Commas are highly customizable and very user-friendly with simple plug-and-play settings that allow traders to create bots with no coding or in-depth technical skills needed.

Traders can set up their own trading bots, select pre-configured bots to run autonomously via artificial intelligence, or simply copy the bots created by other traders.

Easily Copy the Bots Created by Other Users. Image via 3Commas.

Easily Copy the Bots Created by Other Users. Image via 3Commas.If you are going to copy the bots created by other traders, you will be able to see the statistics and performance of the bot before choosing to copy them.

Pro Tip ❗: When selecting to copy a bot, don’t just go for the best-performing one with the highest ROI. If a bot is showing astronomical returns, it is likely taking on an extreme level of risk that will end up blowing the funds eventually. Slow and steady growth usually creates sustainable results.

When I used to work with a team to design bots, we built multiple trading bots that were capable of hundreds, or even thousands of percentage returns per week, but every single one that was capable of those high returns would blow up and lose everything often within hours, days or weeks, hence why I recommended always testing on demo accounts.

Try choosing a bot with more realistic returns and one that has a long successful track record. You are better off selecting a bot that can do 3% per month and has been doing so for a year as opposed to a bot that does 400% in a week and then loses everything the next as it over-leveraged and took on too much risk.

Alright, let’s cover the type of 3Commas trading bots available.

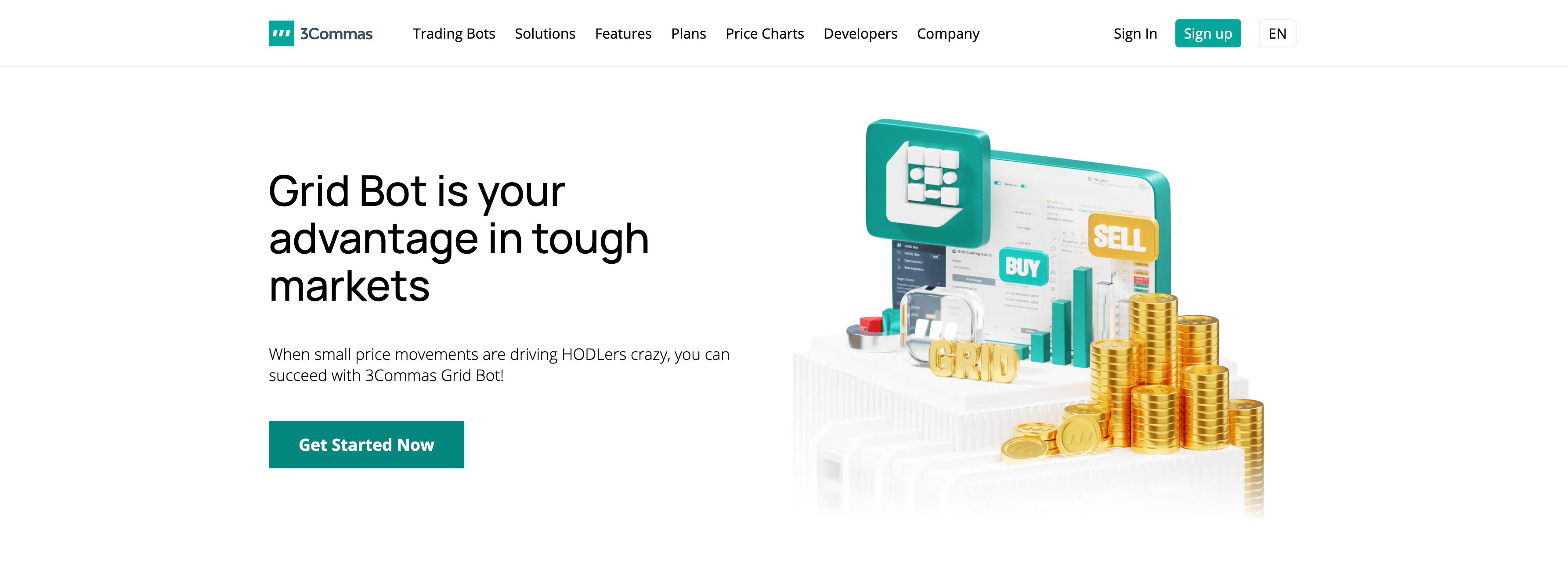

3Commas Grid bots

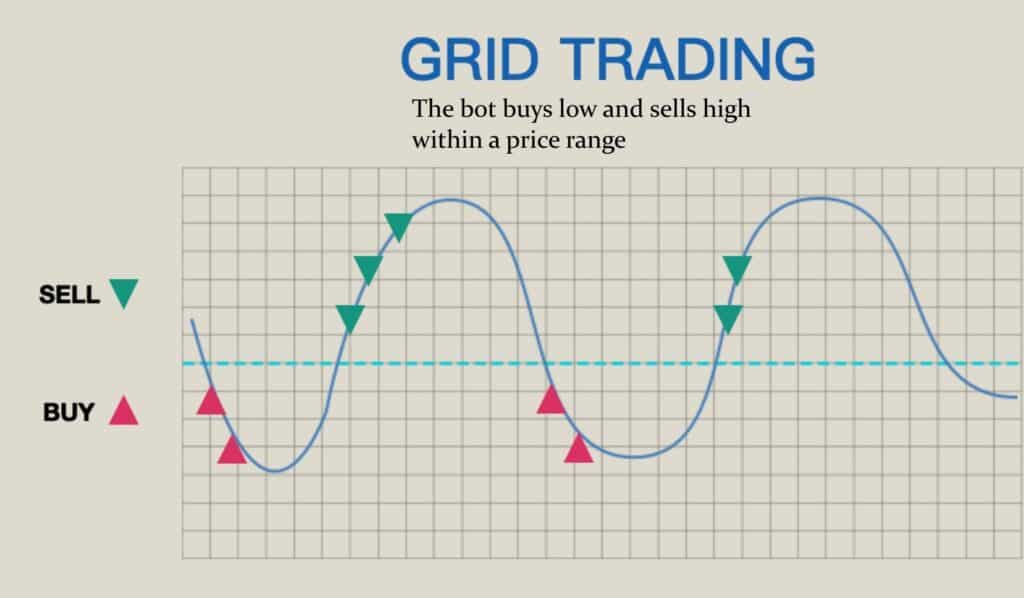

Grid bots are automated trading strategies that execute trades based on a pricing grid.

Image via 3Commas

Image via 3CommasTraders can select a price where they want the bot to open trades, then it will continuously monitor the price and open and close trades depending on the selected trading price range.

An Example of How Grid Trading Bots Operate

An Example of How Grid Trading Bots OperateThere are two options traders can select for the grid bot:

- AI-based Strategy: Here the AI sets the range for the upper and lower limit of the grid in which the bot will be trading within.

- Manual Strategy: This is where the trader sets the range and the bot can only buy/sell within the defined range. Traders need to take into consideration things like Average True Range and volatility before setting the parameters. It is also crucial to be able to identify if a market is range-bound/consolidating or trending as Grid bots do not work well in strong one-directional trends.

In a sideways market, grid bots can perform quite profitably if a trader knows when and how to deploy them and when to shut them down.

Here is a look at the screen where traders can customize a grid trading bot:

Image via 3Commas

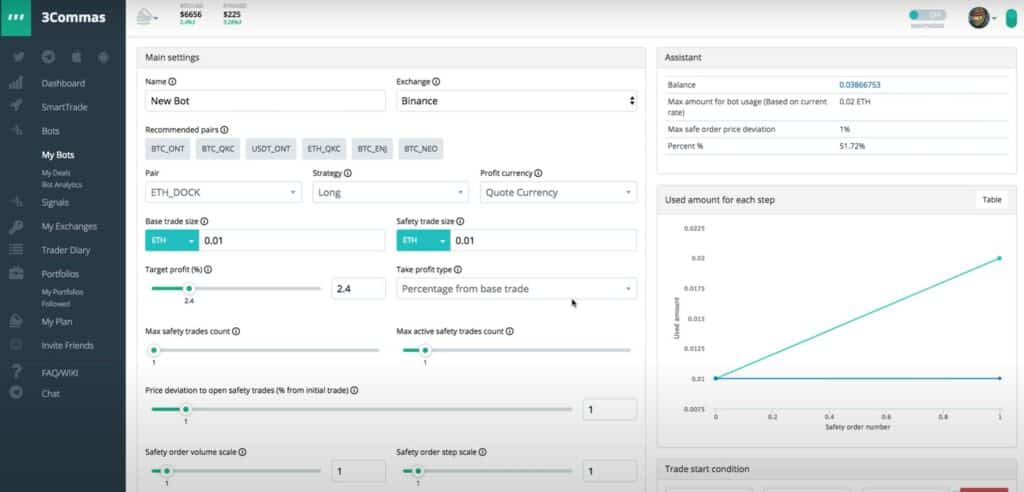

Image via 3Commas3Commas DCA Bots

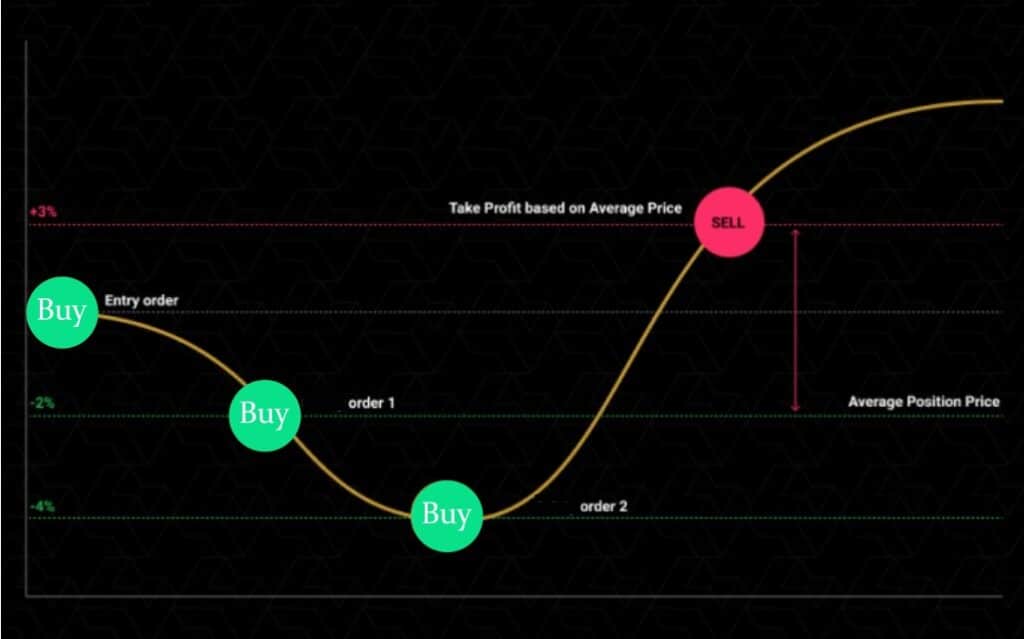

Dollar-cost average bots are suitable for volatile markets where price swings up and down multiple times throughout the day or week, remaining within a fairly stable range with multiple retracements.

An Example of How DCA Bots Trade

An Example of How DCA Bots TradeThis strategy is ideal for traders who want to ensure their position is fully exited once a profit target is reached.

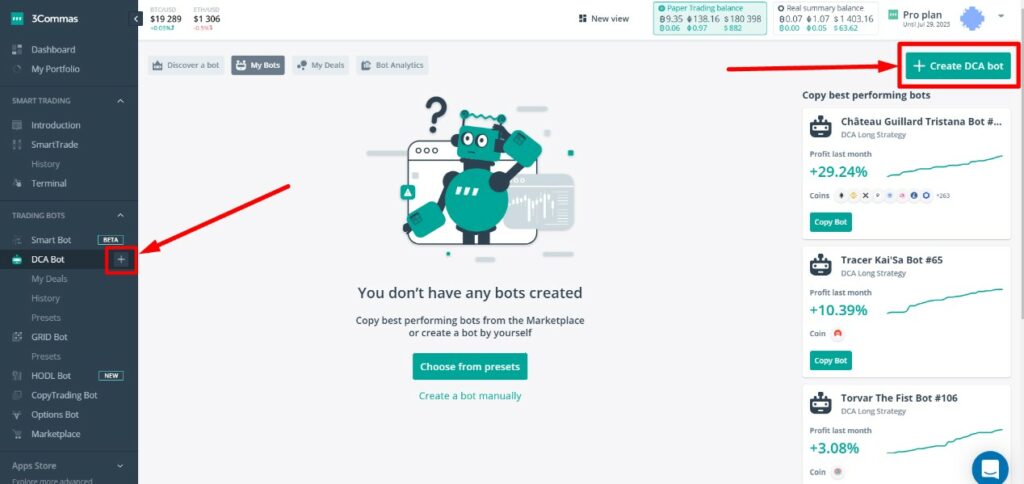

Here is how you navigate to the area to create a bot:

A Look at the Bot Interface. Image via 3commas.help

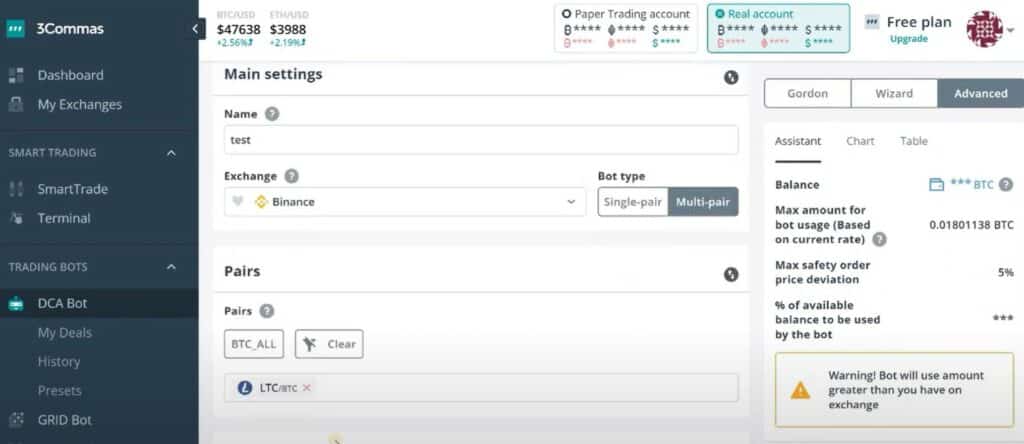

A Look at the Bot Interface. Image via 3commas.helpOnce you hit the “Create Bot” button, you will be taken to a configuration screen to set the parameters, which looks like this:

Image via 3commas.help

Image via 3commas.helpThe weakness is that dollar cost average strategies can fall apart and result in heavy losses when price is in a strong trend against the trader’s open position.

If there are no retracements in price, the basket of trades is unable to close out in profit and losses are magnified due to the extra open positions. During ideal trading conditions, the DCA strategy has the potential to substantially increase a trader’s win rate, but this strategy is not without risks. The chaps over at the FX Axe YouTube trading channel have a fantastic video discussing everything you need to know about the dollar cost averaging (aka Martingale) strategy, along with the risks associated with it.

3Commas Gordon Bot

The Gordon bot is another DCA bot that comes partially configured to help users get started running a DCA bot. This bot can only use a long trading strategy.

3Commas Options Bot

This bot is suitable for options traders and is highly customizable, suitable for options traders with simple or complex requirements.

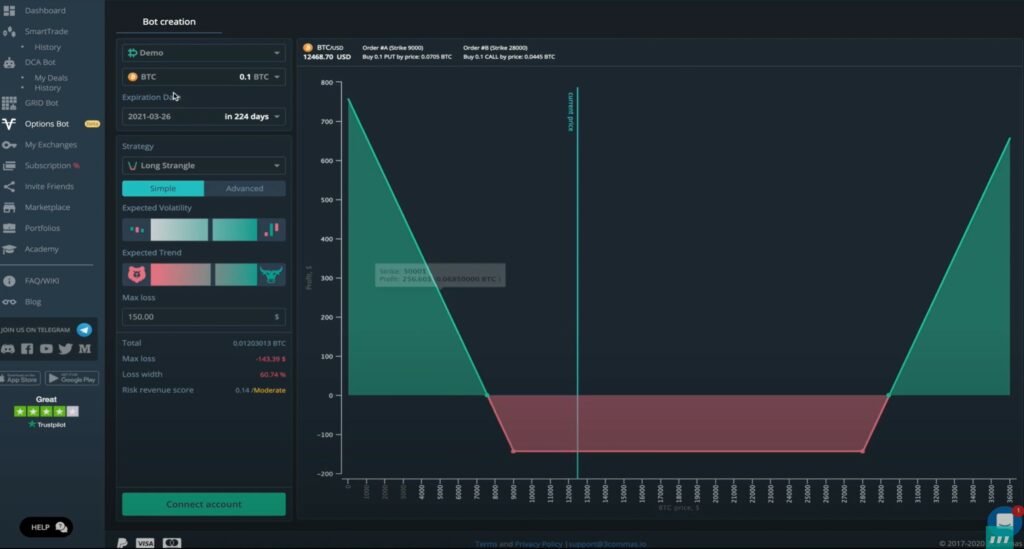

A Look at the Options Bot Configuration Screen

A Look at the Options Bot Configuration ScreenTraders can choose settings such as purchasing x amount based on market conditions and data determined by the user, it can track profit and loss, close out of positions early, and can help calculate the success of a strategy after the position is closed.

3Commas HODL Bot

This HODL bot is great for long-term investors who use a DCA strategy to lower their average entry cost over time. This bot uses a time-based dollar cost average strategy to purchase crypto on behalf of a user at pre-determined timed intervals.

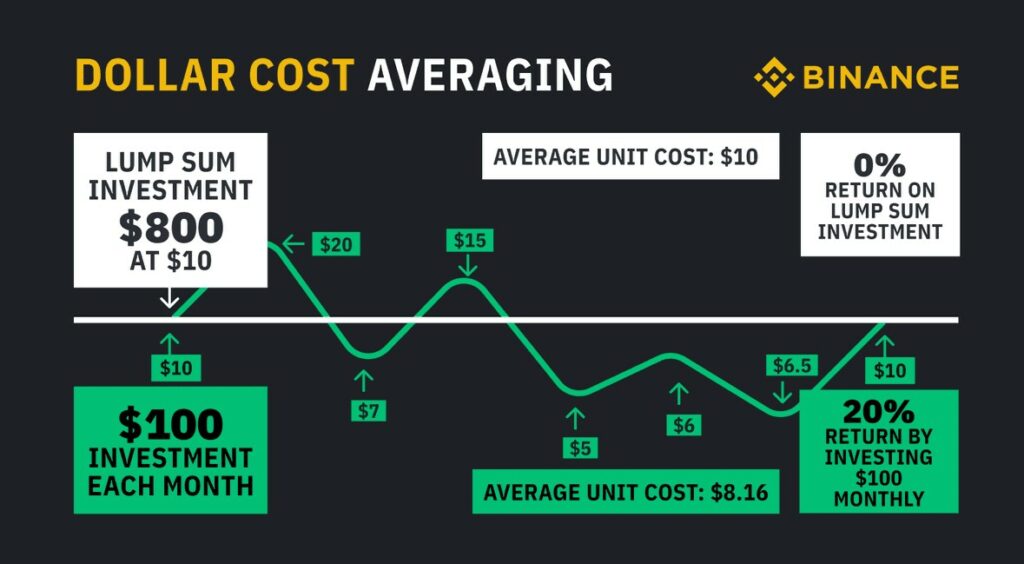

Here is a great image from Binance showing the benefits of a time-based dollar-cost averaging investment strategy:

Image via Binance

Image via BinanceDollar-cost averaging has been shown to provide investors with a better entry price on average over time. Instead of trying to buy all in and time a market bottom, this bot helps ensure that you can continually buy your favourite cryptocurrencies at periodic time intervals regardless of market price to smooth out your average buy price over time.

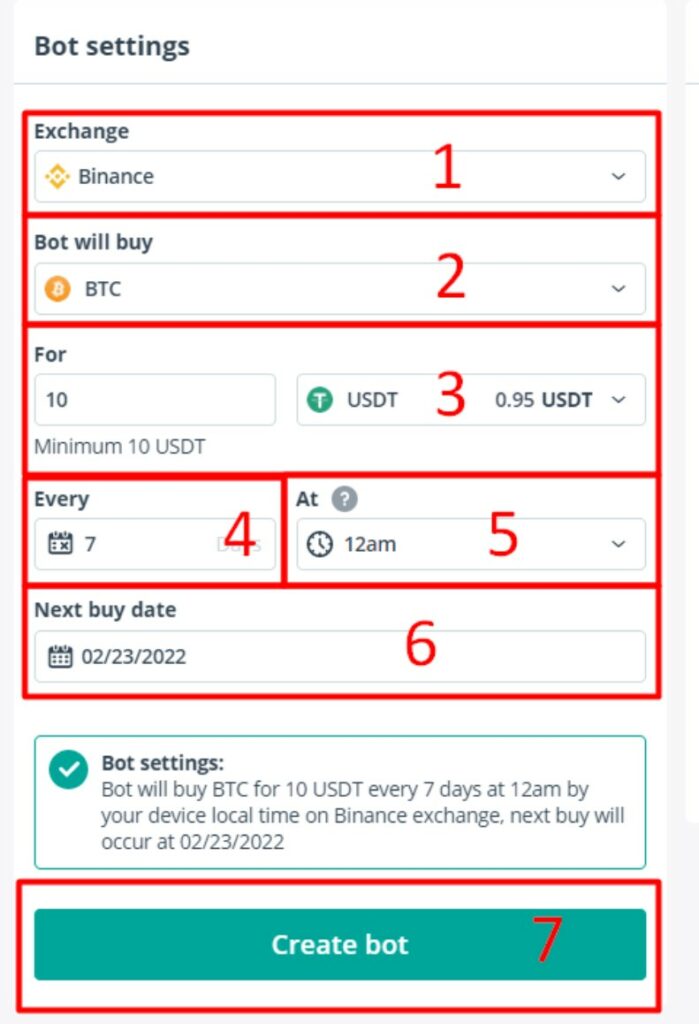

Here is a simple look at the HODL bot settings:

Image via 3commas.help

Image via 3commas.helpThe process of setting this bot up is incredibly easy:

- Select your exchange

- Choose the crypto asset that you want to accumulate

- Choose the fiat currency of the funds you wish to use to invest with

- Choose the time period when the purchases should occur (min 1 day, max 30 days)

- Choose the time of day when the purchase should happen

- Choose the day when the bot will make its first purchase

- Yee-haw, hit the Create bot button

I would like to highlight that though I am a big fan of DCA investing into crypto, many popular exchanges now offer a DCA purchase option natively so signing up to use 3Commas only for the HODL bot may not be worthwhile, but if you are already using the other features on 3Commas then this bot is a great addition.

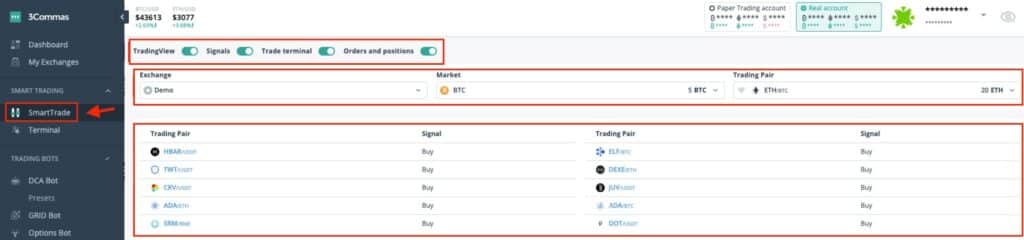

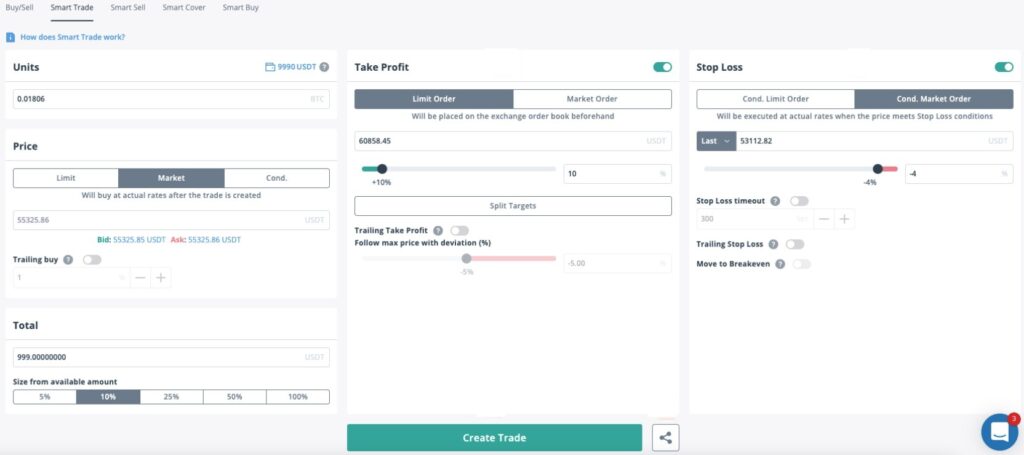

SmartTrade/ Manual Trading

3Commas offers more than just crypto-automated trading strategies. The platform also supports robust and comprehensive settings necessary for many traders who have advanced trading needs available in the SmartTrade section.

Image via help.3commas

Image via help.3commasA major weakness with almost all crypto exchanges is a lack of trade-setting parameters available on the platform. For example, I’ve never seen a crypto exchange that allows traders to split their take profit levels and use trailing profits, heck, most don’t even support simple trailing stop losses.

Smart trading on 3Commas allows traders to set detailed parameters, settings, and customizations for trades. Using SmartTrade, traders can select parameters and settings like:

- Price

- Units to trade

- Notification alerts

- Stop loss timeouts

- Market, limit or conditional orders

- Stop loss, profit target, and split profit targets

- Trailing buys, trailing take profits, and trailing stop losses

Here is a look at the interface where these parameters and settings can be set and adjusted:

Image via help.3commas

Image via help.3commasThe SmartTrade platform also features notes and a trading journal to keep track of your trades and provides an automatic summary of your trading statistics. This is incredibly useful as it is crucial for traders to track their trading performance to identify what works and what doesn’t to improve their trading game.

Tradingview Cryptocurrency Signal Finder

The Tradingview signal finder can scan the crypto markets by the micro-seconds, looking for potentially profitable trade setups and notify you when they arise.

This feature is quite simple to use and very powerful, not to mention, incredibly convenient. Traders will start by selecting or creating a bot:

If you choose to create a bot, here is what the bot interface looks like:

A Look at the Bot Creation Screen

A Look at the Bot Creation ScreenThen hit the “create bot” button.

After that, you will be taken to a page that shows all the bot's target info and a signal that will need to be entered into Tradingview. 3Commas has a great video that walks you through the simple process of how to connect the bot to Tradingview.

The platform can issue four order types when trade setups are found, which fall under the categories:

- Buy

- Strong Buy

- Sell

- Strong Sell

Once a signal is issued, a 3Commas bot can execute an order. The order will always come with proper risk management parameters such as a stop loss and take profit. The underlying specifics of what the bot searches for and what trades to execute can be fully customized.

Trading Signals Marketplace

As if all the other features weren’t enough, traders can also head to the 3Commas marketplace to access trading signals.

Here traders can purchase trading setups of other 3Commas bots after checking out their historical performance. Each bot has its own strategy and risk profile for the trader to choose from.

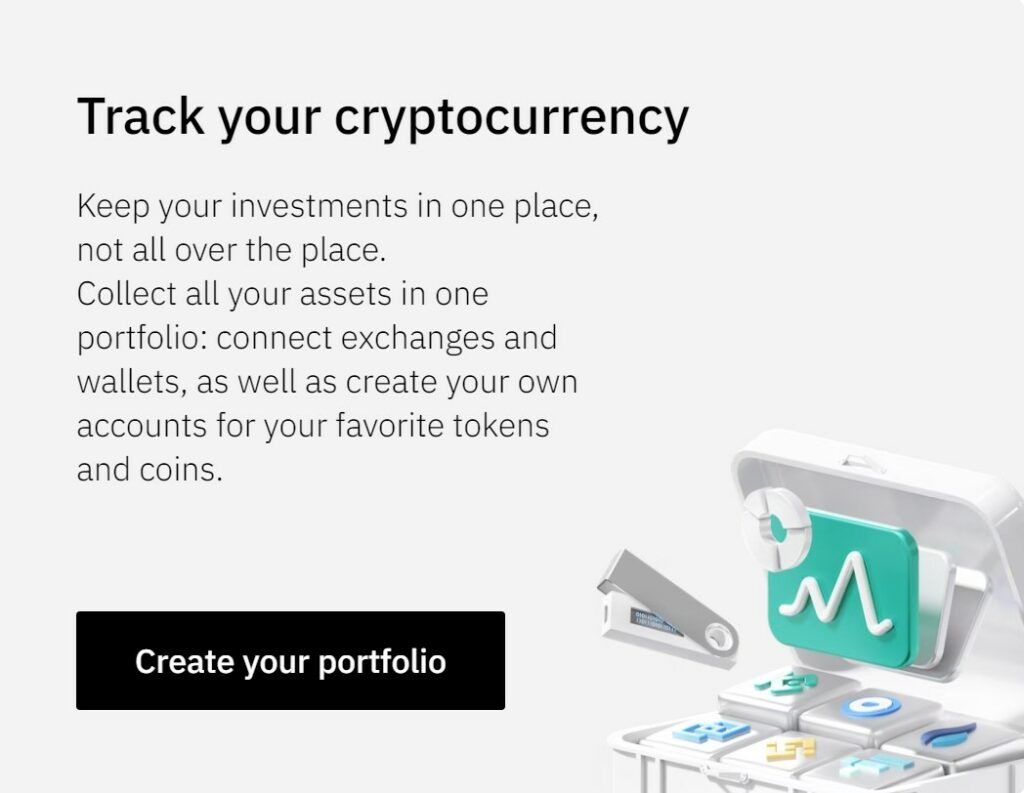

Portfolio Management

Through 3Commas you can manage your own portfolio and also check out other traders’ portfolios for comparison. This makes it possible to not only track and measure your own portfolio over time but compare your strategy and results to other traders and even copy their portfolios while learning from them.

Keep Track of Your Crypto Portfolio with 3Commas

Keep Track of Your Crypto Portfolio with 3CommasTip ❗: When choosing to copy any portfolio it is highly recommended that you are using the same exchange. If you find a portfolio doing well trading BTC/XRP on Binance, for example, it may not be wise to copy that portfolio on your Bybit account as different exchanges can vary significantly in asset pricing and data feeds.

Traders can perform the following functions under the Portfolio Management section:

- Create portfolios with any coin amount

- View performance and analyze other users

- Copy and edit coin ratios of other users to your own portfolio

- Balance or rebalance your portfolio through coin ratio management

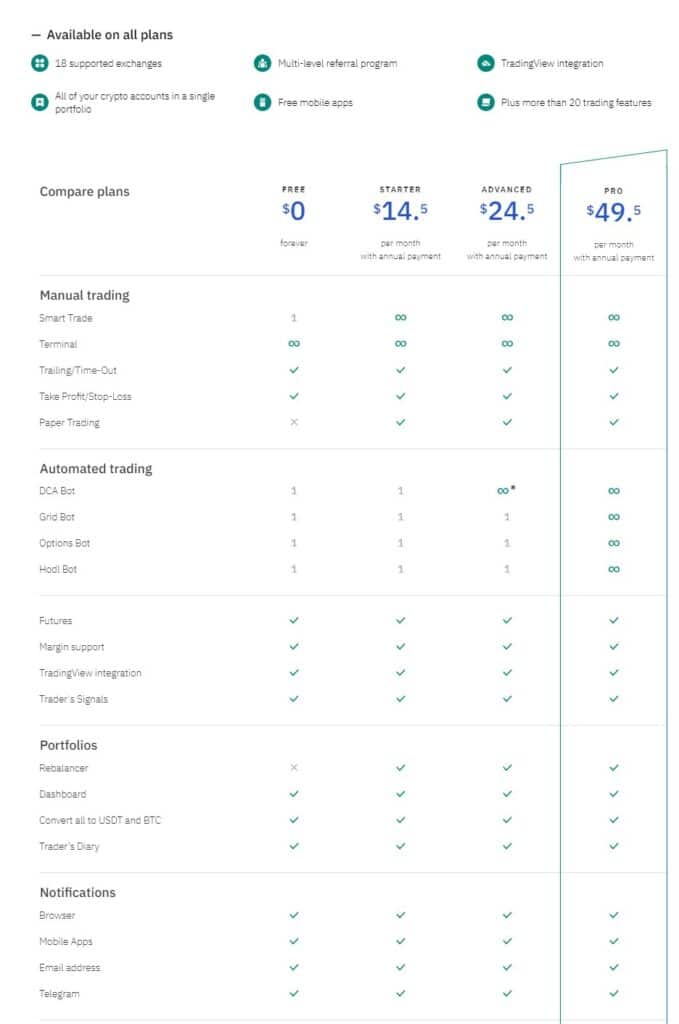

3Commas Pricing

3Commas subscriptions are not the cheapest out of all the crypto auto trading platforms, nor is it the most expensive. When it comes to trading live money and if this is a profession you are going to take seriously, then it probably isn’t wise to go for the cheapest thing on the market; as the saying goes, “you get what you pay for.” 3Commas subscriptions offer more features and products than its competitors and is, in my opinion, the best value for money as it has multiple products to benefit traders.

3Commas is one of the highest-rated and most reputable cryptocurrency trading bot platforms around and is well worth the price for anyone who wants to go down this road. They offer one of the best trading terminals, highly efficient bots, and some of the most robust and comprehensive trading software platforms I have come across.

They offer different pricing packages based on the needs of the trader, the pricing plans are as follows:

Image via 3Commas

Image via 3CommasBefore you buy, definitely take advantage of the 3-day free trial. It gives you a feel for the platform and you get a head start learning how to navigate the site and try out some bots on demo accounts.

3Commas Bot Review: KYC and Account Verification

As 3Commas trading bots only integrate with exchanges, there is no KYC necessary to sign up, just an account creation process. Users can sign up with Apple, Facebook, or email.

You will receive a confirmation email that you will need to verify, and you can use the platform for 3 days without having to enter any payment details, or just choose to continue with the free plan after the trial period ends.

3Commas Security

In December 2022, 3Commas users reported unauthorized transactions on their exchange accounts, resulting in unauthorized trading and there were claims of stolen funds. At first, 3Commas stated that the result was likely a large-scale phishing attack that customers fell for. However, further investigations show there was a hack and users' API keys were leaked. 3Commas is recommending all existing users review and update their API keys.

In October of 2023, less than one year later, 3Commas experienced its second security breach, which compromised several users' accounts. It is safe to say that the Coin Bureau team do not recommend choosing 3Commas at this time. Consider checking out Cryptohopper or Bitsgap as an alternative.

3Commas has since upgraded its security, but users were left upset and demanding apologies after the 3Commas team handled the events very poorly and were criticized for falsely blaming users.

Until the unfortunate API leak, 3Commas was thought to be safe and perfectly secure as it only interacted with user funds via user API keys with no withdrawal functionality.

To make matters worse, the second security breach happened after the team stated that any security issues were patched and the platform was safe to use, even releasing this Security Upgrade blog. The events left a black mark on the team's history. What was worse than the incident itself, was the poor way in which the team handled the incident. Their approach was quite unprofessional and frankly, suspiciously surreptitious. It would have been nice to see the event handled with more transparency and less denying, gaslighting, and incorrectly blaming the user.

Image via 3Commas

Image via 3CommasMany users have lost faith and trust in the platform after the events,

Cryptocurrencies Available on 3Commas

3Commas can be used on over 15 different cryptocurrency exchanges and the popular TradingView, so the tools can be utilized on any asset supported by your exchange.

Using 3Commas: Design and Usability

The 3Commas platform is designed with a nice clean layout and intuitive interface, making the platform a breeze to navigate and use. Because the software is cloud-based, users can access and manage their accounts and trades from anywhere in the world, including from their mobile thanks to the 3Commas app that is available on IOS and Android.

Image via 3Commas

Image via 3Commas3Commas makes it incredibly easy to manage multiple trading accounts on multiple different exchanges all from one convenient platform.

The platform was designed with ease of use and simplicity in mind, I could not find much fault with it. The help section and FAQs were also easy to navigate and find all sorts of useful information.

A Look at More of the Features. Image via 3Commas

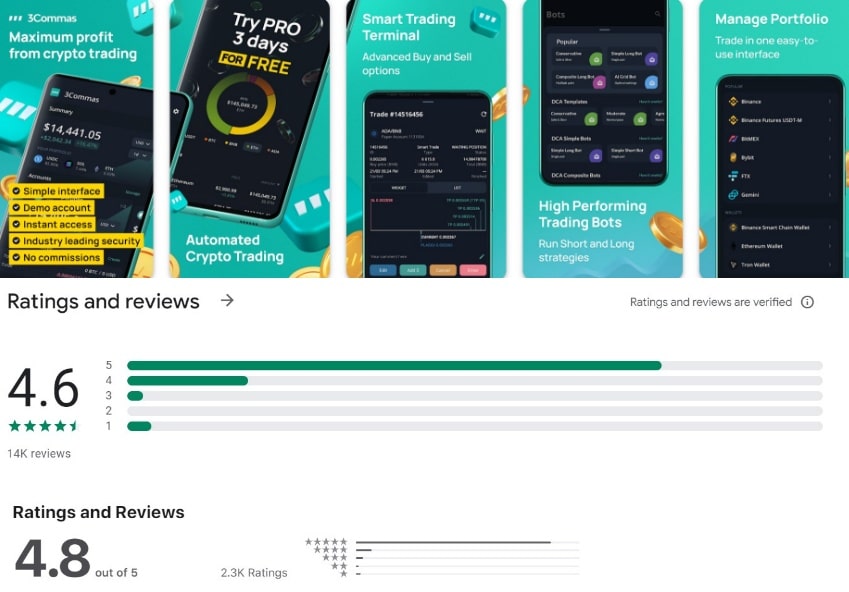

A Look at More of the Features. Image via 3CommasAs far as the app goes, it has all the features and functionality of the web platform, though due to the smaller screen and lack of keyboard and mouse, the app isn’t quite as simple to use. Still, as far as apps go, they did a great job with the UI/UX. This sentiment is echoed by the impressive 4.6 out of 5-star rating on Google Play, and 4.8 out of 5-star rating on the app store on over 14k reviews and 100k+ downloads

Rating Images via Google Play and App Store

Rating Images via Google Play and App StoreThe 3Commas team have done a great job creating a high-quality platform with loads of features in a beautifully and simply designed platform. The reviews speak for themselves.

3Commas Customer Support

Good customer support is incredibly important on a platform like 3Commas because if anything goes wrong, it’s a trader’s live funds on the line. Should anything go haywire or one of your crypto trading bots decides to go all Terminator: Rise of the Machines on you, it's essential to know the platform has your back.

With so many API integrations and moving parts between 3Commas and exchanges regarding bot connectivity, data transmissions, and server uptime, there is a lot that can go wrong, so quick access to support is important.

Over a few days, I ran multiple bots on multiple demo accounts and didn't experience any hiccups or issues. I’ve scoured through reviews looking for common themes about things going horribly wrong. Complex platforms like this often have plenty of pitfalls, but the 3Commas platform functioned very well in terms of trading execution.

Even though I didn't need it, I tested out customer support for the purpose of this review. I was surprised, and I must say they have quite the crack support team. I reached out to them via live chat multiple times over a span of a few days in the morning, noon, and night to test response times and they always got back to me in under five minutes, which is impressive.

Have a Question? Reach out via Live Chat Support

Have a Question? Reach out via Live Chat SupportIt wasn’t only the response times that impressed me, but also the quality of support I received. The team were knowledgeable and knew the platform well.

It is also worth noting that 3Commas has a well-laid-out Help Center and FAQ section full of helpful guides and how-to articles and videos.

Zignaly vs 3Commas

Zignaly and 3Commas both offer automated trading products. 3Commas features a more advanced interface for manual trading and has a significantly more robust bot creation and copy platform.

Zignaly is the better platform for copy-trading live traders. The platform has an innovative Profit-Sharing feature where you can split a pool of your investable assets among multiple traders. Zignaly can be used for free with traders only paying fees on profits earned.

TradeSanta vs 3Commas

TradeSanta is a fantastic platform that offers similar trading bots to 3Commas. The pricing comes in a little lower, but TradeSanta doesn’t offer the advanced manual trading interface, additional products, or in-depth analytics that 3Commas does.

From a pure crypto bot perspective, these two are both very competitive without one significantly outshining the other. I do find the interface of 3Commas is slightly cleaner but would opt for TradeSanta due to the poor security of 3Commas

3Commas Top Benefits Reviewed

3Commas is a comprehensive platform with all the tools and functionality needed for traders looking for advanced trading options or automated trading. I like that 3Commas has solutions for just about any type of serious trader. Whether you're looking for a hands-free approach like bots, trading signals, and portfolio copying, to robust trading settings that cater to traders with advanced trade and risk management strategies, 3Commas has it.

What Can Be Improved

3Commas used to be a leader in the industry and was often cited as the best crypto copy trading platform. After multiple security breaches and their obtuse, frankly, grotesque response to the first incident, the platform has experienced a substantial fall from grace. 3Commas has a lot of work to do if the plan on bolstering their reputation.

Security breaches aside and from a functionality standpoint, as long as your account doesn't get breached and experience unauthorized trades, 3Commas delivers on what it promises and provides a powerful, yet simple enough platform that fills the needs of crypto traders of all styles.

I guess if I was going to be petty, some of the self-help articles could be filled out a little better. The concepts could be explained in more simple and thorough terms as this platform has concepts that are not beginner-friendly at all. 3Commas knowledge base could feature more educational content aimed at beginners.

Review Conclusion

I hope this 3Commas review provided you with all the information you need to decide whether or not the platform is right for you. If you are still on the fence about whether or not crypto trading bots are worth it, we explore those questions in our Crypto Bots- Complete Guide.

The simple-to-use and highly customizable interface, along with advanced tools and features to suit the needs of advanced traders from all walks of life make 3Commas a contender for users looking for an automated trading platform. However, due to the poor security track record, we would consider taking a look at our Top 5 Crypto Trading Bots article to find an alternative.