For a consumer like you and me it feels fairly simple to go grab a coffee from your local coffee shop. The only think we have to do is go there, grab our card and hover it near the card reader. Then our part is done, and we might think that the merchant will now immediately receive the $5 dollars we paid them. Unfortunately, that’s not the case.

When you pay using your card there are multiple steps that take place behind the scenes. This includes your data being transferred through banks and payment companies like Visa and Mastercard. Naturally, they also charge a fee for all of this which is important earnings taken away from the merchants. Another problem merchants typically face is fraudulent card charges which reached over $25 billion in 2019.

All of this is without a doubt a problem and as you might know there are hopes that cryptocurrency will at least partly solve this problem. However, the payment ecosystem surrounding cryptocurrencies isn’t there yet. We know this since the most common way to pay with cryptocurrencies is using a crypto credit card. But that won’t solve the chargeback problem. For example Crypto.com’s card is issued by Visa, and they charge the basic Visa fee. Another possibility would then be to directly pay with cryptocurrencies by transferring it from one wallet to another, but that too has some issues - namely finality, speed, and security.

So where does Amp come in? Well, Amp token is issued by Flexa, which is a payments platform aimed at solving all these problems. But the question is "Can it do that?" That is what we are going to explore in this AMP review.

If you want Guy's take, feel free to check out his video below:

What is Amp Token? Founding and History

To get into the Amp Token itself we need to address the already mentioned Flexa. Flexa is trying to be the payment network that can connect to every existing software and hardware. The idea is to solve the problems mentioned in the introduction by a combination of centralization and decentralization.

This is the core of Flexa. Image via Flexa.

This is the core of Flexa. Image via Flexa.Flexa was founded in 2018 by Trevor Filter, Zachary Kilgore, and Tyler Spalding. The front figure for Flexa is without a doubt Tyler Spalding who you’ll probably find in most, if not all, of the interviews. In early 2018 Flexa had its first funding round in the form of an ICO of the Flexacoin. In the last funding round Flexa was backed by some big names including Pantera Capital and Access Ventures. Less than a month after the last funding round, which was in April of 2019, Flexa released the SPEDN app which made it possible for U.S. residents to pay with cryptocurrencies Bitcoin, Ethereum, and Gemini's GUSD stablecoin at over 30 000 locations. Following the launch Flexa expanded to Canada to an additional 10,000 merchants and started accepting Litecoin and Zcash.

In July of 2020 Coinbase announced their plans to list Flexacoin which hours later was followed by a Flexa announcement of a new token, AMP. The reason for this was that apparently that the technology behind Flexacoin couldn’t support staking it without sending it to a smart contract. Flexacoin holders were then able to swap their coins to Amp in a 1:1 ratio.

How To Stake AMP Token and Its Role in Flexa

As mentioned in the previous section the idea is to have a centralized payments operator combined with a decentralized network that makes it trustworthy and secure. You might have guessed that Flexa acts as the centralized entity and AMP is the decentralized part. Since Flexa is centralized some aspects of its operations are proprietary, however, I found some mixed information on what exactly is open-source and what isn’t. Reading at Flexa’s website they give the implication that everything is open- source although I’m quite certain that that’s not the case. But what I am certain of is that Amp is completely open-source.

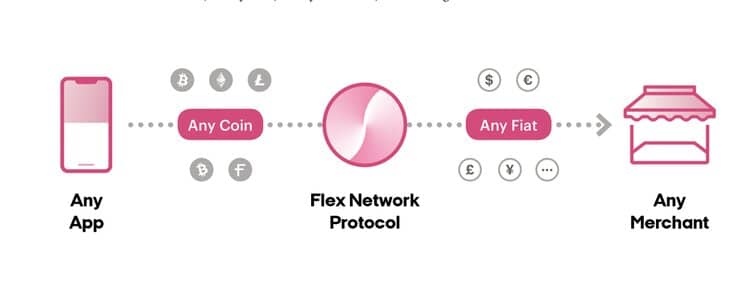

The basic idea behind how Flexa works. Image via Flexa Medium.

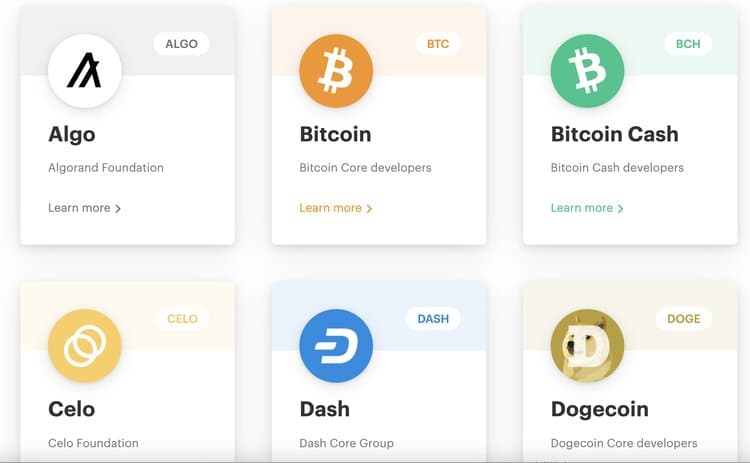

The basic idea behind how Flexa works. Image via Flexa Medium.When using Flexa you can nowadays choose from a variety of stablecoins, coins, and tokens which together make 22 options. When using the SPEDN app or Gemini Pay (Gemini leverages Flexa’s payments) at a store that supports Flexa the merchant will simply scan a QR code on your app and the funds will be sent. In addition to not having to pay high fees (about 1%) there’s another great feature for the merchant, which is that they can choose a default currency to be paid in, including fiat currencies. The funds you send will automatically be swapped for the currency favored by the merchant using Coinbase or Gemini.

Here's just a few, you can find the rest from the image link. Image via Flexa.

Here's just a few, you can find the rest from the image link. Image via Flexa.As you might recall card fraud is a big issue and it can cost the merchant a lot. On top of that you might understand that converting one crypto to a fiat via an exchange isn’t instant although you as a user of Flexa will experience instant finality. Therefore, without any collateral the merchant would take a risk of not getting anything at all if the transaction doesn’t go through. To solve this issue AMP Token is used to collateralize each transaction. To give an example, if you were to buy the coffee we talked about for $5 there would be an amount greater than $5, say $6.50, of AMP being locked up in a smart contract as collateral. Then, if for some reason your payment didn’t go through that locked AMP will automatically be converted to fiat and issued to the merchant. You might now be wondering where that AMP comes from, and the answer is from those who Stake AMP in any of the payment providers leveraging Flexa payment protocol, which are SPEDN and Gemini Pay.

Here's a simple picture of how Amp works. Image via Amp token.

Here's a simple picture of how Amp works. Image via Amp token.Because of how the whole ecosystem around Flexa payments works you might understand that the success of Amp is tightly tied to the success of Flexa. However, looking at Amp’s website it shows that they market AMP as a universal token for collateralization which means that also others could also adopt Amp. In fact, there are already some DeFi projects which do this. Naturally, this means that if Amp can establish itself as a truly universal collateralization token it could tear away from Flexa and experience much stronger growth compared to Flexa. However, there are still some issues with it.

Amp Token Staking

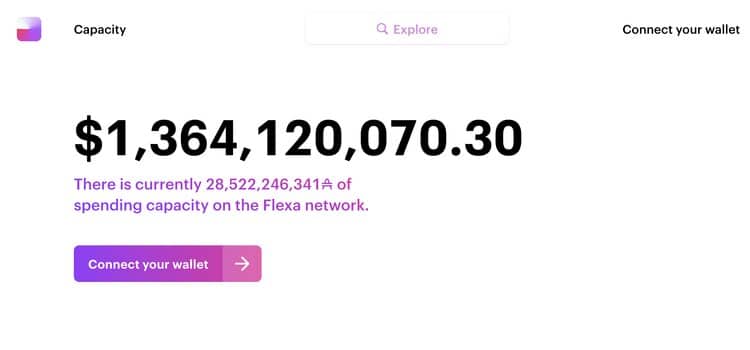

When staking AMP, the tokens are put in a bigger pool with all the AMP currently staked. From there it’s then put in smart contracts to collateralize individual transactions. From Flexa Capacity you can see the amount currently staked and as you can see, we’re sitting at $1.35 billion or 28.5 billion AMP at the time of writing (I’ll leave a picture down below). This also means that we have a limit of how many transactions can be collateralized, which is the amount seen here.

The dollar amount will naturally fluctuate when the price moves, that's why the amount of Amp tells a better story. Image via Flexa Capacity

The dollar amount will naturally fluctuate when the price moves, that's why the amount of Amp tells a better story. Image via Flexa CapacityOn top of seeing how much AMP is currently staked, Flexa Capacity is also where you can stake AMP. This is done by connecting your wallet. There are currently five options including MetaMask and Coinbase. When staking AMP, you’ll receive a cut of the fees paid by the merchant. However, since the fees aren’t that lucrative there is an additional one billion AMP being issued per year as staking rewards, but the idea would be to survive on transaction fees alone. Sadly, even with the additional AMP the rewards are only 2%, which in crypto terms can’t be seen as competitive. However, the bright side for stakers is that there isn’t any lockup time and you’re free to withdraw at any time. This might scare some since it would mean that if there was a sudden outflow of AMP then the whole ecosystem would collapse due to a lack of AMP to collateralize transactions.

AMP Roadmap

Well, this section should be short, since Amp doesn’t have a roadmap. However, after reading about both Amp and Flexa it’s clear that they are basically the same thing although they pretend not to be. Flexa is mentioned multiple times in the Amp whitepaper without mentioning other potential users of AMP as collateral which is why it’s safe to assume that Flexa’s roadmap is in fact also Amp’s roadmap. Sadly Flexa hasn’t a clear roadmap and not even a business plan which is why we’ll just have to stick with the news on where Flexa might be headed.

Since Guy last covered Amp on the Coin Bureau YouTube channel there has been a plethora of updates. First, back then, there were only two payment apps compliant with the Flexa network, Flexa’s SPEDN and Gemini Pay, and while that’s still true today there are a total of 7 others listed as coming soon including BRD, Coinlist, and Coinme. On top of that Guy told us that there were many other cryptos becoming available to pay with and many of them are now available, plus we have new currencies in line too. One of these available soon cryptos is actually AMP. What’s weird though is that when Guy covered Amp in July the AMP token was already listed as available soon, but we are yet to see it being implemented, although others have been. To be honest I don’t know why they haven’t done that yet, but I find it odd that their own currency isn’t accepted.

Another news/update they’ve been dragging on is integration with Shopify. On Flexa’s website you initially get the implication that they would already have a working partnership with Shopify and in fact they say that they are in beta test mode. However, Flexa hasn’t been very busy updating their site since it says it will be available later this summer. It’s interesting since where I live, we certainly aren’t enjoying summer anymore. I also couldn’t find any additional information surrounding this partnership, at least not from Shopify or other non-Flexa sources.

Maybe don't advertise a partnership that isn't even in full effect? Image via Flexa.

Maybe don't advertise a partnership that isn't even in full effect? Image via Flexa.I don’t want to be too harsh on Flexa since without a doubt a partnership with Shopify would be huge for adoption. Additionally, I’m also sure that they are working on it. Sometimes projects do get delayed for various reasons, and that’s fine. Still, if seen from someone’s view who maybe has invested or wants to invest in the project, knowing details on future projects is vital and being kept in the dark makes it impossible to evaluate the investment.

However, the Shopify partnership isn’t the only one Flexa has been working on. Their latest partnership is with GK Software that has a revenue of $425 billion a year. Now, what this means is that if consumers using GK Software start paying with cryptocurrencies it will be huge for Flexa and consequently also Amp. Another upgrade Flexa has made is in supporting fraud proof payments through the lightning network. If you don't know what the lightning network is there's a great video on that on Coin Bureau's YouTube channel. These are the types of partnerships you’ll see Flexa making and when listening to interviews with Tyler Spalding there should be a lot of these about to come. In those interviews, Spalding also mentions the plans to tap into other forms of “digital payments” too, like rewards programs. Now, exactly how they’re going to do this remains unclear but it’s evident that they have big plans to make Flexa ubiquitous.

Lastly, on some Amp specific news. Last month Amp passed its first ever governance proposal. This proposal makes it possible to issue a 1 billion AMP community grant program. This will allow Amp to further increase its visibility in, for example, DeFi integrations and educational content. There is also a second governance proposal on whether those who failed to swap their Flexacoin to AMP resulting in a loss should be given the possibility to have another go at those AMP tokens they truly deserve.

AMP Tokenomics

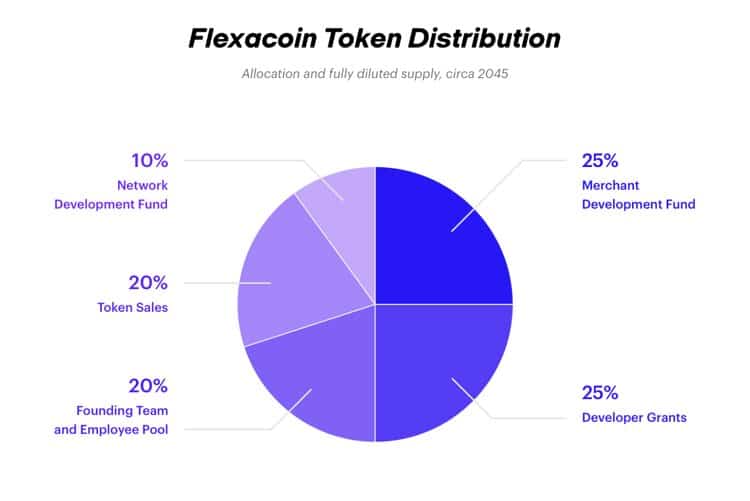

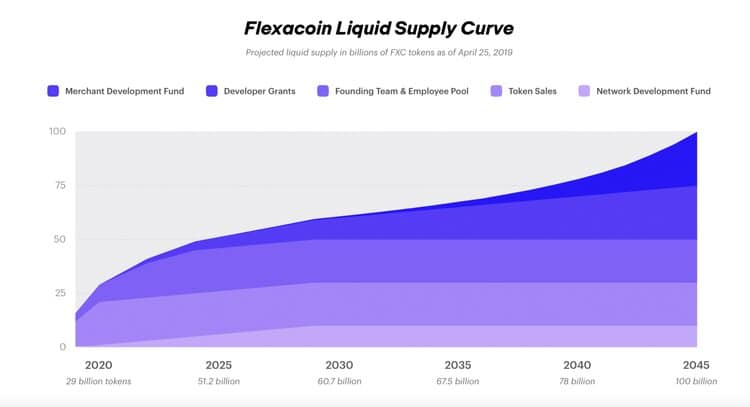

Since the holders of Flexacoin had (have) the right to swap their Flexacoins to AMP in a 1:1 ratio and no further AMP has been released the maximum supply of AMP is 100 billion, same as for Flexacoin. However, not all have been swapped which means that the current supply for AMP will remain slightly below 100 billion until the remaining ones are swapped. When it comes to the vesting schedule of AMP it’s extremely long and will be done in 2045. Now whether that’s a good or bad thing is up to you to decide. But as more and more people are clear to sell and take profits it can (and will) provide selling pressure. I’ll leave a picture down below from where you can see how the token has been distributed between different parties. It’s pretty standard and nothing here pops out as something worth mentioning.

You might notice it says Flexacoin, due to reasons mentioned earlier both of these are the same for Amp. Images via Flexa Medium.

You might notice it says Flexacoin, due to reasons mentioned earlier both of these are the same for Amp. Images via Flexa Medium.When it comes to token allocation there are three addresses that currently hold a combined 75% of the total supply. When Guy last covered AMP on the Coin Bureau YouTube channel there was some uncertainty regarding the owners of those addresses. The three addresses are supposedly Gemini, Coinbase and the staking smart contract. Now, a few months later it’s clear that one was in fact Gemini and one the staking smart contract, they can be verified by looking at Amp’s website where the addresses are listed. However, the Coinbase custody wallet address is wrongly listed but after tracking transactions the now mysterious address should in fact belong to Coinbase. However, it does not have the smart contract page symbol that both the staking contract and Gemini address have which is a bit weird.

Amp’s Potential

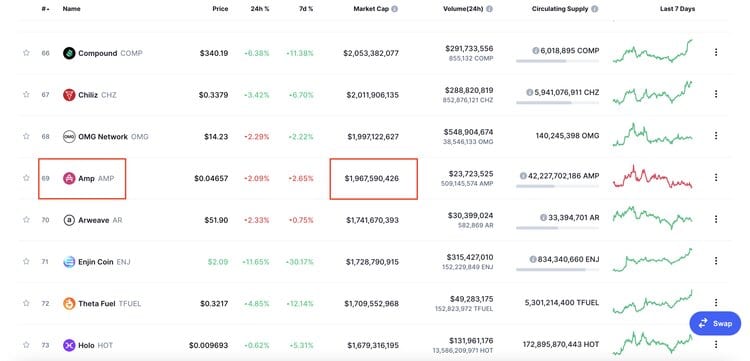

Now, simply looking at the price we see that there’s roughly a 2x left to even hit previous all-time highs (ATH) and to be real if the general market sentiment remains bullish, I don’t see a reason why it wouldn’t at least retake its ATH. What many people on Reddit expect, and want, is a price of $1, which seems to be the target for all cryptos under that. However, as Guy already pointed out in his video, that isn’t going to happen. A price of $1 would mean that AMP’s market cap would be the same as Polkadot’s (roughly $40 billion). I don’t want to say that it isn’t possible to someday reach that price, but it likely won’t happen in the near term.

At the end of the day it's the marketcap that determines how far a crypto can realistically rise. Image via CoinMarketCap.

At the end of the day it's the marketcap that determines how far a crypto can realistically rise. Image via CoinMarketCap.As previously mentioned, AMPs vesting schedule is likely to hold back its price for a long time. It’s easy to understand since those sitting on 10-1000x gains are likely to want to take home some, if not all, of their profit. Another thing I’m worried about that I already mentioned is that since there is no lock-up at all when staking Amp, it’s easy for people to take profits when the incentive to stake Amp isn’t that great. The no lock-up should hold back any major pumps, while it might fuel dumps. Those staking are usually seen as hodlers since they have to go through the trouble of staking in the first place and are often also subjected to lock-up periods. However, Amp does not have this and if a major dump were to happen it might scare off stakers too since it’s easy to cash out. This in turn will further create potential downside since the use case of Flexa will fall when Amp as collateral decreases.

Not be all negative, there are also some bright spots. It’s mentioned that AMP is only backed by its utility which currently lies in the Flexa network. This means that if Flexa can secure the partnership with Shopify, and if cryptocurrencies become more widely used as an alternative payment method, then Flexa and Amp are in a terrific position. Also, the leadership at Amp does have some high growth plans and becoming a leader in cryptocurrency payments is the only thing they’ll settle for. I even read a few posts about a potential Amazon partnership, however, this is pure speculation and should not be considered when making any decision. But still, as you can imagine a partnership that big would be a huge growth driver.

Here's Amp's and Bitcoin's price charts so you can compare. Image via TradingView

Here's Amp's and Bitcoin's price charts so you can compare. Image via TradingViewAnd lastly, I saw a few posts on Reddit about Amp being totally separated from the rest of the crypto markets because it’s only backed by utility. However, I wouldn't count on that. There’s no denying that larger trends in cryptocurrency markets affect almost all cryptos and Amp isn’t an exception to this. You can see this by looking at AMP’s price chart compared to Bitcoin’s. Now, while they might not move hand in hand, they certainly aren’t far from each other either. Almost all tops and bottoms are correlated and that’s just how it is in cryptocurrency. In the long run though, when crypto markets get more mature it wouldn’t be surprising if Amp starts following its utility more than the general markets.

Voices of Concern

First, I want to talk about Amp not really being decentralized. Why I say this is because as Guy pointed out in his video, Flexacoin was likely migrated to Amp because Flexacoin would never have been allowed to be listed on Coinbase since it would have been viewed as a security. Therefore, Flexa wanted to separate the token and the payments network by creating an open-source token. However, the utility is completely the same and while the token theoretically is decentralized, it’s 100% reliant on the success of a centralized entity, Flexa. Because of this structure Flexa and Amp did dodge a bullet of regulations last year. However, since it’s so obvious how tied Flexa and Amp are, along with the fact that regulations around cryptocurrencies are getting tighter, there is a great regulatory risk surrounding Amp.

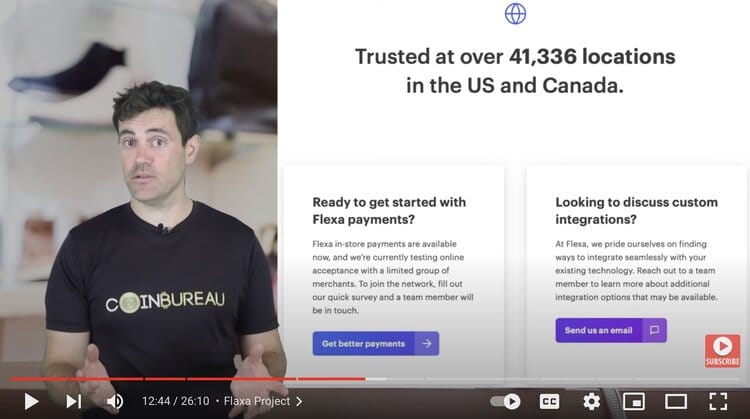

Another potential issue pointed out by Guy is the lack of information surrounding Flexa’s early history. There were very few details about the project although they have been securing major partnerships which normally seems to be impossible if the project isn’t good. This could imply that someone in Flexa has good connections to take them where they need to be, but that’s pure speculation. Also, this lack of information is something I also pointed out in updates around specifically the Shopify partnership. The fact that they haven’t updated their website in regards to that topic is weird. And speaking of not updating their website. The number of supported locations listed on their website is still the same that it was when Guy first made a video on Flexa all the way back in September of 2020 - weird.

...And it still says 41,336. Image via Coin Bureau YouTube.

...And it still says 41,336. Image via Coin Bureau YouTube.Finally, while Spalding speaks of Flexa being completely groundbreaking and not by any means the same as what payment companies like Visa, Mastercard, and PayPal are doing, I wouldn’t be so sure about that. When first listening to Spalding's interviews and afterwards an interview with Visa's Head of Crypto Cuy Sheffield on the Unchained podcast I did hear some similarities in their plans. Visa’s head of crypto didn’t sound like a total moron that would stay out of what Flexa’s doing if it were to be successful. The competition in the whole crypto payment's ecosystem will be tough and Flexa for sure isn’t alone in this.

Where to Buy AMP Token

If you are looking to buy AMP token, there are a few reputable exchanges where it is available. We recommend Binance or Bitget.

Conclusion

It’s clear that crypto payments are coming and that the current infrastructure needs upgrades in order to make crypto payments ubiquitous. It's also clear that Flexa has a good head start with key partnerships already formed, and lots more to come. The founders of Flexa are also determined and at least looking at past partnerships they seem to know what they’re doing. However, as I’ve probably made clear, there are loads of uncertainties when it comes to both Flexa and Amp. This makes it impossible to view it as a safe investment and relying on the hopes that everything is okay under the hood isn’t anything to go by.

Keeping an eye on the project is what I would suggest. Not in an investment way but rather to look at the development of crypto payments. Flexa is without a doubt a key player for crypto payments and it’s interesting to see where they’re headed. Then from an investment perspective when (and if) all of the mysteries surrounding Flexa starts getting untangled it might be worthwhile to have a fresh look. Just remember that both the vesting schedule and the possibility to withdraw from staking at any time is likely to hold back Amp’s price from any major pumps.