The rise of blockchain technology has revolutionised how we think about finance, ownership, and digital identity. Yet, as this space evolves, it becomes increasingly clear that no single blockchain can serve every purpose.

The surge in new Layer-1 (L1) blockchains like Solana and Aptos has addressed critical scalability challenges faced by legacy L1s, but this progress has come at the cost of creating a fragmented and isolated Web3 ecosystem. This fragmentation is more than just a nuisance—it’s a barrier to true innovation.

Imagine if the Internet had never adopted a universal protocol like TCP/IP. Each network would remain isolated, unable to communicate with others, stifling the progress we now take for granted. This is the state of blockchain today, and without interoperability, the dream of a seamless, interconnected Web3 will remain just that—a dream.

Enter Analog, a project aiming to unify the blockchain ecosystem. Analog is not just another interoperability solution, it’s a framework designed to enable decentralised applications (DApps) to communicate across chains, trying to position itself as the TCP/IP of Web3.

In this article, we’ll explore how Analog is trying to enhance blockchain interoperability and cover everything from its impressive technology and visionary team to its growing ecosystem and ambitious roadmap.

Inception and Team

Analog was founded with a singular purpose: to address the growing challenge of blockchain interoperability in an increasingly fragmented Web3 ecosystem. The project’s founding vision was to build a unified, chain-agnostic platform that enables seamless communication between DApps across multiple blockchains.

The Analog Team. Image via Analog

The Analog Team. Image via AnalogThe groundwork for Analog began with the release of its first Timepaper in early 2022, which has significantly evolved over the course of four iterations. Analog’s development is spearheaded by a team based in Bangkok and Zurich. The project was co-founded by Victor Young and Sanchal Ranjan, whose combined experience spans working with startups in the blockchain space and established organisations like Chainlink Labs.

Mainnet and Funding

Analog’s mainnet launched on Dec. 23, 2024, marking the beginning of block production under a Proof-of-Authority (PoA) framework. This initial phase laid the groundwork for a transition to Nominated Proof-of-Stake (NPoS), alongside the rollout of cross-chain messaging and data query functionalities before the token generation event (TGE).

Funding

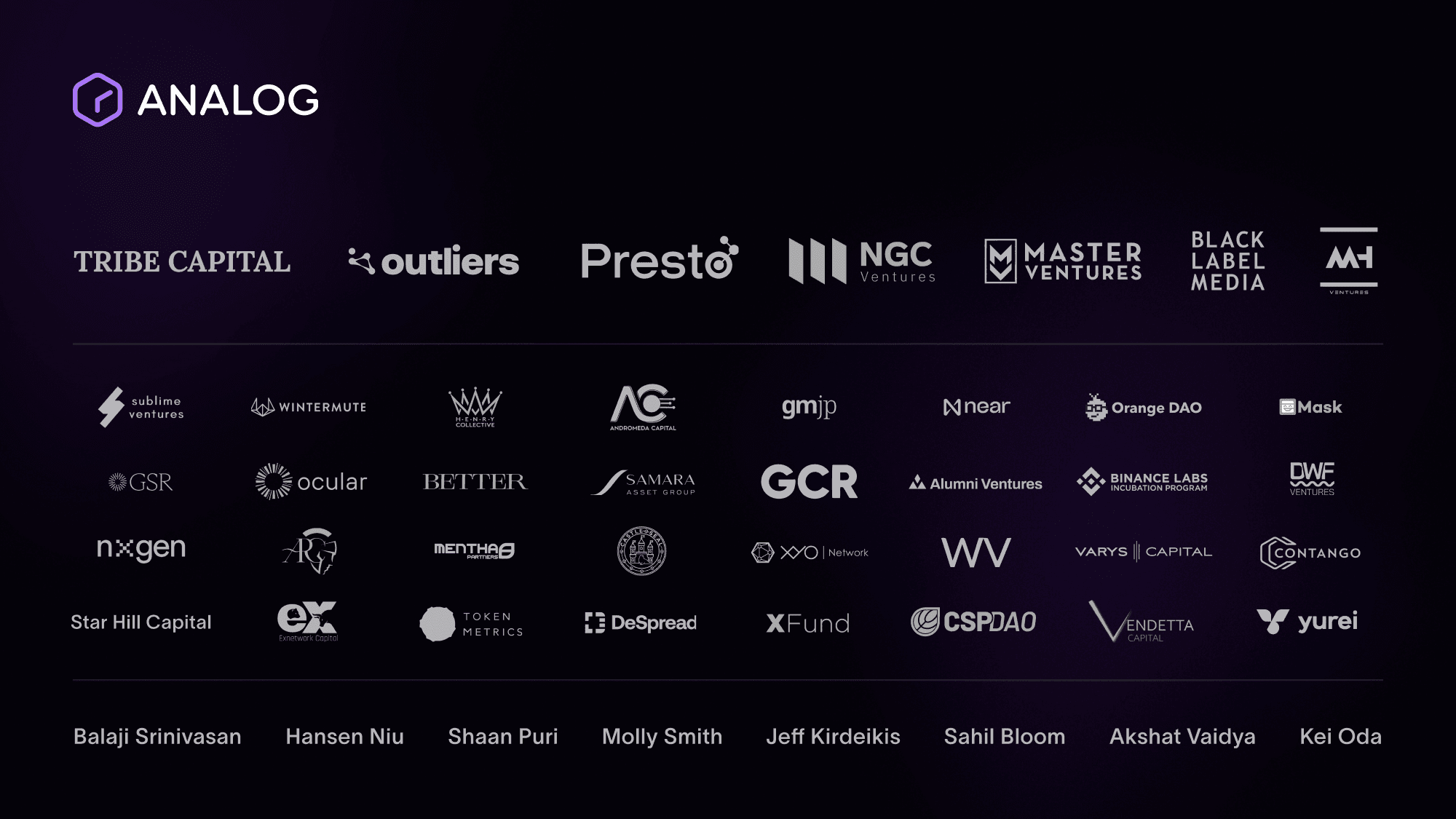

In early 2024, Analog raised $16 million in a seed and strategic funding round, achieving a fully diluted valuation of $120 million. The round was led by Tribe Capital, with participation from Outliers, NGC Ventures, NEAR, and other notable backers.

Analog Backers. Image via Analog

Analog Backers. Image via AnalogAnalog has completed four additional funding rounds, though the specific amounts raised have not been publicly disclosed.

Technology

Analog's technology stack is designed from the ground up with scalability, security, and developer accessibility at its core. And yes, as you might expect, it’s incredibly complex. So, let’s delve into the unique consensus mechanism that powers Analog and explore its three core offerings.

Proof-of-Time (PoT) Consensus Protocol

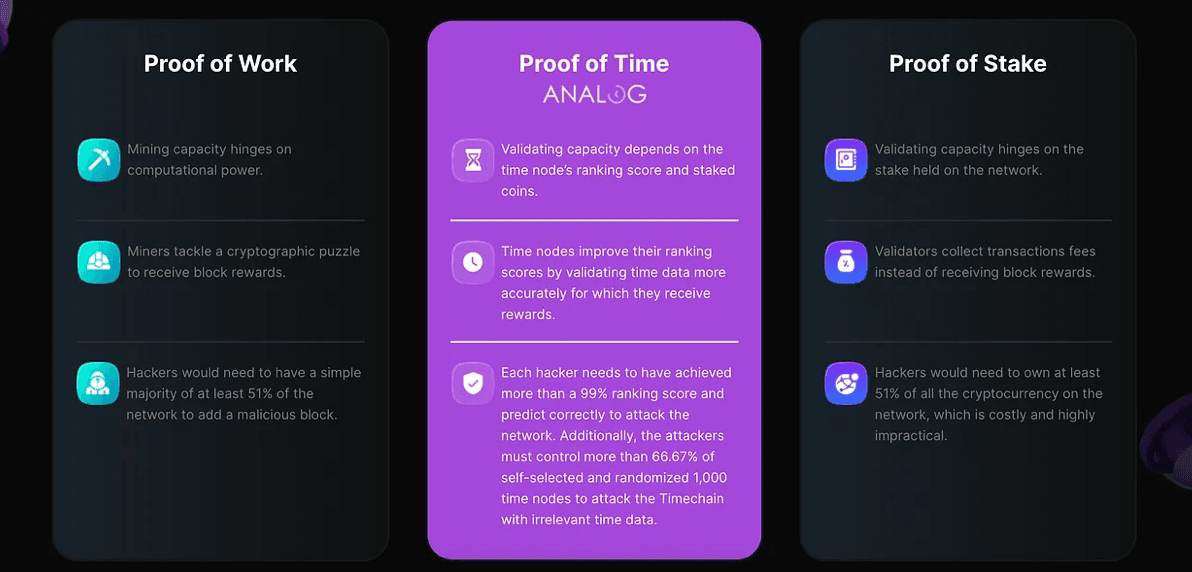

Analog’s Proof-of-Time (PoT) consensus protocol is one of its important innovations, designed specifically to address the challenges of scalability and fairness in cross-chain interoperability. Unlike traditional consensus mechanisms such as Proof-of-Work (PoW) or Proof-of-Stake (PoS), PoT ensures a more inclusive, efficient, and secure approach to blockchain validation.

How PoT Works?

PoT combines three key components to maintain fairness and integrity across the network:

- Ranking Scores (RS): Validators are ranked using a score determined by their tenure on the network, accuracy in past validations, and their relationships with other nodes. This system rewards consistent and honest participation while discouraging malicious behavior.

- Verifiable Delay Functions (VDFs): VDFs ensure that transactions are processed in a specific, sequential order. This prevents any node from manipulating the order of transactions or influencing block proposals unfairly.

- Stake-Based Selection: Validators must stake $ANLOG tokens to participate in the network. This ensures they are financially invested in maintaining the system’s integrity and face slashing for malicious behaviour.

Analog’s PoT Compared to PoW and PoS. Image via Analog

Analog’s PoT Compared to PoW and PoS. Image via AnalogTwo-Stage Validation Process

The PoT protocol uses a two-step process for validating transactions and adding blocks to the Timechain:

- Soft Voting: A designated node verifies and processes the event data, generates a cryptographic proof using a VDF, and shares the result with the network.

- Hard Voting: A random group of 1,000 nodes reviews the data. If at least two-thirds approve, the block is added to the Timechain.

This dual-layer system ensures transactions are processed securely, efficiently, and fairly.

Why Does PoT Stand Out?

- Sub-Second Finality:

- PoT achieves incredibly fast transaction processing times, with blocks finalized in less than a second. This makes Analog suitable for applications requiring high throughput and low latency, such as decentralised finance (DeFi) protocols and cross-chain smart contract execution.

- PoT achieves incredibly fast transaction processing times, with blocks finalized in less than a second. This makes Analog suitable for applications requiring high throughput and low latency, such as decentralised finance (DeFi) protocols and cross-chain smart contract execution.

- Enhanced Security:

- The use of VDFs ensures that all event data is processed sequentially, eliminating opportunities for nodes to manipulate transactions or gain an unfair advantage during block proposals.

- The use of VDFs ensures that all event data is processed sequentially, eliminating opportunities for nodes to manipulate transactions or gain an unfair advantage during block proposals.

- Fair Validator Selection:

- By combining Ranking Scores, VDFs, and staking, PoT ensures that every validator has a fair opportunity to participate in the network, regardless of their token holdings.

Currently, Analog operates on a Nominated Proof-of-Stake (NPoS) consensus mechanism, with plans to transition to the Proof-of-Time (PoT) protocol in future upgrades.

The Timechain: The Backbone of Analog

At the heart of Analog lies the Timechain, a sovereign blockchain designed to serve as the accountability layer for the entire network. Unlike traditional Layer-1 blockchains, the Timechain is purpose-built for interoperability, acting as the central hub where all protocol events—whether on-chain or cross-chain—are recorded, validated, and executed.

Analog Timechain. Image via Analog

Analog Timechain. Image via AnalogBuilt on the Substrate SDK, the Timechain inherits powerful features such as forkless upgrades, fast block times, and robust security. However, it remains an independent blockchain, optimised for cross-chain interactions rather than generic decentralised applications. This independence allows Analog to focus on addressing the unique challenges of interoperability, ensuring transparency and trust across all connected networks.

Core Features

- Validator and Shard Management: Tracks and registers validators while assigning Chronicle Nodes to shards for efficient cross-chain monitoring.

- State Machine Replication (SMR): Ensures validated event data is accurately recorded and processed across connected chains.

- Governance and Upgrades: Implements on-chain governance mechanisms for protocol updates and parameter adjustments.

- Resource Optimisation: Utilises transaction batching and automation to handle high request volumes without sacrificing performance.

Timechain Features. Image via Analog

Timechain Features. Image via AnalogWho Are Chronicle Nodes?

Chronicle Nodes are specialised nodes that enable cross-chain communication on the Analog Network. They are responsible for two main functions:

- Monitoring External Blockchains: Chronicle Nodes observe and validate events, transactions, and state changes occurring on connected blockchains.

- Relaying Data Across Chains: After validating a request, they relay the data or transaction to the destination chain for execution.

By working collectively in groups called shards, Chronicle Nodes ensure that all cross-chain activities are secure and efficient. These nodes play a crucial role in maintaining the integrity and functionality of Analog’s interoperability framework.

How the Timechain Eliminates Cross-Chain Bridges?

A key innovation of the Timechain is its reliance on Multi-Party Computation (MPC) and Threshold Signature Schemes (TSS) to securely validate and process cross-chain transactions. Chronicle Nodes collaborate to manage cryptographic keys and validate requests in a decentralised manner.

This eliminates the need for traditional cross-chain bridges, which often rely on centralised entities to lock and mint tokens across chains. By replacing bridges with decentralised validation, the Timechain removes vulnerabilities like single points of failure and security risks, providing a trustless and secure approach to blockchain interoperability.

General Message Passing (GMP): The Key to Interoperability

The General Message Passing (GMP) protocol is Analog’s flagship solution for enabling seamless communication between blockchains. GMP allows DApps on one blockchain to interact directly with DApps on another, facilitating data sharing, state synchronization, and token transfers. This capability is vital for building interoperable multi-chain ecosystems, where users and developers can interact across networks without barriers.

What is GMP?

GMP provides a standardised framework that abstracts the complexities of cross-chain interactions. It acts as a bridge between blockchains, allowing developers to build chain-agnostic applications that can operate across multiple networks. For example:

- A decentralised exchange (DEX) can route liquidity across different blockchains.

- An NFT marketplace can enable cross-chain minting, trading, and transfers.

By eliminating the need for custom integrations for every chain, GMP simplifies development and reduces the friction typically associated with interoperability.

Analog GMP. Image via Analog

Analog GMP. Image via AnalogHow Does GMP Work?

GMP relies on a combination of on-chain and off-chain components to facilitate secure and efficient cross-chain communication.

- On-Chain Components:

- Gateway Smart Contracts (GSCs):

- These are deployed on every blockchain supported by GMP.

- They serve as the entry and exit points for cross-chain requests, facilitating message passing between chains.

- These are deployed on every blockchain supported by GMP.

- Gateway Smart Contracts (GSCs):

- Off-Chain Components:

- Chronicle Nodes:

- These specialized nodes monitor blockchains for events and validate cross-chain transactions.

- Chronicle Nodes ensure that data is consistent and secure before relaying it to the target blockchain.

- These specialized nodes monitor blockchains for events and validate cross-chain transactions.

- Shards:

- Shards are partitions of Chronicle Nodes that divide the workload, allowing the network to process multiple cross-chain transactions in parallel.

- This improves scalability and ensures the network can handle high transaction volumes efficiently.

- Shards are partitions of Chronicle Nodes that divide the workload, allowing the network to process multiple cross-chain transactions in parallel.

- Chronicle Nodes:

- The Timechain:

- The Timechain acts as the coordinator of all cross-chain interactions. It records, validates, and processes cross-chain requests, ensuring that each action is secure and executed in the correct order.

Key Features of GMP

- Unified Framework: Developers can interact with multiple blockchains using a single protocol, eliminating the need for separate integrations for each chain.

- High Scalability: The use of shards and Chronicle Nodes allows the network to handle multiple transactions simultaneously without bottlenecks.

- Security First: The Timechain’s accountability layer ensures all cross-chain actions are validated, removing risks associated with centralised bridges.

Analog GMP Features. Image via Analog

Analog GMP Features. Image via AnalogAnalog Watch: A Real-Time Multi-Chain Data Platform

Analog Watch is a tool designed to aggregate and index blockchain data across multiple networks. This no-code platform provides developers with the ability to monitor and interact with event data in real time, eliminating the need for costly and complex backend infrastructure.

Analog Watch. Image via Analog

Analog Watch. Image via AnalogCore Features

- GraphQL API: Analog Watch simplifies data querying through a unified GraphQL API. This removes the complexity of sifting through raw blockchain data, allowing developers to access only the information they need in a scalable and efficient way.

- Customisable Views: Users can define tailored data views for monitoring specific events or smart contract activity, making it easier to build applications like cross-chain DeFi dashboards or identity verification systems.

- Real-Time Event Monitoring: Analog Watch tracks blockchain events in real time, enabling applications to respond dynamically to state changes across supported networks.

Analog Watch Features. Image via Analog

Analog Watch Features. Image via AnalogUse Cases

Analog Watch supports a range of applications, including:

- Cross-Chain DeFi Dashboards: Aggregate data from multiple chains to provide users with a unified view of their assets, transactions, and market trends.

- Decentralised Identity Solutions: Monitor identity-related events across chains to enable secure and interoperable identity verification.

Tokenomics

Analog’s native token ANLOG plays several critical roles within the Analog Network:

- Staking: Time Nodes, which validate blocks and secure the Timechain, must stake ANLOG tokens to participate in the network. This ensures that validators have a vested interest in the network's integrity.

- Rewards: Validators (Time Nodes) earn staking yields and fixed block rewards for their contributions.

- Transaction Fees: All transactions on the Timechain, including joining as a validator or initiating cross-chain requests, require fees paid in ANLOG. This mechanism drives demand for the token while funding network operations.

- Collateral for DApps: ANLOG can also be used as collateral for decentralised applications (DApps) built on the Timechain, such as Analog Watch.

- Governance: Token holders can use ANLOG to vote on protocol upgrades, parameter changes, and ecosystem initiatives, enabling community-driven decision-making.

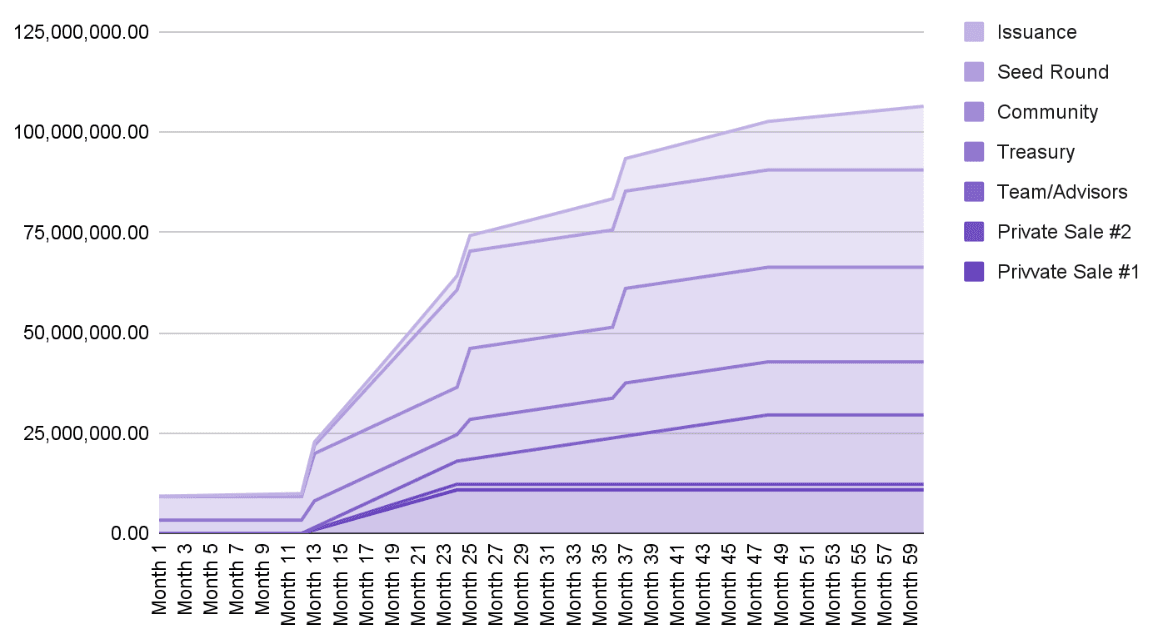

Distribution

ANLOG has a total supply of 9,057,971,000, which was distributed as follows:

| Allocation | Total Tokens | Percentage |

|---|---|---|

| Seed Round | 2,424,840,576 | 26.77% |

| Opportunistic Sales | 311,423,332 | 3.44% |

| Private Sale | 914,546,375 | 10.10% |

| Strategic Round | 334,879,227 | 3.70% |

| Team/Advisors | 1,539,855,070 | 17.00% |

| Treasury | 1,322,463,766 | 14.60% |

| Community | 2,209,962,654 | 24.40% |

A portion of these tokens is locked at genesis and will be released according to a predefined schedule lasting a total of 60 months, which can be best described as moderately aggressive.

ANLOG Vesting Schedule. Image via Analog

ANLOG Vesting Schedule. Image via AnalogInflation Model

The ANLOG token employs an inflationary model to incentivise participants and fund ecosystem growth. Key features include:

- Staking Rewards: The inflation rate, set at 8% annually, is designed to provide reasonable yields for Time Nodes and Nominators while maintaining the ideal staking rate of 60%.

- Treasury Contributions: A portion of inflation is allocated to the Treasury, ensuring resources are available for long-term development and ecosystem initiatives.

- Steady Growth: Inflation is calibrated to strike a balance between token issuance, staking incentives, and maintaining a sustainable total supply over time.

Adoption and Ecosystem Growth

While Analog boasts impressive technology, its adoption metrics remain limited due to its mainnet launching relatively recently in December 2024. However, the network demonstrated impressive adoption during its testnet phase, attracting over 345,000 participating accounts and showcasing its potential for widespread adoption. Additionally, several DApps are already building on the platform.

DApps Building on Analog

Analog currently has over 50 DApps building on its platform, spanning several narratives:

- Prediction Markets

- AI-Related Projects

- DeFi

- Gaming

- NFTs

Here’s a closer look at some of the standout DApps already leveraging Analog’s technology:

- StationX: A platform for multi-chain DAO creation and management, utilizing Analog’s automation workflows to streamline processes across chains.

- PixelPort: Focused on cross-chain NFT solutions, including fractionalization, minting, and transfers, powered by Analog’s General Message Passing (GMP) protocol.

- Frax Finance: Integrating Analog Watch to provide real-time Oracle data, improving the transparency and accuracy of FXS-USD pricing.

Roadmap

Now, whether Analog will continue to see real-world adoption ultimately depends on its roadmap. While Analog has yet to release an official roadmap for 2025, upcoming milestones can be found in community AMAs and recent blog posts.

Technical Upgrades

Currently, Analog’s Chronicle Node services operate under a centralised framework. However, the project is committed to transitioning to a trust-minimized infrastructure, enabling anyone who meets staking and hardware requirements to participate as a node operator. Additionally, Analog plans to upgrade its consensus mechanism from Nominated Proof-of-Stake (NPoS) to its Proof-of-Time (PoT) protocol in future network upgrades.

Ecosystem Expansion

Analog aims to broaden its interoperability capabilities by integrating with additional blockchain ecosystems. These integrations will extend beyond Ethereum Virtual Machine (EVM) networks to include non-EVM ecosystems such as:

This strategy will enable Analog to cater to a wider range of developers and use cases.

Governance

With its mainnet live, Analog plans to gradually hand over control of protocol upgrades and key decisions to its community through on-chain governance. This governance model will be powered by Analog’s native token, ANLOG, and is expected to go live with the token generation event (TGE), which has yet to occur at the time of writing.

Potential Challenges

While Analog’s adoption has been promising given the limited time its core offerings have been live, like every new or established project, it faces challenges that must be addressed to remain competitive in the blockchain space. Let’s explore some of these challenges:

Technical Adaptability

The blockchain space is constantly evolving, and Analog, like every project, must keep pace with emerging technologies and ecosystems that may rise in the coming years.

One advantage Analog has in this regard is its use of the Substrate SDK. Substrate is renowned for its live upgradability, enabling platforms to integrate new technologies and make iterative improvements without the need for disruptive hard forks.

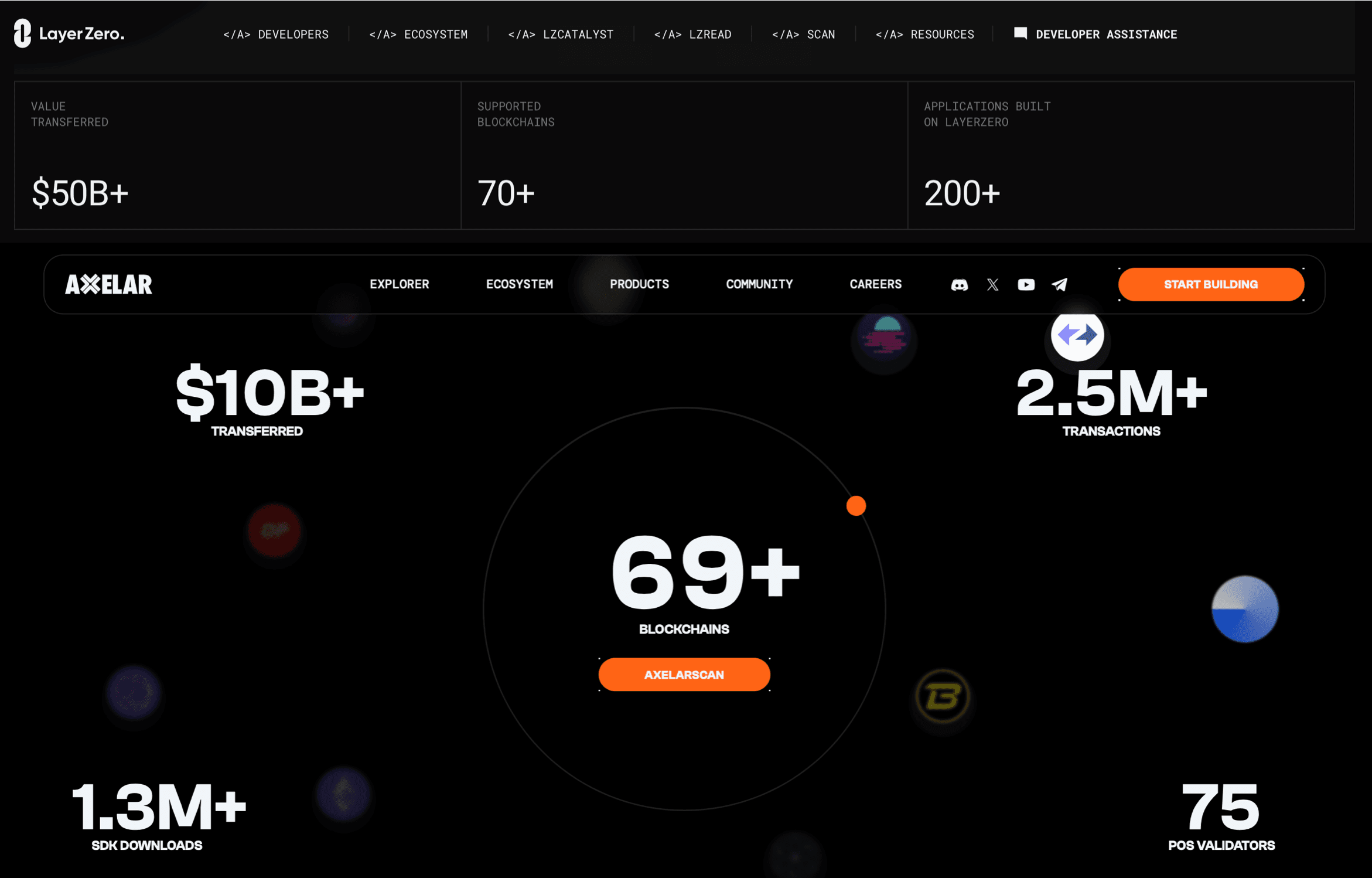

Competition in Interoperability

The blockchain interoperability space is becoming increasingly competitive with established players like Axelar and LayerZero already gaining significant traction. Analog must carve out a unique position to differentiate itself from these projects.

Both Axelar and LayerZero Have Some Impressive Adoption Metrics

Both Axelar and LayerZero Have Some Impressive Adoption MetricsWhile Analog’s Proof-of-Time (PoT) consensus mechanism and event-driven approach are innovative, they must demonstrate clear advantages over existing solutions in real-world applications to gain widespread adoption and trust.

Security Risks

Cross-chain platforms are inherently complex, and security remains a critical challenge. For Analog, its General Message Passing (GMP) protocol and cross-chain functionality must remain secure against potential exploits, such as fraudulent transaction relays or compromised nodes.

Although Analog’s architecture offers the potential to replace traditional cross-chain bridges—which have suffered some of the largest exploits in crypto history—its security claims will ultimately be tested over time.

Closing Thoughts

Analog is an ambitious project aiming to redefine blockchain interoperability through its innovative technology stack. By introducing unique solutions such as the Proof-of-Time (PoT) consensus mechanism and the General Message Passing (GMP) protocol, Analog provides a fresh approach to connecting fragmented blockchain ecosystems.

While the project has demonstrated strong testnet performance and attracted a decent amount of DApp development, its relatively recent mainnet launch means that Analog’s adoption is still in its early stages. The protocol also has yet to prove itself, particularly in terms of security.

If it succeeds, Analog could become a cornerstone of the multi-chain future, providing the foundation for truly interconnected decentralised applications—making it a project well worth keeping an eye on.