Navigating the crypto world can be as puzzling as decoding a Christopher Nolan film plot, but fear not! Let's break it down. Proof-of-Stake (PoS) is a key concept that not only helps you earn rewards but also secures the blockchain. It's like a bustling city where everyone's effort ensures safety and efficiency.

PoS is the green solution for blockchain security, unlike energy-draining Proof-of-Work (PoW). By staking your tokens, you validate transactions and earn rewards, just like interest on a savings account. But here's the kicker: it boosts security and decentralization too!

Enter liquid staking, a game-changer in the crypto space. Liquid staking takes the concept of staking to the next level by allowing you to stake your assets while keeping them liquid and accessible. Imagine having the ability to earn rewards from staking your assets while still being able to trade or use them as needed.

Ankr Staking is one of the platforms in the still-nascent liquid staking vertical.

In this Ankr Staking review, we embark on a journey through the world of crypto staking, exploring Ankr's innovative platform and its myriad features.

Ankr Staking Review Summary

Ankr Staking is your ticket to participating in proof-of-stake networks and earning rewards. With its user-friendly platform, Ankr makes staking accessible to everyone, from crypto newbies to seasoned pros. The platform boasts robust security measures and a focus on decentralization, ensuring your assets are in safe hands.

The Key Features of Ankr Staking Are:

- User-Friendly Interface: Ankr’s platform is as easy as pie, perfect for beginners and pros alike.

- Wide Range of Supported Assets: Stake various cryptocurrencies, including Ethereum (ETH), Binance Coin (BNB), and Polygon (MATIC).

- Liquid Staking: You have the flexibility of staking while keeping your assets liquid. Trade or use them in DeFi protocols without breaking a sweat.

- Secure and Decentralized: With top-notch security measures and decentralized validator nodes, your assets are safe and sound.

- Yield: You can earn competitive rewards and maximize your returns. Ankr's efficient validator selection ensures optimal performance.

- Comprehensive Analytics: Keep tabs on your staking performance with detailed metrics and insights.

What is Ankr Staking?

Ankr is a liquid staking platform that aims to make DeFi participation more user-friendly and efficient, allowing users to easily participate in PoS networks without the need for extensive technical knowledge or resources. Ankr bridges traditional finance and the burgeoning world of DeFi.

Ankr liquid staking addresses the liquidity and capital efficiency challenges associated with traditional staking. Unlike locked-up assets in staking, liquid staking provides instant access to liquid staking tokens, maintaining a 1:1 ratio with the staked assets. These portable tokens, like ankrMATIC and ankrETH, offer flexibility to utilize them in DeFi platforms for additional rewards or instant swapping for other assets.

The key benefits of Ankr liquid staking include:

- Low commitment costs

- Immediate liquidity access

- Risk transfer to Ankr experts

Traditional staking can be complex and requires technical know-how. This is where Ankr steps in, waving its magic wand of simplicity. With Ankr, you can easily stake various cryptocurrencies. Ankr does the heavy lifting, automating validator selection and ensuring your assets are staked securely.

Ankr is a Liquid Staking Platform That Aims to Make DeFi Participation More User-Friendly. Image via Ankr

Ankr is a Liquid Staking Platform That Aims to Make DeFi Participation More User-Friendly. Image via AnkrImagine trying to assemble IKEA furniture without instructions — confusing, right? Ankr makes staking as easy as following a step-by-step guide. Here’s how:

- Automated Validator Selection: Ankr’s system picks the best validators for your assets, ensuring optimal performance and minimizing risks.

- Liquid Staking: This feature allows you to stake your assets while keeping them liquid. You can trade or use your staked tokens in various DeFi protocols. Think of it like having a backstage pass that lets you roam freely and still enjoy the main event.

- Comprehensive Analytics: Ankr provides detailed performance metrics and analytics so you always know how your staked assets are performing. This transparency helps you make informed decisions and optimize your staking strategy.

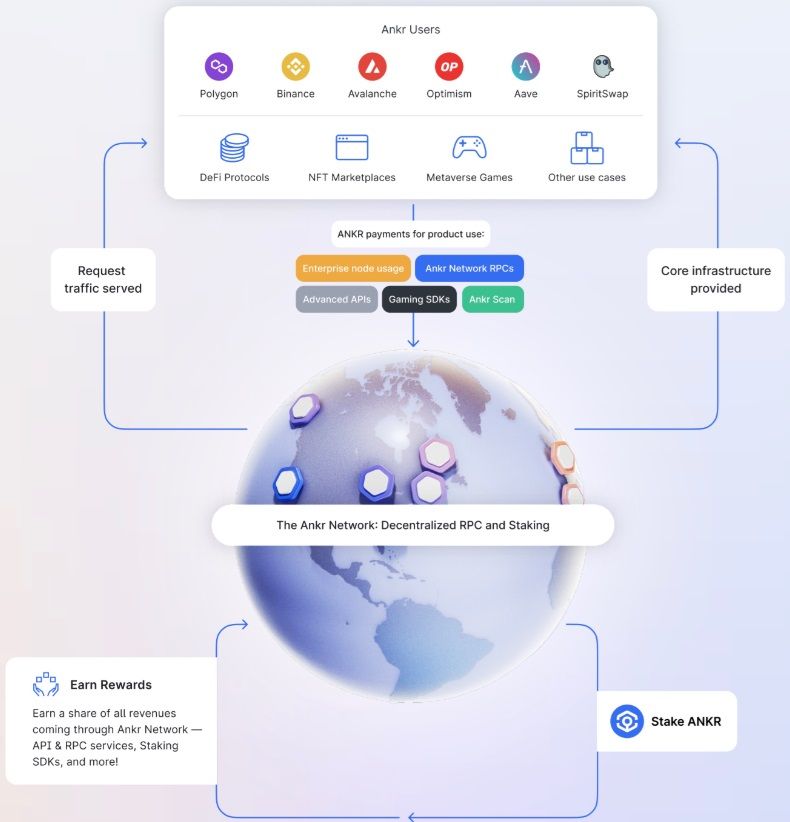

While liquid staking is a significant part of what Ankr does, the platform's offerings extend far beyond. We'll explore some of these in detail later but here's a sampling:

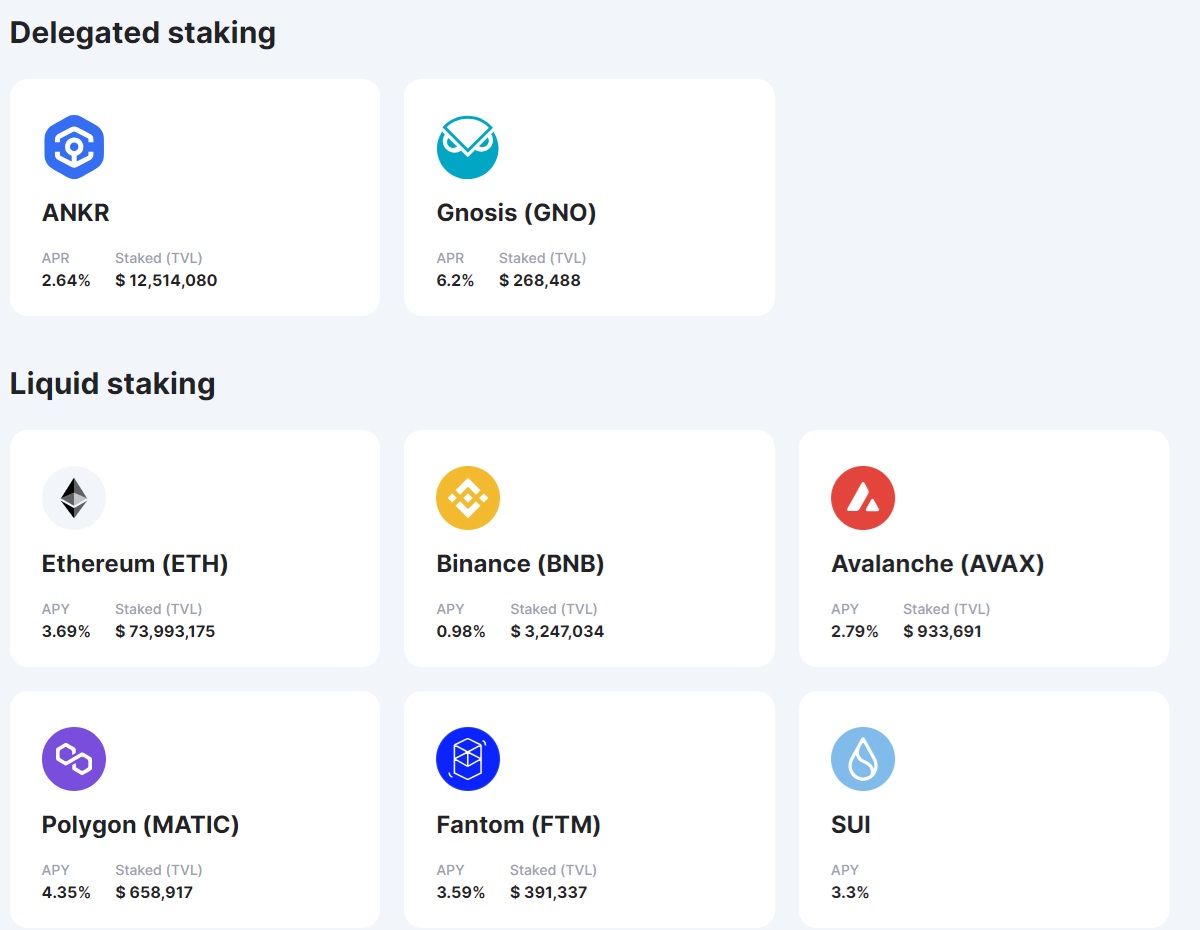

- Delegated Staking: Delegated staking expands upon liquid staking by enhancing decentralization and transparency. Users can choose from a broader range of validators, while validators have the flexibility to offer incentives to attract stakers.

- DeFi: Ankr's DeFi platform offers a comprehensive cross-chain dashboard featuring trading and yield opportunities for liquid sStaking tokens and assets across various platforms. This integration provides users with access to a diverse range of financial activities within the decentralized finance ecosystem.

- Bridge: Ankr Bridge facilitates seamless asset bridging between different networks, enabling users to transfer their liquid staking tokens to platforms offering attractive yield opportunities. The bridge is fortified with ECDSA cryptography and a Threshold Signature Scheme, ensuring enhanced security and protection of private keys.

- Switch: Ankr Switch enables the exchange of liquid staking tokens, allowing users to switch between reward-earning tokens and reward-bearing tokens for the same asset. This feature enhances flexibility and optimizes reward maximization strategies for users.

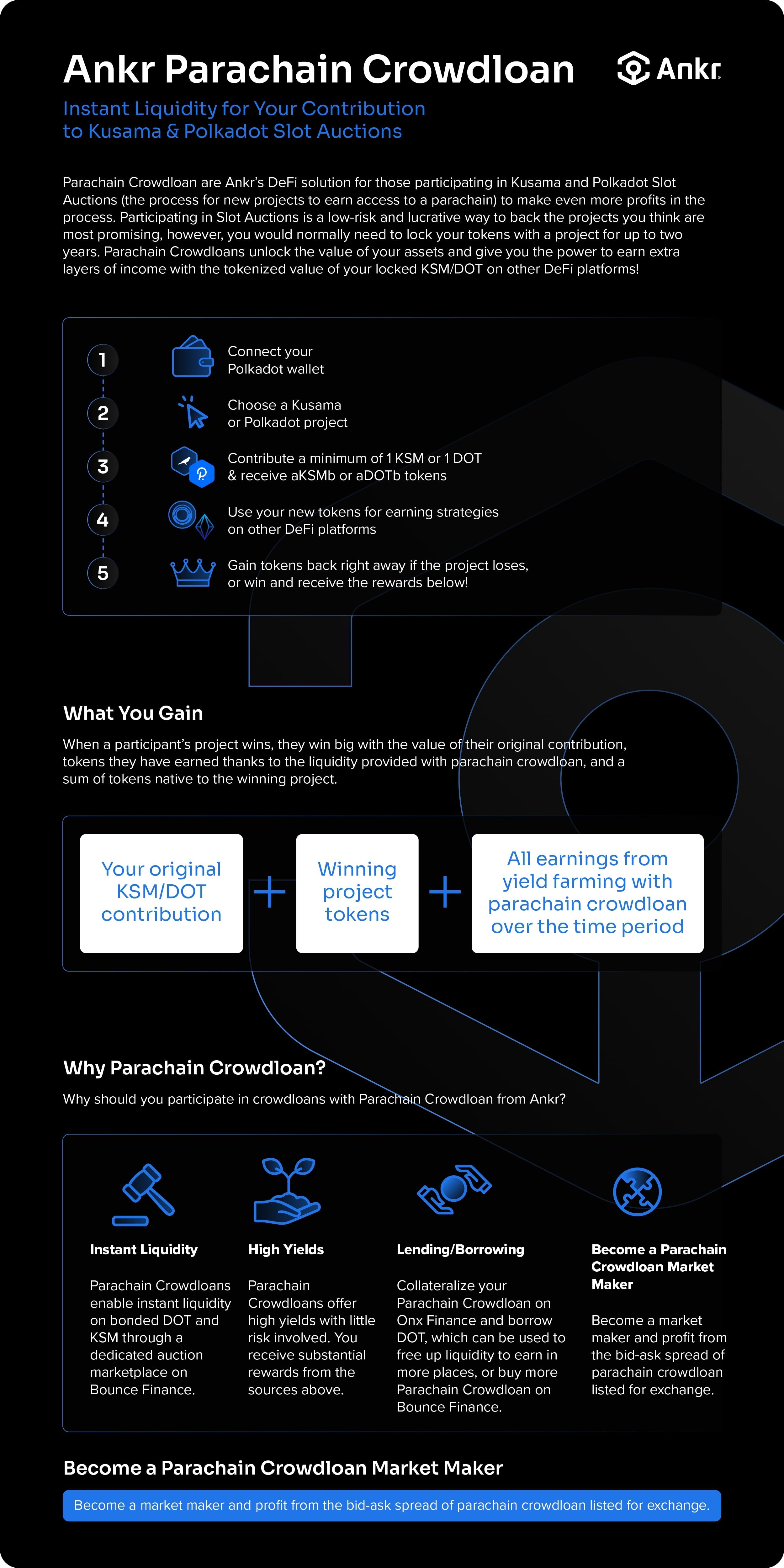

- Parachain Liquid Crowdloan: Parachain Liquid Crowdloan offers benefits similar to traditional staking, allowing users to bond DOT or KSM to a Polkadot project during a Parachain Slot Auction. While the bonded assets remain inaccessible until the project wins a slot, users can obtain instant liquidity through Parachain Liquid Staking tokens, which can be used elsewhere. Token rewards from the winning project are automatically distributed to Parachain Liquid Crowdloan token holders.

- Ankr's Mirage Gaming Platform: Mirage gaming platform offers a comprehensive suite of solutions for developing, enhancing, and publishing Web3 games. By leveraging SDKs, developers can seamlessly integrate with the platform, enabling their games with powerful Web3 capabilities. Gaming SDKs support interaction with all the EVM-compatible blockchains.

- Ankr Verify: This is an identity verification solution for Web3, elevating Single Sign-On convenience to the blockchain level. It operates across all blockchain networks.

How Ankr Staking Works

Imagine you’re gearing up for a major concert. The stage is set, the lights are dazzling, and the crowd is buzzing with anticipation. Now, think of Ankr Staking as the event organizer who ensures everything runs smoothly, making it effortless for you to enjoy the show (or, in this case, stake your cryptocurrency of choice).

Let’s dive into the mechanics of how Ankr Staking works.

Understanding Validator Nodes: The Guardians of the Blockchain

Validator nodes are the unsung heroes of the blockchain world. They play a crucial role in validating transactions and maintaining the integrity of the blockchain, much like vigilant security guards at a VIP event. To become a validator node, you need to meet certain requirements, such as holding a minimum amount of a cryptocurrency and having reliable hardware and internet connection. Ankr simplifies this process by selecting the best validators for you, ensuring optimal performance and minimizing risks.

Delegating Your Ankr Tokens: Making Staking Effortless

Delegation in staking is like having a personal assistant who handles all the technicalities. When you delegate your Ankr tokens, Ankr’s system takes over, automating the selection and monitoring of validator nodes. This ensures your assets are staked with the best validators, maximizing your rewards.

Liquid Staking with Ankr: Flexibility at Its Best

Liquid staking allows you to stake your assets while maintaining liquidity, meaning you can trade or use your staked tokens in DeFi protocols without unbinding them. This flexibility maximizes the utility of your staked assets. Liquid staking tokens provide liquidity to otherwise locked assets, making your crypto investments more versatile and efficient. Unlike traditional staking, where assets are locked, liquid staking offers the best of both worlds, much like having your cake and eating it too.

Ankr Staking Review: Features

When it comes to staking, Ankr has rolled out the red carpet, offering a range of features that cater to both novice users and seasoned crypto enthusiasts. Let’s dive into the features of Ankr Staking.

Liquid Staking

This is Ankr's bread and butter.

Liquid Staking addresses the issue of locked liquidity in PoS networks by providing instant liquidity for staked assets through liquid staking tokens. These tokens represent the value of staked assets and are portable and accessible, allowing for various utilization methods.

By providing liquidity on decentralized exchanges (DEXs), users can earn additional rewards through liquidity mining and receive farming rewards on top of liquidity pool tokens. They can also stake the farmed tokens to increase yield or sell them to generate more yield, creating a compounding effect.

Liquid Staking Addresses the Issue of Locked Liquidity in PoS Networks. Image via Ankr

Liquid Staking Addresses the Issue of Locked Liquidity in PoS Networks. Image via AnkrLiquid Staking is available on the following platforms:

- Avalanche

- Binance

- Polkadot

- Ethereum Mainnet

- Fantom

- Polygon (on both Ethereum and Polygon)

Liquid Staking tokens, such as ankrAVAX, are automatically issued when assets like ETH, AVAX, or FTM are staked, enabling users to participate in liquidity pools and maximize their yield.

Delegated Staking

ANKR token staking introduces a market mechanism to solidify Ankr Network's decentralized node marketplace, aligning developers, node providers, and ecosystem supporters. With smart contracts audited for security, ANKR token staking enables anyone to stake tokens to full nodes, earning rewards and becoming "Ankr Bankrs."

ANKR Token Staking Allows Individuals to Stake Directly to Full Nodes. Image via Ankr

ANKR Token Staking Allows Individuals to Stake Directly to Full Nodes. Image via AnkrANKR token staking revolutionizes the concept of staking by allowing individuals to stake directly to full nodes, rather than validator nodes, for the first time. This opens up the opportunity for anyone to earn ANKR rewards and become an "Ankr Bankr" by participating in the decentralized network.

Ankr says its native token staking is essential for the network to ensure reliable and high-quality node providers to serve RPC requests on supported blockchains. Each node provider requires a significant deposit of ANKR to back their operations, including self-staking.

Additionally, ANKR token staking allows community members to signal support for node providers by delegating ANKR tokens to their nodes. This active involvement helps in identifying reputable and performant service providers, leading to a boost in reputation. In return for staking ANKR, token holders receive rewards from the supported node providers.

While the ANKR staking pool may eventually have a capped size, the initial pool remains uncapped, with plans for expansion. This variability may affect the Annual Percentage Yield (APY) for the initial phase of ANKR staking.

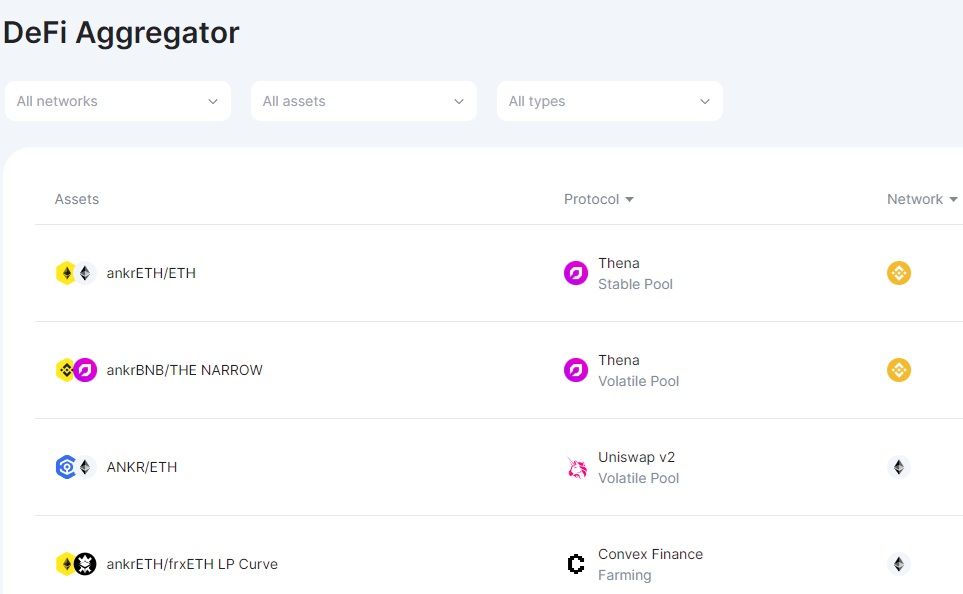

DeFi and Bridge

Ankr DeFi Trade is a liquid staking data aggregation tool that offers real-time trading prices for users. It enables access to various liquidity-staking DeFi integrations, allowing users to trade between liquid staking tokens and other assets. These tokens, such as ankrETH, are obtained when users stake their assets, like ETH, on Ankr Staking.

Ankr DeFi Trade is a Liquid Staking Data Aggregation Tool. Image via Ankr

Ankr DeFi Trade is a Liquid Staking Data Aggregation Tool. Image via AnkrAnkr DeFi simplifies access with a cross-chain dashboard, offering users the convenience of selecting liquid staking tokens and assets for trading, along with a choice of trading platforms.

Bridge

Ankr Bridge facilitates asset bridging between networks. It enables users to transfer their Ankr liquid staking tokens to another network while retaining their validity as a stake, thus allowing continued accumulation of rewards. These tokens are obtained when staking original assets.

Ankr Bridge currently supports the following native Ankr liquid tokens and allows you to transfer them between these networks:

aMATICb

- Ethereum–Polygon–Ethereum

- Ethereum–BNB Smart Chain–Ethereum

- Polygon–BNB Smart Chain–Polygon

ankrMATIC

- Ethereum–Polygon–Ethereum

aETHb

- Ethereum–BNB Smart Chain–Ethereum

ankrETH

- Ethereum–BNB Smart Chain–Ethereum

Ankr said it's planning to add support for BNB, FTM and AVAX soon.

Switch

Ankr Switch is a product designed for converting reward-bearing tokens to reward-earning tokens of the same asset type. For instance, it allows users to switch from tokens like aETHb to ankrETH.

Reward-bearing tokens, such as ankrETH, are issued to users by Ankr Staking when they stake their assets. These tokens maintain a 1:1 ratio to the staked assets and represent the value of the original asset, like ETH, over time. Staking rewards accumulate within these tokens, causing them to increase in value relative to the original asset. However, the number of issued reward-bearing tokens remains constant. When redeeming the stake, users receive their staked original assets along with the accumulated staking rewards.

Ankr Switch currently supports switching:

- aAVAXb –>ankrAVAX

- aBNBb –>ankrBNB

- aETHb –>ankrETH

- aFTMb –>ankrFTM

- aMATICb –>ankrMATIC

Parachain Crowdloan

The Parachain Crowdloan feature lets you support new projects by participating in crowdloans. By contributing your tokens, you help these projects secure a slot on the network and, in return, receive rewards. This feature is a win-win, supporting innovation while offering returns on your investment.

Parachain Crowdloan Lets You Support New Projects on Networks like Polkadot. Image via Ankr

Parachain Crowdloan Lets You Support New Projects on Networks like Polkadot. Image via AnkrHere's how it works:

- Contribute DOT or KSM to a preferred project's Parachain crowdloan.

- DOT or KSM gets allocated to the project's crowdloan via Polkadot.js wallet through Ankr Staking.

- The project uses the contributed DOT or KSM to participate in the Parachain Slot auction.

- If the project wins a Parachain slot, contributors can claim Parachain Liquid Crowdloan tokens (e.g., aDOTp/aKSMp - Project Name).

- These tokens are ERC-20 tokens with claimable rewards throughout the lease period, calculated based on proof of time.

Ankr charges a 5% fee on distributed rewards, with 2% going to Ankr’s corporate treasury and 3% to its buyback program. Parachain Liquid Crowdloan token holders can sell on Bounce Finance auction marketplace or collateralize them to borrow DOT on ONX Finance for liquidity.

Parachain Liquid Crowdloan offers benefits beyond liquidity and addresses the capital inefficiency inherent in Parachain slot auctions. By participating in Parachain Liquid Crowdloan, token holders gain access to liquidity, higher rewards, and lending/borrowing opportunities.

Rewards are expected to be notably higher than traditional staking due to the illiquidity risk of bonding KSM/DOT for extended periods. Additionally, there's an opportunity to engage as a DeFi Parachain Crowdloan Market Maker, estimating fair token values and earning revenue from bid-ask spreads.

Verify

Ankr Verify is a Web3 identity verification solution that enhances Single Sign-On by integrating with blockchains. It operates across all blockchain networks. Unlike traditional KYC methods, Ankr Verify employs zero-knowledge cryptography, ensuring data privacy while meeting regulatory requirements.

Ankr Verify serves both regular Web3 users and enterprises.

- For users, it provides a centralized platform to verify personal credentials, secure access to various chains and decentralized applications (dApps), private experiences on Web3 apps, and swift onboarding across platforms.

- Enterprises benefit from trustless user verification, easy integrations across different blockchain networks, customizable permissions for dApps, and compliance with KYC requirements across jurisdictions.

Scaling with Ankr

As the blockchain world expands, scalability becomes crucial for maintaining network efficiency and user satisfaction. Ankr tackles this challenge with solutions like rollups and sidechains. Let’s dive into how these technologies work and why they are essential for the future of blockchain.

Rollups: The Express Lane of Blockchain Transactions

Ankr's Rollups as a Service (RaaS) provides developers with efficient tools for building scaling solutions like sidechains and rollups across various blockchain ecosystems. By integrating decentralized infrastructure with financial incentives through liquid staking, Ankr offers a sustainable development experience. This addresses the demand for scalable, Ethereum-secure projects.

Rollups are a Layer 2 scaling solution designed to enhance the throughput of blockchain networks. Think of rollups as express lanes on a congested highway, allowing more transactions to be processed quickly and efficiently.

- Batching Transactions: Rollups aggregate multiple transactions off-chain and then submit them as a single batch to the main blockchain. This process drastically reduces the data load on the main chain, akin to reducing traffic by carpooling.

- Increased Efficiency: By processing transactions off-chain, rollups enhance the blockchain’s scalability, allowing it to handle more transactions per second. This efficiency boost is like adding more lanes to a highway, ensuring smoother traffic flow even during peak hours.

- Security and Transparency: Despite being processed off-chain, rollups maintain the security and transparency of the main blockchain. They periodically post transaction data and proofs to the main chain, ensuring all transactions are verifiable and tamper-proof.

Rollups work behind the scenes to ensure your blockchain experience is seamless and efficient, enabling faster transactions with lower fees.

Key offerings include:

- Infrastructure and Scalability: Leveraging its globally-distributed bare-metal and cloud infrastructure along with a network of elite node providers, Ankr ensures scalability for Rollup-centric projects, handling trillions of transactions annually.

- End-to-End Support and Customization: Ankr provides design, engineering, customization, and maintenance services tailored to specific project requirements, covering everything from deployment to financial incentives.

- Architecture Flexibility: As an approved implementation partner with entities like Optimism and Polygon, Ankr offers specialized solutions for different blockchain ecosystems, fostering a more interconnected Web3 environment.

- Liquid Staking and Financial Incentives: Integrating liquid staking technology, Ankr allows developers to use ankrETH for gas fees while providing staking rewards for token holders, reducing operational costs and enabling new revenue streams.

- Comprehensive Developer Tools: Ankr's RaaS solution includes blockchain engineering, rollup infrastructure, development tools, and security auditing, streamlining development and launch processes for projects.

To learn more, you can head over to Ankr docs.

Sidechains

If rollups are the express lanes, sidechains are like parallel roads that alleviate traffic from the main highway. Sidechains are independent blockchains that run alongside the main chain, offering additional capacity and specialized functionality. Here are a few main features:

- Enhanced Scalability: Sidechains increase the overall capacity of the network by offloading transactions from the main chain. This is akin to building new roads to reduce congestion on the primary highway, ensuring a smoother and more efficient travel experience.

- Customizable Features: Each sidechain can be tailored to support specific applications or use cases. For instance, a sidechain might be optimized for faster transaction speeds, lower costs, or specific smart contract functionalities. It’s like having different roads designed for cars, bikes, and pedestrians, each optimized for their unique needs.

- Interoperability: The two-way peg system ensures seamless interaction between the main chain and sidechains. This interoperability allows for the fluid movement of assets and data, enhancing the versatility and usability of blockchain technology.

The sidechains-as-a-service is a framework offered by Ankr that enables the creation of sidechain products across different ecosystems using pre-built components. This framework provides developers and node operators with infrastructure to build and operate their own blockchains quickly, tailored to their specific needs, while maintaining connectivity with relevant Mainnets. Ankr Sidechains allow developers to launch their blockchain within hours, complete with unique specifications and validator sets, and connect it to the corresponding mainnet infrastructure.

The following ecosystems are supported for the sidechain solutions:

- Avalanche

- Binance

- Polygon

The Ankr Advantage: Leveraging Rollups and Sidechains

Ankr leverages both rollups and sidechains to enhance its scaling services. Here’s how:

- Increased Transaction Throughput: By incorporating rollups, Ankr ensures that transactions are processed quickly and efficiently, reducing wait times and lowering fees. This is particularly beneficial for users engaging in DeFi activities.

- Scalability for Growth: With sidechains, Ankr can support a growing number of users and transactions without compromising performance. This scalability is crucial for accommodating the increasing adoption of blockchain technology and the expanding ecosystem of DApps and services.

- Enhanced Flexibility: The use of sidechains allows Ankr to offer customized solutions tailored to specific use cases, providing users with more options and better performance. Whether it’s faster transactions or lower costs, Ankr’s sidechains can deliver the flexibility needed to meet diverse user needs.

Security Considerations for Ankr Staking

Let’s take a moment to consider an essential aspect — security. Staking your assets can feel a bit like putting your money on the line in a high-stakes game, but with the right precautions and a reputable platform, you can mitigate the risks and ensure your assets remain safe.

Choosing a reputable staking platform is crucial for safeguarding your assets. Ankr has established itself as a trustworthy and secure platform, employing various measures to protect users' investments. Here’s how Ankr ensures your assets are safe:

- Robust Security Measures: Ankr uses both on-chain and off-chain security protocols to protect staked assets. This includes advanced encryption techniques and decentralized validator nodes to eliminate single points of failure. Think of Ankr’s security as a fortress with multiple layers of defence.

- Regular Audits and Updates: Ankr conducts regular security audits and updates its protocols to address potential vulnerabilities, ensuring the platform remains secure against emerging threats.

To further secure your assets, follow these best practices:

- Use Hardware Wallets: Store your private keys offline in a hardware wallet. It’s like keeping your valuables in a high-tech safe. Head over to our top picks for the best hardware wallets to choose one.

- Keep Your Private Keys Private: Never share your private keys with anyone. They are the keys to your vault – keep them secure.

- Regularly Update Your Software: Ensure your wallet and related software are up-to-date to protect against known vulnerabilities.

Potential Risks of Slashing

One unique risk associated with staking is slashing — a penalty imposed for validator misconduct. Here’s what you need to know:

- Explanation of Slashing Penalties: Slashing serves as a deterrent against bad behaviour among validators. If a validator misbehaves by validating incorrect transactions, going offline for extended periods, or attempting to attack the network, they can be slashed. This means a portion of the staked assets is forfeited as a penalty. Slashing helps maintain the network's integrity, much like fines and penalties deter illegal activities in the real world.

- Minimizing Slashing Risks: Ankr minimizes slashing risks through its rigorous validator selection process. Ankr’s system automatically selects the best validators based on performance and reliability, reducing the likelihood of your assets being delegated to at-risk validators. Continuous monitoring and a focus on validators with a strong track record further reduce slashing risks.

Despite these measures, users need to understand that slashing can still occur, and it's a risk inherent in the staking process. By staying informed about how Ankr manages these risks and following best practices for security, you can better protect your staked assets.

Ankr Staking Fees

Delegated staking with Ankr involves a technical service fee, which is deducted from your staking rewards. This fee covers the operational costs of managing and maintaining the validator nodes.

Staking Fees

- ANKR: Only the network gas fee is applied.

- GNO (Gnosis): A 30% fee is deducted from the staking rewards in addition to the network gas fee.

Unstaking Fees

- For both ANKR and GNO, only the network gas fees are applicable.

Liquid Staking Fees

The convenience of liquid staking comes with its own set of fees, which are also deducted from your staking rewards.

Staking Fees

- AVAX (Avalanche): 10% of the staking reward plus the network gas fee.

- BNB (Binance Coin): 10% of the staking reward plus the network gas fee.

- DOT (Polkadot): 10% of the staking reward plus the network gas fee.

- ETH (Ethereum): 10% of the staking reward plus the network gas fee.

- FTM (Fantom): 15% of the staking reward plus the network gas fee.

- MATIC (Polygon): 5% of the staking reward, whether on Ethereum or Polygon, plus the network gas fee.

Unstaking Fees

- AVAX, BNB, DOT, and FTM: Only the network gas fees apply.

- FTM: Includes a burn fee, which is calculated based on current liquidity and the amount to be unstaked, deducted by the FantomPool smart contract.

- MATIC: Only the network gas fees apply.

Impact on Returns

While Ankr's fees are competitive, it's important to understand that they can still impact your overall returns, especially for liquid staking. The technical service fees and network gas fees are deducted from your staking rewards, which can reduce your net earnings. For instance, a 10% service fee on staking rewards means you retain 90% of your rewards, and additional gas fees further reduce this amount.

Being aware of these fees helps you make informed decisions about your staking strategy. To maximize returns, consider the fee structure and choose staking options that align with your financial goals. Ankr’s transparent fee system ensures you know the costs upfront, allowing you to plan your staking adventure with confidence.

Ankr Staking Review: Closing Thoughts

Ankr Staking offers a user-friendly experience akin to dining at a top-tier restaurant, catering to both newcomers and seasoned crypto enthusiasts. With features like liquid staking and delegated staking, it ensures accessibility for all users. The platform's robust security measures provide transparency, akin to knowing a restaurant's hygiene standards.

Ankr's use of rollups and sidechains ensures scalability and efficiency, similar to a restaurant expanding to accommodate more guests. While enjoying the benefits, it's crucial to maintain a balanced perspective, understanding the associated risks.

Overall, Ankr Staking provides a well-rounded platform for maximizing staking rewards and exploring the world of crypto investments with confidence.