With a history stretching back to 2006, and operations all around the world, AvaTrade is one of the best-known online forex and CFD brokers. In fact, they were one of the very first online forex brokers, and have been delivering excellent service and trading conditions since day one.

While you might want to try the newest broker, the facts are that length of time in business is a good way to judge the safety and trustworthiness of an online broker. AvaTrade has one of the best reputations in the business, and can be trusted fully for a number of reasons, not least of which is their established reputation.

Traders also feel very comfortable trading with AvaTrade, thanks to their regulation by nine different regulating bodies. While some brokers fail to achieve even one proper regulatory relationship, AvaTrade is regulated by nine different bodies, providing protections to its clients all around the world.

Avatrade Overview

Adding to the credibility of the AvaTrade platform is the steady expansion the broker has achieved. Going from nothing when it was launched in 2006, AvaTrade now boasts over 300,000 clients globally, and over 3 million trades conducted each month on its platforms. And as the broker grows they continue to give back to their clients, adding features such as AvaSocial and AvaProtect.

While the global headquarters of AvaTrade is in the republic of Ireland, the broker also has a number of other entities that make up its corporate structure. These entities are spread across the globe and correspond to the broker’s normal geographical bases of operations.

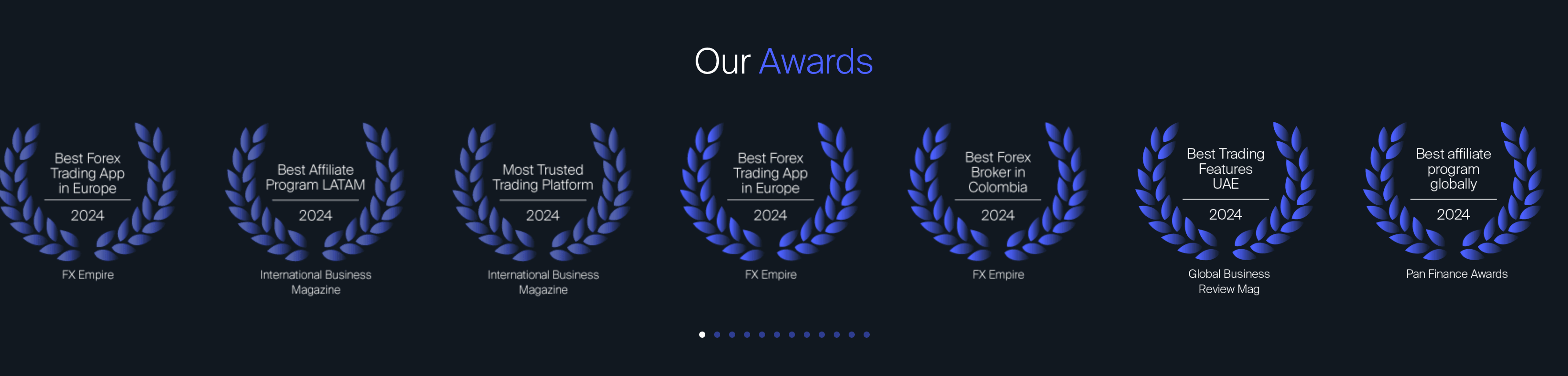

Avatrade Awards. Image via Avatrade

Avatrade Awards. Image via AvatradeAs such Avatrade is regulated in Europe, Australia, Japan, British Virgin Islands, UAE and South Africa. Plus, AvaTrade is the very first forex broker to receive a 3A license in Abu Dhabi which allows them to offer both retail and professional trading services.

Prospective AvaTrade clients will also be impressed by the range of assets available. There are no less than 1,250 individual assets available, which includes more than 50 different forex pairs, 17 CFDs on commodities, equity indices, bonds, ETFs, cryptocurrencies, and over 500 individual share CFDs. And unlike nearly all its peers in the online forex and CFD space AvaTrade also offers trading in options on forex pairs.

Below we go into further detail on all that AvaTrade has to offer so you can make your own decision as to whether or not you want to trade through AvaTrade.

Regulation and Security

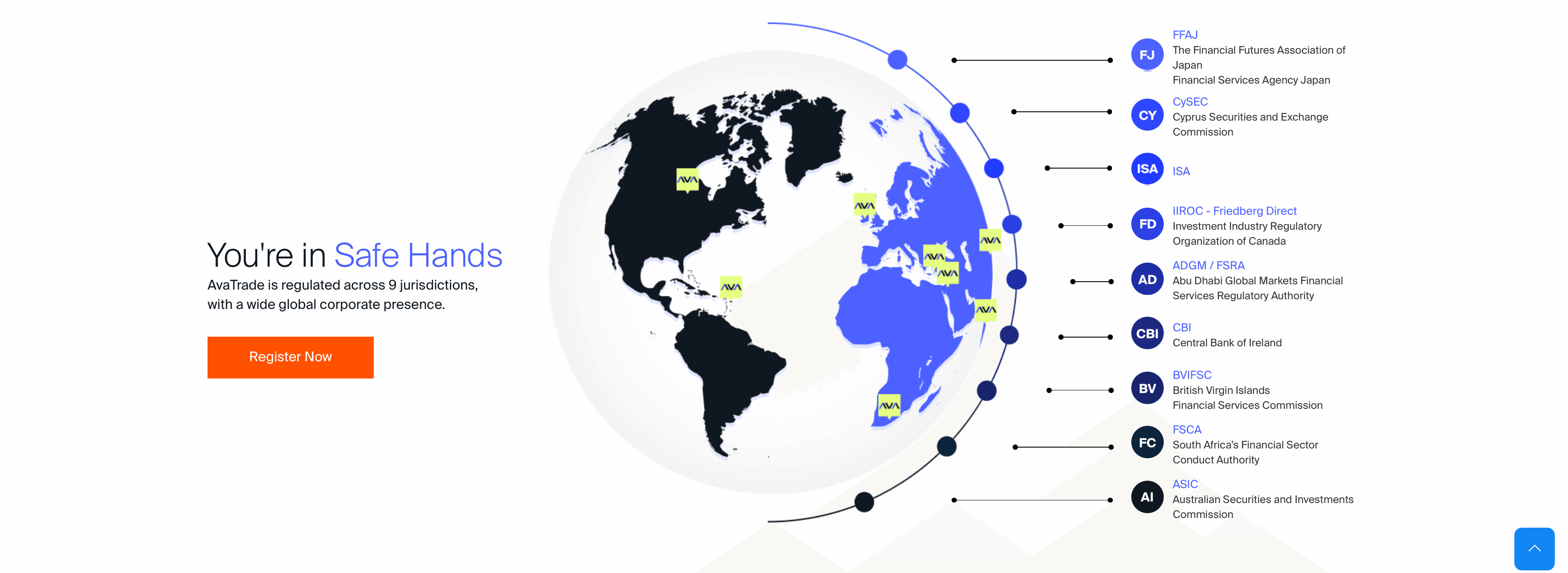

AvaTrade enjoys some of the strongest regulatory oversight you’ll find in the online forex and CFD universe. Its various corporate entities are regulated across nine different jurisdictions as you can see below:

Regulated in six major global jurisdictions. Image via Avatrade.com

Regulated in six major global jurisdictions. Image via Avatrade.com Thus AvaTrade is based in the European Union through its corporate structure in Ireland, as well as Australia, Japan, South Africa, Abu Dhabi, and the British Virgin Islands.

While it is unusual for a forex or CFD broker to be headquartered in the Republic of Ireland, we believe this is actually far superior to most of the other locations you’ll find for these types of operations. Ireland not only provides access to all of the European Union, it also has a very high degree of regulation and infrastructure for financial services companies. Australia is also very well regulated with a strong financial services infrastructure.

And AvaTrade has been able to establish itself in Japan, which is also very well regulated, and not a country that most online brokers have been able to establish themselves in. Finally there is the setup in Abu Dhabi, which is the latest for AvaTrade and which allows for both retail and professional trading, a first for an online forex broker located in this jurisdiction.

Having such a setup allows AvaTrade to differentiate its product offerings depending on the jurisdiction where its traders are located. Laws and regulations for forex and CFD brokers are vastly different in the European Union and the Middle East, and the same goes for other jurisdictions.

Having an entity specifically tailored to various jurisdictions makes trading easier and more seamless for clients. And the fact that AvaTrade has been able to secure so many licenses and regulatory approvals just goes to show what a secure trading experience can be expected for clients.

Multiple regulatory jurisdictions increases the safety of trading with AvaTrade. Image via Avatrade.com

Multiple regulatory jurisdictions increases the safety of trading with AvaTrade. Image via Avatrade.com Regulation in Australia and Ireland (covers the entire EU) provides clients with additional investor protection schemes. In Ireland clients are protected by the Investor Compensation Company, which protects deposits up to €20,000.

And in Australia ASIC is able to refund deposits up to AUD$250,000 at deposit taking institutions. It is presumed that AvaTrade falls under this definition, but there is no precedent for applying this protection to forex or CFD brokers, making it unclear whether or not this protection applies to AvaTrade.

And all of the clients who operate through AvaTrade EU Limited are protected by negative balance protection. And to provide further assurances, AvaTrade has gone so far as to extend this negative balance protection to ALL its clients globally, whether or not they would be granted this protection by their local regulations. This means all clients are protected from any potential events that would cause extreme and unexpected market movements.

Fees

If regulation and security is an important consideration when choosing an online forex and CFD broker, then fees are probably just as important for most traders. High fees can really eat into profits, while low fees help the trader maintain a positive account balance.

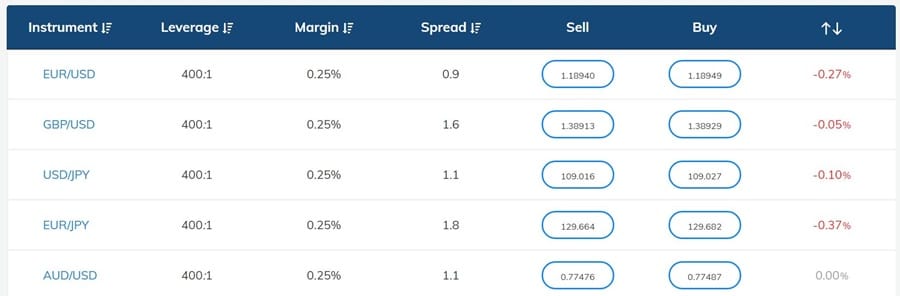

The top area to consider when looking at fees will be the trading fees, and for AvaTrade this specifically means the spreads offered by the broker. AvaTrade does not charge any commissions on their trades, so spreads are the top consideration when opening or closing a trade at AvaTrade.

We found that the average round trip spread when trading the EUR/USD is 0.9 pips. Of course these spreads are based on normal market conditions. Spreads can widen significantly at any broker during periods of extreme market volatility, and the same is true at AvaTrade.

AvaTrade has competitive spreads on all its assets. Image via Avatrade.com

AvaTrade has competitive spreads on all its assets. Image via Avatrade.com That’s just a very small sampling of the spreads at AvaTrade, you can see the complete listing here.

While the spreads on forex pairs is competitive when compared with other brokers, we wondered if the same was true for commodities, cryptocurrencies, and individual stocks.

We were impressed to find that the spread on oil is 0.03 and the spread on gold is 0.34. Both are in-line with the spreads offered at other brokers. Furthermore, the spread on individual stocks is just 0.13% of the nominal trade value.

Overnight Swaps

When considering trading fees we must also consider the cost of overnight financing for any open positions. These overnight financing fees, also known as “swaps” are a charge applied to any position that is open at 22:00 GMT, except during Daylight Savings when the calculation time is switched to 21:00 GMT.

These fees are supposed to be calculated from the intrabank fees, but most retail brokers found online offer rates that are less favorable than the intrabank rates. Overnight swap fees can make swing trading quite expensive, and the fees need to be accounted for when calculating potential profit levels on trades.

At AvaTrade they are totally transparent regarding the overnight swap fees charged. This is unusual in the forex/CFD online broker space, where many brokers keep their swap rates unpublished, or at the least buried deep within their websites or trading platforms.

Be careful about the extra expense added by overnight swap charges. Image via Facebook.com

Be careful about the extra expense added by overnight swap charges. Image via Facebook.com At AvaTrade the overnight financing charge is calculated using the following equation:

Trade Size x End of Day Market Price x Daily Overnight Interest = Daily Overnight Interest Charged/Paid

All interest charges are calculated in the same currency that the actual position is denominated in. It is also worth noting that the AvaTrade platforms will display overnight swap rates in annualized terms.

Finally we consider the miscellaneous charges and fees not related to trading that a client might be charged.

For accounts that have no activity for three months there is an inactivity fee of €/£/$50. This fee is assessed quarterly for as long as the account continues to have no activity. In addition after 12 months of inactivity the account will also become subject to a annual administration fee of €/£/$100. These fees are subject to change, and no fees are assessed against accounts with a balance of €/£/$0.

Overall we’ve found that the fees charged by AvaTrade are average or better than those found across the industry.

Assets Available to Trade

Now that we’ve considered the most important aspects of regulation, safety, and fees we’ll move on to the assets offered by AvaTrade. This is another important consideration, particularly for those who are looking for specific assets to trade.

A new trader might be most interested in the individual forex or stock offerings because this is what they know best and feel most comfortable trading. By contrast a more experienced trader might be most interested in a broker who offers a very broad selection of assets across all the classes. This gives them opportunities no matter which market might be trending most strongly.

At AvaTrade clients get access to all the following assets:

So many assets to choose from. Image via Avatrade.com

So many assets to choose from. Image via Avatrade.com- Forex – Over 55 forex pairs, including major and minor pairs, as well as exotic crosses.

- Commodities – A selection of 17 commodities, including 5 metals, energies, and a selection of soft commodities.

- Indices – A selection of 20 global indices, including several Chinese indices, a green energy index, and a global cannabis index.

- Stocks – More than 500 major individual stocks from the U.S., the U.K., Germany, France, and Italy.

- Options – 42 currency pairs plus options on gold and silver.

- Exchange Traded Funds (ETFs) – 5 major ETFs are available for all clients, while those using the MT5 platform get access to 59 different ETFs.

- Bonds – 2 very major government bonds offered (Euro Bunds and Japanese Government Bonds).

- Cryptocurrencies –16 major cryptocurrencies and cryptocurrency pairs are offered, including Bitcoin versus several currencies, Ethereum, and a Crypto 10 index. (Note residents of the U.K. and Ireland cannot trade on cryptocurrencies)

Overall Avatrade advertises over 1,250 assets available to trade and our investigations shows that the broker does offer all the major assets that most traders will be interested in trading. There could be a larger selection of cryptocurrencies, but the current selection is adequate, particularly with the large leverage available (1:25 for BTC/USD, 1:20 for Ethereum, and 1:10 or 1:5 for most other cryptocurrencies).

Plus, we think it is quite rare to find a CFD broker offering actual options or such a large selection of ETFs. If you need diversification in your trading then AvaTrade should suit you very well

Account Types

Unlike some of the new brokers that offer seven different account tiers, AvaTrade has a limited selection of account types, which will depend upon which branch of the broker you open your account with. Currently accounts are split into two types.

One type is for those residing within the European Union, and the other type is for those residing outside the European Union. This keeps things pretty simple. Also keeping things simple is that all the accounts have a market maker / dealing desk execution.

European Union Accounts

Those residing within the European Union can choose from a Retail Account, a Professional Account, or a Spread Betting Account (only for residents of Ireland and the U.K.).

Retail accounts are of course available for every trader, while the Professional Account has several ESMA regulation requirements to be met is a trader wants to take advantage of the benefits offered to Professional Account holders. In order to qualify for a professional account a trader must meet two of the following three requirements:

- Sufficient trading activity in the last 12 months;

- Relevant experience in the financial services sector;

- Financial instrument portfolio of over €500,000 (including cash saving and financial instruments).

Professionals get higher leverage and better spreads. Image via Avatrade.com

Professionals get higher leverage and better spreads. Image via Avatrade.com The primary benefit of having a Professional Account is access to much greater leverage. ESMA regulations limit retail traders to 1:30 leverage, but Professional Accounts can take advantage of leverage as great as 1:400. In addition, Professional Accounts can take advantage of tighter spreads when compared with the retail accounts.

When comparing the Retail Account with the Spread Betting Account the primary difference is the way that position sizes are measured. Otherwise the costs are the same. Spread Betting Accounts provide significant tax benefits for residents of the Republic of Ireland and the United Kingdom since any profits are exempt from Stamp Duties, Capital Gains Tax, and Income Tax.

For European Union residents, AvaTrade offers a maximum leverage of 30:1 on Forex, 1:20 on indices, 1:10 on commodities, 1:5 for individual stocks and shares and ETFs, and 1:2 on cryptocurrencies.

Non-European Union Accounts

Anyone residing outside the European Union is able to open a Standard Account, or a VIP account if they deposit more than €10,000. The VIP account offers tighter spreads than the Standard Account, but both account types offer leverage as great as 1:400.

More specifically, for residents outside the European Union, AvaTrade offers a maximum leverage of 1:400 on Forex and indices, 1:200 on commodities, 1:20 for individual stocks and shares and ETFs, and 1:20 on cryptocurrencies.

Common Account Features

There are some features that are common to all account types, whether in the European Union or anywhere else in the world. One of these is access to a demo account, which can be used for 21 days to test AvaTrade’s trading conditions, or to test new trading strategies to see if they are profitable. Traders can also speak to their account representative to have the 21 days extended.

There are many benefits to trading through Avatrade. Image via Avatrade.com

There are many benefits to trading through Avatrade. Image via Avatrade.com Also available to all of AvaTrade’s clients is an Islamic Account, which is characterized by the lack of overnight swap charges or payments. These accounts are for Muslim traders who need to comply with Sharia Law.

Anyone can apply for a Vanilla Options Account to trade the options available from AvaTrade.

At AvaTrade there are no commissions charged and all the account types offer variable spreads. In addition all accounts have a minimum deposit of $100, with the exception of the VIP account previously mentioned. All deposits can be made in USD, EUR, GBP, and CHF. Australian residents can also make deposits in AUD.

All of the accounts can choose between the MetaTrader 4 platform and the MetaTrader 5 platform. Options trading can only be performed through the proprietary AvaOptions trading platform.

Plus, every account type offered by AvaTrade is able to take advantage of automated trading, scalping, and hedging. Traders are free to use any of the tools available with the MetaTrader platforms and AvaTrade does not block any of them.

Trading Platforms

At AvaTrade, the platforms used by nearly all traders are one of the two MetaTrader platforms: MetaTrader 4 and MetaTrader 5.

Choose from the powerful MetaTrader 4 or MetaTrader 5 platofrms. Image via Avatrade.com

Choose from the powerful MetaTrader 4 or MetaTrader 5 platofrms. Image via Avatrade.com Considering how popular both MetaTrader 4 and MetaTrader 5 are these platforms are going to be perfect for nearly every trader. I’m just going to describe each briefly because I’m very aware that nearly every trader out there knows MT4 and MT5. Plus, there is a wealth of information already available about these trading platforms. There’s not much I can add to that.

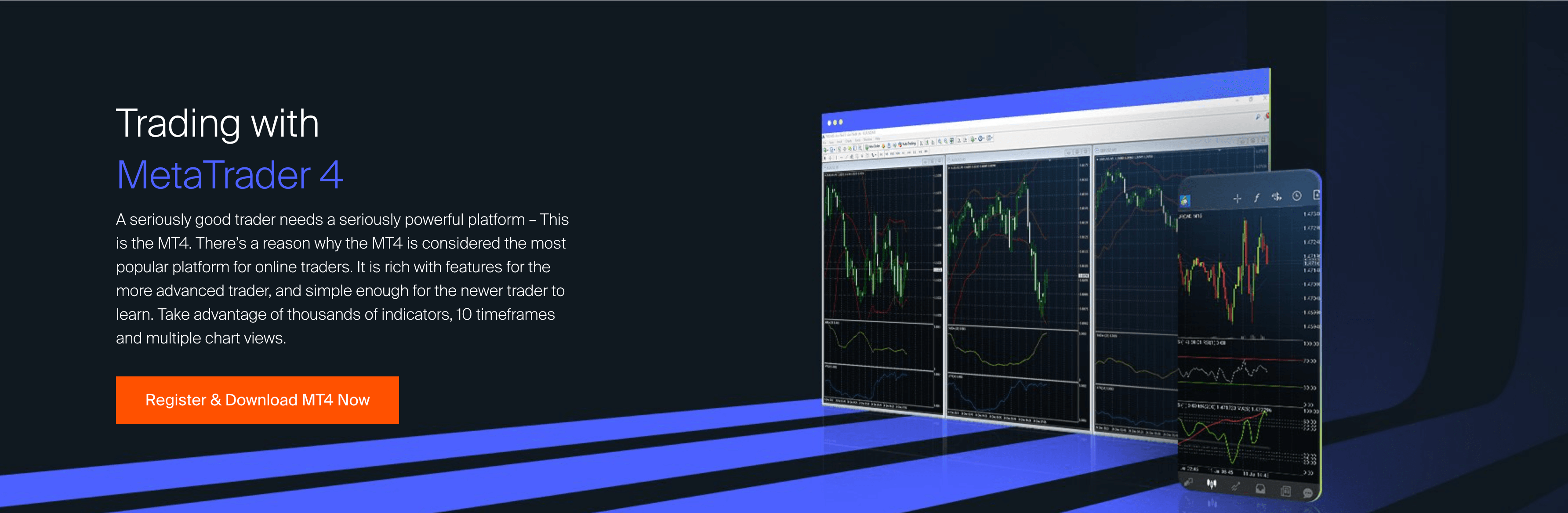

MetaTrader 4

The MetaTrader 4 platfrm was introduced in 2002 and since then it has gained worldwide acceptance and appeal, being downloaded and used by tens of millions of traders. At AvaTrade the MT4 platform is available for desktop systems (Windows PCs only), mobile devices (Android and iOS), or as a web-based platform. It is generally accepted that the PC version is best for trading as it packs the most power and suffers the least glitches.

Possibily the most popular trading platform ever - MetaTrader 4. Image via Avatrade.com

Possibily the most popular trading platform ever - MetaTrader 4. Image via Avatrade.com Even though MT4 is no longer supported by the parent company MetaQuotes it remains one of the most popular trading platforms. Some traders even prefer it over MetaTrader 5, the platform that was created by MetaQuotes to replace MT4.

You can enjoy all the following MT4 features:

- One-click trading

- 9 timeframes

- 3 charts (line, bar, and candlesticks)

- 30 built-in indicators

- 24 graphical objects

- 1 single login across all your devices

- Guaranteed full data backup and security

- 4 pending order types

- Back testing of strategies

- Trade history information

- Micro lots available

- Internal mailing system

- News streaming

- Built-in MT4 and MQL4 guides

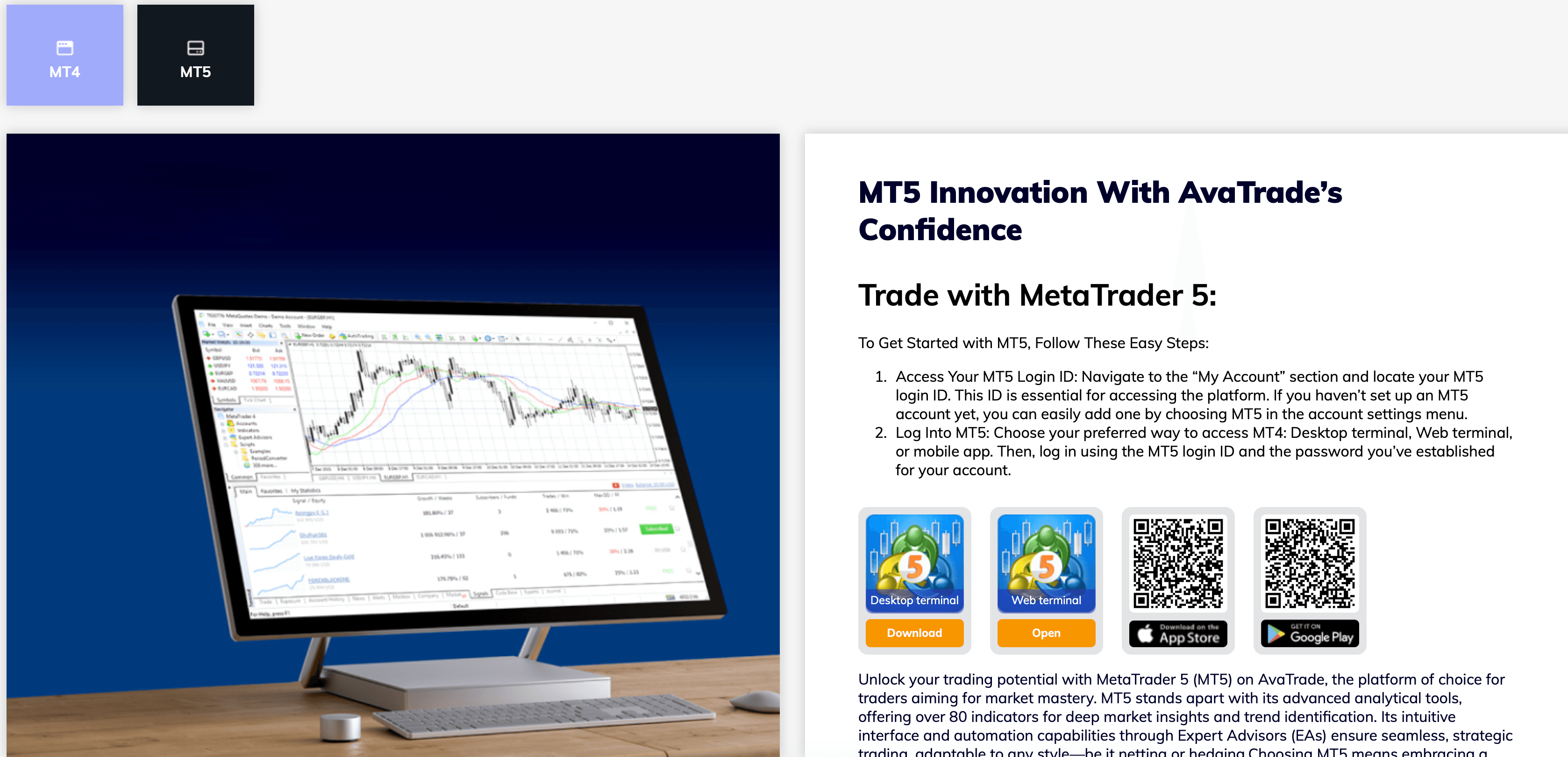

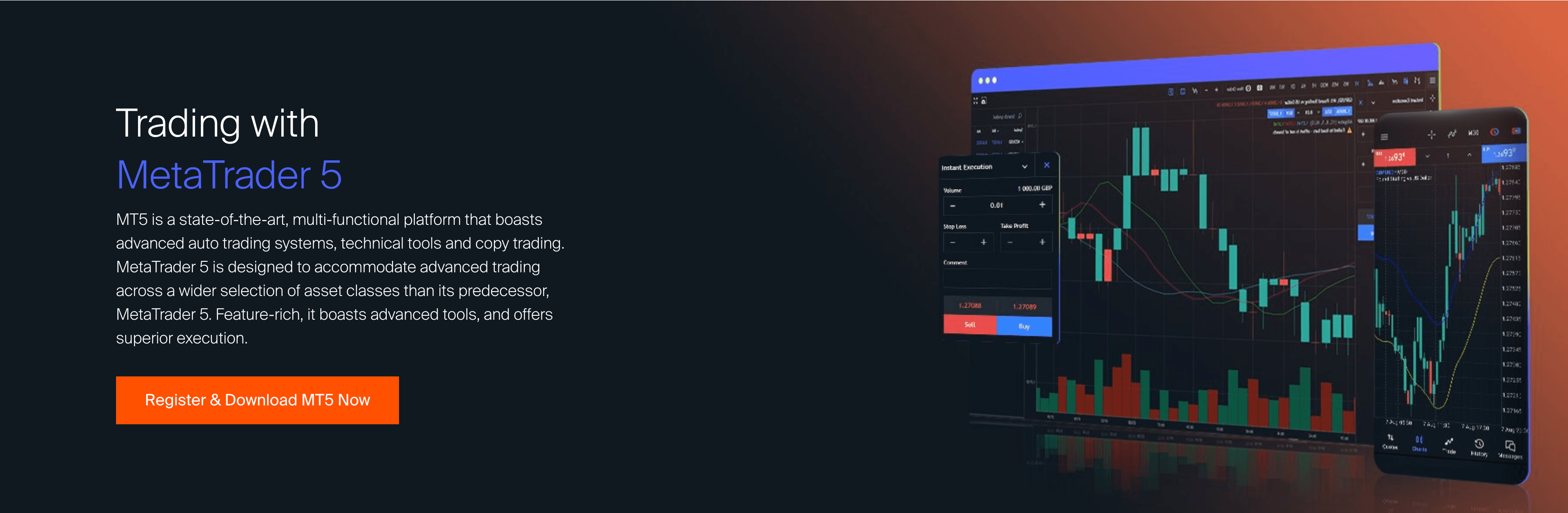

MetaTrader 5

Anyone who has used MetaTrader 4 will immediately recognize MetaTrader 5 and be completely comfortable trading on this next-generation platform.

The MT5 Web Platform at Avatrade. Image via Avatrade.com

The MT5 Web Platform at Avatrade. Image via Avatrade.com MT5 has the same look and feel as MT4, but was created as a more powerful platform, particularly when it comes to its back testing functionality and capabilities. It uses the updated MQL5 programming language and offers more powerful features as you can see:

- Multi-asset trading (Forex, Stock, Index, Commodity, Cryptocurrency and ETF CFDs)

- Inter-account funds transfer

- One-click trading

- EA functionality

- 12 timeframes

- 3 charts (line, bar and candlesticks)

- Direct trading from the charts

- 38 built-in indicators

- 37 graphical objects

- 1 single login across all your trading platforms

- Guaranteed full data back-up and security

- 6 pending order types

- Back testing of strategies

- Trading history information

- Micro lots available

- Internal mailing system

- News streaming

- Multi-threaded strategy tester

- Built-in MT5 and MQL5 help guides

AvaOptions

Because the MT4 and MT5 platforms don’t work with the options available at AvaTrade they created their own proprietary AvaOptions platform. AvaTrade offers options on forex pairs, gold, and silver. If it weren’t for the AvaOptions platform it would be a complex procedure to trade options.

The AvaOptions platform simplifies the process by graphically representing the risks and rewards of each trade. This gives traders a better understanding of their trades before entering into them.

Option trading through the powerful AvaOptions platform. Image via Avatrade.com

Option trading through the powerful AvaOptions platform. Image via Avatrade.com With AvaOptions a trader will see the current implied volatility curve for all markets, the historical implied volatility, and the realized volatility.

Traders can trade right from the platform’s screen with one-click trading, including setting entry and exit parameters for the trade. There are 13 default options trading strategies built into the platform. Traders can thus execute straddles, strangles, risk reversals, spreads, and other options strategies, with just one click.

Plus the platform includes a number of tools for managing risk. This includes special screens where traders can see a summary of portfolio risk, including Delta, Vega, and Theta. Additionally there is an Open Positions page showing each trade’s risk measures, with full sort and filter capabilities.

Other Trading Platform Tools

In addition to the basic trading platforms themselves, AvaTrade also offers a number of plugins and tools that are meant to improve the trading situation of their clients.

Guardian Angel

This is a plugin for the MetaTrader 4 platform that provides risk assessment for each trade. It gives an instant feedback on any trading actions, which in turn helps the trader to learn what works, and what should be avoided. Over time this leads to an improvement in decision making and trading skills.

AvaTradeGO

AvaTradeGO was voted the best forex trading app of 2020 by the Global Forex Awards and it’s easy to see why. This trading portal works on the mobile device or tablet, and allows the trader to see trades at a glance, create custom watch lists, and view live prices and charts. It also includes two of its own very powerful plugins – AvaProtect and Market Trends.

Trade with the #1 forex app of 2020. Image via Apple app store.

Trade with the #1 forex app of 2020. Image via Apple app store. - AvaProtect is available on the AvaTradeGO and on the web-based platform and it functions just like insurance. It allows the trader to protect any single trade against losses of up to $1 million by placing a small hedging cost when the trade is placed. It can really give peace of mind on those trades that are extremely risky, but also potentially hugely rewarding.

- Market Trends is a social trading tool offered by AvaTrade through AvaTradeGO. Available only as part of the AvaTradeGO application it allows a trader to see what others are doing. It will show what other traders are buying and selling, giving a crowdsourced view of the market.

AvaSocial

This is the primary social trading app offered by AvaTrade, which allows anyone to connect with other traders to see how the market is moving. AvaSocial can help beginners to develop a trading strategy based on what works for others, and it can help experienced traders discover new trading strategies, or simply diversify their trading by expanding to assets they wouldn’t usually trade.

Join in the copy trading revolution with AvaSocial. Image via Avatrade.com

Join in the copy trading revolution with AvaSocial. Image via Avatrade.com AvaSocial is offered in partnership with FCA regulated Pelican Trading and gives all the following benefits:

- Learn to trade with the best traders

- Real-time trading signals

- Share your best trades

- Earn awards for everyday trading

- Access hundreds of markets- 24/7

- Pose questions to other traders

- Find, follow, join or even create your own trading networks

- AvaSocial in partnership with Pelican Trading is fully regulated to allow traders to sell their own trading signals and charge others for group access

AvaTrade Education

Education is undoubtedly one of the strong areas of AvaTrade, particularly when compared with the often sub-par offerings found at other online brokers. The trading education you’ll find at AvaTrade is far more than simply filler, it is useful and can be put to use in your own trading.

Let AvaTrade help educate you about the markets. Image via Avatrade

Let AvaTrade help educate you about the markets. Image via Avatrade On the education page at AvaTrade you can find all of the following educational sections:

- Trading for beginners

- Trading videos

- Correct trading rules

- Technical analysis indicators & strategies

- Economic indicators

- Market terms for pros

- Online trading strategies

- Order types

- Trading eBook

Taken all together these sections provide a full trader’s education through the use of videos, articles, blog posts, and a full-length eBook.

Research at AvaTrade

Of course research is not neglected, and AvaTrade offers up quite a bit of content that looks at current market conditions.

First off, traders get daily updates via the AvaTrade morning news brief and the daily strategy newsletter. These let the trader know the sentiment in markets as they are ready to begin their trading day. A combination of technical and fundamental analysis, they give a trader give directional views and are strong starting points to conduct further research and identify strong opportunities.

So much research. Image via TradingCentral.com

So much research. Image via TradingCentral.com More importantly AvaTrade has partnered with Trading Central, one of the best research providers for online traders. This global team of experts has been providing trading research since 1999, and has grown to include quite a large following. They are frequently cited by the likes of Bloomberg, Reuters, Dow Jones, and other major financial portals.

The offerings from Trading Central are worthy of their own post, and they are extremely diverse and in-depth. You can learn more about the service here. AvaTrade offers everything that’s available from Trading Central completely free of charge for its depositing clients.

Customer Support

Typically customer support is something you don’t think of until it becomes necessary. Most clients won’t ever need to contact customer service, but if it does become necessary you will want to know that there’s a responsive team waiting to field your questions or solve your problems quickly and efficiently.

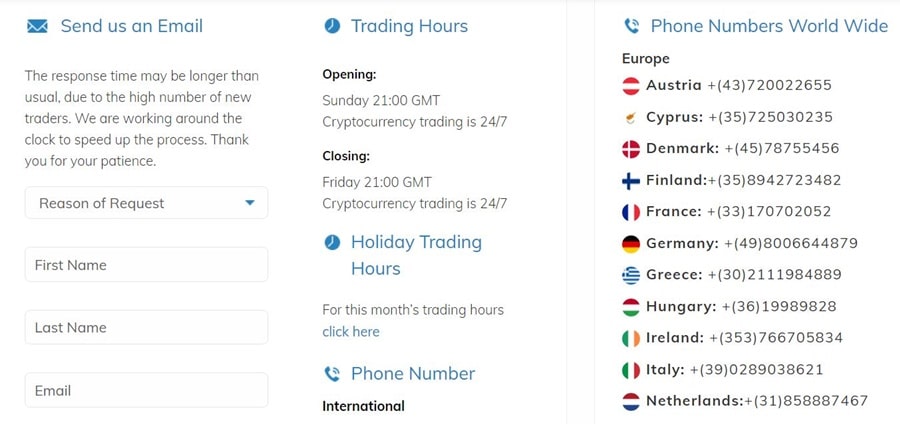

You'll never lack for a way to get in contact. Image via Avatrade.com

You'll never lack for a way to get in contact. Image via Avatrade.com Fortunately the customer support team at AvaTrade has a very good reputation in the forex and CFD trading communities. They understand that keeping clients happy is a large part of running a successful brokerage. A part of that is that support is offered in 15 languages, which makes sense considering the global reach of AvaTrade.

The first line of support at AvaTrade is the online support center, which is loaded with FAQs to answer nearly all of the basic questions a client might have.

If a suitable answer can’t be found here the next level of support is to contact an agent directly. AvaTrade offers live support via online chat, email, or telephone. The Contact page lists 38 local telephone numbers covering a large part of AvaTrade’s global network of operations.

Support is offered from Sunday at 21:00 to Friday at 21:00 for most markets, but cryptocurrency support is available 24/7 as that market never closes.

Bonuses and Promotions

Deposit bonuses and promotions used to be typical throughout the online broker industry, but these days regulation in the European Union forbids bonuses and promotions. This means traders in the EU won’t be offered any type of bonus or promotion.

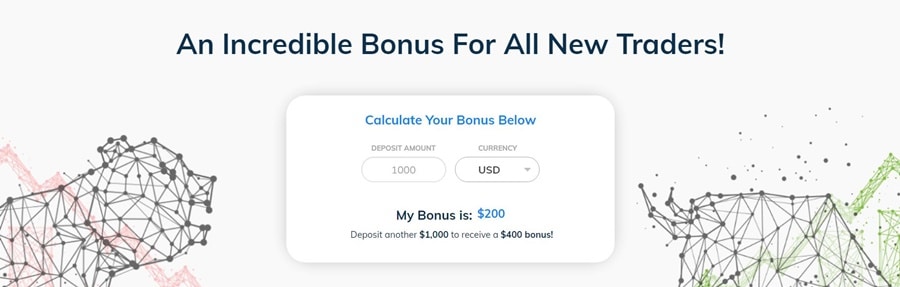

AvaTrade often offers promotions and bonuses for new sign-ups from users outside the EU, often with deals such as a free $40 upon sign up and deposit or 20% bonus on deposits, it is worth keeping an eye out for their frequent promotional periods. The 20% bonus appears to be capped at $10,000, so deposits over $50,000 can only receive the maximum $10,000 bonus.

Non-EU traders can collect a 20% deposit bonus. Image via Avatrade.com

Non-EU traders can collect a 20% deposit bonus. Image via Avatrade.com Note that this bonus is subject to trading requirements in order to withdraw any of the bonus cash. The terms and conditions currently specify that a volume of 10,000 times the bonus amount must be traded within 6 months for the bonus to be withdrawn. That means a person depositing $1,000 would receive a $200 bonus.

In order to withdraw that bonus the trader would have to generate a trade volume of $2 million within 6 months to withdraw that $200 bonus. So the bonus might be good for increasing trade size, but it isn’t likely that most will ever be able to withdraw the bonus, so don’t think of it as free monies.

Also note that deposits made via Skrill and Neteller are not eligible for this bonus.

Opening an Account

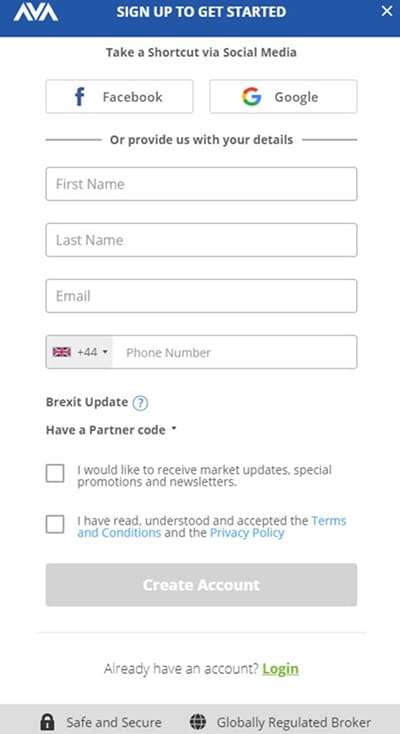

Even in highly regulated areas of the world the account opening process of AvaTrade is quite speedy and works very efficiently. Nearly all traders can expect to have their account approved for deposits and use within 24 hours of filling in the registration form. There are only a few screens to navigate, and AvaTrade will only ask for some basic details during the initial registration process.

Register to start trading. Image via Avatrade.com

Register to start trading. Image via Avatrade.com It is worth noting here that AvaTrade does not accept residents of the United States as clients at this time.

Once through the basic registration process new clients will also be required to verify their identity and place of residence. This is to comply with AML/KYC requirements and the entire process is completed online. Until this process is completed the client is not permitted to make withdrawals from the platform.

Deposits and Withdrawals

The minimum deposit at AvaTrade is a very reasonable $100, and as indicated in the Fees section above there are no fees imposed by AvaTrade on any deposits or withdrawals. However there could be fees imposed by the payment provider and these are out of AvaTrade’s control.

Easy, free deposits and withdrawals. Image via Avatrade.com

Easy, free deposits and withdrawals. Image via Avatrade.com As you might guess from a global broker like AvaTrade there are a wide variety of deposit and withdrawal methods available. These include bank transfers, major credit cards, and major e-wallets. Prospective clients should know that withdrawals from AvaTrade must be made via the same channel the initial deposit was made. This is a usual requirement of any online forex or CFD broker.

Note that you might come across complaints online claiming the withdrawal process at AvaTrade is slower than it should be. Upon closer examination it seemed to us that the delays in processing some withdrawals was slight, and that in nearly every case it was simply a matter of AvaTrade holding to their regulatory obligations vis-à-vis anti-money laundering laws.

As long as all the AML/KYC requirements have been completed by the client there were no cases where we saw AvaTrade delaying withdrawals.

Conclusion

AvaTrade offers pretty much everything you want in an online forex or CFD broker. Fees are competitive for the industry. Trading conditions are good and spreads are also competitive. The range of assets offered is quite diverse, including ETFs and options on currencies and precious metals. The broker has a long history, and has a good reputation in the online broker industry.

Added to this are the multiple regulatory licenses enjoyed by AvaTrade. In many cases online brokers are completely unregulated, or regulated by a minor organization whose regulation is not highly regarded. AvaTrade goes in the completely opposite direction, with regulation from seven major regulatory bodies.

If you are in search of an online forex or CFD broker you could do far worse than AvaTrade, and not much better. They really do tick nearly all the boxes in what traders are searching for in an online broker.

Warning ⚡️: CFDs are complex financial products. You do not own or have any interest in the underlying asset. Past performance of the underlying asset does not guarantee any future results.

Trading CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.