Impermanent Loss, aka the bane of liquidity providers in AMMs, is something that's all too familiar to every liquidity provider in Defi. We all wish it didn't exist but don't know how to go about it without shifting to order-book DEXs.

Thankfully, there seems to be one project that prides itself on its ability to offer users complete protection and insured liquidity provision on its platform- Bancor Network. If you've been searching for a solution to impermanent loss-free liquidity mining, then Bancor might satisfy your need.

In this article, I explore the current Bancor V3 and discuss how it has changed from previous versions. I also look at certain decisions taken by the DEX recently and how it has impacted users. Keep reading to find out!

Bancor Summary

| HEADQUARTERS: | Decentralized |

| YEAR ESTABLISHED: | 2017 |

| REGULATION: | Unregulated |

| CRYPTOCURRENCIES SUPPORTED: | V3 supports around 89 tokens |

| NATIVE TOKEN: | BNT |

| MAKER/TAKER FEES: | Differs from pool to pool |

| SECURITY: | Bancor has two published audits by PeckShield and OpenZeppelin. Two more audits by Certora and Chainsecurity are yet to be published. |

| BEGINNER-FRIENDLY: | Prior experience with Dapps recommended |

| KYC/AML VERIFICATION: | None |

| FIAT CURRENCY SUPPORT: | None |

| DEPOSIT/WITHDRAW METHODS: | Non-custodial |

What is Bancor

Bancor Network is a decentralized exchange built on the Ethereum and EOS blockchain. It facilitates the swapping and trading of assets on its platform via its automated marker maker smart contract system and liquidity pools.

Apart from the usual trading features offered by most DEXs, Bancor sets itself apart by offering its users two key features:

- the ability to provide single-side liquidity to a pool, and

- 100% protection from Impermanent loss

Bancor also has its utility token called ‘BNT’. The BNT token functions both as a reward token used to allow holders to stake a claim in the collected protocol trading fees and a governance token used to vote on proposals put forward in the Bancor DAO. The BNT token also plays a key part in its Impermanent loss protection feature (explained later in the article).

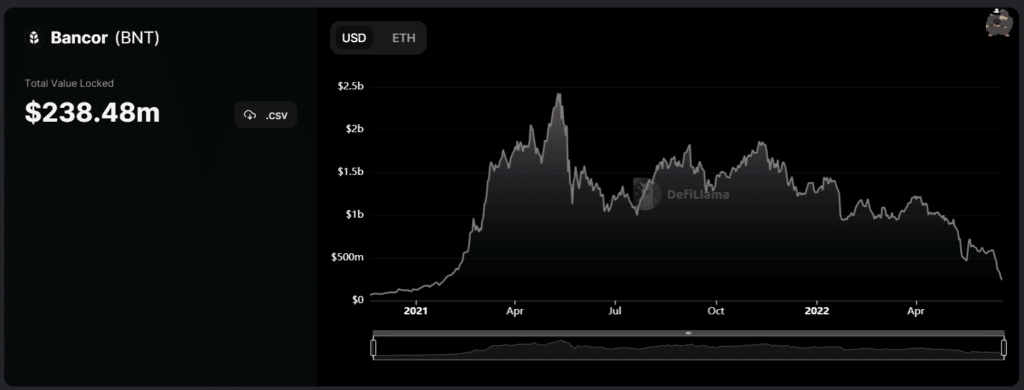

Bancor TVL via DefiLlama

Bancor TVL via DefiLlamaAccording to Defi Llama, Bancor currently occupies the 20th rank in overall Total Value locked (TVL) within the Ethereum ecosystem, with over $238 million in assets locked on its platform. At the peak of the bull market last year, Bancor held around $2 billion in TVL.

Bancor Team & History

The Bancor Network is overseen by the Bancor Foundation, a company founded in 2016 by a group of Israelis with a background in Silicon Valley start-ups. Bancor Foundation is based in Zug, Switzerland and also operates a Research & Development Centre in Tel Aviv, Israel.

This gives the company a foothold in the rising blockchain hub in Zug as well as the rising Middle Eastern technology centre of Tel Aviv. Interestingly, the DEX was named ‘Bancor’ as a tribute to the global currency initially envisioned by John Maynard Keynes in his presentation at the Bretton Woods conference in 1944.

The Bancor Network officially launched in 2017 and was the first decentralized exchange to use an automated market maker (AMM) liquidity pool. Yes, you heard that right. It’s safe to say that Bancor has been in the game for quite a while now.

However, this means that Bancor has also had the time to go under various developments since it began. Bancor Network is currently in its third version called ‘Bancor V3’. We’ve covered V1 and V2 extensively in a review published last year. Check that out if you’d like to learn about V1 and V2.

For this review, we will be focusing on Bancor V3.

Bancor V3 Key Features

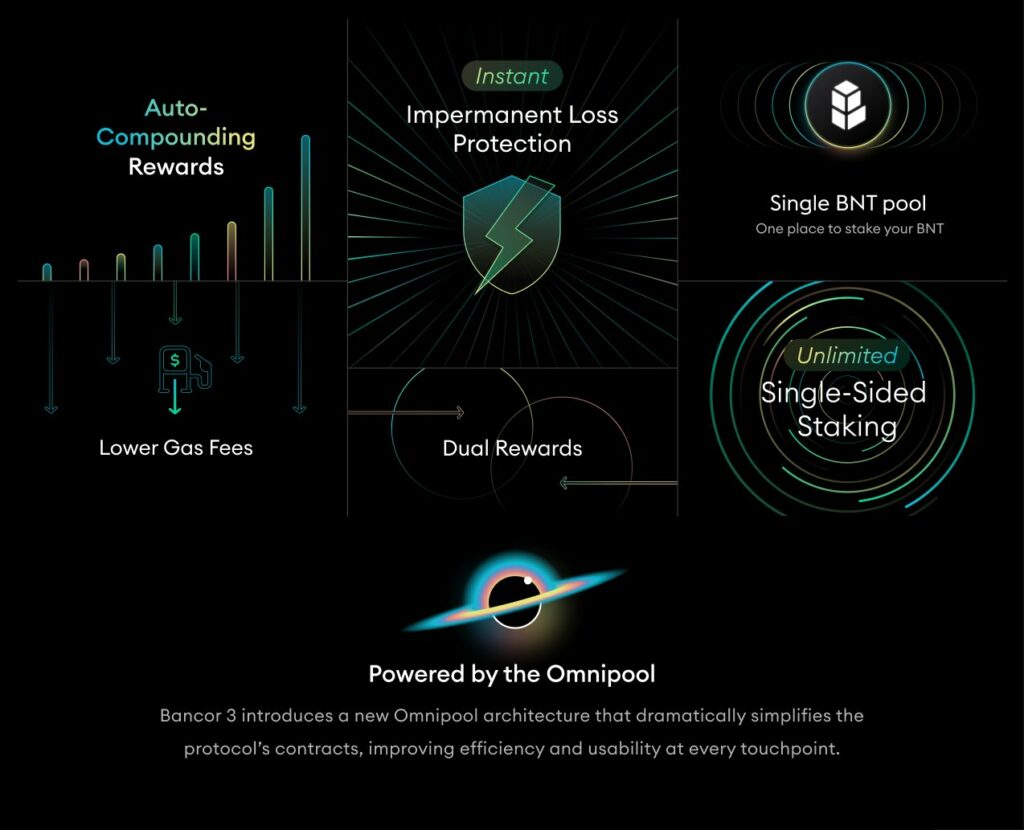

The Bancor V3 ‘beta’ was launched in April of 2022. It features a new Omnipool architecture that dramatically simplifies the protocol’s contract, improving efficiency and usability. An Omnipool allows all trades on the network to occur in a single transaction. Bancor V3 has also modified and enhanced aspects of V2’s single side staking feature and Impermanent loss protection feature.

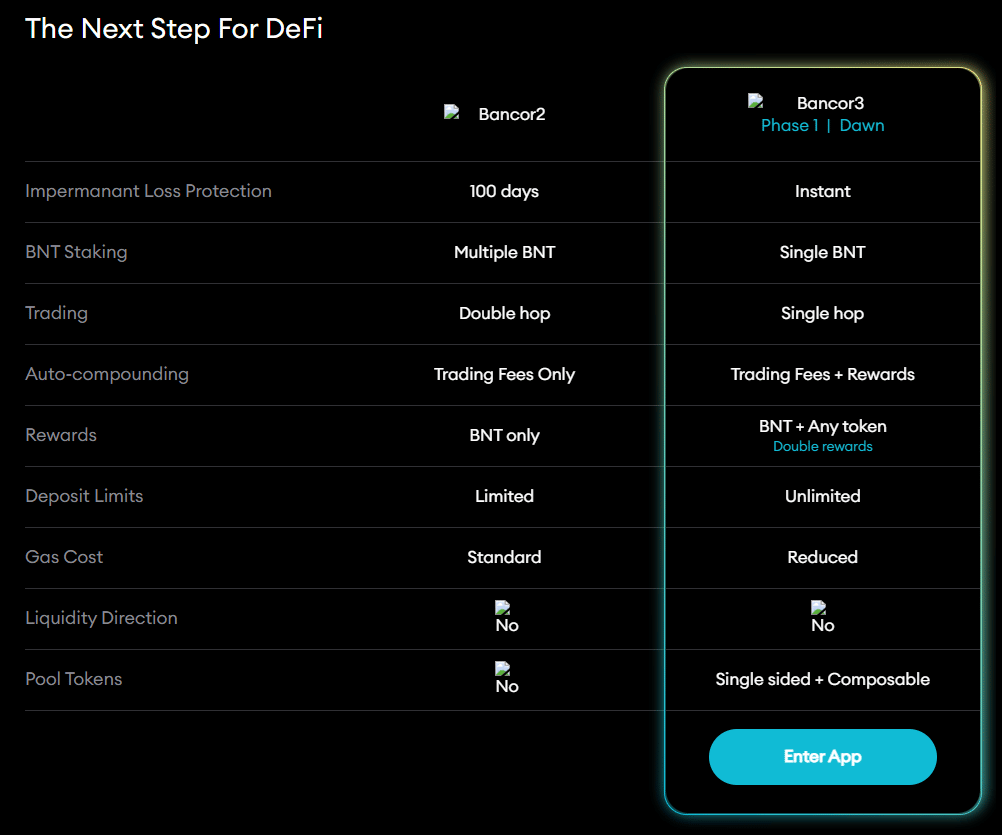

Bancor V2 vs V3

Bancor V2 vs V3Currently, we can say that Bancor V3 has two key features that set it apart from other platforms. Let us look at them in detail and see how Bancor V3 differs from V2.

Single-Side Liquidity Staking

Bancor is all about limiting the effect of impermanent loss on its users. Bancor’s Single-side Liquidity Staking feature allows investors to achieve this by limiting their exposure to the price volatility of a single token and thereby maximizing its upward potential.

Usually, when investors provide liquidity to a pool, they have to provide equal weights of both assets in the pool. However, under the single-side liquidity staking feature, investors can limit their contribution to a single token, and Bancor Network will add the other side of the pool. This is possible because of V3’s Omnipool architecture. Under this architecture, all tokens listed by the platform are held in a single, smart contract that calculates and exchanges tokens from its holdings.

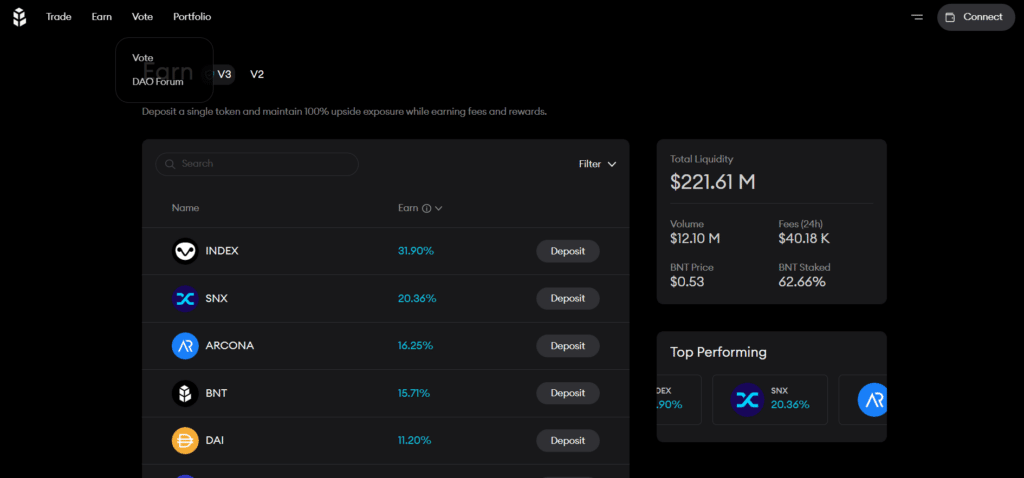

Bancor Single-Side Staking and Projected Interest Rates via Bancor

Bancor Single-Side Staking and Projected Interest Rates via BancorThe single-sided liquidity staking feature displays an expected returns rate based on the platform's average fees over the past week for that asset.

Under Bancor V2, users had a cap on the number of tokens that could be deposited for a single side staking reward. Bancor V3 has removed this limit, allowing users to deposit an unlimited number of tokens under the feature.

Impermanent Loss Protection

If you’ve ever provided liquidity in a decentralised exchange, chances are that you’ve experienced impermanent loss first-hand. And it sucks, doesn’t it?

Well, you’d be glad to hear about Bancor’s Impermanent Loss Protection feature.

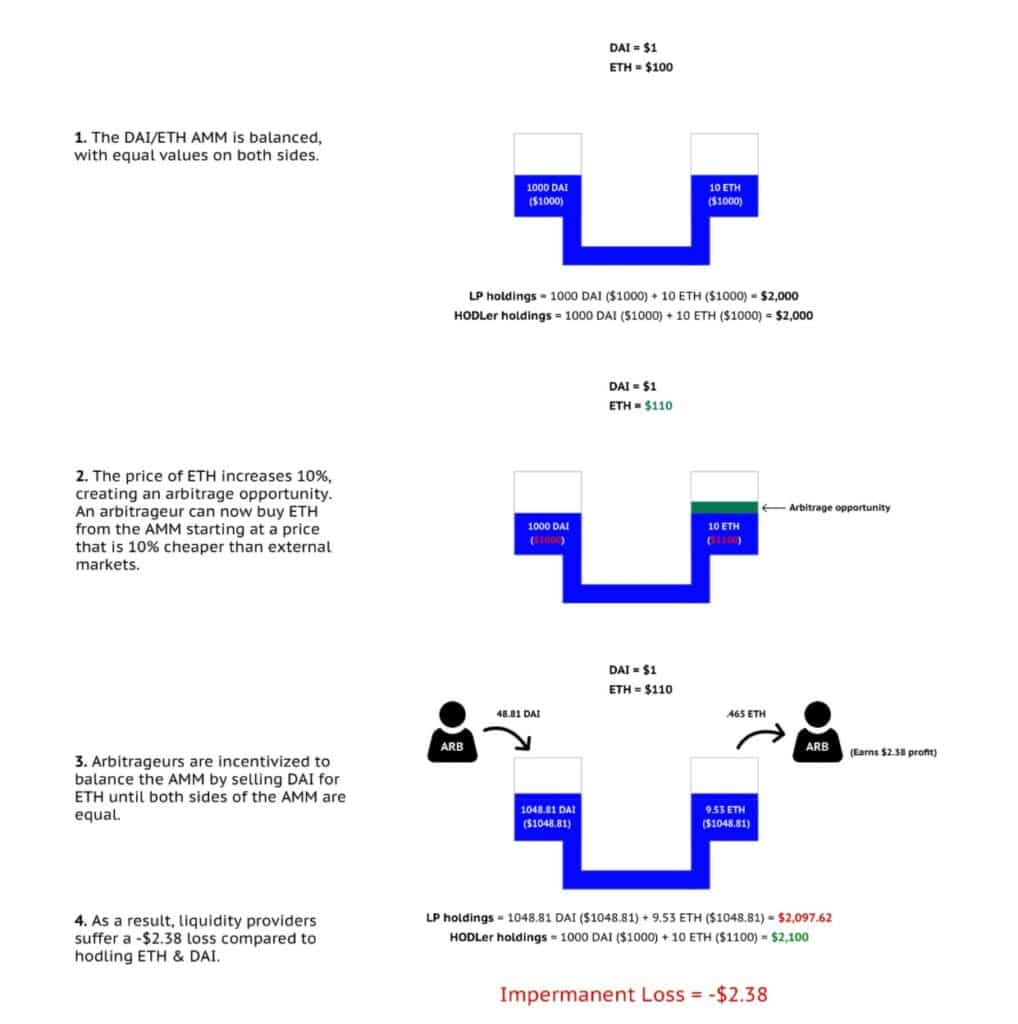

For the uninitiated, before you can understand impermanent loss, you need to understand the process of liquidity mining. When users decide to use their tokens to provide liquidity and mine the rewards, they essentially deposit the equal $ value of two tokens into a pool of the same assets. Now, people using the platform can exchange their tokens with those in the pool for instant liquidity, thereby eliminating the need for a counterparty.

Impermanent Loss Explained Image via Bancor Blog

Impermanent Loss Explained Image via Bancor BlogBut what this means for the liquidity providers is that as the price of the tokens fluctuates over time, the relative number of tokens you receive when withdrawing from the pool will vary due to arbitrage activity. This could mean that you would end up with lesser profits than you would have if you had just held onto the tokens. This relative loss is called ‘Impermanent Loss.’

And liquidity miners hate it. It drives them away from providing liquidity during volatile market conditions. However, Bancor’s Impermanent Loss Protection feature solves this problem. Under the feature, liquidity miners are guaranteed to get the value of their impermanent loss indemnified with protocol-owned BNT tokens.

Bancor offers two types of Impermanent Loss protection programs,

- Bancor Impermanent Loss (IL) Protection

This is Bancor’s de facto loss protection program. Bancor compensates users for their impermanent loss by buying the assets on the market using the protocol fees collection funds. In the event this is insufficient, Bancor offers protocol-owned BNT tokens to the user to redeem the loss. Bancor's IL protection has been designed to compensate users in a more cost-efficient and user-friendly way, as an instantaneous insurance policy, for free.

The loss protection is subject to a 7-day cooldown period and a 0.25% exit fee (adjustable by the DAO). Bancor V3 offers full impermanent loss protection instantly from the moment the tokens are staked, in contrast, V2 offered 100% protection only after 100 days of providing liquidity.

- External Impermanent Loss Protection

Token listings on Bancor are permissioned, this means that the DAO has to whitelist tokens to enable trading on the platform. And since the DAO indemnifies all impermanent losses on the platform, this makes the token listing process very stringent. However, Bancor’s external impermanent loss protection program allows projects to gain an advantage in securing a whitelist by enabling the projects to share a part of the responsibility in Impermanent loss protection for its users.

Note: Due to current market conditions, Bancor suspended its Impermanent Loss protection program on June 19th. Re-activation is expected to take place once market conditions relatively stabilize and improve. Kindly double check current status of the program if you decide to use the platform for its impermanent loss protection feature.

Bancor Fees

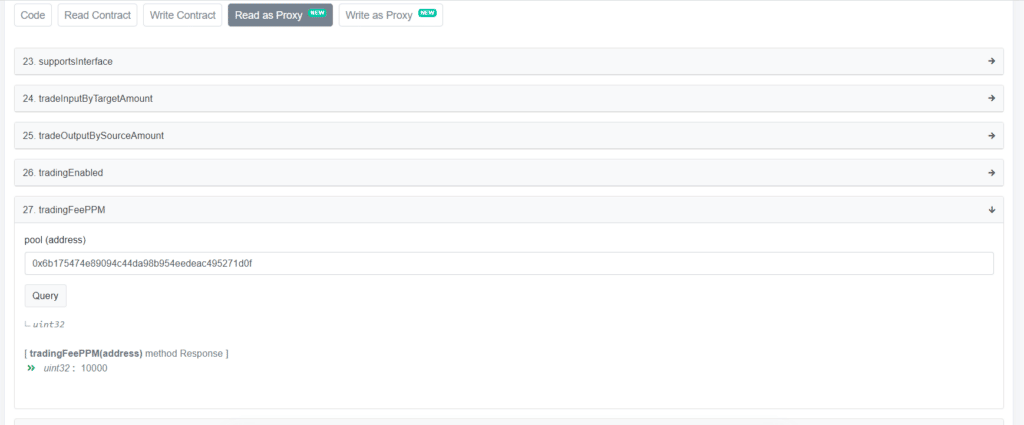

Bancor charges a different fee for each liquidity pool on the network. Given the number of tokens available on the network, it is impossible to list them out here. Therefore, I shall leave you with the means to check it out for yourself.

Step 1- Go to the Etherscan page for the info contract

Step 2- Call the ‘tradingFeePPM’ function (it’s number 27 on the list) on the “Read as proxy” tab

Step 3- Check if the token you want to trade is listed on the Bancor network. If yes, find its contract address from CoinMarketCap and paste it into the ‘tradingFeePPM’ function.

Etherscan Page shows DAI producing a value of 10000

Etherscan Page shows DAI producing a value of 10000Step 4- Click ‘Query’. You should now have a number that shows up. For example, the DAI liquidity pool shows a value of 10000. This 10000 translates to a 1% trading fee. If the value shown is 2000, then the trading fee is 0.2%, and so on.

That should give you an idea of the fee charged by the protocol for different pools. All fees on the protocol are decided by the Bancor DAO.

I know this seems a little bit tedious. But there doesn’t seem to be an easier way. I asked.

Apart from the trading fees, there is also a withdrawal fee for removing liquidity from the protocol. The withdrawal fee is 0.25% and has a seven-day cooldown.

Bancor KYC and Account Verification

Bancor does not have any KYC or Account verification measures on its platform. The only requirements for using the protocol are a self-custody browser wallet or hardware wallet and some ETH to pay for network fees.

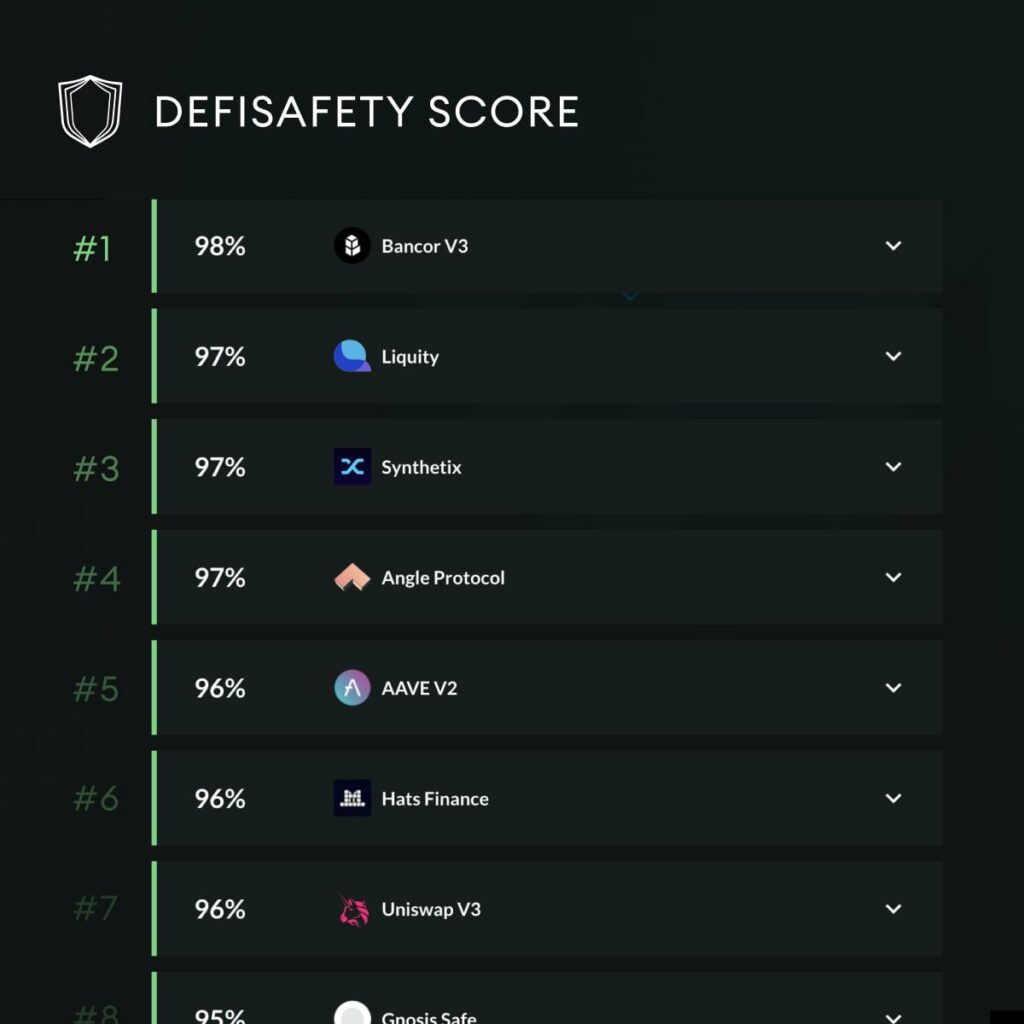

Bancor Security

Bancor has two published audits by PeckShield and OpenZeppelin. Two more audits by Certora and Chainsecurity are yet to be published.

Bancor's Defi Safety Score. Image via Twitter

Bancor's Defi Safety Score. Image via TwitterBancor DAO also has a multisig wallet. In emergency situations, the Bancor DAO MSIG can call the “pause” function which will pause the entire protocol. As long as the “pause” is ongoing, no deposits, withdrawals or transactions can be made until the protocol is “unpaused”. This would likely be called by the Gnosis safe 2 wallet.

Cryptocurrencies Available on Bancor

Token Listings on Bancor need to be approved by the Bancor DAO. Bancor V3 currently has 89 tokens listed on the platform.

Bancor Exchange Platform Design and Usability

Bancor Network has a smooth UI, with a straightforward arrangement of the DEX’s features. Users can readily access the Trading interface on the top part of the home page. The home page also has links to the governance and portfolio page.

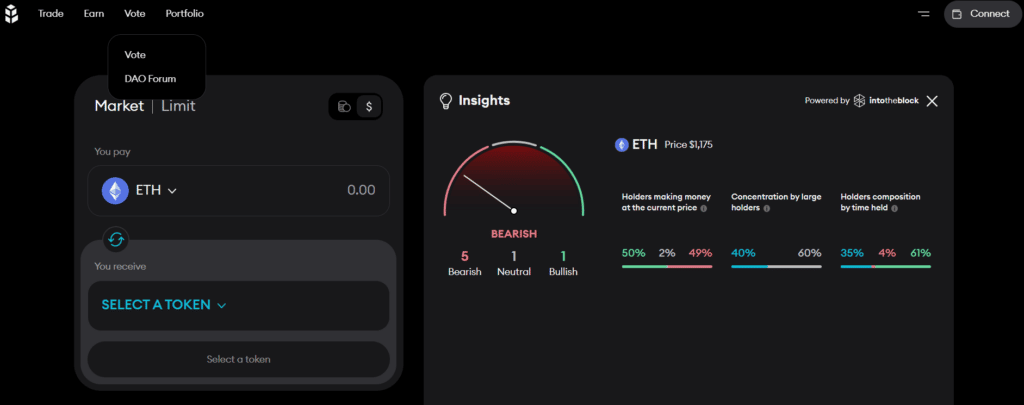

Bancor Interface

Bancor InterfaceThe trading interface also has an insights window. The insights window shows the user the current market trend of the asset chosen to swap.

Bancor Trading Interface with Insights Window

Bancor Trading Interface with Insights WindowThe ‘Earn’ page allows users to access the single-side liquidity staking feature of Bancor. It shows the list of whitelisted tokens and their associated interest rates. The interest rates displayed are an average of the protocol fees earned from that liquidity pool.

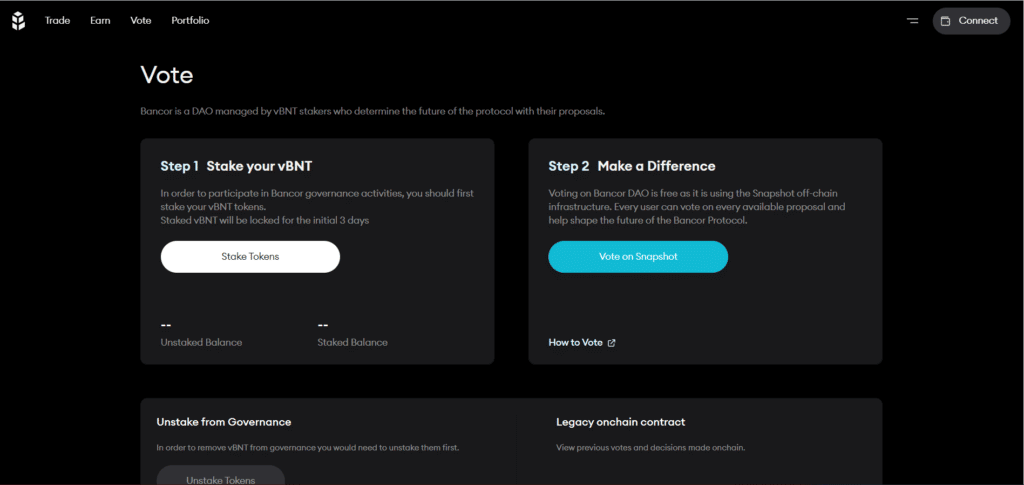

Bancor Governance Interface

Bancor Governance InterfaceThe ‘Vote’ page displays the steps which users must go through in order to vote on a governance decision. It also specifically mentions that governance votes are only given to vBNT stakers. vBNT is obtained from staking BNT in the staking pool.

The Portfolio page displays the various tokens you have staked. It is particularly useful for traders with multiple token stakes as it helps them sort out the clutter.

Deposits and Withdrawals at Bancor

Bancor is non-custodial. The only deposit and withdrawal functions available on the platform are for the single-sided liquidity staking feature. Users are charged a 0.25% withdrawal fee for removing liquidity.

Bancor Token (BNT)

Bancor Network has two native tokens- BNT and vBNT.

Utility

The BNT token is used to indemnify the users of the platform from their impermanent loss. It is paid partly in place of the staked token. The vBNT token on the other hand is the governance token of the platform and is obtained by staking BNT tokens, which thereby compounds the rewards of users.

Token Supply and Emissions

The BNT token has an elastic and dynamic supply. The protocol automatically burns or mints tokens passed on the current trading activity or redemption activity on the platform. Currently, there is a circulating supply of 262 million BNT tokens with a market cap of $139 million.

Price History

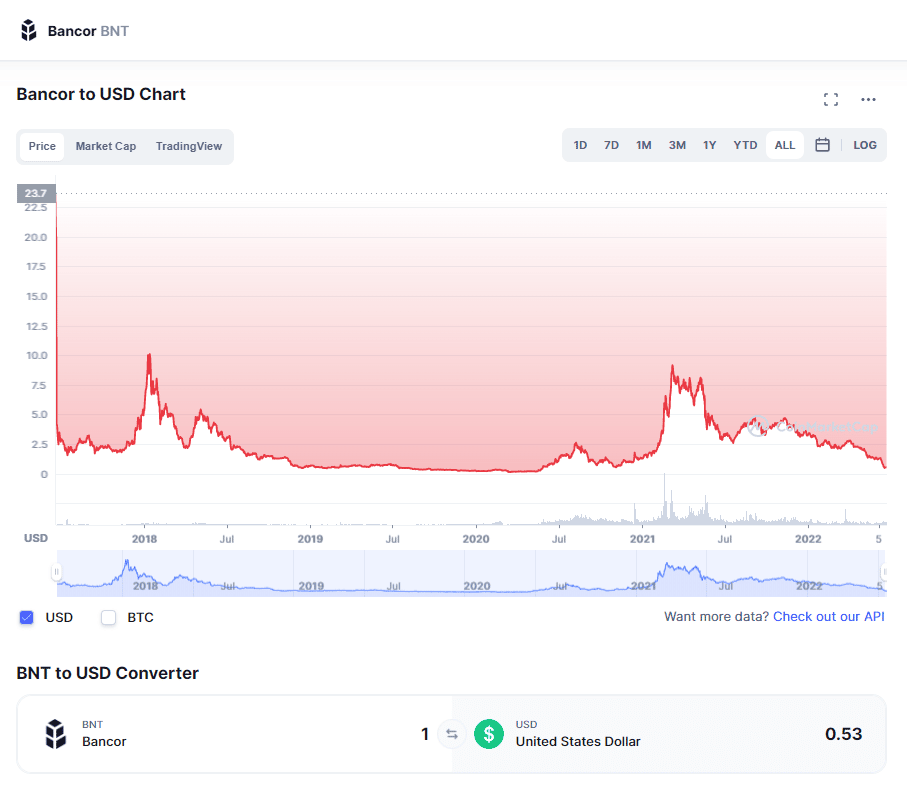

Bancor Price History via CoinMarketCap

Bancor Price History via CoinMarketCapThe BNT token launched in 2017 at a price of $3.92 per token at ICO. It currently trades at $0.53 per token and has hit an all-time high of $10.00 on January 10, 2018 and its all-time low of $0.117415 on March 13, 2020. BNT has been in a downtrend for the past 8 months, this is mostly because of the current macro bear market conditions.

Where to buy BNT?

BNT can currently be bought on both centralized and decentralized exchanges. The available markets are listed below

Centralized Exchanges- FTX, Binance, Kucoin

Decentralized Exchanges- Bancor DEX

Can I stake BNT?

Yes, you can stake BNT on the earn page to receive vBNT, the governance token of Bancor.

Bancor Customer Support

Bancor is a decentralized exchange maintained by the Bancor DAO. Most decisions regarding the DEX are taken via a governance vote on the platform. This includes fee changes, upcoming updates, and token whitelisting.

While there may not be any customer support in the traditional sense, users can get their doubts or queries addressed in the project’s Discord or Telegram channels. Bancor has an active social media presence with users and mods constantly present in its forums.

Bancor V3 Top Benefits Reviewed

- Unlimited Single-Sided Staking- Provide liquidity and earn yield in a single token. No need to pair 50/50 or buy another asset. No deposit limits.

- Single BNT Pool- A single place to stake BNT and earn revenue from the entire network of liquidity pools.

- Instant Impermanent Loss Protection- Receive 100% Impermanent Loss Protection from the moment your tokens are staked. No need to wait 100 days for full protection.

- Auto-Compounding Rewards- Earnings from trading fees and rewards are auto-compounding, enabling a truly “set and forget” staking experience.

- Dual Rewards- Users can now receive both BNT and non-BNT incentives that are auto-compounding and permanently loss-free thanks to third-party token initiatives incentivizing liquidity on Bancor.

- Lower Gas Fees- The new Omnipool architecture allows trades to be processed in one step rather than two, resulting in more efficient trading routes. The Omnipool significantly simplifies the protocol's contract architecture, lowering deposit and withdrawal gas costs.

- Smart Portfolio- A redesigned front-end interface provides complete transparency into your deposited tokens' actual net earnings ("LP vs. HOLD").

Risks

Bancor V3’s key selling point is its single-sided staking pools and Impermanent loss protection feature. However, the way it achieves this is by using protocol-held liquidity or by minting new BNT tokens to indemnify users. This brings in questions regarding the sustainability of the platform during a bear market.

Just a couple of days back, on June 19, Bancor announced that it was suspending the Impermanent Loss protection feature temporarily until better market conditions arrive. Users of the platform were visibly feeling betrayed as they had completely banked on Bancor to indemnify their impermanent losses. Some of the platform’s stakers had held their tokens in the DEX for more than 2 years. They were shocked to hear that their tokens were no longer protected and that withdrawals showed a 50% haircut from their initial deposits.

Bancor Review Conclusion

Bancor is certainly an interesting project and arguably one of the most important Defi projects, considering that the platform was the first DEX to launch an AMM in 2017. It is constantly innovating and raising standards for other protocols. While the Impermanent Loss protection feature is definitely an eye-catcher, many protocols and projects have begun defaulting on liquidity during these current market conditions. BNT makes for a great project during the bull market, but the bear market is a whole different story. We just have to stick around and see how it goes forward.