Finance is evolving faster than ever. What used to be a world of brick-and-mortar banks and slow-moving systems has given way to digital wallets, instant transfers, and decentralized protocols that run on code, not clerks. As DeFi and crypto continue to challenge traditional financial models, companies are racing to innovate and position themselves as the future of money.

Binance, arguably the most recognizable name in the crypto universe, is not sitting still. It has consistently stayed ahead of the curve by expanding its offerings, listening to its users, and creating tools that meet the evolving needs of a global audience.

One of its latest initiatives, Sharia Earn, is a perfect example of that strategy. It addresses a gap that has long existed in the crypto space: faith-aligned financial products for Muslim users. In fact, it's not just restricted to Muslims, but anyone whose ideals align with the Islamic idea of finance, which is more community-centered. With a certified halal staking model, Sharia Earn not only meets the demands of those who require compliance with Islamic principles but also draws in users who were simply waiting for an ethical green light to get involved.

In this analysis of Sharia Earn by Binance, we will explore what the product is, how it works, and why it could be a game-changing move both for Binance and for the broader crypto ecosystem.

Key Takeaways

- Binance Sharia Earn is a fully certified, faith-aligned staking solution that meets Islamic finance principles while remaining accessible to all ethical investors.

- It offers halal staking for BNB, ETH, and SOL, avoiding interest and excessive risk while providing transparent, on-chain yield generation.

- To stake, simply choose a supported token, select your lock-up period or receive a liquid token like WBETH/BNSOL, then confirm through Binance’s Sharia Earn interface.

- The product is certified by Amanie Advisors, ensuring all operations—rewards, mechanics, and underlying activities—meet Sharia compliance standards.

What Is Binance?

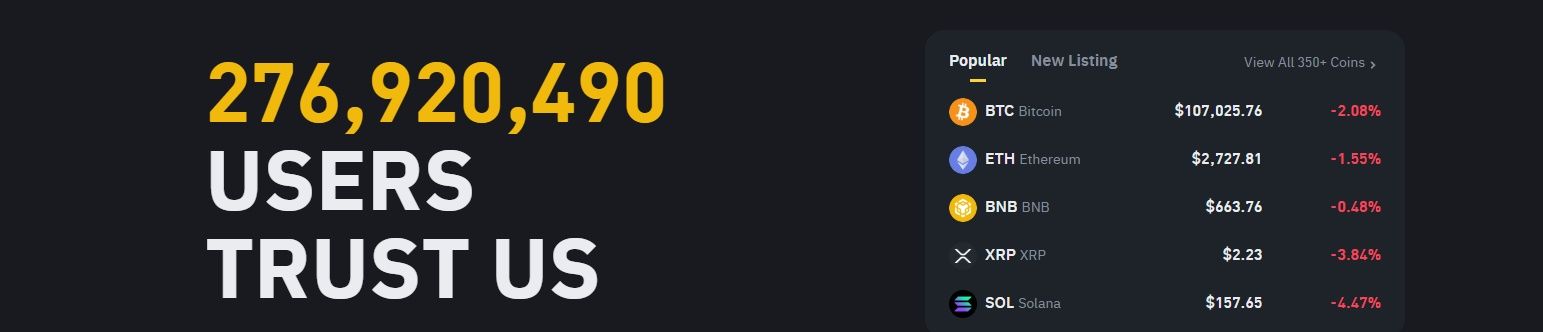

If you've spent even 10 minutes in the crypto space, chances are you’ve heard of Binance. Born in 2017, thanks to the vision of Changpeng Zhao (aka “CZ”), Binance wasn’t just another exchange trying to make a splash. It practically flooded the market. In just a few months, it shot to the top, becoming the largest crypto exchange by trading volume.

Binance stood out by doing the basics really, really well: a smooth user interface, low fees, fast transactions, and access to a huge number of tokens. Whether you were a first-time buyer or a day-trading degen, Binance made crypto feel just a little less intimidating.

Over time, it evolved far beyond a simple exchange. Binance grew into a full-blown ecosystem with its own blockchain, launchpad, NFT platform, staking services, and more. In short, it became a crypto super app. Today, it’s not just a place to buy Bitcoin, it’s where millions of people go to explore everything crypto has to offer.

Binance Stood out by Doing the Basics Really, Really Well. Image via Binance

Binance Stood out by Doing the Basics Really, Really Well. Image via BinanceDon't forget to check these out:

- How to Sign Up on Binance: A Step-by-Step Guide

- Binance App Review: Mobile Trading on the Go

- Binance Security Analysis: Is Binance Safe?

- Binance vs Binance US: An In-Depth Look

- BNB Coin: The Utility Coin for Binance

- Binance NFT Marketplace Review

- Top Binance Alternatives

- How to Buy Bitcoin on Binance

- A Guide to Trading on Binance

- Binance US Review

Binance’s Global Footprint

Binance has gone global in every sense of the word. From Asia to Europe to Africa, it has onboarded users at a staggering pace. It’s especially popular in regions where traditional financial access is limited, making it a kind of crypto on-ramp for the unbanked.

But it hasn’t always been smooth sailing. Regulatory bodies around the world have had their eyes on Binance, and not always kindly. There’ve been fines, warnings, and even bans in some countries. The U.S. levied a $4.3 billion penalty in 2023, and other jurisdictions like the UK, Canada, and France followed with their own restrictions. What's more is that its former CEO, Changpeng Zhao, in 2023, received a four-month prison sentence for alleged securities violations. The case has now been dropped, ending the long-standing legal dispute.

Still, Binance seems to be pivoting toward a more “grown-up” image under new CEO Richard Teng; it’s focusing heavily on compliance, licensing, and transparency. And despite the hurdles, it remains the go-to exchange for millions, cementing its role as one of crypto’s biggest gatekeepers.

Understanding Islamic Finance in Crypto

Islamic Finance Remains Modestly Represented in Digital Finance and Blockchain. Image via Freepik

Islamic Finance Remains Modestly Represented in Digital Finance and Blockchain. Image via FreepikIslamic finance isn’t just banking with halal stamps. It’s a complete system rooted in ethical, faith-driven rules of fairness, promoting a society with a balanced distribution of wealth instead of accumulation by some. And it’s increasingly relevant as crypto shakes up old-school finance. Let’s break this down:

The Foundations of Sharia‑Compliant Finance

At its core, Sharia-Compliant finance (or Islamic finance) operates under three main principles:

- No riba (interest): Charging or paying interest is a no-go.

- No gharar (excessive uncertainty): Contracts must be fair and transparent and not ambiguous or biased.

- No unethical industries: Anything involving alcohol, gambling, weapons, or non‑halal products in general is off limits.

Operators use methods like profit‑and‑loss sharing, asset-backed financing, and sukuk (Sharia-compliant bonds) instead of interest-based loans. The result? A financial system that emphasizes shared risk, transparency, and tangible economic contribution.

Islamic Finance and Its Prospects in Crypto

Here’s where things get interesting. Crypto and blockchain naturally resonate with Islamic finance’s core values: transparency, traceability, and decentralization. For example, you can track where funds go and ensure terms are clear; no hidden clauses, no shady middlemen.

That said, challenges remain. Crypto trading often involves derivatives, speculative play, and unstable token prices, all frowned upon under Sharia principles. But there's growing innovation in sovereign sukuk on-chain, halal staking structures, and transparency-focused protocols that align with Islamic values.

However, let's be honest. While Islamic finance holds deep cultural and spiritual value, not all Muslims strictly follow Sharia-compliant models. In practice, many rely on conventional banking and financial products out of convenience, accessibility, or lack of alternatives. This means that when presented with the Islamic finance options in crypto, many Muslims on the fence will find it much easier to jump in.

The Opportunity Worth Trillions of Dollars

Islamic finance isn’t just a niche; it is a global economic force. In 2024, total Sharia‑compliant assets surged to around $5.5 trillion, and projections from Standard Chartered now estimate a rise to approximately $7.5 trillion by 2028.

S&P Global expects continued steady growth through 2025 and beyond, supported by strong sukuk issuance and economic shifts in core Islamic economies.

Despite this tremendous growth, Islamic finance remains modestly represented in digital finance and blockchain, creating a significant gap and opportunity. Even in regions like MENA, Islamic banking assets represent a minority portion of total financial assets.

Meanwhile, the crypto‑native Sharia‑compliant offerings remain rare; a gap that Binance’s Sharia Earn is primed to fill by delivering mainstream access for faith‑aligned investors.

What Is Sharia Earn?

Every Aspect of the Process is Interest-Free and Certified by Scholars. Image via Freepik

Every Aspect of the Process is Interest-Free and Certified by Scholars. Image via FreepikWith crypto going global and mainstream, one big question kept popping up from faith-conscious investors: “Can I grow my crypto ethically, without compromising my beliefs?” Binance heard the call and responded with something brand new. Sharia Earn is a staking product designed from the ground up to be in line with Islamic finance principles.

Sharia Earn is not just a feature tucked inside Binance Earn. It is a dedicated product that sets a precedent for faith-based crypto investing, and rightly so, as it beckons a huge Muslim population that was otherwise keeping a distance. While the name speaks directly to Muslim users, the ethos behind it, which includes ethical investing, transparency, and purpose-driven wealth generation, can appeal to anyone looking for a principled approach to growing digital assets.

This product is currently available for users in the following countries: India, Pakistan, United Arab Emirates, Saudi Arabia, Bahrain, Bangladesh, Turkey (.com), Egypt, Algeria, Morocco, Sri Lanka, Iraq, Jordan, Tunisia, Lebanon, Nepal, Yemen, Kuwait, Afghanistan, Qatar, Oman, Libya, Palestinian territories, Bhutan, Sudan, Maldives, Indonesia, Kazakstan, Uzbekistan, Kyrgyzstan, Turkmenistan, Azerbaijan, and Tajikistan.

Binance’s Ethical Investment Gateway

At the heart of Sharia Earn is one simple mission: making it easy for users to earn passive rewards without stepping outside the boundaries of what is considered halal. It avoids interest (riba), excessive uncertainty (gharar), and exposure to unethical industries. Instead, it focuses on transparency, real assets, and ethical yield generation.

To ensure this is more than just good intentions, Binance brought in Amanie Advisors, a leading Sharia advisory firm, to certify the product. Their role is essential. They assess everything from how funds are deployed to how rewards are earned. Every process is screened, approved, and continuously monitored to ensure it meets Islamic finance principles.

Sharia Earn is not only about religious alignment. It is also a step forward in creating ethical staking models that others may eventually follow.

Tokens Supported and Their Staking Models

At launch, Sharia Earn supports three major cryptocurrencies: BNB, ETH, and SOL. These were selected not only for their market presence but also for their compatibility with a halal staking framework.

For BNB, the model is simple. Rewards come from on-chain activity and are paid daily to the user’s Spot Wallet. Staking durations can be set for 15, 60, 90, or 120 days, depending on user preference.

For ETH and SOL, things work a bit differently. Users receive liquid tokens like WBETH and BNSOL when they stake. These represent both the initial stake and the accumulated rewards. Over time, their value increases. When users redeem them, they receive the equivalent ETH or SOL along with all accrued halal rewards.

Every aspect of the process is interest-free and certified by scholars to ensure full alignment with Sharia principles.

How Sharia Earn Works

It comes down to How Rewards are generated and What Kind of Financial Activities are Allowed. Image via Freepik

It comes down to How Rewards are generated and What Kind of Financial Activities are Allowed. Image via FreepikSharia Earn is not just a renamed version of existing staking services. It is purpose-built to operate within the ethical boundaries of Islamic finance. For anyone wondering how exactly it differs from traditional staking, here’s a closer look at how it all works behind the scenes.

Key Differences from Traditional Staking

| Aspect | Traditional Staking | Sharia Earn |

|---|---|---|

| Reward Mechanism | May involve interest or speculative rewards | Avoids interest-based returns; rewards are structured to be Sharia-compliant |

| Sharia Compliance | Not built with Islamic finance in mind | Fully aligned with Islamic principles (no riba, no gharar, no non-compliant sectors) |

| Asset Screening | No filtering; may include non-permissible industries | Assets are vetted and regularly reviewed by Amanie Advisors |

| Transparency | Yield strategies can be opaque or unclear | Full clarity on fund usage and return generation |

| Ethical Foundation | Focuses primarily on financial returns | Compliance-driven with ethics at the core of the design |

| User Experience | Select a token, lock it in, and earn rewards | Same basic UX, but the backend mechanics follow a halal-compliant structure |

The core difference comes down to how rewards are generated and what kind of financial activities are allowed. In typical staking platforms, the reward structures might involve mechanisms that closely resemble interest or carry levels of uncertainty that would be considered problematic under Islamic finance.

Sharia Earn avoids this completely. It does not engage in interest-based returns, and it actively screens out all forms of interest, excessive risk, and association with non-compliant sectors. Every staking activity is structured to be in line with halal guidelines and vetted through ongoing reviews by Amanie Advisors.

Transparency is another big one. With Sharia Earn, you can see how your funds are deployed and how returns are generated. There are no opaque mechanisms or ambiguous terms. This level of clarity is not just good practice; it is a necessary part of meeting Sharia standards. The entire framework is compliance-driven, which means the design itself revolves around ethical and legal permissibility.

So while the user experience might feel similar to selecting a token, locking it in, and earning rewards, the mechanics behind it are fundamentally different, and that is what makes it unique.

APR Structure and Reward Generation

In Sharia Earn, reward generation depends on on-chain staking yields. Binance is not paying you interest. Instead, rewards are generated directly from the staking process of the underlying assets, which is how they maintain both transparency and compliance.

For BNB, users receive a fixed APR that corresponds to the reward rate offered under Binance’s Simple Earn Locked Products. This APR is known upfront and distributed daily, so users can track exactly what they are earning.

For ETH and SOL, things work a little differently. Users receive tokenized versions like WBETH and BNSOL, that represent their staked assets. These tokens increase in value over time based on the staking yield. There is no fixed APR shown as a percentage, but the growing token value reflects both the principal and halal rewards accrued. When redeemed, users get back the original asset plus the reward amount, all certified halal.

This structure ensures that Sharia Earn remains firmly within ethical bounds while still offering a clear, trackable return for users.

Why Sharia Earn Matters

It is a Great Opportunity to Break into a Relatively Untapped Market. Image via Freepik

It is a Great Opportunity to Break into a Relatively Untapped Market. Image via FreepikWhen big players like Binance introduce a product like Sharia Earn, it is not just about ticking off boxes. It is about real impact across multiple dimensions, from opening up markets, to shifting narratives on ethics, to charting where crypto goes next.

Tapping a Huge Underserved Market

Muslim-majority regions like MENA (Middle East and North Africa) and APAC (Asia-Pacific) are full of crypto potential, yet traditional platforms have rarely catered to faith-aligned needs. Binance Earn has done well globally, but many Muslim users have stayed on the sidelines because standard staking often conflicts with their values.

By offering a clearly certified halal option, Binance is knocking on the door of the estimated 1.9 billion Muslims worldwide who have had limited access to compliant crypto products. That is a serious market opportunity that could ignite broader adoption and bring substantial new user growth.

Inclusivity Beyond Faith

Here is the kicker. Having a product rooted in ethical finance can appeal to far more than just Muslim users. Guardians of all kinds, those looking for transparent, asset-backed, ethically generated returns, can appreciate a staking model built on such integrity. Sharia Earn shows that ethical finance is not niche; it is universal.

For Binance, it is not only about ticking the religious compliance box. It is a strategic gesture that strengthens its global brand story. This is a platform that listens, adapts, and designs products with a purpose beyond profit. Over time, such initiatives may position Binance at the forefront of ethical crypto, helping it win trust in newer markets and surpass competitors who rely on conventional models.

Most importantly, it is a great opportunity to break into a relatively untapped market and earn long-lasting loyalty as an armor against future competition.

How to Use Sharia Earn

Binance keeps the Whole Process Transparent and User-Friendly. Image via Freepik

Binance keeps the Whole Process Transparent and User-Friendly. Image via FreepikNow let's get to its usage. You do not need to be a crypto wizard or a finance scholar to use Sharia Earn. In fact, Binance has kept the process smooth and beginner-friendly. Whether you are staking BNB for a few weeks or locking in ETH for the long term, here is how you can get started.

Step-by-Step Guide to Staking

STEP 1: Go to the Sharia Earn Page on Binance

Head over to the Sharia Earn section on Binance. Once there, check the box labeled “Sharia Products” to filter for only halal-compliant staking options.

STEP 2: Choose a Token to Stake

You’ll see three supported tokens: BNB, ETH, and SOL. Click on the one you want to stake.

- For BNB, you can select fixed terms of 15, 60, 90, or 120 days.

- For ETH and SOL, staking durations will appear in a popup once you click through.

STEP 3: Enter the Amount

Input how much of the token you want to stake. The minimum amounts are:

- 0.1 BNB

- 0.0001 ETH

- 0.01 SOL

If you want to stake your full balance, just click MAX.

STEP 4: Confirm and Stake

Review the APR, staking term, and other details. Once everything looks good, tick the agreement checkbox and click Confirm.

You’re now staking in a Sharia-compliant way.

Tracking Rewards and Redemptions

To monitor your progress, go to your Assets, then Earn, and click on the Staking tab. Under Sharia Earn, you can track how much you have staked, how your rewards are stacking up, and the status of any redemptions you initiate.

For BNB, you will see daily rewards landing in your Spot Wallet. For ETH and SOL, keep an eye on the value of your WBETH or BNSOL. These tokens automatically grow in value as rewards accumulate, and you can redeem them at any time to receive your base asset plus the earned rewards.

Binance keeps the whole process transparent and user-friendly, so you always know where your assets are and how they are performing.

Closing Thoughts

Sharia Earn is more than just another product on Binance; it represents a thoughtful step toward inclusion, ethics, and innovation in the crypto space. For the first time, a major global exchange has gone beyond the basics to craft a staking experience that aligns with Islamic financial principles while staying accessible to anyone interested in transparent and purpose-driven investing.

We have seen how the principles of Sharia finance, no interest, no uncertainty, no unethical exposure, naturally complement the blockchain ethos of transparency and fairness. By building a product that meets these standards, Binance has just opened the door for millions of previously sidelined users, especially in regions where Islamic finance is not just preferred but a norm.

Let's keep one thing clear: this is not just about religion. Sharia Earn sets a precedent for ethical finance in crypto. It shows that you can grow wealth while staying aligned with your values, and that profit does not have to come at the cost of principles.

Whether you are someone exploring halal investment options or simply looking for a more ethical way to participate in crypto, Sharia Earn is a signal of where the industry is heading: toward inclusion, integrity, and intentional design.