Binance USD is a dollar backed stablecoin that is backed by Binance, one of the worlds largest cryptocurrency exchanges. Indeed, there has been a lot of interest in this coin.

However, the stablecoin market is quite saturated right now. There are a whole host of equally attractive dollar backed alternatives backed by exchanges, trusts and banks. There are also a number of decentralised variants that are taking the market by storm.

So, with so much competition, should Binance USD be considered?

In this Binance USD review, I will attempt to answer that. I will also give you what you need to know about the tech as well as some top tips when it comes to using BUSD.

Note: Users located in the US and UK are not supported.

What is BUSD?

The Binance USD (BUSD) is a stablecoin that is backed and collateralized by U.S. dollars. It gives its users the ability to transact with other digital and blockchain-based assets while minimizing volatility risks.

The BUSD was created with the intention of improving the decentralized financial ecosystem through the use of a frictionless global network which allows digital assets to increasingly add accessibility, flexibility, and speed to transactions.

What is Binance USD? Image via Binance

What is Binance USD? Image via BinanceBinance USD’s were issued as ERC-20 tokens on the Ethereum blockchain. They are backed on a 1:1 basis by U.S. dollars that are held in U.S. bank accounts owned by Paxos, who is the partner of Binance in this project.

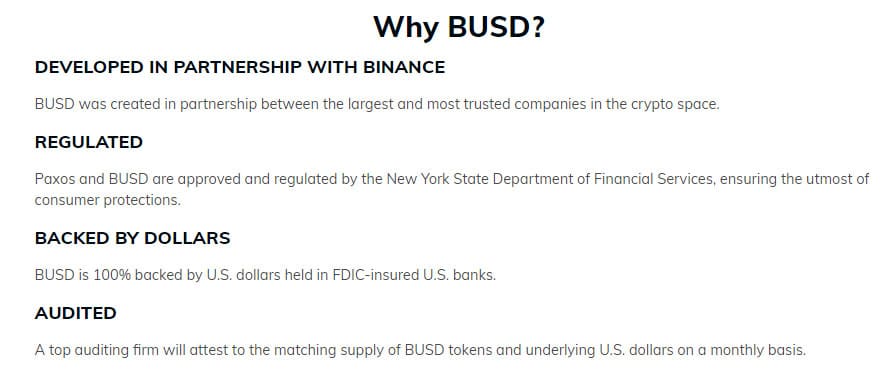

Additionally, BUSD has been one of only three stablecoins thus far approved by U.S. regulators, with the other two being GUSD issued by Gemini Trust Company, and PAX, also issued by Paxos.

Origins of BUSD & Expansion

Binance and Paxos announced their partnership to create the Binance USD stablecoin on September 5, 2019, and that the New York State Department of Financial Services (NYDFS) had given their approval of the BUSD. Beginning September 12, 2019 the BUSD was made available for purchase on a 1:1 basis with the USD from Paxos.

On September 20, 2019 the BUSD became available on the Binance platform in trade with BTC, BNB, or XRP. The stablecoin is audited on a monthly basis by the accounting firm Withum as required by the NYDFS.

Why Use Binance USD. Image via Paxos

Why Use Binance USD. Image via PaxosIn the six months since the launch of BUSD Binance has created several compelling reasons not only to use the stablecoin on the Binance platform, but to also begin using it outside the Binance ecosystem. On the platform itself Binance has expanded trading to include 48 different trading pairs with USD.

This gives investors and traders a chance to trade the token against many of the world’s top cryptocurrencies, as well as against leveraged tokens. Binance has also added a platform that allows for single-click buying and selling with 8 fiat currencies. Investors can do so using USD, EUR, GBP, JPY, RUB, CAD, VND, and CNY with bank transfers or with credit cards.

Tech Behind Binance USD

The Binance USD was created to be fully collateralized with U.S. dollars held in U.S. bank accounts on a 1:1 basis. These accounts are created and administered by Paxos, and are audited on a monthly basis as prescribed by New York state regulations.

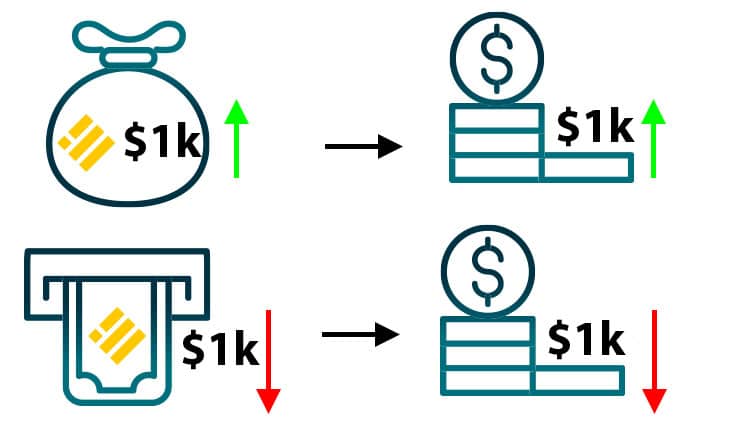

Any requests to buy or sell BUSD are accompanied by a movement of cash into or out of the reserve account. Based on these requests BUSD tokens are either minted or burned accordingly.

As an example, a purchase of $1,000 worth of BUSD will result in 1,000 BUSD tokens being minted and an increase of $1,000 in the reserve accounts. On the other side of this a redemption of 1,000 BUSD will cause the burning of those tokens and a decrease of $1,000 in the reserve as the U.S. dollars are removed and transferred to the person who redeemed the tokens. In the event there is some critical security threat, such as a hack, Paxos has the ability to pause the transfer, creation, or destruction of BUSD tokens.

While Paxos controls the creation and destruction of BUSD tokens, there are also ERC-20 smart contracts in existence that work with BUSD tokens. These smart contracts help provide security for the process as it removes the need for third parties and moves the transactions to the trusted capabilities of the blockchain network.

Process of Issuing & Redeeming BUSD

Process of Issuing & Redeeming BUSDAnd since BUSD is an ERC-20 asset it is simple to trade tokens because transferring and viewing transactions is supported by most wallets and exchanges that support Ethereum.

The NYDFS monitors and regulates BUSD in compliance with the Trust Charter. This ensures that Paxos is following all applicable New York banking laws in its operating procedures regarding BUSD. The regulations in place require Paxos to have a means to freeze accounts, and to wipe account balances of frozen accounts when required.

This regulation is adhered to through a function called “setLawEnforcementRole.” This function can be used if neeed to place administrative restrictions on the circulating supply of BUSD.

Because this goes against the decentralization of assets, Paxos has been very clear in asserting that the function is only in place to meet regulation requirements, and to prevent such illegal activities as terrorist financing and money laundering. In that respect Paxos has said the function will never be used unless required by law enforcement agencies.

BUSD vs. PAX?

Paxos has partnered with Binance to create the Binance USD stablecoin, but prior to that they have also issued their own stablecoin called PAX. Both the BUSD and the PAX are backed on a 1:1 basis by U.S. dollars held in reserve in U.S. bank accounts by Paxos Trust Company.

BUSD Compared to Paxos' PAX Stablecoin

BUSD Compared to Paxos' PAX StablecoinBinance choose to partner with Paxos because of their track record in creating a trusted stablecoin solution. This made it far easier for Binance to launch a trusted stablecoin for their own platform and ecosystem.

There is no mixing of the USD held in reserve to back both stablecoins and they are used separately to support different goals.

Current State of BUSD

As of early March 2020 the Binance USD has been in circulation for six months. In that time it has grown to see a total supply and market cap of nearly $200 million, and daily trading volumes approaching $100 million. That places it in the 35th position on Coinmarketcap.com as of March 25, 2020.

Also, according to data from Binance, as of March 11, 2020 there were more than 40,000 users holding BUSD on Binance and Binance.US, with that user base growing by 20-30% on a weekly basis. There have also been 416 million BUSD purchased since the launch of the token, whether that be through Binance or Paxos, or through any of the 45 exchanges that allow for purchases and trading of BUSD.

Range of Exchanges that Support BUSD

Range of Exchanges that Support BUSDThe growth and momentum of the BUSD stablecoin has been pretty remarkable, although having the backing of Binance has certainly helped. Even so, growing from a market cap of $17 million in September 2019 to $182 million in March 2020 is impressive, and it shows how strong the Binance community is, and how the company has been able to foster adoption of the stablecoin even outside its own ecosystem.

While BUSD is only #35 based on market cap among the total universe of cryptocurrencies, it is also ranked #5 among stablecoins. Interestingly the #4 stablecoin is Paxos Standard (PAX) with a market cap of $262 million. Considering the impressive growth rate of BUSD it could feasibly overtake PAX within the next month or two.

After passing the $100 million market cap milestone on March 11, 2020, former Binance CEO Changpeng Zhao commented in a press release:

BUSD’s market cap crossing $100 million is a big milestone for Binance, illustrating the strong need and use of alternative assets in the market. We are looking forward to seeing more utility through the power of stable digital assets and serving our part with BUSD, a NYDFS-approved USD-based stablecoin.

The team behind BUSD has made these huge strides in just six months through hard work, the development of new features and partnerships, by increasing the use cases for the stablecoin both within the Binance ecosystem and without, and by providing the marketplace with a solid solution to connect fiat currency and cryptocurrency.

The Uses of BUSD

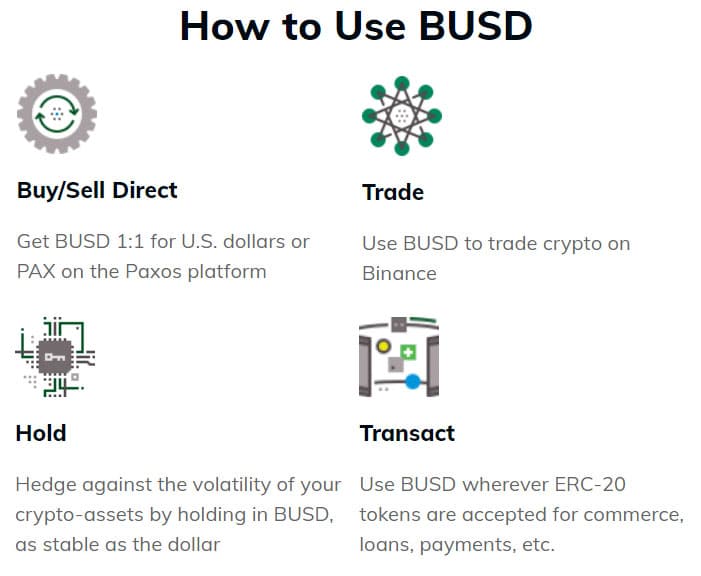

Binance USD is transacted on the Ethereum blockchain network in the same manner as any other ERC-20 token. Any user looking to redeem their BUSD can simply send the tokens to a Paxos controlled address where the tokens will be burned and the corresponding fiat currency amount will be transferred from the Paxos reserve accounts to the user’s bank account.

How To Use BUSD

How To Use BUSDBecause BUSD exists on a public blockchain like the Ethereum network it is possible for traders to use BUSD as an alternative to fiat currencies. This means users and businesses are able to outsource banking needs to Paxos through BUSD. In addition, because BUSD is an ERC-20 token it can be integrated with any of the Ethereum based dApps and smart contracts.

Binance and Paxos have taken advantage of this over the six months since BUSD was launched to add the following use cases and features:

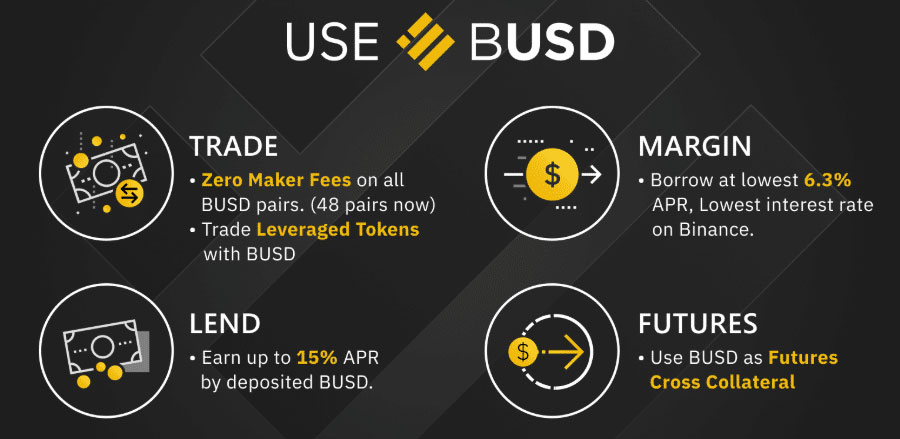

- A zero maker fee promotion for all BUSD pairs traded on Binance;

- Several lending products at Binance where BUSD can be deposited to earn interest of as much as 15% annually;

- BUSD can be used as collateral for borrowing on Binance Margin Trading;

- BUSD can also be used as cross collateral on the Binance Futures platform;

- Binance has introduced 48 different BUSD trading pairs, including trading against the Chinese yuan (CNY), Russian ruble (RUB), and Vietnamese dong (VND);

- Binance platform has introduced a feature that allows users to instantly convert from several other stablecoins to BUSD on a 1:1 basis and without fees. This stablecoin convert feature can be used with TUSD, USDC, and PAX.

In addition to those above features Binance.US has also begun to ramp up adoption of the BUSD. It already features seven different BUSD trading pairs (BUSD/USD, BTC/BUSD, ZIL/BUSD, XRP/BUSD, BNB/BUSD, ALGO/BUSD, and ETH/BUSD).

It has also recently introduced the capability to deposit USDC at Binance.US and have it instantly converted to BUSD on a 1:1 basis without any fees.

Conclusion

Since launching in September 2019 the Binance USD has grown in use from traders and investors, while also finding significant support from companies outside its own ecosystem. Thanks to its fully regulated status it has become considered as a safe bridge between fiat and crypto assets.

In addition, BUSD has many benefits for the financial industry from decentralized finance, or DeFi, to wealth management and account settlements. There are also global use case application for payments thanks to the fast redemptions and minting process that functions automatically through smart contracts.

The exponential growth of BUSD in the first six months since its launch shows that the market was ready for an alternative to the existing stablecoins. Besides providing utility within the Binance exchange, the stablecoin can also be used as a medium of value transfer across the Ethereum and Binance chains. Binance has also indicated that full support for online payments will soon be coming.

BUSD offers several advantages over other stablecoins, such as its improved transparency as a fully regulated stablecoin. It also has price stability, is fully collateralized and audited monthly, has scalability, and is fully supported by the Binance ecosystem, which almost guarantees its continued growth and adoption.