Most U.S. users searching “Binance vs Coinbase” are not comparing features in a vacuum. They are trying to avoid the wrong kind of risk. In 2026, the real trade-offs sit around jurisdiction, continuity, and how much friction you are willing to accept when something goes wrong. Fees matter, but they matter inside a narrower band than most people assume. What matters more is whether the platform works where you live, integrates cleanly with U.S. banks, produces defensible records for taxes, and still exists in the same form a few years from now.

This comparison is written for that reality. It treats Coinbase and Binance as infrastructure, not brands. The question is not which exchange is “better” in the abstract, but which one fits specific roles in a U.S.-based crypto stack: onboarding fiat, executing trades, holding assets, and exiting cleanly. With that lens, the decision becomes clearer and more asymmetric than most side-by-side charts suggest.

Quick Verdict (30 seconds)

The real choice in 2026 is continuity vs cost. Coinbase is the “least regulatory headache” default for most U.S. users (nationwide access, clearer disclosures, smoother recovery and reporting). Binance.US can be meaningfully cheaper on BTC/ETH in supported states, but you accept tighter coverage, a smaller product surface, and leaner support.

Choose Coinbase if you’re…

- U.S.-based and want the “least regulatory headache” default

- A beginner who values simplicity + support

- A long-term holder who prioritizes governance, transparency, and consistency

- Works broadly across the U.S. with fewer “state-by-state” surprises

- Stronger clarity on reporting, recovery, and consumer-grade guardrails

Choose Binance.US if you’re…

- Fee-sensitive and already comfortable trading

- Mostly buying BTC/ETH and want to minimize trading costs (where applicable)

- Happy to trade off some convenience/support for cost structure

- Lower spot fees on majors, especially when Tier 0 promos apply

- Terminal-first tools (OCO/trailing stops, deeper execution controls)

Use both if you want the “best of each”

| Coinbase | Fiat rails, support/recovery, reporting hub, and broader U.S. catalog |

|---|---|

| Binance.US | Selected low-cost execution on majors (where available in your state) |

| Rule of thumb | On-ramp at Coinbase, trade tactically on Binance.US, sweep profits back (or to self-custody) |

Note: State coverage, promos, fees, and listings change frequently. Always confirm current conditions inside the app before you trade.

Quick Comparison Table

| Dimension | Coinbase (U.S. users) | Binance.US |

|---|---|---|

| Which Binance are we talking about? | Not applicable. Coinbase operates as a single global brand with a U.S. operating entity and one unified retail front-end. | Binance.US is a standalone U.S. exchange. Global Binance.com is not legally accessible to U.S. residents. |

| U.S. availability (states) | Available across all 50 U.S. states, including stricter jurisdictions such as New York and Hawaii. | Not available in several states (including NY, TX, WA, VT, and others). Coverage is partial and can change over time. |

| Regulatory posture (headline level) | Publicly listed U.S. company with SEC reporting obligations, audited financials, and long-standing U.S. licensing coverage. | Separate U.S. entity designed to comply with U.S. rules, operating under money transmitter and state-level regulatory regimes. |

| Fees (typical low-volume) + spreads | Advanced Trade maker/taker fees scale up to roughly 0.60% at smaller tiers. Simple buys add a spread on top. | Spot fees often range from 0%–0.38%, with periodic zero-fee BTC promotions. Retail buys still include spread plus card or instant costs. |

| Asset count (U.S. version) | Supports 250+ cryptocurrencies globally, with a broad retail catalog cleared for U.S. compliance. | Lists fewer assets than global Binance and typically trails Coinbase in breadth for U.S. users. |

| Security and insurance scope | Heavy use of cold storage and institutional-grade custody. FDIC-style coverage applies only to eligible USD balances, not crypto. | Comparable exchange-grade controls and segregated custody. U.S. entity does not extend all global Binance programs. |

| Customer support channels | Help center plus email and in-app support, with broader consumer-grade account recovery tooling. | Help center and ticket-based support. Account recovery and escalation paths are generally leaner than Coinbase’s. |

| Best suited for | U.S. beginners, long-term allocators, and users who prioritize compliance clarity and broad fiat on-ramp access. | Cost-focused traders in supported states who mainly want low-fee BTC/ETH execution and a smaller spot universe. |

Note: Fees, promotions, state coverage, and supported assets change frequently. Always confirm current conditions directly on the platform before trading.

The Context Everyone Is Actually Googling

What Users Truly Search For Before Making Decisions

What Users Truly Search For Before Making DecisionsBy 2026, most U.S. users will no longer ask, “Which exchange is cheaper?” The real question has shifted to “Which exchange is likely to still be operating in the U.S., and under what constraints?”

Regulatory settlements, leadership turnover, and enforcement reversals now create trust more than token counts or promotional fee tiers. Against that backdrop, Binance's 2023–2025 enforcement arc and Coinbase’s parallel SEC history play an outsized role in how mainstream users assign platform risk.

Binance 2023 Settlement and Leadership Change

In November 2023, Binance and founder Changpeng “CZ” Zhao agreed to a roughly $4.3 billion criminal resolution with U.S. authorities. The settlement addressed failures tied to anti-money laundering controls, sanctions compliance, and operating an unlicensed money transmitting business. U.S. officials explicitly framed the case as Binance prioritizing growth over compliance. The agreement included multi-year monitoring and mandatory upgrades to AML and sanctions screening.

As part of the resolution, CZ stepped down as CEO of global Binance and later relinquished his role as Binance.US board chair. Richard Teng, previously a regional executive, was installed as CEO to steer the company through a more compliance-first phase. For users, this marked a clear shift away from founder-driven control toward a structure operating under tighter U.S. and global oversight, with knock-on effects for listings, product scope, and jurisdictional access.

In practice, this backdrop increases perceived platform and regulatory risk for mainstream U.S. users:

- Access risk: The settlement formalized Binance’s withdrawal from U.S. operations at the global level, leaving Binance.US as a constrained, locally regulated entity rather than a full extension of Binance.com.

- Product risk: Ongoing compliance monitoring and de-risking pressures can lead to delistings, restricted features, and slower rollout of higher-risk or more experimental products compared with the pre-settlement period.

Since then, Binance has continued adjusting its leadership structure. In late 2025, co-founder Yi He was appointed co-CEO alongside Teng, signaling a move toward shared leadership and a more institutional governance model rather than a single-founder structure. While this may reassure some users, the enforcement history still weighs heavily on perception in tightly regulated markets.

Advantage: Coinbase (trust clarity for mainstream U.S. readers)

For a mainstream U.S. user choosing a stable home for BTC, ETH, and a limited set of majors, Binance’s criminal settlement and leadership reset introduced an extra layer of regulatory risk that must be actively accepted. Coinbase does not carry a comparable criminal resolution history with U.S. agencies, making its trust narrative easier to explain to non-crypto-native stakeholders.

We break down Binance’s fee structure, custody model, and real-world risks in our full Binance exchange review.

Coinbase Regulatory Backdrop

From 2023 through 2024, Coinbase fought a high-profile SEC enforcement action alleging unregistered exchange, broker, and clearing activity, along with claims tied to its staking program. The case evolved into a proxy battle over how U.S. securities law should apply to crypto platforms.

In February 2025, Coinbase and the SEC filed a joint stipulation to dismiss the case with prejudice. The SEC then publicly confirmed the dismissal of its civil enforcement action against Coinbase and its parent company, closing out that overhang.

For most U.S. users, the takeaway is less about legal theory and more about signal. The primary U.S. securities regulator stepped away from a marquee case against the country’s largest exchange at the start of a new administration. At the same time, Coinbase continues operating as a publicly listed company subject to ongoing SEC disclosure requirements. Together, those factors point to lower continuity risk, even as broader policy debates around crypto classification remain unresolved.

Advantage: Coinbase

Coinbase’s status as a U.S. public company, combined with confirmation that a major SEC case has been dropped, creates a cleaner operating story for users who want to avoid surprise shutdowns, forced migrations, or sudden loss of U.S. access. For mainstream readers, that clarity typically matters more than marginally lower trading fees or a handful of additional long-tail listings on a platform that has recently gone through a criminal settlement.

We break down Coinbase’s features, fees, and trust factors in our full Coinbase review.

Binance.US vs Global Binance

Critical Structural Differences Between Binance.US And Global Binance

Critical Structural Differences Between Binance.US And Global BinanceMany U.S. readers still search “Binance” and assume every screenshot, fee chart, or promo tweet applies to them. That’s where bad decisions begin.

Global Binance.com and Binance.US are legally separate platforms. They differ on product scope, listings, liquidity, and even basic availability for U.S. residents. Getting this distinction clear upfront is non-negotiable because of the Coinbase vs. Binance. US comparison only makes sense inside the U.S. regulatory sandbox.

What US Users Can and Can’t Access

For U.S. residents, global Binance.com is off-limits under the platform’s own terms and current U.S. regulatory posture. Using VPN workarounds exposes users to account freezes, forced withdrawals, or sudden access loss.

Instead, U.S. users are routed to Binance.US, a separate exchange operated by BAM Trading under a licensing and technology agreement with Binance, structured specifically to meet U.S. compliance requirements.

Because of that separation, Binance.US runs a much thinner product surface than global Binance. It supports spot trading on roughly 160+ assets but excludes many higher-risk products available internationally, including futures, options, leveraged tokens, and parts of the long-tail listing universe. Liquidity pools and fee schedules are also distinct, which means headlines about global Binance maker/taker promos or derivatives funding rates do not automatically apply to Binance.US order books.

State Availability and Restrictions

Binance.US access is gated not just by federal policy, but by state-level licensing. As a result, service is live in many, but not all, U.S. states and territories.

Its help center maintains an up-to-date list showing where full USD services are available, where users are limited to crypto-only access (for example, trading via crypto deposits without USD rails), and where onboarding is blocked entirely.

These lists are not static. States marked as unsupported or “onboarding paused” can change as licenses are gained or lost. Any fixed state count in an article will eventually go stale. Users should always confirm their specific state status directly on Binance.US before treating it as a primary venue, especially to understand whether they will be restricted to crypto-only mode.

Advantage: Coinbase

Coinbase avoids forcing most U.S. users to think in terms of state-by-state eligibility. That removes an entire layer of “am I even allowed here?” friction from the decision process.

For beginners and long-term allocators who want a single account that continues to work across relocations and job changes within the U.S., that geographic consistency is a real structural advantage over Binance.US’s patchwork coverage.

Fees in the Real World

Trading Costs Accumulate Over Time

Trading Costs Accumulate Over TimeFor most retail users, the “fee story” is not just the headline maker/taker grid. What actually matters is the combination of explicit trading commissions, hidden spreads on one-click buys, and the friction involved in moving fiat and crypto in and out of each venue.

The clean way to think about Coinbase vs. Binance. US is to separate what you pay to trade from what you pay to fund, withdraw, and route assets.

What Fees Actually Show Up

On Coinbase, simple buy/sell flows bundle a trading spread (often low single-digit percentages on small tickets) plus a variable fee tied to the payment method. Advanced Trade strips that down to a visible maker/taker schedule, starting around 0.40% maker and 0.60% taker for users under $10,000 in 30-day volume. ACH deposits are typically free, card and instant funding add extra costs, and crypto withdrawals pass through network fees based on the chain, not a fixed Coinbase markup.

Binance.US uses a more transparent maker/taker grid tied to 30-day volume and asset tiering. Selected Tier 0 pairs (typically BTC and top majors) are often pushed to 0% maker and 0.01% taker or similar promo levels for spot trading. ACH deposits are usually free, while wires and cards may carry third-party or platform fees. Blockchain withdrawals forward on-chain network costs the same way: Cheap on L2s, expensive on congested L1s.

Scenario Calculator Blocks

To make this concrete, assume:

- Coinbase Advanced: 0.40% maker / 0.60% taker at low volume, no extra “Coinbase fee” when staying inside Advanced.

- Binance.US: 0.10% taker baseline for many pairs, with 0%–0.01% taker on Tier 0 BTC/ETH promos.

Network fees are ignored here (chain-dependent), so this reflects pure trading cost.

- $100 buy

On Coinbase, a $100 BTC market buy via Advanced at 0.60% taker costs about $0.60 in explicit fees. Using the simple buy interface instead, a 1–3% spread can easily turn that into $1–$3 of embedded cost on the same notional.

On Binance.US, the same $100 BTC buy on a Tier 0 pair at 0%–0.01% taker typically costs between $0 and $0.01, making the explicit execution cost effectively negligible relative to Coinbase.

- Cheapest path on Coinbase: Fund via ACH, stay in Advanced, and place a small limit order near the mid to hit the 0.40% maker side instead of paying taker.

- Cheapest path on Binance.US: Use a supported Tier 0 BTC/ETH pair from a supported state and execute on the main spot book.

Takeaway: At $100 ticket sizes, Binance.US wins clearly on explicit fees. Coinbase only gets close if you avoid simple buys and stay disciplined inside Advanced.

- $1,000 trade

On Coinbase Advanced, a $1,000 taker fill at 0.60% costs about $6. Work it as a maker at 0.40% and that drops to roughly $4.

On Binance.US, a $1,000 taker trade at 0.10% costs about $1, while a Tier 0 BTC/ETH taker at 0.01% costs around $0.10, with 0% maker possible in some promo configurations.

- Cheapest path on Coinbase: Use Advanced, rely on limit orders with post-only flags, and avoid card funding that adds separate percentage-based costs.

- Cheapest path on Binance.US: Route majors through Tier 0 where available, and pay fees in BNB to shave a bit more off already-low rates.

Takeaway: At a $1,000 size, Binance.US is structurally cheaper on majors. Coinbase remains viable if you value its rails and are willing to pay a few extra dollars per trade.

- $10,000 trade

On Coinbase, a $10,000 BTC/ETH market trade at 0.60% costs about $60 in trading fees. Working that order as a maker at 0.40% brings it closer to $40.

On Binance.US, the same $10,000 taker flow at 0.10% costs roughly $10, while a Tier 0 taker at 0.01% is about $1, creating an order-of-magnitude difference when promos apply.

- Cheapest path on Coinbase: Increase volume to graduate into lower tiers, stick to bank transfers, and avoid simple flows that layer spread on top of commission.

- Cheapest path on Binance.US: Concentrate size in Tier 0–eligible majors, maintain volume to move up tiers, and pay fees in BNB for incremental discounts.

Takeaway: For $10,000-class trades, Binance.US’s fee grid dominates on supported pairs. Coinbase cannot match those economics without promotions, so its value proposition at this size shifts back to regulation, UX, and asset access.

Winner: Binance.US

For users in supported states who mainly trade BTC, ETH, and a short list of majors, Binance.US delivers meaningfully lower execution costs across small, mid, and large tickets, especially on Tier 0 schedules.

The key caveat: Fee optimization is never worth routing through the wrong network, skipping test withdrawals, or ignoring jurisdiction risk. Saving a few dollars in commission is trivial compared with the cost of a stuck transfer or misrouted withdrawal.

Check out our top picks for the best low-fee crypto exchanges.

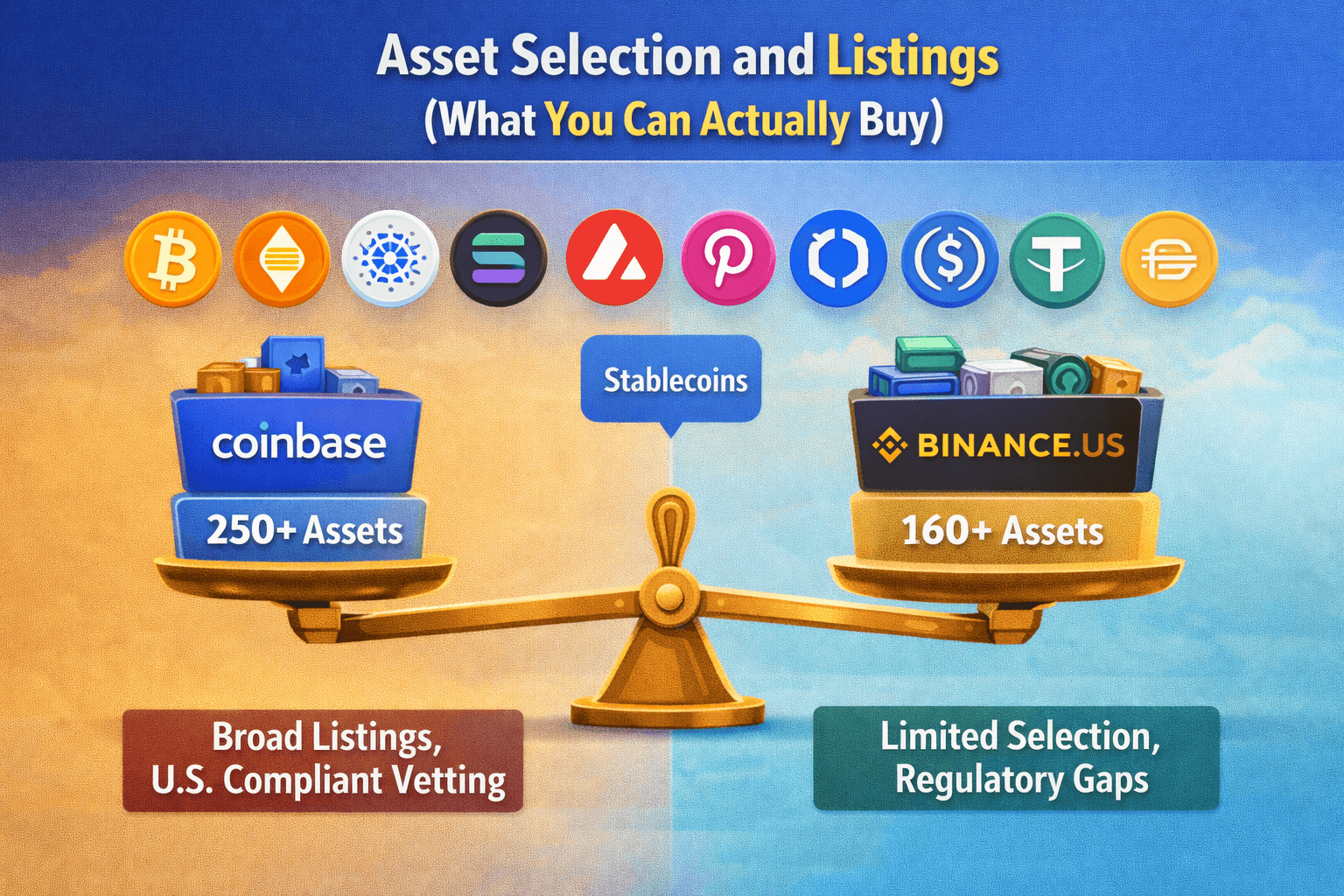

Asset Selection and Listings

Breadth And Depth Of Tradable Assets Compared In Both Platforms

Breadth And Depth Of Tradable Assets Compared In Both PlatformsMost users don’t need hundreds of tokens. What they need is reliable access to BTC, ETH, stablecoins, and the majors that actually drive portfolio movement, plus a sensible path to vetted alts without chasing long-tail vaporware.

Both Coinbase and Binance.US meet that baseline for U.S. users. Where they diverge is in breadth, listing velocity, and how they handle assets constrained by U.S. regulation.

Bread-And-Butter Coverage

Both platforms support BTC, ETH, and core majors such as SOL, ADA, AVAX, DOT, LINK, and MATIC, with deep liquidity and multiple USD pairs for spot trading. Stablecoin coverage is similarly complete: USDC, USDT, and DAI are available on both. USDC often sits at the center of Coinbase’s USD flows due to its U.S. compliance posture and tight integration with Circle’s mint and redemption rails.

Depth in majors is solid across the board. BTC/USD, ETH/USD, and major stablecoin pairs trade with tight spreads and high daily volume, so typical retail-sized orders do not experience meaningful slippage.

Altcoin Depth and Listing Philosophy

Coinbase’s U.S. catalog spans 250+ assets, curated through a deliberate vetting process that prioritizes tokens capable of clearing U.S. securities and compliance thresholds. That approach results in broader exposure to Layer 2 tokens, established DeFi majors, and institutionally oriented alts such as ARB and OP, alongside compliant meme assets and newer listings like SUI or TON when cleared. The trade-off is speed: listings tend to roll out more slowly, but with higher predictability and clearer support for staking or earn programs once approved.

Binance.US runs a much tighter list, roughly 160 assets, constrained both by U.S. regulatory limits and its separation from global Binance’s full catalog. Many longer-tail or higher-risk tokens never make it to the U.S. platform. The gap is most visible in niche DeFi, meme-driven assets, or emerging L1 and L2 ecosystems, where Coinbase has often moved faster following the dismissal of its SEC case.

Winner: Coinbase (broader U.S. catalog in many cases)

Coinbase edges out on asset breadth and diversity for U.S. users. It offers more flexibility across majors, Layer 2 exposure, and staking-eligible tokens without requiring multiple accounts or workarounds tied to global platforms.

Binance.US works well for BTC, ETH, and stablecoin-centric strategies, but it falls short if your approach depends on access to a wider or more current set of U.S.-compliant assets.

Trading Experience and Tools

This is where Coinbase and Binance.US make their target users most obvious.

Coinbase wraps pro-grade tools inside a consumer-fintech shell, letting users start simple and gradually expose complexity. Binance.US does the opposite. It presents an exchange-style interface from the first login, assuming the user wants direct access to books, charts, and execution controls.

For U.S. retail traders, the real choice is whether you want a guided on-ramp with depth behind a toggle, or a terminal-first setup that skips handholding entirely. Differences in order types, charting depth, liquidity views, and automation make that split very clear.

Coinbase Experience

Inside The Coinbase User Experience From Setup Onward. Image via Coinbase Advanced

Inside The Coinbase User Experience From Setup Onward. Image via Coinbase AdvancedCoinbase runs a dual-mode setup that allows users to switch between beginner-friendly fiat flows and full Advanced Trade execution without changing accounts or liquidity pools. That structure bridges casual onboarding and active trading in a single environment.

- Simple Buy/Sell Interface: One-click asset selection, dollar or coin amount entry, payment method choice (ACH, card, wallet), spread-inclusive pricing, and instant execution confirmation.

- Advanced Trade Mode: Full TradingView charts with 50+ indicators, multi-timeframe candles, drawing tools, live order book with depth, recent trades tape, and a customizable order panel.

- Core Order Types: Market, Limit, GTC, IOC, time-in-force options, Stop-Limit protection, bracketed take-profit/stop-loss pairs, and Post-Only orders to avoid maker fees.

- Retail Essentials: Recurring buys for DCA, price alerts, in-view USDC and ETH staking rewards, and a unified portfolio analytics dashboard.

- API Access: REST and WebSocket endpoints for automation, order streaming, and balance queries without moving funds off-platform.

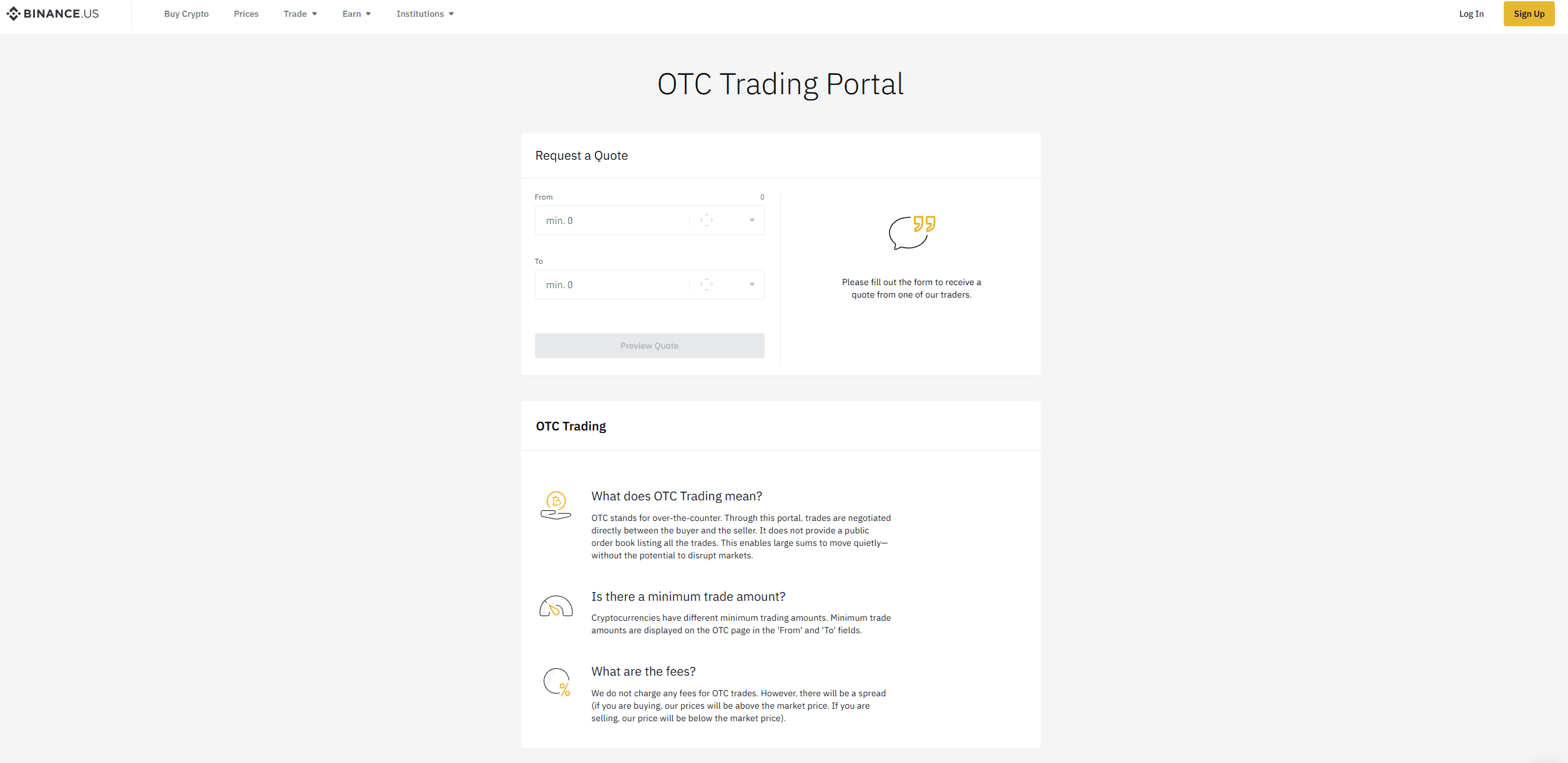

Binance.US Experience

Inside The Binance.US Trading Experience Day To Day. Image via Binance.US

Inside The Binance.US Trading Experience Day To Day. Image via Binance.USBinance.US centers the entire workflow around a terminal-style trading screen, with charts, order books, and execution controls placed front and center. The assumption is that trading is the primary interaction, not a side feature.

- Unified Trading Dashboard: TradingView-powered charts with candlesticks, indicators, and drawings, plus depth charts, order book, live trade history, and a right-side order entry panel for rapid execution.

- Advanced Order Types: Market, Limit (GTC, IOC, FOK), Stop-Loss Limit, Take-Profit Limit, Trailing Stop (delta-based), and OCO (one-cancels-other) paired exits.

- Algo Controls: Self-Trade Prevention (STP) modes such as NONE, EXPIRE_MAKER, and EXPIRE_BOTH, with high-frequency order status streaming via WebSocket.

- API Tiers: Spot exchange APIs, custodial and institutional access, credit line support, bot connectivity, fills monitoring, and execution timing tools.

- Trader Tools: Volume-based VIP fee tiers, BNB fee discounts, and integrated portfolio views with realized and unrealized P&L tracking.

Trading Features That Change the Decision

Beyond raw execution, these platforms diverge on automation, liquidity advantages, and risk tooling, depending on whether you value consumer guardrails or exchange-grade customization.

- Recurring Buys/DCA: Both support DCA on majors. Coinbase ties scheduling to fiat rails with built-in tax tracking, while Binance.US emphasizes crypto-funded automation.

- Price Alerts: Standard app notifications on both. Coinbase layers in portfolio-wide watchlists, while Binance.US integrates alerts directly with chart annotations.

- Liquidity Edge: Coinbase is tighter across a broader set of pairs (250+), while Binance.US concentrates liquidity on Tier 0 promo majors where order books can be deeper.

- Risk Management: Coinbase focuses on bracket orders and post-only controls for retail protection. Binance.US offers trailing stops, OCO structures, and STP modes for more dynamic, algorithmic exits.

Section verdict

Winner for beginners: Coinbase

The simple-to-advanced toggle, recurring buy rails, embedded staking, and guided UX make Coinbase a smoother entry point for users still learning order types, book dynamics, and basic risk controls.

Winner for hands-on traders: Binance.US

The terminal-style interface, trailing and OCO orders, STP controls, robust API streaming, and exchange-first design suit traders who want to live in the order book, automate execution, and optimize fills without abstraction layers.

Explore top-rated exchanges and how they stack up in our best crypto exchanges review.

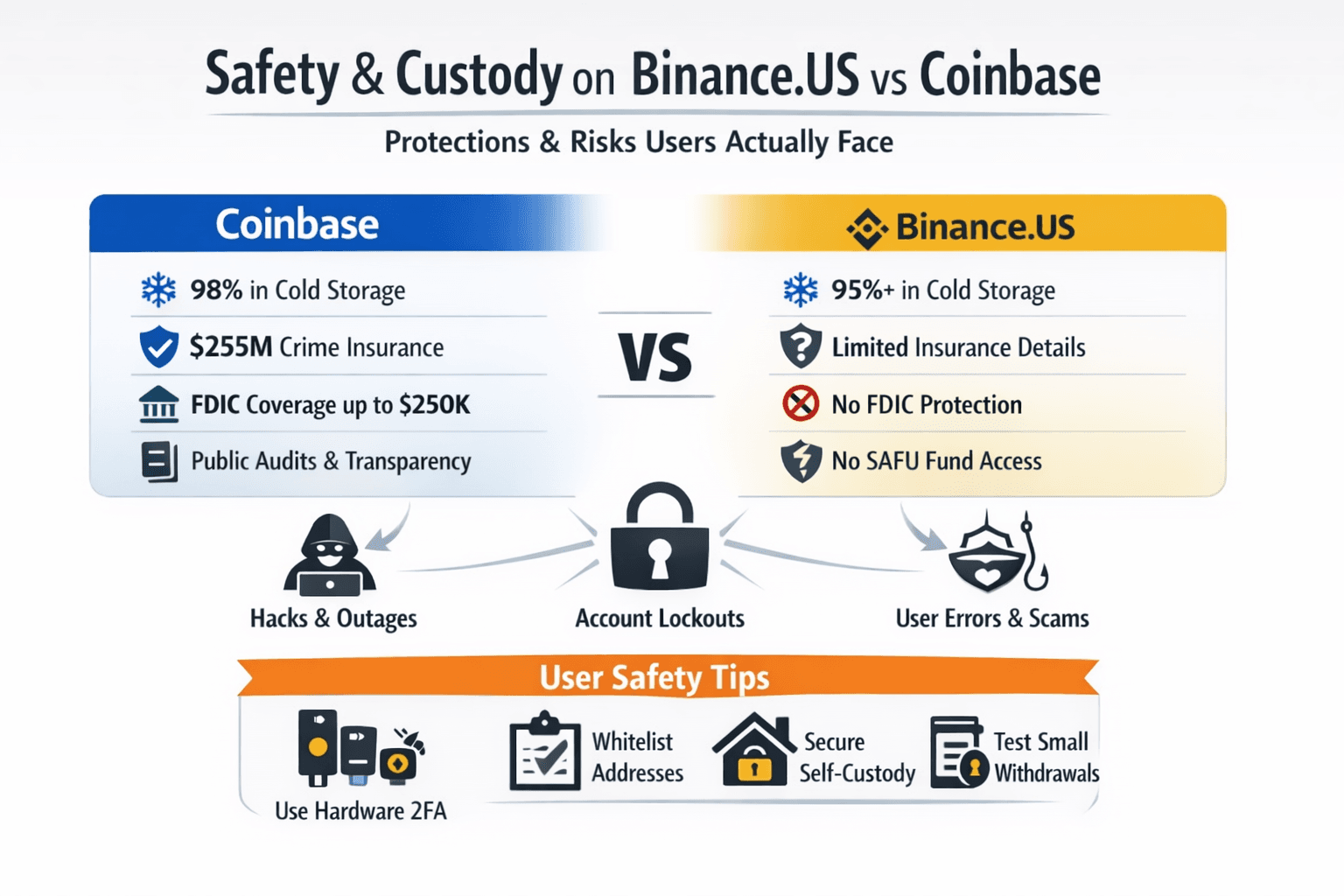

Safety, Custody, and “What If Something Goes Wrong?”

A Look At How Binance.US and Coinbase Protect User Funds

A Look At How Binance.US and Coinbase Protect User FundsSafety is table stakes for any U.S. exchange in 2026. Both Coinbase and Binance.US use institutional-grade custody, keep the majority of assets in cold storage, and segregate client funds. Where they differ is in insurance scope, recovery paths when accounts are locked, and historical incident transparency.

For users allocating real capital, the question is not whether cold storage exists. It’s what happens during an outage, a platform breach, or a personal security failure, and how clearly each venue defines those outcomes.

Coinbase Protection Stack

Coinbase positions itself as a regulated custodian with bank-style controls and public disclosures. Cold storage is the primary defense layer, with client crypto held offline in multi-signature vaults distributed across geographic locations.

- Cold storage: Roughly 98% of client crypto held offline. Hot wallets are limited to operational liquidity.

- Crime insurance: Up to $255 million via a Lloyd’s of London syndicate, covering theft or hacking of platform-held assets. This does not cover price movement or user error.

- USD protection: Eligible USD balances (including funds from direct deposits or USDC redemption) are FDIC pass-through insured up to $250,000 per user when held with partner banks.

- Account controls: 2FA (TOTP/SMS), YubiKey and other hardware security keys, withdrawal address allowlists, biometric app locks, and session timeouts.

The key distinction is disclosure. Coinbase publishes insurance limits, custody practices, and audit-related information as part of its obligations as a U.S. public company.

Binance.US Protection Stack

Binance.US uses exchange-grade custody standards, but its protections are explicitly separate from global Binance programs.

- Cold storage: 95%+ of assets held in cold storage with institutional multi-signature controls and geographic distribution aligned with U.S. MSB standards.

- Insurance: Platform-level coverage for hot wallet incidents (third-party underwritten), with no publicly disclosed coverage ceiling.

- USD coverage: No user-specific FDIC-equivalent protection disclosed for USD balances.

- SAFU fund: The global Binance SAFU fund does not apply to Binance.US users or assets.

- Account controls: 2FA (Authenticator or SMS), anti-phishing codes, withdrawal whitelisting, device management, and IP restrictions.

From a mechanical standpoint, custody security is comparable. The difference is transparency and scope. Binance.US does not extend global Binance backstops, and its insurance disclosures are less explicit.

User-Controlled Safety

No exchange can eliminate user error or social engineering. These practices matter more than platform choice:

- Use hardware-based 2FA (YubiKey, Ledger, Trezor), not SMS, where possible.

- Enable withdrawal allowlists and pre-approve addresses only. Test with small amounts first.

- Maintain a separate exchange-only email with a strong password and IMAP disabled.

- Perform test withdrawals across each chain before moving size.

- Use exchanges as hot trading accounts only. Keep long-term holdings in self-custody, ideally with multisig.

Most exchange losses still trace back to compromised credentials, not custody failures.

Winner: Coinbase

Coinbase’s combination of disclosed crime insurance limits, FDIC pass-through coverage for eligible USD balances, public-company audit obligations, and a clean record of avoiding major U.S. client asset losses gives it a measurable edge for conservative U.S. users.

Binance.US matches on core custody mechanics but lacks equivalent insurance transparency and carries residual global brand overhang. For capital you want to “sleep on,” Coinbase remains the clearer choice.

Learn how to secure assets and avoid common risks in our crypto safety and protection guide.

Regulation, Taxes and Reporting

In the post-2025 crypto policy environment, U.S. exchanges operate under overlapping SEC and CFTC debates alongside expanding IRS reporting mandates. In that context, being publicly listed or having a clean enforcement record materially affects user trust in continuity and compliance tooling.

Both Coinbase and Binance.US issue IRS forms such as 1099s. Where they differ is in disclosure rigor, tax export depth, and how tightly they integrate with the broader U.S. financial reporting stack.

Compliance Posture in 2026

Coinbase operates as a Nasdaq-listed public company (COIN), which subjects it to quarterly SEC filings, Sarbanes-Oxley audits, and continuous investor scrutiny. That structure forces granular disclosures around reserves, risk factors, and operational controls, effectively turning transparency into a legal requirement. For users, this reduces uncertainty around sudden policy shifts, delistings, or jurisdiction exits.

Binance.US operates as a private money services business under FinCEN registration and state-level licensing. It meets compliance requirements, but without the same public reporting cadence. Users rely more on platform attestations and periodic proof-of-reserves snapshots rather than full audited financials. While regulatory uncertainty around crypto classification affects both platforms, Coinbase’s public status and resolved SEC case offer clearer continuity signals.

Does Coinbase report to the IRS? Find that out and more in our article.

Tax Forms and Exports

Coinbase automatically generates and mails the relevant IRS forms, including 1099-MISC (for rewards or staking income over $600), 1099-B (for sales), and 1099-DA (the new digital asset reporting form effective in 2026). It also provides CSV and API exports that integrate directly with tools like TurboTax, CoinTracker, and Koinly, covering cost basis, proceeds, and wash-sale indicators. While users must still track self-custody and DeFi activity separately, Coinbase’s tooling captures the majority of on-platform activity.

Binance.US issues comparable 1099-MISC and 1099-DA forms for qualifying activity and offers downloadable CSV histories for trades, deposits, and withdrawals. However, users often rely more heavily on third-party aggregators to reconcile full tax positions due to lighter built-in cost basis tracking. IRS reporting obligations, such as Form 8949, apply regardless of which forms are issued; exchanges report activity, but the filing responsibility remains with the user.

Winner: Coinbase

Coinbase’s public-company disclosures, deeper tax export tooling, and tight integrations with mainstream tax software make compliance easier for U.S. filers, especially those with mixed fiat, crypto, and staking activity.

Binance.US works for straightforward spot traders, but it typically requires more manual aggregation and reconciliation. For most U.S. users, that tips the edge toward Coinbase for reporting and tax workflows.

Follow this guide to understand crypto tax rules, reporting and filing essentials.

Support and Education

Help Systems And Learning Tools Users Actually Rely On

Help Systems And Learning Tools Users Actually Rely OnSupport quality and learning resources are often what separate exchanges that are merely usable from those that actually onboard and retain users long term. This matters most for U.S. users dealing with KYC checks, account lockouts, recovery flows, or early-stage strategy questions.

Coinbase leans toward consumer-grade accessibility and incentives. Binance.US runs leaner on support, but backs it with deeper technical documentation for users already comfortable with exchange mechanics.

Customer Support Channels Compared

Coinbase centers its support around a searchable Help Center with AI-assisted triage, escalating to human agents for verified users. The system is designed for broad consumer access, including phone support for escalated cases.

Coinbase support system

24/7 in-app and email chat for account issues, trading disputes, and recovery.

- Phone support (U.S. lines) for high-impact cases such as account lockouts, large withdrawals, and compliance flags, available during business hours with callback options.

- Recovery flows: ID re-verification, device audits, and notarized documentation for 2FA resets. Typical resolution windows range from 12 to 24 hours for standard tickets.

- Friction points: High-volume periods can lead to chat delays. Phone support is unofficially relied on for urgent cases, though availability varies.

Binance.US Support System

Binance.US prioritizes AI-powered chat and ticketing through a unified messenger, with live human escalation during defined service hours. The focus is on efficient self-service for trading and KYC-related issues.

- Live chat available roughly 6 a.m. to midnight EST, seven days a week, covering deposits, orders, and account restrictions.

- Email and ticket submissions for complex cases such as state eligibility overrides or API-related issues. No dedicated phone support.

- Recovery flows: Self-service 2FA resets and transaction recovery tools, with 1–3 day response windows for escalated cases.

- Friction points: Limited coverage outside EST hours, and crypto-only state users may need manual intervention to unlock fiat features.

Learning resources

Coinbase Learn is built for absolute beginners, using short, gamified modules that reward users with small amounts of crypto for completing lessons.

Coinbase Learn

Learn-and-earn modules covering wallets, staking, DeFi basics, and U.S. regulatory concepts.

- Quest system: Complete on-chain tasks such as swaps or staking on supported networks to earn rewards.

- Incentives: Earn actual tokens (often $1–$10 per module) in sessions that take 5–15 minutes, with U.S. tax context surfaced inside the app.

- Best for: Fiat-native users building crypto literacy without needing external reading or research.

Binance Academy

Binance Academy offers long-form, reference-style education with depth across the crypto stack.

- 1,000+ articles, courses, and glossaries covering blockchain fundamentals, technical analysis, DeFi, NFTs, and security, available in 30+ languages.

- Structured courses from Bitcoin basics through advanced Web3 topics, with videos and quizzes.

- Focus areas: Order types, market mechanics, economic models, and security practices, supported by university outreach and ambassador programs.

- Best for: Intermediate users who want technical depth and conceptual mastery rather than guided onboarding.

Winner: Coinbase

Coinbase’s hybrid phone and chat support, faster recovery workflows, and reward-driven beginner education make it the stronger option for U.S. users who value accessibility and guided learning over deep technical reference material.

Binance.US remains suitable for exchange-familiar users who prioritize documentation depth and self-service, but for most mainstream users, Coinbase’s support and education stack is easier to live with day to day.

Staking and Earn

Staking on U.S. exchanges is less about headline APYs and more about how rewards are generated, what fees are taken, how quickly you can exit, and where access is restricted. Coinbase and Binance.US both offer PoS staking, but they approach it from different user assumptions.

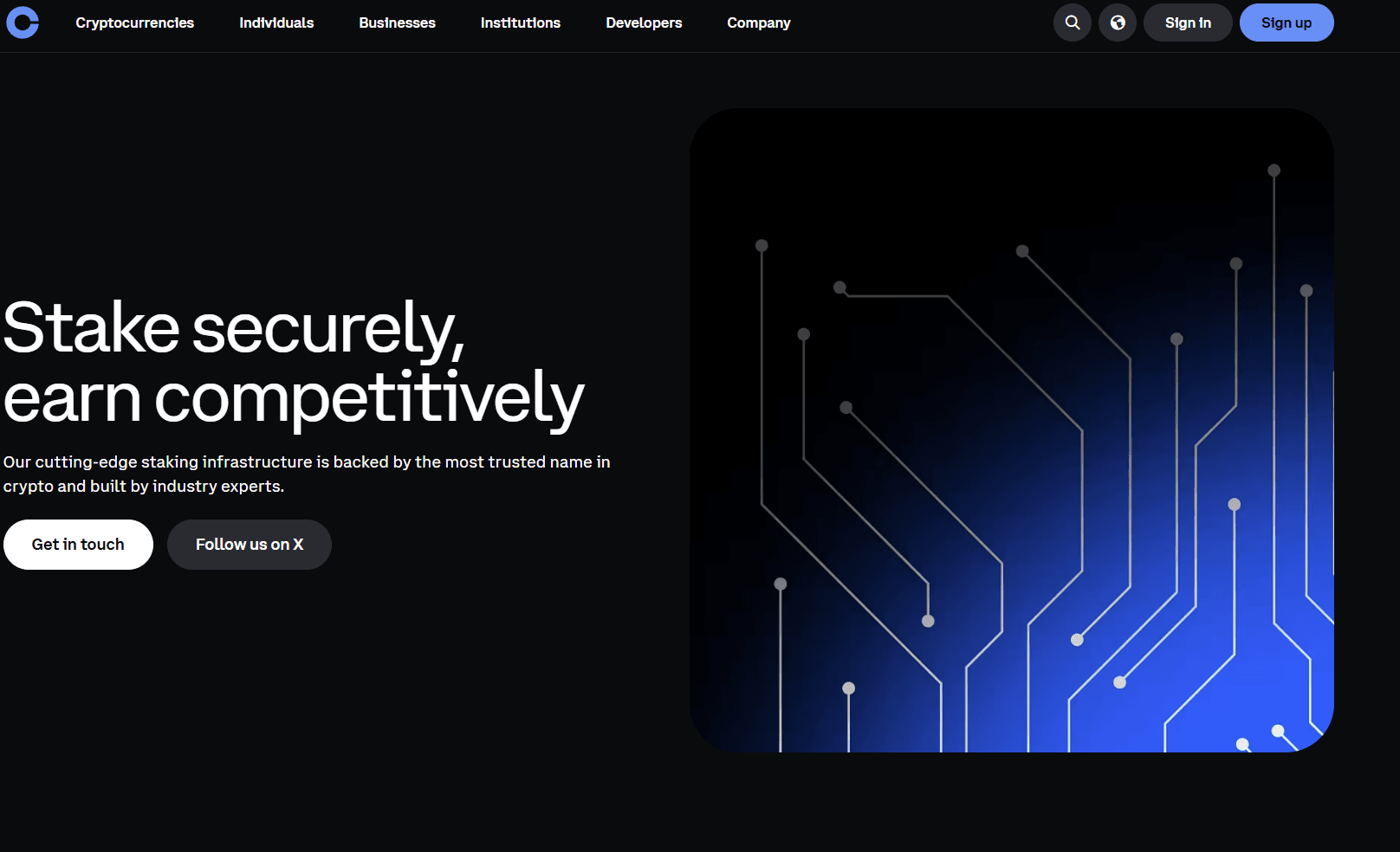

Coinbase Staking

How Coinbase Handles Staking For Long Term Holders. Image via Coinbase Staking

How Coinbase Handles Staking For Long Term Holders. Image via Coinbase StakingCoinbase runs on-chain validator delegation for supported assets, with auto-compounding rewards and clearly defined unbonding periods. Availability is nationwide, with a few state-level exclusions depending on the asset.

How it works in practice

- Rewards are earned directly from native chain staking.

- Coinbase handles validator operations, slashing risk management, and reward distribution.

- Earnings auto-compound, and unstaking follows native protocol timelines.

Snapshot

- Supported assets: ETH, SOL, ADA, ATOM, MATIC, LINK, XTZ, SUI, HBAR (20+ total)

- Fees: 25% service fee taken from rewards (e.g., ETH netting 3–4% depending on network yield)

- Unstaking: Native chain rules (ETH typically 0–3 days post-exit queue; SOL around two epochs)

- Regional limits: Paused or restricted in select states (e.g., NY); asset-specific checks required

Coinbase’s strength is predictability. You know where rewards come from, when you can exit, and what cut the platform takes.

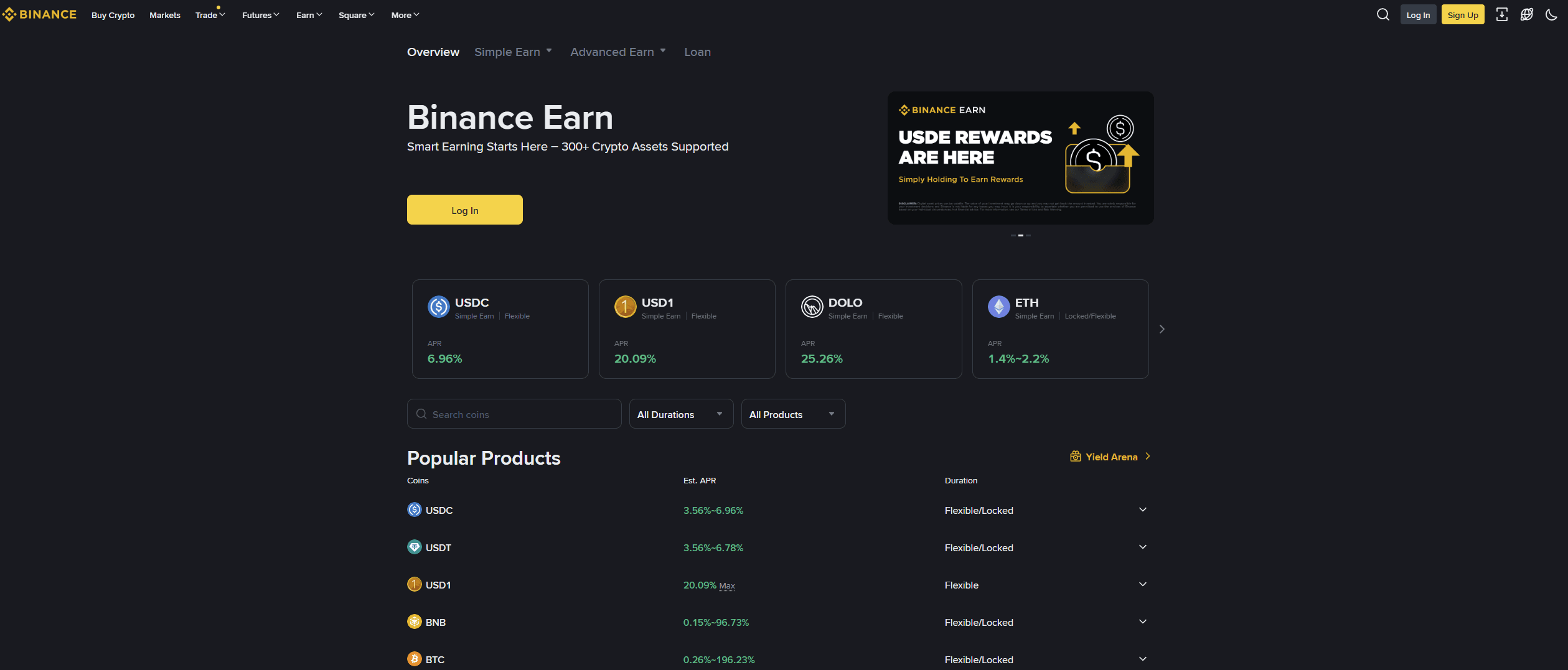

Binance Earn

How Binance.US Structures Yield And Earn Products. Image via Binance Earn

How Binance.US Structures Yield And Earn Products. Image via Binance EarnBinance.US focuses on simplified staking flows for major PoS assets, with an emphasis on rate visibility and API accessibility for users who automate or monitor yields closely.

How it works in practice

- One-click staking for supported assets.

- Mix of flexible and fixed-term products, depending on the asset.

- API endpoints available for stake and unstake status tracking.

Snapshot

- Supported assets: ETH, SOL, ADA, BNB, MATIC (roughly 10–20+ depending on availability)

- Fees: Variable, often 10–30%, with periodic promotions boosting net yields into the 4–6% range

- Unstaking: Either flexible (daily liquidity) or locked terms around 7–90 days

- Regional limits: Supported states only; crypto-only access in some jurisdictions

Binance.US appeals to users who actively rate-shop or want programmatic access, but terms vary more frequently and require closer monitoring.

Rates change frequently. Always check live dashboards before committing.

Verdict

- Coinbase wins on breadth, clarity, and ease for passive staking.

- Binance.US wins for users who chase promos, monitor yields actively, or integrate staking via APIs.

Cards, Payments, and Integrations

How Crypto Connects To Everyday Payments And Apps

How Crypto Connects To Everyday Payments And AppsBeyond trading and staking, the ecosystem around an exchange often matters more over time than marginal yield differences.

Coinbase Ecosystem

Coinbase leans heavily into consumer integrations and adjacent products:

- Coinbase Card: Visa debit with crypto spending and rotating rewards (often 1–4% in assets like XLM).

- Fiat rails: ACH, wire, Plaid, Apple Pay.

- Self-custody: Native Coinbase Wallet app with Base ecosystem integration.

- Extras: NFT drops on Base, and CFTC-regulated derivatives via Coinbase Financial Markets (e.g., futures on select assets).

Binance.US Ecosystem

Binance.US keeps its surface area narrow:

- Fiat rails: ACH, wire, card funding.

- Core features: Spot trading, staking, and advanced APIs.

- Not offered: No card program, no NFT platform, no U.S. derivatives.

Section verdict – Winner: Coinbase

Coinbase’s broader ecosystem, stronger fiat rails, wallet integration, and regulated derivatives access make it more versatile for U.S. users who want everything in one place. Binance.US remains focused and efficient, but intentionally limited beyond core exchange functions.

Who Should Choose What?

Matching User Profiles To The Right Exchange Choice

Matching User Profiles To The Right Exchange ChoiceUser profiles drive most exchange decisions. Beginners want smooth rails and guardrails. Active traders care about execution and fees. Long-term holders focus on custody, reporting, and continuity. This section maps common profiles to the right venue, with practical setup steps to reduce early mistakes.

If You’re a Complete Beginner

Pick: Coinbase

Nationwide access, a consumer-first interface, and built-in education make Coinbase the lowest-friction entry point without state or fee surprises.

Setup steps and security checklist

- Verify email and phone, upload ID for full limits (usually 5–10 minutes).

- Enable 2FA immediately, preferably with a hardware key, and turn on withdrawal allowlists.

- Fund via ACH (free, 3–5 days). Start with a ~$50 BTC or ETH test buy using Simple Buy.

- Set up a recurring buy for DCA.

- Complete 1–2 Coinbase Learn quests to earn small amounts of crypto.

- Export your first transaction CSV early to confirm your tax workflow works.

First-time traders can build fundamentals using this crypto trading starter guide.

If You’re a Fee-Sensitive Trader

Pick: Binance.US

Tiered fees and a terminal-style interface reward users who trade size and pay attention to execution. Confirm state support before committing.

Fee minimization checklist and caveats

- Check your state’s status in the Binance.US help center. Use crypto-only mode if required.

- Concentrate BTC and ETH flow into Tier 0–eligible pairs.

- Pay fees in BNB when supported to shave basis points.

- Use limit and OCO orders; test small size before scaling.

- Enable API access only after manual trading is stable.

- Caveat: state coverage and listings can change. Sweep profits to self-custody rather than leaving excess balances on-platform.

If You’re a Long-Term Holder

Coinbase for rails, plus self-custody for storage

Public disclosures, staking access, and clean tax exports fit long-horizon strategies, but exchanges are not vaults.

Best-practice setup

- Use Coinbase for fiat onboarding, recurring buys, and staking ETH or SOL if desired.

- Enable withdrawal allowlists and hardware-key 2FA.

- Treat the exchange as a transit layer, not cold storage.

- Transfer balances above $10k to a Ledger or Trezor setup, ideally multisig, on a regular cadence.

- Monitor Coinbase disclosures and custody updates through SEC filings rather than social media.

If You Live In a Restricted State

Default: Coinbase

Its nationwide footprint avoids the state-by-state friction that can block or downgrade Binance.US access.

Alternatives

Kraken or Gemini may work in some jurisdictions with a similar compliance posture.

Scope stays narrower, so evaluate asset support before onboarding

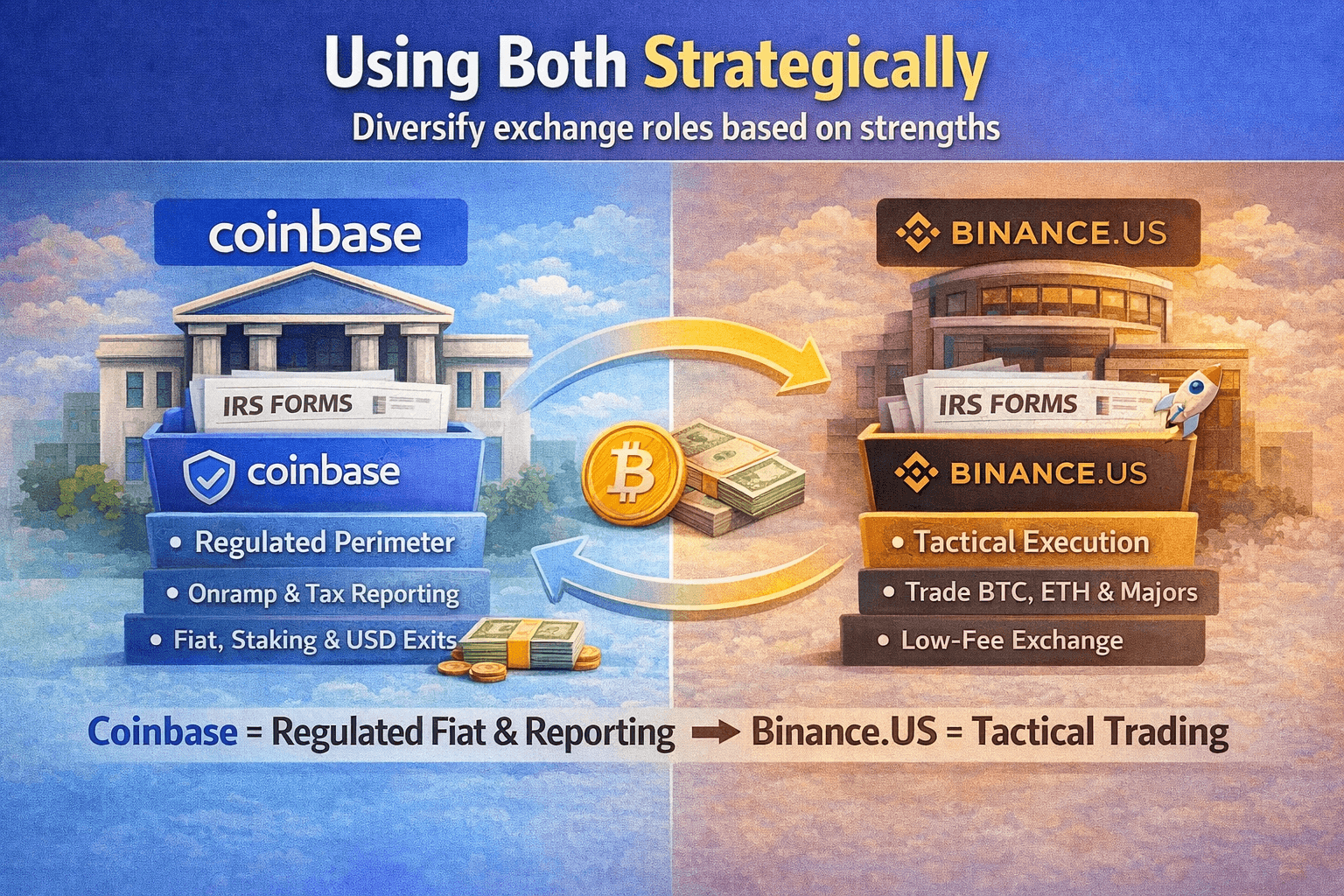

Using Both Strategically

How Smart Users Split Roles Across Exchanges

How Smart Users Split Roles Across ExchangesMore experienced users rarely force one exchange to do everything. Instead, they separate functions: one venue handles regulated fiat rails and reporting, the other handles execution. This reduces platform risk while letting each exchange do what it’s best at.

Think of this as infrastructure design, not platform loyalty.

The Split-Brain Model

The mistake most users make is optimizing for a single dashboard. The smarter approach is optimizing for failure modes.

- Fiat access, tax reporting, and recovery matter most where regulation and support are strongest.

- Execution quality and fees matter most where you’re actually trading.

Splitting those concerns lowers operational risk without adding much complexity once set up.

Recommended Role Assignment

Coinbase = Regulated perimeter

- Fiat rails via ACH, Plaid, wires, and cards.

- Broad U.S. asset access for majors and compliant alts.

- Staking for supported assets.

- Primary support channel for account recovery.

- Tax exports and reporting hub.

Use Coinbase as the place where money enters and exits the crypto system, and where records need to be clean.

Binance.US = Tactical execution

- Low-fee spot execution on Tier 0 majors.

- Better economics for frequent BTC/ETH trades.

- Terminal-style interface for active order management.

- Access to select pairs where Coinbase fees are structurally higher.

Use Binance.US as a trading venue, not a balance sheet.

How Funds Should Flow

Onboard fiat at Coinbase

- ACH or wire in.

- Convert to BTC, ETH, or a stablecoin.

Transfer only what you intend to trade

- Move trading capital to Binance.US.

- Keep excess balances off the execution venue.

Execute trades on Binance.US

- Use limit/OCO orders.

- Capture fee advantages where available.

Return profits or idle balances

- Sweep back to Coinbase for reporting, staking, or off-ramp.

- Or move directly to self-custody if long-term holding.

- This keeps execution risk isolated and reporting centralized.

How to Transfer Between Them Safely

This is where most irreversible mistakes happen, so process matters.

- Always select matching networks

ETH on Ethereum, SOL on Solana. Never assume defaults. - Double-check memos and tags for XRP, XLM, ATOM, etc.

- Send a $10–$50 test transfer first and wait for confirmation.

- Only scale after the test clears both sides.

Hard rule:

Wrong network equals lost funds. A missing memo or tag can permanently burn deposits.

Who This Setup Is For

- Users are comfortable managing more than one account.

- Traders who care about fees but don’t want reporting chaos.

- Holders who want clean fiat rails without overexposing capital to one venue.

If you want a single app to do everything, this isn’t for you.

If you want resilience and control, this is the cleanest way to get it.

Section verdict

Best for experienced users who understand custody, transfers, and execution tradeoffs

Final Verdict

This decision collapses to one question: Are you optimizing for certainty or for execution?

The Simplest Rule That Actually Holds

No platform wins on all dimensions. Each wins at its job.

Choose Coinbase: If you want regulatory clarity, nationwide access, and a setup that survives life events. It works everywhere, behaves like a U.S. fintech, and minimizes surprises around access, taxes, and recovery.

Choose Binance.US: If you actively trade and care about fees more than convenience. When it’s available in your state, it offers meaningfully better execution economics on BTC, ETH, and a short list of majors.

What We’d Actually Do

For most U.S. users, the optimal setup is asymmetric.

About 70% of users should default to Coinbase as their primary hub. Use it for fiat on-ramps, recurring buys, staking, tax exports, and anything that needs clean records or human support. It’s the least fragile place to anchor your crypto footprint.

The remaining 30%, mostly fee-aware traders in supported states, should add Binance.US selectively. Use it only for spot execution on majors where fees matter, then sweep profits back to Coinbase or straight to self-custody on a schedule. Treat it as a tool, not a home.

The Non-Negotiable Safety Line

- Enable hardware-based 2FA and withdrawal allowlists today.

- Do not leave long-term holdings on any exchange.

- Move assets you plan to hold longer than six months into a hardware wallet, ideally multisig.

- Exchanges are optimized for trading and liquidity, not indefinite storage.

If you remember one thing:

Coinbase reduces operational risk. Binance.US reduces trading costs. Self-custody reduces counterparty risk. The smartest setup uses all three, intentionally.