In this Bitquick review, we will dig into supposedly one of the most user friendly ways to buy Bitcoin.

They have positioned themselves as a quick and simple way to get your hands on crypto and have been claiming that theirs is "The premier service to buy bitcoin in just 3 hours".

However, this begs an important question: Is it safe?

This is something that we will try and establish. We will look into the Bitquick history, operators, customer support and online reputation. We will also take you through the step by step process you need to buy coins on the exchange.

What is BitQuick?

BitQuick is a peer-to-peer Bitcoin exchange that allows traders to buy coins from each other. In other words, BitQuick is akin to a LocalBitcoins rather than the likes of a Bitstamp or a Kraken.

BitQuick is run and operated by Athena Bitcoin Inc, which is based in the US and has offices in Chicago, Saint Louis and Dallas. It used to be called BuyBitcoin.us but decided to rebrand in 2013. This was done as they thought the new name was more aligned with their core business.

Athena Bitcoin Inc. is a Bitcoin ATM operator and they bought BitQuick.co from the team behind it at the time, Jad Mubaslat and Chad Davis. This was done just after BitQuick suffered a database breach in 2016 (more on this below).

Given that this is a P2P exchange, the exchange is done directly from the seller to the buyer. The seller will list the coins that they would like to sell and then the buyer will communicate directly with the seller. Once a sale has been agreed, the parties will conduct the exchange and the escrow services of BitQuick will be used.

BitQuick Supported Countries

Image via Bitquick.co

Image via Bitquick.coBitQuick is a decentralised exchange which means that they do not have to face most of the regulatory hurdles that centralised exchanges may have to encounter. They are available to traders in 49 states in the United States.

The only state that is excluded from this list is New York State. This is because of the implementation of the Bitlicence legislation in the state and the cost associated with obtaining a licence.

Although the vast majority of their volume is in USD for sellers in the US, they do have international support for traders in other countries. According to their website, they offer support for the following countries.

- USA

- Canada

- Europe

- Russia

- Australia

However, this appears to just be in writing as there were no offers to sell Bitcoin from any traders outside of the USA. Perhaps traders in Europe and other jurisdictions are more comfortable with their local alternatives.

BitQuick Safety

When it comes to cryptocurrency exchanges, one of the most important considerations is the security of funds. This is something that centralised exchanges have to grapple to a greater extent as they are a large target for hackers and external actors.

BitQuick is less of a target for these hackers as they do not store the client's private keys on their servers. The only time that they have funds with them is when they are completing an escrow transaction. In this case, the amount stored is merely the amount that was sent for the purchase.

Despite this though, hackers have targeted BitQuick before and have managed to extricate data. Hackers were able to gain access to user's names, email addresses and phone numbers. However, there were no client funds that were stolen and no sensitive documents were taken either.

With that out of the way, let us take a closer look at their security procedures.

Multi Signature Wallets

BitGo Secured Multisig Wallets

BitGo Secured Multisig WalletsIn the case of the Multi-sig transactions, BitQuick was one of the first P2P platforms to implement P2SH (Pay To Script Hash) multisignature addresses. These were done through the BitGo platform. They were also the first marketplace in 2015 that implemented an update "proof of reserves".

The multisignature wallet is an added step for the security as it requires the administration at BitQuick and BitGo to use the three keys in order to sign a transaction. This will substantially reduce the risk of a security breach that results in a hacker sending funds out.

These BitGo security procedures allow a user to make a transaction of up to $250,000. This limit should be sufficient for most Bitcoin traders as individual trade sizes are usually much smaller than this.

Secure Communication

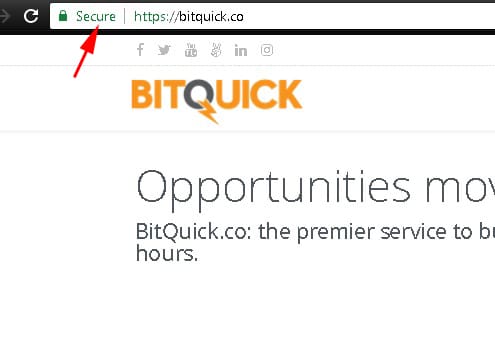

SSL Secured BitQuick

SSL Secured BitQuickAs is the standard these days, the site is fully SSL encrypted. This means that all of the traffic between you and their servers is encrypted using advanced AES 256 encryption standards.

This is particularly important in today's day and age given the prevalence of phishing and man-in-the-middle (MITM) attacks. In fact, you should always make sure that when you are visiting BitQuick you are presented with a secure padlock (shown in image).

KYC Requirements

This is usually quite a big sticking point for traders who use P2P exchanges. KYC documents are a requirement by these exchanges in order to prevent fraud. However, traders could see them as an invasion of privacy.

BitQuick is registered as a Money Service Business by the US treasury (licence number 31000069357653). This means that they have to request certain minimum documents for Anti Money Laundering (AML) regulations.

To that end, they are more onerous in terms of documentation than the likes of LocalBitcoins and other exchanges. The minimum requirement to buy coins on BitQuick is a photo identification. After that, they operate a tiered verification system where higher transaction limits are lifted with more information provided.

This means that you cannot buy / sell Bitcoin anonymously on BitQuick which may be a major hindrance for some traders.

BitQuick Fees

The Fee structure at BitQuick is quite simple. They operate a flat rate of 2% on all purchases. There are no fees charged to the seller of the coins. While this is indeed great news for the seller, the buyer may find the 2% level as quite high when compared to other sites such as LocalBitcoins that charge no fee at all.

One could say that the fees at BitQuick are slightly higher in order to pay for the escrow services that are provided on the platform. However, it may be more equitable if this were shared with the seller as well as they are also benefitting from this.

Funding Options

One of the major benefits with BitQuick is that they can facilitate cash purchases of Bitcoin. Here, the buyer can deposit the cash in the bank account of the seller and BitQuick will authenticate and then release the Bitcoin.

BitQuick does not take US based wire transfers as a payment. However, for those traders who would like to use the service in Europe then EUR SEPA payments are possible.

For the seller of the Bitcoin, the coins will first have to be transferred into the BitQuick wallet before the listing will show up. The moment that one confirmation has completed on the network then the listing will go live.

Customer Support

Given that BitQuick is involved in so many aspects of the transaction, they have to have pretty responsive customer support.

This is indeed something that they have managed to gain a reputation for online. There are four ways in which you can reach customer support at BitQuick. The most efficient way to get hold of someone at BitQuick is through the online form or through their email address.

Of course, they are also pretty responsive on their social channels such as Twitter and Facebook. The average response rate to tickets seems to be about 1 business day.

Using BitQuick: Step-by-Step

Given that BitQuick is aiming to be a fast and effecient way for one to buy Bitcoin, we wanted to test this out for ourselves. In the below guide we go through the steps that we concluded to buy our first Bitcoin on BitQuick.

Buying Bitcoin

If you want to buy Bitcoin, you will select the "buy" order book on the platform. Then you will be presented with the list of all of the offers from the sellers on the platform.

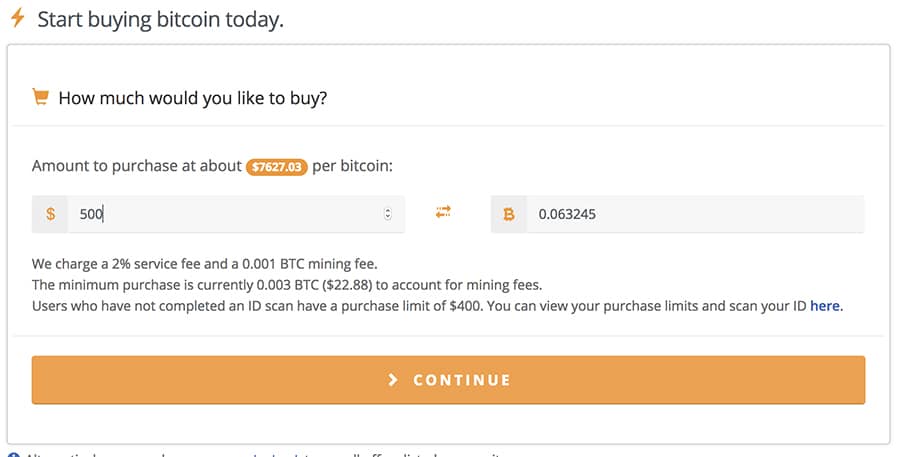

You also have the option to select the "quick buy". What this will do is allow you to enter your requirement and then BitQuick will help you find the best offer. We have done that and it is presented in the below image.

Quick Buy on BitQuick

Quick Buy on BitQuickOnce you have done that, it will present you with a list of financial institutions that you can elect to deposit with. This allows you to easily select the one that is closest and most convenient for you. Each of these relate to a different buyer and hence have different prices.

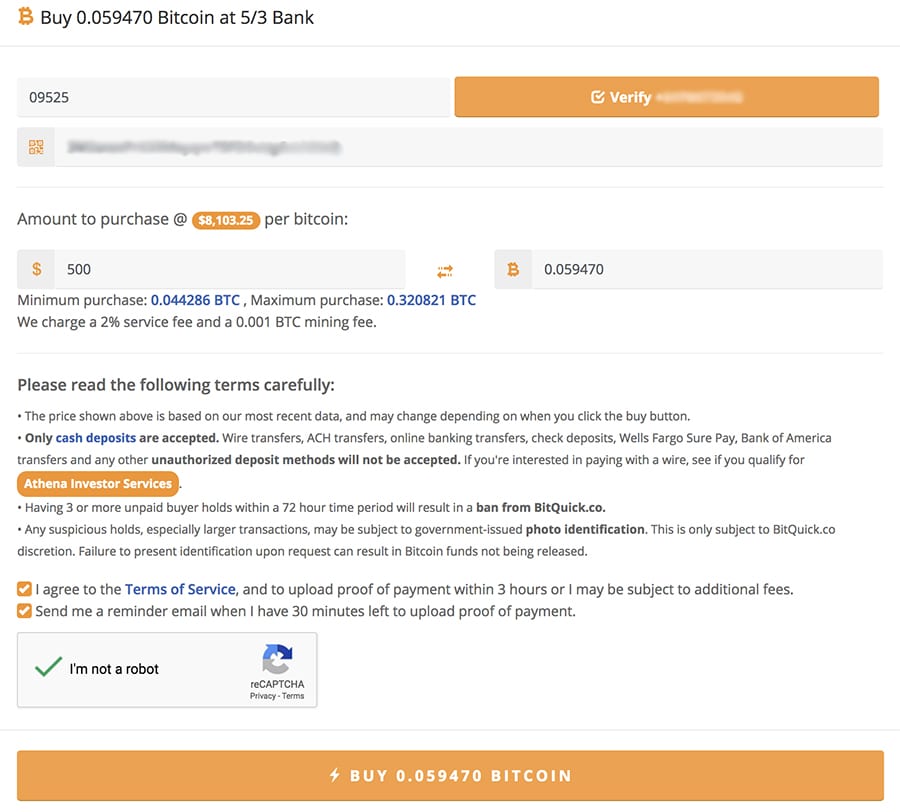

Once you have selected an institution and price that you would like to use then you will be taken to the final page. Here you will have to first verify your phone number and insert your Bitcoin address for the receiving Bitcoin.

BitQuick Buy Order Form

BitQuick Buy Order FormOnce this is done they will ask for your name and an email. You need to use a valid email as this will contain the link to where you can upload your proof of deposit. They may not ask for your ID initially but they have the right to ask this at any time.

Once you have agreed the terms and conditions and submitted the order, you will receive an email to deposit the funds in the chosen bank within 3 hours. All you will then need to do is fill out a deposit order form at the bank, deposit the cash and keep the receipt.

In order to confirm with BitQuick that you have indeed made the payment then you will upload the receipt by following the link that BitQuick sent you. Once the seller has confirmed the money has been paid, BitQuick will release the Bitcoin to the address that you had originally specified.

Selling Bitcoin

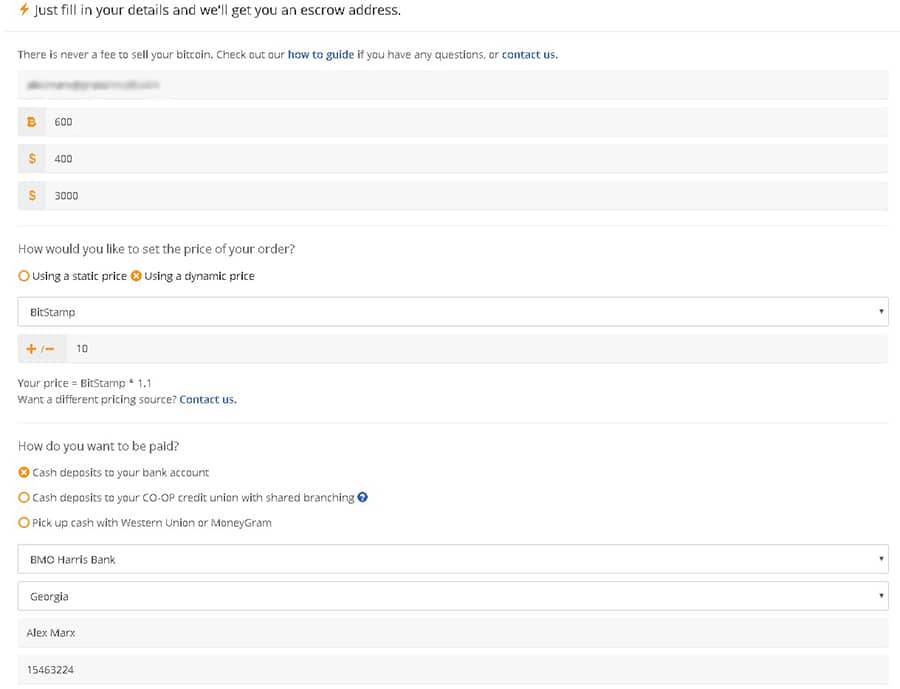

When you want to sell coins on BitQuick, you will hit the sell button and be taken to the online form. Here you are required to fill out all the details that are related to your listing.

BitQuick Sell Order Form

BitQuick Sell Order FormYou will fill in information such as the Bank Account that you would like to use, the price that you are willing to offer them for as well as the amounts that you are willing to sell in general.

You also have the option to set a "dynamic" price. This is a useful tool so that you do not have to constantly keep updating the listing as the price of Bitcoin fluctuates. You will select a percentage price above or below the market price that you are willing to accept for your listing.

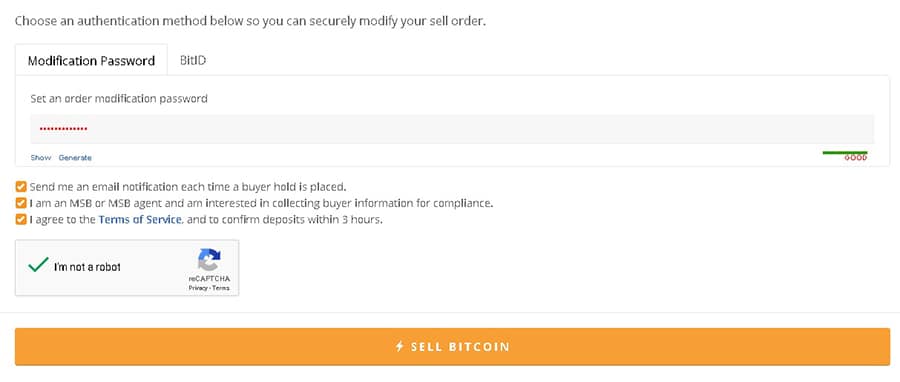

You are also required to insert a password in case you ever need to modify your order. Once you are content with all of your listing information then you can submit it for review.

BitQuick Submit Order Form

BitQuick Submit Order FormYou will be sent a Bitcoin address that you can send the funds to. This will be the multisignature address that we talked about above that is under the control of BitQuick and BitGo.

Once you have completed this, you will need to wait for the buyer to find you. How likely you are to sell your coins will depend on the price that you have set as well as how convenient it is for the buyer to deposit into your chosen bank account.

Once you have received the funds from the buyer in your bank then you can confirm the completion of the sale with BitQuick and they will release the funds.

What We Didn't Like

While BitQuick is indeed one of the most efficient and user friendly ways to buy Bitcoin with cash, there were a few things that we thought needed some improvement on the service. These are listed below:

- Asset Coverage: One of the most striking things for us was that the only coin available for sale is Bitcoin. Granted it is the most dominant coin but there may be some cash buyers who would like to buy other coins.

- Limited Funding: While it is great that users can easily buy Bitcoin with cash in the US, this is not always preferable. Some users would like the option to send funds over through a traditional wire. This is not allowed with BitQuick.

- KYC Requirements: While this is something that BitQuick has to do given their licence from the treasury, there are many traders who are still uncomfortable providing this. BitQuick has suffered a data breach before and once your ID documents are in the hands of a hacker, your identity can be stolen and you can be targeted in phishing attacks.

There is no doubt that the first point can easily be remedied by BitQuick. The second and third point are a slightly harder to address. This all ties in with their Money Business Licence and the strict requirements this places on the users.

Conclusion

As we have shown in this review, BitQuick is indeed one of the easiest and most secure ways for you to buy Bitcoin with cash. While you can always use a service such as LocalBitcoins, this requires you to meet a stranger in person which is far more risky.

Moreover, given that it is a P2P platform, you do not have to store your funds with the exchange and face risks from exchange hacks or other nefarious activity. It is also less error prone as all you need to receive your coins in a Bitcoin address.

It is also a great way for a seller to advertise their coins without paying a fee and receiving the funds right into their bank account.

While the fees are on the higher end, it feels like one may be paying slightly more for the safety and security that is provided by the exchange.

Yes, the KYC documents can make one uncomfortable but as we have established, these are not really under the control of BitQuick and are required by law.

However, if you are looking for a really quick, simple and secure way to exchange your cold hard cash for coins, BitQuick could be the right solution for you.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.