Update 30th Mar 2019: QuadrigaCX is now defunct on account of gross mismanagement of the exchange. We recommend Coinsquare, the largest Canadian Crypto Exchange.

QuadrigaCX is a cryptocurrency exchange based in Canada that provides Canadians with access to a number of digital assets including Bitcoin, Ethereum, and Litecoin.

Visitors to the site are also able to make trades in fiat by using either US Dollars or Canadian Dollars, and the platform is continuing to drum up demand in its native homeland. Despite its growing popularity, the jury is still out regarding just how reliable an exchange QuadrigaCX is.

The following review provides you with everything you need to know about the exchange.

Overview

QuadrigaCX is a Canadian company that is registered and located in Vancouver, British Columbia, Canada. The site claims to be the largest Canadian cryptocurrency exchange and while it does not generate trading volumes comparable to the industry’s leading exchanges it is a significant player in the Canadian market.

However, QuadrigaCX is not regulated, and while the Canadian Securities Administration (CSA) has noted that ICOs, cryptocurrencies, and all related trading and marketplace operations may be subject to local securities laws, no enforcement measures have yet been taken. The exchange is operating legally although the website doesn’t contain any information on the founders, team, or when the platform launched.

As a result, it’s difficult to know exactly how long the exchange has been in operation or who the individuals behind QuadrigaCX are. The exchange is not transparent and the exact background of the company remains something of a mystery.

Despite this, the exchange is currently generating just under $9m worth of daily trading, with the BTC/CAD pairing amassing around $3m worth of daily trading. There is also a healthy amount of Ethereum trading taking place on the site as the BTC/ETH and ETH/CAD pairs are generating over $4m worth of daily trades.

Is QuadrigaCX Safe?

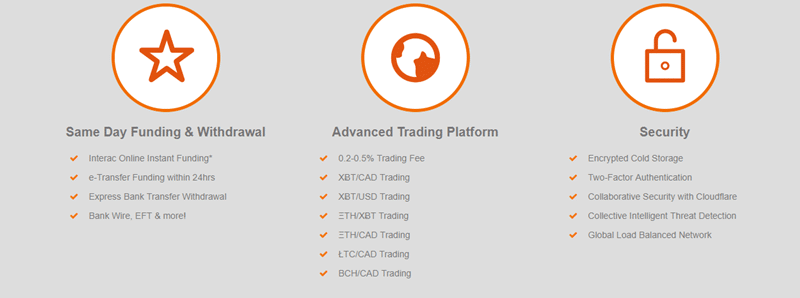

The team behind the platform claim to prioritize security and QuadrigaCX employs a number of advanced security measures that are currently utilized by many of the leading cryptocurrency exchanges. These include using cold storage for the majority of the Bitcoin held within the system, and protecting the trading platform via a partnership with Cloudflare, that ensures the website and API are guarded from malicious attacks.

Company servers employ the use of custom operating systems and software, while user accounts are secured with encryption and Two-Factor Authentication (2FA) is available on all accounts. This acts as an additional security layer and can be activated by choosing either Google Two-Factor Authentication or Email 2FA in the account profile settings.

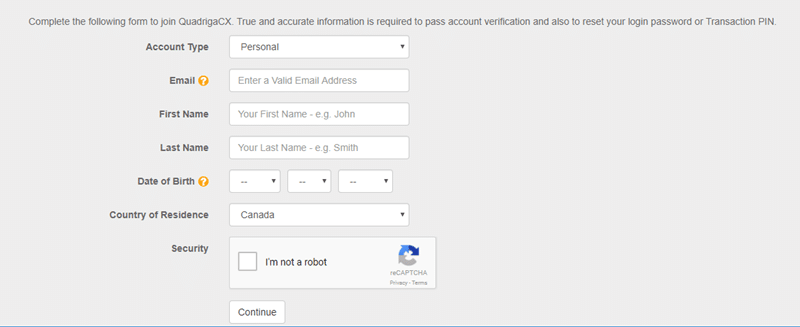

Both options can be selected for even more security. Users are also required to submit their name, date of birth, country of residence, and an email address when signing up and fiat transactions require users to verify their accounts by submitting the necessary identification.

For Canadian users, QuadrigaCX offers two methods of verification:

- ID & Address verification where you securely upload copies of your ID and proof of address.

- Instant verification in partnership with Equifax where you complete multiple choice questions based on information within your credit file.

The instant verification option initially had us slightly worried because they used Equifax systems. If you are not aware, Equifax suffered a massive hack last year where numerous people including some in Canada had their details stolen.

However, when using the verification on Quadriga you are not providing any information to Equifax. They are merely using the Equifax plugin to confirm information that Equifax already has.

Asset Coverage

QuadrigaCX supports Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Bitcoin Gold. On top of this, the exchange also allows for trading in both Canadian and US Dollars and the following trading pairs are available on the site: BTC/CAD, BTC/ETH, ETH/CAD, LTC/CAD, BTC/USD, BCH/CAD, and BTG/CAD.

All the funds in the QuadrigaCX system are highly liquid, and can be withdrawn at anytime, as the exchange initiates all withdrawals within 24 hours.

QuadrigaCX Fees

It’s possible to transfer funds to and from your account fee free by opting to transfers cryptocurrencies and bank transfers made in order to fund your account are subject to a 1% fee.

QuadrigaCX also charges a 0.5% fee on all completed trades on the following order books BTC/CAD, BTC/USD, ETH/CAD, LTC/CAD, BCH/CAD & BTG/CAD. The fee on the ETH/BTC, LTC/BTC, BCH/BTC and BTG/BTC order books is 0.2%.

Note that the fee does not apply to open orders, and is only charged after a trade is executed. In general, fiat-to-crypto trades are subject to fees in the range of 0.00% to 1.00%, while crypto-to-crypto trades incur fees in the range of 0.20% to 0.50%.

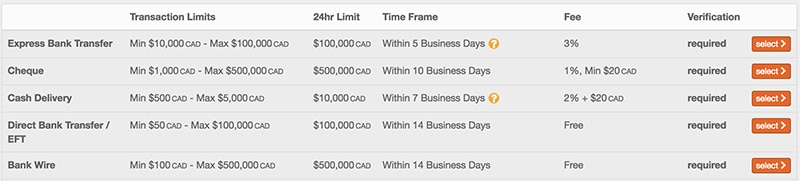

When you are withdrawing your funds, you will not pay any fees if the withdrawal is processed in crypto (apart from network fees). If, however, it is a Fiat withdrawal then the below fees will apply:

Quadriga Fiat Withdrawal Fees

Quadriga Fiat Withdrawal FeesUsing the express bank transfer is clearly quite expensive at 3%. If, however, you are willing to wait for up to 14 business days for your deposit to come in, then you can make use of the EFT or Bank wire options.

Customer Support

The platform operates a ticket system that allows users to contact the support team after submitting queries. There is also a support section that contains a number of FAQs that seek to answer the most common questions.

However, the site doesn’t have any live customer support channels and users should expect extended turnaround and resolution times. This system could easily be upgraded by providing a phone number to call, or a direct chat box that provides live access to a member of the support team.

We wanted to test out the customer service for ourselves to get a sense of the time that it usually took to get a response. We initially had a slight issue with an ETH deposit and sent a support ticket on the dashboard.

We got a response from the team within one hour. This was relatively impressive as it is above an average response time. By perusing some of the online resources, we established that this was the general feeling among the other users.

Funding and Withdrawal

QuadrigaCX offers numerous funding and withdrawal options and certain funding options may require accounts to be verified. The available funding/withdrawal options include:

- Canadian Dollars – Bank Wire, Flexepin Voucher, INTERAC, QCX Voucher, and Crypto Capital. Bank Wires must fall within the limit of a minimum of $50,000CAD and a maximum of $500,000CAD for funding. Withdrawals via Bank Wires must fall within the limit of a minimum of $100CAD and a maximum of $500,000CAD.

- US Dollars - Bank Wire, QCX Voucher, and Crypto Capital. Bank Wires must fall within the limit of a minimum of $25,000USD and a maximum of $500,000USD for funding. Withdrawals via Bank Wires must fall within the limit of a minimum of $500USD and a maximum of $500,000USD.

- Cryptocurrencies – Users can transfer Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Bitcoin Gold into their accounts. Both transfers in and withdrawals conducting via the supported cryptocurrencies are fee free.

We tested a number of the funding / withdrawal options on Quadriga. Cryptocurrencies will usually show up in your dashboard after they have confirmed on the network. In the case of Bitcoin, that is after 3 confirmations (30 minutes).

If you are sending funds in Canadian Dollars to Quadriga via Interac, then this payment will be reflected immediately once they have accepted your email. When you are withdrawing your CAD, the Express Bank transfer is perhaps your quickest option.

We tried this withdrawal option to a bank in Canada and it took about 3 business days for it to arrive.

Recent CIBC Bank Dispute

Towards the middle of 2018 users may have noticed that withdrawals from QuadrigaCX were taking much longer than usual. For example, for some of the larger withdrawals traders were waiting up to three weeks for the funds to finally hit their account.

This all stemmed from a dispute that QuadrigaCX was having with the CIBC bank. The bank decided to freeze $28m in funds that were tied to the exchange's payment processor. This meant that they had to find other ways in which to pay their traders which caused the delays.

The Globe and Mail covered the dispute in more detail should it be of interest. In the end, QuadrigaCX took the CIBC to court and eventually won. While this may be frustrating to those traders who were caught up in the delays, there were many who stood by Quadriga as they fought for what was theirs.

Quadriga Trading Platform

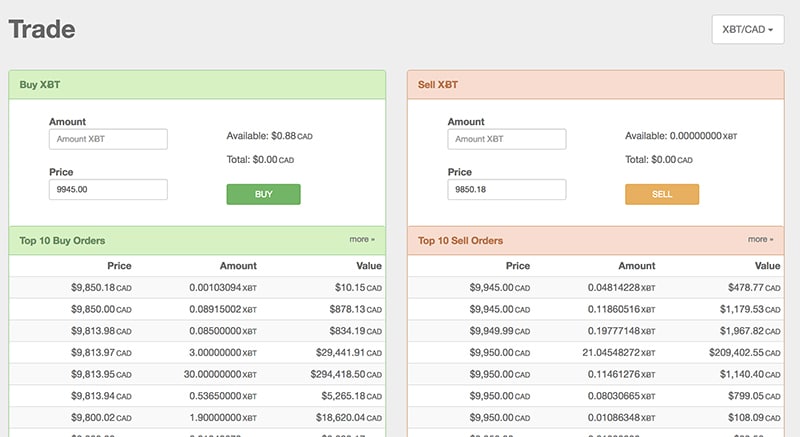

Our immediate impression of the QuadrigaCX trading platform is one of extreme simplicity that is bordering on rather basic. The target would most likely be investors looking for a Canadian "fiat gateway".

Rather than have all the information such as order books and charting on one page, they are split across a few. If you wanted to execute a simple buy or sell order, you will head over to the "trade" tab below the header.

Quadriga Simple Order Books

Quadriga Simple Order BooksAs you can see, this is the simple order book on the exchange. You can see a list of the top 10 sell / buy orders as well as a running collection of the past 10 trades. You can only place a simple order with no options for limit / stop orders at all.

If you wanted a current snapshot of how the market is looking then you can head on over to the "market overview" tab. Here, you will have a simple chart that will show you the price evolution over the past 60 days as well as the same order information on the "trade" page.

This tab really did not serve that much of a purpose in our eyes as one can easily glean this information in the other tabs. Moreover, you cannot change the timescale on the chart which makes it not very relevant.

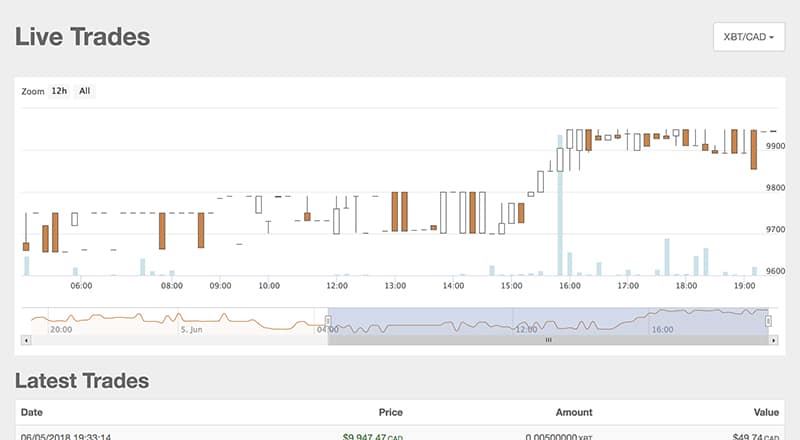

There is one more tab on Quadriga and that is the "live trades" one. On this tab you have a candlestick chart of the price of the asset as well as a long run down of all of the trades that have gone through the order books.

Basic Charting Package on Quadriga

Basic Charting Package on QuadrigaFor those traders who are used to advanced charting with numerous features or analysis etc, then you will be quite disappointed. The QuadrigaCX charting package is substandard to the point of being useless.

The only functionality that it has is the option to adjust the timeframe within the past 24 hours. Moreover, you cannot place trades on this tab which means you will have to switch back to the "Live Trades" tab again. Therefore, this tab really does look like it serves no purpose.

So, in reality, the only tab that you will be using to trade on Quadriga is the simple "Live Trades" tab.

Mobile Trading

For those traders who like to trade on the go, there is no mobile application unfortunately. If you were really concerned about your position then you could always log into the QuadrigaCX website on your browser as it appears to be mobile optimised.

API

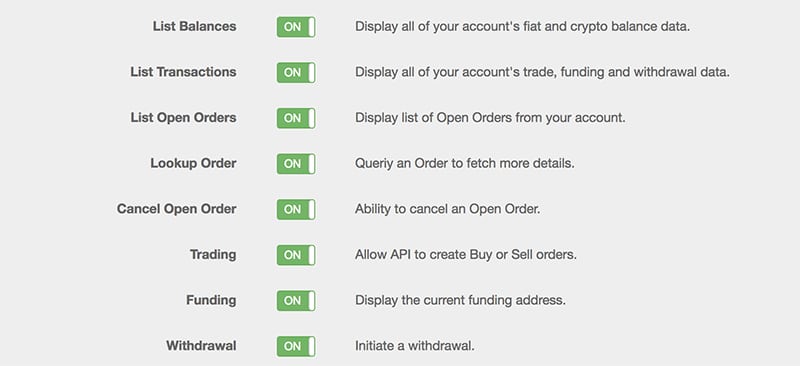

For those traders that would like to code their own trading bots, then Quadriga has a API functionality. If you wanted to access your API key you would first need to confirm that you were in control of the account. They would email you a code.

API Functionality on Quadriga

API Functionality on QuadrigaOnce you have confirmed it you will get given your API key as well as a bunch of options. You can select the API permissions in your dashboard. If you are first trying out your bot coding it is perhaps more prudent to turn off some of the functions.

QuadrigaCX vs Coinsquare

For Canadian cryptocurrency traders who are looking for a CAD fiat gateway, the two best bets are either Quadriga or Coinsquare. Coinsquare is a larger cryptocurency exchange that is based in Toronto, Ontario.

They are considerably larger than Quadriga and have started include a number of other Altcoins. It has also been revelead that Coinsquare is seeking a listing on the Toronto Stock exchange and want to expand their operations globally.

So, which is better between Quadriga and Coinsquare? Let's take a look.

| Quadriga CX | Coinsquare | |

| Location | Vancouver, BC | Toronto, ON |

| Security | Cold Storage, 2FA, Load Balanced, Collaberation with Cloudflare | Cold Storage, 2FA, DDoS Protection, Advanced Ledger Management |

| CAD Deposit Methods | Wire Transfer, Interac, Flexepin, QCX Voucher, Crypto Capital | Interac Online, Interac E-transfer, Credit Card, Flexepin, Bank Draft, Money Order, Wire Transfer |

| CAD Withdrawal Methods | Express Bank Transfer, Credit Card, EFT, Bank Wire, Crypto Capital, QCX Voucher, Gift Card | Direct Bank Deposit, Wire Transfer, Wealth Wire, Rushed Wire |

| Available Crypto Pairs | BTC, ETH, LTC, BCH, BTG | BTC, BCH, LTC, DOGE, DASH, ETH |

| Fiat Currencies Accepted | CAD, USD | CAD |

| Languages | English | English, French |

| Customer Support | Ticket System | Live Chat and Ticket Support |

| Trading Fee | 0.5% (Fiat to Crypto), 0.2% (Crypto to Crypto) | 0.1% / 0.2% (maker / taker) 0.2% / 0.4% (Single / Double) |

| CAD Funding Fees | 0% - 2.5% | 0.5% - 10% |

| CAD Withdrawal Fees | 0%-3% | 1%-2% |

| Mobile App | NA | iOS and Android |

So as you can see, Coinsquare has more options in terms of cryptocurrencies that you can buy. They are also considering adding Ripple XRP in the next few months. It is also beneficial for those French Canadians that would like an exchange that also caters to them.

Coinsquare is also the only Canadian exchange that offers their users the benefit of a mobile application. Unfortunately, QuadrigaCX does not have this although their website is mobile optimised.

However, Quadgriga has lower funding and withdrawal fees for their Canadian clients (although Coinsquare trading fees are slightly lower). Quadriga also has options for USD deposits.

So, if you are going to be choosing between Coinsquare and Quadriga it will have to come down to your own personal preferences. You can read more about them in our Coinsquare exchange review.

Conclusion

QuadrigaCX is quite a confusing entity. The organization has a number of obvious flaws and doesn’t operate at a level of transparency that is starting to become standard among cryptocurrency exchanges.

There is no physical address listed anywhere on the site and the team behind the exchange is also a mystery. On top of this, the platform has a low score on Trust Pilot and has attracted a significant number of negative reviews on the review site.

Despite all this, there are people who claim to be able to use the exchange without any problems and they can be found across the internet. Also, QuadrigaCX continues to generate pretty healthy trading volumes as a significant number of traders continue to use the platform.

For people based in Canada, QuadrigaCX may prove to be a viable option, however, anyone thinking of signing up for this exchange should conduct a large amount of research beforehand and stick to dealing with small amounts as it’s still unclear what the future holds for this exchange.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.