We've all been told that we need insurance, but not all of us get it. Getting insurance is making a bet that if things go wrong, you can get some kind of compensation for it. Sometimes the compensation may be more than what you pay in premiums, but not always. The easiest way to think of it is "just in case" protection.

How Insurance Works

If something happens that you're insured against, you or your benefactor will get a payout. However, you need to subscribe to this privilege by paying premiums. The way that insurance companies do the math (and I don't work in the insurance company, so understand that this is just a very general concept) is that if 10 people pay $100 each, they will have enough money to pay one person $1000 if something were to happen.

However, if something bad happens to all 10 people, which the insurance company thinks is very, very unlikely to happen, everyone might get $1000, and it will be the company paying out of their pocket/profits to do so.

In this scenario, the insurance company is the party in charge of paying out the claims. Where do they get the money from? Primarily through premiums collected from individuals. They then take that money and invest in other growth assets after deducting their "keeping the lights on" costs so they can have enough to pay out claims if and when they arise. So how does this work with crypto?

Insurance for Crypto

As we all know, crypto is not only volatile, but other unexpected things can happen to it. If it isn't a rug pull or a hack, it could be some kind of bug in a smart contract or scams/frauds. With the multitude of unexpected stuff liable to occur any minute, who would have the guts to offer insurance for crypto? Does it work like regular insurance as we know it, or is there a new model being proposed? These are just some of the questions I have in mind as I researched the Bridge Mutual protocol. This is also my first foray into the world of crypto insurance. You're welcome to join me in taking a swim in these seemingly murky waters, murkier than most areas of crypto I know so far. I would also highly recommend checking out Guy's video on crypto insurance as a primer before reading this article. There's also a great article on blockchain insurance for those who prefer reading over watching videos.

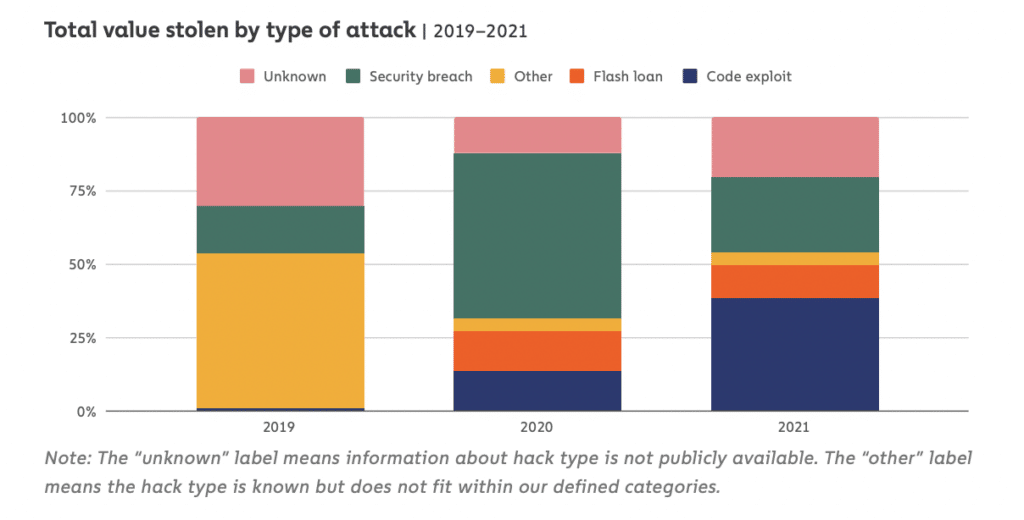

Before proceeding further, here's something to know about the state of the crypto industry. According to the latest Crypto Crime Report issued by Chainalysis, the "detective" firm used by government agencies and institutions for tracing stolen funds and illicit activities, $3.2 billion was recorded as stolen funds in 2021. This is a 1,330% increase from 2020. By the way, the report is fascinating, even if it is 140 pages.

The myriad of ways funds can get stolen in crypto. Image via Chainalysis

The myriad of ways funds can get stolen in crypto. Image via ChainalysisBearing in mind the general environment, one can see that the risks of investing in DeFi protocols are not for the faint-hearted. This is where Bridge Mutual comes in.

Introducing Bridge Mutual

In a nutshell, Bridge Mutual is a platform offering everyone the ability to be an insurance underwriter or buy a policy just in case some of your investments in other protocols suffer a loss. You can think of it as a marketplace of sorts. What's being bought and sold here are insurance policies instead of NFTs.

The project was conceived in Q3 2020, with version 1 of the mainnet launched in Q1 2021. Later in the year, version 2 was released, and it remains the most current version to date, with a TVL (Total Value Locked) of 1,718,334 USDT. The premise is simple enough, but more than most, it's the details that make or breaks this project. This is where the fun starts, so strap your seatbelts on and get ready for the ride.

Insurance for your crypto Defi investments. Image via Bridge Mutual

Insurance for your crypto Defi investments. Image via Bridge MutualHow It Works

There are 3 main roles in this project. Each of these roles is affected by a number of factors. We're going to walk through each role to understand how things work.

Policy Holder (PH)

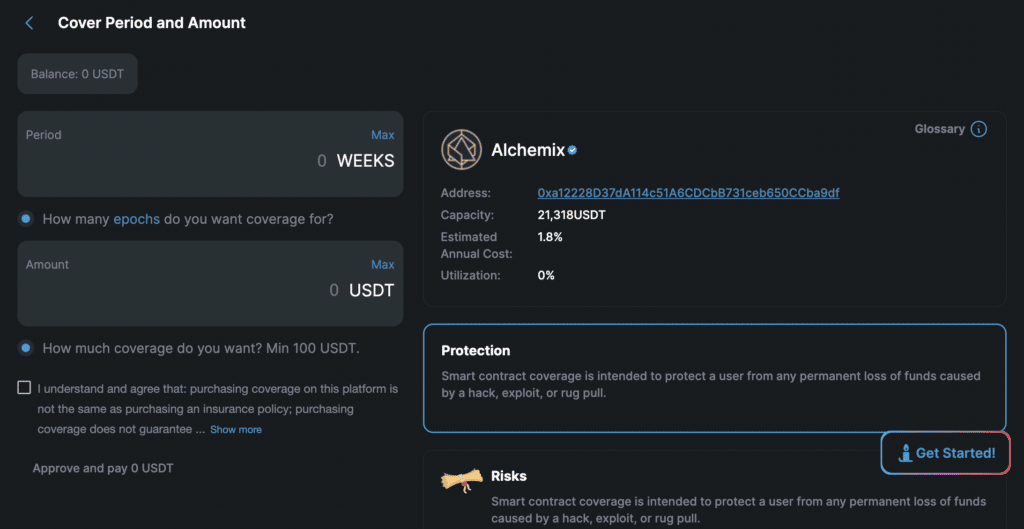

Lisa has heard much about DeFi protocols and is finally keen to give it a try. She chose a protocol called Penguin Finance that was recommended to her by a trusted friend. After conducting some research on her own and it seems solid enough. She provides 1000 USDT worth of liquidity into the DAI/PGN pool, PGN being the native token for Penguin Finance. However, she's also heard lots of stories of protocols suffering from rug pulls, hacks etc., and she's concerned that her funds might be lost if anything were to happen. So she shops around and comes across Bridge Mutual, which provides insurance for Penguin Finance. She logs in via her Metamask wallet and peruses the insurance contracts available. She sees one for Penguin Finance and decides to buy a policy for it.

Just pretend this is Penguin Finance, ok? Image via Bridge Mutual

After studying the form, she decides to buy insurance for 1 month, i.e. 4 weeks or epochs, as it's known in the protocol. She can buy a policy for up to 21,318 USDT based on the Capacity stated, but all she's looking for is insurance for her 1000 USDT, so that's what she's going to do. The cost of the premium is dependent on three factors:

- Amount of coverage required.

- Duration of coverage required.

- Utilisation ratio - this represents the supply and demand for the coverage of that pool. The more people who are buying policies for that pool, the higher the utilisation ratio. That means this protocol is considered quite risky for many of its participants; hence they are seeking coverage.

More importantly, she reads the disclaimer and ticks the checkbox about the risks involved in buying a policy from Bridge Mutual. After completing the entire transaction, she is officially a Policy Holder on the insurance platform.

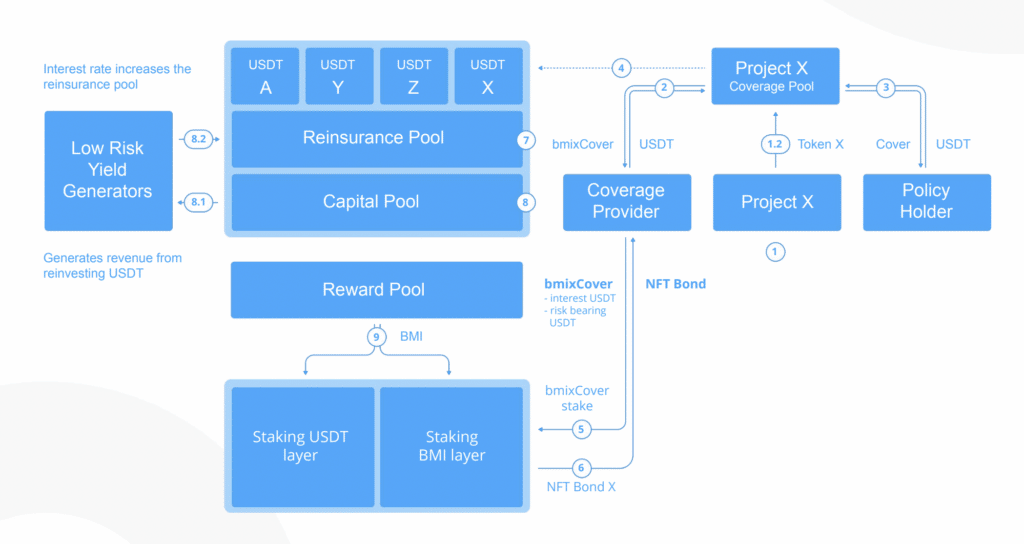

The premium she pays is split into two chunks:

- 80% goes towards the insurance contract pool to the Coverage Providers

- 20% is deposited into the Reinsurance Pool as a protocol fee. This is a pool that collects all sorts of revenue from the protocol. We'll find out more about its role later on.

For a complete understanding of what types of scenarios are/are not covered with the insurance, check out this documentation on Gitbook.

Coverage Provider

Alex has some spare cash on hand and is looking to invest it into something that brings some decent yield. He came across the Bridge Mutual protocol, and the idea of being an underwriter appeals to his risk-loving side. He knows that being a Coverage Provider (CP), as is known on the protocol, is about providing the funds that others may lay claim on if things go wrong. On the other hand, they also stand to earn some pretty good yields when things go well. It's all about probability, and Alex knows this well.

He logs in with his Web3 wallet and peruses the list of contracts he can provide coverage for. He comes across the Penguin Finance contract and decides to deposit his money there. Why that project? Because his uncle's close friend is a founder, and given what he knows, he has confidence in the project. Time to put that insider knowledge to good use!

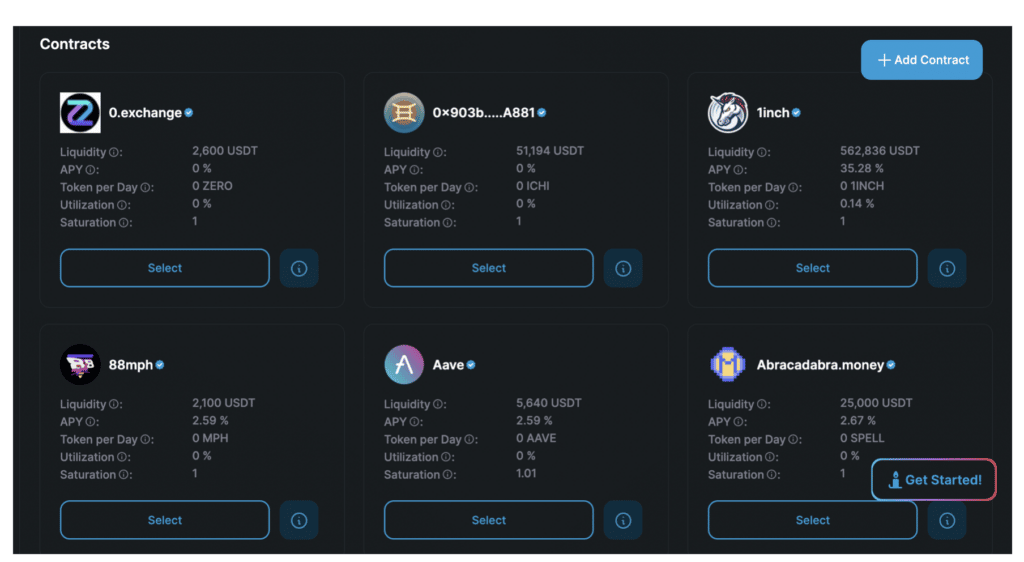

Choose a contract to provide coverage or create your own with Add Contract. Image via Bridge Mutual

Choose a contract to provide coverage or create your own with Add Contract. Image via Bridge MutualAlex deposits 5000 USDT into the contract, and his journey as a CP begins. In addition to the yield generated from the premiums mentioned above, Alex also receives bmiPenguinCover tokens equivalent to the amount he deposited plus any yield earned on that token. These tokens are proof of his deposit, like the LP tokens one gets after providing liquidity.

Being the seasoned DeFi guy he is, Alex proceeds to stake the bmiPenguinCover tokens into the bmiCoverStaking pool. However, only whitelisted insurance contracts can be accepted into the staking pool. As luck would have it, the DAO recently put Penguin Finance on their whitelist, so Alex is on his merry way to earning BMI, the platform's native token, from the Rewards Pool, funded by the protocol's treasury and governed by the DAO. Not only that, but Alex also gets a trade-able NFT bond token that he can sell on the NFT marketplace if he's in a hurry to raise some cash on his investments. Selling that NFT is basically transferring the ownership of those bmiPenguinCover tokens to the buyer of the NFT.

Alex's USDT deposit goes to a Capital Pool, which collects all the deposits made by CPs. The funds in that pool are then invested in other low-risk DeFi protocols such as AAVE, Compound and yEARN to generate revenue for the funds. The revenue will then get deposited into the Reinsurance Pool mentioned above.

The Reinsurance Pool acts like a CP by having the funds in the pool provide coverage to multiple insurance contracts. This helps to bring down the utilisation ratio of the pools, which in turn translates to lower premiums for would-be policyholders.

Voters and Trusted Voters

Judy is an intern in a regular insurance company. As part of her research into competitors of the company, she stumbled onto Bridge Mutual and is quite curious as to how things work. Not having a lot of money, she finds out that she can participate as a voter and review claims as they are presented. To be a voter, she will need to stake BMI tokens to get stkBMI and stake those to receive vBMI tokens. Only holders of vBMI tokens can vote on the claims, but anyone with stkBMI can view them.

The current price of BMI is $0.02 per token, according to Coingecko.com. If she were to buy 1000 tokens, it'd only cost her $20, which she can afford to lose. So she takes the plunge and stakes the tokens, officially joining the ranks of other voters in the protocol.

Two factors influence the weight of her vote: the amount of vBMI tokens held and the Reputation Score. This is represented by a simple formula:

Voting Power = vBMI staked * Reputation Score.

The former is pretty self-explanatory so let's look at the latter. All voters start with a Reputation score of 1.0x. With each vote, the score fluctuates. Reputation scores are added each time the voter voted in the majority, not to mention additional rewards. Conversely, those who vote in the minority will suffer a deduction in their reputation scores. In more extreme cases, where the minority vote is less than 10%, voters may even lose a portion of their staked tokens as a penalty!

The lowest Reputation score a voter can have is 0.1x, while the highest is 3.0x. Voters whose Reputation score is above 2.0x and is in the top 15% level up to become Trusted Voters. These voters are the ones who can vote on appeals, i.e. claims that were previously voted down and are being reviewed a second time. Other interesting voting features include:

- Voters can only vote on claims that they've reviewed the evidence for.

- Voters can vote on multiple claims in a batch to save on gas fees.

- Any value entered greater than $0 is the amount the voter thinks the claimant is entitled to. To vote "no", enter "$0".

Aside from having a higher Reputation Score, voters also get Voting Rewards, expressed as BMI deposited by the Claimant or Protocol Fees (fees sent to the Reinsurance Pool), depending on whether the claim is successful or not.

Making a Claim

As things turn out, a bug was found in the Penguin Finance smart contract, resulting in a loss of Lisa's funds. As horrible as it seems to have lost her money, she consoles herself with the fact that this is why she bought insurance. Therefore, she sets out to make a claim. To kickstart the process, she must deposit 1% of the policy value bought in BMI. Having successfully deposited $10 worth of BMI, she is now known as Claimant. Here's what's riding on her claim:

- Assuming that the premium she pays is 4% of the claim value, her premium fee is $40, of which 20% are Protocol Fees, i.e. $8.

- For her claim to be successful, she needs a 66% majority to vote "yes". If it is a successful claim, she will get back her USD10 worth of BMI tokens and a payout of whatever is agreed on by the voters, not necessarily the full amount. Voters will get $8 as a reward.

- If the claim is unsuccessful, the $10 worth of BMI will be given to voters instead.

What determines the final amount that Lisa can get for a successful claim is based on the weighted average of vBMI tokens and what was voted for by the voters. If 3 voters voted on her claim:

- Voter A - holds 100 vBMI tokens votes for 500 USDT

- Voter B - holds 500 vBMI tokens votes for 200 USDT

- Voter C - holds 2000 vBMI tokens votes for 100 USDT

It's likely that Lisa might only get around 100 USDT rather than 500 USDT.

The first time Lisa submitted her claim, it didn't have enough votes to make it a successful claim. Undeterred, she decides to make an appeal by depositing an additional USD10 worth of BMI to get the process going.

As a Claimant, it's up to Lisa to convince the voters of the validity of her claim with whatever evidence she can come up with. This time she has better luck, and the appeal went through. Lucky for her because the result of the appeal is final. If it is unfavourable, the only option is to make a new claim. This is possible as the policy remains in the protocol even after the claim is denied.

How does this affect the Coverage Provider when the claim is successful? Let's do some back-of-the-envelope math here:

- Pool total = USDT100,000.

- 10 people each providing coverage at $1000: $1,000 x 10 = $10,000 coverage

- Successful claim amount is $1000, so each coverage provider's liability is: $1,000 / $10,000 = 0.1% of their deposit.

- This would come out as $100 per coverage provider.

Protocol Features

Now that we have an overview of how the whole process works let's look at some of the features offered by the protocol that gives it the competitive edge.

Project X Contract pool + Shield Mining

If you don't see a contract you want to provide coverage for, you can always create your own and deposit your own funds to kickstart it. The "X" can be any DeFi protocol. All that's needed is to select the network supported by the protocol, i.e. Ethereum, Binance Smart Chain, Polkadot etc., and the contract ID for the DeFi protocol's token together with the amount.

A bird's-eye view of how Bridge Mutual works. Image via Bridge Mutual

A bird's-eye view of how Bridge Mutual works. Image via Bridge MutualOnce a new pool is set up, you can incentivise other CPs to provide coverage by offering extra rewards in the DeFi protocol's native tokens. This is known as Shield Mining. How this works is that the party kickstarting the insurance pool will also deposit some native tokens into a designated Shield Mining pool. Then, the tokens get distributed along with the standard yield to CPs. The user sets the distribution period across a period with a minimum timeframe of 1 month.

Even though, technically, anyone can kickstart a new insurance pool, due to the permissionless nature of the protocol, not that many people would be able to offer native tokens of DeFi protocols from thin air. So this leads me to conclude that new insurance pools are likely to be started by the DeFi protocol's team as they would be able to offer the extra rewards.

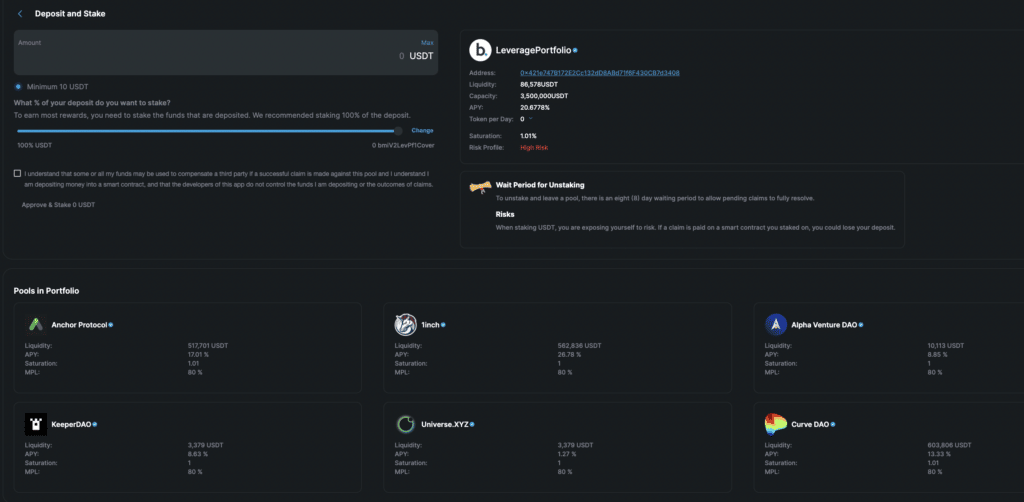

Leveraged Portfolio

Another feature of Bridge Mutual is the Leveraged Portfolio. Instead of providing coverage to one insurance pool, you can provide coverage for multiple insurance pools. As a result, the APY offered is higher than a regular pool but is riskier too. One of the key metrics that determine the riskiness is known as Maximum Permissible Loss (MPL). Each pool included in the portfolio has an MPL "score" assigned to it. This score determines the amount of money in the portfolio used to cover the loss. According to their documentation on Gitbook, here's an example of how this works:

"For example: if a leveraged portfolio has a parameter of 80% MPL for the AAVE pool, this means that in the event of AAVE being hacked and all policies in the AAVE pool being honoured at 100%, the leveraged portfolio could lose 80% of its total capital."

6 pools listed in the leveraged portfolio. Image via Bridge Mutual

APY for the portfolio consists of APY from the following:

- All coverage pools in the portfolio in USDT

- Shield Mining pools associated with the coverage pools in the portfolio

- BMI is based on the risk profile of the portfolio.

In other words, participating in the Leveraged Portfolio is not for the faint-hearted. You'd need to be able to weather the ups and downs of various protocols at the same time instead of just worrying about one. On the other hand, the risk of everything going to custard is also mitigated. As with everything else, you'll need to gauge your risk tolerance before jumping into something like this.

Tokenomics

The BMI token is basically how the protocol makes money, so to speak. It was initially used to get funding for the project. At the time of the ICO launch, it was sold for $0.125 per token, according to ICO Drops, one of the key platforms for crypto ICOs. 8.65% of its finite supply of 160 million tokens was used for the fundraising exercise.

Another reason for calling BMI a moneymaker for the protocol is because staking BMI is the only way to become a voter. The funds provided by the Coverage Providers and the premiums paid by the Policy Holders don't wholly belong to the protocol. Even the 20% protocol fees charged by the protocol go to the Reinsurance Pool that provides coverage to the other insurance pools. Therefore, only the staked BMI truly belongs to the protocol, so the more voters participate in the voting process, the better it is for the protocol.

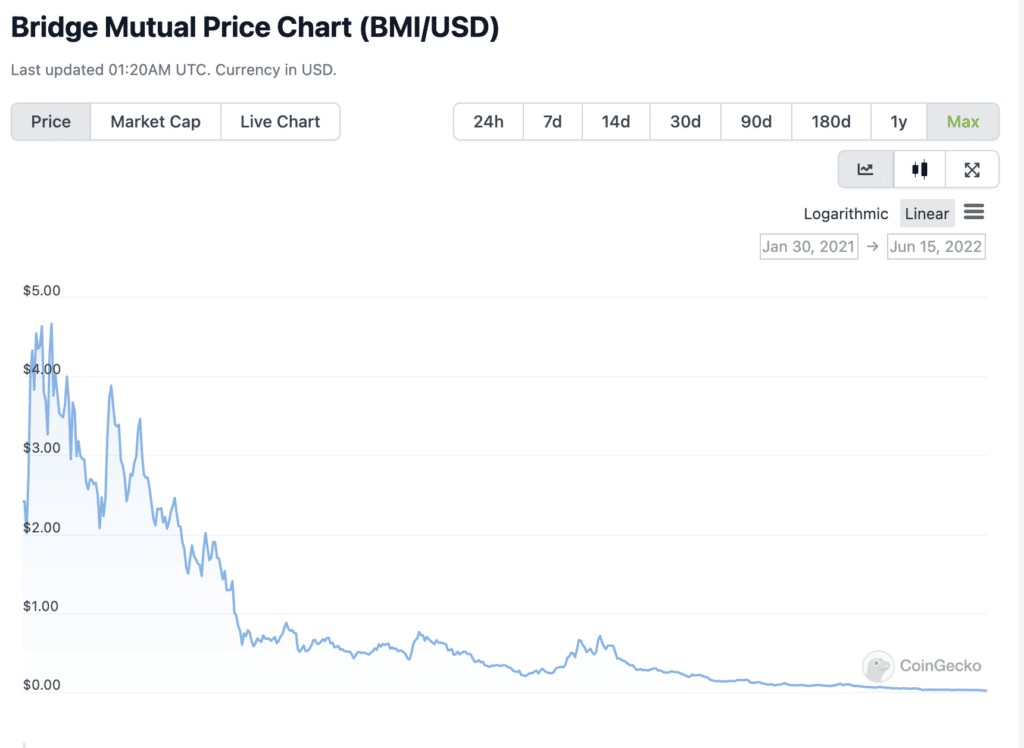

Since the project's launch, the token has made some decent progress, reaching as much as $5.46 at its peak before dropping down. Due to the brutal market conditions, the token is trading at $0.017, even lower than its ICO price. It is worth noting that the token is not yet widely available in most major exchanges.

Only time will tell if the token can recapture some of its former glory. Image via Coingecko

Only time will tell if the token can recapture some of its former glory. Image via CoingeckoPartnerships

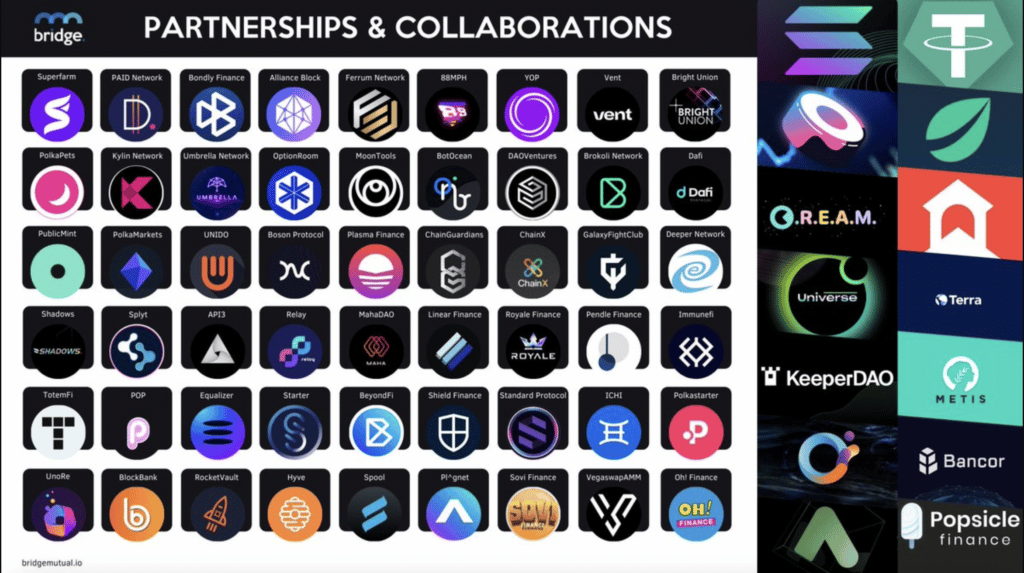

The project was built on the Polkadot chain, but it's not currently seeking any kind of parachain slots in the Polkadot ecosystem. It is also supported by Tether and in collaboration with SushiSwap. In addition to other partnerships they have forged with many well-known DeFi projects, they also feature integration with Coinbase wallet. This means you can connect to Bridge with the Coinbase wallet app if you don't have Metamask or Wallet Connect.

DeFi projects collaborating with Bridge Mutual. Image via Bridge Mutual Discord channel

DeFi projects collaborating with Bridge Mutual. Image via Bridge Mutual Discord channelFuture Features

As the team is working on a new roadmap that will be unveiled shortly, a few things stand out for me that are worth looking into if it's not already in the roadmap yet.

- Stablecoin Depegging insurance - this is something mentioned early on in the project but doesn't seem to be enabled yet. Claims for depegged stablecoin are put through automatically, unlike other DeFi protocol claims that need to be voted by voters. However, given the de-pegging of USDT recently, this would need to proceed with caution, I imagine.

- Transition to the DAO - the protocol aims to transition to a full DAO structure sometime in 2022. By that time, only essential admin staff would be keeping the platform going while the majority of key decisions will be decided by the community.

- vBMI tokens phased out - currently, vBMI tokens are the entry-level criteria for a user to become a voter. The vBMI tokens have been phased out with a recent upgrade, but details are not yet forthcoming.

- Coming soon to Binance Smart Chain and Polygon - plans are afoot to launch the app on these two blockchains. Keep an eye out for them there!

Risks and Responsibilities

For a platform that aims to be as hands-off as possible, there are still certain things it's responsible for, even when it migrates to a full DAO model. Here are a few points that occurred to me:

- Safeguard funds in the Capital Pool as these originated from the deposited funds from the Coverage Providers. They are currently deployed to a handful of DeFi protocols to earn yield.

- Ensure a fair voting process so that claims are properly processed. Even though it's the claimant's responsibility to prove that the claim is legit, the rate of successful claims can't be too low.

- Careful deployment of the Reinsurance Pool funds to benefit as many participants in the protocol as possible.

- Reliability of the platform and relevant infrastructure so that the protocol itself is not hacked or suffer from code exploits.

When it comes to risks, it would be ensuring all of the above happen with no unwanted consequences. The protocol has had its project audited by Consensys and Zokyo, which shows the project's legitimacy to a certain degree. As long as the audits are performed each time there is a significant update, and the team takes the usual precautions associated with running a blockchain project, fingers are crossed that things will tick along.

Final Thoughts

Now that I've come to the end of my journey in understanding what Bridge Mutual is, I draw the conclusion that it's no riskier or safer than any other legitimate DeFi protocol out there. That being said, I guess the real test is whether people have successfully made claims on it and whether it's difficult for Coverage Providers to withdraw their funds if they choose. Also, there is an 8-day period once the withdrawal process is initiated. If, within 8 days, there is a successful claim made, the funds will still be used to pay for the claim.

Initially, I was filled with a certain amount of trepidation about the protocol as it seems that the probability of having to pay out claims might be high. I was also unsure if anyone would manage to be successful in any claims since it relies on the vote of the masses. However, having understood more about how the protocol works, it seems to be a working business model.

One quick note on their Discord channel: it's quieter than some of the active ones I've seen in other projects. This is a double-edged sword because as much as I like not having a lot of noise, a chatty Discord indicates active participants, which is usually a good sign. So this is something to take note of.

Given the amount of risk involved, for those who are curious enough to give it a try, I'd say throw in a large slice of doubt and a small amount that you don't need in the foreseeable future.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.