Imagine a trader named Bob who anticipates that the price of a stock he owns might fluctuate significantly. Bob understands that he has two options – either ride the volatility and hope to end up on greener pastures or leverage the volatility to profit from it.

Bob is a seasoned trader; he'd use options theory rather than place consecutive long and short orders to benefit from volatility. A traditional put option gives the trader the right, but not the obligation, to sell an asset at a predetermined price, known as the strike price.

If Bob's asset rockets upwards, he can sell it at a higher price. On the other hand, if the asset plummets, Bob can exercise his option to sell the asset at the strike price (which will become higher than the market price) and use the capital to reaccumulate the asset at a lower cost. With good timing and proper research, Bob can profit regardless of where the market moves.

This strategy exemplifies how volatility, often seen as a risk, can be transformed into an opportunity. Using options, Bob turns potential market instability into a structured plan that enables protection and the potential to leverage volatility for profit. This concept is at the heart of Bumper, a revolutionary DeFi platform designed to provide similar opportunities for cryptocurrency investors.

Unlike Bob, we are not all trading experts with mastery in Options theory, nor do we have the time to glue our eyes to candlestick charts, waiting for the right opportunity to make profitable trades. However, Bumper and other derivative products are essential tools for extracting value from the market.

Bumper Review Summary

Bumper is an AI-powered decentralized pooled risk market. It simplifies leveraging volatility and risk in the market to generate returns regardless of the direction of the market. Using Bumper, traders can create more value out of the volatility in ETH and BTC without the overheads and complexity of options or earn a yield to provide a shield against the volatility to other traders. It operates on the Arbitrum network.

The Key Features of Bumper Are:

- Decentralized: Bumper operates completely on-chain. All the protocol calculations and operations are managed with Bumper smart contracts running on Arbitrum.

- Accessibility: Bumper is accessible to anyone with an on-chain address on Ethereum and some funds to deposit in the protocol.

- Easy to Use: Bumper requires very little technical know-how to use. The user guides are very helpful for preliminary training and using the protocol. However, considerable skills and knowledge are needed to understand the crypto market at large.

- Trade or Yield: Bumper offer both trading and yield farming opportunities. Trading requires risk assets like ETH and BTC, while yield farming is done with stablecoins.

- Bumper AI: Bumper charges a dynamic premium (streamia) to users. AI-trained models ensure premium calculation and position settlements are optimized for competitive premium and a stable yield.

- Endless Opportunities: Traders with a keen sense of the market can always find lucrative positions on Bumper, even when the market is volatile or stable.

Crypto investors, like their counterparts in traditional finance, seek ways to protect their assets from sharp downturns while staying exposed to potential gains. This is where Bumper comes into play. By leveraging advanced DeFi mechanisms, smart contracts, and AI, Bumper offers a unique solution that enables a simple yet intuitive interface for options-esque crypto asset speculation and yield farming strategies for stablecoin holders.

Behind Bumper is a team of seasoned professionals led by Jonathan DeCarteret, a serial entrepreneur passionate about DeFi and technological innovations. Alongside him is Gareth Ward, with two decades of tech and finance experience, and Samuel Brooks, the CTO, known for his work on the economic model for Synthetix. Their combined expertise ensures that Bumper's innovative approach to managing crypto volatility is robust and reliable.

Importance of Leveraging Volatility in the Crypto Market

The crypto market is infamous for its extreme volatility. Due to small size and fragmented liquidity, crypto assets react sharply to market events. The volatility is even more significant on the downside, as these tend to nosedive significantly more often than sharp upward rallies.

For a diligent trader, volatility is an opportunity rather than a risk:

- High Volatility: Cryptocurrencies are infamous for their volatility. Prices can swing wildly quickly, resulting in significant gains and substantial losses. If you anticipate volatility, you can benefit from it with short-term trades or take hedge positions to shield yourself from it.

- Preservation of Capital: Managing volatility helps preserve capital, which is particularly important in the crypto market, where the high-risk environment can potentially wipe out investments quickly. By employing strategies such as stop-loss orders, options, and hedging techniques, investors can limit the amount of money they are willing to lose, thereby protecting their initial investment from severe market downturns.

- Building Confidence: Effective risk management can increase an investor's confidence in dealing with a highly unpredictable market. Knowing that measures are in place to limit losses allows investors to make more reasoned decisions rather than reacting out of fear during market dips.

- Long-Term Sustainability: Managing volatility is essential for investing in cryptocurrencies as a long-term venture. It allows investors to weather the storms of bear markets and benefit from the eventual upswings without being forced out of the market by short-term losses.

However, managing volatility is an intricate process, requiring considerable skills and trading experience. Above all, hedging may require a constant eye on the market, which may not be feasible for retail investors with other responsibilities. There are several challenges investors face while managing volatility:

- Lack of Knowledge: Many retail investors enter the crypto market attracted by the allure of high returns without a comprehensive understanding of how cryptocurrencies work or how to manage risks. The complexity of the market, knowledge of blockchain technology, and the specifics of various coins can be overwhelming.

- Emotional Investing: The crypto market can be highly emotional due to its volatility. Retail investors often fall prey to panic selling during downturns or FOMO (fear of missing out) buying during rallies. These emotionally driven decisions can exacerbate losses rather than mitigate them.

- Access to Tools and Strategies: While institutional investors have access to sophisticated tools and algorithms for risk management, retail investors might have different access levels. Tools like advanced trading platforms with features for setting automated trading strategies are often less accessible to average investors.

- Regulatory Uncertainty: The crypto market still operates in a relatively uncertain regulatory environment. Regulation changes can have abrupt and significant impacts on the market, creating additional risk management challenges for retail investors who might not always be current with the latest regulatory news.

- Market Manipulation and Liquidity: Many crypto assets' smaller market caps and lower liquidity than traditional markets make them more susceptible to price manipulation. Such conditions can lead to sudden and unexpected market movements, which are difficult for retail investors to anticipate and manage effectively.

Managing risk in the cryptocurrency market is not just important; it's essential for anyone looking to sustain their investments over the long term. While retail investors face several challenges in effectively managing these risks, understanding these difficulties, educating themselves about the market, and using available tools can significantly help in mitigating potential losses. Building a disciplined approach to investment and continuously learning about new risk management strategies is vital to navigating the volatile world of cryptocurrencies.

Bumper Overview

Bumper is an AI-powered decentralized pooled risk market. Bumper uses smart contracts and liquidity pools to offload the risk of a speculative asset like ETH or BTC on a stable asset like USDT. Bumper believes that the crypto market is especially susceptible to volatility. It has created a market for risk with two kinds of participants:

- Traders: They pay a premium to protect their speculative asset position at a floor price. Traders can hedge their portfolio value against downside risk or leverage the volatility to accumulate more assets at a lower cost.

- Yield Farmers: They make the other side of the market by supplying stablecoins to hedge traders. In return, they receive dynamic premiums distributed by the Bumper protocol.

Bumper Logo. Image via Bumper Brand Assets

Bumper Logo. Image via Bumper Brand AssetsUnlike a traditional options market, Bumper calculates the premium dynamically, reacting to price changes and the available liquidity in the pools. It also strategically rebalances the stable and speculative asset liquidity to ensure optimal yields. To achieve maximum efficiency, Bumper uses AI and LLMs (Large Language Models) to assess the volatility and probability of trader claims. It can then offer competitive premiums for traders and maximum earnings for yield farmers without exposing the market to systemic risk. It is the first DeFi protocol to use smart contracts with LLM technology.

The following characteristics summarize Bumper:

- Not a Derivatives Market: One may perceive Bumper as an alternate derivatives market because the investment products they offer resemble derivatives like options in design. However, products on Bumper are less complex for the average trader to understand and include in their investment strategy.

- Non-Zero-Sum Market: Derivatives markets are traditionally zero-sum, meaning that one trader's profit stems from another's loss. Bumper, however, is a non-zero-sum as it leverages market volatility for speculation, risk protection, and yield farming.

- Governed by AI and Smart Contracts: Bumper abstracts much of the complexities of derivatives by algorithmically calculating the risk premium (the yield paid to farmers) as a function of the protocol's internal liquidity and the term of protection. It uses LLMs trained in financial data to predict market sentiment for calculating premiums and the best timings for rebalancing pools. Algorithmic calculation keeps market forces from inflating (or deflating) risk premiums, ensuring an economic price for risk sellers and stable returns for buyers.

- Quad-Pool Design: Bumper comprises four liquidity pools. Two pools are for exchanging risk, and the other two are reserves that ensure efficient pool rebalancing and predictable premiums.

- BUMP Token: Bumper's native token BUMP's utility is woven into the protocol's core functionalities. Users can also bond BUMP tokens to open positions on the platform to earn tokens.

How to Use Bumper

You can engage with the Bumper protocol as a user with one of the roles — takers or makers. The DApp is intuitively designed, splitting out Express and Advanced Hedge/Earn strategies as well as providing more detail on the protocol performance and data on the Market Data page.

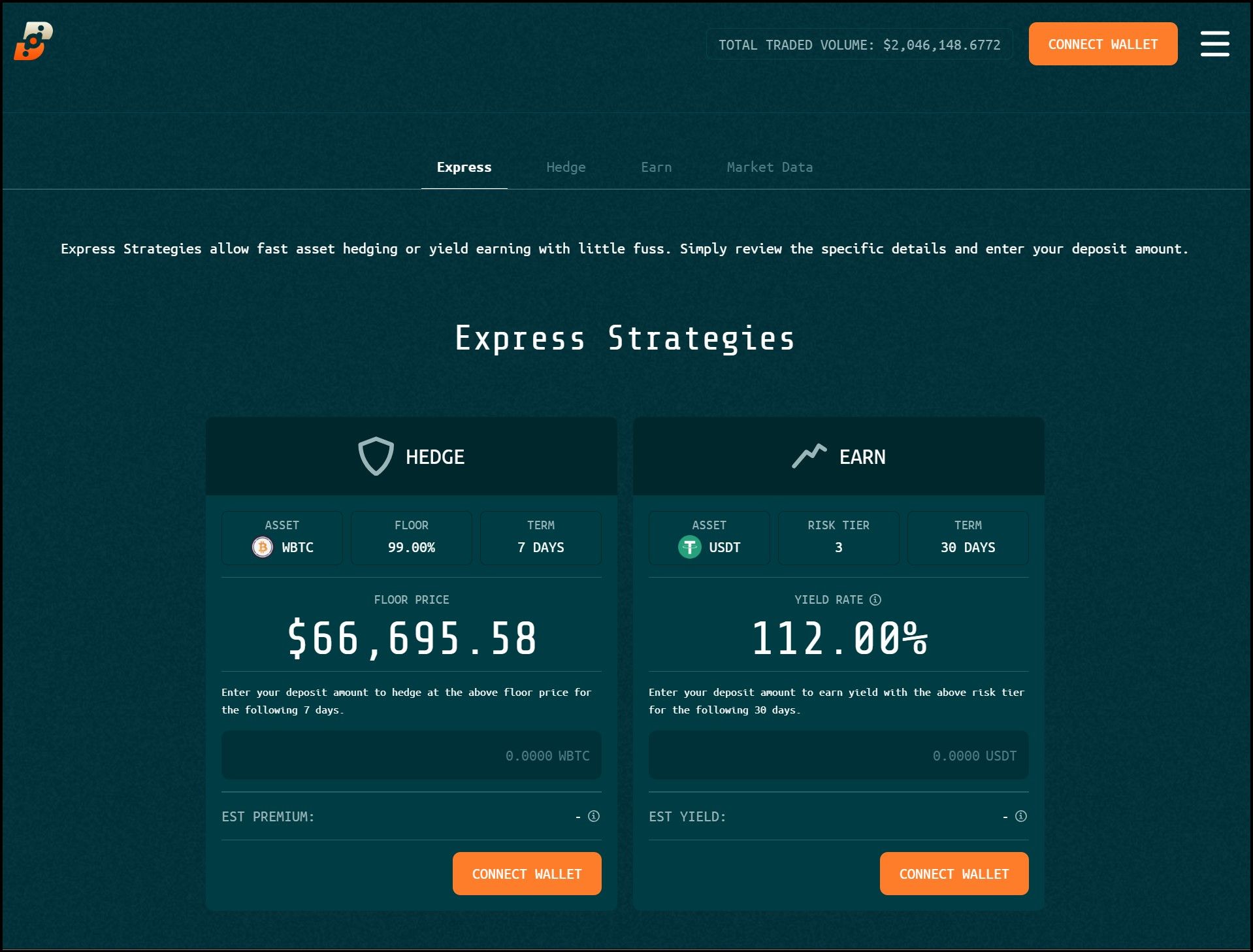

The Bumper DApp

The Bumper DAppWhen landing on the Bumper DApp, users have the option to take out an Express Hedge or Earn strategy. The Express Hedge simplifies the process of protecting wBTC at a 99% floor for 7 days. A user might employ this simple strategy if their short-term outlook is a plummeting BTC price.

The Express Earn strategy offers users a stablecoin deposit at a medium risk level on a 30-day term. For Express Strategies, users simply enter the amount they wish to deposit and confirm the transaction in their wallet to open a position.

Navigating to Hedge gives the user more data and control over their Hedge position. This allows them to choose a floor and term which aligns with their market outlook. The information boxes illustrate the expected premium they are likely to pay over the position duration. It also shows the user the level at which they will be able to exercise a profitable trade.

Bumper Market Overview. Image via Bumper Dapp

Bumper Market Overview. Image via Bumper DappSimilarly, the Earn page gives a user more control over their stablecoin-yielding position. Offering a range of terms and risk levels. Risk levels allow users to differentiate themselves based on their risk appetite and outlook on the underlying asset's price.

Looking at the Market Data page provides essential information about the scope of protection prevailing in the Bumper economy. The Markets Overview reflects the average outlook of the Taker and Maker positions active in the protocol. A higher floor or a longer term may suggest that Takers expect volatility in the market. For the Makers, their higher risk tier suggests the Maker's confidence in the price recovery of the insured risk asset.

In the 'Select Market' section, you can get a deeper look at the nuances of each Bumper market. Assess the current premiums and yields across all terms and risk levels to understand the demand for risk and use the insights to open a strategic position.

Learning Bumper Strategies

Now that we know how to navigate the Bumper DApp let's discuss some strategies to help us make the most of the Bumper protocol. Whenever you open a hedge or an earn position on Bumper, you expect the speculative asset's price to move in a particular direction.

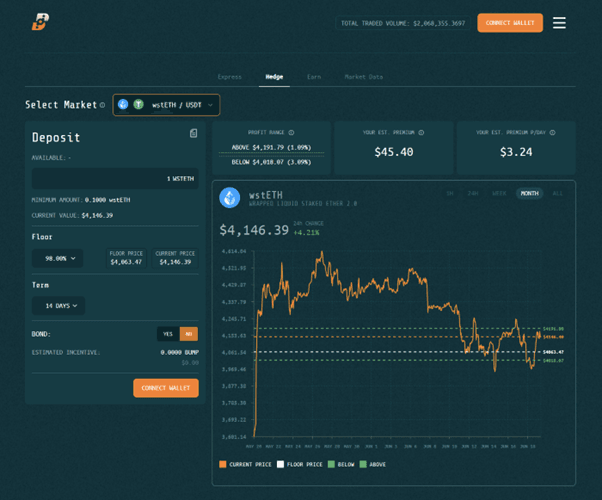

Bumper Economics. Image via Bumper

Bumper Economics. Image via BumperBroadly speaking, opening a hedge position entails the trader expecting the asset's price to deviate significantly from the current market price, or the trader expects volatility. The price moving in either direction is profitable for the trader:

- If the price goes up, the value of their asset increases, and they will make a profit after paying the premium.

- If the price goes down, they are eligible for a claim at the protected floor price, the same as selling the asset at a higher price than the market.

A user in an earning position sees the market differently. With yield as the source of their income, they prefer the hedge positions stay open for as long as possible and make as few claims as possible. This behavior pertains to a market that is either climbing up, discouraging speculators from making claims, or moving sideways and not accumulating enough incentive for the speculators to close their positions.

Therefore, as a trader, your first course of action is to judge the market of a speculative asset to discern volatility or sideways movement. If you expect volatility, there might be an accumulation opportunity of buying the asset at a lower price than the current market price, so hedge positions may be more favorable. On the other hand, if you expect a sideways or a rising market, there is a decreased chance of users making claims, so a yield position on stablecoins may be more desirable.

Understanding the Interplay of Yield, Volatility, and Premium

The Bumper protocol is designed to react dynamically to the apparent volatility in the market. It adjusts the premium charged to the hedge position holders to match the volatility and risk in the market. For instance, while it is generally true that a sideways market is favorable for yield farmers as there is little chance of claims, it also means that the Bumper protocol will make the premiums really cheap, reducing the yield. At the same time, if the volatility is too high, the yield might increase with premium, but the looming risk of claims increases significantly.

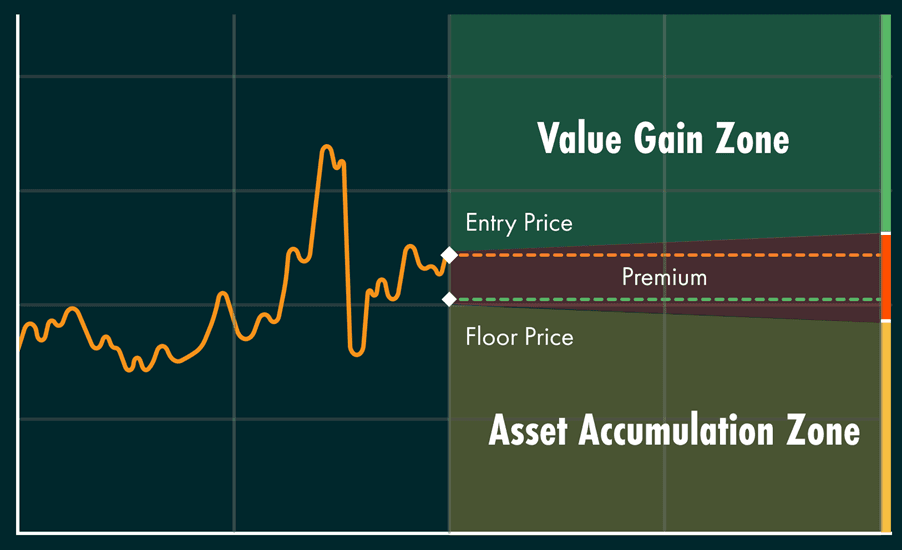

This interplay is illustrated in the image below:

Supply and DEmand Mechanics on Bumper

Supply and DEmand Mechanics on BumperA diligent trader should be able to anticipate volatility and turbulence in the market and use their insights to make intelligent trades on Bumper. Remember that if you own both stablecoins and risk assets, Bumper will have profit-making opportunities regardless of how the market behaves.

Bumper Trading Strategies

In this section, we will review some trading strategies one can use in the Bumper ecosystem during different market conditions to make returns by hedging speculative assets or farming stablecoins. These strategies leverage the Bumper demand and supply mechanics discussed previously.

The first step towards devising your strategy is realizing your market sentiment - where the price of the speculative asset will be relative to the current market price in the short and long term. Here are some strategies to get you started:

Farming Strategy

If you are bullish on an asset in the short term as well as the long term, opening a hedge position in this case is not helpful. Instead, you could use stablecoins to earn a yield on Bumper with the comfort of knowing that there is little chance of claims as the price of risk asset would keep rising. Since there is a reduced risk of claims, you could opt for a longer term and a higher risk rating to maximize your yield. However, remember that the Bumper protocol will also anticipate the rallying market and adjust the premium accordingly.

Accumulation Strategy

You can use this strategy when you believe the risk asset looks bullish in the long term, but a short-term correction is imminent. In this case, open a hedge position on Bumper and choose a higher floor price. Remember that a volatile market could inflate premiums, which, coupled with a higher floor price, may cause considerable premium charges.

Once the asset price corrects, you have an accumulation opportunity. Make a claim on Bumper on the corrected price to earn the protected value in stablecoins. Then, use the stablecoins to accumulate more speculative assets. You can further optimize your accumulation strategy by deducing the degree of correction. A steeper correction means you can have a lower floor and still protect enough capital to accumulate more cryptocurrencies and save some money by lowering the premium charged on your position

Hedging Strategy

A hedging strategy is applicable when you are bullish in the long run but still have some doubts about a possible correction. Since you are more confident about the asset price rising, a hedge position with a lower floor is the ideal choice. The hedge position will protect you from an unexpected correction in the market, while a lower floor and a longer term will tame premiums and keep them from growing out of hand.

How to use Bumper: Conclusion

This section covered the dynamics of using Bumper in a practical setting. It aims to help you gain a point of view about how you can play with hedge or earn positions, terms, and risk tiers to devise strategies that may be profitable in a wide variety of market conditions. The easiest way to use Bumper properly is to nail your short-term and long-term market analysis and then use these insights to devise Bumper strategies. Find more information on different strategies applicable to Bumper on their blog.

Bumper vs. Options Markets

Options are a type of derivative that gives you the right (but no obligation) to buy (a call) or sell (a put) an asset at a predetermined price at a future date. This construct allows traders to capitalize on the asset's apparent volatility. Trading crypto options is very similar to traditional stock-based options.

For instance, if I expect Bitcoin's price to fall in one month, I can buy a BTC put option contract at today's strike price. As the buyer of the Put option, I will have the right to sell Bitcoin at today's price to the option seller. The seller will charge interest, a premium, to assume the risk of buying Bitcoin at a lower cost.

In such a scenario, if the price does fall, I can sell my assets at a higher price than the market. Conversely, if the price stays the same or rises, I can ignore the contract and keep my holdings, with the loss limited to the premium payments made to the options seller.

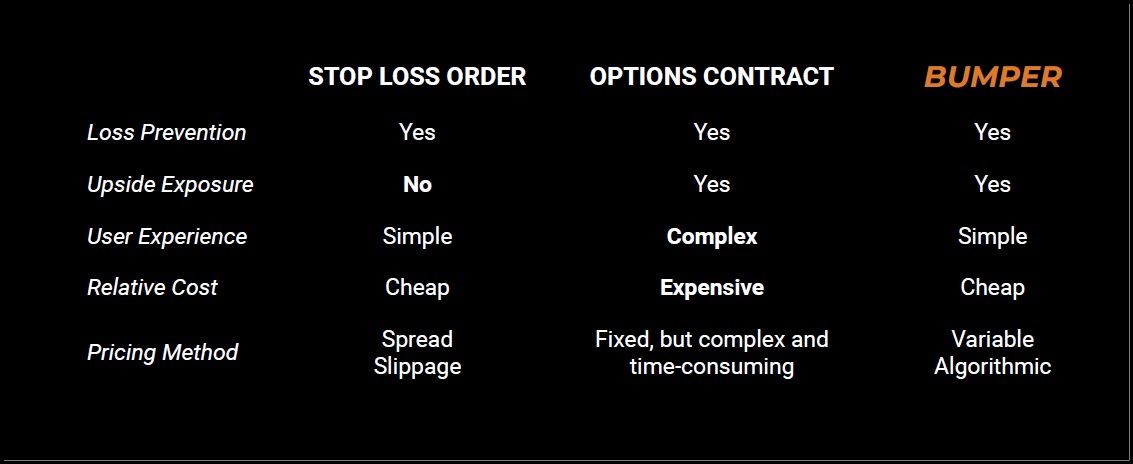

Bumper's products resemble options in their design. However, several notable differences can make Bumper more ideal for the average investor; let's go over them:

Collateralization

Simple options contracts do not involve collateral, so the price of an options contract is the premium one pays to the options seller, which is often several times less than the underlying market price. This characteristic exposes options traders to positions magnitudes greater than their funds would allow in spot markets, which is the source of the options market's extreme volatility.

On Bumper, users must lock the assets they seek protection for and some BUMP tokens as a bond for their position (not yet mandatory). Collateralization limits the buying potential of the traders and mitigates against unsustainable leverage in the market.

Premium Calculation

In traditional options markets, individual risk perception collectively decides a static premium. Traders may factor in the asset price, options expiration time, market volatility, and much more, valuing every aspect uniquely.

On the other hand, Bumper uses AI algorithms trained in financial data to calculate premiums by accounting for the total supply of collateral and net demand for risk, abstracting much guesswork from the traders. It is an ideal choice for traders without the time or knowledge to engage in the derivatives market.

Accessibility

Including futures and options in one's investing strategy can prove exceptionally beneficial. However, they have a steep learning curve to use efficiently and require constant attention, making them unfeasible for uninitiated or passive investors. In contrast, Bumper uses algorithms to ensure that risk protection is available at economic rates and that those who assume this risk receive adequate compensation, making it more accessible to retail crypto investors.

Bumper is not a speculative derivatives product. Therefore, it is not subject to the same regulatory restrictions as derivatives markets, which can become even more sensitive when cryptocurrencies are involved. Bumper's universal accessibility makes it even more appealing for many crypto investors worldwide.

Bumper vs. Options: Conclusion

In conclusion, Bumper and put options help mitigate downside volatility in crypto markets. However, specific differences in design alter their experience. The premium in Bumper is predictable, and the position does not require constant monitoring as the algorithm abstracts premium calculations away. On the other hand, options are susceptible to market forces, requiring skill and precision from traders to make profits. The ideal alternative for any investor depends on their knowledge, money, and time they are willing to invest, as well as their risk preferences.

Bumper vs. Stop Loss Strategies

Let's compare Bumper with stop-loss strategies. Both can protect investors from losses resulting from declining asset prices, but they operate differently and have distinct characteristics.

Stop-loss orders are trades in which investors set a predetermined price level below which they are willing to cut corners and sell their assets to limit their loss due to the asset's falling price. When the asset's price reaches or falls below the stop-loss level, a market order is triggered to sell the asset at the prevailing market price, potentially realizing the loss.

Let's examine stop loss and Bumper closely:

- Based on risk perception, Bumper traders can choose the floor price and term length. Stop-loss orders are also flexible; a trader can define price levels or terminate the order with changing market conditions.

- Bumper traders pay fees as premiums to liquidity providers, while there are no costs to stop loss orders.

- Bumper traders do not need to predict the market's future position, but placing a stop-loss order requires strategic planning and market analysis.

- Market volatility or whipsaw movements can prematurely trigger stop-loss orders, potentially reducing returns. In contrast, traders on Bumper have the right but no obligation to exercise their protection, helping them ride market volatility.

Bumper vs. Stop Loss: Conclusion

Both Bumper and stop-loss strategies aim to mitigate losses from downside volatility in asset prices, but they operate through different mechanisms and have distinct features. Bumper provides defined downside protection through contractual agreements, while stop-loss orders offer flexibility and simplicity in execution. Investors may choose these strategies based on risk preferences, investment objectives, and market outlook.

Bumper Compared With Other Trading Strategies. Image via Bumper

Bumper Compared With Other Trading Strategies. Image via BumperThe Bumper Protocol

The Bumper protocol runs on the Arbitrum network. Smart contracts perform all the market calculations with complete autonomy. Unlike traditional markets, where maker and taker orders match, Bumper users never directly interact with one another. Akin to DEX protocols, users only interact with smart contracts and liquidity pools, which also interact with each other to run Bumper. The Bumper protocol has three main objectives:

- Remain solvent to protocol participants: The Bumper protocol must be liquid enough to adequately compensate traders and yield farmers. Note that this compensation does not ensure farmers' profitability of yield, as they assume Market risk and may be subject to impermanent loss.

- Minimize the cost of protection for traders: The protocol aims to minimize the premiums and fees charged to traders. In traditional options contracts, the premium is agreed upon and decided in advance. At the same time, it is dynamic in Bumper, affected by apparent liquidity, asset prices, and more (we'll touch on this a bit later).

- Maximize yields: The protocol must provide adequate yields to stablecoin yield farmers and keep them incentivized to maintain liquidity in the protocol for as long as possible.

Overall, the protocol must ensure that the yields and premiums do not go out of hand to the point that it breaks the natural flow of supply and demand while also accounting for extreme market volatility as efficiently as possible.

How Does Bumper Work?

Decentralized Finance (DeFi) revolutionizes traditional financial mechanisms with innovative, blockchain-based solutions that transcend the limitations and restrictions typical of conventional financial markets. Traditionally, in an options market, each transaction is conducted live, matching orders on a one-to-one basis. Here, a trader wishing to buy a put option at a specific premium and expiry date finds a counterpart willing to sell the same option under identical conditions.

This direct matching is deeply influenced by individual perceptions of current and future market states, inherently fragmenting liquidity across diverse options, each characterized by unique dynamics.

DeFi Protocols Operate Differently

In stark contrast, DeFi applications eschew the traditional order book model, opting for a system that aggregates liquidity from all participants. This shift is evident in how decentralized exchanges (DEXs) function; they pool token liquidity and employ mechanisms like the constant product formula to determine asset prices. This formula dynamically adjusts prices based on the asset's current value and the pool's overall liquidity, allowing for more fluid and responsive market conditions.

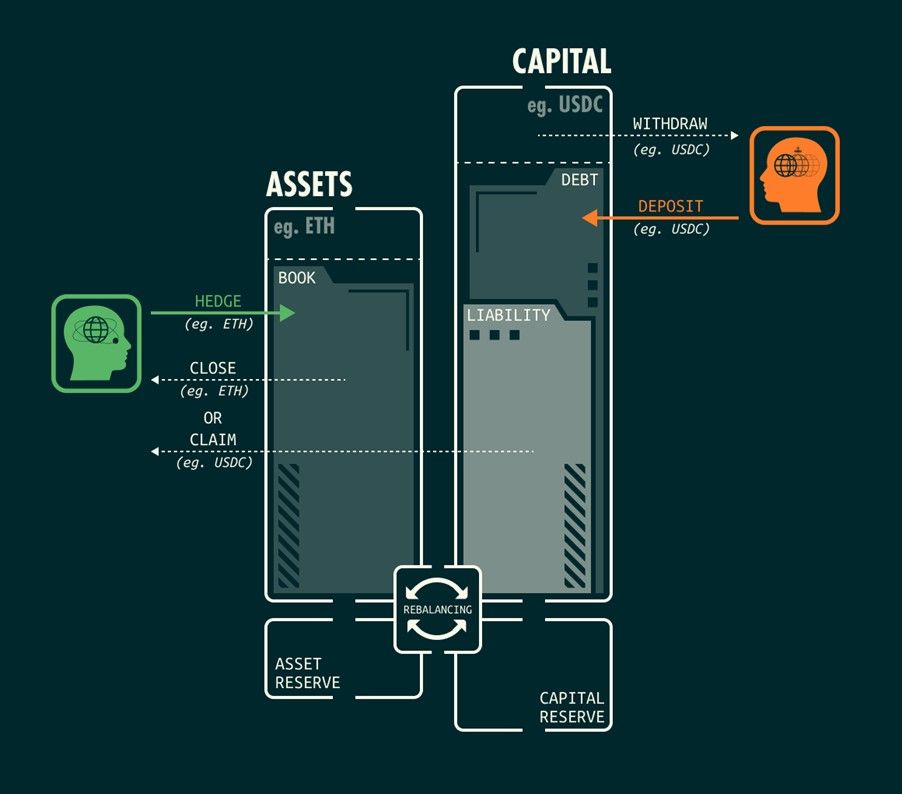

Liquidity Pools of Bumper Protocol

Bumper leverages this unique pooling system by introducing two types of pools:

- The asset pool holds speculative assets, such as Staked Ether or Wrapped Bitcoin, which are subject to protection against volatility sought by traders or 'takers.'

- The capital pool consists of stablecoin deposits provided by yield farmers or 'makers.' If the Taker's position ends up negative at the end of their term, the protocol compensates them with the help of the Capital pool.

Unified Liquidity

A significant innovation in Bumper's approach is the abandonment of one-to-one risk matching, which is typical in traditional markets. Instead, Bumper calculates premiums based on factors including total pool liquidity, prevailing asset prices, and the current demand for risk protection. These premiums are then proportionately distributed among the Makers.

This model allows for flexibility in terms of protection provided; for instance, a Maker contributing to the pool for a shorter term might find themselves protecting a Taker whose protection term is considerably longer. Such flexibility is impossible in traditional options markets, constrained by rigid, order book-based matching systems.

In subsequent discussions, we will delve deeper into the transactional dynamics between these participants and explore the sophisticated mechanics that underpin the Bumper Protocol. This exploration will help us understand how Bumper not only simplifies but also enhances the efficiency of risk management in the volatile cryptocurrency market.

Bumper Architecture

As a protocol running on Arbitrum, all the operations in Bumper, including exchange between Takers and Makers, use smart contracts and execute permissionlessly.

While DEXs use two pools, the Bumper protocol utilizes four pools to store and exchange Taker and Maker deposits, two pools for each type of participant. According to Bumper, a quad-pool design ensures liquidity efficiency and keeps the funds solvent. Let's see how these pools work:

Bumper's Quad-Pool Design

In Bumper, the protocol participants – the Takers and Makers never interact directly. Instead, the value exchange happens between users and pools and between different pools.

This design helps calculate premiums, controls slippage and unifies liquidity, which can help tame premiums and ensure a positive yield for the Makers.

Bumper Protocol Architecture. Image via Bumper brand Assets

Bumper Protocol Architecture. Image via Bumper brand AssetsThe liquidity in the Bumper Protocol is scattered across the following four pools:

- The Asset Pool: It stores the deposits from the Takers, comprising speculative assets like Ether or Bitcoin.

- The Asset Reserve: The reserve stores the premium collected from the Takers and the assets they leave behind if they make USDT claims.

- The Capital Pool: It stores the stablecoin deposits from Makers.

- The Capital Reserve: This reserve pool also holds stablecoins and helps manage short-term liquidity.

The quad-pool design is essential for the efficiency of liquidity management. Bumper argues that by having additional reserve pools, the short-term liquidity required to address claims will not require value exchange between the primary pools, incurring less transaction costs and less slippage and contributing to the system's overall stability.

For instance, if a Taker requests a claim settled in USDT, the reserve pool can address short-term liquidity needs without swapping the Taker's ETH with Maker's USDT on a DEX and giving time for the primary pools to adjust periodically. The protocol rebalances the pool over time.

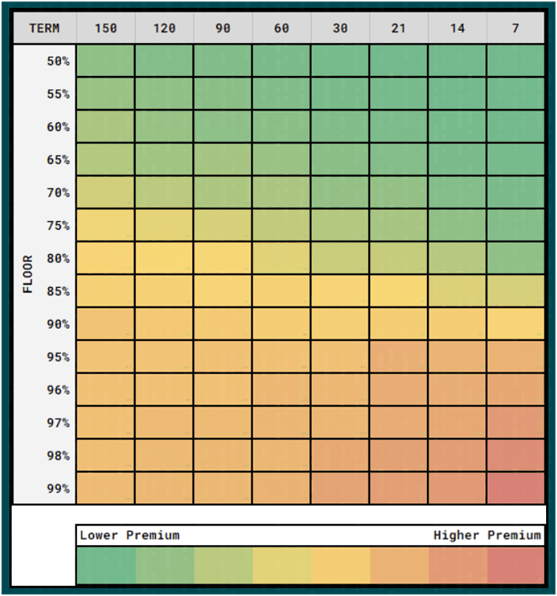

Premium

The premium is a cost that a Bumper taker pays the makers for offloading its asset price risk on them. Adequately calculating premiums is central to the Bumper protocol and for takers looking to extract the maximum revenue from their positions.

In one of its blogs, Bumper claims that it outperformed traditional Put Options pricing on Deribit by as much as 30%. So, what's unique about Bumper premiums?

Premiums on Bumper (Streamia)

A traditional options market employs the Black-Scholes Options Pricing formula to calculate premiums. This age-old technique calculates premiums as a single upfront cost, determined when the option is purchased. In contrast, Bumper premiums are not set once at the beginning; they accumulate progressively throughout the term. This change means that the cost of protection adjusts dynamically as the duration increases, reflecting the ongoing changes in risk, asset price, and market conditions.

Factors Influencing Bumper Premium

Three major factors influence the premiums on Bumper:

- Price Risk Factor: The Bumper protocol continuously monitors the asset prices to determine their volatility algorithmically. Higher volatility leads to higher risk factors and more significant premiums.

- Liquidity Risk Factor: A liquidity risk is the risk of the Bumper protocol failing to meet its obligations—satisfying a taker's or a maker's claim. During volatility and high demand from takers, Bumper protocol liquidity is stressed, so the protocol adjusts the premiums to reflect dynamic market conditions.

- Risk Rating of Positions: A taker's term length and floor price (the protected price) determine its risk rating. Generally, a higher floor and a shorter term costs more premium, and vice versa.

In contrast, the Black-Scholes options pricing is primarily influenced by historical volatility, influencing investor behavior. On the other hand, Bumper reflects the dynamics of the ever-changing crypto markets.

Bumper Premium Heat Map. Image via Bumper Blog

Bumper Premium Heat Map. Image via Bumper BlogThe matrix above illustrates risk pricing in Bumper. In general, a lower floor and a longer-term are less daunting on the protocol's liquidity, with a lower floor decreasing the claim's value and longer term allowing the market to stabilize. Therefore, such taker positions attract a lower premium, which heats up with higher floors and shorter terms.

Pooling Liquidity and Spreading the Risk

Bumper distributes market risks between Takers and Makers. Takers' premiums are pooled globally and calculated based on individual risk and protection duration, optimizing gas costs. Makers, however, share a dynamic yield pool that can be positive or negative, depending on market conditions. Instead of facing fixed payouts like in put options, Makers can wait for conditions to improve or renew their positions to continue earning. This approach distributes risk and stabilizes the protocol's economics, encouraging broader participation.

Benefits of Bumper's Premium Pricing Technique

Bumper provides a more accurate reflection of current market risks, making it potentially more cost-effective and fairer for users who need protection tailored to the current environment. If the price increases and the probability of a taker claim decreases, the premium decreases. If the price starts tanking and the probability of a claim increases, the rate of increasing premium reflects the apparent volatility of the market.

Traditional options pricing techniques based on the Black-Scholes formula may be effective for traditional financial instruments. Still, they may not always capture the nuances of rapidly changing markets, especially in the highly volatile crypto space. Bumper's dynamic premium model is designed to be more adaptive and responsive to the actual conditions in the market, offering a modern and flexible approach to risk management for crypto assets. This helps users maintain the protection that aligns closely with the real-time risk landscape.

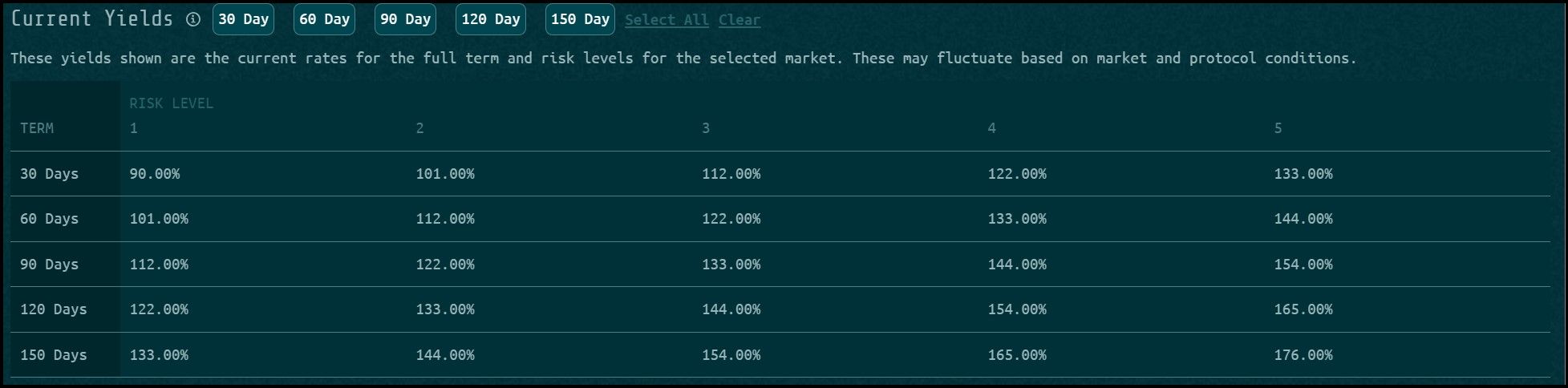

Yield

Yield is the return makers earn for assuming the price risk of the takers—makers deposit stablecoins, which are used to protect takers who pay a premium. The collected premium is the source of the Maker's yields.

As mentioned, Bumper combines all the maker and taker positions to form capital and asset pools. If a taker's term expires under the money (lower than the floor price), they make a claim, which reduces the size of the capital pool, affecting all the makers slightly, rather than any individual maker.

The share of the total pool for an individual maker is measured in bUSDT with respect to their initial USDT deposit. However, Makers may not receive an equal amount of bUSDT as their initial deposits; this figure depends on the following factors:

- The Maker's USDT deposit.

- Amount of USDT in the Capital Pool.

- Amount of bUSDT issued.

- Amount of ETH in the Asset Reserve.

- The selected risk tier.

The longer they stay vested in the protocol and the risk of a risk tier they opt for, the additional risk they are assuming and are rewarded accordingly. Yield works by gradually increasing the amount of USDT in the Capital Pool, increasing the per unit claim for bUSDT.

An Example of Yields Offered by Bumper. Image via Bumper

An Example of Yields Offered by Bumper. Image via BumperImpermanent Loss

Bumper does not guarantee that Makers will make a positive return on their investments. After all, they earn yield for taking additional risks; sometimes, that risk plays out as impermanent loss. It is an event when there are insufficient funds in the Capital Pool to compensate the Takers and Makers.

During periods of extreme volatility, the Takers might exercise their right to claim protection more often, draining the Capital Pool and not leaving enough funds around for the Makers. Bumper uses AI-powered models to mitigate such risks (more on it later).

Therefore, Makers must remain in the protocol for enough time to let the Bumper protocol rebalance protocol pools. Rebalancing involves converting the ETH in Asset reserves, left behind by Takers when they exercise claims, back into USDT. It also includes BUMP token-related incentives, all collectively working to minimize the losses that Makers may incur.

Risk Tiers

When Makers open a position in Bumper, they must decide on risk tiers between 1-5. A higher risk tier exposes them to greater returns but reduces the protocol's preference for compensating their impermanent loss with rebalancing. Risk tiers ensure that makers ride the volatility by staying invested for longer and receiving their appropriate value.

Automated Yield Farming

The Bumper protocol calculates how much liquidity it might require at any time to ensure that all claims and withdrawals are met without stressing the protocol. Any excess capital is considered 'idle' and is used in yield farming managed by Bumper smart contracts. This strategy ensures that the Bumper protocol extracts the maximum possible yield from the pooled capital to improve yield economics. These returns are distributed to all the makers proportionately.

Rebalancing

Rebalancing is a crucial mechanism in Bumper. Protocol imbalance happens when takers claim a volatile market, leaving behind their devalued risk asset and gaining back the protected value of the asset in stablecoins. In a nutshell, the protocol owes takers their risk assets or stablecoins if they make a claim. Similarly, the protocol owes stablecoin yields to makers.

The protocol conducts rebalancing based on the difference between total assets, total capital, and the protocol's liabilities to ensure liquidity is spread adequately across all the pools. Cross-side rebalancing is crucial in exchanging stablecoins and risk assets in a DEX to regain liquidity equilibrium. Bumper leverages AI to find the most optimal time for rebalancing pools.

How AI Makes Bumper More Efficient

Bumper leverages AI to enhance the efficiency and accuracy of its protocol, particularly in calculating premiums and optimizing rebalancing strategies. Here's how AI is utilized:

- Premium Calculation: Large Language Models (LLMs): Bumper employs a 70 billion parameter LLM trained on extensive financial data to predict future Bitcoin prices. This model helps in determining the premiums by accurately forecasting market trends and price movements. Reinforcement Learning from Human Feedback (RLHF) fine-tunes the model to align with actual market behavior, ensuring premium calculations are grounded in real-time data.

- Sentiment Analysis: 8 Billion Parameter LLM: This model analyzes vast amounts of financial news and social media data to gauge market sentiment. By understanding the mood and opinions of market participants, Bumper can adjust premiums based on the anticipated impact of sentiment on price volatility. This predictive capability allows for more responsive and dynamic premium adjustments.

- Technical Analysis: LLAVA Model: Bumper uses a Large Language And Vision Assistant (LLAVA) to perform technical analysis. This model interprets price charts and technical indicators like RSI and MACD, integrating visual and textual data to predict future price movements. The model employs Long Short-Term Memory (LSTM) networks to analyze historical price data, enhancing its ability to forecast short-term market trends.

Rebalancing Techniques

AI assists in determining the optimal times for rebalancing the protocol. By predicting future price and volatility, AI helps maintain equilibrium between the Taker and Maker pools. This proactive rebalancing ensures the protocol remains solvent and efficient, adjusting positions to mitigate risks and optimize returns.

Benefits of AI Integration

By incorporating AI, Bumper enhances its capability to manage risks dynamically and efficiently. The AI models provide smart contracts-powered real-time insights into market conditions, allowing for more accurate premium pricing and timely rebalancing actions. This approach improves the protocol's overall performance and provides users with a robust and adaptive risk management tool.

The BUMP Token

The BUMP token, the native token of the Bumper protocol, is integral to establishing its dynamic two-sided market for price protection of on-chain assets. The utility of the BUMP token is deeply entwined with the operations and success of the Bumper protocol, directly influencing its market value and overall network effect.

Core Market Access

The BUMP token's primary function within the Bumper ecosystem involves its role in market participation. Currently, both Takers and Makers may post a proportional bond in BUMP tokens at the start of their term. This bond must be maintained as long as the participant is in an active position. For supplying a Bond users are rewarded with additional tokens. This design aligns the users' incentives with the network's health and growth. By tying the token's value directly to the protocol's usage, the market demand for Bumper inherently supports the BUMP's price.

Coordination Stimulus

Bumper may issue BUMP tokens as incentives under specific conditions to encourage robust participation and ensure sufficient liquidity. These coordination incentives are designed to attract additional asset or capital liquidity when regular premiums and yields do not suffice.

Governance

BUMP token holders also play a crucial role in the governance of the Bumper protocol. They have the power to influence the development and feature updates of the protocol through a system of representative voting. This governance process is structured to prevent large token holders from disproportionately swaying decisions, thus preserving the decentralized ethos of the platform. Like other decentralized protocols, the community engages in this process through raising, voting on, and implementing Bumper Improvement Proposals.

In essence, the BUMP tokenomics are crafted to foster a self-sustaining ecosystem where the token's utility and value are directly linked to the active participation and growth of the Bumper protocol, reflecting a well-thought-out economic model that encourages engagement, governance, and security.

Risks of Using Bumper

When engaging with the Bumper protocol, users are exposed to various risks that can affect their investments and interactions. These risks fall into three primary categories: market-related, protocol-related, and user-related risks. Each category encompasses specific challenges and potential drawbacks that participants should know.

Market-related Risks

Several market-related risks are inherent to using the Bumper protocol. One significant risk is the potential for a negative yield position due to impermanent loss, especially if the market conditions shift unfavorably during the term of protection. For Takers, there's a risk that a rapid and severe devaluation of the protected currency could push the protocol towards insolvency, especially if the asset significantly falls below the protected floor price. However, the Bumper team is aware of this risk and tested the system thoroughly with historical data, where the protocol held up in call cases

Furthermore, the dynamics of supply and demand can lead to fluctuating premiums. In times of extreme market fear or uncertainty, the demand for protection might drive the premiums so high that it becomes economically unviable for new or existing participants. Conversely, if there's a drop in the demand for protection—possibly because other yield farming or investment opportunities become more attractive or appear safer—yields could decline sharply, making Bumper less competitive.

Additionally, the BUMP token, which is central to the operation and utility within the Bumper ecosystem, could be subject to rapid devaluation due to market volatility or shifts in investor sentiment toward DeFi protocols in general.

Protocol-related Risks

Protocol-related risks begin with the inherent vulnerabilities associated with smart contracts. Despite rigorous testing and audits, smart contracts can still harbor bugs or flaws that might be exploited, potentially leading to the loss of user funds.

Regulatory risk is also significant; changes in how DeFi platforms are regulated could impact how Bumper operates or its ability to operate in certain jurisdictions.

The systemic risk in DeFi refers to the interconnectedness of various protocols and platforms within the DeFi ecosystem. Failures or exploits in one protocol can have cascading effects throughout the system, potentially impacting Bumper even if it remains secure.

Operational risks related to the decentralized application include downtime or failures in the infrastructure that supports Bumper, which could affect transactions and the execution of protocol functions.

User-related Risk

From the perspective of the users, specific risks include potential liquidations. For Takers, neglecting a hedge position and failing to withdraw their deposits on time can lead to position expiration penalties. If not addressed, the accruing premiums could exceed their initial deposits, liquidating their position, including any bonded BUMP tokens.

For Makers, there is a risk of significant losses due to a sharp devaluation of the currency and simultaneous claims from Takers. If the losses exceed their initial stablecoin deposits, it could also lead to the liquidation of their position.

Risks of Using Bumper: Conclusion

The risks associated with using the Bumper protocol are diverse and multifaceted, reflecting the complex nature of DeFi platforms. Market-related risks underscore the volatility and unpredictability of the crypto markets, while protocol-related risks highlight the technological and regulatory challenges. User-related risks stress the importance of active and informed participation in the protocol. Prospective users must carefully consider these risks, weigh them against potential benefits, and engage with the platform with a complete understanding of the possible financial outcomes.

Closing Thoughts

Bumper is a revolutionary platform where traders can execute options-like investment strategies without the complexities and steep learning curve often associated with the derivatives market. With Bumper, users learn to view market risk as a tool one can leverage to extract value from the market rather than an uncertainty to be averse of.

Crypto markets often get called out for their volatility, but this notion misses the bigger picture. A diligent investor with a keen eye for spotting short- and long-term market movements can leverage this volatility in several ways. A value investor with a long-term goal may use Bumper as a hedging tool to protect their portfolio's value in the long term, while a short-term speculator makes use of the price swings to buy crypto assets at a reduced price.

What's beautiful about Bumper's economics is that you don't need to time the crypto market's volatility perfectly to make profitable trades, but it lets you customize your positions based on your perception of the market's status. If you're confident about your analysis, use shorter terms and higher floors to accumulate more value. Otherwise, choose lower floors and longer terms to leave room for unexpected swings.

Bumper also introduces a novel yield farming narrative in DeFi. While farming crypto is primarily dominated by lending and liquidity provision in different DeFi protocols, Bumper allows users to capitalize asset price risk and farm yields with stablecoins. Leveraging a variety of yield farming techniques in different market conditions is essential to making the most out of your crypto holdings.

I want to add that while one can make returns on Bumper regardless of the market's direction, it does not mean that Bumpered investments are risk-free. To make the most out of the Bumper protocol, users must conduct extensive market research before opening hedge or yield positions, or they might end up paying unexpected premiums or incurring impermanent losses.

Going forward, there is immense potential in 'Bumpered' assets finding use cases outside speculation and investing. One idea is using Bumpered assets as collateral for issuing loans with very competitive interest rates. Since the monetary value of a speculative asset is protected, a lending protocol could offer stablecoin-like interest rates for risk assets like Ether and Bitcoin. Therefore, Bumper has created a novel risk market that might permeate other factions of decentralized finance in due time.

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.