Bybit is a cryptocurrency and derivatives trading platform headquartered in Dubai. It offers several services such as trading bots, lending, institutional services, referral and affiliate programs, copy trading and the Bybit debit card, which is the focus of this article.

Crypto debit cards play a major role in today's digital economy by bridging Web3 and Web2. Acting like conventional debit cards tied to a traditional bank account, these cards allow users to spend their cryptocurrency holdings just like fiat currency.

Crypto debit cards typically work in one of two ways, either by manually converting from fiat to crypto in lump sums prior to purchase, or automatically converting cryptocurrency holdings into fiat currency at the time of purchase, removing the necessity of converting crypto to fiat via an exchange beforehand. This takes away a major hassle, thereby encouraging more frequent and widespread use of crypto in everyday transactions.

This Bybit card review will explore its features, fees, security and the rewards and incentives Bybit is currently offering.

Before we go any further, as this article only focuses on the Bybit crypto card, you can head over to our in-depth Bybit review if you want to know more about the exchange as a whole. We also have a few other Bybit-centric pieces:

- Bybit All-In-One Crypto Platform: More than Just Crypto Trading!

- Bybit Trading Guide

- Bybit Earn Review

- How to Sign Up For Bybit

- Bybit Copy Trading Review

Right, moving on!

Crypto Cards’ Impact on the Crypto Economy

Some critics within the crypto circle argue that the secret sauce to mainstream crypto adoption lies in simplicity.

I've used a debit card since I was 18 but I've never thought about the intricate mechanics behind it. Is paying for my coffee without having to do any mental gymnastics too much to ask for? Much like the transition from carrying cash to using debit cards revolutionized traditional finance, crypto solutions need to seamlessly integrate into people's daily lives without requiring them to become experts in cryptography or decentralized ledgers.

Crypto cards are a step in that direction.

By allowing users to off-ramp their crypto at the point of sale, these cards eliminate the barriers associated with liquidity constraints, allowing users to spend their crypto holdings with ease. What does this achieve? Two things — It encourages the Average Joe to spend their crypto more often (because it's convenient), and longer term, fosters a future with greater acceptance of digital assets in mainstream commerce.

Leveraging the infrastructure of existing payment networks like Mastercard and Visa, crypto cards enhance the accessibility and usability of cryptocurrencies. In addition, features such as cashback rewards, zero foreign transaction fees, and real-time spending notifications incentivize continued usage of the card.

The familiarity and convenience of using a card for transactions resonate with consumers who have long been accustomed to traditional banking systems. This makes it easier for them to transition into using crypto in their daily lives. As more individuals experience the benefits of using crypto cards, they are likely to become advocates for digital assets and contribute to the broader adoption trend.

If you are in the market for a crypto card, we have a great article for you, feel free to check out our article on the best crypto debit cards.

What is the Bybit Card?

The Bybit card is a Mastercard-powered crypto debit card accepted at over 100 million locations. It gives you access to exclusive benefits through the Bybit Card Loyalty Rewards Program, and you can unlock a treasure trove of rewards, including exclusive offers and special experiences from its partners.

The Bybit Card is Accepted Anywhere Mastercard is Accepted. Image via Bybit

The Bybit Card is Accepted Anywhere Mastercard is Accepted. Image via BybitThe card comes in three forms:

- Bybit Card Lite: The card has a lifetime spending limit of 150 EUR, applicable to both fiat and crypto transactions. The Lite version doesn't have a physical card.

- Bybit Virtual Card: Compared to the Lite version, the virtual card and its physical version both have higher spending limits.

- Bybit Physical Card: This one is suitable for cash withdrawals through an ATM.

If you get the Lite card and then decide to upgrade, you can do so upon completing the address verification process.

In addition, you can add your Bybit card to Google Pay on Android devices and not the website. However, Google Pay on iOS and Apple Pay are not currently supported. Additionally, Google Pay is unavailable for users from Switzerland, Estonia and Norway.

Bybit already imposes a strict verification process to comply with Know Your Customer (KYC) standards. The exchange takes it up a notch for its crypto debit card, and users may be required to update their identity verification even if they had previously completed their Bybit account’s identity verification.

There is a major caveat, however: The Bybit card is only available in Australia and the European Economic Area at the time of writing.

Bybit Card Features

Here are some of Bybit card's top features:

Worldwide Acceptance

Picture this: You're strolling the streets when the eateries lining the sidewalks become too enticing. With the Bybit card, there's no need to fumble for cash, convert crypto to fiat, or worry about carrying multiple cards for use at home vs abroad. Thanks to its contactless payment capability, you can effortlessly complete transactions with a simple tap.

The Bybit card is accepted by merchants worldwide. Whether you're exploring exotic markets in distant lands or simply grabbing your morning coffee at your favourite cafe, the Bybit card has got you covered.

Support for Mainstream Cryptos

Bybit card supports a range of currencies, including both fiat and multiple cryptocurrencies:

- Fiat currencies supported: EUR or GBP, determined by your address verification during the card application process.

- Supported cryptocurrencies: BTC, ETH, XRP, USDT, USDC, TON, MNT and BNB.

EVM 3-D Secure

The Bybit card utilizes EMV 3-D Secure technology to safeguard your funds.

One major concern is fraud during online payments, especially when the card is not physically present. To combat this, payment card issuers and merchants use a system called EMV 3DS.

EMV 3DS works by allowing merchants and card issuers to exchange information securely to verify the identity of the person making the transaction. This information includes details about the transaction, the payment method used, and the device used for the transaction. By analyzing this data, card issuers can quickly detect and prevent fraudulent transactions without making the payment process overly complicated, which could discourage customers from completing their purchases.

Cashback Rewards Points

The Bybit card offers an enticing cashback reward program, allowing users to earn up to 10% cashback equivalent in points on their transactions. This feature provides an attractive incentive for users to make purchases using the Bybit Card, effectively turning everyday spending into potential savings or rewards.

Note that unlike some of the other popular crypto debit cards that offer cashback in crypto, Bybit offers “points” which can be used for trading bonuses, trading fee coupons, fee discounts, NFTs, airdrops, merchandise and more. The conversion rate is 500 rewards points per 1 unit of fiat currency spent. You can find the details on the Bybit Help Center.

No Annual Fee

One of the standout features of the Bybit card is the absence of any annual fees. This means that users can enjoy the benefits and convenience of the card without having to worry about recurring charges, making it a cost-effective option for managing finances and making payments.

How to Get Your Bybit Card

Applying for the Bybit card is a fairly simple affair.

Here's a step-by-step guide to getting the virtual card, which is a prerequisite if you'd like the physical version.

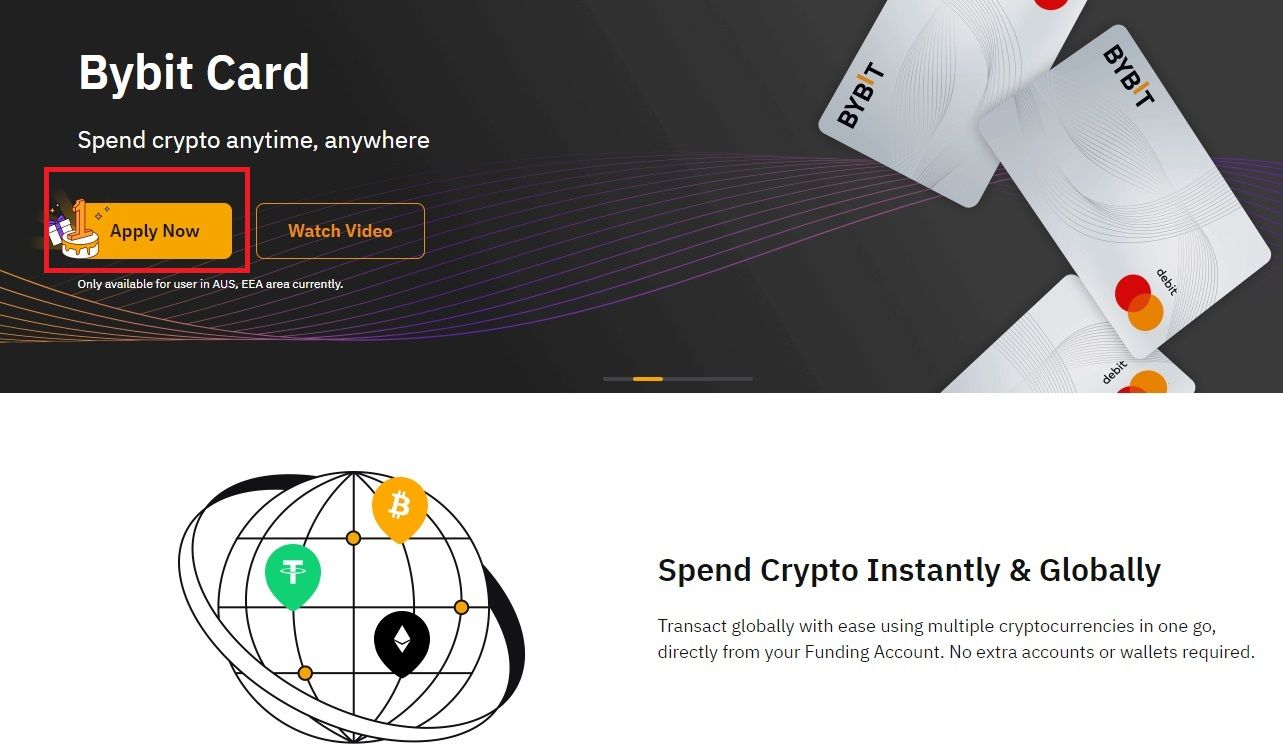

STEP 1: Navigate to Finance then Card to access the Bybit card page, then click on “Apply Now.”

Signing Up For Bybit is Easy. Image via Bybit

Signing Up For Bybit is Easy. Image via BybitSTEP 2: Choose your country of residence from the options provided.

Bybit card's availability is currently limited to certain countries. If your country is not among the supported ones, your interest will be registered, and you'll be notified when the Bybit card becomes available in your country.

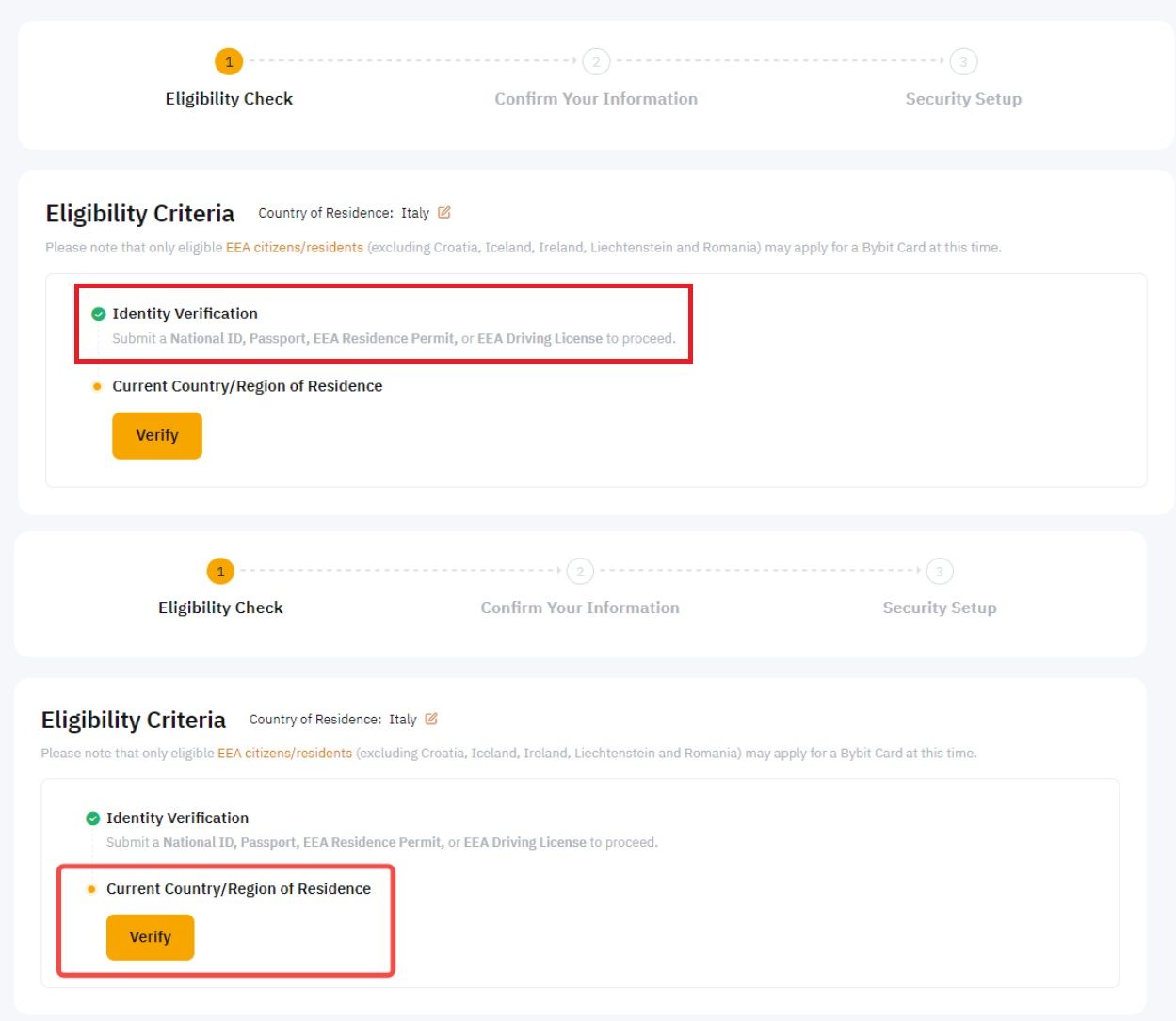

STEP 3

- Complete the first part of the eligibility check, which is identity verification. To begin click on "Verify". Bybit's accepted proofs of identity include national ID, passport, EEA or Swiss residence permit, or EEA or Swiss driving license. In some cases, you may need to submit two types of proof of identity.

You Will Have to Complete Identity Verification. Image via Bybit

You Will Have to Complete Identity Verification. Image via Bybit- Complete the second part of the eligibility check, this time focused on address verification. Choose the country/region of issue (the country/region that issued your proof of address) and click “Verify.” The proof of address must be issued within the last three months and from one of the supported countries. In some cases, you may need to input your address and can verify without a proof of address.

STEP 4: Confirm (or set up) your registered phone number and email address. You'll also be prompted to set up Google 2FA if you haven't already done so. You can input a referral code at this stage if applicable. Note that once confirmed, the referral code cannot be changed.

STEP 5: Set up your security question and click “Submit.” Enter your email and Google 2FA code to complete your virtual Bybit card application. The security question may be used for identity authentication during transactions, so ensure to remember your answer.

And just like that, you're done!

Upon successful submission, your virtual card application will undergo a review, typically taking a few minutes. In some cases, the review process may extend up to seven working days. You'll receive an email notification once your application is approved.

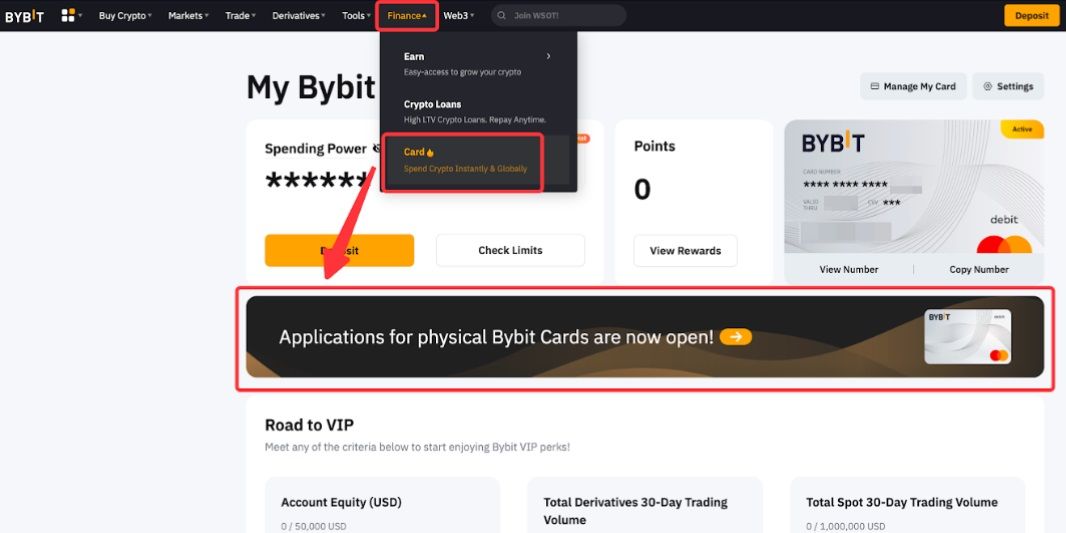

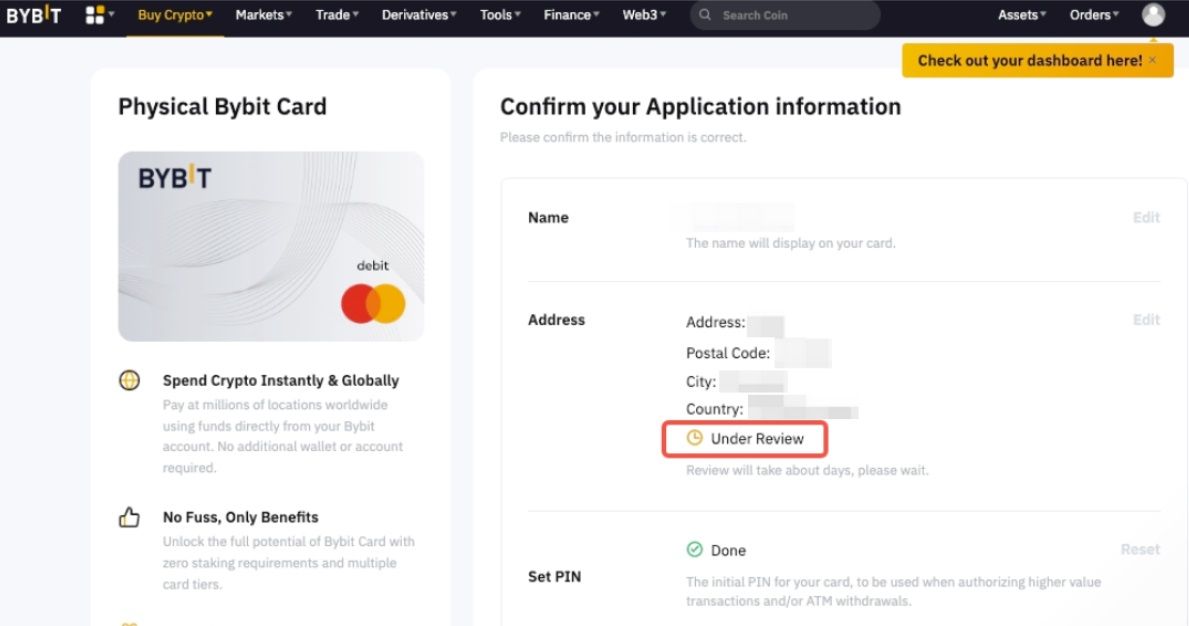

Applying for the Bybit Physical Card

As noted, to begin the application process for a physical Bybit card, you must first obtain the virtual card. Once you have that, here's how you can apply for the physical card.

STEP 1: Navigate to Finance > Card and click on the banner labelled “Physical Bybit card Application.”

You Must Get a Virtual Card Before Applying for a Physical One. Image via Bybit

You Must Get a Virtual Card Before Applying for a Physical One. Image via BybitSTEP 2: Customize the display name on your card. The display name can contain up to 21 Latin characters and spaces.

STEP 3: Update your shipping address.

- Ensure this matches the address submitted for your virtual card's address verification. Bybit says it reserves the right to reject address change requests if the edited address is inconsistent with your virtual card's address verification. Bybit currently doesn't support additional proof of address submission to change the shipping address.

STEP 4: Set and confirm your PIN. This PIN will be used for ATM transactions and making large purchases at retail merchants. You can reset the PIN after activating the card, but ensure to keep it secure and private.

STEP 5: After confirming your details, click on “Apply.” Your address change request will undergo a review within seven business days, and you'll receive an email notification of the outcome.

You Can View the Status of Your Request on the Platform. Image via Bybit

You Can View the Status of Your Request on the Platform. Image via BybitSTEP 6:

- Once your address review is approved, return to the application page and proceed to pay the card issuance fee of 5 EUR/GBP/USDT/USD. The issuance fee for the physical card is deducted directly from your funding account. Select your preferred payment method and click “Pay.” Confirm the payment by entering your email and Google 2FA code.

- In case of application rejection, you'll have the option to edit the address and resubmit the application.

STEP 7: Upon successful payment, a pop-up confirming your application's success will appear.

Card delivery may take up to 60 days. Unfortunately, tracking information isn't available as the delivery method Bybit uses does not offer tracking services.

Bybit Card Fees and Limits

Here's a detailed breakdown of fees associated with the Bybit card.

| Fee Type | EEA | Australia |

|---|---|---|

| Foreign Exchange Fee | 0.5% (On top of Mastercard's foreign exchange rate) | 1% (On top of Mastercard's foreign exchange rate) |

| Crypto Conversion Fee | 0.9% (On top of Bybit’s One-Click Sell Exchange rate) | 0.9% (On top of Bybit’s One-Click Sell Exchange rate |

| Annual Fee | None | None |

| Inactivity Fee | None | None |

| Card Cancellation Fee | None | None |

| Card Issuance/Replacement Fee | None for the virtual card 5 EUR/GBP/USDT for the physical card | None for the virtual card 5 USD/USDT for the physical card |

| ATM Withdrawal Fee | 2% after the first 100 EUR/GBP monthly | 2% after the first 100 USD monthly |

Bybit Card Spending Limits

Both virtual and physical Bybit cards share a single spending limit. However, the Virtual Card Lite is subject to a lifetime spending limit of 150 EUR. The spending limit of the Bybit card does not current support adjustments.

| Period | Maximum Limit |

|---|---|

| Daily | 5,000 EUR/GBP 13,500 USD |

| Monthly | 50,000 EUR/GBP 27,000 USD |

| Annual | 250,000 EUR/GBP 270,000 USD |

Bybit Card ATM Withdrawal Limits

The Bybit physical card can be used to withdraw money from ATMs. Before you go about doing that, it's important to be aware of the withdrawal limits

| Limit Type | Frequency | Limit |

|---|---|---|

| Max Number of ATM Withdrawals | Within 24 hours | 10 |

| Max Value of ATM Withdrawals (€, $) | Within 24 hours | 2,000 EUR/GBP 600 USD |

| Max Number of ATM Withdrawals | Per month | 300 |

| Max Value of ATM Withdrawals (€, $) | Per month | 10,000 EUR/GBP 1,800 USD |

| Max Number of ATM Withdrawals | Per year | 2,500 |

| Max Value of ATM Withdrawals (€, $) | Per year | 75,000 EUR/GBP 13,500 USD |

Managing Your Bybit Card

Managing your Bybit card is easy with a range of features and security options available right at your fingertips. Whether you're using the Bybit app or accessing it through the website, you can view your card details, freeze or unfreeze your card, reset your PIN, replace your physical card, terminate your card, and more.

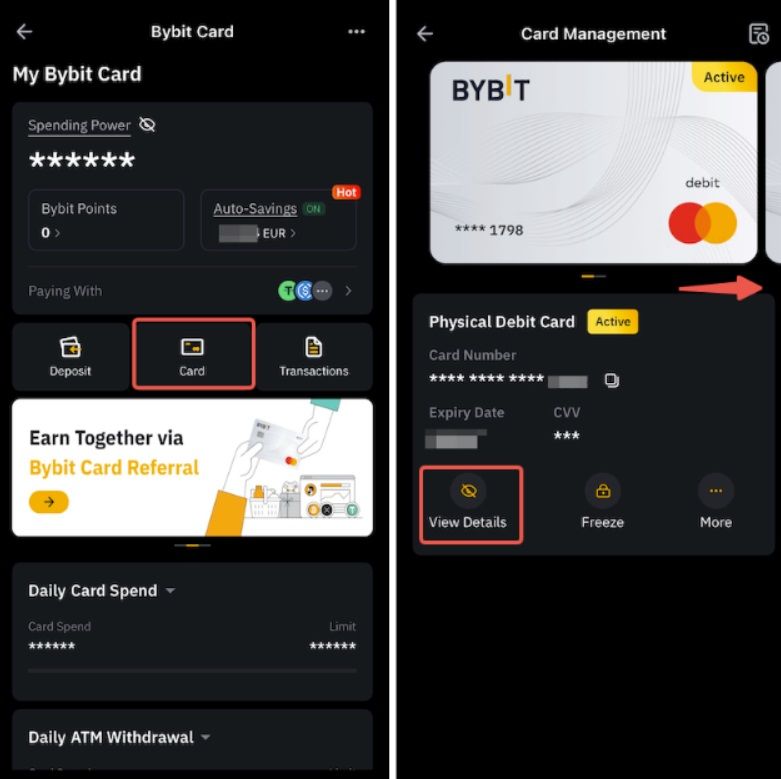

Access to Card Details

Delving into your Bybit card details is a breeze, providing instant insight into your card's vital information. Simply navigate to the "My Bybit Card" section on the website or tap on "Card" within the Bybit app to access a comprehensive overview of your card details. From card numbers to expiry dates, and everything in between, users can monitor and manage their cards, even when juggling multiple accounts.

You Can Access Your Card Details From Within the App. Image via Bybit

You Can Access Your Card Details From Within the App. Image via BybitReplacement Options

In the unfortunate event of a lost, damaged, or compromised Bybit physical card, users can initiate a replacement. With just a few simple steps within the Bybit app, tapping on "More" under Physical Card and selecting "Replace Card" initiates the process. Users can choose the appropriate reason for replacement and follow the prompts to transition to a new card.

Biometric Verification

For individuals prioritizing security, enabling biometric verification adds an extra layer of protection to Bybit card transactions. Within the Bybit app's security settings, users can choose between Face ID or fingerprint for biometric authentication.

Checking Your Spending and ATM Withdrawal Limits

Head to the My Bybit card page and click on “Check Limits.” Here, you can view your daily and monthly spending limits, along with the remaining quota under the Spending Power Status. Both virtual and physical Bybit cards share these limits. Additionally, you can view your physical Bybit card's ATM withdrawal limit and remaining quota under the “ATM” tab.

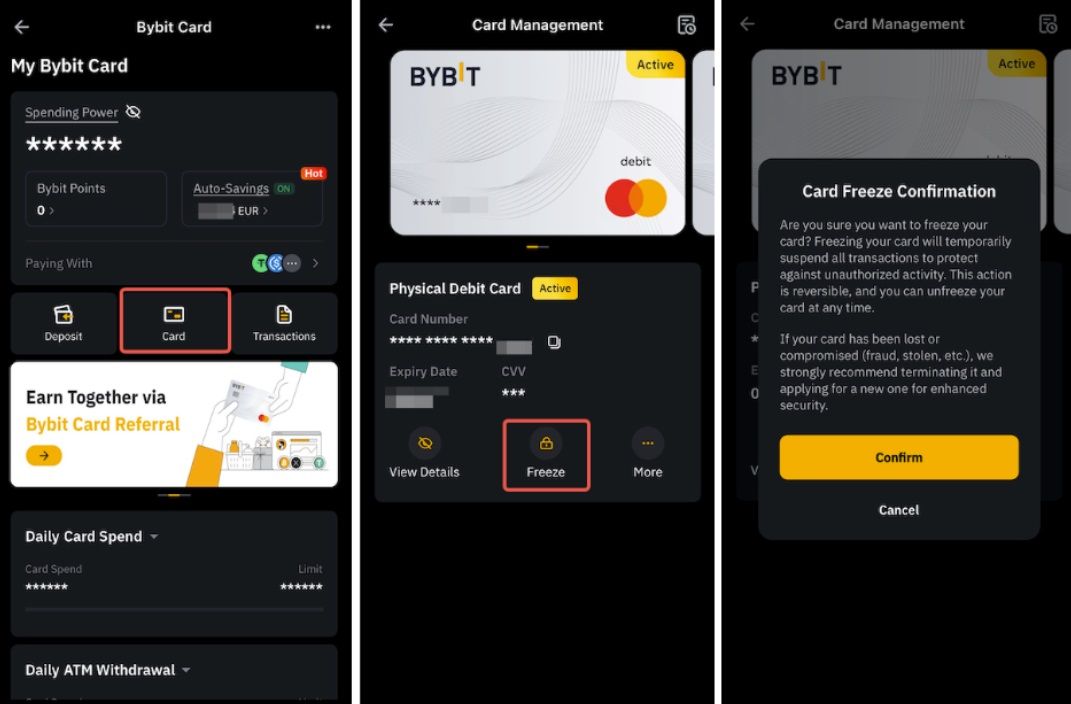

Freeze and Unfreeze Options

The ability to freeze or unfreeze your Bybit card offers an added layer of security and peace of mind. Should the need arise to temporarily disable transactions for any reason, users can do so with just a few taps. Within the Bybit app, selecting your card and tapping on "Freeze" instantly suspends all transactions, safeguarding your account against unauthorized activities. When ready to resume card usage, a simple tap on "Unfreeze" reactivates the card.

Lost your Card? You Can Freeze it From the App. Image via Bybit

Lost your Card? You Can Freeze it From the App. Image via BybitManaging Your Payment Crypto Assets

Your Spending Power, representing the estimated amount of funds you can spend, is calculated from the available balance of the base currency in your funding account and your selected payment crypto asset converted to your base currency. Customize your payment preferences by selecting up to five cryptocurrencies — the default order being USDT > USDC > XRP > ETH > BTC — for your Bybit card payments. You can rearrange the order or add/remove coins on the card dashboard by clicking “Paying With.”

Viewing Your Transaction History

Navigate to the My Bybit card page and click on "Full Records"." Here, you can access your transaction details under Transaction and Authorization. Filter your transaction records based on different criteria to gain insights into completed transactions, authorization statuses, refunds, reversals, and more.

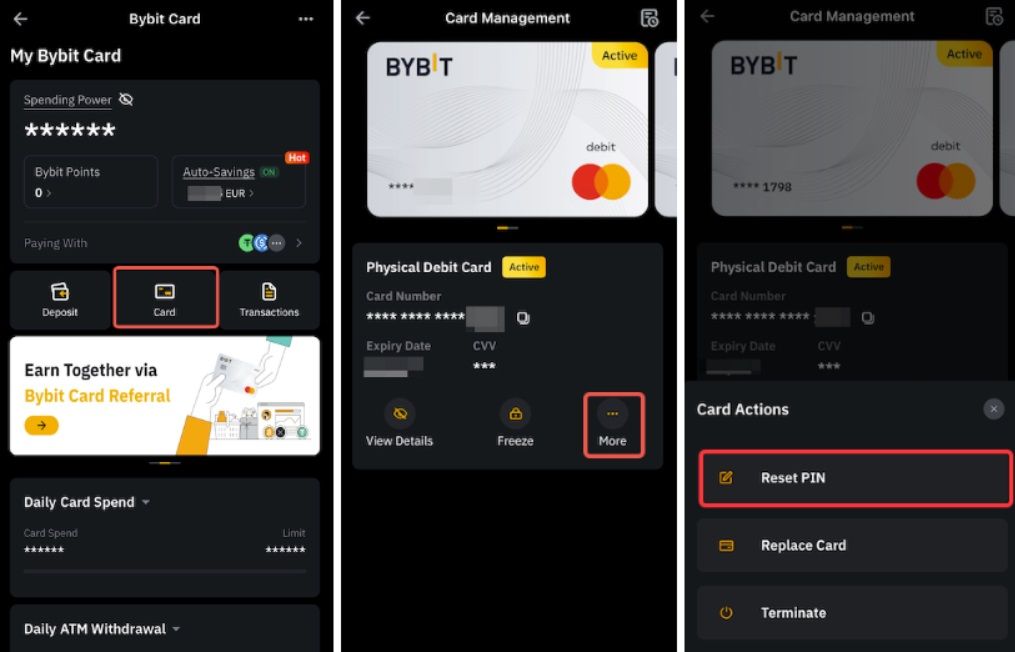

PIN Reset Process

Resetting your physical Bybit card PIN is a straightforward process too. Through the Bybit app's interface, users can navigate to the "Card Management" page, access the "More" menu under Physical card, and select "Reset PIN". Following clear prompts, users can input a new PIN and complete the verification process.

The Bybit App is a Powerful Card Management Tool. Image via Bybit

The Bybit App is a Powerful Card Management Tool. Image via BybitBybit Card Rewards and Incentives

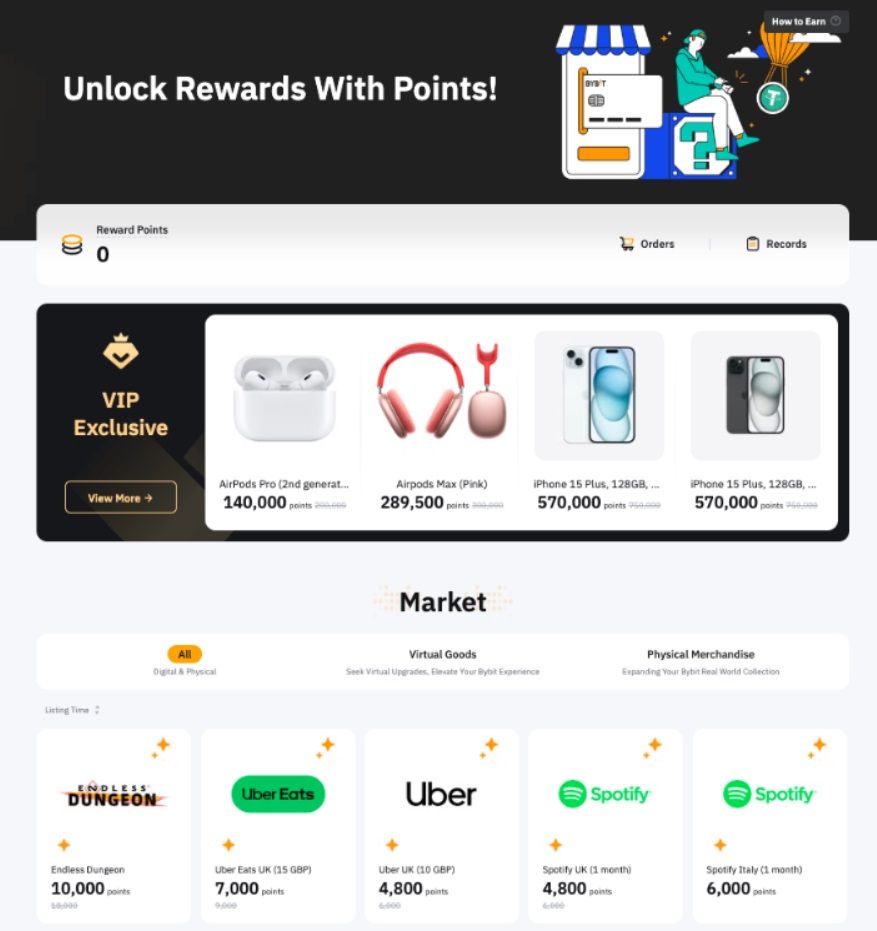

The Bybit card loyalty program aims to appreciate and incentivize users for their ongoing support and loyalty and is heavily entwined with the broader Bybit ecosystem. Users have the opportunity to earn rewards points by making crypto-funded transactions with their Bybit card. These points can later be redeemed for a variety of rewards, including bonuses, coupons, exclusive merchandise and more.

Earning rewards points is based on individual user VIP levels, with varying point multipliers and monthly caps. These points accrue after each transaction and remain in pending status for a period of three days. After this timeframe, they are converted into available rewards points, ready for redemption at the rewards market. There is no expiry date for accumulated points, allowing users to accumulate them over time for future redemption.

You can Unlock Several Benefits With the Bybit Card. Image via Bybit

You can Unlock Several Benefits With the Bybit Card. Image via BybitHere's what point variations look like across different VIP levels.

| VIP Tier | Point Multipliers | Monthly Maximum Point Limit | Equivalent Monthly Cashback Rate |

|---|---|---|---|

| 0 | 1 | 5,000 | 0.2% |

| 1 | 5 | 37,500 | 1% |

| 2 | 10 | 75,000 | 2% |

| 3 | 20 | 100,000 | 4% |

| 4 | 30 | 150,000 | 6% |

| 5 | 40 | 200,000 | 8% |

| Supreme | 50 | 300,000 | 10% |

The conversion rate is 500 rewards points per 1 EUR for an EEA card and 1 USD for an Australian card.

Bybit Card Security

We've already touched on how the Bybit card utilizes EMV 3DS technology to protect user funds. Outside of the card, the Bybit platform offers 360 platform protection:

- Triple Layer Asset Protection & Platform Security: Bybit stores user funds offline in cold wallets, safeguarding them from online threats. Advanced methods like multi-signature, Trusted Execution Environment (TEE), and Threshold Signature Schemes (TSS) are employed to prevent unauthorized access. Regular audits of reserves are conducted for transparency.

- Privacy Protection: Bybit emphasizes user privacy by clearly outlining the data collection process, its usage, and sharing practices.

- Advanced Data Protection: User data is encrypted both at rest and in transit, making it inaccessible to unauthorized individuals. Access is tightly controlled to ensure only authorized users can retrieve personal information.

- Real-Time Monitoring: Bybit's systems constantly monitor user behaviour for any anomalies, triggering enhanced verification steps for withdrawals if suspicious activity is detected.

- Security by Design: Bybit's platform is built with security as a foundational principle, following secure development practices, rigorous testing, and ongoing bug bounty programs to identify and address vulnerabilities.

Bybit Card vs. Crypto.com Card

| Feature | Bybit Card | Crypto.com Card |

|---|---|---|

| Card Type | Debit | Debit |

| Issuer | Mastercard | Visa |

| Available in | Australia, EEA | US, UK, Canada, Australia, Europe and Asia |

| Cashback | Up to 10% | Up to 5% |

| Annual fee | None | None |

| Inactivity fee | None | €5 per month after 12 months of inactivity |

| Monthly free ATM limit | 100 EUR/GBP/USD | €200 to €1,000 depending on card tier |

| ATM withdrawal limit | €2,000 daily, €10,000 monthly, €75,000 yearly | €2,000 daily, €10,000 monthly, €75,000 yearly |

| Max number of ATM withdrawals | 10 in 24 hours, 300 per month, 2,500 yearly | 3 daily, 30 per month, 360 yearly |

| Spending limits | 5,000 EUR/GBP daily, 50,000 monthly, 250,000 yearly | €25,000 daily, €25,000 monthly, €250,000 yearly |

One notable aspect of this comparison is the differentiation in cashback rewards, with the Bybit card offering a higher potential cashback of up to 10%, compared to Crypto.com's maximum cashback of 8%.

Additionally, the absence of annual fees for both cards presents a significant advantage for users looking to minimize costs associated with card ownership. However, it's essential to note Crypto.com's inactivity fee of €5 per month after 12 months of inactivity, which could impact users who infrequently utilize their cards.

Regarding ATM usage, the Bybit card and Crypto.com Card share similar withdrawal limits, but the Bybit card allows for a higher number of ATM withdrawals within specific time frames.

When deciding between different cards, it is also important to compare what tier or VIP level you will want or be able to qualify for. To become a VIP level 1 on Bybit, users need to meet the 100,000 USD account balance limit or have a minimum monthly trading volume of 10,000,000, which is no small feat. Users who do not meet this threshold are only eligible for a 0.2% equivalent cashback rate.

The Crypto.com entry-level cards are more attractive, with a free card that offers no additional benefits then the Ruby card, which is one step up offering 1% cashback in crypto for simply locking up and staking 350 EUR worth of CRO token. Though the higher cashback rewards for the Crypto.com card are also difficult to attain for average users as you will need to lock up over 350,000 EUR if you want that top-tier 8% cashback.

Head to head, the Bybit card is better for those who are heavily involved in the Bybit ecosystem while the Crypto.com card offers far better cashback rewards and perks for average users, even those who are not indebted to the Crypto.com ecosystem. Bybit could do more to step up their rewards as the Crypto.com card also offers perks such as Spotify, Netflix, Amazon and X rebates, additional perks for Expedia and Airbnb plus airport lounge access and more, making this card suitable for “in-real-life” benefits outside of crypto.

You can learn more about the Crypto.com card in our Crypto.com review.

Lastly, the spending limits for both cards highlight the potential for significant usage, with the Bybit card offering slightly higher daily spending limits compared to the Crypto.com Card. This may be preferable for users with larger transactional needs.

Bybit Card Review: Closing Thoughts

With its seamless integration of crypto and fiat currencies, worldwide acceptance, and generous cashback point rewards of up to 10%, the Bybit card offers a convenient and rewarding payment experience for heavy Bybit users.

The absence of annual fees and inactivity fees makes it a cost-effective choice for making transactions. The card's robust security measures, such as EMV 3DS technology, ensure the safety of user funds and personal information.

When compared to competitors like the Crypto.com card, Coinbase card, Wirex card, or others, the Bybit card could do a better job in being more competitive. Reaching higher cashback reward tier levels is much more attainable on other cards as they are quite prohibitive on Bybit, being attainable by whales with massive account balances and/or trading volume. Bybit rewards points' primary benefits are also restricted to the Bybit ecosystem, not offering many “real-world” benefits offered by the likes Crypto.com.

Though for those with deep pockets and Bybit power users, the Bybit card stands out with its higher cashback rewards, flexible spending limits, and greater number of ATM withdrawals allowed within specific time frames. These factors, combined with its user-friendly management features and transparent rewards program position the Bybit card as a great value add for Bybit users.