It wouldn't be wrong to say that crypto earn products have been a game changer, offering investors a pathway to passive income. They not only allow individuals to HODL their coins but also enable them to participate in various protocols, earning rewards and yields in return.

Crypto-earn products take a hands-off approach, allowing users to leverage their existing holdings to generate income without the need for active trading. This aligns with the idea of passive income, a money stream that requires little or no continuous effort.

With mainstream adoption lagging, crypto exchanges are currently leading the charge in crypto-earn products. OKX Earn, KuCoin Earn and Binance Earn reflect the industry's proactive stance toward empowering users.

Bybit also offers a crypto earn program. In this Bybit Earn review, we will explore its features, benefits and opportunities, highlighting its position in the realm of crypto earn products.

Bybit Earn Summary:

Bybit Earn is a versatile crypto-earning platform that offers a range of innovative financial products for investors. Through Bybit Earn, users can engage in activities such as staking and structured investments, enabling them to generate passive income from their cryptocurrency holdings.

The Key Features of Bybit Earn are:

- Bybit Savings

- ETH2.0 Liquid Staking

- Liquidity Mining

- Dual Asset

- Double-Win

- Wealth Management

- Launchpool

- Copy Trading Platform

Note: Users located in the US and UK are not supported.

Bybit Overview

Bybit is a Dubai-based cryptocurrency and derivatives trading exchange that launched its services at the end of 2018. Since its launch, Bybit has grown into one of the top exchanges that provides users with access to a wide range of assets as well as services.

Bybit is a Dubai-based Cryptocurrency and Derivatives Trading Exchange. Image via Bybit

Bybit is a Dubai-based Cryptocurrency and Derivatives Trading Exchange. Image via BybitBybit has over 270 assets in the spot market and 200+ contracts in the derivatives market. It also offers users services such as trading bots, lending, institutional services, referral and affiliate programs, the Bybit debit card, P2P market, copy trading, and more. The exchange boasts over 15 million users, and it is available in 160 countries.

Bybit allows users to trade with up to 100x leverage on select assets, but it also has a variety of tools that ensure risk is properly contained. Some of the tools include Bybit’s insurance fund, auto deleveraging and cross and isolated margin accounts, among other things.

Bybit has 24/7 customer service available for users to get any issues addressed.

For more information, head over to our in-depth Bybit review. If you want to see how Bybit stacks up against other exchanges, check out our comparison pieces:

Bybit vs:

If you are interested in a guide, we have put together this Bybit Trading Guide, or alternatively you can check out Guy's Bybit Exchange Guide below:

Bybit Earn Products

Bybit Earn hosts seven products in total. The first two are suitable for crypto newbies, while the other five are targeted toward advanced investors.

Bybit Savings

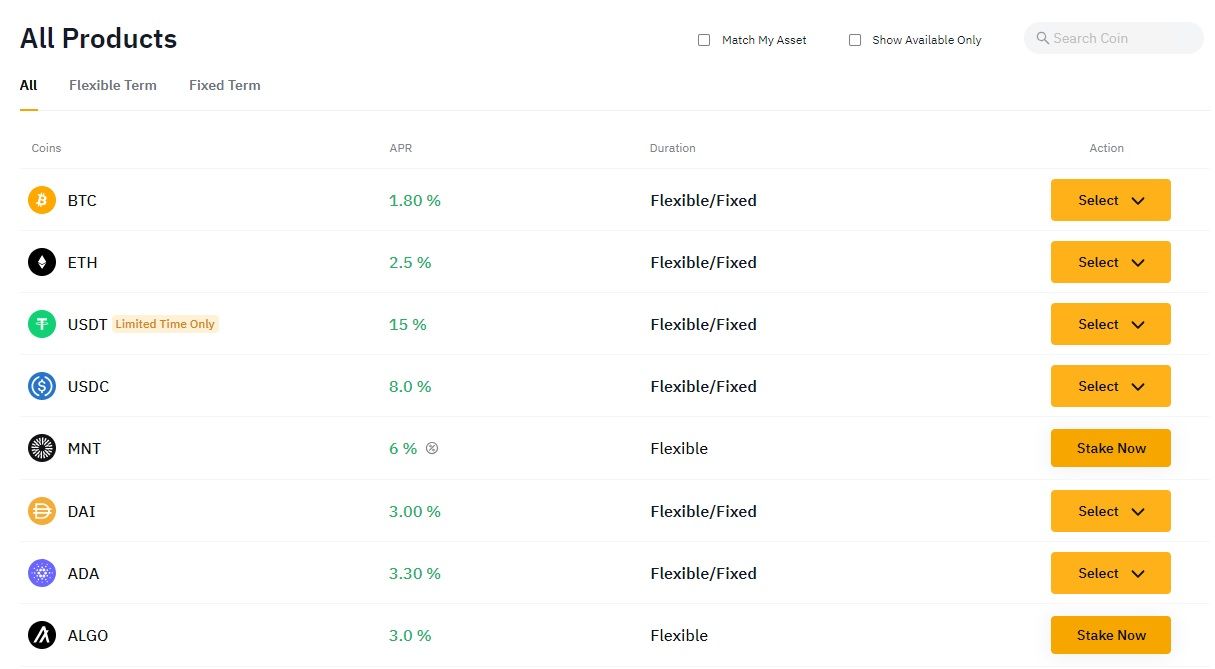

Bybit Savings is the exchange's staking product. It supports coins such as Bitcoin (BTC), Ethereum (ETH), USDT (limited time), ADA and ALGO. You can go about staking your tokens in two ways:

- Flexible: Your staked tokens can be unstaked anytime. They will be auto-credited to your Earn account immediately once unstaked.

- Fixed term: If you choose to stake a coin for a fixed term, you cannot unstake it once the product plan goes into effect.

Bybit Savings is Crypto Exchange ByBit's Staking Product. Image via Bybit

Bybit Savings is Crypto Exchange ByBit's Staking Product. Image via BybitA feature called APR Booster kicks in when your first daily yield starts to be calculated. Here's how it works: If you've purchased Flexible Savings with a 100% APR and the APR Booster you've selected offers a 10% APR, your product plan will have a cumulative APR of 110%.

The yield from the APR Booster is capped at a certain amount. The cumulative APR will be valid until the selected booster expires or the cap has been reached.

Unfortunately, compounding is not currently supported, which means neither your flexible nor fixed-term yield will be reinvested automatically to generate additional yield.

ETH Liquid Staking

Liquid staking works in the same manner as standard staking, meaning you can lock up coins to secure a blockchain network. Where the two diverge is that in liquid staking, users can maintain access to virtual funds even while staked, something not available with standard staking where your funds are locked away.

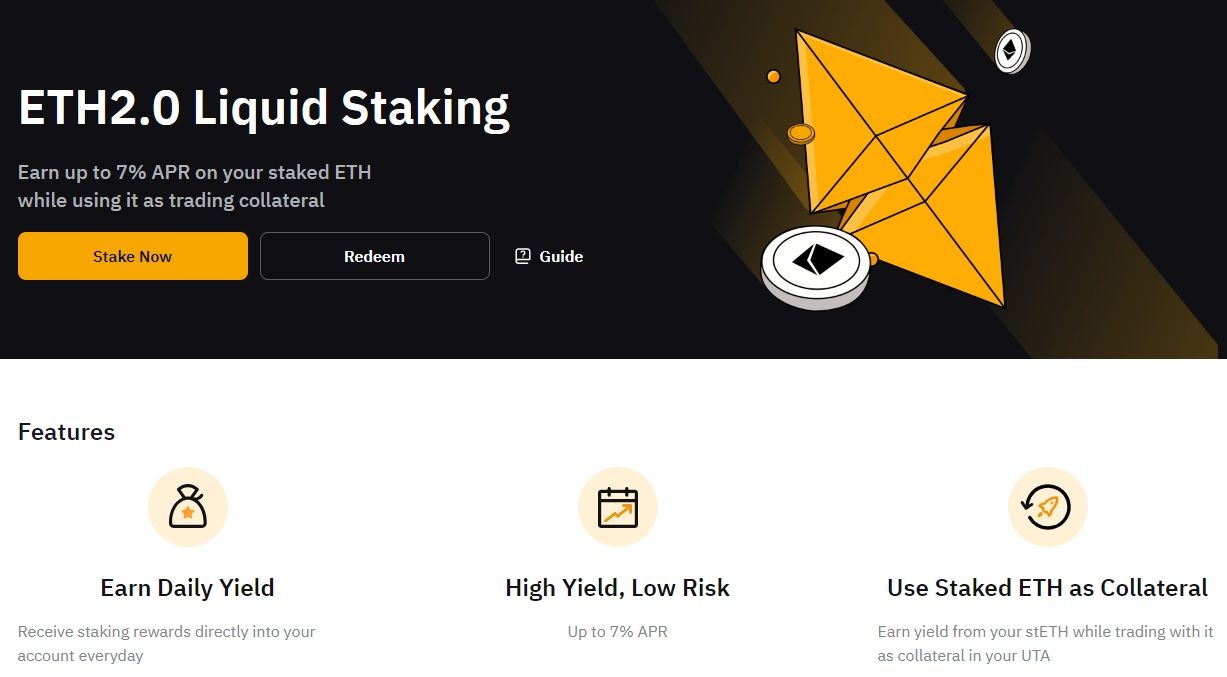

Bybit Lets You Earn up to 7% APR on Your Staked ETH. Image via Bybit

Bybit Lets You Earn up to 7% APR on Your Staked ETH. Image via BybitBybit lets you earn up to 7% APR on your staked ETH while using it as trading collateral. Liquid staking is a software solution that allows users to stake directly on a proof-of-stake network. The protocol mints a liquid staking token (LST), granting liquidity access while the user stakes. Token holders stake their assets and receive LST as a receipt, confirming their ownership. LSTs are transferable, tradable, and usable in decentralized finance (DeFi) or supported decentralized applications (DApps).

You can stake your ETH for stETH — the tokenized representation of your staked ETH that generates yield. stETH is a token issued by the decentralized staking pool Lido. Users who hold stETH will receive daily yield in their funding accounts, and you can redeem your stETH for ETH on a one-to-one basis.

Liquidity Mining

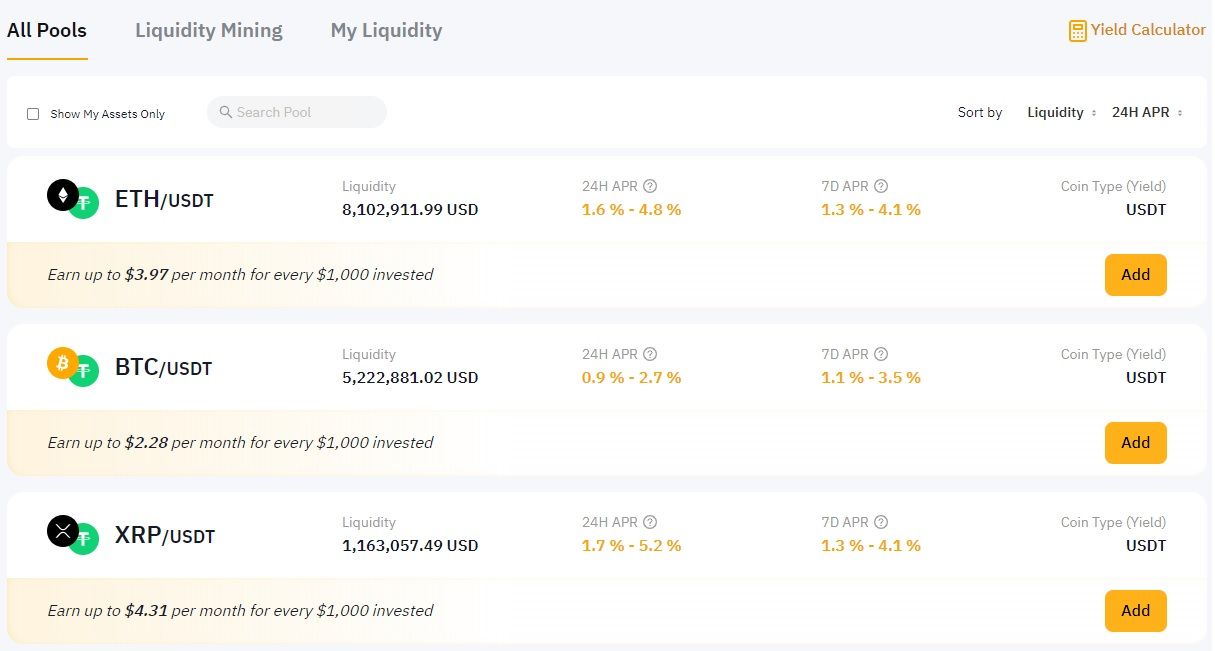

Bybit Liquidity Mining features a number of liquidity pools developed based on a revamped automated market maker (AMM) model. Each pool contains a pair of coins, which you can swap. The liquidity you've added to the pool will be applied to the market, thus ensuring higher yield and better capital utilization.

Bybit Liquidity Mining Features a Number of Liquidity Pools. Image via Bybit

Bybit Liquidity Mining Features a Number of Liquidity Pools. Image via BybitYou can add liquidity to a pool to become a liquidity provider and earn yield derived from swap fees in the pool. You can also add liquidity to increase your share in the pool, grab additional liquidity, and amplify your yield. If you decide to add leverage, you should be aware that it may entail liquidation risks.

BTC/USDC, ETH/USDC, BTC/USDT, MNT/USDT, ADA/USDT and BNB/USDT are some of the pools available. For the meme coin aficionados, DOGE/USDT is available as well.

Dual Asset

If you've been waiting for a token to hit an even lower price, this one's for you.

Dual Asset Lets You Capitalize on Price Movements. Image via Bybit

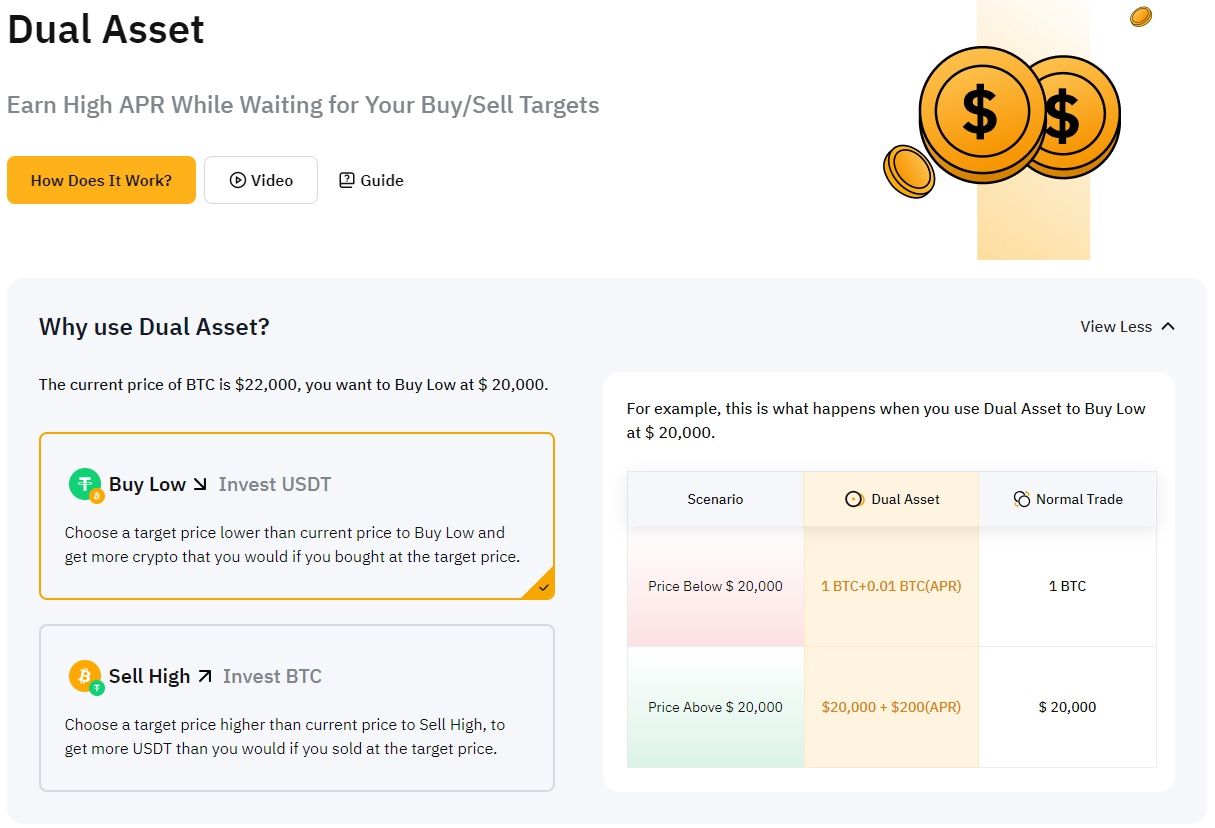

Dual Asset Lets You Capitalize on Price Movements. Image via BybitBybit Dual Asset is a non-principal protected investment product with floating returns. It allows you to capitalize on price movements by predicting the direction of a given crypto asset within a predetermined time frame while enjoying returns on your capital.

A variety of token pairs, duration and target prices are on offer. Your yield may vary, depending on the price movement of your selected cryptocurrency. While the APR is guaranteed, there are certain risks as well:

- The returns on asset value are not guaranteed due to market volatility.

- Subscribed assets are locked, which means you cannot cancel or redeem them before the settlement date.

- In the event that the price moves further away from the target price, you lose the opportunity to buy or sell at a favourable price.

Double-Win

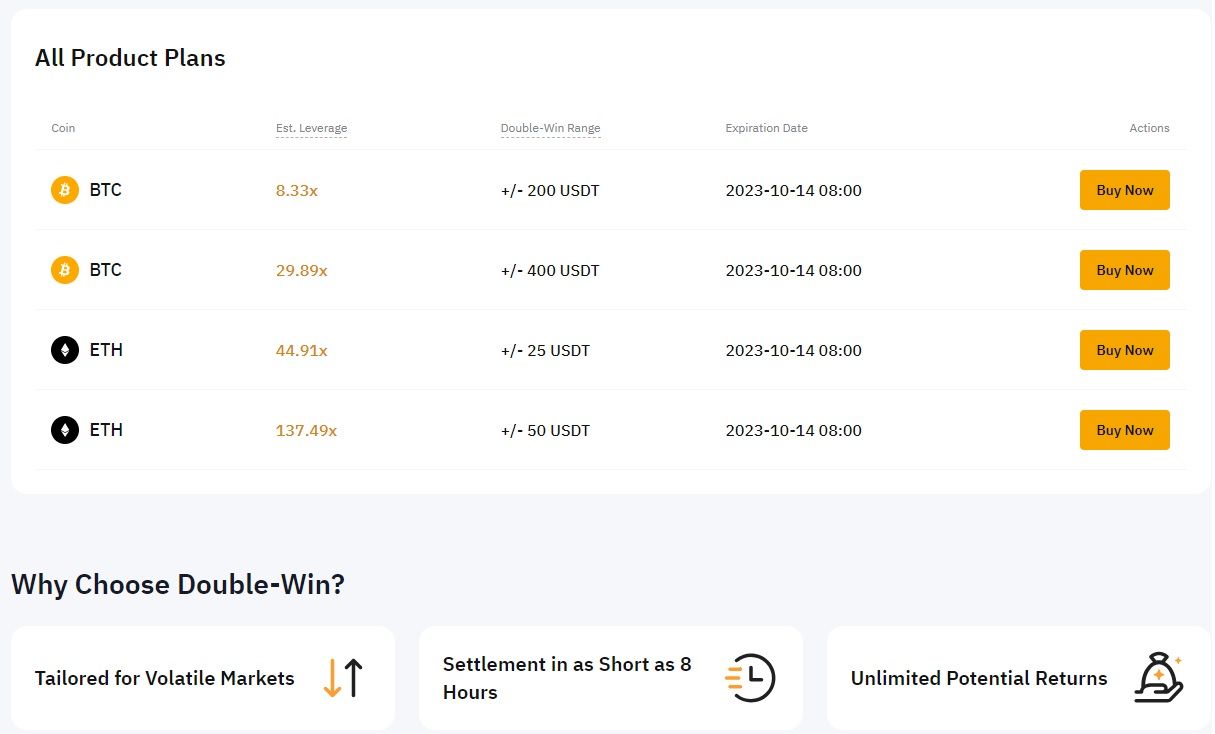

Bybit Double-Win is an advanced short-term structured product that helps users preempt strong market movements in both directions. The product is based on the concept of binary options. At expiration, users either receive a payoff if the settlement price sits outside the preset range, or nothing at all if the price falls within the range.

Double-Win is an Advanced Short-Term Structured Product. Image via Bybit

Double-Win is an Advanced Short-Term Structured Product. Image via Bybit The maximum risk of a Double-Win plan is limited to the investment amount, but profits vary depending on how far the price of the underlying asset moves. That makes it ideal for the following two situations:

- When you anticipate strong market movements but are unsure of the direction, especially before the release of key financial indices or industry headlines.

- When you want to leverage or hedge against spikes in market volatility.

It's important to note that once you've subscribed to Double-Win, you can't modify or cancel that order.

Bybit provides a handy example of how Double-Win works:

- Investment Amount: 500 USDT

- Current Price: 27,000 USDT

- Entry Price: 27,050 USDT

- Estimated Leverage: 20x

- Double-Win Range: +/- 200 USDT

- Expiration Date: Sep. 30, 2023, 8 a.m. UTC

Calculation

Given the Double-Win range of +/- 200 USDT, the lower range price is 26,800 USDT and the upper range price is 27,200 USDT.

Now, let's consider three (3) scenarios at expiration:

Winning Scenarios

- Settlement Price: 27,500 USDT

In this scenario, the payoff would be approximately 610.90 USDT based on the following calculations:

500+20×500×(27,500−27,200)/ 27,050 = 610.90 USDT

- Settlement Price: 25,000 USDT

In this case, the payoff would be approximately 1313.31 USDT based on the following calculations:

500+20×500×(26,800−25,000) / 27,050 = 1313.31USDT

Losing Scenario

- Settlement Price: 27,000 USDT

In this case, the settlement price falls within the range of 26,800 USDT and 27,200 USDT, resulting in zero payoff. As a result, the user loses the entire investment amount.

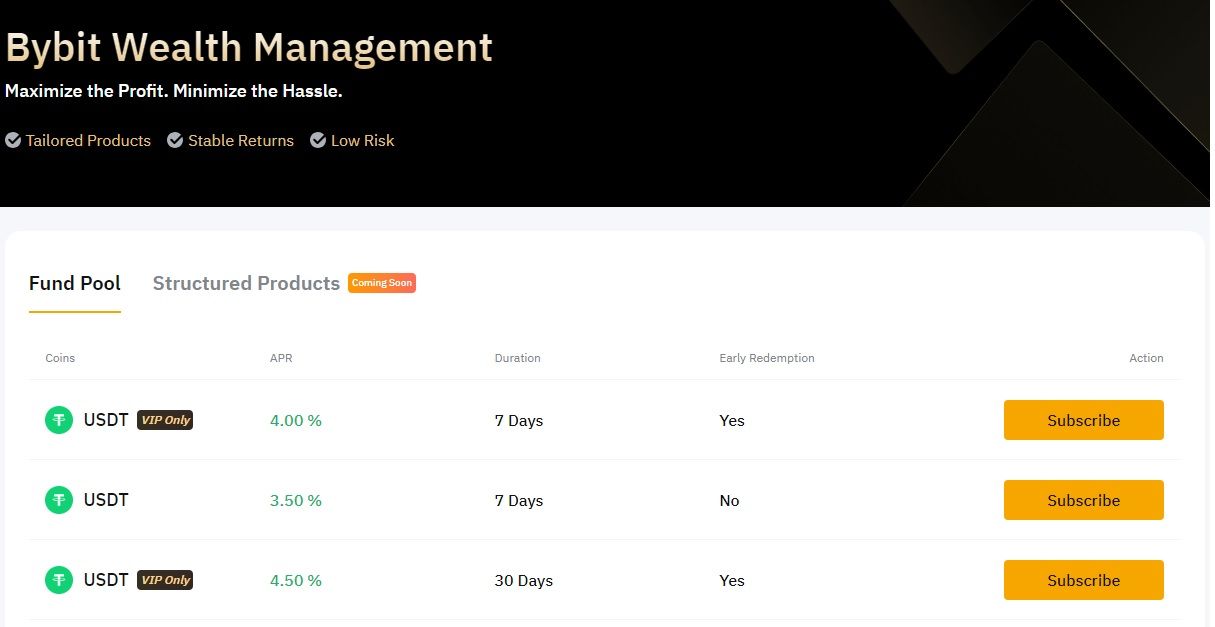

Wealth Management

Manage, plan, and invest digital assets!

Bybit Wealth Management Offers a Variety of Investment Strategies. Image via Bybit

Bybit Wealth Management Offers a Variety of Investment Strategies. Image via BybitBybit Wealth Management offers professional investment strategies, and a variety of portfolios to help users achieve their investment goals. All funds are held within Bybit, and all investment activities are conducted within the platform without any on-chain transactions.

The funds under Bybit Wealth Management are managed by trusted third parties, which might include entities that are affiliated with Bybit. The company said these entities have undergone stringent screening processes. It would be nice to see some transparency here surrounding who these “Trusted” third parties are.

Launchpool

In DeFi, a launchpool is designed to facilitate the launch of new tokens or projects. It involves a platform where users can stake or provide liquidity in exchange for rewards in the form of newly minted tokens. Launchpools are often utilized by new projects to bootstrap their liquidity and create interest in their tokens. Users, on the other hand, participate in launchpools to earn rewards and potentially profit from the appreciation of the newly launched token.

Bybit Launchpool allows you to stake and earn tokens for free. The best part? Staked tokens can be unstaked anytime. The number of tokens you earn depends upon the number of tokens you stake in the pool. You may simultaneously earn your staking currency, new tokens and a USDT bonus.

Bybit Exchange Security

The security of a cryptocurrency exchange is important because it directly impacts both the user and the exchange platform. Users should prioritize platforms with proven security measures to protect their assets and personal information.

Here's an overview of Bybit exchange's security:

Platform Security

Triple Layer Asset Protection and Platform Security

- User funds are stored securely offline in cold wallets. These funds are protected from unauthorized online access through a combination of advanced multi-signature, Trusted Execution Environment and Threshold Signature Schemes.

- Bybit regularly conducts Proof of Reserves audits and publishes them to the public.

Privacy Protection

- Bybit integrates a privacy-first philosophy into all of its products and services.

- The company is upfront about the data it collects, including how it is used and shared.

Data Protection

- Data is encrypted both in storage and in transit, using desensitized query interfaces.

- Access is subject to strict authorization controls to ensure that only you have access to your personal and private information.

Real-Time Monitoring

- Bybit’s risk controls monitor and analyze user behaviour in real-time.

- As soon as suspicious activity is identified, withdrawals will be subject to strengthened authentication measures.

Bybit meets industry best practices not only when it comes to security, but also when it comes to Proof of Reserves.

Security and Compliance Initiatives

Bybit works closely with regulatory bodies and institutions.

- Know Your Customer: The exchange bases its KYC on the principles of Customer Due Diligence, partnering with solution providers to make the process easy and efficient for users.

- Law Enforcement: Bybit collaborates with law enforcement organizations to combat cybercrimes including anti-money laundering schemes, assisting in tracking and recovering users’ missing assets.

- Responsible Trading Programs: The company provides timely trading updates and a wide range of resources on risk management and security tips, empowering our users to trade safely.

Bybit Earn: Benefits and Risks

Diversification, risk management and staying in the know are some of the key components of a successful investment strategy. Here are some of Bybit Earn's benefits and risks.

Bybit Earn Benefits

- Diverse Investment Options: Bybit Earn offers a variety of staking and investment products, catering to both beginners and advanced investors. Users can choose from flexible and fixed-term staking, liquid staking, liquidity mining, dual assets, and advanced structured products.

- Liquidity Access: Bybit's liquid staking and liquidity mining options allow users to stake their assets while still maintaining access to them. This liquidity access feature is particularly advantageous.

- User-Friendly Interface: Bybit's platform is designed to be user-friendly, making it accessible for both beginners and experienced traders. The interface is intuitive, making it easier for users to navigate through various investment options.

- Security Measures: Bybit employs robust security measures, including offline storage of funds, privacy protection, real-time monitoring, and compliance initiatives, ensuring the safety of user assets and data.

Bybit Earn Risks

- Market Volatility: Cryptocurrency investments are volatile. The value of assets can fluctuate dramatically, leading to potential losses, especially in leveraged or highly volatile products like Double Win.

- Lack of Guarantees: Bybit's investment products, such as Double Win and Dual Asset, do not offer principal protection. As a result, users risk losing their invested capital if the market moves in the opposite direction.

- Regulatory Uncertainty: Changes in regulations can impact the availability and terms of certain investment products, potentially affecting users' earnings.

- Liquidity Risks: While liquidity mining can be profitable, it involves providing liquidity to various pools. Sudden shifts in market demand or changes in the liquidity pool dynamics can impact the profitability of liquidity mining.

- Wealth Management Lack of Transparency- A core ethos in crypto is “don't trust, verify”, which is often simple to do in crypto as everything is on-chain and publicly verifiable. Bybit's statement: “We use trusted third parties” does not instil confidence in us, we would like to know who these third parties are.

Bybit Earn Review: Closing Thoughts

Bybit Earn offers several crypto earn products that cater to both novices and seasoned traders. With options like flexible and fixed-term staking, liquid staking and liquidity mining, Bybit Earn makes it easy for users to participate in Earn products.

Bybit's emphasis on user-friendly interfaces and robust security measures enhances the overall experience, making it accessible and secure for investors to explore various investment strategies. The ability to maintain liquidity access, especially in liquid staking and liquidity mining, adds a significant advantage, allowing users to balance potential earnings with asset flexibility.

Ultimately, educated decision-making, diversified portfolios, and continuous monitoring of market trends are crucial elements in maximizing the benefits of Bybit Earn's offerings.

Feel free to use our sign-up link and get up to a $50,000 bonus and enjoy 0% maker fees for 30 days!