Copy trading has become a popular way for new and time-strapped traders to participate in the crypto markets. Instead of researching charts, building strategies, or reacting to every price swing, users can automatically mirror the trades of proven professionals.

In this article, we’ll explore how BYDFi approaches copy trading, how the system works behind the scenes, the fees and risks to understand, and whether it’s the right fit for your trading style.

What is Copy Trading?

Copy trading allows individuals to automatically duplicate the trade methods and actions of market participants with experience. This process requires only a few selections. Instead of performing detailed market analysis, monitoring asset value paths, or reacting quickly to shifting conditions, copy trading lets individuals link their asset accounts to those of proven leaders. The system transfers the same trade moves in real-time.

The key thing here is that copy trading closes the distance between new traders seeking to learn and professionals who want to grow their influence. The system operates much like a social network following. Investors, called "copiers" or "followers," review public display pages of various experienced traders. These pages show key numbers such as profit and loss totals, successful trade rates, asset loss figures, average returns, current positions, and risk levels. By checking these numbers, individuals select the trader whose method and idea set match their own objectives and loss acceptance level.

Once a follower chooses a master trader to copy, all trade moves, like buying, selling, starting, or closing magnified positions, are transferred to the follower’s account automatically. The value of copy trading lies in its automation. Manual action remains minimal, making the method accessible for individuals with time constraints or those still building foundational market knowledge. Individuals set several key values on their end. These include trade size (a fixed amount or a percentage of their assets), risk limits, and which traders to follow or stop following at any moment.

This method sees growth for several reasons:

- Knowledge Value: By watching experts make trades, followers build an understanding of effective trade methods, risk management, and decision consistency.

- Time Reduction: Automation frees up time that would otherwise be spent watching charts or consuming market news.

- Asset Diversification: By splitting capital across multiple skilled traders, individuals reduce dependence on one market view.

- Decision Advantage: With the mental part of decision-making assigned to experienced traders, users avoid rash trades driven by fear or excessive desire.

Copy trading functions as a direct path for those new to crypto and also as a tool for established users to refine their portfolios, learn from peers, and use the knowledge of the group.

Check out our top picks for copy trading platforms. And while you are at it, also take a look at the common mistakes to avoid while copy trading.

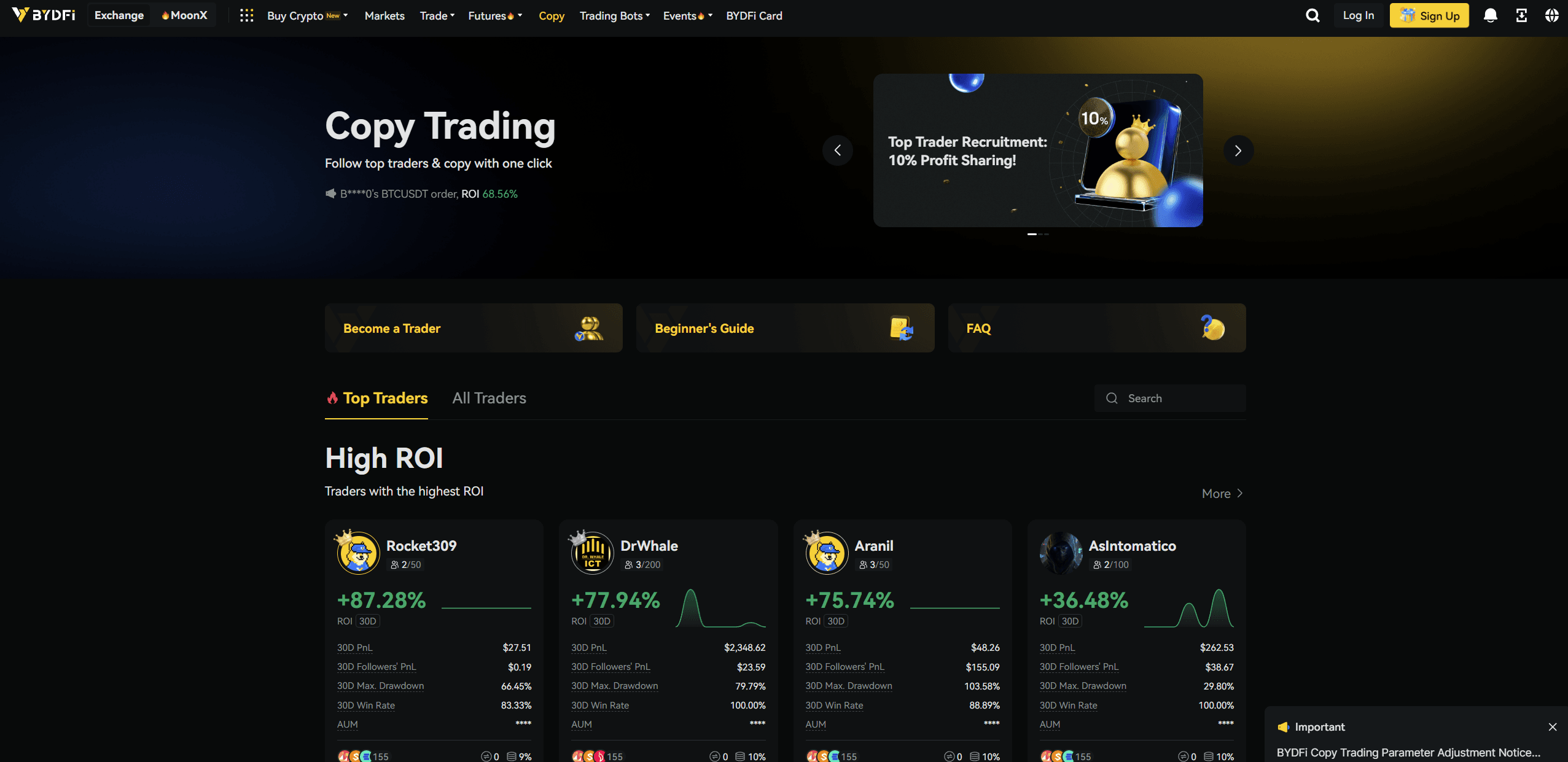

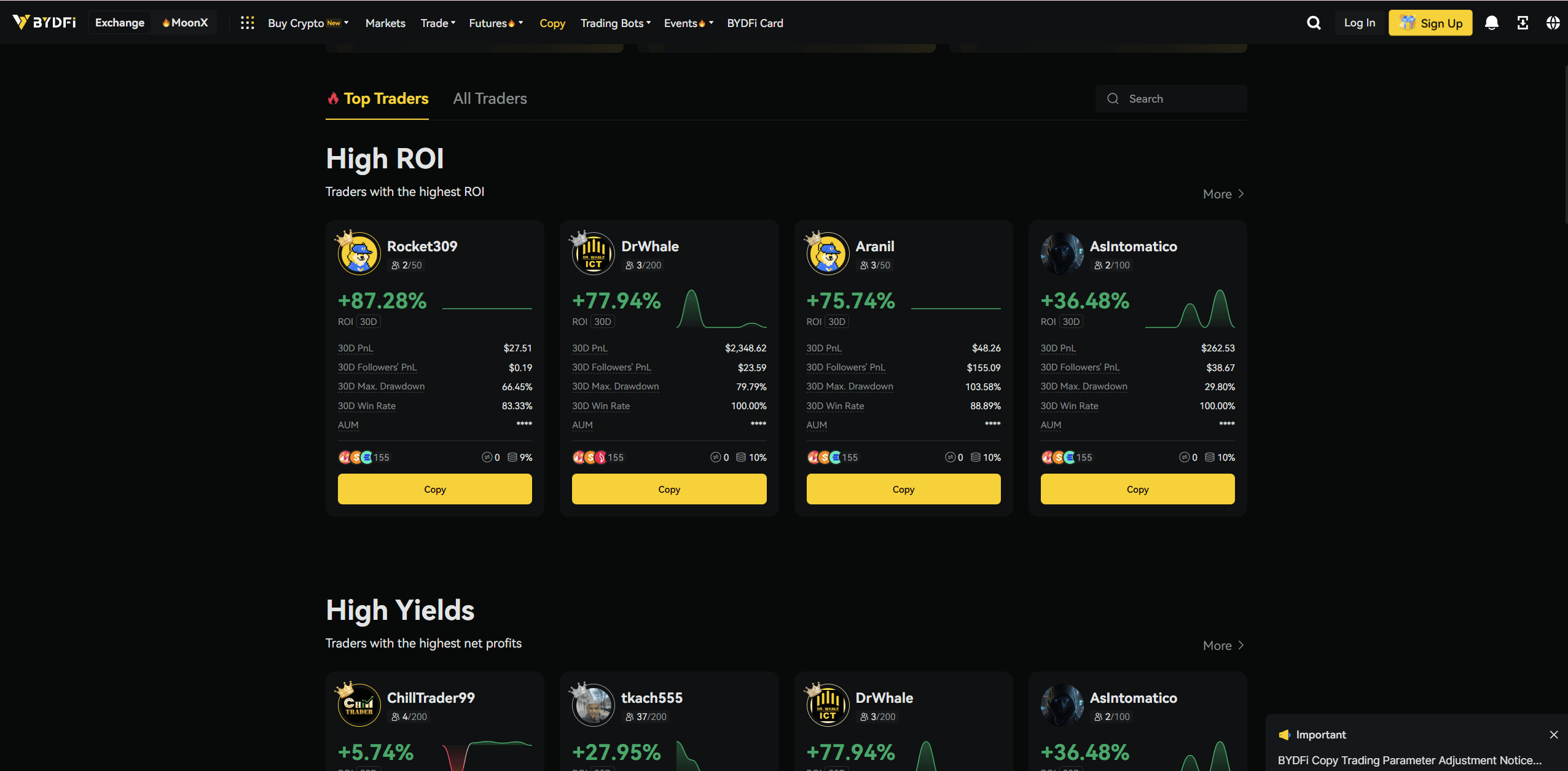

How BYDFi Copy Trading Works

Overview Of BYDFi’s Full Copy Trading Process. Image via BYDFi

Overview Of BYDFi’s Full Copy Trading Process. Image via BYDFiThe BYDFi copy trading platform places social investment at the front. It creates a simple path for users to utilize the knowledge of skilled traders without the difficulty of independent analysis and execution. The process aims for open operation, customization, and user focus. It supports both new users planning to learn and professionals looking to diversify their methods or gain followers.

The base of the BYDFi system starts with its real-time ranking boards. Users see a full list of “Lead Traders” or “Masters”, who are seasoned individuals with their performance data, historical trades, success rates, loss figures, and asset interests publicly available. This open view provides great value. It allows copiers to compare trade styles, risk profiles, and consistency over time. Each trader’s page includes full data: recent outcomes, account history, risk grades, and even comments on their method. Followers make informed decisions rather than following unknown signals.

Role Differentiation

- Lead Traders: These experienced market participants build their standing through consistent results and complex methods. They receive a part of the profits generated by copiers (often a fixed fee or percentage). This model gives them motivation to perform well.

- Copiers/Followers: Copiers move assets to a separate “copy trading wallet” inside BYDFi. They select one or many lead traders to imitate. The system takes control from there. It transfers each trade move automatically in proportion to the copier's selected asset commitment.

- Copy Modes and Risk Controls: Users generally choose between two primary copy modes:

- Fixed Amount: Users assign a set value to each copied trade. This provides precise control over asset exposure.

- Ratio-Based: Users commit a percentage of their assets as a ratio of the lead trader’s position sizes. This allows for fluid scaling and growth but introduces variability in risk and returns.

Risk management tools, including maximum loss limits, total loss caps, and automatic-stop functions, work together so users never risk more than they accept losing. BYDFi also allows simple adjustment for starting, changing, or ending copy relationships at any moment. This gives users day-to-day freedom over their asset pools. Once all settings are confirmed, BYDFi’s system executes trades nearly instantly. However, small delays can occur during volatile market periods. Copiers benefit from the platform’s high asset pool, wide trade pairs, and stable margin system. Funds remain under user control always. Assets can be removed or redirected as needed.

Detailed Mechanics of BYDFi Copy Trading

In-Depth Breakdown Of BYDFi’s Copy Trading System. Image via Shutterstock

In-Depth Breakdown Of BYDFi’s Copy Trading System. Image via ShutterstockBYDFi’s copy trading system is notable for its close attention to trade duplication, risk oversight, and position size determination. Whether an individual acts as a copier seeking simplicity or an advanced trader looking to adjust every detail of the copy trading method, BYDFi presents a system built around adaptability and practical controls.

Every lead trader on BYDFi receives a full profile. Their pages display a detailed view of recent trades, success rates, accumulated profits, average loss figures, and movement exposure, along with discussion on trade philosophy and strengths. The data analysis interface lets copiers organize and filter based on trade style (fast-in-and-out, short-term movement, trend-following), asset class preference, magnification use, and time frame of operation. This selection process, driven by data, helps individuals match their financial objectives and loss acceptance level to the right trader.

After selecting a trader, copiers decide the asset amount to commit to copy trading. Two popular modes exist:

- Fixed Amount: Copiers commit a set dollar (or equivalent stablecoin) value per duplicated trade. This suits those who prefer stable, predictable exposure without a change in trade size.

- Proportional (Ratio-Based): Trade sizes change relative to the lead trader’s position amounts. For example, committing 10% of a lead trader’s open order means every copied position reflects 10% of their market exposure. This aids growth and scaling but creates variance in risk and returns.

- Margin, Leverage, and Risk Management: BYDFi supports multiple margin methods (cross margin, isolated margin). This allows each user to set the level of risk separation. Cross margin uses the individual's entire account balance to protect against asset liquidation. Isolated margin sets aside specific funds for each position, separating risk. Magnification ratios adjust and transfer the lead trader’s magnification, set a fixed magnification, or impose limits.

Risk management functions serve as the center of the BYDFi system. Copiers set:

- Stop Loss/Take Profit levels: These ensure losses remain capped and profits are realized efficiently.

- Maximum allowable drawdown: This function pauses copying if total losses reach a preset limit.

- Auto-unfollow triggers: This function disconnects automatically if a trader’s performance numbers fall below custom points.

- Execution and Monitoring: BYDFi’s system ensures fast trade duplication with minimal delay. Volatile markets might cause negligible delays. The platform’s control panel offers real-time tracking as individuals watch open positions, realized profit and loss (P&L), total exposure, and historical outcomes at a glance. Copiers receive alerts for major changes, staying informed without requiring manual operation.

BYDFi’s design moves copy trading from a “set and forget” model to a “set and optimize” model. This empowers users to find a balance between automation and specific risk and return values.

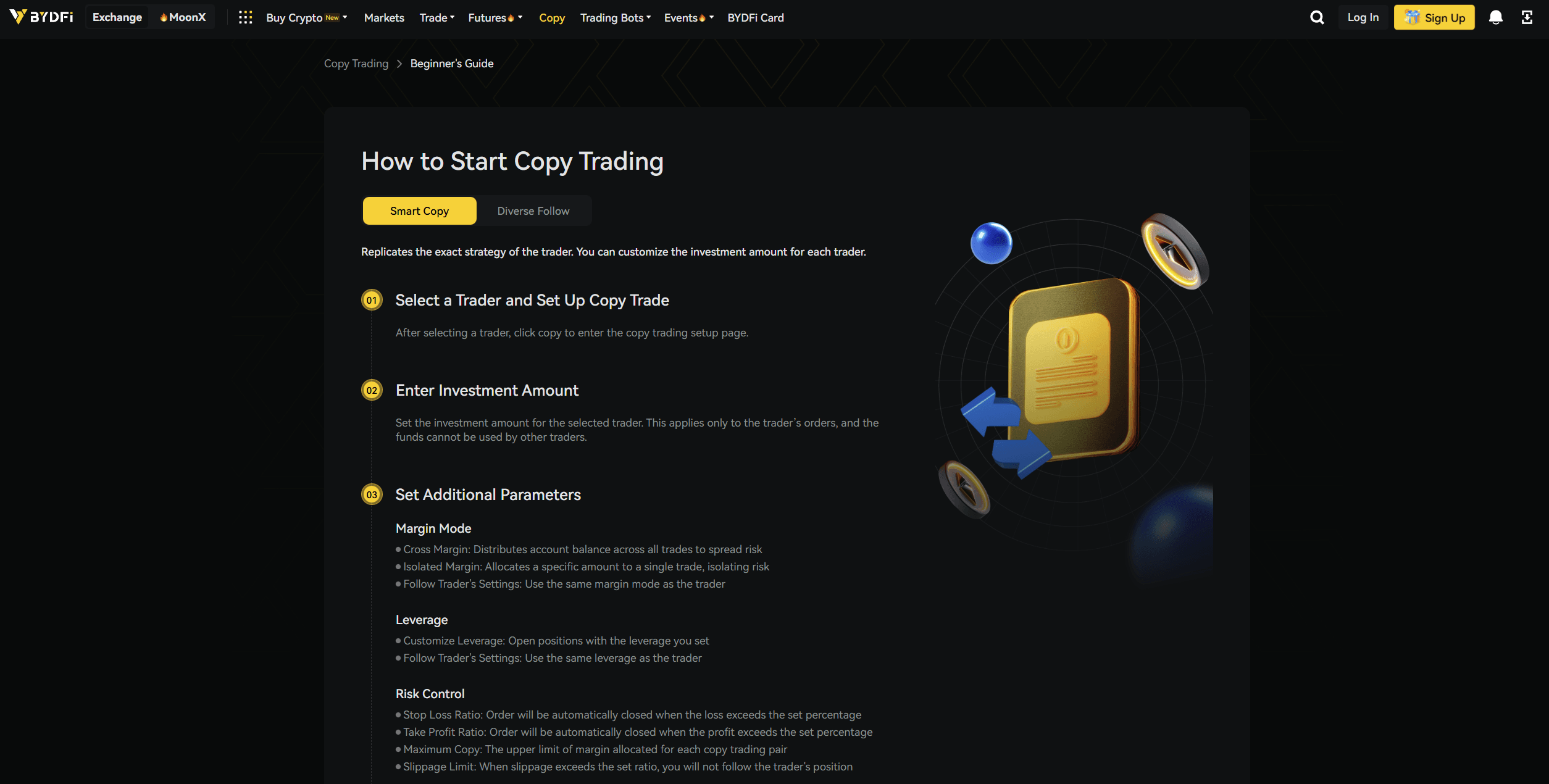

Step-by-Step Guide: How to Start Copy Trading on BYDFi

Starting copy trading with BYDFi follows a clear path. The process combines a simple user control panel with a logical order designed for both new users and experienced traders. The steps work for maximum simplicity, yet BYDFi ensures every stage receives stable support and clear direction.

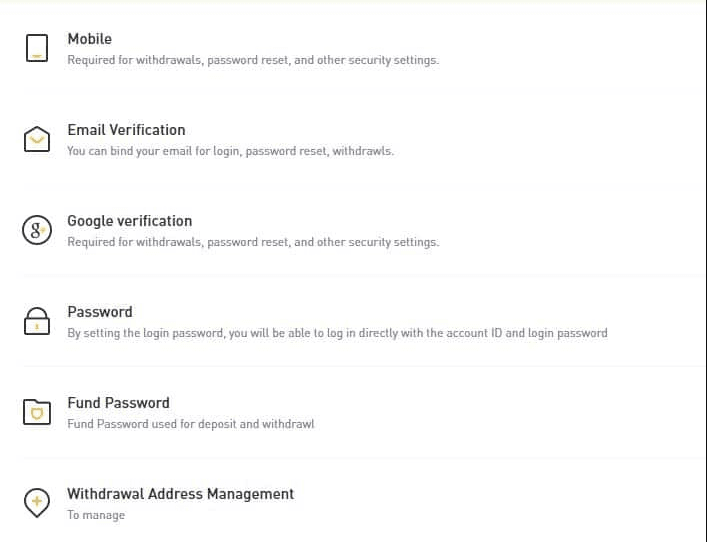

Step 1: Register and Secure Your Account

Register and Secure Your Account On BYDFi. Image via BYDFi

Register and Secure Your Account On BYDFi. Image via BYDFi Start by creating an account on BYDFi’s official site or mobile program. Registration generally needs only basic details like email, password, and optional phone confirmation. For users wanting higher withdrawal limits or stronger safety functions, user identity verification (KYC) works, but it remains optional for most copy trading activities.

If you are new to crypto trading, check out our beginner's guide to understand the fundamentals.

Step 2: Fund Your BYDFi Wallet

Instructions For Adding Funds Into Your BYDFi Wallet. Image via BYDFi

Instructions For Adding Funds Into Your BYDFi Wallet. Image via BYDFiOnce the account is active, navigate to the “Wallet” section to deposit funds. BYDFi accepts a broad range of crypto assets for funding, including Bitcoin, Ethereum, USDT, and many popular altcoins. Fiat money access also works through selected payment partners. Deposits generally process within minutes, allowing quick access to trade functions.

Read about our top picks for the best crypto wallets.

Step 3: Access the Copy Trading Hub and Select Traders

Guide To Reaching The Hub And Choosing Traders. Image via BYDFi

Guide To Reaching The Hub And Choosing Traders. Image via BYDFiMove to the main menu and locate the “Copy Trading” or “Social Trading” selection. This specialized center displays ranking boards. These boards feature many lead traders, complete with data on recent outcomes, asset interests, loss figures, success rate, and more. Review trader profiles. Filter by performance, asset group, method style, and risk score. Use the available data analysis to match your financial objectives and loss acceptance. If desired, mark or shortlist traders for later comparison.

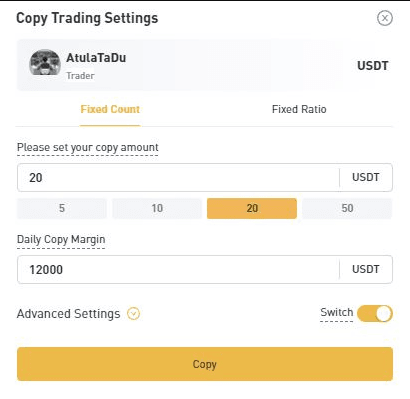

Step 4: Set Your Copy Parameters

Explanation Of Custom Settings For Copy Preferences. Image via BYDFi

Explanation Of Custom Settings For Copy Preferences. Image via BYDFiSelect the preferred copy mode, fixed amount or proportional, and move funds from the main wallet to the copy trading account. Adjust risk controls, such as maximum loss figures, stop loss, magnification limits, and automatic-unfollow points, to match your portfolio method.

Step 6: Activate Copy Trading

Click to confirm selections and start duplicating trades in real time. The platform transfers the chosen trader’s moves immediately, buying or selling assets as directed. You monitor open positions and make changes as needs evolve.

Step 7: Monitor and Adjust

BYDFi’s control panel provides immediate updates on copy trading outcomes, open positions, realized profits, and current statistics. Downloadable transaction records and immediate alerts keep you informed. You end, pause, or modify copy arrangements at any moment.

BYDFi’s process is built for accessibility. Anyone can start copying without prior technical knowledge, while offering enough depth for advanced users to manage asset pools strategically.

Fees and Costs of BYDFi Copy Trading

Summary Of All Charges In BYDFi Copy Trading.Image via Shutterstock

Summary Of All Charges In BYDFi Copy Trading.Image via ShutterstockUnderstanding the fee structure holds importance when choosing a trade platform. BYDFi works to make its costs as open as possible. This helps users calculate expected returns and manage capital effectively. The platform groups fees into several types, each affecting the copy trading experience.

Trading Fee

The primary cost of BYDFi comes as trade commissions. For copy trading, most positions run on your behalf (spot or derivatives) result in standard platform trade fees. These generally move from 0.1% to 0.3% per trade for spot assets and slightly higher on highly magnified derivatives. Exact rates vary based on the asset type and market status. Trades match with deep liquidity partners, ensuring close value differences and competitive costs across the board.

Copy Trading Service Fee/Profit Share

Many lead traders on BYDFi participate in a profit-sharing deal. When a copier earns realized profit through the automated method, a percentage is deducted and credited to the lead trader as payment. This model motivates traders to produce positive returns. It calculates automatically, requiring no manual action from the user. BYDFi recently announced a "Copy Trading Leader Program," declaring up to 30% profit share for top traders.

Withdrawal and Deposit Fees

Depositing funds into BYDFi’s wallet is generally free or incurs minimal charges, based on the payment system used. Crypto asset withdrawal fees are standard blockchain transaction costs. These costs move based on network volume and asset type. Usually, no hidden costs exist for internal asset transfers, such as moving funds between the main wallet and the copy trading account.

Ancillary Costs

BYDFi often runs offers that include periods of zero-fee trade or lower commissions for new users. This occurs particularly during major updates or marketing efforts. Individuals must check for current deals or upcoming changes to the cost structure. These changes impact the final return.

Transparency and Monitoring

All fee actions show clearly in the account control panel, allowing simple review and matching. Copiers access downloadable records and historical breakdowns of trade fees, profit-sharing deductions, and withdrawal charges. This offers full visibility for checks and tax purposes.

BYDFi’s model aims to maintain clarity, fairness, and competition. This ensures traders optimize methods based on the net cost. By including fees and costs in the copy trading plan, individuals calculate realistic return expectations and limit unexpected results.

What is BYDFi?

BYDFi is a centralized cryptocurrency exchange that focuses on high-leverage trading, optional KYC, and simple access to both CEX and DeFi markets. It started in April 2020 under the name BitYard and rebranded to BYDFi in January 2023, short for “BUIDL Your Dream Finance.”

The platform offers 1,000+ spot pairs and 500+ perpetual futures, with leverage up to 200x on select contracts. It supports copy trading, native grid and Martingale bots, leveraged tokens, and a BYDFi Card for spending crypto like cash. Fees are transparent and flat, with spot trading at 0.10% maker/taker and competitive derivatives rates designed for active traders.

What separates BYDFi from many mid-tier exchanges is MoonX, its on-chain trading engine. Through MoonX, users can route memecoin and DeFi trades on Solana and BNB directly from their CEX account, no separate wallet or bridge needed. This sits on top of a security stack that includes Proof of Reserves above 1:1, an 800 BTC protection fund, and registrations with regulators such as FinCEN, FINTRAC, and ACRA.

Check out our full BYDFi review.

Key Features of BYDFi

What is Copy Trading? Image via Shutterstock

What is Copy Trading? Image via ShutterstockBYDFi carves out a middle ground between strict, heavily regulated giants and bare-bones offshore platforms. It combines high-leverage derivatives, copy trading, on-chain access, and optional KYC in a way that works for both casual users and serious traders.

Multi-Market Trading

BYDFi supports a full stack of markets. You get 1,000+ spot pairs, 500+ perp contracts, and leveraged tokens, all inside a single interface. Core pairs like BTC, ETH, SOL, USDT, and others sit alongside a wide range of altcoins, so you can run everything from simple spot buys to complex hedges.

Spot trading comes with Classic and Advanced layouts. Classic suits, quick market, and limit orders. Advanced adds TradingView charts, depth, and order book tools for technical traders. On derivatives, you can choose isolated or cross margin and tap up to 200x leverage on select pairs, with clear funding intervals and fee displays before you hit confirm.

Copy Trading System

Copy trading is one of BYDFi’s headline features. Instead of guessing who to follow on social media, you get a public leaderboard of “leader” traders with live stats. Each profile shows P&L, ROI, win rate, drawdown, and follower count, all sourced directly from the platform.

Followers can start from as little as $10 and pay a 10% profit share only on winning copied trades. You can cap risk with max-loss settings, limit the number of open positions, and still adjust TP/SL on copied orders. It feels more like a structured learning and scaling tool than a blind “auto-trade” switch.

High Leverage Options

For derivatives traders, BYDFi focuses on leverage and control. Perpetual contracts support up to 200x leverage on select markets such as BTCUSDT. You can mix isolated and cross margin modes, layer in TP and SL, and use advanced order types like Post-Only, IOC, FOK, Iceberg, and scaled orders.

Funding occurs every eight hours, which makes it easier to plan holding costs. The flip side is obvious. High leverage can amplify slippage and liquidations on thinner books, so the platform also surfaces margin ratios and liquidation warnings in real time.

Security and Regulation

The exchange uses a cold–warm–hot wallet structure, with most customer funds in offline cold storage and only operating liquidity in hot wallets. Withdrawals require multi-sig approvals, and users can set address whitelists, device binding, 2FA, and anti-phishing codes.

On the transparency side, BYDFi runs Proof of Reserves with 1:1+ backing on core assets and publishes wallet data and third-party audit results. It partners with Hacken for external reviews and maintains an 800 BTC Protection Fund as a buffer against extreme incidents.

Regulation is handled via registrations with FinCEN in the US, FINTRAC in Canada, and ACRA in Singapore, plus Travel Rule support through the CODE VASP alliance. Optional KYC up to defined withdrawal limits lets users choose their comfort level while still keeping the platform inside global AML expectations.

Flexible Account Management

Funding and account setup are built around flexibility. Crypto deposits are free, with only network fees on the blockchain side. Withdrawals support multiple networks, so you can pick cheaper routes such as TRC20 for USDT when cost matters.

On fees, spot trading uses a flat 0.10% / 0.10% maker–taker schedule. Perps start at 0.02% maker and 0.055% taker, with VIP tiers lowering costs as 30-day volume increases. BYDFi also offers a Visa card product for eligible, KYC-verified users, letting them spend their balances in the real world with clear card fees and FX rules.

KYC tiers structure access and limits: unverified users can trade and withdraw within lower caps, while Level 1 and Level 2 verification unlock higher withdrawal ceilings, fiat ramps, and regional perks. In practice, this lets privacy-focused users stay light, while more active or high-volume traders can step into higher limits and smoother banking rails.

Benefits of Copy Trading

Key Advantages Users Gain From BYDFi Copy Trading. Image via Shutterstock

Key Advantages Users Gain From BYDFi Copy Trading. Image via ShutterstockBYDFi’s copy trading platform delivers a set of advantages designed to draw a wide group of crypto enthusiasts, from new entrants to strategic professionals. The system structure empowers users to employ collective knowledge, simplify asset pool management, and increase profit options with little effort.

Accessibility for New Traders

Immediate market access is a hallmark advantage. Copy trading on BYDFi removes technical barriers. Users participate in complex trade methods and high-movement markets without the need for vast education or prior experience. The simple control panel, automated trade duplication, and open ranking boards clarify crypto investment. This allows anyone to start trading and learning simultaneously.

Learning Through Observation

Duplicating seasoned traders is a continuous educational experience at BYDFi. The exchange's interface allows users to monitor every copied position. They review trade logic and track performance via detailed data analysis. Over time, copiers naturally absorb risk management practices, entry and exit methods, and market understanding from their selected leaders. This builds their own trade confidence and skills gradually.

Time Efficiency

Traditional trade often demands full-time attention and constant watch. Copy trading sharply reduces the time needed. Market research, method creation, and order execution are managed by lead traders. Users set parameters and let automation work. This frees up time for other activities while maintaining access to live profit options.

Portfolio Diversification

BYDFi permits copiers to commit funds across multiple lead traders. Each trader follows distinct methods, risk levels, and market focuses. This lowers dependence on a single view or market sector and helps buffer against isolated losses. Diversification extends to asset classes, magnification settings, and trade frequency, all adjustable through the copy trading control panel.

Risk Management Tools

Complete controls, such as maximum loss caps, automatic-unfollow triggers, and customizable margin settings, empower users to manage exposure based on personal loss acceptance. The ability to pause, stop, or change traders at any moment offers an extra layer of protection and flexibility.

Emotional Discipline

Trade often suffers from rash decisions rooted in fear or excessive desire. Copy trading naturally limits emotional trading by automating decisions and sticking to preset methods. This results in steadier outcomes and a calmer, more rational approach to market movements.

Community and Support

BYDFi’s community center, frequent contests, and ready support strengthen the feeling of shared purpose and continuous learning. This positions copy trading as a tool for connection to a wider crypto network as well.

In summary, BYDFi’s copy trading system presents powerful, functional advantages for traders seeking streamlined portfolio expansion, education, and enhanced safety, all within a system that focuses on the user.

Drawbacks and Risks of Copy Trading

Important Limitations And Risks To Consider Here. Image via Shutterstock

Important Limitations And Risks To Consider Here. Image via ShutterstockUsers must know the limits and the risks that naturally impact asset pools and come with BYDFi copy trading. This holds regardless of the platform’s standing or the expertise of the selected lead traders.

- Dependence on Trader Performance: A copier's results tie directly to the skill and decision-making of the lead traders selected. Even with strong performance data, past profit is never a guarantee of future success. If a top trader suffers losses, fails to adapt to market shifts, or faces an emotional low, those losses transfer proportionally to the copier's account.

- Limited Control Over Individual Trades: Once automation starts, users cannot interfere with the small details of every trade. BYDFi’s system works to duplicate trades precisely. Copiers essentially transfer the task of method and execution to another party. While users set overall risk limits, pause or stop copying, and exit positions at predefined points, they give up direct control over the entry, exit, or asset choice for each trade instance.

- Risk of Over-Reliance and Complacency: Copy trading automates much of the investment process. While this offers convenience, it can discourage users from developing their own market research, trade skills, or critical thought. Depending too much on others for results limits growth and leaves the user vulnerable if they ever transition to solo trading.

- Market Volatility and Sector Risks: Crypto markets possess a reputation for high movement. Sudden value changes, external news events, or rapid shifts in mood impact even the most disciplined traders. Loss periods, unexpected price differences (slippage), and liquidation events all happen, especially in magnified trade settings, leading to quick asset depletion.

- Execution Lag: BYDFi designs for speed, but system delays occur occasionally in quickly moving markets. This means a copied trade executes a moment or two after the lead trader’s trade. This results in different entry/exit values and impacts profit, particularly during times of high movement.

- Vetting and Transparency Limitations: BYDFi displays extensive statistics and history, but some specifics of a trader’s method or psychology are hard to measure or predict. New traders or those with little public record introduce extra uncertainty. Users must exercise care and avoid following traders based only on impressive profit numbers without confirmed track records.

- Potential for Irregular Activity: Social platforms carry inherent risk. While BYDFi employs strict checks and active monitoring, a small risk remains that some traders manipulate their statistics, engage in rapid asset buying and selling schemes, or present misleading records.

Understanding and actively controlling these risks holds importance. BYDFi provides users with tools for risk reduction, but the responsibility ultimately rests with the investor to watch, research, and adjust copying methods regularly to protect their assets

Checklist: Questions Before Copy Trading on BYDFi

Essential Questions To Review Before Copy Trading. Image via Cheqmark.io

Essential Questions To Review Before Copy Trading. Image via Cheqmark.ioBefore starting the copy trading process on BYDFi, pausing to assess expectations, loss acceptance, and readiness for the active crypto world is essential. Careful preparation increases the chances of success and ensures the investment method aligns with personal objectives and financial reality.

What Are My Investment Goals?

Define the goals for copy trading. Are you looking for quick returns, long-term asset growth, risk division, or simply education through direct experience? Goals determine the types of lead traders to follow and the amount of capital to commit.

How Much Risk Can I Tolerate?

Evaluate the ability to handle market losses without emotional or financial difficulty. BYDFi allows setting maximum loss limits, stop-loss triggers, and automatic unfollow options. Still, comfort with the risk profile of chosen lead traders and asset groups is necessary, especially with asset magnification.

What Capital Am I Willing to Allocate?

Decide the amount of money you can commit (and possibly lose) to copy trading. Never commit emergency funds or more than you comfortably spare. The option to divide funds across several traders and methods depends on the starting capital.

Have I Researched the Traders?

Investigate the data analysis, success rates, average returns, and commentary of prospective lead traders. Look for stability, open information, and acceptable loss figures, not just high profit numbers.

Do I Understand All Fees?

Become familiar with BYDFi’s trade, profit-sharing, withdrawal, and additional fees to calculate realistic net returns. Include these costs in portfolio commitments and profit expectations.

Check out the top low-fee exchanges.

Am I Prepared for Crypto Volatility?

The blockchain markets move quickly and sometimes intensely. Even the most reliable platforms and skilled traders see unexpected losses. Prepare mentally and financially for rapid value changes.

Do I Have an Exit or Contingency Plan?

Set rules for when to stop copying a trader (for example, after many losses in a row, poor communication, or a changed method). Consider rules for reassigning capital or removing funds from the platform if performance numbers decline.

Will I Monitor My Investments Regularly?

Copy trading is not fully “set and forget.” Check the control panel often, review performance, and adjust methods as markets change and personal goals shift.

Finally, commit to continuous education. Use BYDFi’s guides, data analysis, and community support to build trade knowledge, explore new methods, and remain agile in a quickly changing sector.

This checklist helps protect capital, build skills, and improve the total copy trading experience on BYDFi. And while it seems volatile, you can mitigate crypto trading risks with these proven strategies.

Copy Trading—Not Just for Beginners

Insight On Why Copy Trading Suits All Levels. Image via Shutterstock

Insight On Why Copy Trading Suits All Levels. Image via ShutterstockCopy trading, especially as offered on BYDFi, often faces misunderstanding as only a tool for crypto novices seeking a quick path into the market. While its accessible design and automation make it suitable for new users, the fact is that BYDFi’s copy trading platform benefits individuals across the entire range of experience.

For Beginners: A Launchpad and a Learning Tool

For those new to digital assets, copy trading significantly shortens the learning time. Instead of feeling overwhelmed by technical charts, trade terms, or quickly changing values, beginners start participating immediately by mirroring the actions of proven professionals. Through real-time exposure to trade execution, risk oversight, and market cycles, new users gather functional knowledge faster than through guides alone.

BYDFi’s open trader data allows newcomers to understand why certain methods succeed or struggle. This fosters growth through modeling, not just memory.

For Experienced Traders: Diversification and Performance Optimization

Experienced traders turn to copy trading for different reasons. It does not replace their skills; it acts as a portfolio improvement tool. It allows them to divide methods beyond their main asset groups or comfort zones. BYDFi’s wide choice of lead traders covers multiple market areas (from main assets to mid-size tokens and derivatives), offering exposure to trade philosophies and assets they might otherwise ignore.

Experienced users also value the option to test new methods in “copy mode” before fully integrating them into independent practice. This reduces both risk and lost opportunity cost. For those managing large asset pools, copy trading makes it simple to commit a portion to passive, systematically managed methods while saving time to focus elsewhere.

Here are several crypto trading strategies employed by experienced traders that stand out.

A Social and Strategic Edge

Copy trading is inherently social. BYDFi’s ranking boards and community functions foster an open exchange, peer review, and a collaborative spirit that solo trading often lacks. Both beginners and professionals gain from transparent data sharing, crowd-sourced understanding, and the collective pursuit of more consistent results.

Flexibility for All

BYDFi’s copy trading platform is a toolkit: beginners get a path to learning and earning; professionals get division, automation, and scalable methods. The ability to customize risk, trade size, and selection criteria means every investor customizes their copy trading experience to fit unique needs and changing objectives.

Closing Thoughts & Recommendations

Copy trading on BYDFi works well because it strips trading down to something people can actually use. New users get a clear path into the market without drowning in charts, and they learn by watching real traders make real decisions. The platform gives enough structure to keep mistakes contained, and enough freedom for people to adjust their approach as they go.

For experienced traders, BYDFi becomes a way to expand their reach. They can test ideas, diversify their exposure, or automate parts of their strategy without giving up control of the bigger picture. The key is to review who you’re copying, check your limits, and keep your expectations grounded. BYDFi provides the tools; the outcomes depend on how thoughtfully those tools are used.