When it comes to tax season, people typically take one of two approaches. Those with simple tax situations or the time and knowledge to handle it themselves often deploy the DIY (do it yourself) approach. For those with more complex tax situations, it is common to hire an accountant or tax professional to ensure they are not only compliant with local tax laws but also help ensure that their taxes are completed in the most optimal way possible.

Hiring professionals can help save you time and money as they can tap into their extensive industry knowledge and play financial gymnastics in ways that can lead to tax savings, benefits and write-offs.

When it comes to paying taxes on your cryptocurrency investments, a professional can help you comply with local laws and regulations, ensure that you pay the correct amount of taxes on your gains (without overpaying), and save you countless hours when it comes to sorting through your crypto transactions.

This article is going to review CoinTracking’s Full-Service offering and outline my experience with the service to help you determine if a full-service solution is appropriate for you.

The Crypto Tax Conundrum

Accountants and tax lawyers require years of study and certifications in order to gain employment in the tax industry. Saying that taxes are complex and nuanced would not be an overstatement.

Then when it comes to crypto taxes, in particular, it is an entirely different set of challenges altogether. All this strange and wonderful “magic internet rainbow money” has perplexed tax professionals worldwide for years.

Accountants Trying to Make Sense of Crypto Transactions. Image via Shutterstock

Accountants Trying to Make Sense of Crypto Transactions. Image via ShutterstockSome argue that crypto tax does not require a new framework and that cryptocurrencies and all their quirks can fall under traditional taxation umbrellas.

To that, I must disagree. As someone who has been around the crypto block a time or two and has tried both approaches of doing my own taxes and hiring a tax professional (after going through 3 accountants before finally finding one that could help with my complex crypto tax situation), my opinion is that crypto requires an entirely new taxation framework.

To further emphasize this, let us consider the simple fact that until the invention of smart-contract-capable blockchain networks, the following types of transactions and ownership have never existed:

- Airdrops

- Staking rewards

- Liquidity provision income

- Liquid staking/restaking income

- Gas fees

- Community/Governance tokens

- Fractional ownership of NFTs

- Earning income from play-to-earn games.

In our Cointracking review, I highlight this scenario to further illustrate that crypto situations, especially for DeFi users, may not fit into traditional tax frameworks and that specialized software and knowledgeable professionals are necessary when navigating this new financial paradigm.

Here’s a fun situation: what happens if you buy $100 worth of Ethereum, use a bridge to convert $20 to a Layer 2, pay $10 in ETH gas fees, make a capital loss on the L2 token you bridged but you stake the L2 to earn an APY, then liquid stake half of the remaining $80 worth of ETH on a platform like Lido, use the stETH to take out a loan, default on the loan and lose it. The price of your remaining Ethereum goes up but what about the portion of your initial investment that went to gas fees? You lost your stETH, the dollar value of your L2 went down but the number of tokens went up due to staking and you received an airdrop for using the L2 worth hundreds of dollars, which magically showed up in your wallet out of thin air.

-Have fun dealing with that, Mr Tax Man.

All this is a long way of saying that taxes, especially crypto taxes, can be incredibly difficult to understand. Unless you are lucky enough to live in a crypto-tax-friendly country, tracking transactions and categorizing them correctly can be borderline impossible without using tax software like the one offered by CoinTracking.

CoinTracking offers a platform that significantly streamlines the tax process and can benefit anyone who dabbles in crypto. For those who do their own taxes, using the tax reports generated by CoinTracking’s platform can make the process simple to file yourself, or those same reports can be sent to your accountant so they can file on your behalf.

For those who go seriously deep into the weeds of DeFi, use multiple wallets and platforms, and have thousands of transactions, or for those who just don’t want to bother sorting their own crypto transactions, CoinTracking also has a full-service solution where they do 99.9% of the heavy lifting for you.

We will cover the full-service offering as we progress through this article, but if you are interested in the CoinTracking platform as the do-it-yourself type or already have a solid accountant, I recommend checking out our dedicated CoinTracking review so you can see for yourself why CoinTracking makes our list as a top crypto tax tool and offers one of the best free portfolio trackers and in-depth trade analysis dashboards in the industry.

Introducing Cointracking Full-Service

For those who need a little extra help or assurance, CoinTracking offers an all-in-one solution for hassle-free tax reporting.

CoinTracking employs a team of CoinTracking software experts and qualified tax professionals for a two-pronged approach, ensuring that your crypto transactions are imported and categorized accurately and that you are compliant with optimized and accurate transactions from a taxation point of view.

With CoinTracking’s Full-Service, users benefit from:

Premium Support- A CoinTracking expert will offer personalized support and help you make sense of the messy world of crypto transaction importing, identifying, and classifying. The support rep can also assist you with resolving account discrepancies and platform navigation. The CoinTracking platform is seriously robust and all-encompassing; to get the most out of it, having someone show you the ropes and make sense of the data-rich platform may be helpful.

Account Service- If you are someone with thousands of transactions or multiple wallets, and use multiple DApps and exchanges, gathering all that information can take dozens of gruelling painstaking hours, and chances are something will be imported incorrectly and you will see an overwhelming number of transaction errors or missing transaction IDs.

This is exactly the step I realised I needed some professional help. It took me about 45+ hours to collect all my wallet addresses and accounts, set up the APIs, import transaction spreadsheets, etc. After what may have been the most boring 45 hours of my life, I had over 15,000 transactions with errors or missing information on over half of them.

In my defence and my excuse for messy bookkeeping, when I moved to Portugal 4 years ago, there was no tax on crypto so I didn’t bother with bookkeeping or accounting (as a responsible crypto user should from the start) so I had a multi-year mess on my hands as Portugal changed their tax laws in 2023 and I needed to backtrack my transaction history… Thanks a lot, government.

I was faced with a dilemma- do I want to spend weeks trying to reconcile years of transactions in a futile attempt to categorize them and label them correctly, and likely risk doing it wrong and messing up my taxes, or just hire a pro? I chose the latter.

The CoinTracking rep helped significantly streamline data import and error reconciliation, quickly and efficiently sorting the mountain of mess that I was unable to make heads or tails of.

Tax Service- If you have questions about your tax situation or need help filing, CoinTracking can also pair you up with a tax consultant who can answer your questions and take care of each step from the creation of your tax report to filing to the tax office in your jurisdiction. CoinTracking has tax professionals in over 75 countries including the United States, so chances are they will have someone who can help you at every step of the process.

Additionally, the Full-Service can assist with:

- Reviewing your CoinTracking account

- Importing all of your transactions from exchanges, wallets and blockchains

- Reconcile complex situations such as margin trades, DeFi, NFTs and Lending

- Resolve transaction import and reconciliation errors

- Validate data for completeness

- Accounting for ICOs, exchange shutdowns, airdrops, gifts, etc.

- Creating and reviewing tax reports.

In a Hurry?

Left your taxes to the last possible minute? CoinTracking also offers Express Account Services to prioritize your account and do everything in their power to ensure you meet your tax deadline!

Who is Cointracking Full-Service For?

The Full-Service offered by CoinTracking isn’t for everyone. Users who primarily take the buy-and-hold approach will have a very different set of requirements than frequent DeFi users or active traders.

To compare with traditional scenarios and my personal situation, I used to do my own taxes back when my situation was simple. In my early 20s, I had one source of income and was single with no dependents. I could file taxes myself in about ten minutes.

Fast forward a few years and my tax scenario became more complex. I quickly realized I needed an accountant or risked wasting time and being non-compliant by attempting to do it myself. I found utilizing an accountant not only saved me time and money but also led to a degree of confidence and relief, knowing my taxes were being done correctly.

A Good Accountant Is Worth Every Penny. Image via Shutterstock

A Good Accountant Is Worth Every Penny. Image via ShutterstockThe journey was similar with crypto. In the early days, I would only trade a few coins now and then and I used a crypto tax tool like CoinTracking to integrate directly via API to my crypto exchange of choice. That was all I needed as the tax tool would spit out a simple-to-understand profit and loss report that I could hand to my accountant.

Then, as many of us do, I ended up going down the DeFi rabbit hole, started chasing airdrops, providing liquidity, holding a series of utility tokens for special access to platforms, and paid a small fortune in bridging and gas fees. On top of all that, my career at the Coin Bureau certainly didn’t help as I found myself setting up accounts at multiple crypto exchanges for testing and review purposes, testing dozens of DeFi protocols and wallets, and making tens of thousands of transactions for testing purposes and just playing in the crypto playground.

How I Felt Trying to Figure Out My Crypto Tax. Image via Shutterstock

How I Felt Trying to Figure Out My Crypto Tax. Image via ShutterstockI soon realized my crypto tax situation was extremely complex and similar to the realization that I needed an accountant for my “in real life” tax, I also needed to employ the services of blockchain professionals to make sense of the tens of thousands of crypto transactions I’ve wracked up over time, the vast majority of which were uncategorized, went to and from wallet addresses that I no longer use and transactions that I didn’t remember or recognize.

So, if you do all your trading on one exchange and directly integrate your exchange of choice with a tool like CoinTracking and have a great accountant who understands crypto, you might not need to use a full-service solution. But if you are a frequent DeFi user, have multiple wallets across multiple blockchains and if your accountant looks at you with a glazed look in his eyes when you try and explain airdrop hunting, peer-to-peer lending and how you earn income on magic internet money, then CoinTracking’s Full-Service could save you an immeasurable amount of time, effort, and overall stress.

CoinTracking Full-Service Process

In this section, I will explain the process and my experience using CoinTracking’s Full-Service.

Step 1: Signing Up and Intro Call

The first thing you’ll need to do is head over to CoinTracking and hit the “Request Your Full-Service Now” button.

Note that you can do this without being an existing CoinTracking customer or having an account, you can set an account up at this stage of the process.

Then you will need to select the country of which you are a tax resident and provide your email address. A CoinTracking representative will reach out to you to schedule an exploration call. Note that Unlimited CoinTracking users get a one-time 30-minute premium support consultation for free.

I found the first call to be quite helpful. The CoinTracking rep asked some probing questions to understand my tax situation and what my pain points were (my reason for requesting the service). He was very helpful, clear and concise about all the ways they would be able to assist and how the process would work.

The rep made things incredibly clear and simple to understand, and, to my surprise, was refreshingly transparent about the limitations of the service as well. What I mean by that is that because I had let my tax situation get so out of hand, he stated that they can’t perform miracles but can get as close as humanly possible to a compliant tax situation.

Had I been utilizing their services correctly from the start, even just their free tax tool from day one, then the accuracy would likely have been 100%. Even with the stated limitations, I was amazed that of my tens of thousands of transactions and years of neglecting bookkeeping, in the end, we still managed over 95% accuracy and only had a handful of transactions that had to be plonked into a generic “taxable” or “non-taxable” category.

After the first call, the expectations had been set and I had a good idea of the step-by-step process we were about to follow.

Step 2- Gathering the Data

This is a step I have done myself multiple times before on many different crypto tax platforms. This is the part where you set up direct API integrations with all your exchanges, import wallet addresses, spreadsheets from your exchanges etc. For me, this process typically takes about 2 weeks or 40+ hours. It is also incredibly tedious, so I was happy that the CoinTracking representative did most of this for me.

Previously, when I tried to DIY this step myself, regardless of the tax software I was using, I imported all the data and was hit with a wall of thousands of missing transaction errors and incomplete data. I will get to why that happened in a bit and I also explain in my CoinTracking review why it is important to find a crypto tax software that can support direct API connections and direct CSV file imports from your exchanges of choice because if you need to start formatting and changing spreadsheets around to fit into your tax tool and if direct APIs are not supported, you’re gonna have a bad time.

Okay, so this time around, instead of me spending 40+ hours to compile all this data on my own, this process was cut down by about two-thirds as the CoinTracking rep sent over the exact instructions for each supported platform that can integrate directly via API and instead of me uploading the CSV files myself or manually adding my dozens of wallet addresses one by one, everything was sent to the rep in an email and they did all the heavy lifting.

CoinTracking supports integration with over 300 exchanges and wallets and over 27,500 digital assets, so there is a good chance they'll be able to meet the needs of most crypto users.

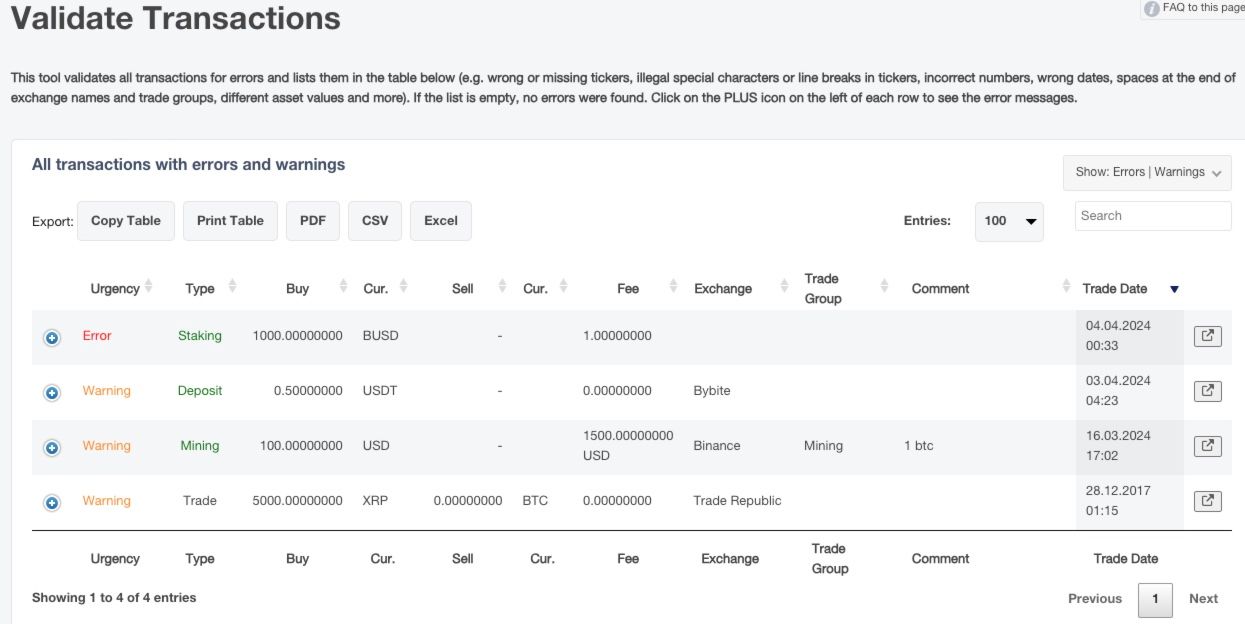

Step 3- Missing Transactions and Error Reconciliation

Once all your data is imported into CoinTracking either by yourself or a CoinTracking rep, you will likely find transaction discrepancies and errors. If you keep on top of your crypto transactions and use a tax software from the start and check in on it regularly, you will likely be able to remember the transactions and rectify them yourself.

If not and you let a year lapse or spend way too much time in DeFi, you might find yourself staring at a scary wall of thousands of missing transaction errors or transactions that are not categorized or labelled… * Gulp * oops, this is where the CoinTracking rep swoops in and saves the day.

Because these guys eat, sleep and breathe this stuff day in and day out, all those errors and missing transactions are familiar to them and they’ve seen it all before so have a good grasp on what to do with the majority of them.

The Pros at CoinTracking Can Help Reconcile and Validate Transaction Errors. Image via CoinTracking Demo Account

The Pros at CoinTracking Can Help Reconcile and Validate Transaction Errors. Image via CoinTracking Demo AccountFrom this point, the rep schedules another call and you go through some of these errors together so they know what needs to be with them. This is the part where you realize that you really should have been doing a better job with your bookkeeping over the years. Playing fast and loose with your crypto transactions may have flown a few years ago, but no longer as tax authorities are getting wise and cracking down.

What is amazing is that during this step, even though I had thousands of wonky transactions, it only took the rep about 20 minutes to talk through them with me. They don’t need to go through every one of the transaction errors with you as they recognize the categories and identify similar transactions that should be labelled in the same way and can validate/rectify transactions in bulk.

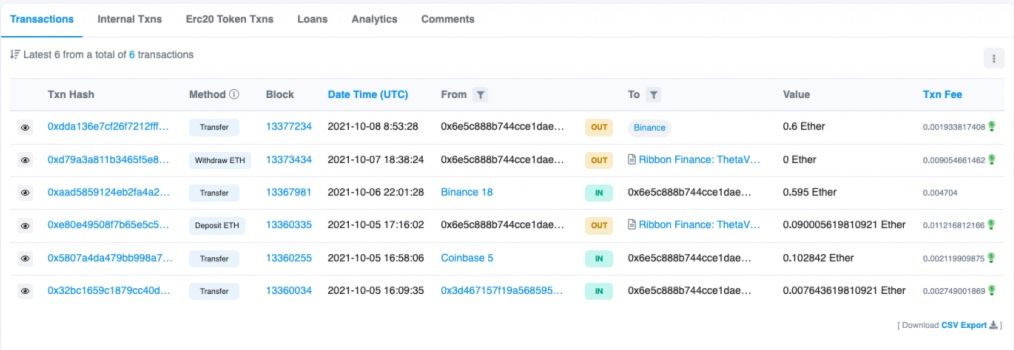

These guys are also blockchain explorer wizards, so when I wasn’t able to make heads or tails of trying to follow the transaction breadcrumbs for some of my transactions in Etherscan, these guys were able to make quick work of tracking everything down.

CoinTracking Experts Do a Fantastic Job of Making Sense of All This. Image via collectiveshift.io

CoinTracking Experts Do a Fantastic Job of Making Sense of All This. Image via collectiveshift.ioFor a few of the transactions that I could not remember, speaking to the rep as he talked me through the transaction really helped jog my memory and after two or three calls we managed to categorize, label, and reconcile every last transaction with astonishing accuracy…Sweet.

I shudder to think of how many weeks or even months it would have taken me to do the same process and the majority of the transactions I would have had to just give up on and guess.

At one point the conversation almost felt like I was talking to a therapist who was taking me through childhood memories, but instead of childhood memories, it was like taking a trip down DeFi memory lane, uncovering transactions and protocols from the past. But it worked! And we were able to uncover multiple wallets and DeFi platforms I had completely forgotten I had ever even interacted with.

Step 4- Categorizing and Labelling

What do Airdrops, LP tokens, staking income and earning rental income from digital real estate in a token that lost 85% of its value all have in common?

I have no idea how to handle any of those on my taxes (nor does my accountant) 🤦

Fortunately, the guys at CoinTracking do.

Once all the transactions were imported and labelled correctly, now was the time to figure out which transactions were and were not taxable. For the DIY type, the CoinTracking software automatically figures this out, presuming you categorize and import your transactions correctly.

The rep here was exceedingly helpful as I had quite a few transactions that would have had a pretty significant tax impact if I had incorrectly categorized them, so once again, the CoinTracking rep had to put on his Sherlock Holmes hat as we went back and identified where some of the unknown deposits came from.

Step 5- The Tax Report

With all that being done, CoinTracking now generates a tax report that you can use in a tax software like Turbotax if you do your own taxes or pass the report to your accountant. As I already have an accountant, I sent my tax report to him, but if I did not have one, or if I was still using one of the three accountants who gave me that glazed-over look at the mere utterance of the word “Bitcoin”, I could have further employed the CoinTracking team to file for me.

CoinTracking can offer tax reports suitable for over 100 countries, covering 14 different tax methods such as FIFO, LIFO, AVCO, HIFO, LOFO and more, and for US users, CoinTracking can help populate Form 1040, Form 8949, Schedule D, Schedule 1, Form 1099-NEC, and 1099-MISC.

In total, I found that using CoinTracking’s Full-Service not only saved me an immeasurable amount of time and headache but for the first time since buying Bitcoin way back when, I am actually confident in my crypto tax reporting situation. In crypto, people often joke about how there is a high chance of ending up in tax jail for misreporting taxes, not because they are purposely trying to evade it, but because nobody seems to have a clue what to do. So I have definitely been able to rest a lot easier now that I am compliant and I am not looking over my shoulder waiting for the tax authorities to break my door down because I failed to report a 2 Euro Ethereum gas fee that one time four years ago.

CoinTracking Full-Service Price

There are a few different options here with different costs that come with varying levels of service that users can choose from.

Access to the CoinTracking platform is free of charge and for the DIY type or anyone looking for a solid portfolio tracker and trade analysis, there are no costs involved until it comes time to generate a report. I won’t cover the costs here for the platform itself as you can find that information on their pricing page and we also cover why CoinTracking is one of the best value-for-money crypto tax providers as we compare it to other platforms in our CoinTracking review.

Here we are just covering the optional additional costs associated with the Full-Service.

Basic Full-Service: 999 EUR (inc. VAT) - Basic Full-Service is available for individuals who need support in extracting trading data and importing it into CoinTracking for users with 5,000 transactions or less.

Here is what is included:

- Introductory call for service explanation

- Support in extracting cryptocurrency trading data

- CoinTracking balance reconciliation

- Capital Gain and Income reports that cover all cryptocurrency taxable data

- Covers up to 4 hours

- Suitable for users with no more than 5,000 transactions, using no more than 4 exchange/wallet accounts, doing basic transactions (e.g. trades, income, mining, airdrops, etc) and no DeFi

- Any additional hours will be charged at 200 EUR per hour

Advanced Full-Service: 2499 EUR (inc. VAT)- Advanced Full-Service is for individuals with a large number of transactions who need support in extracting data and imports.

Here is what is included:

- Introductory call for service explanation

- Support with extracting cryptocurrency trading data

- CoinTracking balance reconciliation

- Capital Gain and Income reports that cover all cryptocurrency taxable data

- Covers up to 8 hours

- Suitable for users with large number of transactions and using many different exchange/wallet accounts and doing complicated transactions such as gambling, crypto loans, DeFi, NFTs, etc

- Any additional hours will be charged at 250 EUR per hour

From the USA?

For users located in the USA, CoinTracking offers a Full-Service package starting from $1950. The service includes:

Certified crypto CPAs who will do your crypto tax calculation and prepare your current and/or prior year (past due or amended) tax returns.

U.S. tax return prepared and submitted by CPAs who understand crypto and can answer tax questions.

- Current year tax return preparation for federal and home state (additional fees apply to extra states)

- Review of information provided for accuracy and quality

- No additional charge for reporting crypto transactions on your tax return if you are a CoinTracking Basic or Advanced Full-Service customer

- Declaration of income and expenses from all sources (Additional fees may apply based on the scope)

- Optimization of tax position and identifying tax-saving opportunities (includes a one-hour free consultation call upon request)

- Free e-filing of tax returns with the IRS and state tax authority

- Free preparation of quarterly estimated tax calculation based on safe harbor rule

- IRS and state tax audit protection and representation (additional fees apply)

- Preparation of prior year amended tax returns (separate engagement and additional fees apply)

👉 Note that there is a 20% discount available for users who are subscribed to CoinTracking Unlimited and Coin Bureau readers can shave a cool 10% off their subscription using our CoinTracking Sign Up Link.

Is the Cost Justified?

It really depends on the needs of the user. If your crypto situation is casual with very few transactions and you are the do-it-yourself type and/or already have a good accountant, then you likely won’t need to shell out for the Full-Service. If you have been meticulous about keeping records of your financial transactions and have been doing so since the beginning of your crypto journey, then you may not require the full-service package either.

For those who don’t have the time or desire to DIY, or have no idea what is going on in the wild world of crypto tax, or for regular DeFi users, the Full-Service can be the difference between paying way too much in taxes, or worse, getting in trouble from the tax authorities for not being compliant.

For me, the Full-Service has been a lifesaver. As soon as Portugal changed their tax laws I realized I was in big trouble as I hadn’t been keeping transaction records for years. I was even more worried when my first three accountants didn’t know how to help and I saw nothing but errors and missing transaction data warnings when I tried to do it myself. I was sure I was about it be in tax trouble.

So for me, the cost was absolutely justified. Working with the CoinTracking team was also a pleasure as I learned a lot about the platform, how to navigate the features and functions, decipher the mass amount of data and insights, and I was taught why there were issues in the first place with my data imports. The primary reason for the majority of the issues with my data imports stemmed from the fact that I had interacted with dozens of wallets, protocols, platforms and exchanges for testing purposes that I no longer used so could not import account data. By diving into block explorers, tracking down and recognizing missing transactions, the CoinTracking rep was able to identify the missing puzzle pieces. It must have been quite tedious and difficult so I tip my hat to the individual assigned to my account.

Cheeky Pro Tip- If you employ their services, learn as much as you can and use this as a fresh start to keep up on your bookkeeping. Now that I understand the process, I will know how to do it myself accurately and compliantly for future years and hope to not need to dish out for the full-service again. If you play your cards right, this could be a one-time upfront investment that can benefit you for a lifetime of crypto use. 😉

Conclusion: Is Cointracking Full-Service Right for You?

Only you understand your crypto tax situation well enough to know if the service is worth it for you. I have taken you through my journey and highlighted who may benefit from it, and why the service was right for me and I am thrilled and immensely relieved to feel like I am finally in control of my crypto tax situation.

For peace of mind and the fact that I was able to save weeks' worth of time, effort and frustration, for heavy DeFi users or users who have transactions beyond mere buying and selling crypto, then using the CoinTracking Full-Service may be one of the best ways to ensure you are both optimizing your tax situation while remaining compliant with tax laws.

Aside from the Full-Service, CoinTracking also offers Premium Support, Onboarding Calls, Account Reviews and Express Account Services, so they will have solutions for nearly any tax conundrum you may find yourself in.

If nothing else, it is worth signing up for CoinTracking for free, importing all of your transactions and enjoying the best portfolio tracker I’ve come across along with over a dozen helpful analytical reports (also free!) then when tax time comes around, if you find yourself struggling with transaction error reconciliation and validation, you can always choose to hire their services at a later date.