While its name may make you roll your eyes, Cream Finance is actually not another shady, food themed DeFi protocol. It is also not a Poland-based loans service (which you may accidentally stumble upon when trying to learn about Cream Finance). The Cream in Cream Finance stands for “Crypto Rules Everything Around Me” and it is a cryptocurrency project with serious potential.

The DeFi space has been in a constant state of frenzy with wave after wave of yield farming opportunities leaving some satisfied and others with food poisoning. The APY of some of these protocols is now exceeding 16 000%. Behind the scenes, Cream Finance is quietly putting together a DeFi platform which is meant to last using the best bits and pieces from your favorite DeFi protocols.

A brief history of Cream Finance

Cream Finance was first announced by founder Jeffrey Huang on July 16th earlier this year. The self-proclaimed “semi-benevolent dictator of Cream” is also the mastermind behind Mithril, an Ethereum-based social media platform. Huang is also the creator of Machi 17, a Taiwanese social media company boasting over 42 million users across its various apps and websites.

Jeffrey Huang, founder of Machi 17, Mithril, and Cream Finance. Image via Medium

Jeffrey Huang, founder of Machi 17, Mithril, and Cream Finance. Image via Medium While Cream Finance was initially supposed to launch on the Binance Smart Chain, the protocol was suddenly deployed on Ethereum on August 3rd starting with a liquidity mining pool called YOLO Alpha. The naming of the pool was meant to be a sort of tribute to yearn.finance creator Andre Cronje and others in the DeFi space with an all-in mentality.

Image via Medium

Image via Medium Cream Finance’s development has been quite erratic. A new update has been posted by the project via Medium almost every day since its launch in August. These updates reveal that the Cream Finance team is watching the DeFi space very carefully and skillfully picking out the elements which make other projects such as Compound Finance and Uniswap so successful.

Huang, who is the author of Cream Finance’s Medium updates, has also been lumping in other important DeFi news with each post such as the release of Curve Finance’s CRV token. He has also repeatedly thanked Compound Finance for their assistance in developing the protocol.

Cream Finance finally launched a second version of its protocol on the Binance Smart Chain on September 11th.

What is Cream Finance?

Cream Finance is a multipurpose DeFi protocol built on the Ethereum blockchain. It describes itself on its website as “a lending platform based on Compound Finance and an exchange platform based on Balancer Labs”.

This is just the tip of the iceberg as Cream Finance has been revealing new dimensions to the protocol on an almost bi-weekly basis since its launch in August. Cream Finance is currently in the process of transitioning to a community- governed decentralized autonomous organization.

The goal of Cream Finance is to push the boundaries of DeFi by creating and integrating better protocols based on existing ones. The protocol borrows uses source code from the likes of Compound Finance, Balancer, Curve Finance, Uniswap, and Blackholeswap.

None of this code has been audited, and Cream Finance creator Jeffrey Huang has made the bold claim that it does not need to be audited by anyone else than the entities which created it (e.g. Compound Finance should audit Cream’s Compound code).

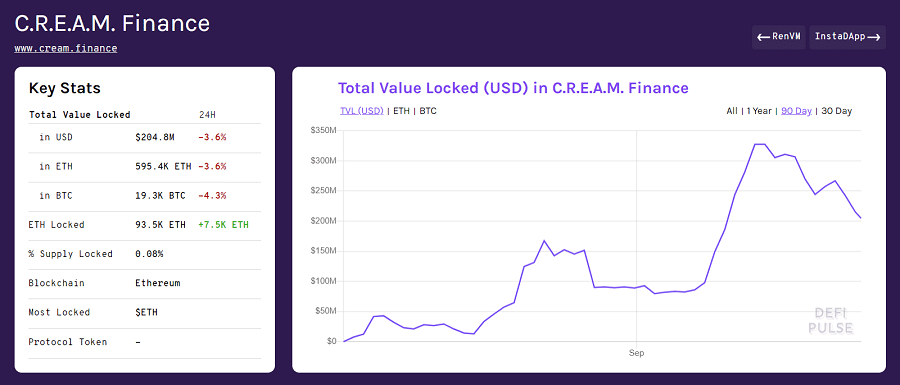

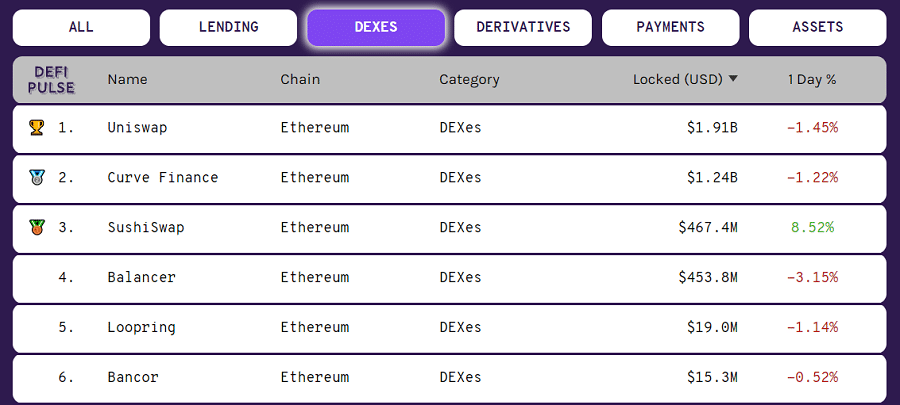

Cream Finance Assets Under Management. Image via Defipulse

Cream Finance Assets Under Management. Image via DefipulseCream Finance’s has been incredibly transparent since the outset with all the changes it has made to the protocol. The core Cream Finance team to consist of four people: founder Jeffrey Huang and three developers with extensive computer science backgrounds, one of which has also worked on OmiseGo and Ethereum. Around 200 million USD of cryptocurrency is currently locked in the protocol at the time of writing.

How does Cream Finance work?

As mentioned previously, there are many dimensions to Cream Finance and a new one is added almost every other week. At the time of writing, these can be grouped into the following categories: lending and borrowing, liquidity mining, governance, and various automated market maker protocols (DEX and DEX-like services). Most of these are identical in function to the protocols they are “forked” from.

Cream Finance lending

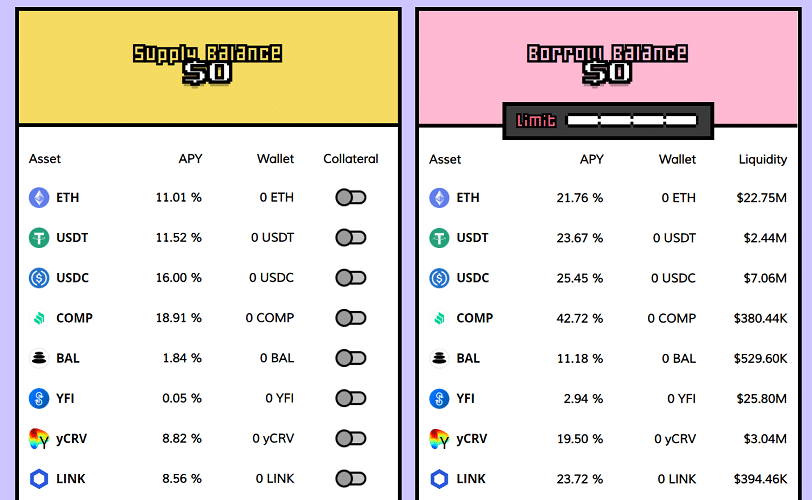

The first dimension of Cream Finance involves decentralized borrowing and lending services. This is what you see when you are on the Dashboard tab of the Cream Finance app. This protocol is almost an exact copy of Compound Finance save for one small detail that is hard to miss: many more cryptocurrency assets are supported for lending on borrowing on Cream Finance.

As with Compound Finance, to borrow cryptocurrency on Cream Finance you need to deposit an amount of cryptocurrency (in USD) which is greater than the amount of cryptocurrency you will be borrowing (in USD). This deposited crypto is referred to as collateral and having more money deposited than you are borrowing is referred to as overcollateralization.

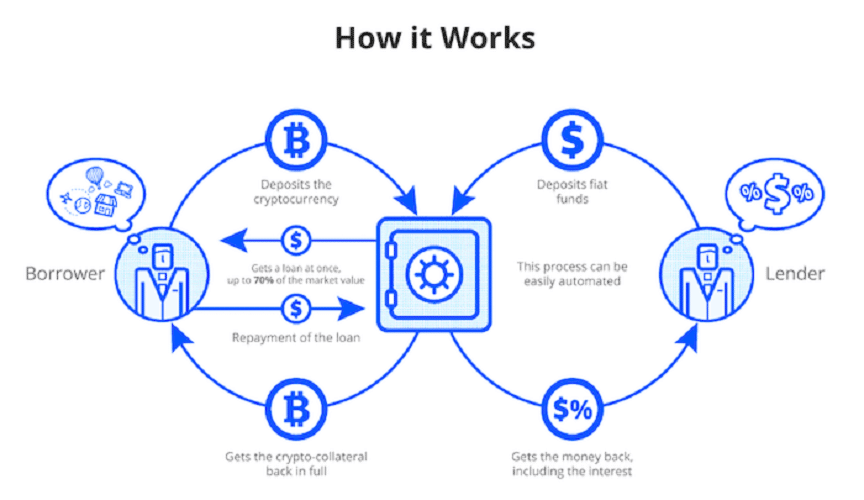

Peer to peer lending and borrowing illustrated. Image via Moonwhale.io

Peer to peer lending and borrowing illustrated. Image via Moonwhale.io You are currently allowed to borrow up to 60% of the USD value of the cryptocurrency you deposited. This may change in the future as the collateralization requirement has already changed twice since the protocol was launched. This is slightly less than the 66% you are able to borrow on Compound Finance.

In case you did not know, no personal documentation or credit checks are required to borrow cryptocurrency on Cream Finance and there is also no time limit on when you must pay back the loan. The catch is that if the USD value of your collateral falls such that you have now technically borrowed more than 60%, your collateral risks being liquidated (sold at a discount to other users of the platform).

To make it possible for you to borrow a cryptocurrency other than the type you deposited as collateral, Cream Finance incentivizes lenders to supply their cryptocurrency assets into a series of lending pools. The interest rates that lenders can make on deposited funds (and that borrowers will owe on borrowed funds) depends on the supply and demand for that asset, and lenders can withdraw at any time.

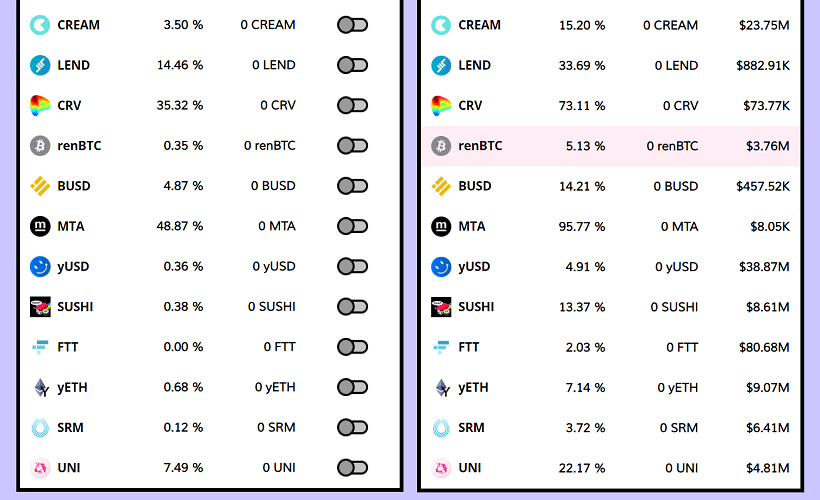

For example, the demand to borrow mStable’s MTA token is currently high, resulting in a comfy APY of over 50% for lenders who supply MTA to the protocol. Consequently, the interest rate to borrow MTA is likewise very high – nearly 100%.

This is to disincentivize borrowers from borrowing too much. Like Compound Finance, Cream Finance entices both lenders and borrowers to use the protocol by rewarding them with CREAM tokens when lending or borrowing.

Cream Finance liquidity mining

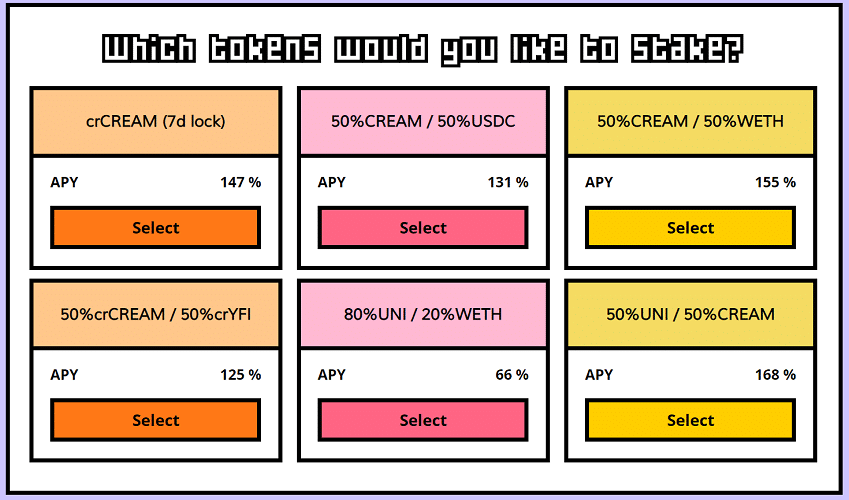

If you toggle the Reward or Pools tabs on the Cream Finance app you will be presented with a series of pools. Here you can stake cryptocurrency to receive even more incredible yields of nearly 200% (for some pools). Unless otherwise specified, you can withdraw these funds at any time.

As with other protocols such as Curve Finance, Cream Finance rewards those staking tokens in these pools by giving them a cut of the trading fees in Cream Finance Swap (DEX). The goal of liquidity mining on most protocols is usually to ensure sufficient liquidity for users who are swapping between assets on that protocol’s DEX.

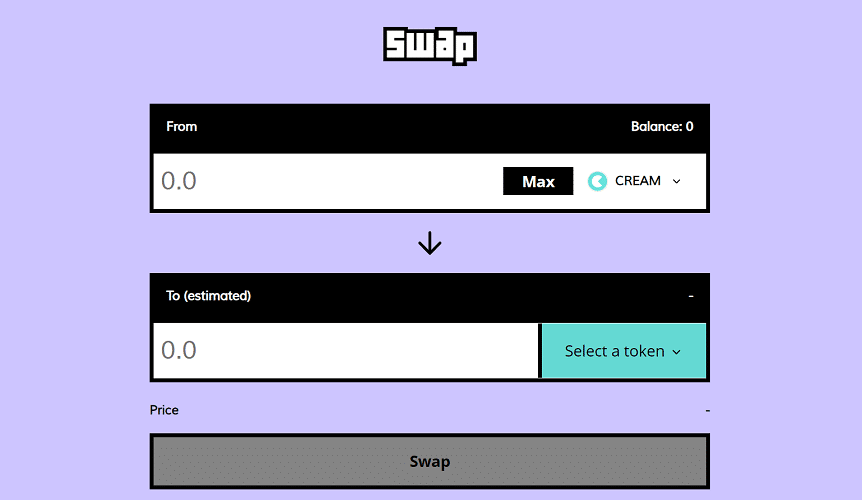

Cream Finance Swap

Released on September 4th, Cream Finance describes Swap as “a fork of Balancer with a Uniswap-like frontend”. In plain English, Cream Finance Swap is an automated market maker just like other DEXs like Balancer and Uniswap. In even plainer English, this means it is a protocol which uses the ratio of two assets in a pool to determine price instead of an order book like a centralized exchange.

We covered AMMs in depth in our Curve Finance article and they best explained with a simple example we detailed there:

“Imagine you have 10 Ethereum and 1000 USDC in a pool. This means each Ethereum is worth 100 USDC since the ratio is 1-100. Suppose someone comes and buys 1 Ethereum from the pool. Now that ratio has changed, and once you math it out, the price of Ethereum is now 111$USD.

This gives incentive to someone to arbitrage (take advantage of a price difference on two trading platforms) and buy 100$USD on another exchange like Coinbase, and sell it in this hypothetical pool for 111$USD, restoring the equilibrium (which is the actual current market price of the asset – 100$USD).”

Top DEXs in DeFi (Cream Finance is categorized a lending protocol on Defipulse). Image via Defipulse

Top DEXs in DeFi (Cream Finance is categorized a lending protocol on Defipulse). Image via Defipulse The biggest difference between Cream Finance Swap and other AMMs is lower fees. Cream Finance Swap only charges a 0.25% trading fee while the unofficial industry standard is 0.3%. 0.20% of these fees go to liquidity providers (the users depositing their funds into the pools in the previous section). The remaining 0.05% is allocated to the “Cream Finance network” (it is unclear what is meant by this).

Cream Finance DAO (Governance)

While the project had been hinting a transition to a DAO since it was released, this was officially announced by Cream Finance on September 2nd. While Cream Finance’s DAO is still in development, the Medium posts seems to indicate that it will take bits and pieces from other projects such as Aragon to build it. CREAM token holders will have governance, though it is unclear how voting will work at the current time.

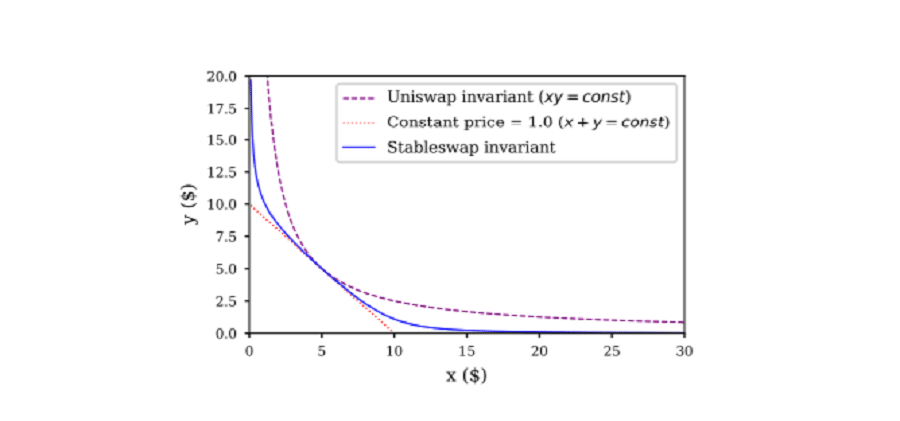

CreamY automated market maker

Inspired by Curve Finance, CreamY is an AMM which provides high liquidity swaps between cryptocurrency assets of the same value. This includes stablecoin-stablecoin swaps and swaps between wrapped versions of Bitcoin and Ethereum. The September 20th announcement of CreamY also hints that CreamY v2, the second version of the protocol, will feature more volatile crypto assets.

One “CreamY USD” featuring Andre Cronje. Image via Medium

One “CreamY USD” featuring Andre Cronje. Image via Medium CreamY v1 has not yet been launched but will likely function exactly like Curve Finance. This means that it will feature a modified bonding curve. While this is again covered in-depth in our Curve Finance article, the watered-down version is that the ratios of two assets in a given pool will be able to vary more without affecting the price.

Various bonding curves in AMMs. Image via the StableSwap whitepaper, Curve Finance's original whitepaper

Various bonding curves in AMMs. Image via the StableSwap whitepaper, Curve Finance's original whitepaper As with regular AMMs, these specialized stablecoin/stable asset AMMs reward liquidity providers by giving them a cut of the trading fees on the platform. While this has not been confirmed, CreamY will likely Curve Finance’s lead and also use those pools to provide liquidity to other protocols such as Compound Finance. This will theoretically further increase the yields for liquidity providers as they will earn both a cut of the trading fees on CreamY and the interest for being a lender on Compound.

CREAM Cryptocurrency

CREAM is an ERC-20 token built on the Ethereum blockchain. It is given to those who interact with Cream Finance by either lending, borrowing, or providing liquidity in its various protocols.

CREAM token holders will also have governance over Cream Finance and all its protocols once it has transitioned to a DAO, which is currently in progress. Some regard CREAM to be a more equitably distributed version of Compound Finance’s COMP token.

CREAM cryptocurrency ICO

There was no ICO for the CREAM cryptocurrency token. All tokens were pre-mined with an initial supply of 9 million CREAM. 67.5% of these tokens were burned on September 20th after community discussion, leaving a new max supply just shy of 3 million CREAM (2 992 500 to be exact).

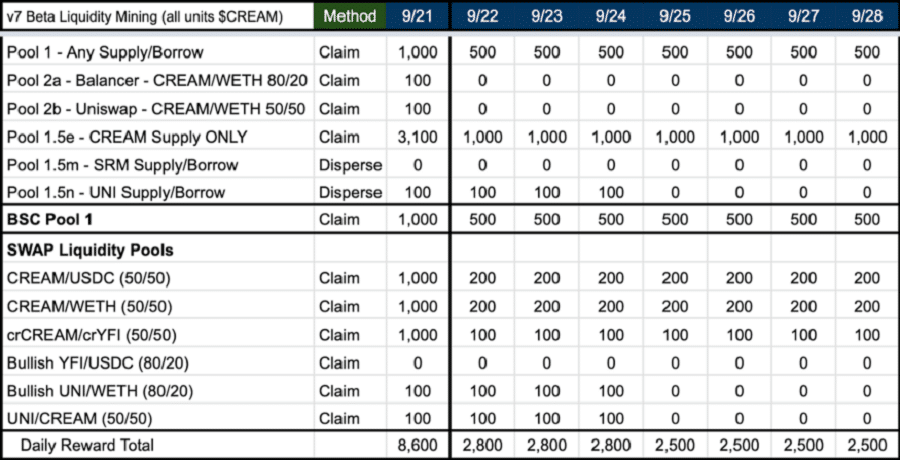

CREAM token distribution schedule for liquidity providers. Image via Medium

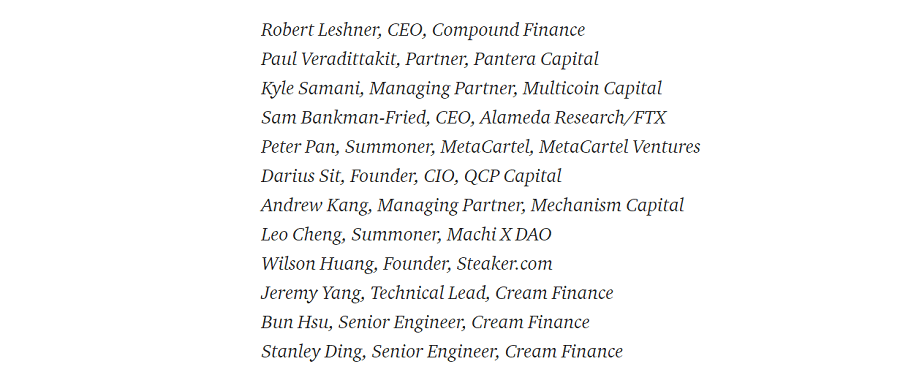

CREAM token distribution schedule for liquidity providers. Image via Medium Of this total supply, 61.5% has been reserved for liquidity providers, 23.1% has been allocated to the team and advisors of Cream Finance, 7.7% has been set aside for Compound Finance, and another 7.7% will go to seed investors.

While 92.5% of the total CREAM supply is in control of the team, these assets are held in a multi signature wallet. There are currently 12 wallet keyholders and the list includes individuals from Pantera Capital and Compound Finance along with the three aforementioned Cream Finance developers.

Cream Finance multisig wallet key holders. Image via Medium

Cream Finance multisig wallet key holders. Image via Medium Tokens allocated to Cream Finance’s team, advisors, seed investors, and Compound Finance will be released monthly over the course of a year starting on September 24th, 2020.

CREAM cryptocurrency price analysis

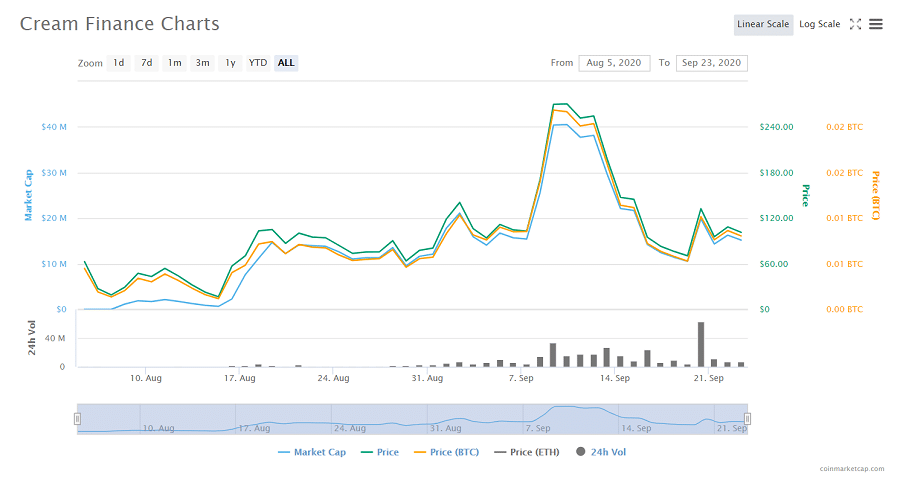

CREAM has a short yet impressive price history. Hitting a low of just over 12$USD shortly after its release on August 7th, one month later it was trading at a whopping 280$USD – a more than 20x increase in price!

CREAM cryptocurrency price history. Image via CoinMarketCap

CREAM cryptocurrency price history. Image via CoinMarketCap While the price of CREAM has since fallen to what appears to be a support level of around 100$USD, the token remains in a clearly visible uptrend.

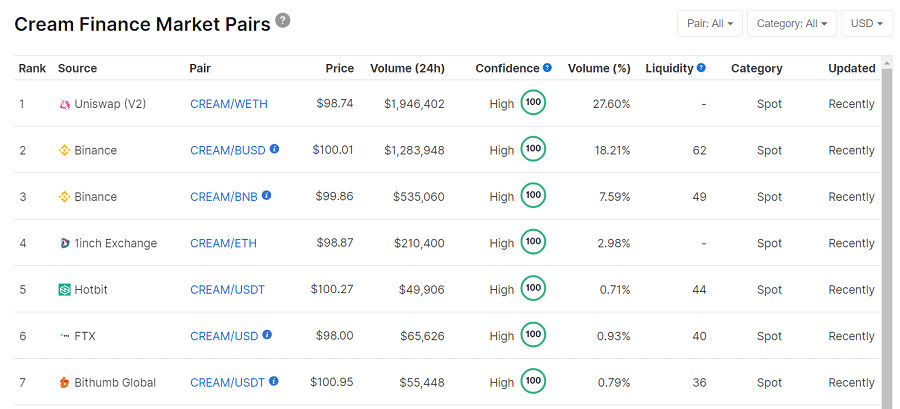

CREAM Exchange Listings

If you want to buy CREAM cryptocurrency your two best bets are Binance and Uniswap. Note that the latter is decentralized and will require a Web 3.0 wallet to interact with. You will also have to pay Ethereum network fees (gas) which have recently been quite expensive. As such, you are better off with Binance.

CREAM cryptocurrency markets. Image via CoinMarketCap

CREAM cryptocurrency markets. Image via CoinMarketCap Conversely, you can opt to farm some CREAM by borrowing, lending, or providing liquidity to protocols on Cream Finance.

CREAM cryptocurrency wallets

Once you are satisfied with all the CREAM you have accumulated, you are going to need somewhere safe to store it. Since CREAM is an ERC-20 token, it can be stored on just about any wallet that supports Ethereum based assets. Where you decide to store your CREAM will fundamentally depends on what you plan on doing with it.

Image via Ledger

Image via Ledger If you are planning to hold on to it long term, consider getting a hardware wallet such as a Ledger or Trezor. If you intend to participate in the governance of Cream Finance, a Web 3.0 wallet such as Metamask is your best bet. If you are somewhere in the middle, a mobile wallet such as the Atomic Wallet is the choice for you!

Cream Finance Roadmap

For the time being Cream Finance does not appear to have a clearly defined roadmap. Development has been quite spontaneous and fairly unpredictable. It is clear that Cream Finance is going around cloning some of the best DeFi protocols around.

However given that it has already cloned most of the major players in the DeFi space it is anyone’s guess as to what they will build next. It seems possible that the DAO will be completed before any more major changes are made. Once this is done, the future of the project will be in the hands of the community.

Why Cream Finance rules DeFi

If events such as Sushiswap’s migration of 1.16 billion USD from Uniswap have taught us anything, it is that the top protocols in the DeFi space are not immune to competition – quite the contrary. The open source nature of many of these projects makes it easy for crafty onlookers to launch their own versions.

Cream Finance sweater by loldefi. Image via Twitter

Cream Finance sweater by loldefi. Image via Twitter Although Cream Finance has not (yet) dethroned any of the big players, it has done a remarkably good job of integrating their functions and presenting them on what is fundamentally a more user-friendly platform.

This is not to say there are no issues with Cream Finance. The remarkably short token vesting schedule seems to fly in the face of the apparent long-term vision of the project, and the seeming disregard for safeguards such as code audits of the protocol is also concerning.

Despite not being entirely untangled from venture capitalists and seed investors, these relationships seem to be much less pronounced than with many of the projects Cream Finance is inspired by and based off.

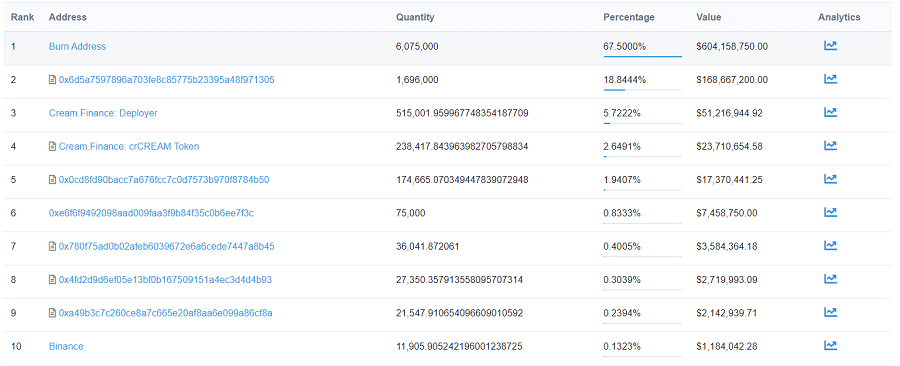

Largest CREAM token holders. Image via Etherscan.io

Largest CREAM token holders. Image via Etherscan.ioNow for the CREAM token. It is unclear how long it will it maintain its valuation given that the founding parties and investors have begun receiving their share of CREAM tokens. Still, the fact of the matter is that the price of CREAM depends on the relationship between supply and demand and it seems that Cream Finance is still waiting for its watershed moment; it has yet to truly take the DeFi world by storm.

While this is not necessarily a good thing, the relentless development behind the scenes gives the impression that it is only a matter of time before Cream Finance really takes off!