Quick Verdict

Crypto.com is a polished, mobile-first all-rounder with strong fiat ramps, a popular Visa card, and a deep feature set. Entry-tier and third-party on-ramp costs can sting, but fees improve with volume and CRO. Liquidity and derivatives breadth trail specialist venues. Excellent for everyday investing and card perks; not the first stop for fee hawks or perp die-hards.

Who It’s For

- Everyday users who want easy bank/card on-ramps

- Mobile-first investors who value a clean app and portfolio tools

- Card-rewards seekers and long-term holders using yield products (where available)

Who Should Consider Alternatives

- Fee-sensitive traders operating at low volumes

- Pro derivatives traders needing maximum depth and instruments

- Users in regions with limited feature availability

Top Alternatives to Consider

- Coinbase: Regulated, beginner-friendly on-ramp with clear UX and strong compliance.

- Kraken: Security-first; responsive support and advanced spot/margin.

- Binance.US: Low spot fees and solid liquidity in the U.S., but a narrower product set.

Crypto.com Quick Facts

| Fact | Details |

|---|---|

| Cryptocurrencies Supported | US: 400+; Global: 400+ (includes BTC, ETH, SOL, and altcoins) |

| Trading Fees (Maker/Taker Range) | Base: 0.25% / 0.50%; with tiers/CRO: down to 0% / 0.075% |

| Funding Methods | ACH: Free (US); Wire: Free; Card: 2.99% |

| Typical Withdrawal Fees | BTC: 0.0006 BTC (~$36); ETH: ~0.004 ETH (~$10); USDT: 1–5 USDT (network-dependent) |

| Products | Exchange (spot/futures); App (buy/sell/earn); Visa Card (up to 8% cashback); Earn (up to 19% APY); DeFi Wallet (non-custodial); NFT (marketplace) |

| Availability | Over 100 countries (US full except NY limits; EU/UK/SG compliant); restrictions in 80+ (e.g., Afghanistan, Algeria, Cuba) |

What Is Crypto.com? Platform Overview & 2025 Updates

Crypto.com is a full-stack crypto platform: app + exchange, Visa card, staking/earn, and DeFi rails, positioned between breadth and compliance. It shines on mobile UX, ecosystem perks tied to CRO, and expanding regulated products (CFTC-regulated options in the US, on-chain staking on web). Trade-offs are mid-pack base fees (improve with CRO/VIP), occasional support lag, and region-gated features.

Background & history

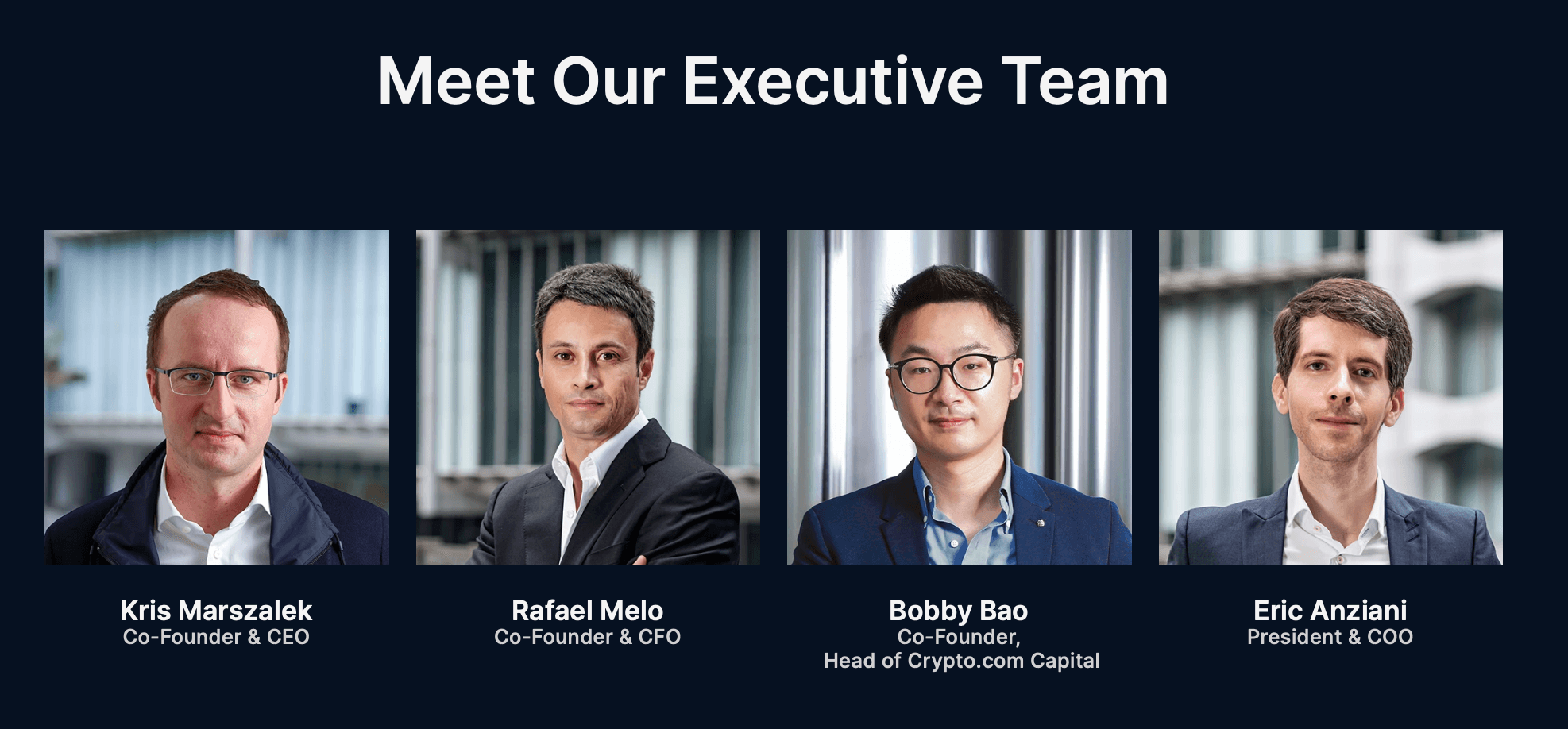

Founded in June 2016 by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo, Crypto.com grew from a “make crypto usable” idea into a buy-trade-earn ecosystem.

Most of the Original Founders are Still on the Executive Team Which is Usually a Good Sign of Confidence | Image via crypto.com

Most of the Original Founders are Still on the Executive Team Which is Usually a Good Sign of Confidence | Image via crypto.comKey milestones:

- In 2022, the team expanded its venture arm to a $500 million fund.

- 2024–mid-2025 user growth past 100 million

- Ongoing: expanding security to acquire SOC/ISO/PCI certifications and support for 400+ assets.

The company markets fast execution, a polished app, and strict compliance as core pillars.

2025 highlights

In September 2025, on-chain staking expanded to the web platform with up to 13% rewards on 30+ tokens and a “Level Up” program (zero trading fees tiers, high-yield cash returns, up to 6% CRO back). Institutional custody deals pushed CRO higher in Q3. The roadmap adds a native stablecoin, ETF listings (via Foris Capital US), tokenized stocks, Crypto Baskets, Sports Contracts, and a U.S. prediction market. A high-profile CRO custody/staking deal in August boosted visibility.

Positioning & who it’s for

Crypto.com pitches itself to both newcomers and active traders who want fiat on-ramps, staking/earn, and a rewards card in one app, framed as “America’s premier crypto platform.” Differentiators: compliance footprint, rewards tied to CRO, and growing TradFi-style products.

Crypto.com's positioning compared to competitors:

| Competitor | Target Audience/User Profile | Unique Value Prop vs. Crypto.com |

|---|---|---|

| Coinbase | Beginners, U.S.-focused investors; user-friendly for novices. | Crypto.com offers lower fees and more earning options (e.g., staking yields, Visa rewards); Coinbase has higher fees but stronger beginner education. |

| OKX | Advanced traders, global users; high-volume spot/futures. | Crypto.com emphasizes security and rewards; OKX leads in trading volume but lacks Crypto.com's Visa integration and broad earning perks. |

| Binance | Global, low-cost traders; beginners to pros with advanced tools. | Crypto.com provides better security certifications and U.S. compliance; Binance has massive volume (4x Bybit/OKX) and lower fees. |

| Kraken | Security-focused, long-term investors; advanced users. | Both prioritize security, but Crypto.com adds earning yields and Visa perks |

How to Get Started

The registration and onboarding process for Crypto.com is straightforward and familiar. Users with experience using other centralized exchanges will find it easy to follow, while new users have the flexibility of using emails for registration. KYC is mandatory for using this platform, and certain features or fiat rails may differ by location.

Here are the broad steps for registration, funding and trading:

Registration & KYC

Goal: create your account and unlock full features.

Crypto.com Registration Process is Simple and Straightforward | Image via crypto.com

Crypto.com Registration Process is Simple and Straightforward | Image via crypto.comSteps

- Get the app / sign up: Download Crypto.com on iOS/Android or click Sign Up on crypto.com.

- Create account: Enter a valid email → confirm via the verification link.

- Verify phone: Add your number with country code → enter the 6-digit SMS code.

- Set passcode: Create a 6-digit app passcode (enable biometrics if offered).

- Start KYC: In the app, follow the verification prompt.

- Enter your legal name (match your ID exactly).

- Upload a government ID (passport preferred; DL/National ID accepted).

- Complete the selfie/liveness check.

- Submit & wait: Status shows Verification Pending. Reviews usually complete within hours to a couple of business days. If it stalls beyond 3 business days, use in-app chat.

- Region-specific add-ons: Some features (e.g., Visa Card tiers/perks) may require staking CRO; this is separate from KYC.

Tip: Turn on 2FA (Authenticator app) under Security before funding.

Funding with Fiat

Goal: add USD/EUR (or your local currency) so you can buy crypto.

Crypto.com Supports Wire Transfers and Instant Pay Options | Image via X

Crypto.com Supports Wire Transfers and Instant Pay Options | Image via XBank Transfer (Fiat Wallet)

- Accounts → Fiat Wallet (or Deposit → Fiat).

- Set up currency: Tap + Set Up New Currency (e.g., USD, EUR).

- Provide details: Expected transaction volume, income bracket, occupation, address.

- Get bank instructions: You’ll see your unique transfer details (SEPA for EUR, Wire/SWIFT for USD).

- Send from your bank: Include any reference code shown in-app.

- Settle: Funds typically arrive in 1–3 business days and appear in Fiat Wallet.

Card / Apple Pay / Google Pay (instant buy)

- Buy → choose a coin.

- Select payment method: Add a card, or choose Apple Pay / Google Pay.

- Confirm: Review fees, enter amount, and authorize. Purchases convert directly into crypto.

Note: Availability of methods varies by region and requires completed KYC.

Your First Spot Trade

Goal: place a simple buy/sell at market price.

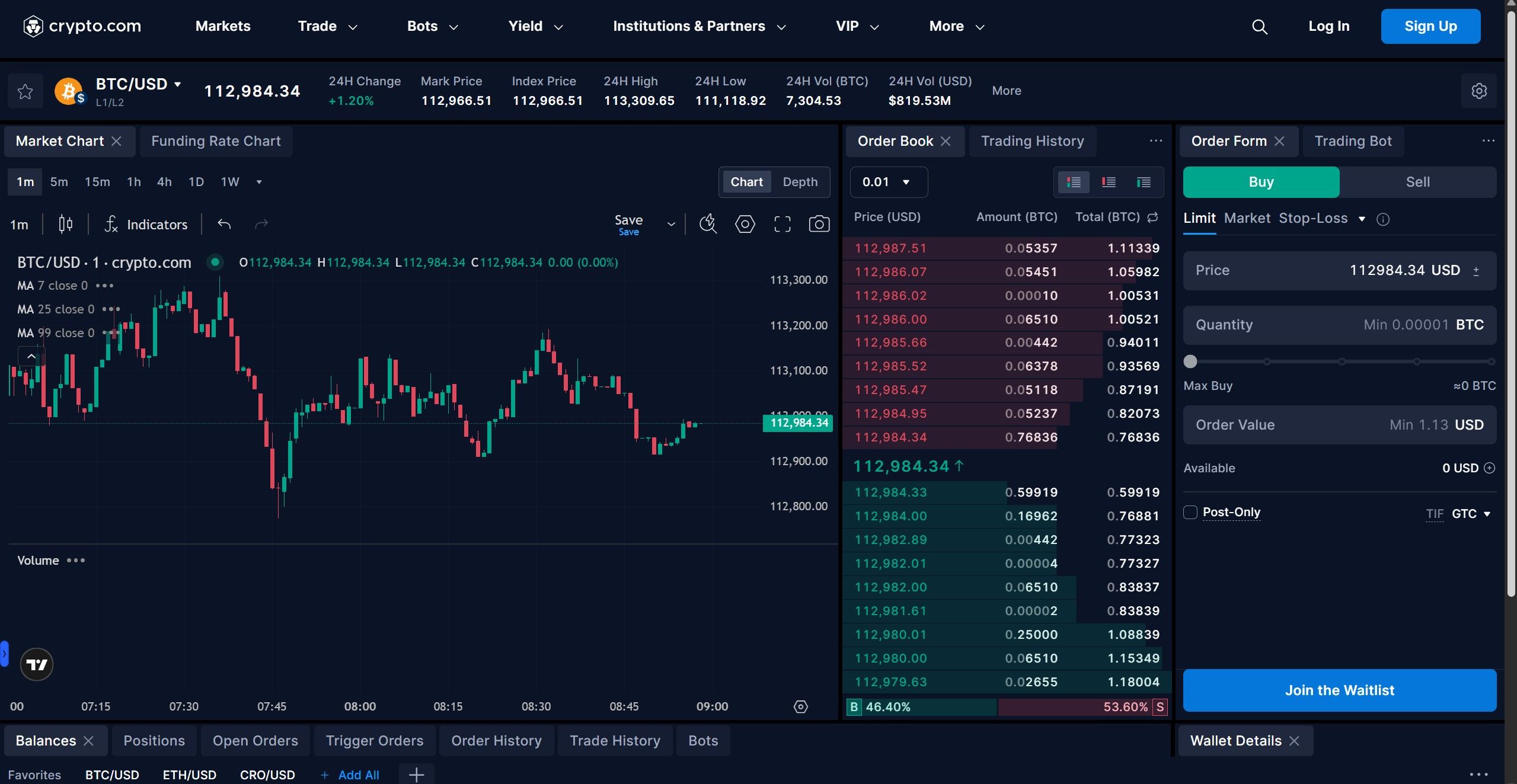

Crypto.com Spot Trading Interface | Image via Crypto.com

Crypto.com Spot Trading Interface | Image via Crypto.comSteps

- Log in: exchange.crypto.com (web) or via the app’s Exchange section.

- Transfer in funds: Transfer/Deposit from App Wallet to Exchange Wallet if needed.

- Trade → Spot. Search and select a pair (e.g., BTC/USDT).

- Choose order type: Market (instant) or Limit (your price).

- Enter amount → Review fees/slippage → Buy/Sell.

- Track it: Check Open Orders / Trade History; filled assets show in your wallet.

Good practice: Start small, enable price alerts, and keep 2FA on.

Crypto.com Trading Features

Trading features at a glance: Crypto.com lines up well with the big exchanges, offering hundreds of assets and pairs for spot trading, plus derivatives and US-regulated options for eligible users.

Binance and OKX still lead on derivatives depth and headline leverage, while Bybit competes on perps and options; Coinbase focuses on CFTC-regulated futures in the US. Crypto.com’s pitch sits between breadth and compliance: broad spot coverage, a growing derivatives lineup, and CFTC-regulated Strike/UpDown options access for US users where available.

Token Coverage & Pairs (Sept 2025)

- Assets: 400+ cryptocurrencies supported across the platform as of September 2025.

- Pairs: ~480 spot pairs on the Exchange; majors and liquid alts dominate base markets (USD, USDT, CRO).

Markets You Can Trade

- Spot: Buy/sell across 4000+ assets; Exchange lists ~480 pairs. Market, limit and stop-loss orders + trading bots also available

- Perpetuals & Futures: Derivatives on majors and select alts; account leverage up to 50x supported in product docs (availability depends on jurisdiction and instrument).

- Options (US): UpDown and Strike options offered via a CFTC-regulated venue for US users; underlyings include BTC, ETH (and select majors).

- Note: Leverage limits and product access differ by country; margin/derivatives face geo-restrictions.

Wallets, Accounts & Syncing

- App (custodial) for buys, fiat, card; Exchange for spot/margin/derivatives; Onchain (DeFi Wallet) for self-custody.

- Fast transfers: Move funds instantly and fee-free between App ↔ Exchange.

- Link DeFi Wallet: Connect Onchain to the App for a unified view and easy moves.

Web vs. Mobile: Tools & UX

- Mobile App: Simple flow for quick buys, alerts, staking, card; TradingView charts integrated (core overlays/indicators).

- Web/Exchange: Pro interface with TradingView (multi-chart layouts, indicators) and API/bot support (e.g., TWAP bot on select pairs).

- Performance claims (Exchange US): “64M TPS matching engine” and “370-ns core latency.” (Vendor claim; actual user experience varies by route and venue.)

Bottom line: Broad spot coverage, region-gated derivatives/options, and a clean split between App (simple) and Exchange (advanced), with instant internal transfers and TradingView across platforms.

Crypto.com App Review (iOS & Android)

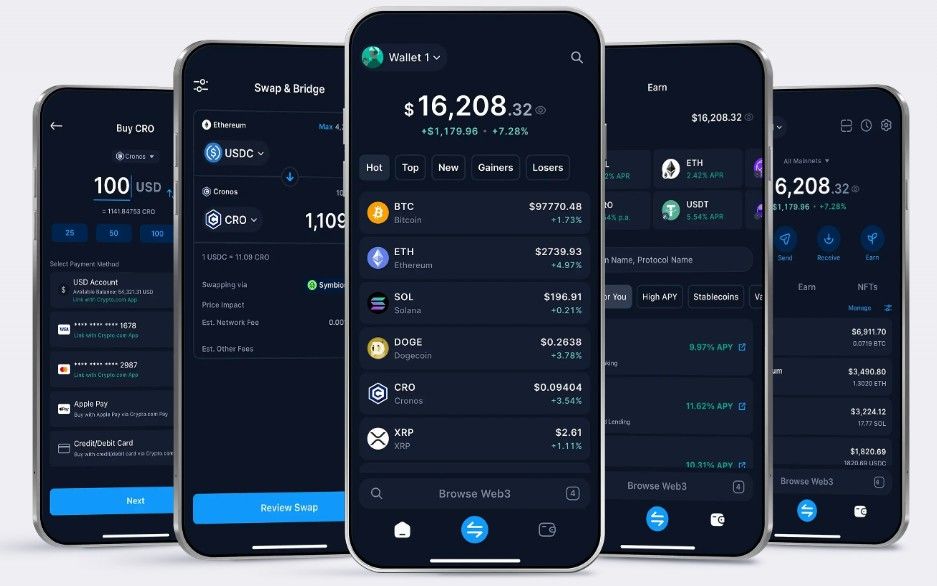

Crypto.com has mobile apps for iOS and Android that extend the web's most features to mobile. Users can access all the markets, crypto earn rewards, on/off ramp funds and even access DeFi integration with the wallet. Here are the essential features and their parity with the web version:

- Coverage: Buy, sell, trade, stake, and manage all supported cryptocurrencies, fiat deposits and withdrawals; Crypto Earn, and Visa Card integration also available. Access DeFi tools through the Onchain wallet, crypto baskets, and basic charting.

- Crypto.com Web: Mirrors most mobile functions like trading and portfolio management. Some mobile-first items are limited on the web in certain regions, for example, direct fiat purchases and full card controls.

- Exchange features: Advanced trading, deeper order books, and higher leverage up to 50x live on the Crypto.com Exchange interface. The retail app does not fully replicate the experience on the web version.

Verdict: Mobile covers roughly 80–90% of web features. Web excels at analytics and multi-screen workflows, mobile prioritizes on-the-go access and rewards.

A Look at the Mobile App UI | Image via Crypto.com

A Look at the Mobile App UI | Image via Crypto.comRatings and rank vs peers (Sept 2025)

- Crypto.com: 4/5 on Google Play, 4.7/5 on the App Store. Frequently in the top 100 in Finance in the US.

- Coinbase: 4.4/5 on Google Play, 4.7/5 on the App Store. Often top 10 in Finance.

- Binance (global): 4.5/5 on Google Play, 4.8/5 on the App Store. Binance. US has around 4.3/5 on Google Play.

Takeaway: Competitive ratings overall. Coinbase leads for beginner appeal on iOS, Binance scores higher on iOS globally, while Crypto.com remains strong in Finance category rankings.

High-level review

What works well

- All-in-one experience for retail users, with simple funding and integrated Earn and Visa Card perks.

- Smooth onboarding, clear design, basic charts that are easy to read.

- Security messaging is strong, including cold-storage custody and industry-standard controls.

Where users report friction

- Fees on certain flows due to spreads.

- Customer support response times can lag during peak activity.

- The breadth of modules can feel busy for first-time users.

UX compared with other exchange apps

- Crypto.com: Modern, feature-rich, intuitive for core tasks like buying crypto and staking. Rewards visualization is a standout. Some users find the app crowded due to the wide surface area that now spans crypto, stocks, and extras.

- Coinbase: Minimalist flows and very clear onboarding. Best for newcomers who want straightforward buys and simple portfolio views.

- Binance: Suited to advanced traders who want depth, custom layouts, and the broadest pair list. It can feel complex, and US access is narrower.

Positioning: Crypto.com trails Coinbase on simplicity, often edges Binance for integrated rewards and fiat bridging, and sits in the middle for power tools when paired with the Exchange.

Section takeaway: If you want one app for retail crypto with strong fiat rails, rewards, and card integration, Crypto.com delivers. For the simplest beginner path, choose Coinbase. For maximum trading depth, pair Crypto.com with its exchange or consider Binance, where available.

Fees & Cost Analysis

Crypto.com's trading fees follow a maker/taker model, where makers (who add liquidity via limit orders) pay lower fees than takers (who remove liquidity via market orders). Fees are tiered based on 30-day spot trading volume in USD, with additional discounts for holding or staking CRO. Here are the fee details for Crypto.com in the US. Exact fees can vary by region or network conditions.

| Category | Condition / Tier | Fee / Rate | Notes |

|---|---|---|---|

| Trading (Spot) | Entry Level 1 (<$10k / 30d) | 0.25% maker / 0.50% taker | Maker/taker model; volume-tiered |

| Entry w/ CRO balance/stake | 0.00% maker / 0.44% taker | CRO balance/stake required | |

| Higher retail tiers | Taker ~0.05% (top retail) | Steps down as volume rises | |

| VIP1 (≥$2.5M / 30d) | 0.065% maker / 0.10% taker | CRO can add rebates | |

| VIP5 | Near-zero | Exact rates vary by tier | |

| Fiat Deposit | ACH (US) | Free | Min $1; high limits |

| Wire (inbound) | Typically free | Your bank may charge | |

| Card purchase/top-up | ~2.99% (some top-ups ~1%) | Varies by method/issuer | |

| Fiat Withdraw | ACH | Free | — |

| Wire (outbound) | ~$15–$25 | Bank-dependent | |

| Crypto Withdraw | On-chain transfer | Network-dependent | Gas/fees vary by chain/congestion |

| Visa Card | Annual / issuance / replacement | $0 | Generally free |

| Top-ups | ~1% | Method-dependent | |

| ATM withdrawals beyond free monthly cap | 2% | Cap varies by tier (~$200–$1,000) | |

| FX | ~0–0.5% spread in rate | Uses interbank rate; no separate fee |

Trading Fees (maker/taker)

Trading fees are tiered by 30-day spot volume with extra discounts for holding/staking CRO.

- Entry tier (Level 1, <$10k 30-day volume): 0.25% maker / 0.50% taker. With a CRO balance: 0.00% maker / 0.44% taker.

- Higher tiers: Fees step down as volume rises; top retail tiers reach ~0.05% taker.

- VIP (≥$2.5M spot over 30 days): from 0.065% maker / 0.10% taker (VIP1) to near-zero at VIP5. CRO can add rebates on top.

Funding & Withdrawals

Fiat deposit fees are as follows:

- ACH (US): Free (min $1; high daily/monthly limits).

- Wire: Typically free inbound; banks may charge.

- Card: ~2.99% for direct card purchases/top-ups (some top-ups ~1%).

Fiat withdrawal fees are as follows:

- ACH: Free.

- Wire: Often $15–$25 (bank dependent).

On-chain withdrawal fees are mostly network-dependent.

Visa Card Fees

- Fees: No annual fee; issuance/replacement generally free. Top-ups ~1% in some cases.

- Rewards: 1–8% back in CRO depending on tier/stake.

- ATM: Free monthly allowance by tier (e.g., ~$200 to ~$1,000); 2% beyond the cap.

- FX: No separate foreign fee; uses interbank rates with small spread (~0–0.5%) baked into the rate.

Hidden/Indirect Costs to Watch

Beware of these indirect fees:

- App spreads on instant buys/sells: often ~0.5–2% versus the Exchange order book.

- Slippage: 1–5% on large or illiquid trades during volatility.

- Network congestion: On-chain gas (ETH, BTC) can dominate small withdrawals.

How to minimize

- Use the Exchange with limit orders instead of instant App buys.

- Batch withdrawals; choose low-fee networks (e.g., TRON for USDT).

- Stake/hold CRO for fee rebates.

- Trade during calmer periods.

Crypto.com Fees vs Other Exchanges

Here is a fee comparison table between Crypto.com and other leading exchanges:

| Exchange | Base Spot Fee (Maker/Taker) | Typical BTC WD | Typical ETH WD | ACH Deposit | Card Deposit |

|---|---|---|---|---|---|

| Crypto.com | 0.25% / 0.50% | ~$36 | ~$10 | Free | ~2.99% |

| Coinbase | 0.40% / 0.60% | $30 | $12.5 | Free | N/A (1–3% via card rails) |

| Kraken | 0.25% / 0.40% (<$10k) | Network-only (~$20) | Network-only (~$8) | Free / ~$4 | N/A |

| Binance | 0.10% / 0.10% (lower w/BNB) | Network-only (~$5–10) | Network-only (~$3–5) | Free | ~1–2% |

Takeaway

Crypto.com sits mid-pack on entry fees, improves meaningfully with CRO and volume, and becomes institution-friendly at VIP. Real costs hinge on order type, spreads, and network fees, use the Exchange, plan withdrawals, and pick networks wisely.

Deposits, Withdrawals & Payment Options

Crypto.com supports a wide range of fiat rails and on-chain transfers, with costs driven mainly by your region, payment method, and the network you withdraw on. Expect free or low-cost bank transfers in most regions, card fees on instant purchases, and variable network fees for crypto withdrawals.

Supported Fiat & Methods

- Fiat: 60+ currencies (USD, EUR, GBP, CAD, AUD, BRL, SGD, TRY, more). Availability depends on KYC level and country.

- Bank transfers:

- US (USD): ACH: free; instant for eligible banks.

- EU (EUR): SEPA: free; ~1–2 business days.

- UK (GBP): Faster Payments: free; same day.

- Global: SWIFT: bank fees may apply.

- Cards & wallets: Credit/debit cards (~2.99%), Apple Pay/Google Pay (region-dependent), PayPal/Wise in select markets.

Tip: Bank transfers are usually fee-free; cards are instant but costlier.

Withdrawal Flow & Timelines

Prerequisites: Completed KYC; linked bank account for fiat transactions; whitelisted address for crypto transactions recommended.

Security holds: After device changes, large transfers, or recent KYC updates, holds of 24–72h can apply.

Crypto withdrawals:

- Internal (App ↔ Exchange): instant.

- External: typically minutes to ~2–3 hours (review + chain confirmations).

- Fees vary by asset/network (e.g., BTC ~0.0006 BTC; ETH ~0.004 ETH; USDT 1–5 on TRON vs higher on Ethereum).

Fiat withdrawals:

- ACH/SEPA/FPS: usually free, ~1–2 business days.

- SWIFT (USD): $25–$45 typical bank fees, 3–5 business days.

Avoiding mark-ups & unnecessary costs

- Trade venue: Use the Exchange with limit orders to avoid App instant-buy spreads (~0.5–2%).

- FX awareness: If moving across currencies, consider converting via USDT/USDC or use the Visa Card’s interbank rate instead of bank FX.

- Network choice: Withdraw stablecoins on low-fee networks (TRON, Polygon) rather than Ethereum during congestion.

- Timing: Send on weekends/evenings (UTC) to dodge gas spikes.

- Batching: Combine smaller withdrawals to avoid minimums eating into funds.

- CRO benefits: Holding/staking CRO can unlock fee rebates.

Takeaway: Use fee-free bank rails for fiat, the exchange for tight spreads, and low-fee networks for stablecoins. Keep KYC current, whitelist addresses, and time transfers around gas conditions. Done right, funding and withdrawals on Crypto.com are fast, predictable, and cost-efficient.

Crypto.com Visa Card Guide

Crypto.com’s Visa lineup ties card perks to CRO commitment. You choose either a CRO stake or a monthly subscription on select tiers, then earn CRO cashback plus travel and subscription benefits. In 2025, a Signature Visa credit card joined the long-standing debit card, but the debit product remains the primary path for crypto spending. Rewards scale quickly with tier, while lockups and CRO exposure are the key trade-offs.

Crypto.om Offers Tiered Credit Cards in Partnership With Visa | Imagie via Crypto.com

Crypto.om Offers Tiered Credit Cards in Partnership With Visa | Imagie via Crypto.comTiers, stake or subscribe

- Midnight Blue: No stake.

- Ruby Steel: $500 CRO stake or $4.99/month.

- Jade Green: $5,000 CRO stake or $29.99/month.

- Royal Indigo: $50,000 CRO stake.

- Icy White: $500,000 CRO stake.

- Rose Gold / Obsidian: $1,000,000 CRO stake each.

Stake values reference CRO’s USD price at lock. Annual subscriptions have a ~16% discount on eligible tiers.

Lockups, cooldowns, downgrades

- Lockup: 12 months. Funds cannot be withdrawn during this period.

- Cooldown after unstake: 28 days before CRO becomes transferable; rewards keep accruing during cooldown.

- Downgrade effects: Immediate loss of higher-tier perks if stake or subscription conditions are not met. No explicit penalty, but opportunity cost applies if CRO price falls during lock.

Rewards and perks

Cashback in CRO (instant):

- Midnight Blue: 0–1.5% (often travel only)

- Ruby Steel: 2% every day, cap ~$25/month, up to 5% travel

- Jade Green: 3% everyday, cap ~$75/month, up to 10% travel

- Royal Indigo / Icy White: 4–5% day, uncapped, up to 15% travel

- Rose Gold / Obsidian: 8% everyday, uncapped, up to 15% travel

Subscriptions and lounges:

- Spotify/Netflix: none on Midnight Blue; 3 months Spotify on Ruby; 6 months both on Jade; ongoing rebates from Royal Indigo upward (typical caps apply).

- Priority Pass: none on lower tiers; limited visits on Jade annual subscribers; unlimited with +1 guest from Royal Indigo upward.

Regional availability

Issued in 150+ countries, with regional entities and varying benefits. SEPA integration supports EU and UK users, ACH is common in the US. Availability and specific perks can differ by market, and US users may face additional compliance rules on crypto rewards. Always confirm your region’s card issuer and benefit table.

Real-world usage

- Every day spend: Load via fiat or crypto in the app, then pay at any Visa merchant. Example: $1,000 monthly on Jade Green yields ~$30 in CRO plus a Netflix rebate. Crypto top-ups often carry a 1% load fee; fiat top-ups can be cheaper.

- Travel: Higher travel rates (up to 15% on select bookings), no separate foreign fee, interbank FX with a small embedded spread (~0–0.5%). Priority Pass can save $30–50 per lounge visit.

- ATM: Free withdrawals within a monthly tier cap (about $200 to $1,000), then 2% on overage. Local bank ATM fees may still apply.

Crypto.com Staking Relaunch (September 2025)

Crypto.com rebooted staking as part of Level Up, extending it to the web interface and tightening links to the mobile app and DeFi. The relaunch brings zero-fee trading promos, QR-code flows, and headline yields up to 14% APY on select assets, plus occasional campaigns (e.g., ETH staking paid in BTC).

Crypto.com Has Relaunched Staking With Higher Rewards and Wider Coverage | Image via Crypto.com

Crypto.com Has Relaunched Staking With Higher Rewards and Wider Coverage | Image via Crypto.comSupported assets & indicative APYs

- Breadth: 30+ coins and stablecoins now supported on web and mobile.

- Examples: BTC (up to ~4%), ETH (~5%), SOL (~7%), DOT/ATOM (~12%), AVAX (~7.25%), TIA (~10%); stables (USDT/USDC/DAI/USDP) included.

- Variance: Rates depend on asset, term, and region; typical range 0.25%–13.74%.

Staking modes & payouts

- Flexible: No lock, lower APY.

- Fixed terms: 1–3 months for higher APY; optional auto-restake.

- On-chain option: Stake from a non-custodial wallet for greater control.

- Payout math: Rewards accrue as a simple daily rate, paid weekly in the staked asset (no compounding by default).

CRO staking: ecosystem unlocks

- Yield: Up to ~9.5% APY on CRO with Level Up enhancements; flash promos can run higher.

- Fee rebates: Up to 50% off maker/taker; lower effective trading costs and potential VIP access for high activity.

- Card tiers: CRO stakes from $500 → $1M unlock Visa Card cashback (1–8%), subscription rebates, and lounge access.

Earn program updates

- Coverage: 20+ coins/stables overlapping with staking (BTC, ETH, USDT, USDC, etc.).

- Earn Plus: No tiered quotas; simpler allocations.

- Caps: Campaign-specific (e.g., “500 ETH at 6% p.a.” or “1M ONE at 10% p.a.”).

Risks to weigh

- Counterparty: Custodial exposure to Crypto.com; no FDIC insurance on crypto.

- Protocol: Smart-contract, validator, or bridge risks for on-chain stakes.

- Slashing: Up to ~5% if a validator underperforms.

- Rate drift: APYs adjust with markets; headline figures can drop.

- DeFi add-ons: Impermanent loss where LP strategies are involved.

How it compares

- Coinbase: ~2–10% APY on fewer assets; strong compliance, lower top rates.

- Binance: Up to ~16% across a broader menu.

- Kraken: ~1–13% with a conservative stance.

- Crypto.com: Competitive top-end yields (to 14%), plus CRO-linked fee rebates and card perks at the cost of custodial risk and CRO exposure for maximum benefits.

Takeaway: The relaunch significantly enhances staking breadth, UX, and headline yields, especially when you also stake CRO and utilize Level Up perks. If you want integrated rewards and can tolerate custodial and rate risks, it’s a compelling package; if you prioritize minimized counterparty risk, on-chain-only options (e.g., native staking or liquid staking protocols) remain the safer route.

Security & Regulatory Compliance

Crypto.com pairs a hardened security stack with broad regulatory coverage. Below is a concise view of how accounts are protected, how assets are custodied and insured, what third-party assurances exist, and where the platform is licensed.

Security Stack

- Account controls: Mandatory MFA (authenticator/passkeys/U2F), anti-phishing codes, device/session management, real-time alerts.

- Withdrawals: Address whitelisting with verification before external transfers.

- Custody: Operational hot wallets are minimized; 100% of client crypto is held in cold storage with strict multi-sig/HSM access.

Certifications & Audits

- Frameworks & certificates: SOC 2 Type II; PCI DSS v4.0 L1; ISO/IEC 27001, 27701, 22301; NIST CSF/Privacy (Tier 4).

- Testing & disclosure: Ongoing pen-tests, public bug bounty (HackerOne).

- Proof of Reserves: User-verifiable Merkle proofs; ongoing attestations (most detailed AUP published in 2022).

Insurance & Custody Model

- Coverage: Up to $750M total crypto insurance (incl. cold-storage coverage); scope excludes user-side negligence.

- Fiat: USD balances at partner banks FDIC-insured up to $250k per user (bank failure only).

- Segregation: Client assets held 1:1, not commingled with company funds.

Regulatory Footprint (Sept 2025)

- US: FinCEN MSB; state money-transmitter licenses incl. NY BitLicense; CFTC-regulated derivatives where offered.

- EU/UK: MiCA/MiFID permissions via EU entities; FCA authorization in the UK.

- Singapore: Major Payment Institution license under the Payment Services Act.

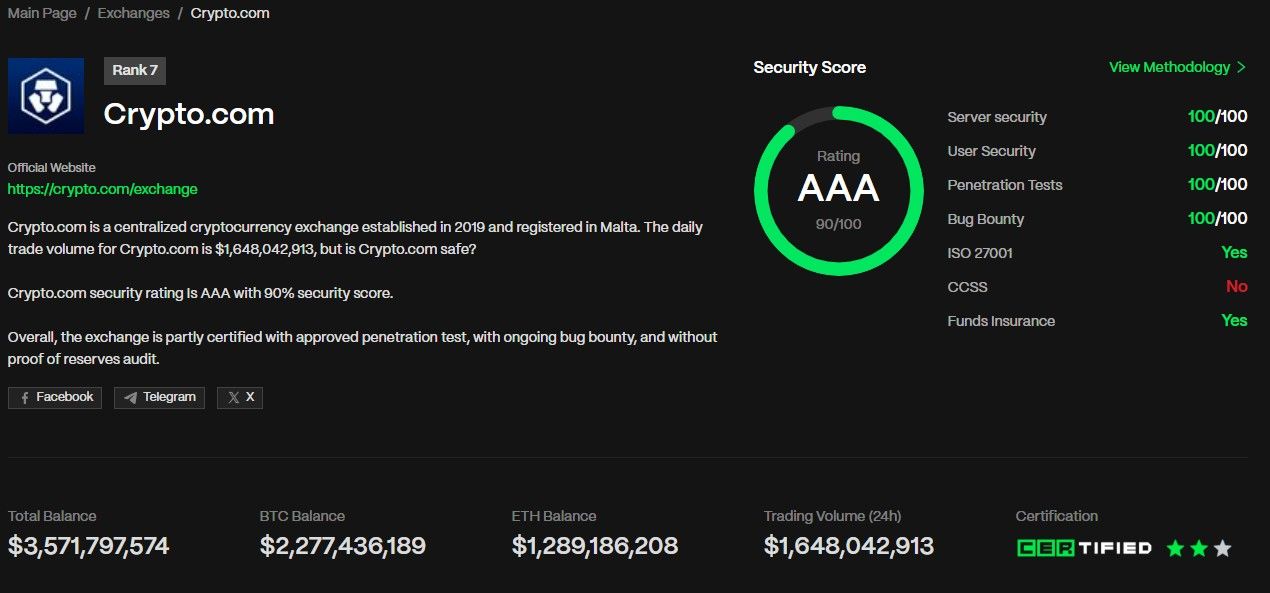

Crypto.com Safety

CER.live placed Crypto.com in the top tier in 2025, with no major incidents reported this year. Risks remain typical of centralized custody and evolving regulation. Enable MFA, whitelist addresses, and monitor sessions.

Read: Is Crypto.com Safe?

Crypto.com Has Received Solid Third-Party Security Ratings | Image via CER.live

Crypto.com Has Received Solid Third-Party Security Ratings | Image via CER.liveTakeaway: High certification coverage, large insurance limits, segregated custody, and PoR transparency make Crypto.com a strong compliance player. Safety ultimately depends on user hygiene and your tolerance for centralized-custody risk.

Customer Service & Real-User Feedback

Crypto.com’s support is accessible and always on, but real-world experiences vary. Expect fast triage via chat, slower resolutions for complex cases, and noticeable differences by region and time zone.

Support channels & response times

- Live chat (in-app, 24/7): Bot-assisted triage; humans take over for account/transaction issues. Replies can start within minutes, but peak loads push waits to hours; typical resolution 1–3 days.

- Tickets / Email: Filed via Help Center or support@ first responses 24–72 hours; complex cases 5–7 days.

- Help Center: 24/7 FAQs/guides; multilingual articles (EN primary + major EU languages).

- Social (e.g., @cryptocomcs): Ad-hoc for non-sensitive follow-ups.

What users say (Sept 2025 snapshot)

- Positives: Clean app UX, broad asset selection (400+), integrated rewards.

- Negatives: Support lag (“days to weeks”), perceived high withdrawal fees/spreads, and account locks during KYC/large transfers (sometimes requiring extra deposits to withdraw).

- Ratings mix: ~4.5/5 on app stores vs. materially lower scores on third-party review sites (e.g., Trustpilot/Capterra), where complaints cluster around slow resolution and communication gaps.

Regional variations

- US / EU-UK: Generally smoother for fiat rails (ACH/SEPA/FPS); faster chat handoffs, but stricter KYC triggers more precautionary holds.

- Asia (e.g., SG): Feature availability differs (cards/limits), and time-zone coverage can stretch responses to 3–5 days.

- Common friction points: KYC/AML reviews, withdrawal fee disputes, login glitches/forced updates.

- Practical fixes: Complete advanced KYC early, whitelist addresses, start with small test transactions, and use in-app chat (then escalate via ticket/DM if stalled).

Takeaway: Support is available 24/7 and fine for routine issues, but complex cases can be slow. Plan ahead for KYC checks and withdrawals, use whitelisting, and keep documentation handy to cut through back-and-forth.

Crypto.com vs Top Competitors

Crypto.com wins in ecosystem breadth (DeFi, NFTs, stocks), mobile UX for accessibility, and card perks (up to 8% cashback). Coinbase excels in beginner simplicity and US compliance; Binance in lowest fees and global volume; Kraken in pro derivatives and security focus.

| Feature | Crypto.com | Coinbase | Binance (US/Global) | Kraken |

|---|---|---|---|---|

| Spot Fee Base | 0.25%/0.50% | 0.40%/0.60% | 0.10%/0.10% | 0.25%/0.40% |

| BTC/ETH Withdrawal | BTC ~$36; ETH ~$10 | BTC ~$30; ETH ~$12.50 | BTC ~$5-10; ETH ~$3-5 | BTC ~$20; ETH ~$8 |

| Assets Count/Pairs | 400+ coins/480 spot pairs | 318 coins/463 spot pairs | 414 coins/1400+ spot pairs | 496 coins/~1200 spot pairs |

| ACH/Card Fee | ACH free; Card 2.99% | ACH free; Card 3.99% | ACH free; Card 1-2% | ACH free/$4; No card |

| Earn APYs Snapshot | Up to 19% (SOL 7%, ETH 5%) | 2-14% (ETH 5%) | Up to 16% | 1-13% (SOL 7%) |

| Card Perks | Up to 8% cashback | Up to 4% BTC back | Up to 8% in regions | None |

| US Availability | Yes (limits) | Full | Restricted | 48 states |

| Derivatives Access | Up to 50x | Up to 10x | Up to 125x global | Up to 50x |

| PoR/Certs | PoR (Mazars); SOC2 Type II, PCI DSS 4.0, ISO 27001 | PoR audited; SOC2, ISO 27001 | PoR audited; SOC2, ISO 27001 | PoR audited; SOC2 Type I, ISO 27001 |

2025 Outlook & Recent Updates

Crypto.com relaunched staking on Sept. 2, 2025, under Level Up: up to 9.5% APY on CRO with a 12-month lock, zero trading-fee promos, and up to 5% APY on USD cash accounts (US only). On-chain staking moved to the web with up to 19% APY across 30+ tokens and collateral access for staked assets.

- Roadmap: Q1 exchange expansions, fiat ramps, stocks and ETFs; Q2 stock options and institutional custody; Q3 stablecoin launch, AI trade tools, Cronos One; Q4 margined derivatives, Cronos ETF filing, global transfers.

- Compliance & geography: Progress on US (FIT21, stablecoin rules), EU MiCA passporting, Asia licenses. Rollout of Visa cards in Latin America, debit in MENA. Some regions limit DeFi features and card funding methods.

- UX & card economics: AI-assisted flows and tighter Level Up integration. Card perks sustained via subscriptions or CRO stakes, with up to 6% CRO back on Signature Credit Card and 5% on prepaid, plus targeted partner rebates.

Final Verdict: Who Should Use Crypto.com?

Ideal profiles: Mobile-first investors, Visa card rewards maximizers, CRO stakers, and “one-app” users who want fiat ramps, staking, and trading in a single ecosystem.

Not ideal: Heavy/fragmented withdrawers focused on minimizing every fee, New York residents with access limits, and desktop-only pro traders who prioritize deepest liquidity/derivatives tooling.

If not Crypto.com, try: Coinbase (beginner-friendly, US focus), Kraken (support/reliability), Binance (lowest fees/liquidity, where available).