Of all the DeFi protocols out there, Curve Finance was the most interesting one when it first came out. What made it unique at the time was that it mainly dealt in stablecoin pairs. This makes the risk of suffering impermanent loss small. If this is the first time coming across a DeFi protocol and you are unfamiliar with some of the terminology used, you might want to check out Guy's video on it to get the basics.

In this review, we're going to review the platform itself, gauging it on a few metrics such as usability and design, security etc. In addition, we will also briefly touch on its role in DeFi and how it has accumulated a kind of kingmaker type of influence with these DeFi protocols.

Curve Finance Summary

| HEADQUARTERS: | Switzerland |

| YEAR ESTABLISHED: | 2020 |

| REGULATION: | Unregulated |

| SPOT CRYPTOCURRENCIES LISTED: | Stablecoins, various wrapped versions of ETH and BTC, MIM, YFI, BTRFLY, OHM, BADGER, TOKE, FRAX, SILO to name a few. |

| NATIVE TOKEN: | Curve (CRV) and veCRV (locked CRV) |

| MAKER/TAKER FEES: | None |

| SECURITY: | Non-custodial so users are fully in charge of their own assets. Smart contracts audited by Trail of Bits. |

| BEGINNER-FRIENDLY: | Recommended for users with prior experience using Dapps. |

| KYC/AML VERIFICATION: | Not needed |

| FIAT CURRENCY SUPPORT: | NIL |

| DEPOSIT/WITHDRAW METHODS: | Non-custodial |

What is Curve Finance

Stablecoins are one of the biggest and most important element in DeFi. Not only is it a way to get crypto beginners into crypto (without the volatile risk), it acts as an intermediary for assets that do not have a direct trading pair with each other. You can convert asset A to a stablecoin before using that same stablecoin to convert to asset B. Where then, would you find pools of stablecoin for you to borrow from? You go to Curve Finance!

Known as the "backbone of DeFi", Curve Finance is a decentralised trading exchange that specialises in liquidity pools for swapping assets of similar value to each other. This includes most stablecoin pairs and crypto assets with its own staked derivative, such as ETH and stETH. Any user can create a market on Curve and earn trading fees from token swaps.

The reason for it being known as such is because many DeFi protocols use Curve Finance for liquidity. Many of them design their protocols with Curve Finance in mind, making it a key component in these protocols, officially or not. The most notable ones are Yearn and Convex Finance.

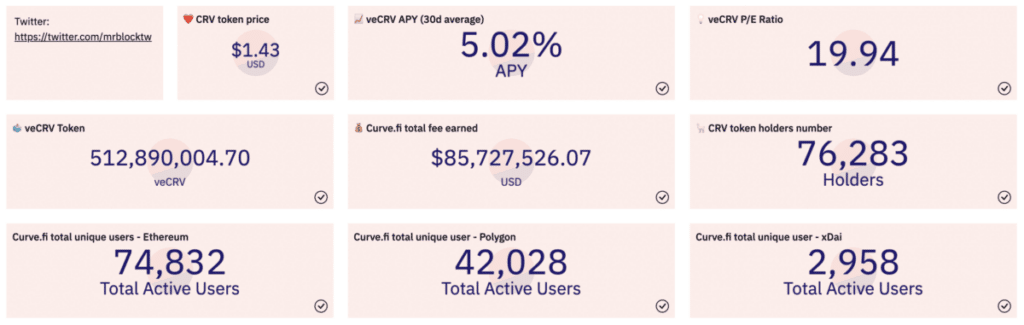

Some impressive-looking stats. Image via Dune Analytics

Some impressive-looking stats. Image via Dune Analytics TVL for the protocol currently sits at $5.6 billion, according to DappRadar, in 4th place, sandwiched between AAVE ($6.6B) and Uniswap ($5.56B).

A Brief History

The founder of Curve Finance, Michael Egorov, dabbled in BTC back in 2013. He got into DeFi in 2018 with MakerDAO. He then proceeded to Uniswap in 2019 but found that there was a lot more room for improvement. Consequently, he developed his own DEX called StableSwap and published the whitepaper on it in Nov 2019. In 2020, he changed the name to Curve Finance.

Curve Finance Exchange Key Features

Before Curve Finance came along, DEXs were mostly about the novelty of peer-to-peer trading brought to a new level. People were trading crypto assets without needing to involve themselves in CEX and it was just the beginning of what DeFi would eventually come to look like today. Impermanent loss (IL) was the keyword of the day and one of the biggest risks for participating in DeFi protocols. In a nutshell, it refers to the amount of money you could lose having locked it up in a liquidity pool versus having the asset in your hand at that moment. Curve Finance was the first DEX that decided to focus on stablecoin assets, thereby greatly reducing the risk of impermanent loss since these aren't as volatile as crypto assets.

Decidedly, stablecoins and how they are used in the protocol is a key feature of Curve. Other features include Factory for creating pools and incentivising users to provide liquidity to the pool, the Curve DAO and the 10 networks it supports.

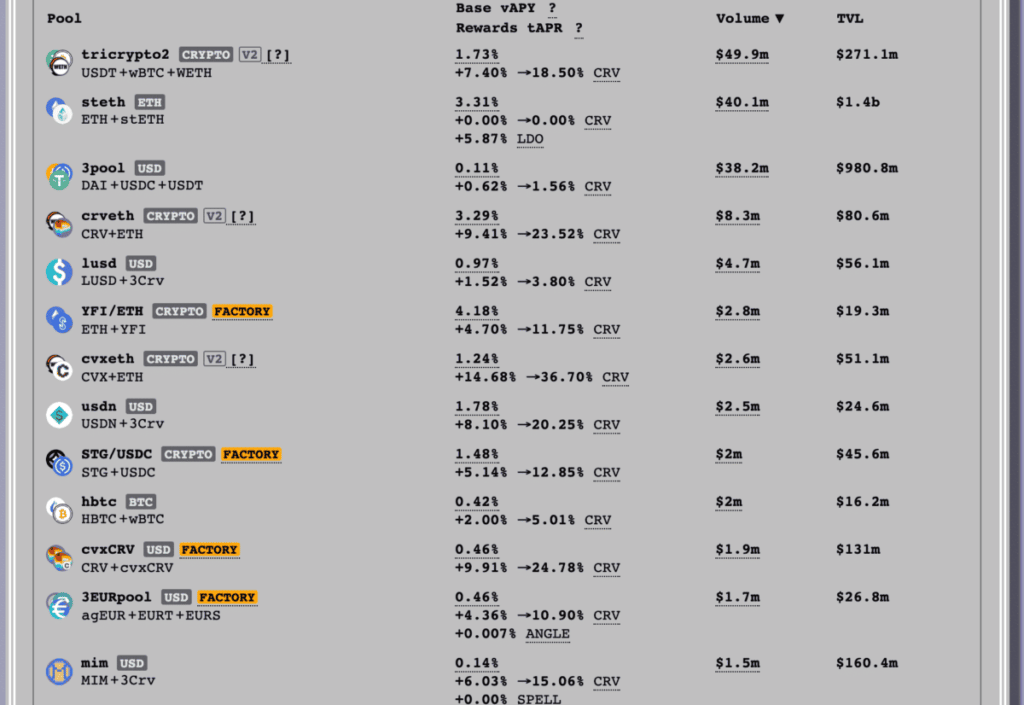

3pool ("3CRV")

Of all the active pools in the protocol, the 3pool, consisting of DAI + USDC + USDT, also known as 3crv, is the most well-known pool. Not only is it popular on its own, it is frequently combined with another stablecoin asset to make up one half of a trading pair. The amount of liquidity in the pool is slightly less than $1 billion, which is of a very good size, considering that most of the other pools are in the mid-millions. The only pool larger than this is the ETH/stETH pool valued at $1.4 billion.

How many 3CRV pools can you spot in this picture?

How many 3CRV pools can you spot in this picture? Factory and Gauges

The Factory is where you can set up a liquidity pool in CRV. While the interface is fairly straightforward, ie fill in the blanks style, you'd really need to know what you're doing before you fill in the form. I can imagine lots of DeFi protocol founders wracking their heads over what kind of a pool to set up, how to do so that would reach their yield-earning goal, and most importantly, the gauge set-up as that's crucial to the success of the pool.

Pool operators want lots of liquidity in the pools they set-up, and the way to do that is to give some sort of incentive for people to do so, very much like walking around a street full of bars, with each bar yelling out the kind of free drinks you can get from them. Curve has a mechanism called the gauge weight that helps pool operators lure in customers, so to speak. This gauge allows CRV token holders to vote on which pool(s) deserves to get how much extra rewards in CRV. The vote is held biweekly and open to all token holders with locked CRV. Setting up the gauge requires a minimum of 2500 veCRV tokens.

This mechanism plays a large part in how DeFi protocols engage with Curve Finance, as you will be able to find out in the CRV token section.

Supported networks

You can interact with Curve through the following networks: Ethereum, Arbitrum, Aurora, Avalanche, Fantom, Harmony, Optimism, Polygon, xDai, Moonbeam. As you can see, the main Ethereum L2s are supported, which will certainly help with gas fees.

Curve Finance Fees

There are three kinds of fees that are administered by Curve. Swap fees for swapping tokens are 0.04% flat for all tokens. Deposit and withdrawal fees range between 0% to 0.02%.

Curve KYC and Account Verification

Being a decentralised platform, there is no such requirement in this area. As long as you have funds, you can be a participant regardless of nationality, gender, sanction status etc. Wallet addresses are the only way to "identify" someone and even then, it's not a guarantee of uniqueness because one person can have multiple wallet addresses.

Curve DeFi Security

The security of the platform is mainly concerned with the smart contracts governing the pools. These are audited by Trail of Bits, a reputable security research company that also runs audits for Gemini exchange, Github, and also non-crypto companies such as Meta, Airbnb etc. The audits are executed when there has been a change to the smart contracts. These are, by design, not upgradable, which is part of its security features.

From a governance risk perspective, there is an Emergency DAO consisting of 9 people and a multisig set-up. The DAO has limited governance function but are able to pause a pool during the first 2 months' of its existence or even cut off emissions to a pool. We saw this happen for the first time with the $MOCHI fiasco.

The other risk component would be the pools itself. The protocol details this well in its docs section:

“when you provide liquidity to a pool, no matter what coin you deposit, you essentially gain exposure to all the coins in the pool which means you want to find a pool with coins you are comfortable holding.”

Therefore, DYOR before you deposit anything into a pool.

Cryptocurrencies Available on Curve

The majority of tokens available are varieties of stablecoins, some not as well-known, like $LUSD, $USDN, $alUSD (from Alchemix) and $GUSD (from Gemini), to name a few. Variations of BTC and ETH derivatives can also be found such as stETH, renBTC, WETH, WTBC etc.

Curve Exchange Platform Design and Usability

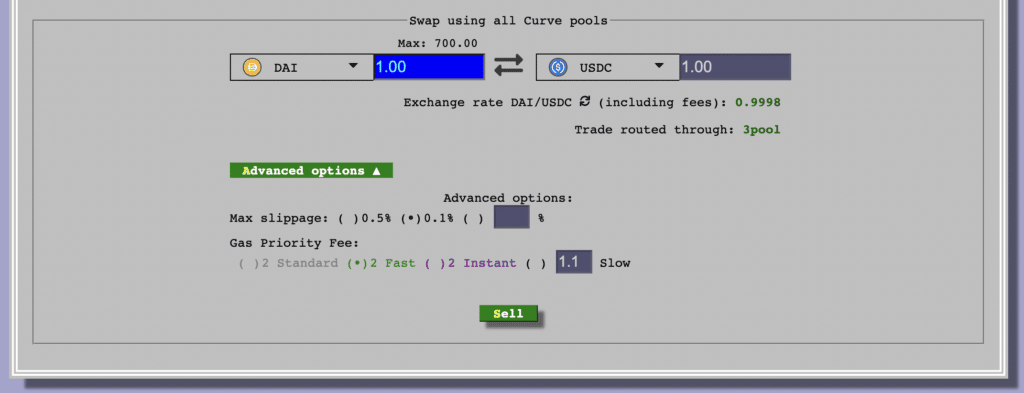

The platform itself has a retro feel on purpose. There are no fancy graphs or colours. It looks very much like a webpage from the early days of the Internet. There are a lot of descriptions on the terminology found throughout the platform, which is great, because there's a lot of stuff going on. However, it is certainly aimed at more advanced DeFi protocol users, ie people who know what they're doing. The descriptions act more as prompters or to define a term used exclusively on the platform, such as base vAPY. This is one of the protocols where reading the available documentation before diving in is highly recommended.

No-nonsense and blocky interface.

No-nonsense and blocky interface. Deposits and Withdrawals at Curve Finance

Like most decentralised exchanges, Curve does not support any kind of on-ramp facility for converting fiat to crypto. If you don't have any crypto to start with, you'll need to find a way to get your hands on some. The most common way of doing so is buying through a centralised exchange. If you don't know which one to pick, check out our review on some of the top exchanges available.

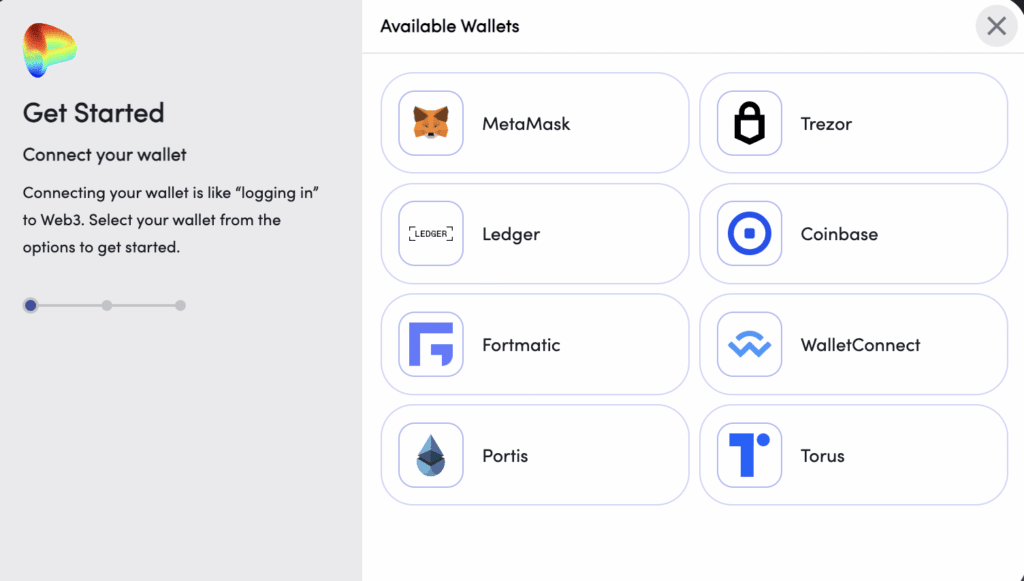

Once you've found your way to obtain some crypto, deposit them into a Web3-enabled wallet. You'll need it to interact with the platform.

These are supported by Curve. Do you have any of them? Image via Curve Finance

These are supported by Curve. Do you have any of them? Image via Curve Finance Withdrawals are pretty much a "click-and-send" kind of transaction. Agree to the gas fees, check that the wallet address you're withdrawing to is correct, check that the network you're transacting on is the right one, and you're good to go!

Curve Token (CRV): Uses and Performance

Just like other DeFi protocols, liquidity providers are incentivised to do so by earning CRV tokens. It is also a way for the Curve team to keep fees low. Unlike most DeFi protocols where the utility of the token itself stops at governance, the Curve team did a small bender with tier design, which makes all the difference. This is where things get really interesting.

veCRV token

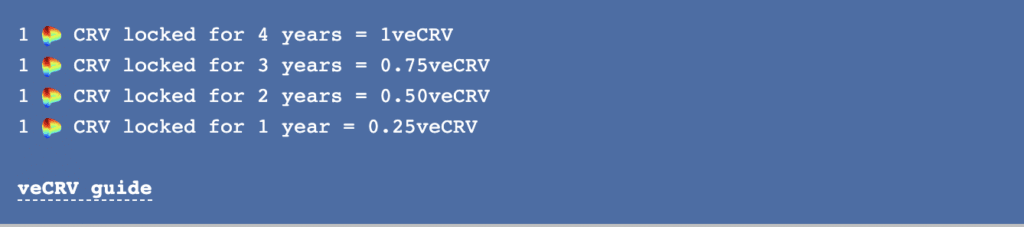

In order to participate as a voter, token holders need to lock their CRV tokens for a period ranging between 1 week to 4 years into the Curve DAO. Doing this nets you voting-escrowed CRV tokens, known to most as veCRV. These are the real voting tokens. How many you get is dependent on the number of CRV tokens you choose to lock it and for how long. This chart gives you an idea:

Ratio of conversion for CRV to veCRV

Ratio of conversion for CRV to veCRV What can be deduced from the chart above is that the more CRV you lock in for a longer period, the more veCRV you will get. In addition to the veCRV tokens, you also get a boost from the liquidity you provide. Here's a quick look at how that works:

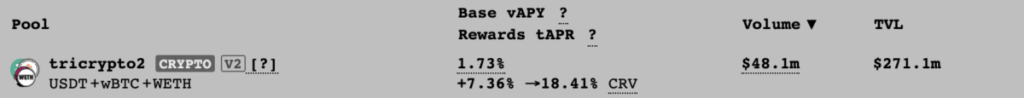

What you can earn or earn even more if you lock CRV

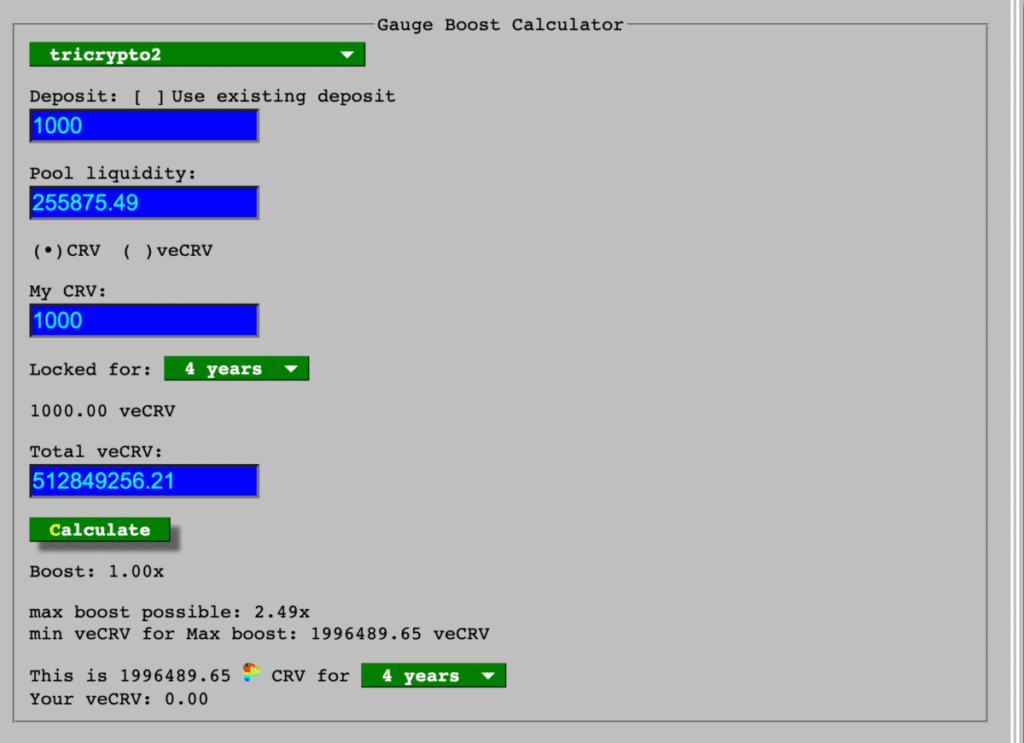

What you can earn or earn even more if you lock CRV Say you want to provide liquidity to the tricrypto2 pool with USDT. 1.73% is the trading fees you can earn annualized. This fee is based on volume, so the higher the volume, the higher the rate. The 7.36% is the rewards you can earn as decided by the rewards gauge as we mentioned above. Using this number as a reference, you can "boost" your own earnings up to 18.41% by locking in your CRV tokens. How much you need to lock in for how long can be figured out using the calculator in the platform.

All that CRV locked in for just 1% boost

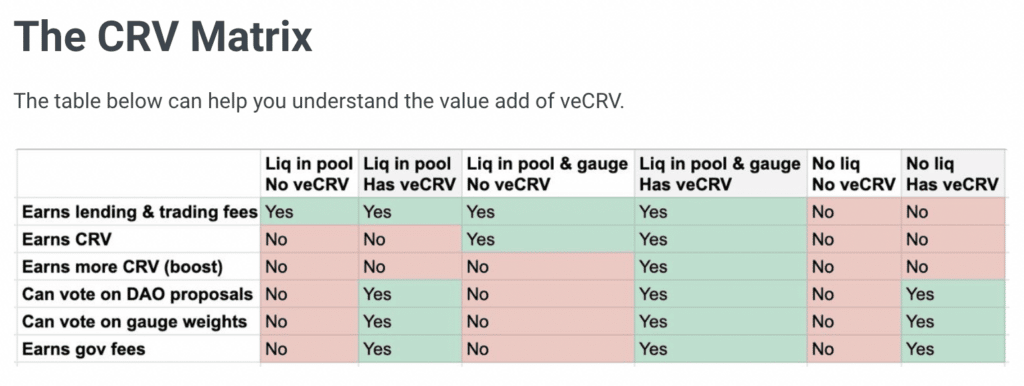

All that CRV locked in for just 1% boost As a veCRV token holder, you can also earn a share of the trading fees. As of Sept 2020, a proposal was passed by the community whereby 50% of trading fees are distributed to veCRV holders. This is in the form of 3CRV tokens, the LP for the 3pool, which are bought using the aforementioned trading fees. If all this sounds a bit confusing, here's another chart to help clarify the situation from the Curve Finance docs:

A chart to show the difference between having and not having veCRV

A chart to show the difference between having and not having veCRV On-line Bribe

I'd like to draw your attention to the second to last line, "can vote on gauge weights". Basically, this is where voters decide how CRV rewards should be distributed across all the pools in Curve. The more locked CRV you have, the greater your voting power and the chances of you tilting the rewards to favour the pools you have skin in the game in is higher. So if you want your pools to earn the highest possible rewards, time to make some bribes!

The app, released by Andre Cronje of Yearn Finance, allows pool operators to earn native tokens of the protocols that want more liquidity. Convex Finance was the first to get in on this by offering CVX tokens to veCRV holders. Other platforms were quick to follow. This then brings us to…

The Curve Wars

In a nutshell, protocols are incentivised to accumulate as much CRV tokens as they can to lock them in, get the veCRV and vote for as much of rewards going to their own pool as possible. Convex Finance, a DeFi protocol built on top of Curve, started absorbing the CRV tokens sold by Yearn to gain voting power. Yearn cottoned on to what Convex Finance was doing and decided to run their own scheme to do so. Other protocols with stablecoins saw what was happening and they also got into the melee, hoovering up the CRV tokens.

The idea is that pools with more rewards will be able to attract more liquidity providers, thus jumpstarting a very healthy cycle of more liquidity = more users to their own protocol. Stablecoins with high liquidity also has very low slippage when being exchanged, which further incentivises users to use them.

CRV Price action

With all the hoopla surrounding the token, you'd think that the price of the token itself would look really juicy, right? Well, not quite.

A spectacular debut followed by ho-hum. Image via Coingecko.com

A spectacular debut followed by ho-hum. Image via Coingecko.com

When a token has great utility, it's not necessarily a tradable one, especially not with something like this, where the value of the token lies in it being locked, not floating around in the market. The current price of $1.38 is pretty much a reflection of how the market feels about this token. The chances of it hitting its all-time high again is unlikely. It's probably one of the few tokens where it can generate more yield by being in DeFi protocols versus trading it.

Initial distribution of the token is as follows, starting from a fixed supply of 3 billion:

- 5% to early liquidity providers with one-year unlock period.

- 5% Curve Finance DAO

- 3% to Curve Finance DAO employees with one-year unlock period.

- 30% to Egorov + 2 investors. Egorov has a 4-year unlock period while the other investors' are for 2 years.

- 62% to current and future liquidity providers on Curve.

On average, there are 776,000 CRV distributed daily, with a reduction of 2.25% each year.

In addition to the yearly reduction, what supports the token's deflationary trait is that the locked CRV is not considered part of the token supply, since they are illiquid and most of them are locked in periods measured by years.

Curve Customer Support

Being a decentralised platform, there will certainly be no voice chat or live chat agents available to help you out. The most you can do to get help is from one of their community channels, which are Twitter, Telegram, and Discord.

Curve DeFi Top Benefits Reviewed

Curve Finance exchange is probably the best place to swap for stablecoins due to low slippage and the enormous amount of liquidity they have. Other great benefits include:

Influential voting power - those who hold lots of veCRV gets to influence the CRV rewards distributed by the pools. As you saw, wars are fought over this voting power.

Permissionless - anyone can set up a liquidity pool.

Secure - the platform itself doesn't have a lot of bells and whistles to it, which reduces the amount of attack surface for hackers. As long as Curve guards those smart contracts well, funds are relatively safe.

What can be Improved

Seeing how the Curve Wars played out, there is already a handful of players that have the ability to tilt the rewards emission in their favour. In the interest of decentralisation, perhaps there could be a cap as to how much voting power a single wallet has or any kind of mechanism that doesn't result in the formation of whales. It's a bit of a catch-22 because smaller protocols would benefit more from the liquidity offered by Curve. However, the pools for these protocols won't be able to offer as much in rewards as the larger pools. However, these large pools are able to put in funding to hoover up CRV tokens thus having more of a say in the rewards emissions being guided to their own pools.

The playing field, which may never be leveled, shouldn't be too off-kilter as to disincentivise smaller players to try out for themselves or have to cosy up to the bigger players.

The Curve-Vyper Exploit

On July 30, 2023, several Curve liquidity pools on Curve Finance were exploited in a hack, accumulating damages of about $61 million in various crypto tokens. Following the incident, Curve set a bounty offer of $1.85 million on the hacker’s identity.

How did the Exploit Transpire?

The Curve Finance protocol is made of several liquidity pools, which are smart contracts that operate on the blockchain. Like every other software, programming smart contracts involves using a compiler, an environment where programmers write and test the code to iron out bugs and prime them for deployment on the blockchain mainnet.

The liquidity pools (smart contracts) that suffered from the hack were programmed using the Vyper compiler, particularly versions 0.2.15, 0.2.16, and 0.3.0. These versions were plagued with an issue, making the smart contracts complied on them vulnerable to reentrancy attacks, in which an attacker can trick the contract’s balance calculations and steal funds.

What’s interesting about this attack is that it sourced a vulnerability from the smart contract compiler and not the Curve codebase itself. Swapping out a cook’s salt jar for pepper would ruin the dish even if the cook follows the recipe impeccably, similarly, a perfectly compiled smart contract may still be vulnerable if the compiler itself is inherently vulnerable.

While smart contract protocols run robust bounty programs to keep their code in check, compilers do not receive similar attention, which is perhaps why this vulnerability could slip past Curve Finance’s watchdogs all this time. While several white hat hackers have chipped in to mitigate the attack, it is worth mentioning that Curve pools complied with Solidity (another smart contract compiler) remain unaffected and operate as intended.

Curve Finance Review Conclusion

"Imitation is the sincerest form of flattery" as the saying goes. Since Curve Finance came up with the idea of the voting-escrow token, there have been a few other protocols who followed suit. One of them, Saber, on Solana, was created based on the Curve source code and attempts to replicate what Curve has but with less success.

The success of Curve Finance can be seen as somewhat of a gamechanger in the DeFi world as you have protocols built on top of it. At the very least, it's known as the platform to perform swaps involving large amounts of money due to the low slippage. As the world of DeFi progresses, it will be interesting to see how much of an influence it remains in the future.