Despite what the name implies, many stablecoins haven't proven to be very stable in recent years. The ramifications of the implosion of the UST algorithmic stablecoin in May 2021, are still felt to this day. Even though we've now moved to the FTX contagion, it is not difficult to trace a line from Alameda's woes all the way back to the UST collapse. So, who would, in their right mind, want to release another stablecoin at this moment? The answer: those who do not see failure as an obstacle but use it as a stepping stone for a better version.

Before we look at what the Djed stablecoin is, we're going to do a brief run-through of what stablecoins are and what type does Djed potentially fall under. Next, we'll look at what it is, how it works, and how it differs from other stablecoins.

A Brief Introduction: What are Stablecoins?

The most exciting and dangerous thing about crypto assets is their volatility. The industry needed a token where the price does not fluctuate by the minute, hence the invention of stablecoin, a token nominally pegged to the equivalent of one unit of cash. The most popular currency used is the US dollar, but there are also other currencies that are pegged, such as the Euro and the Japanese Yen. This makes some sort of sense as the US dollar is the world's reserve currency. That token is known as a stablecoin.

It's raining stablecoins! Image via Shutterstock

It's raining stablecoins! Image via ShutterstockDespite the variations of stablecoins out there, they can be classified into three types:

Off-chain collateralized stablecoins

Basically, anything that fits the "one-for-one" concept, i.e. I give you one USD, you give me one token. This exchange happens outside of the blockchain, hence the off-chain description, and takes place instead at a centralised entity. In the case of USDC, for instance, Circle is the company that is generating the tokens. Give Circle your money, they give you USDC.

On-chain collateralized stablecoins

The collateral used to back the token can be viewed online in a transparent manner. When DAI first started out, it was minted by depositing ETH, BTC, and other less-volatile cryptos.

Non-collateralized stablecoins/ Algorithmic Stablecoins

As the name implies, there's no collateral involved in this type of stablecoin. What maintains its stability is an algorithm, which determines how much or little of the stablecoin should be in circulation based on market supply and demand. The rules of the algorithm are backed by smart contracts, and can only be changed based on consensus using governance tokens. Aside from actions that directly affect the supply, such as minting and burning, oracle contracts are also included.

These contracts, which consider a minimum of 6 sources, obtain real-world pricing of the stablecoin in the market. When 3 out of the 6 sources' information has been confirmed, only then is the information fed to the rebase contract, which decides whether to mint or burn more to maintain equilibrium.

Within algorithmic stablecoins, there exist two models: single and multi-token models. The Single model relies on one token for everything, i.e. value balancing, governance, etc. This means that token holders are the ones responsible for refinancing the token if it breaks the peg, i.e. trading below the $1 value. This is because someone needs to be around to suck up the demand if the rebase contract mints more, thinking it needs more tokens. The Multi-token model, on the other hand, separates the value-balancing function of the token from other functions.

What is Djed?

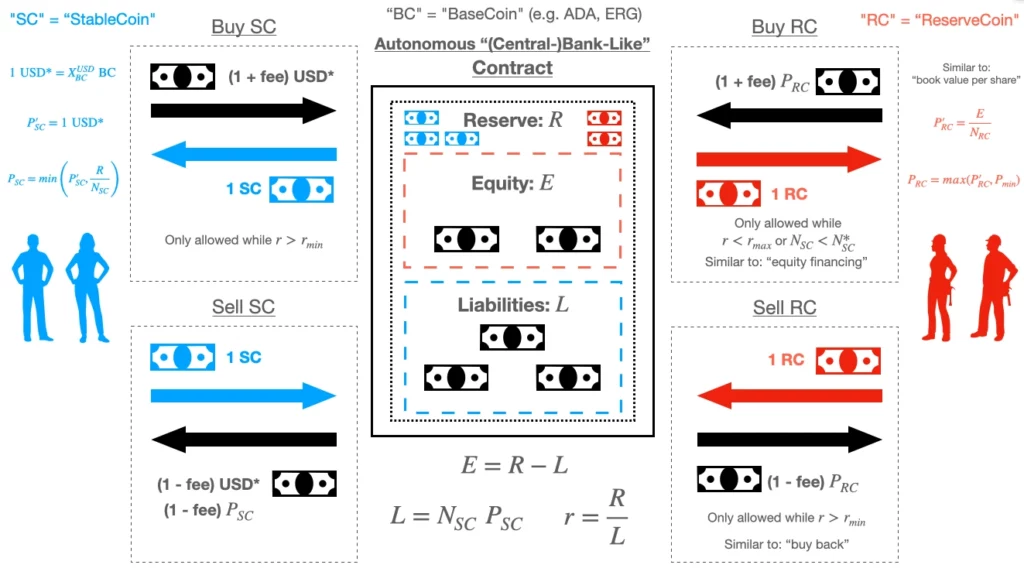

Djed is an algorithmic protocol that behaves like a bank. It buys and sells stablecoins based on a pegged target price. The product it sells is the Djed stablecoin, pegged to the US Dollar. What maintains the peg is something called a reserve coin and an algorithm overseeing its supply in the market.

Just like a bank with reserves, DJED also has its own reserve pool made up of ADA. There are three ways for ADA to appear in that pool: via the selling of DJED and its reserve coin SHEN, plus fees associated with the prior two actions. Other mechanisms are in place to ensure that there is always enough in the pool for DJED redemptions. Let the fun begin as we delve into how the whole thing works.

How Djed works

Let's imagine you have some ADA burning a hole in your wallet. Amongst some of the many ways you can make good use of it, here are two more choices:

- Swap it for DJED: Fork over some ADA (4, as the price is around $0.25 at the time of writing) and you can receive 1 DJED. You can always swap it back for the equivalent of $1 worth of DJED. So, if the price of ADA goes down to $0.20 after you got the 1 DJED, you can swap it back and get 5 ADA. The DJED that got returned will be burnt, i.e. taken out of circulation. Conversely, you would only get back 1 ADA if it went up to $1.00.

- Swap it for SHEN, the reserve coin: one reason why you might want to get SHEN is that you can trade it in the market and take advantage of the price fluctuations. Unlike DJED though, it's not a given that you are able to obtain or sell SHEN at your will because it is subject to something called a Reserve Ratio.

- Fees paid in ADA: Any kind of minting and burning of SHEN and DJED incurs fees charged in ADA that also go into the reserve pool, thereby helping to grow the reserves, increasing liquidity and the price of SHEN. Here are the fee breakdowns:

- DJED mint & burn fee: 1.5%

- DJED operational fee: 0.5% (goes to COTI treasury)

- SHEN mint fee: 0.2%

- SHEN burn fee: 0.5%

Illustration of how DJED works. Image via IOHK

Illustration of how DJED works. Image via IOHKWhat is SHEN? - The Reserve Coin

The sole reason for SHEN's existence is to maintain DJED's peg to the dollar. It does so by maintaining both minimum and maximum reserve ratios. A minimum amount of SHEN tokens is needed to safeguard DJED from falling lower than one dollar. There's also a maximum amount of SHEN in circulation to stop DJED from going beyond the dollar.

No SHEN is minted when it's at or above 800% of DJED's token amount, as that's the maximum ratio. This is to prevent dilution of returns for other SHEN token holders. When the ratio is at a minimum of 400% though, no new DJED can be minted unless there is more SHEN burnt to offset the demand for DJED. At this point, users can either get more SHEN or swap their DJED back for ADA.

The algorithm governing SHEN's supply also monitors the situation diligently.

In this way, the DJED peg is maintained through its own natural supply and demand and also from SHEN holders. The availability of SHEN is determined by the algorithm that is part of the protocol. When DJED goes above peg, it buys SHEN, bringing the price down. When DJED goes below peg, it buys DJED with SHEN, bringing the price up.

Why SHEN

If you think about it, the reserves from regular banks come from deposits made by everyone (still). Fractional reserves aside, banks usually have enough to allow customers to withdraw their money. When it comes to fully collateralized stablecoins like DAI, you could say that there are zero reserves involved. Other centrally minted stablecoins like USDC take the money and put it in (hopefully) not-risky assets like bonds. None of these are liquid or quick enough to react to market pricing like SHEN is designed to.

That's why the team concludes that utilising the concept of a reserve coin that is tradeable gives token holders a chance to participate in maintaining DJED's peg and still retain their own interest. This is because SHEN holders are entitled to a share of the reserve pool as a reward for their participation.

The two versions of DJED

Minimal DJED

This was launched in Q1 2021 with a 1% fee for buying and selling the token. The oracle pricing updated every hour. It possesses a number of theories supporting its stability, a few of which are briefly outlined below:

- Upper bound of the Peg - no incentive for users that the price goes more than $1.00

- Lower bound of the peg - same but for the opposite end

- Robustness of peg in a market crash

- No insolvency - there will always be enough for people to redeem

- No bank runs - no fear that users need to race to get their money out

- No reserve draining

After they tested this out, they saw the following issues:

- Reserves can be drained as an attempt was made and the attacker lost $100,000.

- Users still see an incentive to get their money out, forming a bank run.

- Fees are rigid.

- When the peg is broken, DJED holders suffer a loss.

- When there are no more reserves left, the price of the reserve coin also falls to zero, so a minimal price is introduced.

- It's cheaper to buy 10 DJEDs in one go than to buy 5 each.

Extended DJED

In this version, the fee increased to 2% and the oracles update every 12 minutes. In addition, each update can only affect the pricing by up to 0.49%. More changes were made to address the following issues seen above.

Teams behind the project

The mainnet for the DJED stablecoin will be launched on Cardano in January 2023, issued by the COTI blockchain. The COTI team is responsible for the successful implementation. Having a stablecoin crossing two blockchains is a rare sight. We'll need to understand the blockchain teams behind this project as part of the understanding of how stablecoins work.

Currency Of The Internet (COTI)

The COTI blockchain was launched in 2017 by Samuel Falcon and David Assaraf. The current CEO, Shahaf Bar Geffen, was later brought into the project. The initial purpose of its creation was to be the global payment app on the Ethereum network.

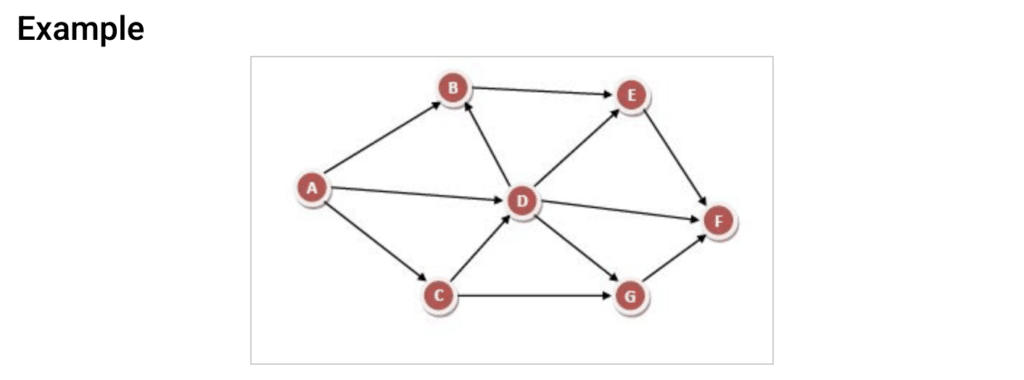

Unlike most standard blockchains, COTI utilises Directed Acyclic Graph (DAG) technology for its base infrastructure. My understanding of this mathematical concept is that a series of activities, each of which is represented by a circle called "vertex," is connected by a line to another circle, known as the "edge." The direction of where the line goes is predefined, hence "directed," and there is no possibility of the lines pointing to the initial circle that started it, which is where the "acyclic" part comes in - no cycle.

Simple illustration of what is DAG. Image via Tutorialspoint

Simple illustration of what is DAG. Image via TutorialspointInstead of blocks, COTI has multiple DAGs, known as TrustChain. The consensus mechanism it uses is called Proof-of-Trust, with each user and the associated transaction having a TrustScore. This score increases with each valid transaction made and decreased when faced with an invalid transaction. Each transaction can only be added after linking with two prior transactions with the same TrustScore. Transactions with higher trust scores get confirmed faster.

COTI is the native coin used on the COTI blockchain. Buy and deposit COTI tokens into the COTI Treasury to get rewards. Users can get up to 84% APT based on how much is deposited and the locking period (30 or 120 days).

If you'd like to find out more about the COTI blockchain and its risks and potential, check out Guy's video to learn more about this not-blockchain project.

COTI and DJED

In December 2018, the COTI team met up with the Cardano team in Israel at a conference for start-ups. By the end of 2019, they had launched ADAPay and were a recipient of the cFund from Cardano in April 2021. By that point, they already had plans to launch DJED together.

What also solidifies this partnership is that every DJED transaction also charges an operating fee, paid in ADA. This fee is converted into COTI and deposited into the COTI Treasury. Holders of the COTI coin can also reap some benefits from this partnership through the yields earned in this manner.

What is Cardano?

In case you've not heard of this OG blockchain project, Cardano is a Layer 1 blockchain that uses the EUTXO model with the Proof-of-Stake consensus. ADA is its native token, used for gas fees and yield rewards. One thing unique about Cardano's staking pools, which act as node operators, is that there is a limit to the amount of ADA that can be staked in each pool. This incentivises more pools to be created, thus making the network as decentralised as possible. We've got a great guide on how to select the right staking pool for your ADA.

Cardano is one of those projects that's been around for a long time with what seems like little to show for its efforts. While other similar projects, such as Solana and Avalanche seem to get more attention, the Cardano team continues to plod along at their own pace, ignoring a lot of the FUD about it in the market. If you'd like to know what else Cardano has in store for everyone, check out our article on the Top 10 Cardano projects in 2022.

Slow and steady does it, says the Cardano team.

Slow and steady does it, says the Cardano team.We also have a deep-dive Cardano article if you want to find out more about this blockchain protocol.

DJED vs UST

Many of us still have nightmares about the UST collapse. Aside from wiping out billions from the market, the contagion effect from its downfall rippled throughout 2022 with other crypto companies and centralised lenders tumbling over one after another, domino-style. It wouldn't be a stretch to say that the UST debacle was the worst crisis faced by the community, causing many to lose the belief that an algorithmic stablecoin is possible.

Disputable shenanigans aside, there were two huge factors that played a role in UST's downfall: a bank run and a drain on reserves. Both of these were addressed by the DJED team in their design, as explained above.

The way UST was minted was solely through the burning of LUNA tokens. Conversely, when more and more people redeemed their UST, which resulted in the expansion of the LUNA supply, the demand for LUNA wasn't quick or deep enough to absorb the amount of LUNA flooding the market. This further deteriorated the situation. The BTC reserves bought by the Luna Foundation Guard were used, supposedly, to shore up the peg by absorbing the supply, but it didn't work out.

Based on the mechanics described above, it is possible for UST to be under-collateralised, which is what we saw happen.

DJED, on the other hand, doesn't wholly rely on ADA as the backing collateral and also has a built-in feature of a reserve coin. In addition, there are parameters that have both a ceiling and floor limit governing the reserve coin pool. These measures ensure that DJED maintains its stability even if the price of the backing asset, ADA, plummets. The reserve pool is also kept in constant liquidity from what is brought on by trades from SHEN.

Why get DJED?

It's all well and good that DJED has some solid mechanisms behind it. But why should you get DJED to begin with? That's where the functionality for DJED needs to shine bright and wide to generate demand.

The initial plans for DJED are to be used for payments, lending, payroll, settlements, alternate banking, and DeFi apps. One of the first apps to launch is DJEDPay, a payment app for merchants, e-commerce platforms & non-profit organizations, encouraging them to accept DJED as a form of payment. The app allows transfers using just your name and email address. It's been in testnet mode since May 4, 2022, and will be launched on mainnet in Jan 2023. If you'd like to be kept up-to-date on this development, follow their Twitter account.

A sneak preview of the app unveiled back in Nov. Image via DJED Twitter

A sneak preview of the app unveiled back in Nov. Image via DJED TwitterPartnerships

Below is a list of known partnerships that will be using DJED in their apps:

- WingRiders - AMM Dex on Cardano

- JaraNetwork - Open Finance portal

- Cardano Warriors - MMRPG on Cardano

- Cogito Protocol - creates a new asset class called "tracercoins." It uses an algorithm and the fractional reserve framework to track synthetic indices.

- Empowa - RealFi project on Cardano that enables local African housing developers to offer lease-to-own options for eco homes.

- AXO - a network of trading-oriented smart contract variants, known as programmable swaps.

- Yepple Inc - NFT creation services, DeX registration, smart contract services and building web dApps from scratch.

After DJED has made its official debut, I'm curious to see if there will be more partnerships signed.

Risks For Djed

Despite what the name implies, there are quite a number of risks associated with stablecoins. I won't list all of them, but here are some to keep in mind:

- Too much supply / too little demand for DJED and/or SHEN

- Not enough reserves for redemption

- Oracle contracts - how accurate they are in relaying information to the protocol.

- The minimum and maximum reserve ratio gets changed or compromised

- Smart contract risks

Note that individually, the risks aren't too bad, but a combination of them can be really bad for the project.

Conclusion

Does the market need another stablecoin? Well, yes, if it's different from the ones we already have. DJED is looking to establish a new model for the stablecoin makeup. According to the abstract from the protocol's 87-page whitepaper (that comes with pages of math):

"...stability claims are precisely and mathematically stated and proven. Furthermore, the claims and their proofs are formally verified using two different techniques: bounded model checking, to exhaustively search for counter-examples to the claims; and interactive theorem proving, to build rigorous formal proofs using a proof assistant with automated theorem proving features."

In other words, they've really done their homework to ensure all known risks about stablecoins have been taken into account. The team behind this project, perhaps having learned from some of the abysmal failures of certain stablecoins, decided to throw the kitchen sink at it when designing this one.

Only time will tell if this is going to work out or not. For my part, I will be taking a cautious approach to it and keep an eye out for its progress after its mainnet launch.