After spending the past few days researching the recently launched Ethena protocol, it's clear that a deeper exploration of the mechanisms behind the impressive yields is necessary. We’ll dive into the origins of these yields, how they are generated, and how you can get involved.

Additionally, as the title suggests, we will explore the potential risks and evaluate whether the measures implemented by the Ethena team are adequate to reassure those who may have experienced a little PTSD from previous failures in DeFi. We will also clarify some of the “new-to-us” terminology to ensure a thorough understanding of why Ethena has rapidly ascended to over $2 billion in TVL and become a significant talking point in financial circles.

What is Ethena?

It all started with a little inspiration …

Ethena began by actually implementing an idea first proposed by Arthur Hayes in 2023. And, as a nice nod to Hayes, they've included a tab on their website that links to the blog where Hayes originally shared the concept.

Image via Ethena

Image via EthenaSo, what is this concept?

Overall, the idea is pretty straightforward: you give us collateral for our synthetic dollar (USDe) and then stake it for a decent yield. Then, we’ll keep things balanced by holding a short derivatives position to counteract the risk associated with the collateral you just deposited. Pretty simple, right? For the most part, yes. But a lot of people have been burned with promises of high APYs in DeFi, so it is really important that we try to figure out exactly what’s going on behind the scenes here.

At its core, Ethena's USDe can be likened to a tokenised version of the “cash and carry” trade.

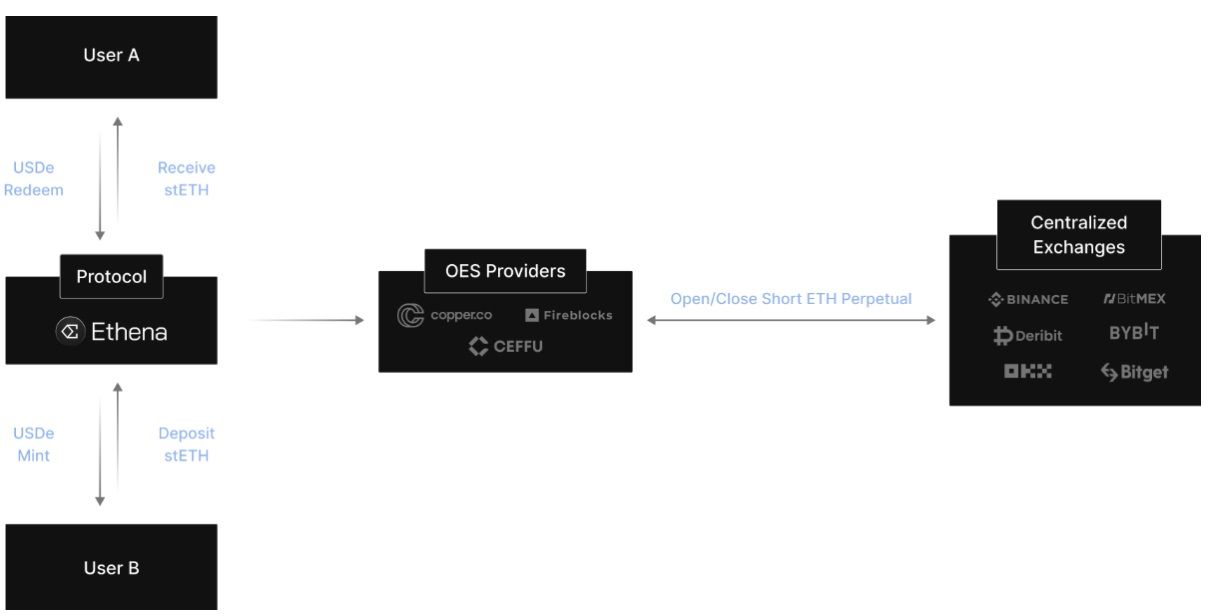

Here's the workflow: you start by depositing collateral into the protocol, which could include assets like stETH, USDC, or USDT. Ethena then engages in what is known as "delta hedging" by staking this collateral and concurrently initiating an equal short position to neutralise the long position held in the collateral. This is where understanding the definitions gives us a better understanding of what’s actually going on.

Image via Ethena

Image via EthenaDeciphering Delta Hedging: Key to Ethena's Stability

Delta hedging is a strategy to reduce the market risk associated with the collateral. Take Ethereum as an example: if Ethereum and stETH are the collateral, Ethena would short Ethereum on centralised and decentralised exchanges with no added leverage —effectively, a fully counterbalanced short position. This approach ensures that the value of your collateral remains unaffected by ETH's market price fluctuations.

When Ethena stakes ETH, you receive the native yield from stETH, contributing to the overall yield. However, the more substantial portion of the yield stems from the “funding rate” or “carry” — the premium paid by those holding long positions in ETH futures to those in short positions. This premium can be pretty lucrative during bull markets and is a significant factor in the high yields seen with USDe.

This cash-and-carry method has been a staple in TradFi for some time. Institutions purchase an asset and simultaneously establish a corresponding short position in the futures market. By fully delta-hedging, they mitigate any price risk associated with the asset and profit from the carry. This time-tested strategy is precisely the mechanism at the heart of USDe's function.

So, essentially, USDe keeps its value stable by making an offsetting countertrade in the derivatives market whenever the protocol takes in collateral to balance out any price changes in the collateral. Think of it as having a seesaw where USDe sits on one end and the derivatives position on the other, keeping everything level no matter how the market swings.

Image via Shutterstock

Image via ShutterstockUnderstanding The Funding Rate Within Ethena

Since the bigger part of the yield will likely come from the funding rate, we should probably dig in a bit deeper here. To explain the concept of the funding rate within Ethena, particularly in the context of perpetual futures, let's break down some key points:

Perpetual Futures vs. Traditional Futures

Unlike traditional futures contracts that you might find on exchanges like the CME, which have specific expiration dates (monthly, quarterly, etc.), perpetual futures don’t expire. This means there's no set date when the price of the future must converge to the spot price of the underlying asset.

Price Premium and Convergence

Typically, perpetual futures trade at a premium to the spot price of the underlying asset, which can vary greatly. This persistent premium is due to the perpetual nature of these contracts.

Role of the Funding Rate

To manage the premium and align the perpetual futures price more closely with the spot price, a mechanism called the "funding rate" is employed. The funding rate serves two main purposes:

- Downward Pressure: It applies downward pressure on the perpetual futures price when it is significantly higher than the spot price, helping to tether it back to more realistic levels.

- Incentivisation: The funding rate provides a financial incentive for traders. If you buy (or go long on) a perpetual future, you will pay the funding rate. Conversely, if you sell (or go short on) the perpetual future, you will earn the funding rate. This dynamic encourages short selling when the futures price is too high compared to the spot price, helping to stabilise the market.

Variable Rate and Market Conditions

The funding rate is not fixed; it varies based on market conditions, particularly the balance of traders going long versus those going short on the perpetual future. The rate adjusts depending on how bullish the market is: the more traders expect the price to rise (going long), the higher the funding rate they will pay. This higher rate discourages excessive long positions and encourages more short selling, promoting a balance that keeps the futures price in alignment with the spot price.

Market Dynamics and Comparison with Traditional Futures

In traditional futures markets, like those for commodities such as crude oil, prices are set for specific future dates, reflecting expectations about future supply and demand. In perpetual futures, the dynamic is more immediate and continuous, with the funding rate adjusting to reflect current market sentiment and trading behaviors.

By using the funding rate, Ethena can maintain a more stable and realistic pricing environment for perpetual futures. This ensures that prices do not stray too far from fundamental values while allowing continuous, expiration-free trading. Unquestionably, it’s a pretty solid way to handle things.

How Does Ethena Work?

It’s pretty remarkable how straightforward and intuitive the user experience is, especially given the complexity behind the scenes. To illustrate this, let’s walk through the simple process of acquiring your synthetic dollar, internet bond, and the yields they generate.

To obtain USDe tokens, users must first deposit collateral (some options are pictured below). When you click “buy,” the USDe tokens are minted. You are now left with USDe that you can stake on the platform to get some sUSDe, which can then be imported to your wallet when you see the prompt. This sUSDe will generate additional yield, and it’s also there in your wallet to use on other DeFi platforms if you choose.

Image via Ethena

Image via EthenaIt’s really that simple. You can be set up within about 5 minutes of visiting the site and connecting your wallet. Just for clarification, it's the action of staking your minted USDe that creates what is called the internet bond. Let’s dig a little deeper into that concept next.

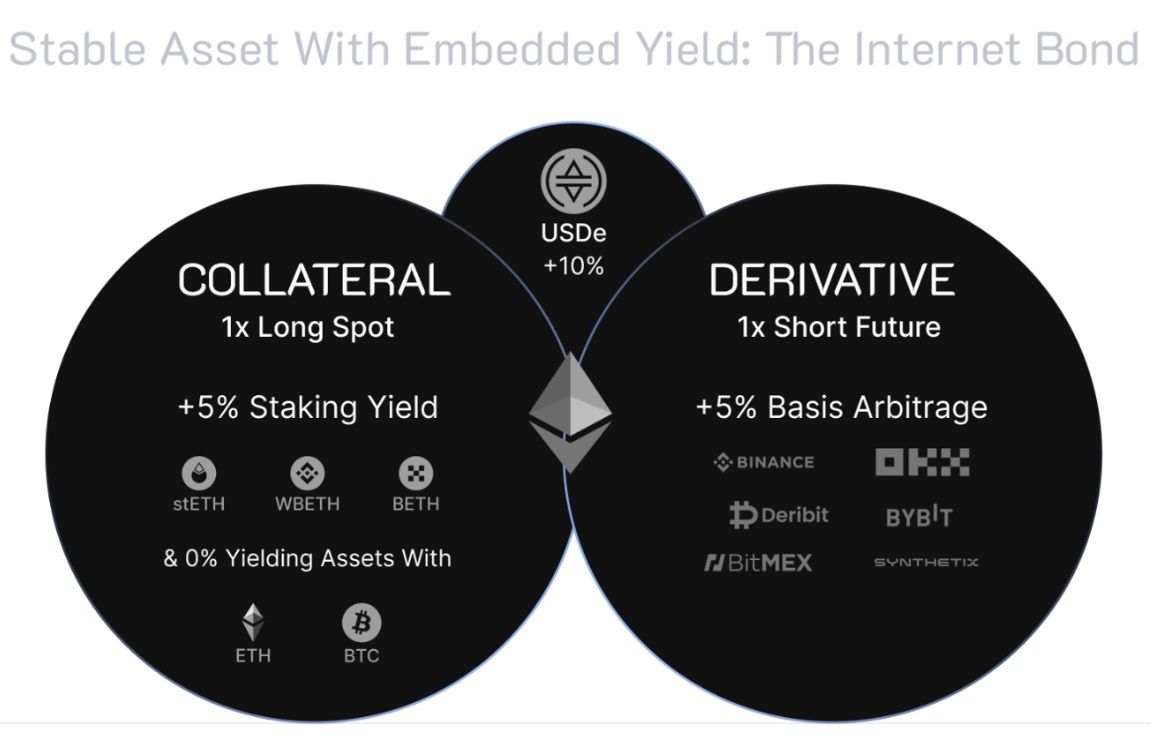

Ethena's Internet Bond

The Internet Bond is an innovative financial product that comes from the yield-generating activities of USDe. So when you're looking at Ethena's USDe system, think of it in two layers. The bottom layer is the USDe itself: you give Ethena some crypto assets as collateral, and they do a delicate balancing act. They stake the collateral while, at the same time, they short it in the futures market to neutralise any price swings. This is meant to keep the value of your collateral stable no matter what the market is doing.

Now, the top layer — that's your Internet Bond. This is where things get interesting. The staking and the shorting don't just keep things stable; they also generate yield. Part of this yield comes from the staking rewards, which most of us are familiar with. But then there's the "carry" or the funding rate from the futures market, which can sometimes be a nice little earner, especially when the markets are feeling bullish.

The Internet Bond taps into this yield. It's kind of like a savings bond, where the interest comes from the yields generated by the USDe operations. The beauty is that since all this is happening in the crypto space, it's decentralised and transparent, free from the usual tangles of traditional banking systems.

So, in the big picture, the Internet Bond isn't just sitting there next to USDe; it's directly linked to it, growing in value as the protocol efficiently manages the aforementioned cash and carry trade strategy while maintaining USDe's stability and scalability. It’s a powerful tool that strengthens USDe's position as a stable synthetic asset and offers an attractive yield-bearing instrument in the form of the bond.

Image via Ethena

Image via EthenaIs USDe a Stablecoin?

The team will continually attempt to clarify this, but most writers and influencers discussing the project seem to gravitate toward the term without mentioning that this is not the case. Here’s a quick explanation as to why it’s not a stablecoin:

Traditional stablecoins, such as USDT (Tether) and USDC (USD Coin), aim to peg their value to a fiat currency, typically the US dollar, to maintain price stability. They usually achieve this peg by holding reserves in the equivalent fiat currency, via other assets, and occasionally, through algorithms. This means for every USDT or USDC in circulation, there's supposed to be one real US dollar or an equivalent asset tucked away in a bank or reserve.

Now, contrast this with Ethena's synthetic approach. As mentioned, instead of relying on fiat reserves, Ethena uses crypto assets like USDC or DAI as collateral. It hedges away the volatility of this collateral using derivatives to maintain stability. Ethena's strategy allows USDe to be scalable since it’s not limited by cash reserves and provides a degree of censorship resistance since it operates outside traditional banking systems.

Image via Dall-e

Image via Dall-eIn addition, the Internet Bond concept we just discussed offers a unique product that grows with the USDe ecosystem. This is a step away from reserve-backed stablecoins and towards a more integrated financial product that leverages blockchain technology and the crypto-assets themselves to maintain stability and generate returns.

Dispelling Comparison with Terra-Luna

The Ethena team addresses this in their FAQs, but that still doesn’t stop the comparison from popping up pretty much in every discussion.

The difference between this and UST is significant. UST operated a mint and burn mechanism where Luna, Terra's native currency, was used as collateral. The assumption was that Luna would retain some inherent value, but as we saw, there was no real value to Luna — it was based purely on market perception. The whole system collapsed when people realised Luna wasn’t worth much. In contrast, USDe is backed by fully liquid collateral like Ethereum, which has a well-understood and observable market value.

Navigating Risks: Understanding Ethena's Protocol Vulnerabilities

Ethena’s USDe is not risk-free. There are multiple risks involved. To their credit, the Ethena team has thoroughly addressed these risks in their FAQs. For brevity’s sake, we’ll discuss the most important risks here, but if you’d like to see the EXTENSIVE risk section that Ethena has addressed in its docs, feel free to check it out here.

Funding Rate Risk

To summarise the funding rate risks for Ethena in the context of negative funding and the use of the reserve fund:

Ethena is exposed to risks if perpetual futures funding rates turn more negative than the yields from stETH. In such situations, the protocol's reserve fund is designed to cover settlements, protecting the backing of USDe. However, if negative funding persisted over a prolonged period, the reserve fund could be exhausted, leading to a gradual erosion of USDe’s principal and possible depegging. However, sustained negative accrual would likely prompt users to redeem their staked USDe, triggering Ethena to close out short positions, which could rebalance funding rates back to neutral or positive.

The reserve fund itself is replenished by positive funding payments from Ethena's short positions when perpetual futures funding rates are positive. It can also receive injections from capital raised during fundraising. Historically, both ETH and BTC funding rates have shown a positive bias, even during bear markets, averaging between 7% and 9% on an open interest or volume-weighted basis. Only one address holds the reserve funds, and its composition is publicly viewable.

Image via Shutterstock

Image via ShutterstockLiquidity Risk

Ethena's users are directly impacted by the liquidity levels in the markets, as low liquidity can lead to higher slippage during the minting or redeeming of USDe. This means users could get less favourable rates when they trade, and because Ethena needs to maintain its hedge positions promptly, it sometimes has to accept this slippage. This is particularly relevant when large positions need to be unwound, and market liquidity isn't sufficient to do so without moving the price significantly. Although it’s an unlikely scenario, Ethena is prepared to manage mass redemptions and has limited the volume of transactions per block to prevent large, sudden withdrawals that could destabilise the system.

Additionally, Ethena has introduced funding mechanics that adjust shorts according to supply changes, usually improving funding rates and market stability. Additionally, a seven-day cooling-off period for sUSDe prevents the vault from being liquidated too quickly and offers a buffer against volatility. As for the liquidity of LST collateral onchain, the primary concern is the stETH-ETH Curve pool, where most stETH liquidity is held. The risk lies with protocols that can’t wait for the staking redemption process and need to use the liquidity pool instead. If this pool's liquidity is drained, stETH could depeg, leaving any protocol that needs to redeem their stETH urgently to face potential losses.

Other risks include liquidity risks — if large positions cause slippage due to insufficient market liquidity — and collateral risks, such as a potential depeg from Lido's stETH. There’s also the risk of exchange failure, but it's important to note that USDe does not deposit your collateral on exchanges; it's held with third-party custodians using MPC technology. The only things placed in the exchanges are the short positions.

It is also important to note that Ethena has recently added Bitcoin as a backing asset to USDe. This move will significantly allow the protocol to scale its supply from $2 billion. Bitcoin’s massive liquidity and higher open interest on exchanges are key factors that make it suitable for backing and scaling USDe, offering a more secure product for holders. The choice reflects the platform's strategy to optimize the scalability of USDe, particularly in light of Bitcoin's rapid growth in derivative markets, which are expanding faster than Ethereum's, offering enhanced scalability and liquidity for hedging strategies.

Image via X

Image via XCustody Risk

In the event of custodian bankruptcy, assets in segregated vaults like Copper's would be unaffected as they never legally belong to the custodian, ensuring they remain outside the bankruptcy proceedings. Transfers to other wallets would be possible, albeit with potential minor delays. For Omnibus Solutions, assets are held in a trust under English law, which means they remain outside the custodian's estate and are not subject to creditor claims, though access to assets may be delayed per Copper's policies. In both cases, the protocol would adjust hedging to maintain its position neutral to market movements.

Staking Withdrawal Risk

If there's a rush to unstake simultaneously, users will be placed in a queue and must wait their turn due to network capacity limits. However, this could benefit the protocol since it would command a larger share of the ETH staking yield, a more substantial part of the network's stake.

Conclusion: Balancing Enthusiasm with Caution

Despite the mentioned risks, the market response has been overwhelmingly positive, with USDe issuance skyrocketing and becoming history's fastest-growing US dollar-denominated asset. There was also significant excitement around the $ENA airdrop, its governance token, which airdropped about 720 million to participants, further enhancing governance participation.

Ultimately, the project was established to address the urgent need for decentralised, globally accessible base money asset in the crypto space, independent of traditional banking systems. Given the vulnerability of DeFi, which often relies on traditional stablecoins, they appear to have developed a scalable, crypto-native currency that could support a truly independent financial system. This initiative could provide 8 billion people with a censorship-resistant, dollar-denominated option for storing capital, meeting a massive market demand for a stable yet decentralised financial instrument.

Ethena promises to transform the space, particularly through its approach to hedging against the volatility inherent in cryptocurrency markets. Their use of delta hedging strategies and integration of Bitcoin as collateral represents an innovative leap towards creating a more secure synthetic dollar. By focusing on liquidity and risk mitigation, such as addressing the challenges of negative funding rates and providing safeguards against custodian bankruptcy, Ethena positions itself as a forward-thinking player that could potentially offer investors a safer haven within the often turbulent crypto space.

Notably, their documentation highlights the project's importance to the space. And, if they can successfully execute their plans, it’s hard to doubt their potential. They have meticulously prepared for various scenarios, from addressing black swan events to maintaining a 5% reserve fund to manage prolonged periods of negative funding rates—they seem to have a solid answer for everything, which is always good.

However, with that said, the enthusiasm for the protocol needs to be tempered with caution. The long-term viability of synthetic stablecoins like USDe is not without question. They operate in uncharted territories, with regulatory landscapes still in flux and market behaviours being unpredictable. Investors considering such instruments must recognize the delicate balance between innovation and risk. Synthetic stablecoins could be the cutting edge of financial technology, offering unprecedented yields and novel mechanisms for maintaining stability.

However, their resilience in the face of market stresses, regulatory shifts, and technological challenges remains to be seen. The prospective investor should weigh the potential for high returns against the possibility of unanticipated pitfalls in a market that is still maturing. In essence, while USDe exemplifies the groundbreaking potential of synthetic stablecoins, it also serves as a reminder of the need for rigorous due diligence and the acceptance of the significant risks associated with high-reward crypto investments.