Growth DeFi is a new decentralized finance platform looking to improve on the DeFi experience. Built on top of the already successful Aave, Mooniswap, and CURVE protocols the platform seeks to allow its users to maximize the yields they earn as liquidity providers.

This hands-off approach to investing in the cryptocurrency space is becoming increasingly popular, so let’s look at Growth DeFi and see if they have what it takes to become a dominant player in this increasingly crowded DeFi space.

What is Growth DeFi?

The platform is clear in its intention to become a complete suite of DeFi tools that will offer its users optimized strategies for all existing DeFi protocols.

It is built around the GRO tokens, which are deflationary tokens that grant users voting and staking rights while also going after capital appreciation. Tied to the GRO tokens are the gTokens that provide a direct appreciation source for GRO tokens through fee burning.

Get ready for Growth. Image via GrowthDeFi.com

Get ready for Growth. Image via GrowthDeFi.com While it initially seems that the gTokens are the interest-bearing tokens for the platform that payout based on a users deposited funds, it soon becomes clear that they offer more value since they benefit from the minting (deposit) and burning (withdrawal) fees charged by the platform. This fee is 1%, half of which gets locked into liquidity pools with varying GRO pairs. These locked gTokens are occasionally burned to increase the scarcity of the token and to lift demand.

As a result, users holding gTokens benefit from the yield of the underlying protocol along with the arbitrage profits of the minting and burning fees.

Additionally, users can always count on low slippage with near no impermanent loss because the protocol constantly locks up liquidity. This is critically important since one of the goals of Growth DeFi is introducing liquidity provider exposure without suffering from impermanent loss.

What is Impermanent Loss?

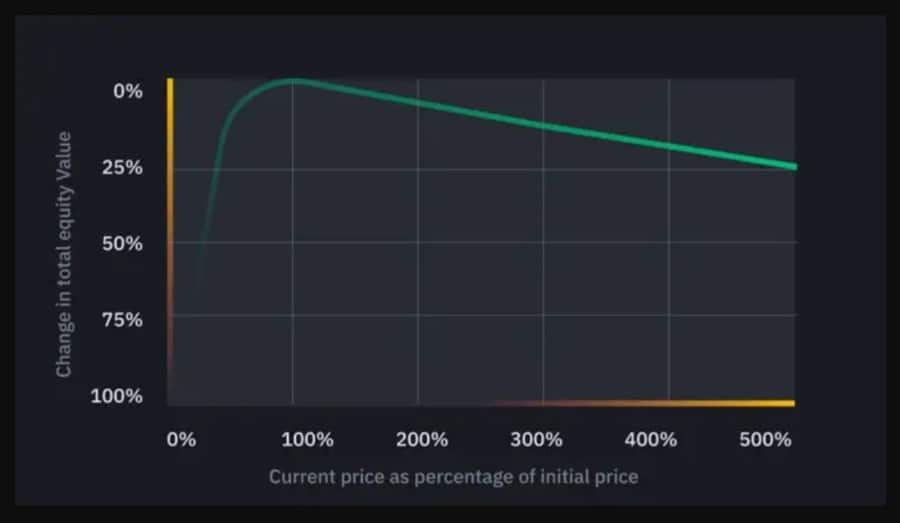

Impermanent loss is a concept from finance, and is akin to opportunity cost. In a DeFi platform an impermanent loss occurs whenever a deposit is made to a liquidity pool and subsequently the price of the underlying asset changes, leading to a change in the value of the assets versus when they were added to the liquidity pool.

The larger the price change the more the user becomes exposed to impermanent loss. In simple terms this means the assets have a lower value when withdrawn than they had when deposited.

It's not so hard to grasp. Image via Finematics.com

It's not so hard to grasp. Image via Finematics.com Pools that are based on stablecoins, wrapped versions of coins, and other assets that trade in a tight range benefit from having less impermanent loss exposure. This means those who provide liquidity in these types of assets have less risk of being affected by impermanent loss.

So why would liquidity providers put themselves at risk of suffering a potential loss by depositing their coins and providing liquidity?

Because trading fees can and do offset the potential losses brought about by impermanent loss. In fact, even pools that are heavily exposed to impermanent loss can be profitable if the trading fees provide enough of a buffer.

For example, at Uniswap every trade is charged a 0.3% fee which goes directly to the liquidity providers. When the trading volume in a given pool increases enough it can become profitable to provide liquidity in that pool even when impermanent losses are a high probability. This is a complex situation however as the potential losses or profitability depend on many factors such as the asset being deposited, the specific pool, the protocol, and even the conditions in the broader markets.

An Example of Impermanent Loss

To give a concrete example of how an impermanent loss might come about consider the following situation.

Yield farming can yield losses. Image via Binance Academy.

Yield farming can yield losses. Image via Binance Academy. A liquidity provider, we’ll call him Guy, provides liquidity to a Uniswap DAI/ETH 50/50 pool. A 50/50 pool requires the liquidity provider to provide an equal value of each token in the pool. In this case let’s assume DAI is $1 and Ethereum is $500. Guy provides the pool with 10 ETH worth $5,000 and 5,000 DAI worth $5,000.

At this point the value of both tokens deposited to the liquidity pool is equal.

Now the price of ETH begins rising until it reaches $550 on an external platform such as Binance. As the price difference in ETH on Binance and ETH on Uniswap increases arbitrageurs take notice and they come into the market to try and make a profit from this price difference in a process known as arbitrage.

At Uniswap there is a product market maker that is constantly buying and selling tokens to maintain the proper ratio in all the liquidity pools. This means when ETH is bought from the pool it is replaced with ETH at a higher cost basis, raising the price of ETH on Uniswap. The arbitrageur will continue buying the cheaper Uniswap ETH until the price matches the higher price at Binance. How much ETH buying will it take before the price reaches equilibrium?

By using the external (Binance) price in a few formulas derived from the constant product market maker formula, we see the point where the Uniswap ETH price will be at $550 is when there are 5,244.045 DAI and 9.535 ETH in the pool.

So the arbitrageur is basically able to buy 0.465 ETH in order to achieve equilibrium between Uniswap’s and Binance’s ETH price, costing 244.045 DAI and achieving the average price of 524.83 DAI per ETH. Bought ETH can be instantly sold for DAI or any other USD based stable coin on an external venue for $550. The arbitrageur just earned ~12USD minus the fees.

Simple visual showing how impermanent loss happens. Image via TrustWallet.com

Simple visual showing how impermanent loss happens. Image via TrustWallet.com Of course this also had an impact on our liquidity provider, Guy.

Before the arbitrageur came along Guy had 5,000 DAI @ $1 and 10 ETH @500 for a total value of $10,000 provided as liquidity.

After the arbitrageur was done with his business Guy’s DAI had increased to 5,244.045 @ $1, but his ETH decreased to 9.535 @ $550. The total value now is $5,244.045 + (9.535 * $550) = $10,488.295.

However, if Guy had simply held onto his DAI and ETH without offering them up as liquidity he would have $5,000 + (10 * $550) = $10,500. As you can see Guy has an impermanent loss of $11.705 from providing liquidity.

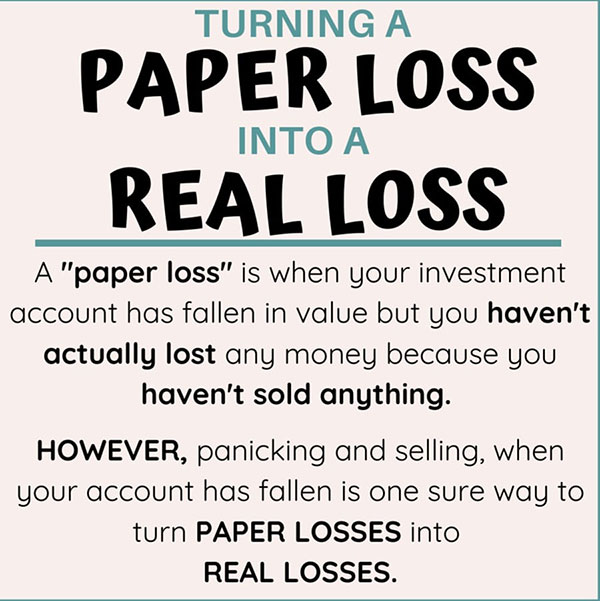

However impermanent loss is called impermanent because at this point it is only a paper loss. It doesn’t become a permanent loss until Guy withdraws his liquidity. If he leaves it and the price of ETH goes back to $500 there is no impermanent loss.

Don't worry, we only suffered a paper loss. Image via OurRichJourney.com

Don't worry, we only suffered a paper loss. Image via OurRichJourney.com Keep in mind however that this example doesn’t account for any trading fees earned by providing liquidity. There’s a very good chance that the fees earned in this liquidity pool would have offset the impermanent losses and made the provision of liquidity in this case profitable.

It’s also possible that the trading fees would not have been large enough to offset the impermanent loss completely. In either case it’s important a user understands impermanent loss and the possibility that it will affect them before providing liquidity to a pool.

Risks to Liquidity Providers at AMMs

Impermanent loss may be a confusing name, but it is used because these “paper losses” don’t become permanent unless you withdraw your coins from the liquidity pool. While the trading fees earned can help offset an impermanent loss, the name is still a bit misleading at best.

One area where extra care is needed is when depositing into an Automated Market Maker (AMM). I’ve mentioned above that some liquidity pools have greater risk of impermanent loss than others. A basic rule you can use is that the more volatile the underlying assets, the greater the risk of impermanent loss.

You can also get some idea of the risk of impermanent loss by making a small initial deposit to see how the pool behaves. Once you have a rough idea of what your returns should be and your risks, you can deposit a larger amount if it makes sense.

There must be a solution to impermanent loss at AMMs. Image via Medium.com

There must be a solution to impermanent loss at AMMs. Image via Medium.com Another way to protect yourself is to look for the more established and known AMMs. These are a known commodity, with known returns. One issue with DeFi is that anyone can take an existing AMM and fork it, adding some changes along the way. This exposes users to potential bugs that could leave your funds trapped in the AMM forever.

Remember risks and rewards go hand in hand. If an AMM is offering you returns that are far greater than average, there are probably matching risks that are far greater than average as well.

GRO's Value Proposition

The stated purpose of Drowth DeFi is to create an ecosystem where the holders of its GRO and gTokens get to profit from the compound interest combined with the share of profits from arbitrageurs, without the risks of suffering an impermanent loss.

It seeks to achieve this by leveraging the power of three or more DeFi protocols, the primary of which are AAVE, CURVE, and Mooniswap. Eventually it plans on being able to use any DeFi protocol at all.

GRO Token Explained

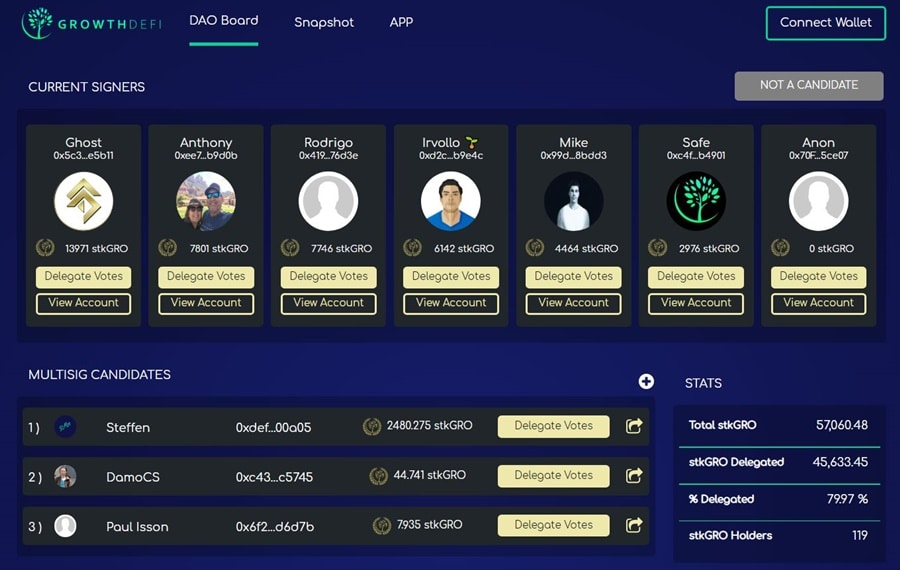

GRO is meant to be the governance token of the protocol, and it will power the GRO DAO. It has a total supply of 1,000,000 GRO tokens and the main use case of the tokens are for staking to provide voting rights in any proposals, which allows the holders of the token to determine the future course of the protocol.

Governance at work with GRO. Image via GrowthDeFi.com

Governance at work with GRO. Image via GrowthDeFi.com Below are the three primary characteristics/uses of the GRO token:

- Staking: Staking isn’t yet implemented, but it is expected in the first quarter of 2021. Users who wish to participate in the governance of the protocol will be required to stake their GRO and receive stkGRO in return, which keeps their tokens liquid even when being staked. There are no lock-up mechanisms planned for the staking system.

- Liquidity: The liquidity for gTokens is provided by the different GRO pairings, and this allows users to buy and sell their tokens any time with low slippage.

- Deflationary: Half of the fees required when minting gTokens are burned, and there is also a 10% fee for staking GRO, half of which is burnt. This decrease in tokens not only decreases the available supply of tokens, it also ensures they are deflationary.

Growth DeFi is setting itself up as a sustainable farming protocol, with the tokenomic design meant to reward those who are intending to hold tokens for a long period of time. The team is attempting to create a complete ecosystem where users are able to enjoy investment stability across a broad range of DeFi protocols. Essentially they believe there are no limits to what they can build as an add-on to the protocol.

Farming for the future. Image via Twitter.

Farming for the future. Image via Twitter. Recently the entire v1 code has been audited by Consensys Diligence, and while there were some action items and recommendations made, in general the code appears to be safe. There was some question about the loose definitions of many states, roles, and permissions, particularly as they apply to Growth DeFi’s owner role.

According to the Consensys auditor these loose definitions “suggest that future plans to transition this role to a DAO-governed multisig have not been well thought through. In its current configuration, it would be incredibly difficult to transition the management of the Owner’s extensive permissions to a DAO-governed multisig.”

Introducing gTokens

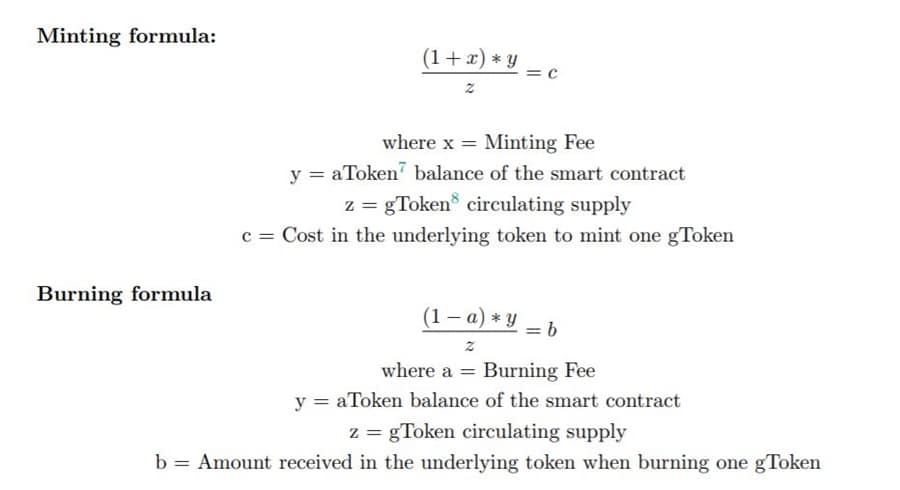

One of the core components of the Growth DeFi ecosystem are the gTokens. These unique tokens not only offer the compound interest potential that comes from providing liquidity, but they also take arbitrage profits and a portion of minting and burning fees. They also benefit from the higher liquidity provider profits generated at Mooniswap, and offer additional GRO incentives by providing liquidity. Basically the gTokens are a way for liquidity providers to access higher yields than usual and accumulate more of the underlying tokens.

Introducing gTokens for every purpose. Image via Twitter.

Introducing gTokens for every purpose. Image via Twitter. Locked Liquidity Pools

One of the key features of the gTokens are Locked Liquidity Pools that was first demonstrated by the Proof of Liquidity experiment carried out by UniPower. gTokens have adopted locked liquidity pools as a means to distribute the profits that come from locked liquidity pools to the GRO and gToken holders.

Locked LPs accumulation

Locked liquidity pools get a boost to their balances by accumulating a 0.5% portion of all minting and burning fees. Each gToken provides the fees generated to the corresponding liquidity pool, so any gDAI fees go to the GRO/DAI pair, gETH fees go to the GRO/ETH pair, etc.

Burning Profits

Those holding gTokens receive periodic rewards as the fees generated by the locked liquidity pools is occasionally burned, taking it out of circulation and reducing the overall supply. This all comes from trading volume and market volatility and it is and additional profit/growth source for gToken & GRO holders.

For those of you who love the maths. Image via Growth DeFi Whitepaper.

For those of you who love the maths. Image via Growth DeFi Whitepaper. gToken Arbitraging

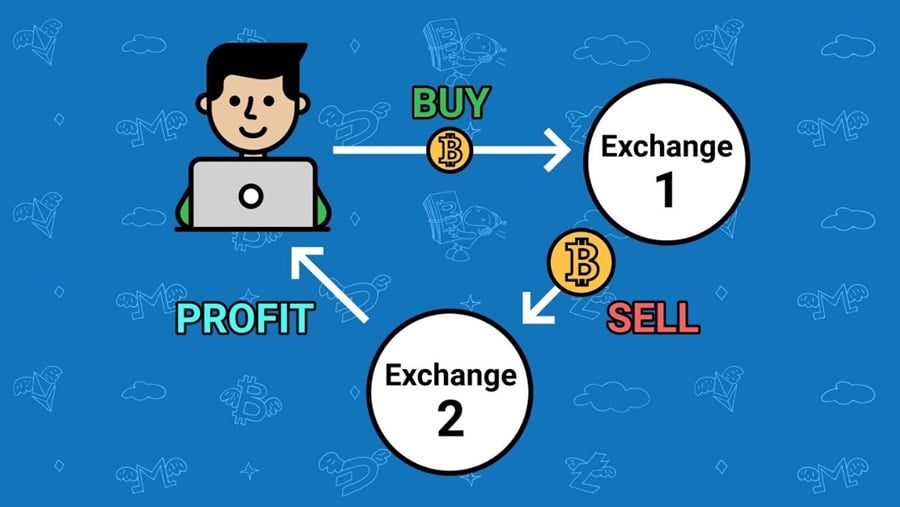

Arbitraging is the unique strength of the gToken. Until the creation of Growth DeFi there was no other way to profit from the activity of arbitrageurs other than providing liquidity to pools. Of course this also increased the risk of suffering impermanent losses, which was a less than ideal situation. One of the primary reasons for creating gTokens is to solve this problem of impermanent losses caused by arbitrage behavior in liquidity pools.

A new take on an old way to make money. Image via 3commasTutorials.com

A new take on an old way to make money. Image via 3commasTutorials.com This also highlights the importance of high liquidity to the GRO/gToken pairs. The greater the liquidity of these pairs, the greater the fees that are generated by the activity of arbitrageurs. In order to achieve the maximum level of liquidity possible Growth DeFi combines its permanent liquidity pools with incentives in the form of GRO rewards for providing liquidity for the pairs, this mechanism is also known as ”Liquidity Farming”.

Providing liquidity for GRO/gToken pairs

Also helping combat impermanence losses and collect some extra yield on the gToken is by providing liquidity for any of the gTokens. When liquidity is provided in this way the provider earns liquidity fees and is farming GRO via liquidity farming. 25% of the total supply of GRO tokens (250,000 GRO) has been allocated to rewarding those who provide liquidity to GRO/gToken pairs.

Here's where all the good stuff happens. Image via Growth DeFi App.

Here's where all the good stuff happens. Image via Growth DeFi App. Here’s a full list of the potential profit sources for liquidity providers:

- 50% of the liquidity pool is GRO which increases its value with the volume across all GRO pools and the minting & burning fees of all gTokens.

- The other 50% is from gToken’s which are constantly accruing interest and compounding fees from supply fluctuations and arbitrage opportunities (it also appreciates after the periodic burns from the locked LP happen).

- 3% of the volume in the pool is collected as LP fees.

- Besides the LP fee Mooniswap also forces arbitragers to compete between them and giving a part of those profits to LPs.

- When providing liquidity for a GRO/gToken pair the LP will also receive GRO as an extra reward for providing liquidity.

Who is Behind Growth Defi

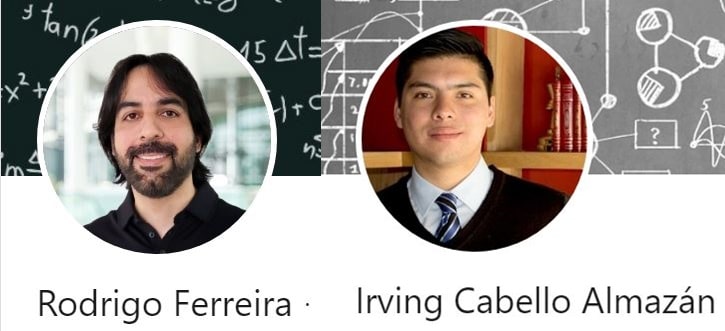

Rodrigo Ferreira is the Head Developer for the backend code of Growth DeFi. He has a Ph.D. in Computer Science from Yale, and has a deep background in formal semantics, program verification, and compilers. Rodrigo is deeply interested in cryptocurrencies/blockchain and has previously developed a mobile wallet and a cryptocurrency exchange.

As he says on his LinkedIn, “As a software engineer I am able to assemble and deploy complex systems in a variety of languages and platforms. As an entrepreneur I like to build applications for interesting business cases that can scale with automation.”

The men behind the Growth DeFi project. Images via LinkedIn.

The men behind the Growth DeFi project. Images via LinkedIn. Irving Cabello Almazán is the Head Developer for the frontend code of Growth DeFi. As a full-stack javascript developer with a strong passion in Ethereum, DeFi and the blockchain ecosystem Irving has gained experience by building platforms on React and Node for over 4 years and has also developed multiple DAPPS for Ethereum using Solidity, Web3 and Truffle.

GRO Token Future Prospects

The GRO token debuted on August 26, 2020 at a price of $19.66 (based on Coinmarketcap.com data), hit a high of $24.66 on that day, and closed slightly lower at $19.03.

Since then the token has been quite volatile. For example a week after its listing it closed at $31.08, but a week following that it was back down to $12.97. Those ups and downs have continued and as of December 22, 2020 the token is trading at $23.69.

Volatility is the name of the game. Image via Coinmarketcap.com

Volatility is the name of the game. Image via Coinmarketcap.com With a project and token this young it is nearly impossible to predict what’s coming next, although the DeFi space is extremely hot as we head into 2021. That could provide a significant tailwind for GRO as it is linked to some of the fastest growing DeFi projects in the space.

As is the case with any blockchain project what Growth DeFi really needs to grow is adoption. The more people that use the platform, the faster the GRO token can appreciate since its supply tokenomics are tied tightly to the burning of tokens collected as trading fees.

As of December 22, 2020 the token is ranked #859 by total market cap with a cap of $3,519,545. That puts the coin fairly low on the list, and one of the primary reasons at this point could be a lack of widespread usage of the platform. There is very limited information and data regarding the platform, and several other yield farming platforms such as Yearn.finance and Harvest Finance have a significant lead in the space.

Conclusion

The DeFi ecosystem is undoubtedly the fastest growing industry in crypto as we enter 2021, and Growth DeFi is looking to improve on the user experience by providing its unique take that provides liquidity provider exposure without suffering from impermanent loss. Is that enough to differentiate the platform and help it grow to take on the leaders in the space?

How fast can Growth DeFi grow? Image via GrowthDeFi.com

How fast can Growth DeFi grow? Image via GrowthDeFi.comPreviously we wouldn't have been sure, but with cryptocurrencies rallying and reaching record levels having that protection from impermanent loss could be a game-changer. After all, who wants to lock up their coins to collect a 6-8% yield only to watch the total value of their cryptos fall by 10% due to price changes in the underlying assets.

In fact, this trend is already showing in the market. As of late November 2020 there was $14 billion in Ethereum and Bitcoin locked up in DeFi. That represents a jump of over 500% in the value of ETH locked up in 2020, and a massive increase of over 10,000% for BTC locked in DeFi in 2020.

And yet at the same time the actual number of ETH has fallen almost 25% since October 2020. There's no clear reason why, but a good hypothesis is that investors are shying away from yield farming due to the impermanent losses caused by rallying cryptocurreny prices.

If that's the case a platform like Growth DeFi could stand to benefit greatly as DeFi continues to mature, evolve, and grow.