The Huobi Derivatives Market is the digital asset derivatives platform of the Huobi Global cryptocurrency exchange - one of the largest and most well known in the space.

Launched a year after the main exchange, Huobi DM offers a large array of tools and functionality to trade crypto with leverage of up to 100x. It also is trying to piggyback off of the reputation of said exchange.

However, is it really safe?

In this Huobi Derivatives review we will attempt to answer that. We will also give you some top tips that you need to know to make the most of your trading.

Note: Users located in the US and UK are not supported.

Huobi Derivatives Overview

Huobi DM was launched in December of 2018. This was on the back of the successful expansion of the main Huobi exchange. Huobi is one of the largest crypto exchanges in the space which launched in 2013.

Huobi has global offices in Asia, Europe & the Americas. Apart from the derivatives exchange they also have their main spot exchange as well, mining pools, OTC desks, and Huobi cloud - so quite an extensive list.

When it comes to the Huobi derivative instruments, they offer futures and perpetual swap instruments. These are leveraged up to a maximum of 20x on the futures and 125x on the swap instrument.

Since the launch of Huobi Derivatives, they have been quite successful in growing their trading volume. For example, over the last 24 hours there was a total of $9 billion in volume that was traded on the platform.

Huobi DM provides this trading functionality through numerous platforms. These include the likes of their web trading interface as well as their PC clients and mobile applications.

This is a global platform and as such they have translated it into 7 different languages. Despite their reach, there are a number of countries in which the service is not available. This includes the likes of the USA, Hong Kong, Turkey and a few other regions. You can see the full list here.

Is It Safe?

This is perhaps one of the most important questions that one can ask before they are using a new exchange and it is the reason that it is our main criteria.

With the Huobi derivatives exchange, the expertise and security at the main exchange no doubt plays into the measures that are in place on the derivative exchange. Let's take a look at some of them.

Exchange Security

Huobi operates a hot and cold wallet storage procedure. This means that they keep the vast amount of their coin holdings in an offline environment away from hackers. They then have a smaller percentage in "hot" wallets with multisig capability.

Some of the security procedures in place at Huobi Derivatives

Some of the security procedures in place at Huobi DerivativesThey also operate a decentralized server structure around the world which can ensure uptime irrespective of whether one of the servers goes down. You can think of this as effective load balancing.

Finally, they have anti DDoS measures in place. We all know that crypto exchanges are prime targets for Denial of Service attacks and it can be quite frustrating when these are perpetrated in peak market times.

Risk Management

This is specific to the derivatives exchange. They need to have safeguards in place in order to manage the risk that comes from severe market movements when the traders are using significant leverage.

This is why Huobi DM operates an insurance fund. This is something that is used by a number of other exchanges as well and helps to protect the trading pool in case a liquidation does not take place above the bankruptcy.

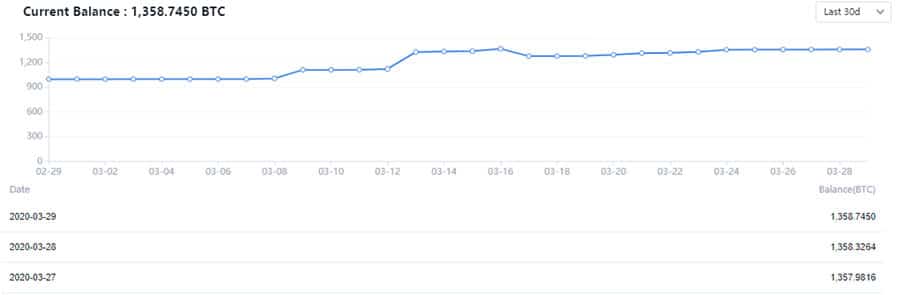

The Huobi Insurance Fund which Protects Trades

The Huobi Insurance Fund which Protects TradesIn essence, the insurance fund is used in order to prevent what is termed "socialized losses". This happens when profitable traders on the other side of the trade will have their profits diminished to fund the insolvency.

Communication

All communication with the Huobi servers is done through a 256 Bit SSL encrypted connection. This means that all your private data including your passwords and KYC information is hidden from prying eyes.

This can also be a great way for to identify potential phishing attempts. If you land on a page that does not have the secure padlock in the browser it means that you should leave immediately as they will use your private info.

Account Security

Often times, we are the weakest link in our own security. That is why Huobi have provided a number of tools to secure your accout and prevent intrusion.

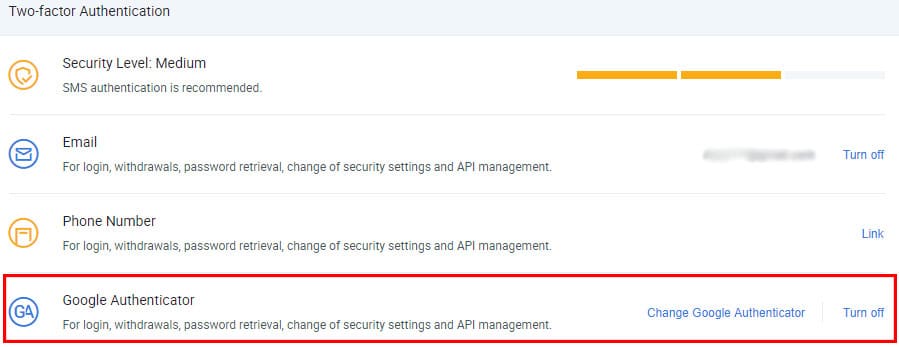

The first and most important measure that they have is two factor authentication. This means that when you log in you will have to confirm the login on your phone. This can either be done via SMS or through Google Authenticator. We would suggest the latter to avoid sim swap fraud.

Setting Two Factor Authentication in the Account

Setting Two Factor Authentication in the AccountApart from 2FA, you also have the option to set a password for your assets. This means that if you want to withdraw your funds you will have to insert a password beforehand - which could protect against hackers.

Finally, they also have the option to set an anti-phishing code. This means that all the emails that you get from Huobi will have this unique code and will allow you to identify nefarious emails.

Assets & Instruments

As mentioned, there are two types of instruments that you can trade on the Huobi derivatives platform. These are your traditional futures as well as the perpetual swaps or futures.

With these instruments, you are trading crypto on margin. This means that they are leveraged and your exposure is often many multiples of the amount that you have put down as collateral.

So, for example, if you have an initial margin requirement of 2% it means that you have leverage of 50x. If Bitcoin moves by $1 your notional position will move by 50 times more than that.

Now that you have a brief understanding of leverage, let's take a look at the instruments on offer at the Huobi exchange.

Futures

Futures are instruments that allow the holder to buy or sell some asset in the future. Essentially, you are trading some future price of the instrument on the chose delivery date.

With the futures instruments, you have leverage options of 1X, 5X, 10X and 20X. These are on 9 different cryptocurrency assets including Bitcoin, Ethereum, EOS, Litecoin, Bitcoin Cash, XRP, Etheruem Classic, Tron & BSV.

In terms of expiry dates, they have weekly, bi-weekly and Quarterly which settle every Friday. When it comes to the specifics of the contract, they differ according to which asset is being traded. Here are some examples:

- Bitcoin: Face Value of $100 and min price change $0.01.

- XRP: Face Value of $10 and min price change $0.0001.

- TRX: Face Value of $10 and min price change $0.00001.

- All Others: Face Value of $10 and min price change $0.001.

You should also take a look into the contract specifics in the Huobi docs. This includes such information as the index reference for the prices as well as your last trading price. The latter can only be done up till 10 minutes before the expiry.

It is also important to point out though that although these are futures instruments on the asset, they are only delivered in the difference in digital asset prices. So essentially, to physical delivery will take place.

Swaps

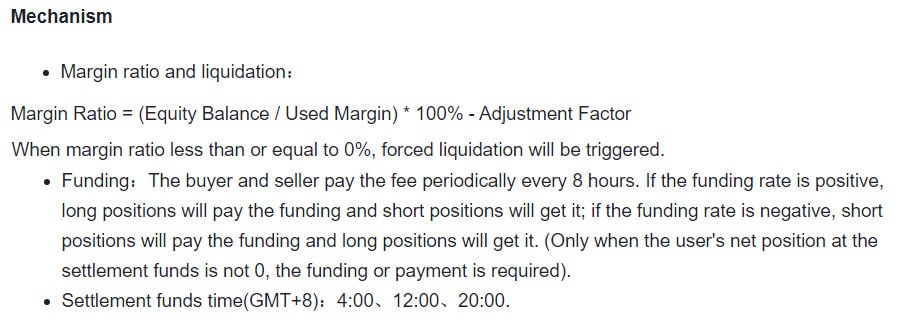

Perpetual swaps are leveraged instruments that do not have have a delivery date. They are marked to market everyday and settle 3 times a day. They are sometimes also called "perpetual futures" at other exchanges.

The reason that they are called "Swaps" at Huobi Derivatives is because you are swapping the returns of one asset for the returns of another. Here, you are swapping crypto returns for returns on the US dollar.

Perpetual Swap Specifics at Huobi DM

Perpetual Swap Specifics at Huobi DMGiven that you are doing this, you will have to pay a funding rate. This is used to make sure that the perpetual swap price is anchored to the spot market. When it is positive you will have the longs paying the shorts and vice versa for negative.

At Huobi DM, the Perpetual swaps have leverage up to 125x and they are written on 5 different assets. These are Bitcoin and Ethereum with other coins to be added soon.

Index Reference ❓: This is basically the price that is used by the exchange to reference the underlying. It is a combined price to take account of any potential anomolies.

You should also note that although the max leverage on the exchange is 125X for the swaps, this is only for lower positions. The larger the positions you take the higher your initial and maintenance margin.

Huobi Derivatives Fees

This is another really important consideration for any trader. The fees that you pay directly impact on your trading profitability in the long run.

Huobi operates what is called a "maker taker" model for their fees. This basically means that they will offer different fees based on whether you are making or taking liquidity.

The fees will also differ depending on whether the instrument is a Future or a swap. So let's look at this shall we?

Futures

There are three fees in the Futures fee schedule. These are the maker, the taker and the delivery. The delivery fee is that which is paid if the underlying asset is actually delivered to you.

For the standard fee structure, all Maker fees are 0.02% and all taker fees are 0.03%. Bitcoin futures have a delivery fee of 0.015% whereas all the others futures instruments will have a delivery fee of 0.05%.

VIP & Market Maker Fee structures on Futures

VIP & Market Maker Fee structures on FuturesIf, however, you are a trader that can provide significant volume to the platform then you can apply to be a market maker. This will actually see you getting a rebate at the maker rate depending on the level of volume that you are doing.

You also have the chance to apply for being a VIP client. This is reserved for those traders who come from other platforms over to the Huobi DM exchange. There are also different tiers here although you should note that the rates are not as lucrative as those of the market maker.

To Apply 📝: If you want to apply to be a market maker then you can email [email protected] and if you want to apply for VIP then you can email [email protected]

Another really important benefit of using Huobi's derivatives over some of the competitors is that they don't charge liquidation fees. Hence, if you are unable to close your position before liquidation then you won't be charged fees on top of that.

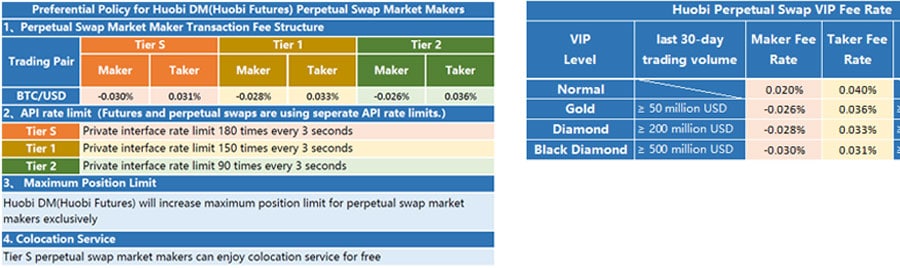

Perpetual Swaps

When it comes to the perpetual swaps, the maker fee is 0.02% for all pairs and it is 0.04% for the taker fee for all crypto. There is no delivery fee as these are perpetual swaps with no underlying delivery.

As is the case with the futures, Huobi has different fee tiers for those who are either VIPs or those who are providing significant liquidity to the exchange.

VIP & Market Maker Fees on Swaps

VIP & Market Maker Fees on SwapsIn general, the fees on Huobi DM are about in line with those of other futures exchanges such as ByBit or OKEX. They do offer slightly better maker rebates to those of you that are providing the required liquidity to be in this tier.

When it comes to any other fees on the network, you will have withdrawal fees which are basically just miner network fees. These are minimal though and are not charged on the exchange side.

Registration

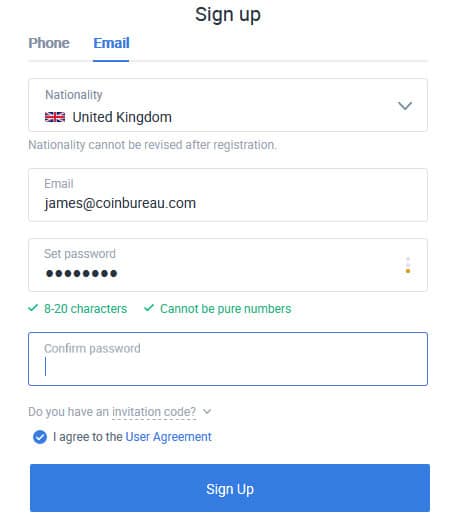

If you would like to give Huobi Derivatives a go then you will need to create an account. This is actually pretty simple. All they require to complete the signup is a phone or email address as well as your nationality.

They will send you an email with a verification code which you can then use in order to verify the email. Do note that this is only valid for 60 seconds so confirm it quickly.

Once you have confirmed your email you are registered. One of the first things that you will want to do now is to set up that two factor authentication to ensure that your account is safe from the get go.

KYC & Verification

Now something that you need to know about Huobi DM is that they require full KYC and verification before you can trade. This means that you will need to verify your account with some personal documentation like a passport, ID or some other form of ID.

Signing up at Huobi Derivatives

Signing up at Huobi DerivativesPrivacy Hawks 👀: If you would prefer not to hand over your ID documentation then there are still a number of exchanges that don't require KYC including the likes of PrimeXBT and Binance

If you are going to be verifying your account at Huobi Derivatives then it should take no more than a day. Once this has been done, you will need to approve futures trading in your account. They just ask you to electronically acknowledge the risks that come from futures trading.

Deposits & Withdrawals

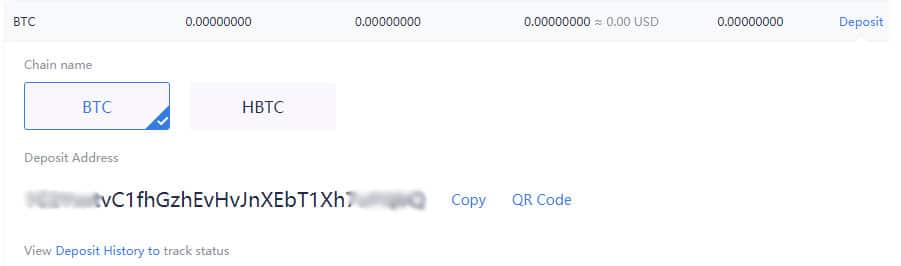

If you want to fund your futures acccount, you will have to transfer funds over from your spot account. In your spot account, there are a number of ways in which you can buy crypto with fiat.

You can use a card or you can fund through wires in numerous different cryptocurrencies. You can also elect to do an OTC transaction with one of the numerous sellers that they have listed in their marketplace.

You can think of this OTC market as akin to the likes of Local Bitcoins. You can view all the stats for these sellers and then you can choose those that have the best deal terms for you. These dealers have options such as Wires, Alipay, Western Union, SWIFT etc.

Funding your accuont with Bitcoin

Funding your accuont with BitcoinIf you have Bitcoin already then it is that much easier to fund your account. You will just have to head on over to your "Fiat account" and hit "Deposit". This will pull up a Bitcoin address that you can use to fund your account.

Note 📝: You will have to wait for one confirmation on the Bitcoin network before your funds are credited. You can view a block explorer to track your deposit.

Of course, you can also deposit funds in a range of other cryptocurrencies. I encourage you to head on over to the exchange account overview and you will see the complete list.

Withdrawals

Withdrawals are just as easy. You will need to hit the "withdraw" option and this will generate a form. Here you can insert your offline Bitcoin address and send the coins to your wallet. Do take note of the withdrawal limits at the exchange though.

Huobi DM Futures Platform

When it comes to trading, you need the right tools to operate with. This is where the Huobi futures and swap platforms come into play.

The platform is near identical when it comes to layout for the futures and the swaps. They will only differ in the way of the functionality and the assets that you can trade with these instruments.

The layout is pretty intuitive and easy to find your way around. On the left you have all the markets that you can trade. In the middle you will have the chart, to the left you have your order books as well as previous orders. Then, below the charts you have your order forms. Immediately below that are all your past orders and positions.

Huobi Futures Platform User Interface

Huobi Futures Platform User InterfaceWhen it comes to the charts, there are three different options for you. These are either the standard Huobi chart, the market depth chart or the tradingview chart. For those of you who don't know, Tradingview is one of the best charting packages on the market. It is often used by technical analysis traders.

Night Owls 🦉: If you prefer a darker UI then you can switch to either Dark Blue or Dark. This is on the switch just above the charts

When it comes to the difference between the Futures and the Swap interface you will notice that for the futures, you will have information around the expiry and open interest at the top. However, if you are on the swaps you will notice the funding rate at the top of the platform. I have talked about this above.

One more thing to note about the platform is although it is pretty intuitive, there are no panels / widgets that you can move around. This means that unlike other platforms, the layout cannot be customised.

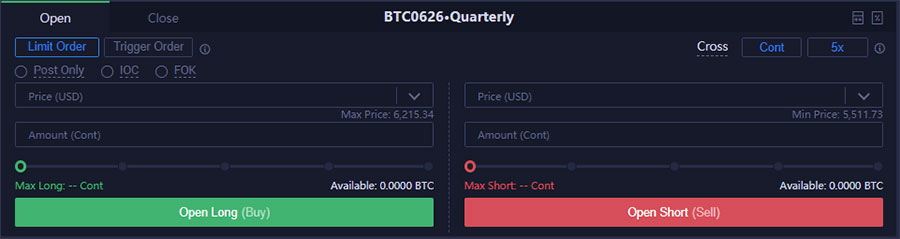

Order Forms

You do have some customisation options around your orders on the Huobi platforms. Firstly, you can either choose whether you would like to open your long or close your trade.

Order Forms on Huobi Futures Platform

Order Forms on Huobi Futures PlatformWhen it comes to the order types, you have two that you can place:

- Limit Order: This is basically an order that is set at a predetermined price you have chosen. The order will not get executed until the market reaches this level.

- Trigger Order: With a trigger order, the limit order will only be placed once the market has moved past a particular trigger price.

You also have additional parameters at your disposal around how long you would like the order to be open. Let's take a look at some of these shall we?

- Post Only: With this order, the order will not be immediately executed in the market. They are placed so that you can be assured of that market maker status with the reduced fees.

- Immediate or Cancel: With this order, it will be executed all or part of it immediately and cancel that which was not executed immediately.

- Fill Or Kill: With a FOK order, either your entire order will be executed or it won't be done at all. The main different between this an IOC is that it does not allow for partial orders

You will also notice on the order form that you have the option to "cross margin". the same digital currency asset of your account will be used as margin of all the open positions of that digital currency.

For example, if you open one position of BTC contracts, then all the BTC in your account will be the margin of that position, and if you open several positions of BTC contracts, then all the BTC in your account will be the margin shared by these open positions. The profits and losses of positions of one digital currency can be mutually offset.

Warning ⚠️: If you are going to be placing a trade, make sure that you always leave an adequate stop in place. This will protect your downside risk

One more really handy tool that you have at your disposal is the position calculator. This will allow you to calculate all of your most important levels prior to the trade. This includes liquidation, potential profit and margin requirements.

Huobi Apps

While you do have the online trading interface, Huobi does have computer programs and mobile apps that you can use.

I found that the PC programmes were more functional as they did not have to rely on the PC browser and were hence much faster. They also have better charting and you are in more control of your trading parameters. These programs are available on Windows and Mac devices.

However, if you are a trader that is always on the go, that is where the Huobi mobile apps come in. These were developed for the main exchange but you can switch to the derivative markets on the futures and swaps platform.

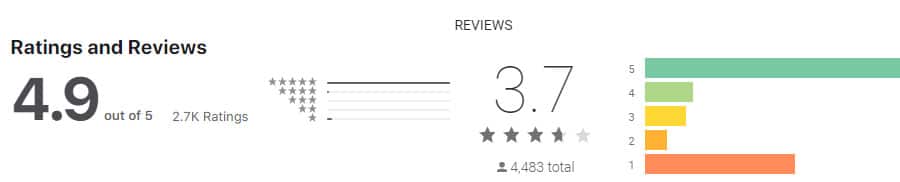

This was a pretty well designed application and you have one-touch ordering as well as some basic charting functionality. The app is available in iOS and Android and you can head on over to the respective app stores to get a sense of the feedback.

Customer Feedback in the iTunes Store and Google Play

Customer Feedback in the iTunes Store and Google PlayAs you can see, the feedback is generally quite positive. What is also encouraging is for those that do have concerns, you can see that the support team follows up instantly. This shows that they are pretty quick on the ball (something I will cover in a bit).

I think I should point out now that I am not, in general, one of the biggest fans of mobile trading. This is because they can never really be as effective as charting and monitoring markets on a PC. However, if you can't practically be in front of your PC all the time then it is a decent alternative.

API

For those of you who are programmers, you will be happy to learn that Huobi global API can be used on the Futures and Swap markets.

There is both a websocket as well as a REST version available. It is suggested that you use the REST for one off operation to trade and withdraw. You should use the websocket for market data & order updates. You should also note that you can be a market maker on through the API.

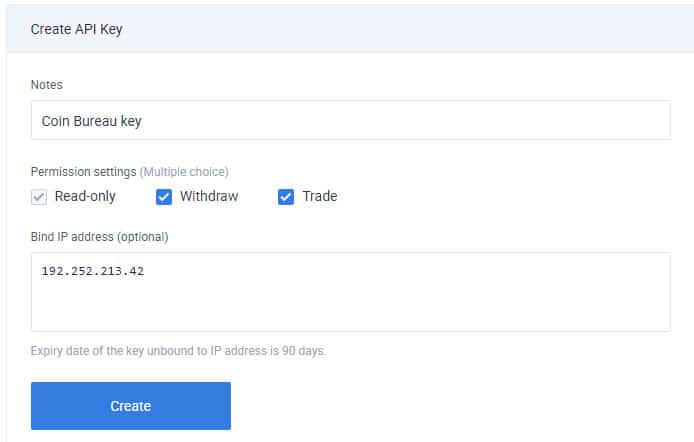

Generating the API Key at Huobi

Generating the API Key at HuobiIf you want to start using the API then you will to get yourself an API key. This can easily be done in the API management of your account dashboard. Here you can select whether you would like it to be a read-only, Withdraw or Trade. You can also bind an IP address to this API so you can ensure than no other person will use your account even if compromised.

Warning ⚠️: Do not provide this API key to external parties like bot operators etc. There have been a number of cases of these services using trader API keys to embark on nefarious tactics

There are a host of handy guides that could take you through the API and all the functionality in the docs which you can read here. They are split between the docs for Spot trading, Futures and Swaps.

Support

Something else that is crucial to the entire trading experience is the level of support that the exchange provides. There is nothing more frustrating than having to wait hours for response from support.

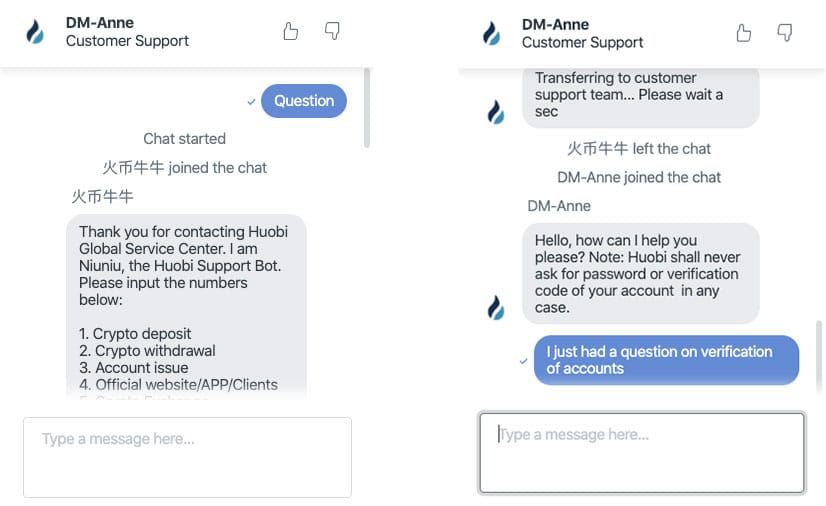

When it comes to Huobi, there are actually quite a few options to reach their customer support. Perhaps the quickest and most effective way is through their live chat function. Firstly, they will try to help you with the available resources. If that does not work then you can reach out to a live agent.

Live Chat Support at Huobi Derivatives

Live Chat Support at Huobi DerivativesWhen we did that, we were helped within 2 minutes. The person helping us was also quick to address our queries and knew what we were looking for. This live chat function is open 24/7

Alternatively, you could also just submit a ticket through in their support section. This will ensure that your query is routed to the right department and it will allow you to track your case most appropriately. They try to reply to all queries in under 24 hours.

Top Tip ✅: If you want to chase up your ticket then you could hit them up on their social media channels. This includes the likes of Twitter and Telegram

Alternatively, if your question is more routine in nature then you can always just jump over to their FAQs and support docs - these are filled with handy guides and others will no doubt have asked similar questions before.

Community & Education

While some brokers like to leave their traders to their own devices, others like to give them some handy guides and educational resources to improve their trading. This is where Huobi tries to make an exception.

Perhaps the quickest way to learn about how to use the Huobi platform is through their instructive videos. These are their "contract trading 101" videos that are quite well presented and are clear enough for people with varying degrees of experience.

These include such videos as:

- What is digital asset trading?

- How to open trades

- Leverage

- Margin Mechanism

- Spot & Contract Trading

If you wanted more in-depth overviews then you can check out the additional guides and resources. These go over similar topics but use instructive examples and are pretty comprehensive.

Community

Something else that Huobi Derivatives have that could benefit all traders is an active community. This is great as it allows you to bounce ideas off of other traders and get a sense of what is going on in the market.

These communities are run by Huobi on chat apps including WeChat, Telegram and Tencent. However, it seems that currently the bulk of the users in the Telegram are not very active which is unfortunate.

Joining Huobi Community

Joining Huobi CommunityPerhaps as more traders start to use the derivatives at Huobi then they are more likely to get involved with other traders. There is still an active community in WeChat and Tencent for those Chinese traders out there.

Areas for Improvement

While there was a lot of things that we really liked about the Huobi DM offering, there are still quite a few areas for improvement that need to be worked on.

Firstly, it would be great to see more asset coverage around their perpetual swaps products. This would make them competitive against all the other exchanges that offer these types of instruments with numerous assets.

When it comes to the trading platform, it would also be great to see more order functionality. Currently, you can only place limit and trigger orders. While these will satisfy most traders, it will leave some of the most professional types wanting.

Finally, it would be great to see if they could incorporate panels into their user interface. This would allow traders to adjust the layout to best suite their trading needs.

Conclusion

So, in summary. We really liked the Huobi futures products. It is not only highly functional but is also secure and leverags the expertise that the team have at the main Huobi exchange.

For the futures instruments, there is a decent range of assets and leverage. Markets are also pretty liquid and these are all traded on a simplistic yet technically able trading platform. It's also great that you can trade on PC programs and mobile apps as well.

When it comes to security, they have taken all of the same precautions that are used on the main exchange. Their 20,000 BTC strong insurance fund keeps them well protected and they have not had a single clawback of trader funds since their inception.

Yes, there are areas for improvement but the exchanges is still evolving and building out functionality. One can only hope that they take trader suggestions into account.

So then, is it worth considering?

Well, if you are looking for a highly functional and secure futures exchange that is backed by one of the biggest names in the business, then it is well worth a try.

Warning ⚡️: Trading leveraged futures products is incredibly risky. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.