When you're new to cryptocurrencies, one of the biggest challenges you face is choosing a cryptocurrency exchange you can trust. Of course, every crypto enthusiast has their favourites, usually based on personal experience. Still, the essential component is whether an exchange offers the security, products, and services you need. In addition, a record of customer service should also count in your decision.

Gemini and Kraken are reputable, established, USA-based cryptocurrency exchanges. Gemini began in 2014. The Winklevoss twins, Tyler and Cameron, opened the launch with a determined focus on security first and quickly became one of the most regulated and compliant crypto exchanges worldwide.

Kraken is one of the largest crypto exchanges popular with beginners, advanced traders, and investors. Established in 2011 by Jesse Powell and owned by Payward.Inc, Kraken was among the first to offer users access to derivatives, spot trading and index products.

In this Gemini vs Kraken article, we will look at two of the top cryptocurrency exchanges suitable for all levels of investors and traders. Hopefully, you will soon know if either of these companies is right for you.

We intend to look at each exchange individually, but below is a quick overview of our findings by comparing Gemini and Kraken.

Gemini vs Kraken: Products Offered

Gemini Products

Gemini has an excellent range of services that appeal to all levels of traders and investors.

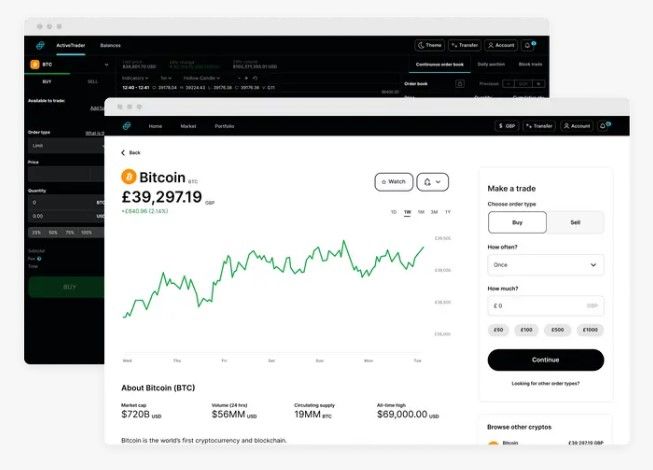

- Web Trader: A beginner-friendly platform for retail traders. It's an easy interface to navigate if you're just starting in crypto trading

- ActiveTrader: Once you have some trading experience under your belt, Active Trader is the next step. You must request access to this service. Once you have permission, you can place the following orders:

- Limit Order: A pre-placed buy or sell order to execute at a predetermined price.

- Market Order: An immediate live buy or sell order to the market.

- Maker-or-Cancel: An order executed (only) if it gets you the "maker" fee.

- Immediate-or-Cancel (IOC): It will execute part or all of your order.

- Fill-or-Kill (FOC): Immediate order execution. You cannot do partial orders

- Auction: A daily auction (inc holidays and weekends) for Gemini's listed cryptocurrencies. To engage, switch to "Daily Auction" from the ActiveTrader interface.

- Block Trade: Liquidity can be affected by large orders coming into the market, which can cause slippage issues. Placing a block trade order is like an OTC (over-the-counter) service.

- Gemini Earn: Earn a small yield from your crypto whilst you aren't using it. The small interest rates won't pay the mortgage, but every bit helps, right?

- Gemini Clearing: This service enables two parties to trade directly and anonymously. Gemini acts as a trusted third party.

- Gemini Mobile: You can use the mobile app (for iOS and Android) with Web Trader but not ActiveTrader.

So, I'm sure you will agree that Gemini has an impressive product range, so now let's look at Krakens products.

Kraken Products

After registration and account verification, you can access Kraken via the web platform or, if you prefer, download the Kraken app (available for Android and iOS).

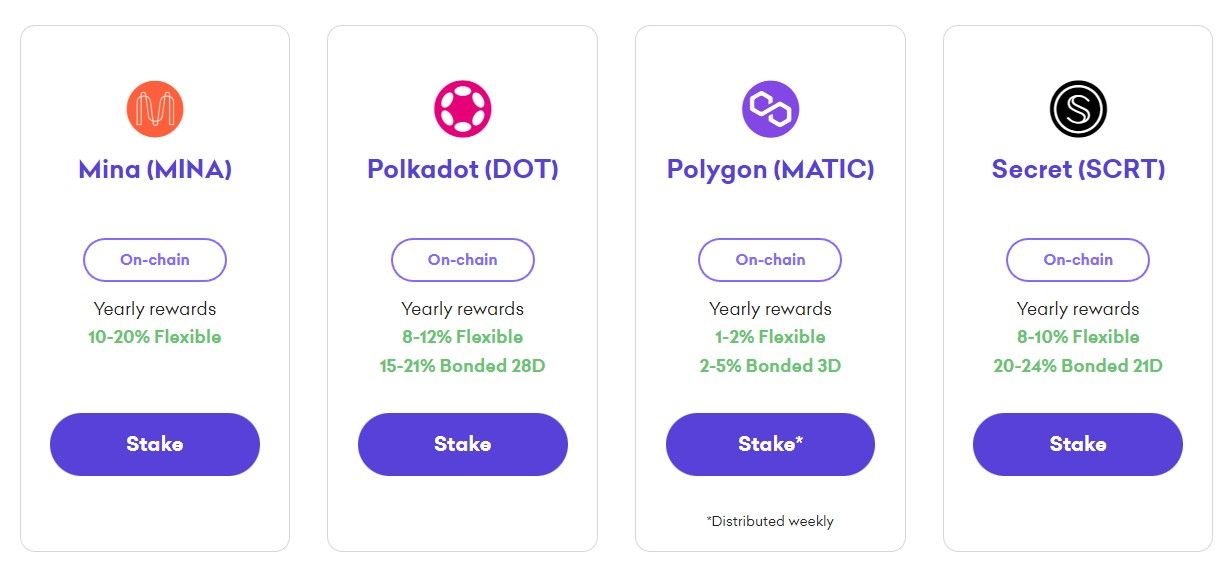

- Staking: No matter what's happening in the crypto market, you can earn up to 23% with popular PoS (proof-of-stake) crypto assets listed with Kraken.

- Crypto Education: Kraken Learn is a superb service to help educate you on everything crypto. The video, webinars, crypto guides, and podcasts provide in-depth information and can only help you learn how to maximise your financial understanding of cryptocurrencies.

- Kraken App: Kraken has two mobile apps. One is for advanced trading, and the other is for day-to-day trading and hodling.

- Kraken Pro: This app has an easy and attractive interface. It is super easy to navigate, even for beginners. You can execute, monitor and adjust trades on the go.

- Kraken App: With over 1M downloads, the Kraken app is popular with users for tracking, converting, buying, and selling cryptocurrencies listed with Kraken. It has low fees, exceptional security (biometric & password protected), 24/7 support, and multiple payment options.

- Kraken Pro: For more advanced traders, the Kraken Pro platform offers lower fees than the standard platform, more suitable for beginners. You gain access to more order types, charting, and tools for advanced trading.

Kraken may not have as many products as Gemini, but it has an excellent reputation for providing a good service for its users and is often considered the most secure exchange in the industry.

Gemini vs Kraken: User Friendliness

In the early days, navigating the user interface on most cryptocurrency exchanges was like dropping an alien in the middle of London and asking it to find a specific street (from over 40,000). Buying, selling and trading cryptocurrencies was so complex it repelled many new users from adopting cryptocurrencies and changing their finances.

Thankfully, times have changed. Gemini and Kraken are user-friendly with easy-to-navigate interfaces. Still, are there differences between the two, and if so, what are they?

Gemini and Kraken have iOS and Android mobile apps for trading and managing your crypto portfolio. Of the two, Gemini has the slight advantage of user-friendliness, as it is a bit easier for beginners to navigate the interface. In addition, the AutoTrader option is ideal for more advanced traders. Gemini also has multiple guides to help support crypto newbies.

Kraken is a user-friendly platform but leans slightly towards a more advanced user, especially with Kraken Pro. It's not quite as intuitive as Gemini's interface. However, finding your way around Kraken's website and trading platforms is not challenging once you familiarise yourself with how it works.

Both crypto exchanges are suitable for all levels of traders and investors. Still, if you are new to cryptocurrency exchanges, anticipate a bit more of a learning curve with Kraken.

Gemini vs Kraken: Fees

Both Kraken and Gemini have competitive fees. Though the breakdown can seem a little complex, it isn't once you understand how the fee structure works.

Deposit and Withdrawal Fees

You can deposit most fiat currencies for free with Kraken. Withdrawal fees vary depending on what currency you are withdrawing. There is a minimum withdrawal fee and a flat fee for transactions when moving your funds from your Kraken account.

Deposit fees for Kraken are variable, but some crypto deposits incur variable on-chain costs, such as Ethereum and Ethereum Classic. Terra Classic and TerraUSD Classic deposits incur a 0.2% tax burn.

Wire deposits and bank transfers are free with Gemini, but check transfer fees from your bank. You can deposit with a debit or credit card with fiat currencies, but there is a 3.49% fee, and this service is not available to United States users.

Each month, Gemini allows you to have up to ten crypto withdrawals for free, which you cannot roll over into the next month.

Trading Fees

Both exchanges base fee structures on 30-day trading volume at variable levels.

Gemini Web & Mobile Trading Fees (Standard)

- Less than $10.00 = $0.99

$10.00 to less than $25.00 = $1.49

$25.00 to less than $50.00 = $1.99

$50.00 to less than $200 = $2.99

$200+ = 1.49% of the order value

Gemini Maker & Taker & Fees

| 30-Day Volume Maker Taker | Maker | Taker |

| $0 | 0.40% | 0.20% |

| $10,000 | 0.30% | 0.10% |

| $50,000 | 0.25% | 0.10% |

| $100,000 | 0.20% | 0.08% |

| $1,000,000 | 0.15% | 0.05% |

| $5,000,000 | 0.10% | 0.03% |

| $10,000 | 0.08% | 0.02% |

Kraken Maker & Taker Fees

"Kraken fees for buying, selling, or converting assets using Instant Buy consists of a displayed fee and, where applicable, a spread which is included in the price. Any spread is calculated before orders are executed and may differ for similar transactions because the spread is determined based on a combination of factors, including but not limited to transaction size, asset, payment method and market conditions."

(Source: Kraken)

| 30-Day Volume | Maker | Taker |

| $0 - $50,000 | 0.16% | 0.26% |

| $50,001 - $100,000 | 0.14% | 0.24% |

| $100,001 - $250,000 | 0.12% | 0.22% |

| $250,001 - $500,000 | 0.10% | 0.20% |

| $500,001 - $1,000,000 | 0.08% | 0.18% |

| $1,000,001 - $2,500,00 | 0.06% | 0.16% |

| $2,500,001 – $5,000,000 | 0.04% | 0.14% |

| $5,000,001 - $10,000,000 | 0.02% | 0.12% |

| $10,000,000+ | 0.00% | 0.10% |

Gemini vs Kraken: Security

From the offset, Gemini determined security as a priority. They take it very seriously indeed. From asset protection, user account management, internal control, and compliance, Gemini stands above many leading crypto exchanges for its attention to security.

Gemini Prioritises Account Security. Image Source: Shutterstock

Gemini Prioritises Account Security. Image Source: ShutterstockThe following are some of the security measures taken to protect your Gemini account and digital assets: -

- 2FA (two-factor authentication).

- Support for hardware security keys.

- Whitelisted withdrawal addresses.

- Gemini stores most crypto assets in multisig (multiple signatures required for access) cold wallets.

- Gemini's HSMS (hardware security modules) are "FIPS 140-2 Level 3 rating or higher." In simple terms, HSMS is hardware that protects private keys with built-in security mechanisms, and Gemini's HSMS provide premium-level security.

- Third parties do annual penetration tests to assess potential weaknesses.

- Gemini has a private Coordinated Disclosure Program for ethical hackers to report potential vulnerabilities.

- Gemini has a community service for anyone to report fraudulent activity or scams.

These are warp-level security measures and enable Gemini customers to feel safe that the platform is doing everything possible to protect their assets.

Kraken also places security as high priority for its users, as per the the following: -

- 2FA withdrawal email confirmation

- Air-gapped cold storage

- Strict surveillance

- Precise API key permission control

- SSL encryption

Overall, Kraken's high-level security is unquestionable and one of the reasons the platform has a high review rating. Kraken is one of the few major exchanges that have never experienced a security breach, they are ranked number 2 in the world behind Crypto.com in terms of security by independent security company Certified, and have even launched Kraken Security Labs, a security company that works with other blockchain companies.

Both cryptocurrency exchanges offer exceptional levels of account security, so you can tick that as a top-tier bonus for both platforms.

Gemini Overview

What is Gemini?

Founded in 2014, Gemini is a privately-owned cryptocurrency exchange with a user-friendly platform that prioritises security and enables cryptocurrency users of all levels to easily buy, sell, trade, and safely store over 115 cryptocurrencies.

Notably, Gemini is majority-owned by Cameron and Tyler Winklevoss, who gained public attention through their legal battle against Mark Zuckerberg. The Winklevoss twins famously claimed that Facebook was their idea, resulting in a $65 million settlement. This incident led to the movie "The Social Network." Interestingly, all three were Harvard University students at the time.

The Gemini platform offers a tiered service catering to casual investors and hardcore traders, with separate interfaces and fee structures. It provides a user-friendly website and a beginner-friendly mobile app for on-the-go access.

Gemini has a good range of fiat currencies: -

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Euro (EUR)

- Great British Pound (GBP)

- Hong Kong (HKD)

- Singapore Dollar (SGD)

- United States Dollar (USD)

One distinctive feature of Gemini is its native currency, the Gemini dollar, which is a "stablecoin" pegged to the U.S. dollar, thus ensuring its value remains stable.

Gemini has gained popularity due to its emphasis on security and ease of use. It employs rigorous security measures, storing most users' cryptocurrencies in offline "cold storage" to protect against potential cyber threats.

Additionally, the exchange keeps ready funds in an insured "hot wallet," ensuring quick access for users.

Over time, Gemini has evolved and introduced additional features to enhance its services. It now includes a payment app, an interest-paying savings account, a credit card, and a comprehensive trading platform.

CoinMarketCap lists Gemini within the top fifteen exchanges, with a trading volume of over $10 million (24 hours) and 150 trading markets (May 2023).

"The most trusted crypto-native finance platform. Create a free Gemini account in minutes." (source: Gemini)

The Gemini exchange quickly expanded internationally to Canada and the United Kingdom by mid-2016 and later to Hong Kong, Singapore, South Korea, and Japan to cater to the growing population of Asian cryptocurrency enthusiasts. Currently, Gemini operates in over 60 countries worldwide.

In September 2016, Gemini made crypto history by introducing the first-ever daily Bitcoin auction. This innovative approach to trading quickly became standard practice in modern cryptocurrency exchanges, further establishing Gemini's influence in the industry.

Gemini is a reputable cryptocurrency with a comprehensive range of services, extensive cryptocurrency offerings, and a global presence, making it a popular choice among novice and experienced crypto enthusiasts.

Cryptocurrencies Offered by Gemini

Gemini offers more than 115 cryptocurrencies. That might not seem like a lot compared to other leading crypto platforms. However, Gemini aims to provide a range of cryptocurrencies established in the market, including the following: -

- Bitcoin (BTC)

- Cardano (ADA)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Gemini Dollar (GUSD)

- USD Coin (USDC)

- Uniswap (UNI)

Gemini Products

Gemini has an impressive range of products for casual or advanced crypto traders and investors.

- ActiveTrader

- Auction

- Block Trade

- Cryptopedia: Crypto Education

- Gemini Credit Card (U.S. only)

- Gemini Custody (crypto storage)

- Gemini Derivatives

- Gemini Dollar (native stablecoin)

- Gemini Earn

- Gemini Clearing

- Gemini Mobile

- Web Trader

"Ask for permission, not for forgiveness. From day one, Gemini has prioritised the security of your assets. We never have and never will compromise on that." (source: Gemini)

Gemini Types of Accounts and Fees

When you open a Gemini Account, it has the following subaccounts:

"One or more associated User Accounts; A fiat currency account (“Fiat Account”) that reflects its fiat currency balance; and A Digital Asset account (“Digital Asset Account”) that reflects its Digitals Asset balance. Each Digital Asset Account is subdivided into a depository account (“Depository Account) and a custody account (“Custody Account”)." (source: Gemini)

Gemini Standard Account Fees

- Less than $10.00 = $0.99

- $10.00 to less than $25.00 = $1.49

- $25.00 to less than $50.00 = $1.99

- $50.00 to less than $200 = $2.99

- $200+ = 1.49% of the order value

Gemini Has Won Many Awards: Image Source: Gemini

Gemini Has Won Many Awards: Image Source: GeminiGemini Maker & Taker Fees: Based on 30-Day Volume

- 0%: Maker 0.40% Taker 0.20%

- $10,000 Maker 0.30% Taker 0.10%

- $50,000 Maker 0.25% Taker 0.10%

- $100,000 Maker 0.20% Taker 0.08%

- $1,000,000 Maker 0.15% Taker 0.05%

- $5,000,000 Maker 0.10% Taker 0.03%

- $10,000,000 Maker 0.08% Taker 0.02%

Fiat Deposit Fees

- ACH: Free

- Wire Transfer: Free

- Debit Card 3.49% of the total purchase amount

- PayPal: 2.50% of the total deposit amount

Fiat Withdrawal Fees

- ACH: Free

- USD Wire Transfer: $25.00

- Non-USD Bank Transfers: Free

Gemini Security

It is free to deposit cryptocurrencies to Gemini and transfer from Gemini Exchange to Gemini Custody. However, "transferring crypto from Gemini Custody to Gemini Exchange incurs a fee of $125 per withdrawal."

Gemini takes account security seriously and aims to protect against vulnerabilities with top-level measures, such as:

- 2FA (Two-Factor Authentication).

- Support for hardware security keys (Yubikey, for example).

- Allowlisting (whitelisting) addresses.

- Multisig (multiple signatures for transfers)

- Rigorous employee background checks and ongoing screening.

- All private keys are stored at high-security data centres offsite.

- Production systems can only be accessed with hardware security keys (not susceptible to phishing).

- Tyler Winklevoss (CEO) and Cameron Winklevoss (President) cannot jointly or individually transfer cryptocurrencies from the Gemini cold (offline) or hot (online) storage.

High Performance Tools on Gemini For Active Traders: Image Source: Gemini

High Performance Tools on Gemini For Active Traders: Image Source: GeminiOverall, Gemini is a reputable cryptocurrency exchange with a good range of products and services suitable for advanced and novice users. Gemini focuses on providing top-level account security, which is a bonus for anyone considering opening a new account.

Kraken Overview

What is Kraken?

Kraken is the third-largest cryptocurrency exchange globally by volume and liquidity (CoinMarketCap), with almost $300 million daily trading volume (24 hours) and more than 750 average liquidity (May 2023). Kraken, launched in 2011 and based in San Francisco, California, has over 700 markets and 225+ listed cryptocurrencies.

Kraken supports a good range of fiat currencies: -

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Swiss Franc (CHF)

- Euro (EUR)

- Great British Pound (GBP)

- Japanese Yen (JPY)

- United States Dollar (USD)

"Kraken has the liquidity to fuel your business. Kraken is one of the longest-running, most trusted and healthiest exchanges. Our clients benefit from access to industry-leading liquidity, deep markets and direct access to our Principal OTC desk and Futures exchange" (source: Kraken).

Payward Inc owns Kraken, and in 2022, David Ripley replaced Jesse Powell as the CEO. An association with the leading market data provider helped Kraken gain popularity among the trader community.

Shortly afterwards, Kraken partnered with the popular chart service provider, TradingView.

Cryptowatch is a unique Kraken portfolio management product where you can "watch your portfolio and 2,000 crypto markets across multiple exchanges." In addition, you can analyse the charts to monitor price movement, order flow, volume and more before trading on one of the multiple exchanges available and see real-time portfolio changes.

"Cryptowatch makes it easy to keep tabs on the crypto markets and make trades when the conditions are right" (source: Kraken).

Kraken has an NFT marketplace and offers zero blockchain fees for NFT trading. You can track rarity scores, "collect NFTs across multiple blockchains", and bid with cash or crypto.

Earn A Yield By Staking Your Cryptos: Image Source: Kraken

Earn A Yield By Staking Your Cryptos: Image Source: KrakenCryptocurrencies Offered

Kraken has a good range of top cryptocurrencies. Similarly to Gemini, Kraken lists cryptos with an established history, thus reducing the risks of onboarding potential scam coins or ponzi projects.

The following are some of the top listed coins on Kraken: -

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Litecoin (LTC)

- Polkadot (DOT)

- USD Coin (USDC)

Kraken has a product range suitable for beginners and advanced traders and investors: -

- Extensive Crypto Education

- Kraken Mobile App

- Kraken Pro Web & Mobile Ap

- Margin & Futures Trading

- An NFT Marketplace

- Staking

"Institutional clients enjoy fiat and crypto funding options with high monthly limits, including fiat funding in 7 global currencies, via multiple international partners. For the most efficient trade execution, we have expanded rate limits for clients trading algorithmically using either our REST or WebSocket APIs" (source: Kraken)

Kraken Types of Accounts and Fees

Kraken provides three types of accounts: -

- Starter

- Intermediate

- Pro

Kraken has a strict KYC policy, and before trading or investing, your details require verification, such as a proof of address document, a valid government-issued I.D. document, a face photo, and an SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number).

Kraken calculates maker and taker fees on a 30-day volume

- $0 - $50,000: Maker 0.16% Taker 0.26%

- $50,001 - $100,000: Maker 0.14% Taker 0.24%

- $100,001 - $250,000: Maker 0.12% Taker 0.22%

- $250,001 - $500,000: Maker 0.10% Taker 0.20%

- $500,001 - $1,000,000: Maker 0.08% Taker 0.18%

- $1,000,001 - $2,500,00: Maker 0.06% Taker 0.16%

- $2,500,001 – $5,000,000: Maker 0.04% Taker 0.14%

- $5,000,001 - $10,000,000: Maker 0.02% Taker 0.12%

- $10,000,000+ Maker 0.00% Taker 0.10%

Fiat Deposit & Withdrawal Fees

Credit Card Deposits: 3.75% + €0.25 for each credit card purchase

ACH purchases vary

- There is a $10 minimum per transaction.

- Six maximum transactions per 24 hours.

- There is a $10,000 maximum spending within a time-based 7 day rolling period.

- You can connect a maximum of three bank accounts at any given time.

For example, you can withdraw USD via Fedwire (USA only) with fees starting from $4.00 and worldwide via SWIFT from $13.00. Minimum withdrawal requirements depend on the method used and can take 1 – 5 days to deposit to your bank.

Kraken Has The Liquidity To Fuel Your Business: Image Source: Kraken

Kraken Has The Liquidity To Fuel Your Business: Image Source: KrakenKraken Security

Kraken Security Labs has an "elite team of security researchers that aims to protect and grow the cryptocurrency ecosystem." (source: Kraken)

"Kraken is the most secure digital asset exchange because we live and breathe security – in fact, we have multiple world-class teams dedicated to testing our products and services. However secure we might be, though, we know our success is linked to the success of others within the cryptocurrency community." (source: Kraken).

Kraken's security measures include the following: -

- 2FA withdrawal email confirmation

- Air-gapped cold storage

- Strict surveillance

- Precise API key permission control

- SSL encryption

Overall, Krakeni s an established, popular and trusted exchange with over 9 million clients. The platform supports over 190 countries worldwide and has a quarterly trading volume of over $200 billion.

Kraken aims to provide high account security and a range of services and products suitable for everyone, from beginners to professional traders and investors.

Gemini or Kraken: Conclusion

Both Kraken and Gemini are worthy of consideration. Gemini has a broader product range, but Kraken has over twice the number of cryptocurrencies listed. Maker, Taker, and withdrawal fees are comparable, and the security for both platforms is exceptional.

Kraken has a significantly higher trading 24-hour volume ($385+ million) than Gemini's $13 million. However, liquidity is not massively different, with Kraken at an average of 759 and Gemini at 668.

Generally, the consensus is that Gemini has a slight edge as a platform suitable for beginners. There's a bit more of a learning curve with Kraken. Both exchanges do an excellent job with the user interface, and Kraken Pro is explicitly for more experienced traders. Customer support is available 24/7 by live chat and phone and, in addition, a contact form for Gemini customers.

Both platforms have an education portal, but Kraken takes the edge with a wide range of crypto subjects across multiple media channels, such as blogs, webinars, video content and podcasts.

Gemini and Kraken have a great range of fiat currencies, and both exchanges provide mobile apps for iOS and Android. Gemini has a native token, the Gemini Dollar (GUSD), a stablecoin pegged to the U.S. dollar.

CoinMarketCap gives every listed exchange a score from zero to ten, based on" Web Traffic Factor; Average Liquidity; Volume, as well as the Confidence that the volume reported by an exchange is legitimate." Gemini has a score of 6.6, and Kraken's score is 8.5. That doesn't mean one is better because CoinMarketCap assigns scores from analytics.

In conclusion, Gemini and Kraken both have excellent reputations in the crypto industry. We hope that this comparison has helped you decide which you might prefer.