Maybe you’ve recently heard about Kusama, although it isn’t a new project. Launched in May 2019 it is a parallel Polkadot network. It was built using the same code base and the same structure, but works far more rapidly than Polkadot.

Although some may think of it as a testnet it is far more than that. It is a development environment that can be used in the same way as Polkadot, but far more rapidly, allowing teams to try out new technologies, innovate on existing projects, and prepare for a full Polkadot deployment.

Kusama is a Polkadot experimental hotbed. Image via kusama.network

Kusama is a Polkadot experimental hotbed. Image via kusama.network In fact that’s one of its strengths. Many projects will certainly use Kusama as a test bed for their development before transitioning to Polkadot. Not all will move on though. Some will be happy to remain in the wild west that is Kusama, providing a diverse and growing ecosystem for the cousin network of Polkadot.

We've talked about Polkadot just a couple months back when the project launched its mainnet. It wouldn't be a bad idea to review that Polkadot post before reading about Kusama, since the two are so closely linked.

The Intended Use for Kusama

Kusama has been called the Canary network for Polkadot in a reference to the practice of miners carrying canaries with them into a coal mine to provide an early warning of carbon monoxide and other dangerous gases that could hurt the miners or even cause the mine to explode. Kusama is the canary that warns developers of any problems, dangers, and vulnerabilities in the code they are building.

Kusama is also called the “wild cousin” of Polkadot, and developers are warned to “expect chaos” and that there are “no promises” when building on Kusama.

All the warnings come because even though Kusama is built on the same code base as Polkadot, it is also an unaudited version that is intended to act as a developmental environment to test new features before launching them on Polkadot. That means code on Kusama can be broken or contain vulnerabilities. It gives developers the chance to play with the code and new features, and even break things to highlight issues. Once the code has been tested and optimized it can then move to Polkadot.

It's the Canary in the Polkadot coal mine. Image via the Kusama Network Guide

It's the Canary in the Polkadot coal mine. Image via the Kusama Network Guide It’s important to point out that Kusama is a real blockchain network, not simply a testnet. It has its own governance, which operates as a DAO, and its own token. Teams looking to move fast in their development choose Kusama and can later move to Polkadot once they have a project that is more mature. And for some teams Kusama simply has conditions that are better suited to their project in comparison with Polkadot.

In short, Kusama is no testnet. A testnet is a development environment, but they use valueless tokens. Kusama has the KSM, which has a definite value. Kusama is the developmental network where new features for Polkadot are tested and perfected, but it is also an environment for rapid development and innovation.

User Roles on Kusama

Users are able to participate in the Kusama network in a number of ways, similar to the ways in which they participate in the Polkadot network.

Builders

The builders are those who are creating parachains, bridges, parathreads, and other features on the network. In essence these are the development teams and individual developers. There are a number of reasons why development teams might considering using Kusama for their development efforts:

- Because Kusama uses the Polkadot code base developers will have almost the same experience as building on Polkadot;

- Kusama development is far faster than development on Polkadot;

- Once built these projects from Kusama can easily be moved to Polkadot if desired;

- Deploying on Kusama is likely to be far less expensive than deploying on Polkadot.

Network Maintainers

Kusama uses the same set of actors as Polkadot to maintain its network. These actors include the nominators, collators, validators, and the governance actors. It’s a diverse set that work together to ensure the security, stability, and evolution of the network.

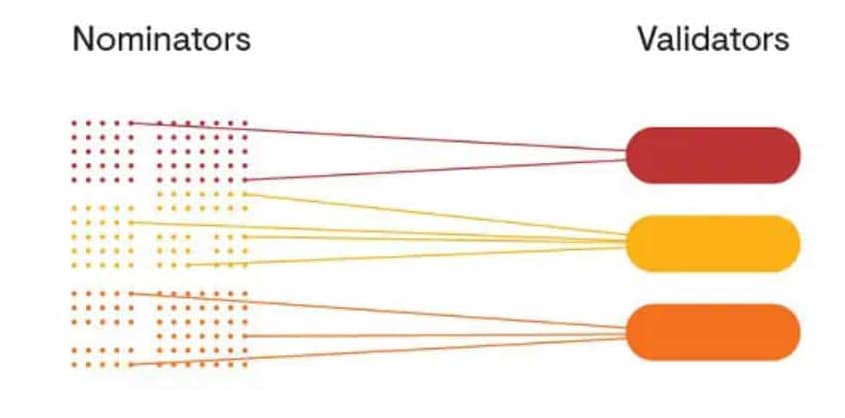

The processes begins with the nominators, whose role it is to choose validators who will act properly and who will remain reputable. Nominators can be anyone and they vote for validators by delegating their tokens to the validators they choose. In return they receive a portion of the block rewards earned by the validators they have voted for.

A visual of the relationship between nominators and validators on Kusama. Image via Polkadot.network

A visual of the relationship between nominators and validators on Kusama. Image via Polkadot.network Collators have the responsibility of creating blocks on the parachains that contain the most up-to-date transactions. Validators then jointly decide which of these blocks is the most accurate representation of the state of the parachain and then add those blocks to the relay chain. Collators are required to stake KSM to connect the parachain to the relay chain.

Validators are responsible for maintaining the network by adding new blocks and by reaching consensus with other validators. They are rewarded under the Proof-of-Stake system for their efforts, but also bear the risk of slashing if they are found to be acting in a malicious manner that is detrimental to the network. Validators are chosen anew every 24 hours.

The third set of actors is the governance actors. This group basically steers Kusama into the future, determining how the platform will evolve by voting for or against protocol and code base changes. Anyone with a minimum number of KSM is able to submit proposals for change. Votes are done on the top proposal (determined by the amount of KSM bonded to each proposal) once every 8 days. There are three branches to the governance process on Kusama:

- Referendum chamber:This is the sum of all KSM holders and is the group that submits change proposals and votes on those proposals to see which will go forward. They also vote for the council members, and can apply to become council members themselves.

- Council: The Council consists of 13 members who are elected to represent the members of Kusama who remain passive. There is a vote every 24 hours to determine the council members. The council is responsible for electing the technical committee, the can veto referendum, and can propose and fast track referendum as well.

- Technical committee: As mentioned above the technical committee is elected by the council. It can include devs or dev teams and the role it takes is to determine how critical each proposal is and then decide along with the council whether it needs to be fast-tracked. This ensures that urgent proposals get voted on and implemented first regardless of the amount of KSM being bonded to the proposal.

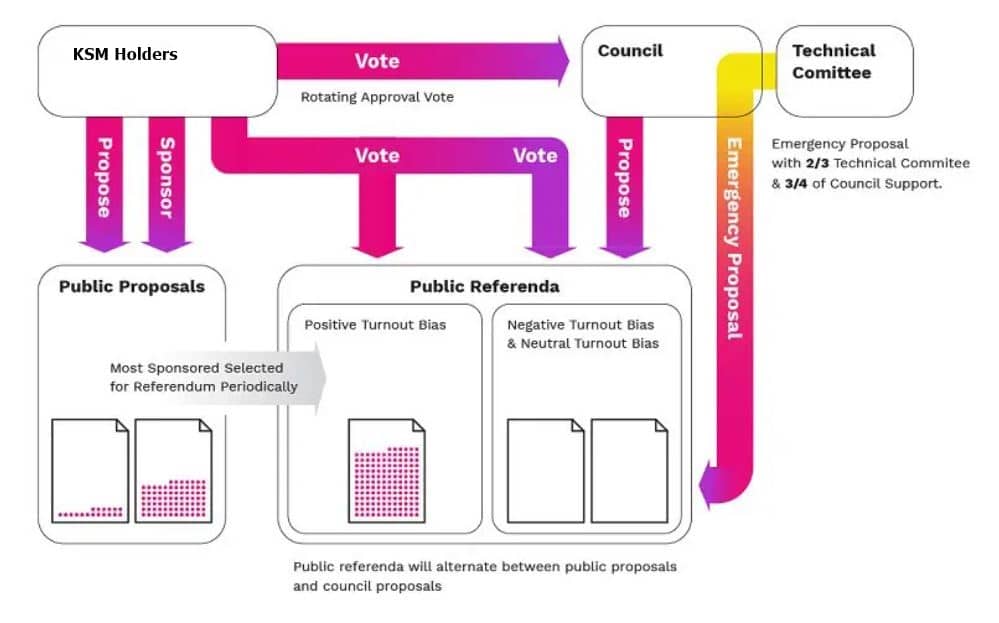

The Kusama Governance Process

The governance process can begin with any of the three governance actors. The referendum chamber can make a public proposal, or the council can submit its own proposals, and the technical committee is able to submit emergency proposals. All three can potentially result in a change to the Kusama protocol.

The primary aspect of governance is the referendum, which contains the proposal and allows for a vote on whether or not to make changes to the protocol. There are any number of changes that can be made through referendum such as changing the parameters of the network, registering or de-registering a parachain, voting on funding a project from the treasury, and many others.

On Kusama referendum are voted on every 8 days. The proposal backed with the most stake is the top proposal and becomes a referendum. The top proposal will alternate between public proposals and council proposals so that neither gains precedence.

The governance flow on the Kusama network.

The governance flow on the Kusama network. After a proposal becomes a referendum anyone with a KSM stake is able to vote (stake-weighted) for or against it. If the referendum is passed it is enacted after an 8 day waiting period.

Kusama uses a new concept in voting known as Adaptive Quorum Biasing which makes it either easier or more difficult to pass a proposal depending on which governance group submitted the proposal and the number of voters who turn out to actually vote. In short, when turnout rate is low, a super-majority is required to reject the proposal, which means a lower threshold of "aye" votes have to be reached, but as turnout increases towards 100%, it becomes a simple-majority.

The Kusama Treasury

The Kusama treasury consists of funds collected from transaction fees, lost deposits, inefficiencies in staking, and slashing penalties. Any KSM holder can make a spending proposal by bonding 5% of the amount proposed to be spent from the treasury. In order to pass a proposal must receive an aye vote from a minimum of 60% of the council. If the proposal gets fewer than 50% of the council vote the 5% bond is slashed. This process occurs once every 6 days.

Parachains and Parathreads

From a technological standpoint there is little difference between a parachain and a parathread. In fact, the parachain can become a parathread and vice versa. The real difference between the two is economic.

Parachains Are Layer-1 Blockchains Running In Parallel With The Relay Chain. Parathreads Are 'Pay-As-You-Go' Parachains - Image via Polkadot.network

Parachains Are Layer-1 Blockchains Running In Parallel With The Relay Chain. Parathreads Are 'Pay-As-You-Go' Parachains - Image via Polkadot.network Parallelizable chains, called parachains in Kusama, are a simplified blockchain that relies on the Layer-0 security provided by a Relay Chain instead of providing its own security. The Relay Chain validators provide validation for transactions and blocks after receiving the created blocks from parachain collators.

The collators are responsible for retaining all the parachain information and creating new blocks. Each parachain requires its own slot and it is projected that a Relay Chain will be able to have between 50 and 100 parachains. Each parachain will be acquired through an auction process.

Parathreads differ from parachains in that rather than being acquired through an auction, the parathreads will have a fixed registration fee. It is expected that parathreads will be far less expensive to acquire. However, in the long run, they could become more expensive since they will be subject to a fee for each new block produced and included on the Relay Chain.

Test On Kusama, Redeploy On Polkadot

Parachains are a foundational component of both the Polkadot and Kusama architectures and can be defined as all those diverse Layer-1 blockchains operating in parallel with the central Relay Chain. Furthermore, parachains embody Polkadot’s overarching vision of a future interoperable blockchain ecosystem, based on dynamic applications, flexibility and cross-chain composability.

Parachains Are The Foundation Layer Of Both The Polkadot And Kusama Infrastructures - Image via CoinQuora

Parachains Are The Foundation Layer Of Both The Polkadot And Kusama Infrastructures - Image via CoinQuora For Polkadot, parachains constitute the last piece of core functionality to be delivered, as outlined in the Polkadot Whitepaper, and will allow the project to realise its scalable multi-chain architecture. Parachains are currently being tested 'in the wild' on the Kusama Network in order to study their application and behaviour in real economic environments and, after a period of considerable auditing, testing and optimisation, parachains will be ready for deployment on Polkadot.

Polkadot’s parachains launch is expected to begin once two things have happened: firstly, a full external audit should be completed on all new logic. Secondly, the Kusama canary network should have demonstrated that the new logic works in the wild by executing at least one successful auction involving crowdloans and hosting at least one functional parachain. - Gavin Wood - PolkadotNetwork Medium

Parachains On The Rococo Testnet

While Polkadot’s founder Dr. Gavin Wood is yet to provide a specific date as to when Polkadot will begin launching parachain slot auctions, a few projects such as Acala Network, Phala Network and Litentry are among the strongest candidates to secure an allocation as parachains on its Network.

On March 26th 2021, Acala announced that it had won the first slot auction on Polkadot’s testnet called Rococo, a Polkadot-based platform designed strictly for testing parachain functionality. Rococo launched as a parachain testnet in August of 2020 in order to effectively test cross-shard communication protocols for Polkadot and allow projects to be deployed as parachains on Polkadot’s sister chain, Kusama Network.

Kusama Parachain Auctions

Polkadot’s ‘canary network’ and sister chain Kusama has started implementing parachain slot auctions and is looking to on-board projects of the highest quality as parachains on its Network. Launching parachains on Kusama represents the culmination of a multi-stage process that began with the launch of Kusama Chain Candidate 1, back in August 2019.

The first real-world, functioning parachain to launch was Statemine, which is essentially Kusama’s version of Polkadot’s Statemint. Designed by Parity Technologies, Statemint is a Polkadot-based, generic asset parachain developed to provide users with functionality for deploying assets such as CBDCs, stablecoins, other fungible tokens and NFTs.

Kusama’s Statemine acts as a common goods parachain and, thus, its slot was granted through governance instead of an auction system. The Statemine parachain can also be used to deploy central bank digital currencies (CBDCs), NFTs and other fungible tokens on Kusama. While Statemine’s utility as a solitary chain remains of key importance to the KSM ecosystem, its inherent value will only be realised once a community of interoperable parachain networks goes live on the Kusama architecture.

Kusama’s first parachain slot auction opened on June 15th 2021 and resulted in Karura Network winning the first slot with a total lock-up bid of 500,000 KSM, equating to more than $100 million at the time of writing.

Karura Network is looking to deliver a DeFi hub similar to that of its sister chain Acala Network, but on Kusama. After Karura, the second and third parachain slot allocations were granted to Moonriver and Shiden Network respectively. However, by analysing the Polkadot JS App, it is indeed clear that there are bound to be many more.

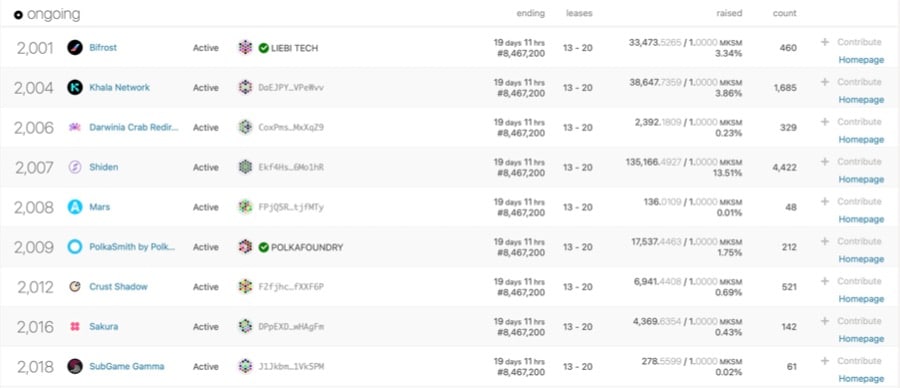

The Numerous Parachain Slot Auctions And Crowd-Loans On-Going In The Kusama Ecosystem - Image via PolkadotJSApp

The Numerous Parachain Slot Auctions And Crowd-Loans On-Going In The Kusama Ecosystem - Image via PolkadotJSApp With parachains going live, Kusama is ultimately fulfilling its role as the experimental hub for its sister chain Polkadot and is currently testing the performance of parachains in real economic conditions. After the Kusama-based parachains prove to be functional and are fully optimised, Polkadot will begin deploying parachain slot auctions on its own network.

KSM Price History

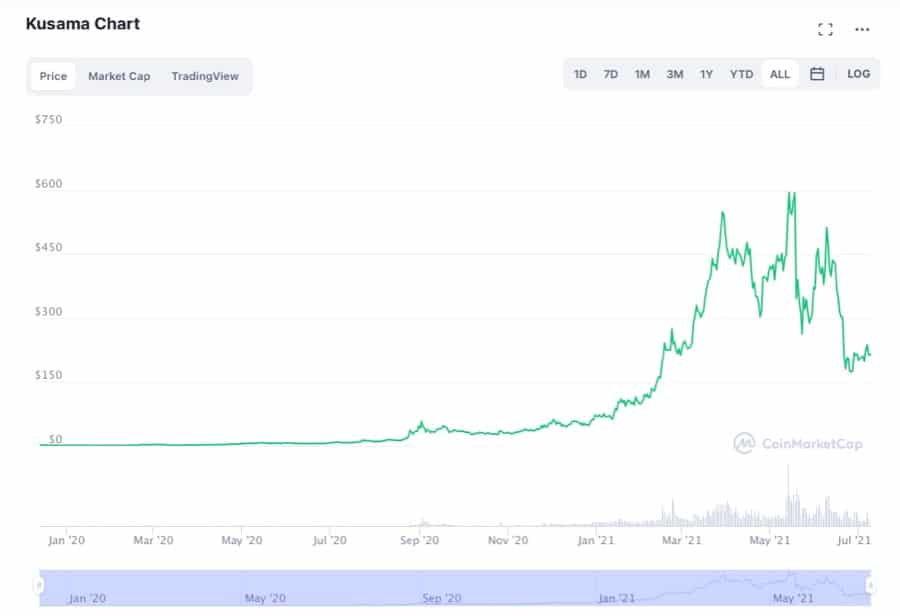

The KSM token began trading before the DOT token, opening at a price of $1.71 in December 2019. The price quickly dipped and headed into 2020 just below $1.20. After bouncing between $1 and $1.20 for January and the beginning of February price began moving higher. It continued climbing steadily higher through mid-August, when it hit levels above $14 and then took off higher in response to the launch of the Polkadot mainnet.

KSM Spiked In Mid-May 2021, But Has Since Retreated - Image via CoinMarketCap

KSM Spiked In Mid-May 2021, But Has Since Retreated - Image via CoinMarketCap Price hit a staggering all-time high of $621.71 on May 18, 2021 and has retreated since. The KSM token is currently trading at $214.42 and firmly holding the 50th position in terms of largest market capitalization (according to Coinmarketcap).

How High might KSM Go?

If you’ve been following what’s happening with decentralized finance (DeFi) then you probably know that the current pricing of Kusama (and Polkadot) is likely far less than what it could be. Just consider the huge market capitalizations we saw back in 2017/2018 for all kinds of coins even though there was very little adoption. DeFi is creating massive adoption of cryptocurrency.

Most of the world is still in the dark about how central DeFi is to cryptocurrency, but really it is what Bitcoin was made for. Decentralized finance is the future of cryptocurrency and blockchain. The previous years have seen numerous projects launch that were little more than a money grab. Programmers or entrepreneurs who jumped on the rising tide of the cryptocurrency revolution and created an ICO off a blockchain that wasn’t necessary because it created a tokenized solution where a token wasn’t necessary.

But DeFi is where blockchain began. Remember the message in the genesis block of Bitcoin; “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. Bitcoin began what is now gaining momentum as blockchain technology is now reaching a developmental phase where the reach and platforms are in place to scale DeFi to the masses. Kusama and Polkadot will be central to much of this new development as they make it easier for projects to scale and grow to the size needed for real global DeFi to take hold.

A small selection of the projects building on Kusama.

A small selection of the projects building on Kusama. Just look at the entire Polkadot/Kusama ecosystem and the projects that are building on this technology and it’s simple to see that the growth happening now is far different from the speculative excesses of 2017 and 2018. Adoption is coming more rapidly now, but token growth is more measured and realistic. Right now we’re in a stage similar to late 2016 and early 2017 when Ethereum was the easy investment. At the time everyone was building on the Ethereum network, and anyone familiar with cryptocurrency knew that once all the projects began launching demand for ETH would skyrocket.

Kusama and Polkadot are at a similar place now, but with DeFi the use case is far more real than it was with the Ethereum dApps, most of which have never caught on with the mainstream. Polkadot and Kusama are already catching on, and their use case is as great, or even greater, than Ethereum’s ever was.

How to get KSM Tokens

There are a number of ways to get KSMs aside from simply buying them from an exchange:

DOT indicator token holder: Kusama has aligned with the Polkadot community by offering KSM tokens to anyone who previously purchased DOT during its ICO. Those with a DOT indicator token are able to follow these instructions to claim an equal amount of KSM. There is no deadline for claiming the KSM.

Treasury proposals: If you have a project that will add to the value of the network you could submit a treasury proposal.

Bug bounty program: The Bug bounty program rewards anyone who discovers vulnerabilities in the Kusama code.

Validators: Validators are able to claim staking rewards for running the validating node. The number of KSM needed to become a validating node is dynamic and changes over time. As of October 2020 the APY is roughly 7.5%.

Nominators: The nominators in Kusama take a passive investing role by delegating their KSM to up to 16 validators. They receive rewards for this that are dynamic and change over time. As of October 2020 the APY for nominators is roughly 7.1%.

Buy KSM: Of course the easiest way to obtain KSM is to simply purchase it. Many different exchanges include KSM pairs, including Binance, HTX Global, and MXC.com.

In Conclusion

As a cousin network to Polkadot we see a great deal of potential in Kusama. Not only was it developed by the same visionary mind that first helped bring us Ethereum and then went on to create Polkadot, it also shares the solid development team behind Polkadot and the innovative and forward-thinking code base of Polkadot.

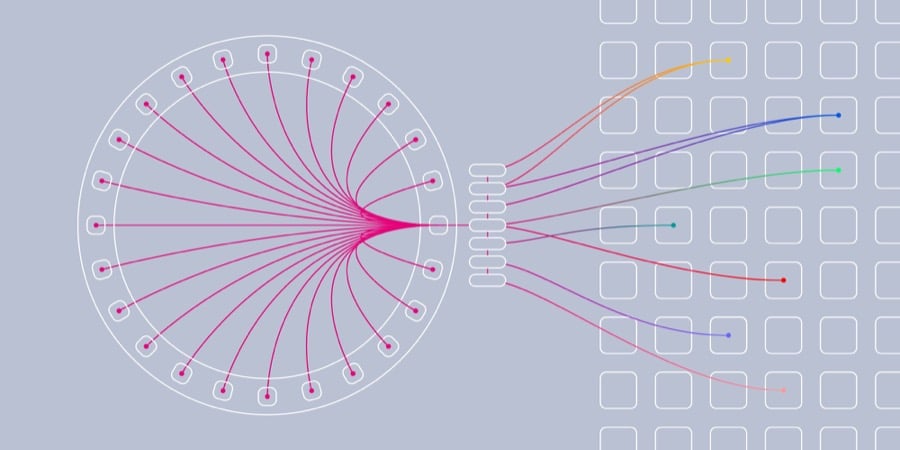

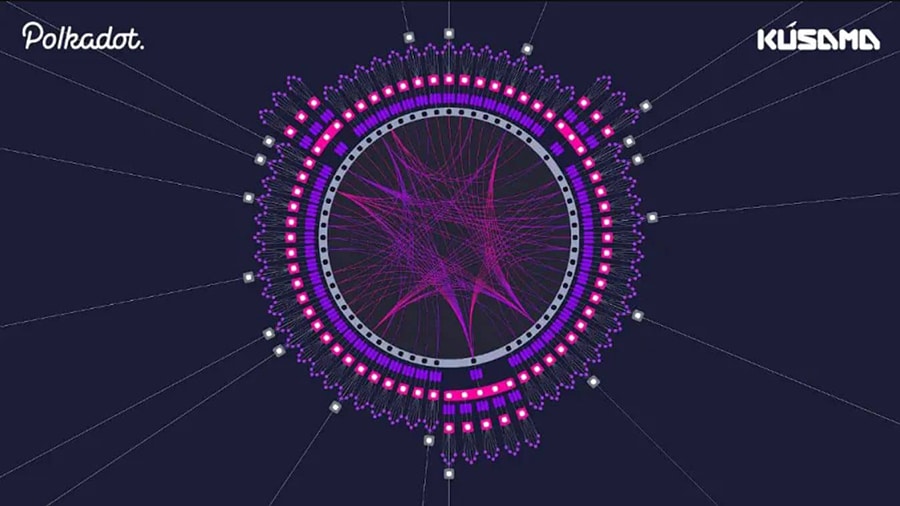

A visual of Kusama and Polkadot's architectures

A visual of Kusama and Polkadot's architectures There might even be reasons to like Kusama even more than Polkadot. For example, while it is meant to be a springboard for projects to develop on before launching on Polkadot, it could be that many projects choose to simply continue on Kusama. Development is faster and more innovative, and the costs for a parachain are expected to be far smaller on Kusama.

Consider too the already strong momentum being enjoyed at Polkadot and Kusama. Many mid-level and even some large-cap cryptocurrencies are based on Substrate, which makes them compatible with Kusama and anything Polkadot related. There’s even a bridge coming for Bitcoin, which means complete interoperability may be just around the corner.

Like its bigger cousin Polkadot, there’s just so much to get excited about regarding Kusama. The increasing adoption, and the growth of areas like DeFi that are a perfect match for these projects means this could be the next token to catapult to the moon or further.