When Polkadot's initial development and Proof of Concept (PoC) design first emerged in 2016, the project was still relatively under the radar of crypto enthusiasts and institutional investors, but it has since proven to be one to keep an eye out for. In fact, from 2016 onwards, Polkadot has built an incredibly reputable ecosystem of top-notch developers, architects and project leaders, has designed a sophisticated future roadmap and has experienced exponential growth, allowing it to secure a spot within the Top 10 most valuable cryptocurrencies in 2021. A 2021 CoinShares report also highlighted that Polkadot was among the most attractive cryptocurrency assets for institutional investors.

While 2021 was extremely bright for the Polkadot community and ecosystem, 2022/2023 has been unequivocally unkind, not just to DOT, but the broader crypto industry as we went through a period that has proven to be the most brutal bear market in crypto history.

But, like many blockchain projects, Polkadot’s builders and contributing DAOs kept their heads down and continued building during the bear market, and have emerged with some exciting developments coming down the pipeline. Polkadot has shown impressive resilience in the face of adversity and has showcased that the project is ready to continue the momentum it experienced prior to the sluggish crypto winter we just experienced.

There have been a few titles thrown around by the community to try and describe the ambitions of what Polkadot is trying to achieve such as “The Mother of All Blockchains”, “The Ultimate Layer Zero”, and of course, “Ethereum Killer”. Some of these titles are more accurate than others as even Polkadot’s founder insists that Polkadot is not a competitor to Ethereum. As we will dissect in this article, we agree that Polkadot is not looking to compete with Ethereum, but may, nonetheless, transform the blockchain world forever.

History of Polkadot

The history of Polkadot begins with Ethereum, specifically, one of Ethereum’s co-founders, Dr. Gavin Wood (PhD in Software Engineering). Dr Wood has over 20 years of experience working as a software developer both inside and outside of the crypto space.

Polkadot and Ethereum co-founder Dr. Gavin Wood. Image via Parity

Polkadot and Ethereum co-founder Dr. Gavin Wood. Image via ParityHe coded the first functional version of Ethereum and even authored Ethereum’s Yellow Paper. What Dr. Wood is perhaps most famous for, however, is creating Solidity, the coding language used to build smart contracts on Ethereum.

In January 2016, Dr. Wood left his position as Ethereum’s CTO and core developer. The exact reasons for his departure vary (even from Dr. Wood himself) but can be summed up as being due to his frustration about the slow development to Ethereum 2.0.

Later in 2016, Dr. Wood began developing a new cryptocurrency which would “deliver on the promises which Ethereum could not”. The first draft of the Polkadot whitepaper was finished by the end of 2016.

Polkadot's journey, following its initial conceptualization by Dr. Gavin Wood, has been marked by significant milestones, and the project involves other notable founders alongside Wood. Here's a brief overview:

Major Events in Polkadot’s Life:

- Whitepaper and Initial Concepts (2016): Polkadot's whitepaper was published in 2016 by Gavin Wood, outlining its innovative multi-chain framework.

- Web3 Foundation Launch (2017): Web3 Foundation, dedicated to facilitating a fully functional and user-friendly decentralized web, was established. It played a key role in funding and guiding the development of Polkadot.

- ICO and Fundraising (2017): Polkadot's initial coin offering (ICO) in 2017 was one of the most successful of its time, raising over $140 million. However, due to a vulnerability in the Parity wallet, a significant portion of the funds were frozen.

- Development Milestones (2018-2019): Polkadot underwent various phases of testing and development, launching the experimental "canary network" Kusama

- Mainnet Launch (2020): The Polkadot mainnet launched in 2020 with its first phase, bringing the network live with limited functionality initially. Full functionality was rolled out in subsequent phases, including enabling the governance, staking, and bonding features.

- Parachain Rollouts and Auctions (2021-2022): The introduction of parachains, a key feature of Polkadot, began with auctions for these slots, marking a significant step in realizing Polkadot's multi-chain architecture.

- Web3 Foundation Announces DOT Token is No Longer a Security (2022): After a multi-year discussion with the SEC, Polkadot self-declared DOT as a software, not a security.

- Polkadot 2.0 (2023): The new update marks the end of Parachain Slot Auctions, one of the most significant events in the cryptosphere, to adopt the more dynamic Parachian marketplace.

- Cardano Announces Adoption of Polkadot Tech (2023): At the 2023 Cardano Summit, Hoskinson announced that Cardano will be using Polkadot SDK for their partner chains.

Other Founders:

Besides Gavin Wood, who is a central figure in the development of Polkadot and a co-founder of Ethereum, Polkadot's founding team includes several other notable individuals:

- Robert Habermeier: A significant contributor to the Rust and blockchain communities. He has been actively involved in the development and conceptualization of Polkadot's technology.

- Peter Czaban: Former Technology Director of Web3 Foundation. He has been instrumental in guiding the foundation's mission and overseeing the technological developments of Polkadot.

Each of these individuals has brought unique expertise and vision to the project, contributing to Polkadot's development as a scalable, interoperable, and secure multi-chain ecosystem. Their collective efforts have been key to Polkadot's progress and ongoing evolution in the blockchain space.

The DOT Token ICO & Funding Rounds

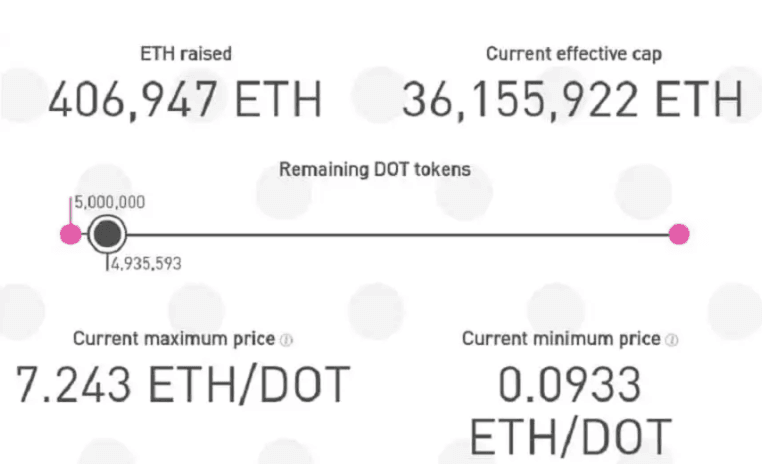

The initial coin offering of Polkadot’s DOT utility token is something which is still vividly in the memory of many veterans in the cryptocurrency space and certainly for the Polkadot team. The DOT ICO took place in October 2017 and raised over 145 million USD in Ethereum.

A snapshot from the Polkadot ICO. Image via Trustnodes

A snapshot from the Polkadot ICO. Image via TrustnodesHalf of DOT’s initial total supply of 10 million was sold in two rounds to public and private investors (2.25 million and 2.75 million, respectively). The price per DOT token for these funding rounds was initially 28.80 USD.

However, In August 2020, DOT was redenominated after a community vote, which in practice, resulted in the number of DOT held by each DOT holder increasing by 100. The redenomination price results in an actual ICO price of the DOT token being $0.29.

Shortly after the ICO, over 90 million USD of the funds raised were permanently frozen due to an exploit of a vulnerability in Polkadot’s multisig wallet code. One week after the attack, the Polkadot team confirmed that they still had enough funding to develop Polkadot and pressed onwards despite the frozen funds. Although there have been efforts to retrieve the funds, over 500,000 ETH are still locked.

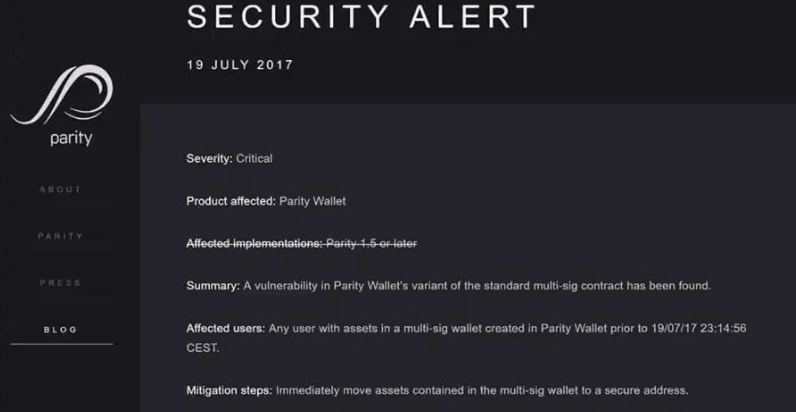

The first Polkadot wallet hack. Image via Steemit

The first Polkadot wallet hack. Image via SteemitThe post-ICO debacle marked the second time the team’s wallets had been hacked because of a code vulnerability. The first hack took place earlier in July of 2017 and saw over 33 million USD of Ethereum drained before the attack was stopped by a benevolent group of hackers known as the White Hat Group. In both cases, the Polkadot team released follow-up documentation detailing the hacks and how to prevent them from happening again.

In January 2019, another private funding round was held by Polkadot in an attempt to make up for the lost (frozen) funds from the DOT ICO. 500 000 DOT were sold, raising over 60 million USD.

In July 2020, a third private funding round was held, selling just under 350,000 DOT tokens. This raised another 43 million USD, then in 2022, they raised another $4 million.

Trying to get accurate figures on the total amount of funds raised is difficult. According to data collected by Cruchbase and Cryptorank, Polkadot has undergone 12 funding rounds in total for a collective $327,130,000, while Alpha Growth shows that Polkadot has raised north of $665,400,000

What is Polkadot?

Polkadot is a blockchain project that seeks to power the decentralized future of the internet (Web 3.0). Polkadot is often referred to as a Layer 0 blockchain, in contrast to networks like Bitcoin, Ethereum, Solana, etc., which are Layer 1 blockchains and Arbitrum, Lightning Network, Optimism, etc., which are Layer 2 blockchains.

For some quick background:

Layer 0 provides shared security and interoperability. Other notable projects that fall under the Layer 0 category include Avalanche and Cosmos. Of these mentioned, Polkadot is the only layer 0 that provides full shared security across the entire ecosystem.

Layer 1 is the application-focused chain. Examples are mainnets such as Bitcoin, Ethereum, Solana, etc. We cover this in more detail in our article on Layer 1 Blockchains.

Layer 2 most commonly refers to scalability solutions on Layer 1s with notable examples being Arbitrum and Optimism for Ethereum and the Bitcoin Lightning network. You can learn more in our article “What is a Layer-2 Blockchain”

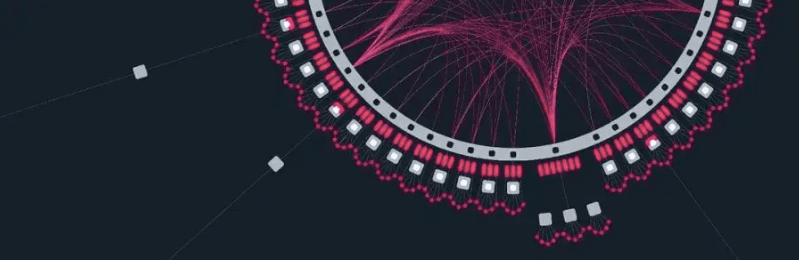

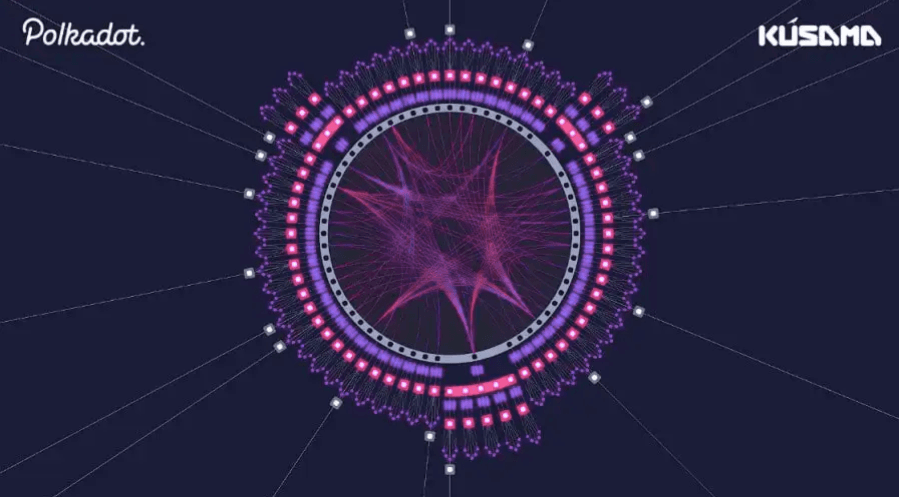

The core utility of Polkadot is that it seeks to provide a secure bedrock of continuous general-purpose computation. To put it simply, Polkadot provides shared security and secure interoperability with the ability to support multiple interoperable blockchains that run in parallel. The term “Layer 0” refers to Polkadot main chain’s (relay chain) intentional limited ability to provide security and finality to the Layer 1 chains, which in turn host smart contract applications and more. I once heard someone describe Polkadot as being like a giant shopping mall providing space and security to different shops. Shops are close together and can easily communicate within the same building.

A Common misconception is that Polkadot will be able to directly connect multiple networks like Bitcoin and Ethereum, which is a little inaccurate. Polkadot achieves interoperability through the use of bridges which can be built on Parachains. Polkadot does not connect disconnected blockchain networks but rather connects Parachains, providing them with the necessary infrastructure to enable them to focus on application and utility.

Parachain systems may offer interoperability with other networks as a utility, and this is expected to increase over time. An example of this already in practice is the Moonbeam network, an EVM-compatible Parachain that supports cross-chain interoperability with Ethereum, allowing its developers to build Dapps and NFTs on Moonbeam. There is also Snowbridge, an Ethereum-Polkadot bridge Parachain that enables interoperability between the two networks.

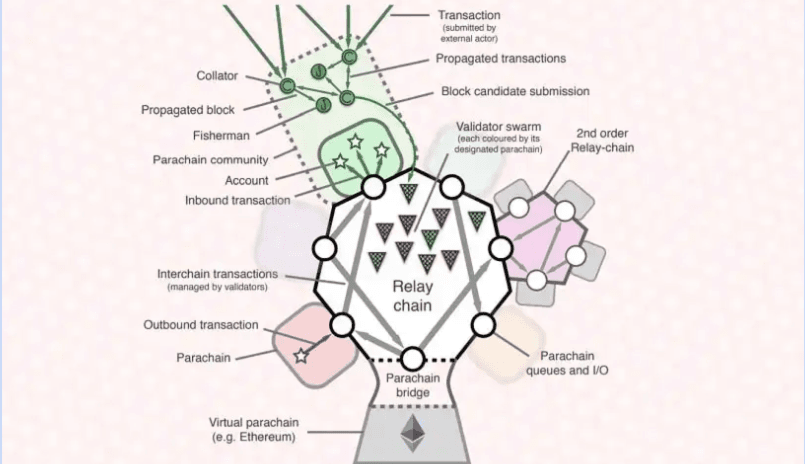

An Illustration of the Polkadot Network and How Parachains Achieve Interoperability. Image via Twitter

An Illustration of the Polkadot Network and How Parachains Achieve Interoperability. Image via TwitterPolkadot’s parachains allow for the creation of smart contracts and the relay chain supports new blockchains (and tokens), making it possible for blockchains to exchange information. Notably, Polkadot is upgradeable without needing hard forks and the protocol is governed by those who hold DOT, Polkadot’s native cryptocurrency. Polkadot’s upgrade to Polkadot 2.0 may usher in smart contract capabilities on the Relay chain.

Polkadot is a project by Web3 Foundation, a Swiss non-profit based in Switzerland’s Crypto Valley (Zug). Web3 Foundation commissioned UK-based Parity Technologies to develop and maintain the initial implementation Polkadot network, which is now maintained by Polkadot’s on-chain governance system.

Dr. Gavin Wood is the co-founder of both Web3 Foundation and Parity Technologies and remains Chief Architect of Polkadot working alongside hundreds of developers. Polkadot is built using Substrate, a blockchain-building tool developed by Parity Technologies.

How Does Polkadot Work?

Polkadot is certainly among the most technologically advanced blockchains in existence. At the Coin Bureau, we normally try our best to explain blockchain and cryptocurrency in layman’s terms in an easily digestible format, and this is another attempt at distilling a complicated blockchain stack for our readers.

The Polkadot whitepaper calls the Polkadot network a scalable heterogeneous multi-chain. Layer 1 blockchain designs like Bitcoin and Ethereum perform all blockchain functionalities under a single layer. The functionalities are largely classified under three categories -

- Data Retrievability: Blockchain networks maintain a distributed ledger that stores a record of all transactions or data entries. Data retrievability refers to the concept that this ledger should be accessible to all participants in the network. In a public blockchain, anyone can join the network, download a copy of the entire blockchain, and verify transactions. This ensures transparency and trust in the system because participants can independently verify the data's existence and integrity.

- Consensus: Consensus mechanisms are the protocols that enable blockchain participants to agree on the validity of transactions and the order in which they are added to the blockchain. Consensus is crucial for preventing double-spending and maintaining the integrity of the blockchain. Common consensus mechanisms include Proof of Work (PoW), Proof of Stake (PoS), and others, which vary in terms of how they achieve agreement among participants.

- Execution: Execution refers to the process of validating and executing smart contracts or transactions on the blockchain. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. When conditions specified in a smart contract are met, the code automatically executes the contract's terms without the need for intermediaries. The execution of smart contracts is a key feature of many blockchain platforms, such as Ethereum.

These three functionalities work together to create a secure, decentralized, and tamper-resistant system in which data can be reliably recorded, transactions can be agreed upon, and smart contracts can be automatically executed. Legacy blockchain networks like Ethereum use a single global blockchain network to handle all three core tasks under a monolithic framework, which is the source of its scalability issues as the network nodes can be overworked from handling all the processes themselves.

Polkadot is a heterogeneous multi-chain that abstracts these functions in two separate layers, namely - the Relay chain and the Parachain:

The Parachains are several Layer 1 networks that run in parallel in the Polkadot network. Execution of smart contracts or transactions is also handled by individual parachains. Each parachain can have its own set of rules, logic, and execution environment, allowing for flexibility and innovation at the parachain level. Parachains can implement their own consensus mechanisms and execution environments, such as Ethereum-compatible execution environments to execute smart contracts. Unlike the Ethereum Layer 1, Parachains are not burdened with consensus, allowing them to achieve the desired scalability. All the Parachains share necessary block data with the Polkadot mainnet, called the Relay chain, for achieving consensus and inheriting its security and finality.

The Relay chain forms the bedrock of the Polkadot network. It is responsible for achieving consensus among parachains and ensuring the security and validity of the entire network. Polkadot uses a unique consensus mechanism called Nominated Proof-of-Stake (NPoS) to achieve this consensus. Validators on the relay chain are responsible for producing blocks and securing the network by staking DOT tokens.

Data availability for individual parachains is primarily the responsibility of the parachains themselves. Each parachain has its own set of validators and maintains its own data and state. The relay chain indirectly helps ensure data availability by coordinating the network and providing security, but the specific data availability for each parachain is managed within that parachain's network.

Polkadot Architecture

An Illustration of Polkadot's Architecture. Image via substrate.stackexchange

An Illustration of Polkadot's Architecture. Image via substrate.stackexchangeThe Polkadot Network comprises of the following three roles:

Validators

Validators refer to the full nodes of the Polkadot relay chain that participate in its consensus process to secure the Polkadot network, including parachains. Note that the parachains are only concerned with the execution and rely on the relay chain for consensus and finality, which they achieve with the help of validators.

Each parachain is appointed a validator subgroup. These subgroups accept parachain blocks and conduct the necessary validity checks to ensure the blocks were constructed per the rules of consensus of the parachain. Once all new parachain blocks have been properly verified, the validators include them in the relay chain block. Now the validators need to validate the relay chain block itself; they do so by processing all the transactions of the relay chain and including the final parachain changes in the block.

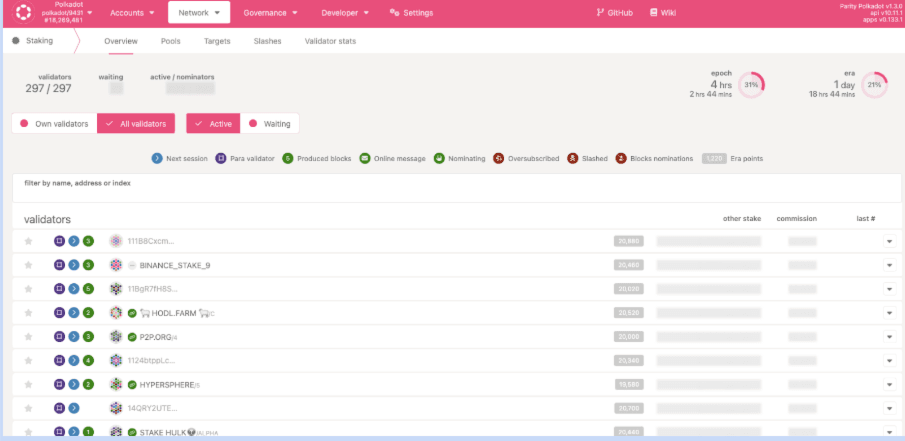

The amount of DOT required to be considered as a Validator depends on network participation and can change over time. It depends not only on how much stake is being put behind each validator, but also on the size of the active set and how many validators are waiting in the pool. Furthermore, the list of validators changes every era, which is every 24 hours.

The staking dashboard on Polkadot.js showing validators: Image via Js.org

The staking dashboard on Polkadot.js showing validators: Image via Js.orgPolkadot started with 20 open validator positions and has opened more gradually. The ultimate bound on the number of validators has not been determined yet and should only be limited by the bandwidth strain of the network due to peer-to-peer message passing, but the end goal for Polkadot is to have 1000 validators authenticating transactions on its network.

When a new block containing Parachain transactions is generated by validators on the Relay chain, 20% of block rewards are distributed among validators in accordance with the amount of “era points” they have accumulated. The validators are responsible for a handful of more infrastructural tasks for network upkeep. The more tasks they perform, the more era points they earn.

Nominators

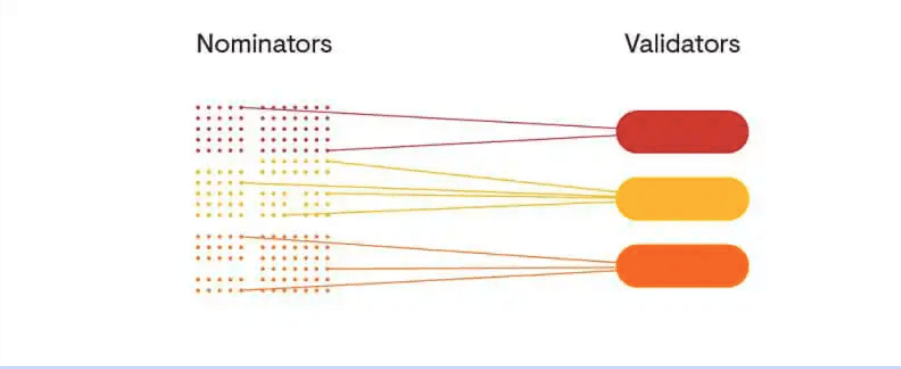

A nominator is a network participant who delegates its DOT to the validator to participate in the Polkadot consensus. They have no additional role except to place risk capital to signify that they trust a particular validator to act honestly to propagate the Polkadot network.

An illustration of the relationship between nominators and validators. Image via Polkadot

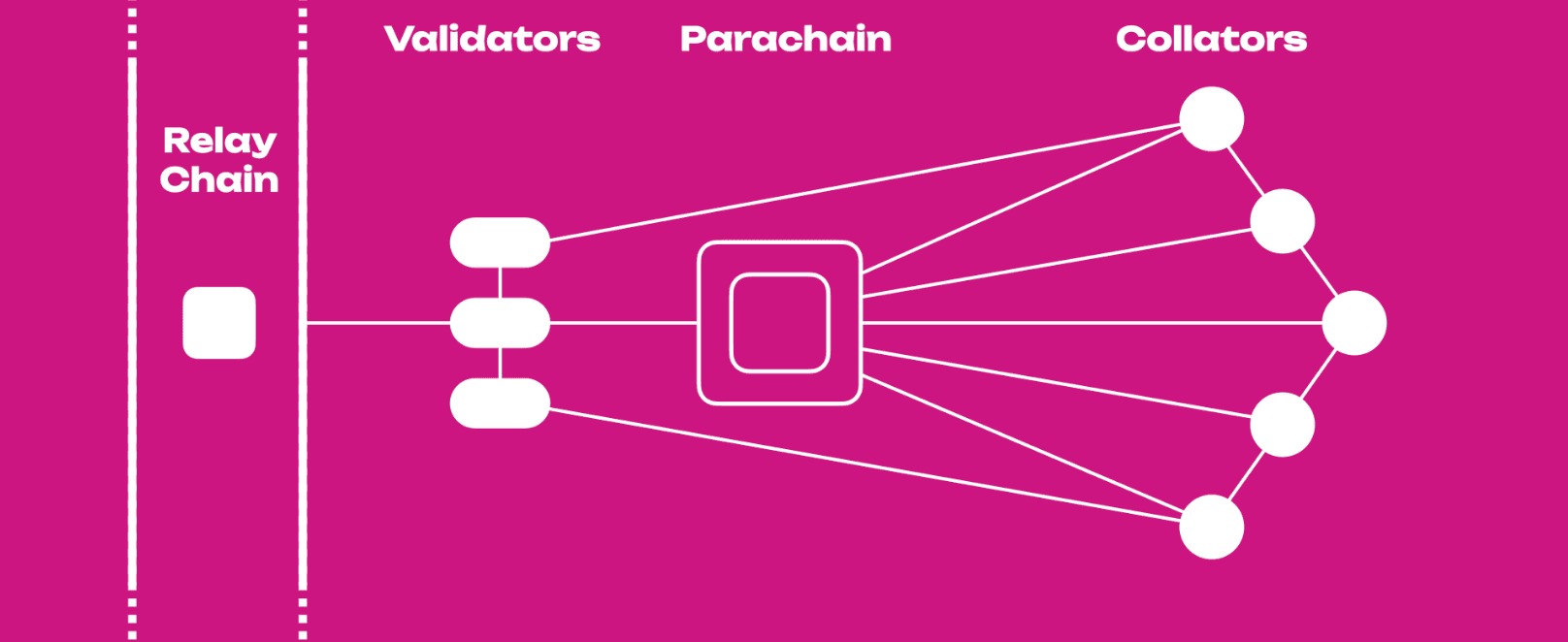

An illustration of the relationship between nominators and validators. Image via PolkadotCollators

Collators assist the validators in consensus by constructing the parachain blocks. Collators maintain a full node for a particular Parachain and a full node of the Relay chain. As a Parachain full node, they retain all necessary information, like transaction data, signatures, and state transitions, to construct parachain blocks. They collate and execute parachain transactions to create parachain blocks. They provide these blocks, along with a zero-knowledge proof of the validity of Parachain transactions to one or more validators responsible for proposing the Parachain block.

An illustration of where Collators fit in the Polkadot network. Image via Polkadot Wiki

An illustration of where Collators fit in the Polkadot network. Image via Polkadot WikiPolkadot Consensus

The Polkadot relay chain adopts a novel Nominated Proof of Stake (NPoS) consensus process to secure its blocks, designed to optimize network security and efficiency. Here’s how it works:

- Roles: NPoS involves two main roles:

- Validators: Responsible for validating transactions and maintaining the blockchain.

- Nominators: Stake their tokens by backing trustworthy validators, helping to secure the network.

- Nominating Validators: Token holders can nominate validators they trust. This process involves staking DOT, Polkadot's native token.

- Election of Validators: An election mechanism selects validators from the pool of nominees. This process considers the amount of stake backing each validator to ensure a balanced and secure network.

- Staking Rewards and Risks: Both validators and nominators receive staking rewards proportional to their staked amount. However, they also share risks; any malicious actions by a validator can lead to slashing, where a portion of the staked DOT is lost.

- Security and Efficiency: NPoS is designed to maximize the amount of stake securing the network, enhancing its security. Validators are incentivized to perform efficiently and honestly due to the economic stakes involved.

In summary, Polkadot's NPoS is a sophisticated consensus model that aligns the incentives of various network participants to maintain a secure, efficient, and decentralized ecosystem.

Polkadot XCM (Cross-chain Messaging)

In the Polkadot ecosystem, XCM stands for Cross-Consensus Messaging. It's a protocol designed for communication between different blockchains (parachains) within and external the Polkadot and Kusama networks. XCM enables these diverse blockchains to send messages to each other, despite potentially having different consensus mechanisms or state transition functions. Here's a detailed look at how XCM facilitates cross-chain communication:

- Protocol Design: XCM is a language and format for messages. It's designed to be as general and abstract as possible to accommodate a wide range of potential use cases and blockchain designs.

- Message Sending and Receiving: A parachain can send an XCM message to another parachain without those messages needing to be stored on the Relay chain.

- Cross-Consensus Compatibility: XCM is designed to be compatible across different consensus systems. This means that a blockchain using one consensus mechanism can communicate with another blockchain using a different mechanism.

- Use Cases: The uses of XCM are varied and can include transferring tokens between parachains, making calls to smart contracts located on another parachain, or any other kind of information or command that might need to be communicated in a multi-chain environment.

- Decentralization and Security: XCM leverages the shared security model of Polkadot. This ensures that cross-chain communication is as secure as the internal operations of a single parachain.

In summary, XCM in Polkadot is a powerful tool for enabling interoperable functionality between different blockchains in a secure, efficient, and decentralized manner, which is a cornerstone of the Polkadot philosophy. XCMP is the transport layer for delivering XCM messages. It gives the transportation method and a secure route but not a framework for binding agreements.

Life of a cross-chain message in XCM

The life of XCM format facilitated cross-chain message in Polkadot involves several steps. Here’s a breakdown:

- Message Creation: A user or application on a Parachain initiates a cross-chain operation, creating an XCM message. This message is formatted to be universally understood across different parachains with varying consensus mechanisms and state transition functions.

- Submission to Local Parachain: The XCM message is first submitted to the local Parachain. Here, it's processed according to the parachain's rules and prepared for transmission to another parachain.

- Relay Chain Involvement: The local Parachain forwards the XCM message to the Polkadot Relay chain. The Relay chain plays a central role in Polkadot's architecture, interconnecting all parachains and facilitating their communication.

- Routing the Message: The Relay chain then routes the message to the destination Parachain. This routing is based on the information contained in the XCM message, which specifies the target Parachain and the intended operation.

- Receipt by Destination Parachain: The destination Parachain receives the XCM message from the Relay chain. It interprets the message according to its own logic and executes the requested operation.

- Execution and Response: The destination Parachain executes the operation requested in the XCM message. This could involve token transfers, smart contract executions, or other blockchain operations.

- Feedback Loop (if applicable): Depending on the nature of the cross-chain operation, a response or confirmation may be generated by the destination Parachain and sent back to the original Parachain using the same XCM protocol.

- Finalization: The operation is completed, and any changes are finalized on both the origin and destination Parachains.

Throughout this process, the security and consensus mechanisms of Polkadot ensure that the cross-chain communication is secure and reliable. The XCM protocol's design as a generic and abstract messaging format allows for a wide variety of cross-chain interactions within the Polkadot ecosystem.

How Are Parachains Selected?

The Ethereum network is completely permissionless, meaning anyone can conduct any operation on the network, as long as it adheres with the consensus process of the Ethereum protocol. Therefore, developers have complete autonomy over deploying any smart contract they want on the Ethereum mainnet, including smart contract rollups.

The Polkadot network works slightly differently. The project’s initial vision only wanted to let good quality and efficiently developed Parachains to connect to the Relay chain and benefit from its security. So, Polkadot introduced slot auctions to regulate the number of Parachains on Polkadot at any time. Here’s how the auction worked prior to the Polkadot 2.0 upgrade.

- Purpose: Slot auctions are used to determine which Parachains will be connected to the Polkadot Relay chain. Being connected to the Relay chain allows a Parachain to benefit from the shared security and interoperability features of Polkadot.

- Parachain Slots: These are the available positions on the Relay chain for Parachains to connect to. Each slot has a limited duration, typically ranging from several months to a couple of years.

- Auction Process:

- Candle Auction Format: Polkadot uses a version of the candle auction, a mechanism historically used for selling ships. The end of the auction is determined retroactively after the auction has ended, making it hard to game the system by making last-minute bids.

- Bidding: Projects bid for slots by locking up DOT tokens. The amount of DOT locked and the duration of the lease are factors in the bidding process.

- Random Ending: The exact ending time of the auction is not known to participants, which discourages last-minute bidding strategies.

- Winning the Auction:

- Determination of Winners: The winner is the project that has the highest bid at the randomly selected ending point of the auction.

- Leasing the Slot: Winning projects get to lease the Parachain slot for the duration they bid for. During this time, their Parachain is connected to the Relay chain.

- Locked DOT: The DOT tokens bid in the auction are locked for the duration of the slot lease. They are not spent but are rather a bond securing the Parachain's place on the Relay chain.

- Crowdloans:

- To gather enough DOT for a bid, projects often use crowdloans, where they crowdsource DOT from their community.

- Contributors to crowdloans may receive rewards from the project, such as tokens or a share in the project’s success.

- End of Lease: Once the lease period ends, the Parachain slot is up for auction again, and the locked DOT is returned to the project or its crowdloan contributors.

Slot auctions are a fundamental part of Polkadot's governance and economic model, ensuring a fair and transparent process for allocating limited resources (parachain slots) in the network.

Coretime in Polkadot

The validators of the Polkadot network are dynamically assigned to validate different parachain blocks. Polkadot offers strong guarantees that the Parachain state transitions are valid through a set of validators cryptographically randomly segmented into a subset for each Parachain; with these subsets differing for every block.

Coretime refers to the availability and allocation of these validator subsets as computational resources (cores) for processing parachain blocks. The Polkadot network currently supports 50 such cores. Each core can host a Parachain that utilises all the resources or multiple parathreads that use some of the available resources. The cores run in parallel, processing multiple complex tasks simultaneously. Polkadot is also referred to as the “Polkadot Supercomputer,” representing the collective ability to process a large number of tasks.

Polkadot OpenGov - A Democratic Governance Structure

The Polkadot network recently overhauled its governance mechanism. It gave up Governance V1 to adopt OpenGov, a more democratic and equitable format of protocol governance that slashes privileges and enables a greater voice for the DOT community. We recommend reading about Governance V1 to appreciate the changes introduced in OpenGov.

Parting with Governance V1

The first governance system of Polkadot included three main components: the Technical Committee, the Council, and the Public (all token holders). The Technical Committee was responsible for managing upgrade timelines, while the Council, an elected body, handled parameters, administration, and spending proposals. While the Public (token holders) played a crucial role in the governance process, the Council would scrutinize their proposals before they could enter the voting phase.

Despite its effectiveness in managing treasury funds and facilitating upgrades, Governance V1 had limitations. It allowed only one referendum to be voted on at a time (except for emergency proposals), with voting periods lasting several weeks. This system favoured carefully considering a few proposals over a broader range of ideas, potentially limiting the network's ability to adapt and evolve quickly. V1 also limited the public’s voice by implementing the council and having to secure endorsements. The need for greater decentralization and democracy led to the adoption of OpenGov.

Polkadot OpenGov

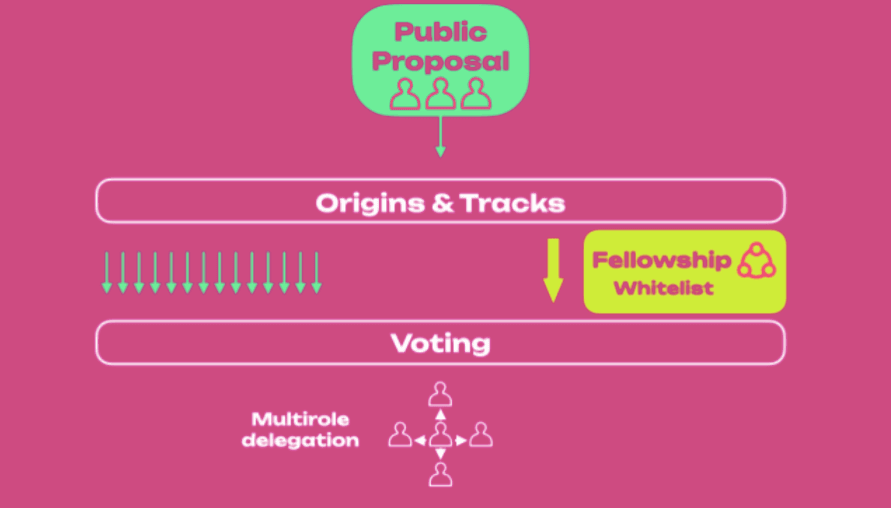

Polkadot OpenGov introduced significant changes to address the shortcomings of Governance V1. The new system aims to decentralize decision-making further and increase the number of collective decisions possible at any given time. Key changes include:

- Dissolution of the Council and Technical Committee: The Council collective was dissolved, and the broader Polkadot Technical Fellowship replaced the Technical Committee.

- Direct Democracy Voting System: The responsibilities of the Council were migrated to the public, who can now directly initiate new proposals.

- Enhanced Delegation Options: Users can now delegate voting power to community members in more diverse ways, allowing for a more nuanced representation of stakeholder interests.

- Multiple Origins and Tracks: Proposals are now initiated by the public and enter different tracks based on their nature, with each track having a dedicated origin. This system allows for simultaneous voting on multiple referenda, enhancing the governance process's flexibility and responsiveness.

Note: A deep dive on how OpenGov works is also available for those who want to learn more.

OpenGov architecture described in Polkadot Docs

OpenGov architecture described in Polkadot DocsIn OpenGov, DOT holders initiate all proposals. Unlike Governance V1, OpenGov allows the community to work on multiple proposals in parallel. OpenGov organizes the proposals on the basis of what it aims to implement, categorized under fifteen different Origins. Each origin follows a specially crafted ‘track’ comprising preset configurations to govern the voting process. The Origins & Tracks system ensures every proposal receives adequate exposure to the community’s time and resources.

Some governance proposals are time-sensitive, requiring decisive decision-making, while others are more foundational and resource-intensive, demanding greater introspection and testing. OpenGov is a platform where all such diverse kinds of proposals do not compete with one another for the community’s attention and can develop together holistically.

Key Benefits of OpenGov:

- Decentralization: OpenGov shifts the governance power from a centralized council to a more direct democracy model. By dissolving the Council and the Technical Committee, and transferring their responsibilities to the public, OpenGov fosters a more decentralized approach to decision-making.

- Inclusivity and Community Empowerment: OpenGov introduces more nuanced delegation options. This feature encourages broader participation in governance, as stakeholders can contribute to decision-making in areas they are most knowledgeable about or interested in.

- Adaptability and Evolution: The introduction of multiple origins and tracks for proposals under OpenGov allows for a more flexible and responsive governance system. This system can adapt to different types of proposals, ensuring that the governance process is efficient and effective.

- Transparency and Accountability: The introduction of the Technical Fellowship and the ability to whitelist proposals for expedited processing enhance the network's ability to respond swiftly to critical updates or improvements.

- Scalability and Efficiency: OpenGov's design allows for multiple referenda to be voted on simultaneously, increasing the governance system's efficiency. This scalability is crucial for the dynamic coretime management system in Polkadot 2.0.

Polkadot 2.0 proposed a direction for the network that lets go of its periodic slow auctions model to adopt a dynamic, ‘pay as you go’ model for plugging Parachains to the Polkadot network. The new vision cited some limitations of the slot auctions like the following:

- Rigidity in Resource Allocation: The original slot auction model allocated parachain slots for fixed periods, lacking the flexibility to adapt to varying project needs or changes in network conditions.

- High Entry Barrier for New Projects: The requirement to lock up is significant.

Polkadot 2.0

In Polkadot Decoded 2023 held in June, Parity Technologies founder Gavin Wood shared a new vision for the Polkadot network. The amount of DOT needed for extended periods could be prohibitive for smaller or newer projects, limiting their ability to participate in the Polkadot ecosystem.

- Inefficient Resource Utilization: Fixed slot leases might not always align with actual resource usage, leading to situations where allocated resources are underutilized.

- Economic Constraints: The need to bond a large number of DOT tokens for slot auctions could lead to reduced liquidity in the market and potentially higher opportunity costs for projects.

- Challenges in Long-Term Planning: Projects might face uncertainty in long-term planning, given the competition and uncertainty associated with winning subsequent slot auctions to maintain their parachain status.

The renewed Polkadot vision does not introduce any new paradigm to the ecosystem. Rather, it underpins the groundwork laid down by the network at the most fundamental level. At its most basic, the Polkadot network:

- Is a platform that provides a secure blockspace, rather than secure blockchains.

- Is a platform to build applications. Although Polkadot facilitates building chains, enabling utility through applications for users is its core objective.

- Provides continuous coretime, i.e. a vessel for general-purpose computation.

- Is a supercomputer, with multiple cores that operate perpetually in parallel.

The above generalization represents a paradigm shift from Polkadot behaving as an ecosystem that services chains to an application-focused ecosystem. With the slot auctions, Polkadot 1.0 allocates a core to each Parachain for a fixed period. In the new system, all the cores are available as resources consumable by all the Parachains, without any explicit allocation like before. Therefore, there will be no need for slot auctions anymore.

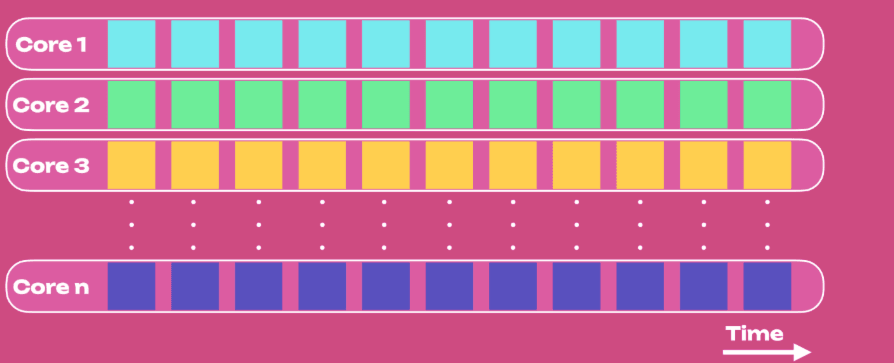

Core Usage in Polkadot 1.0 vs 2.0

In Polkadot 1.0, each core allocated to a parachain produced a block every 12 seconds, regardless of network requirements and demand, leading to inefficient use of coretime. The figure below illustrates core usage. Each colour represents a Parachain propagating in blocks in separate cores in time.

Polkadot coretime illustration | Image via Polkadot docs

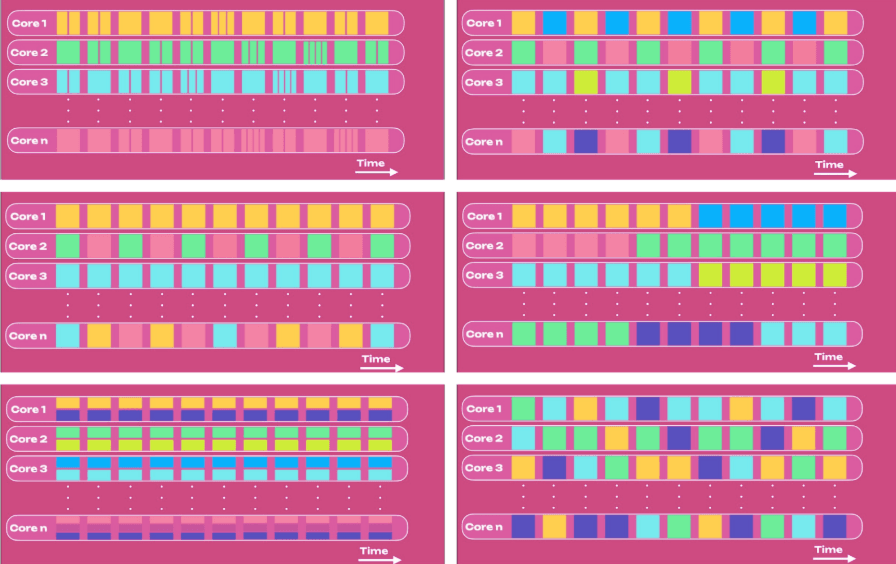

Polkadot coretime illustration | Image via Polkadot docsTo achieve full efficiency, the cores must be optimized for maximum usage regardless of Parachain. In Polkadot 2.0, the cores are utilized as a homogeneous resource, allowing for a single core, or even a single coretime to provide computation to multiple Parachians together. A coretime generalization at this scale leads to efficient resource usage. We can illustrate this shift in several configurations:

Possible coretime configurations in Polkadot 2.0 | Image derived from Polkadot docs

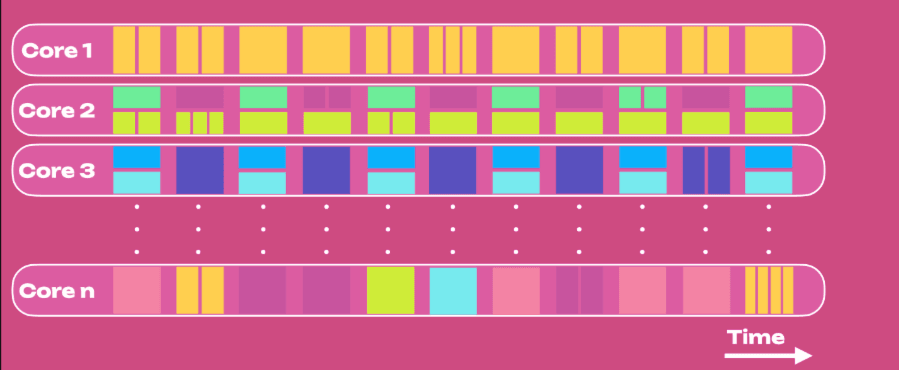

Possible coretime configurations in Polkadot 2.0 | Image derived from Polkadot docsFinally, an agile coretime allocation and core usage illustrated in the configurations above will be composable, enabling an efficient decentralized computing system that is global within Polkadot, as opposed to localized within cores.

Polkadot 2.0 facilitates an agile composable computer | Image via Polkadot docs

Polkadot 2.0 facilitates an agile composable computer | Image via Polkadot docsCoretime Marketplace

How does Polkadot enable this core agility? Quite surprisingly, it already existed but was never used. The cores as defined above essentially perform their computations on a modern CPU, which can easily and swiftly change what job they perform and what computations they execute. Therefore, the cores have always been agile and could perform general computations.

However, the slot auctions in Polkadot 1.0 prevented the network from leveraging this agility by limiting the cores to a single Parachain. The new vision replaces slot auctions with the coretime marketplace, where coretime is commoditized. The coretime marketplace in Polkadot 2.0 will tokenize coretime, enabling its trade such that any Parachain in need of more coretime and buy it from Polkadot or other Parachains with excess available coretime.

Parachains will be able to buy need-based coretimes:

- Bulk coretime - A standard coretime rental through a broker parachin at a fixed price for a fixed time period.

- Instantaneous coretime - Available through sale of coretime for immediate use at spot price. The community has often referred to this as “pay as you go.”

This system will allow for old Parachains to buy coretime in advance and new Parachains with limited resources to buy coretime as needed.

XCM and Accords

The Polkadot documentation argues that while the XCM cross-cain messaging format guarantees faithful delivery of cross-chain messages between chains, there is still a chance that the chains may interpret these messages incorrectly. After all, Parachains are offered design flexibility by the relay chain, so a chance of misinterpretation does exist.

Polkadot 2.0 describes Accrods, which acts as a sort of treaty between any two Parachains. While XCM guarantees efficient delivery of cross-chain messages via XCMP channels, Accords will guarantee faithful and correct execution of those messages on the destination chain.

Asynchronous Backing

Asynchronous backing is an effort to further improve the efficiency of the Polkadot network by loosening the rules that define how Parachains commit to the relay chain, without sacrificing the security and resiliency of the network.

Synchronous backing in Polkadot 1.0

Let’s break this term down to understand it a little better. Firstly, backing refers to the anchoring process of collators. The Parachain collators submit Parachain block headers to the relay chain to inherit its security. The synchronous backing in Polkadot 1.0 meant that the collators were only allowed to anchor to the latest Relay chain block. As Parachains and the Relay chain run in parallel, every current Parachain block could only anchor to the current Relay chain block within a short time window available for them, a limitation that the Polkadot devs argue leads to congestion and slowed throughput.

Asynchronous backing in Polkadot 2.0

The Polkadot 2.0 upgrade proposes to break this synchrony. The Parachain and the Relay chain still run in parallel, producing new final (linked) blocks together. However, with the optimization of Polkadot’s consensus protocol, the collators will be allowed to anchor current Parachain blocks to historical relay chain blocks. Asynchronous backing improves efficiency in two broad ways:

- With Parachains no longer limited by the throughput of the Relay chain, they can pipeline blocks, or produce multiple unlinked blocks that may anchor to a later Relay chain block, increasing efficiency and scalability.

- Ancestor Relay chain blocks with no links to a particular Parachain are still good for proposing new Parachain candidates, improving network resource usage.

Polkadot devs claim that asynchronous backing can provide up to 4x more time for Parachain to execute its operations and produce blocks, as well as 2x the throughput of those blocks. The proposed upgrade leads to several benefits like efficient resource usage and reduced latency for the Polkadot ecosystem that will realize over the short to long term.

The preliminary testing of asynchronous backing will first happen on Versi and Rococo testnets. If successful, Polkadot’s on-chain governance will first deploy it on the Kusama network and finally on Polkadot if everything works as intended.

Polkadot 2.0 Summary

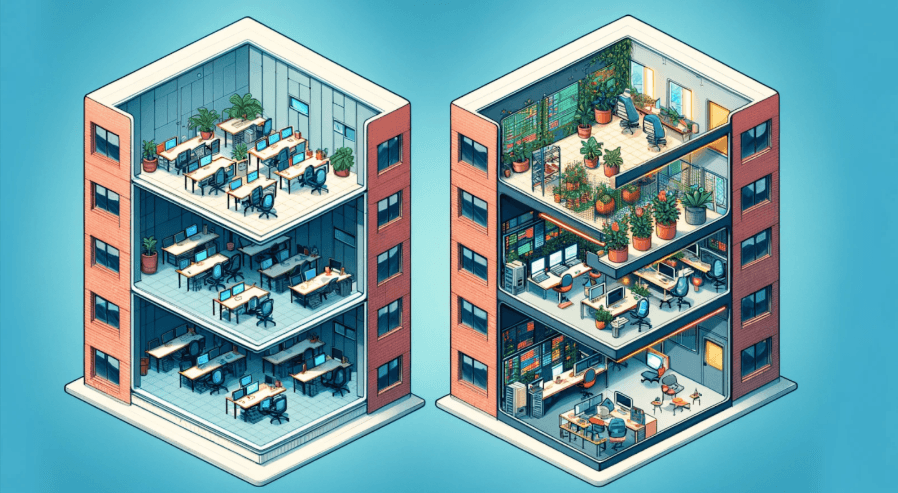

The Polkadot 2.0 upgrade marks a significant evolution in the network's architecture, akin to the shift from a traditional office setting to a modern co-working space. In this analogy, Polkadot 1.0 resembles a traditional office where resources, like office space (parachain slots), are leased out on long-term, fixed contracts. This setup, while stable, offers limited flexibility and can be less efficient for dynamic or growing organizations.

The introduction of Polkadot 2.0 transforms this model into a co-working space, where resources (blockchain computational capacity or "cores") are available on a more flexible, demand-driven basis. In this new environment, akin to a co-working space, entities can use resources as needed, adapting quickly to changing requirements and opportunities. This shift not only maximizes resource utilization but also lowers entry barriers, fostering a more vibrant and inclusive ecosystem. Just as a co-working space encourages collaboration and innovation among its diverse occupants, Polkadot 2.0 paves the way for a more dynamic, efficient, and collaborative blockchain network.

The analogy stated above illustrated with an AI-generated image.

The analogy stated above illustrated with an AI-generated image.

The illustration above clearly depicts this transition. Polkadot 1.0 (left) represents a rigid office building with one Parachain per core (office floor). Polkadot 2.0 (right) represents dynamic usage of cores. Different co-working settings represent each core running multiple Parachains simultaneously.

Polkadot’s DOT Cryptocurrency

DOT is the native cryptocurrency on the Polkadot network. It is used for governance, staking, and bonding on the Polkadot network. Anyone who holds DOT can vote for proposed changes to Polkadot.

As noted in the section on how Polkadot works, DOT is used for staking by Validators and Nominators on the network. DOT is also used for bonding Parachains to the Relay chain via Collators.

The three purposes of DOT - Image via MultiResearch Medium

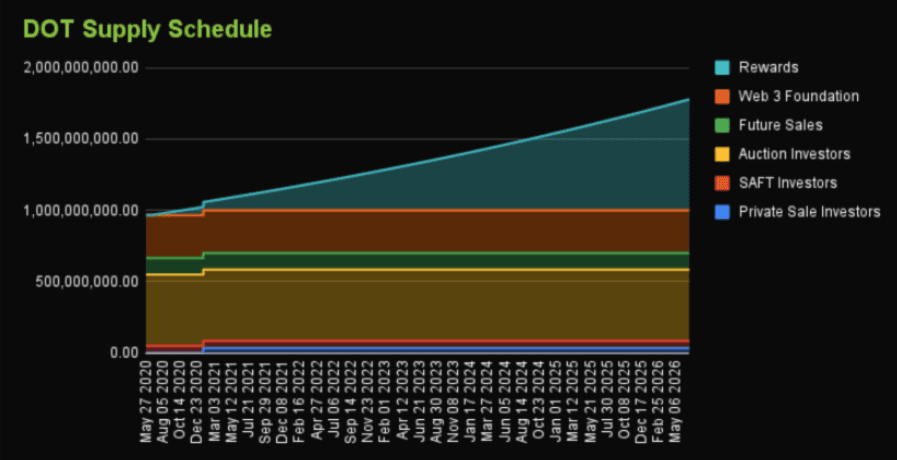

The three purposes of DOT - Image via MultiResearch MediumAlthough DOT initially had a max supply of 10 million, this was changed to allow for a degree of inflation to incentivize network participation.

The target participation rate for events such as staking and Parachain auctions for Polkadot is 75%, which corresponds to an inflation rate of 10% per year. The inflation rate can be as high as 100% per year if there is not enough network participation. The current total supply of DOT is over 1.2 billion.

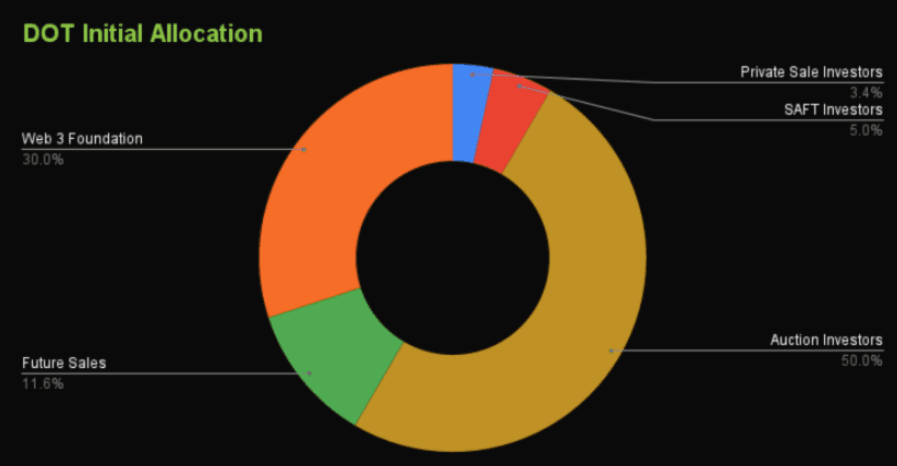

As for Tokenomics, DOT distribution is as follows:

Image via CoinGecko

Image via CoinGecko- 3.42% is allocated to Private Sale Investors

- 5.00% is allocated to SAFT Investors

- 50.00% is allocated to Auction Investors

- 11.58% is allocated to Future Sales

- 30.00% is allocated to Web 3 Foundation

And here is a look at the Polkadot supply schedule, showing no major token unlocks that users need to be wary of:

Image via CoinGecko

Image via CoinGeckoWhere to Buy Polkadot (DOT)

Those looking to buy Polkadot have plenty of options. As this is a large-cap project with vast potential, DOT is available on most reputable exchanges. We recommend Bybit, Binance or OKX for those looking to trade DOT and SwissBorg or Kraken for those looking for secure and easy places to buy DOT.

For those who prefer to take the DEX route, HydraDX is a leading DEX on Polkadot where users can DCA into DOT, provide liquidity, and trade in a decentralized manner. You can find out more about all the projects building in the Polkadot ecosystem by going to dotmarketcap.com.

Best Polkadot Wallets

In the early days, the choice of Polkadot wallets were slim as most mainstream wallets did not offer DOT support. Now, for folks looking for the best Polkadot wallet, there are some solid choices, both hardware and software wallets are available.

For users wanting to get involved in the DOT ecosystem, Nova Wallet is a good choice for mobile wallets and Talisman is a popular browser extension wallet.

For hardware wallets, one of our favourites for long-term holding and staking DOT is the ELLIPAL Titan wallet. Ledger also supports Polkadot but does not support Parachains at this time.

For advanced users and developers, users can consider the Polkadot Vault, the Polkadot-JS UI Web Wallet and Subkey.

How Polkadot 2.0 Aligns With the Evolving Web3 Landscape

The Polkadot 2.0 upgrade represents a shift in the ethos of the Polkadot ecosystem into a platform made for users from a platform made for chains. This shift resonates with the growing significance of Web3 entering 2024 and aligns with the overreaching technological trends evolving in this landscape:

- Interoperability: Polkadot 2.0's focus on enhanced interoperability aligns well with the Web3 vision of a decentralized and interconnected internet. As more blockchain projects and decentralized applications emerge, the ability to communicate and share resources across different networks will be increasingly vital.

- Scalability: Although the Polkadot network was already highly scalable with ample resources to handle large amounts of traffic, upgrades in Polkadot 2.0 aim to improve scalability even more, ensuring the network is prepared for the mass adoption of Web3 technologies. By allowing for efficient and dynamic allocation of resources (through mechanisms like elastic cores and dynamic coretime), Polkadot can better accommodate growing numbers of transactions and users.

- User Experience: Improvements in transaction speed, cost, and overall network efficiency can significantly enhance user experience, a key aspect of broader Web3 adoption. Polkadot's upgrades are expected to contribute to a smoother and more accessible experience for users and developers alike.

- Decentralization and Security: Polkadot's shared security model and decentralized governance structure embody core Web3 principles. Upgrades that enhance these aspects will further align Polkadot with the ethos of a decentralized, user-empowered internet.

- Innovation and Flexibility: As the Web3 landscape evolves, so do the needs and aspirations of its participants. Polkadot 2.0's more flexible framework is likely to encourage innovation, allowing developers to adapt and create solutions that meet emerging needs and opportunities.

Polkadot was already believed to be a high-quality project with massive potential prior to the rollout of 2.0. To quote our friends over at Altcoin Daily about their take on Polkadot 2.0:

“The Polkadot of the past was quality. The Polkadot of the future is exceptional” (Source)

While the specifics might evolve, the core principles and features being introduced with Polkadot 2.0 are likely to be well-aligned with the needs and trends of the Web3 landscape in 2024 and beyond.

Image via Polkadot

Image via PolkadotNow, we would be remiss if we did not take a moment to compare Polkadot to Ethereum.

On a high level, Ethereum and Polkadot adopt two very different blockchain designs that serve different goals:

- Ethereum is a monolithic, general-purpose blockchain. The sole purpose of Ethereum is to execute the smart contracts in the Ethereum Virtual Machine and keep all the nodes in sync with the results of those executions.

- Polkadot is a heterogeneous blockchain, think of Polkadot as a blockchain with two layers, and each layer with its own sole purpose. The Parachains execute state transitions like the Ethereum Virtual Machine, and the relay chain keeps the nodes in sync with consensus.

Ethereum vs Polkadot: Sharding

The Polkadot ecosystem is a purely sharded network. It is characterized as ‘pure’ because each Parachain is, in fact, a separate but parallelly operating blockchain. So, Polkadot is a sharded network where the shards (Parachains) are actually split networks that make their block data available to the Relay chain to inherit its security. Therefore, scalability from sharding on Polkadot is achieved by actually running separate networks in parallel.

The rollup-centric roadmap of Ethereum thinks of sharding from a different perspective. Ethereum will soon implement Danksharding. Danksharding is different from Polkadot’s sharding logic in the following ways:

- Danksharding will improve the scalability of Ethereum by improving the throughput of rollups.

- Danksharding will not actually split the Ethereum network like Parachains are in Polkadot, instead, the Danksharding upgrade will substantially increase the amount of transaction data rollups can commit at each Ethereum block such that they achieve scalability of an actual sharded network.

To summarize, one may call Polkadot a real sharded network, while Ethereum is an effectively sharded network. Feel free to refer to the Polkadot docs to dive deeper into the architectural differences between Polkadot and Ethereum.

Another Illustration of Polkadot. Image via Polkadot

Another Illustration of Polkadot. Image via PolkadotThere are only a few issues we see with Polkadot. The first involves the learning curve, which is already very steep for cryptocurrency in general, much less the various applications and protocols within DeFi. Then, as with other projects, we should be cognizant of the long list of questions about everything that could go wrong with a community-governed hybrid consensus network.

As with many blockchain technologies, there is regulatory uncertainty surrounding aspects of Polkadot's operation, particularly concerning cross-border transactions, security laws, and the status of its native token (DOT). Navigating this evolving regulatory landscape is a challenge for most blockchains and their users.

Fortunately, Parity Technologies has been in active engagements with the SEC to classify Polkadot as a software and DOT was never explicitly named as a security when the SEC decided to make wide-sweeping claims against 68 cryptocurrencies they feel are securities.

Polkadot Has Escaped Early Securities Accusations From the SEC. Image via CoinTelegraph

Polkadot Has Escaped Early Securities Accusations From the SEC. Image via CoinTelegraphWhile it is still too early to say how the regulatory landscape will impact the crypto industry in the long run, this is a positive early sign and a landmark moment showcasing that Polkadot, as a technology, could be well-positioned to survive the onslaught of the upcoming regulation storm that is brewing.

The final issue Polkadot faces involves interoperability. While the project is marketed as being extremely interoperable, in reality, this is only true regarding other blockchains built using Substrate. Any “external” blockchains such as Bitcoin or Ethereum will require a bridge to connect to Polkadot via its Parachains. Thankfully, bridge protocols for Polkadot such as Hyperbridge and Snowbridge are paving the way for cross-chain interoperability along with Picasso as a bridge to the Cosmos ecosystem, and there are numerous mid-cap and even large-cap cryptocurrencies being built on Substrate.

It's important to note that the Polkadot community is actively working on addressing these issues, and the network is continually evolving. As with any emerging technology, some challenges are expected and can be seen as opportunities for growth and improvement. For Polkadot to succeed, it needs a robust ecosystem of developers, applications, and services. Encouraging development and ensuring that there are compelling use cases and applications on Polkadot.

Closing Thoughts

Polkadot represents a significant and innovative force in the blockchain landscape, aiming to redefine how diverse networks can interoperate and scale. With its multi-chain architecture, Polkadot promises enhanced scalability, interoperability, and flexibility, aligning well with the evolving Web3 paradigm. However, it also faces challenges inherent to advanced blockchain systems, including complexity, slow adoption and modest TVL in the ecosystem. With regards to price, prolonged sell pressure of the DOT cryptocurrency along with declining social dominance has been negatively impacting the token’s performance. A similar trend was experienced by many blockchain projects as we entered a prolonged period of decline and stagnation in the 2022/2023 bear market. It will be interesting to see if the excitement and euphoria surrounding the Polkadot project returns as we enter the next bull run.

The transition to Polkadot 2.0 reflects the project’s adaptation and response to many of the challenges faced in the early days, offering more adaptable and efficient solutions. Like any successful technology, the Polkadot community understands that the Polkadot network needs to evolve and adapt to not only reach healthy adoption, but to remain relevant in the rapidly advancing landscape.

As Polkadot continues to evolve, its ability to address these issues and capitalize on its unique strengths will be crucial in determining its role and success in the broader blockchain ecosystem. The journey of Polkadot is emblematic of the broader development and maturation of blockchain technology, highlighting both the vast potential and the intricate challenges of building a decentralized, interoperable future.

Editors Note: The Coin Bureau received payment for this updated review. This article was reviewed and fact-checked by a few core members of the Polkadot community prior to publication. However, the opinions, views, and criticisms held within this article remain the truthful and honest opinions of the Coin Bureau Editorial team. The Polkadot community had no influence over the overarching narrative of this article.