Polkastarter is a new decentralized exchange that was built on Polkadot and is meant to facilitate the interoperability between different blockchains.

It also includes a decentralized finance protocol allowing companies to do fund raising through a cross-chain token pool. The secure, decentralized environment ensures that the funds remain safe.

The following Polkastarter review will take a detailed look at the project to determine if it is really feasible in the real-world, and will also look at the tokenomics of the project to determine if it is worth investment.

What is Polkastarter?

Polkastarter is a decentralized exchange (DEX) that was created based on the concepts of decentralized finance (DeFi).

It has an infrastructure that allows for different blockchain protocols to interact with one another in a decentralized way.

Because of this it means different blockchains have interoperability with one another, which opens up a host of features and benefits. Polkastarter was made possible by being built on the Polkadot network.

Polkastarter is built on the Polkadot network. Image via Polkastarter.com

Polkastarter is built on the Polkadot network. Image via Polkastarter.com With Polkastarter any decentralized entity is able to easily raise capital through its DEX. They are able to list any token on the DEX for exchange, and they can also use it to raise funds through a sealed-bid auction, or through a Dutch auction process.

One benefit to Polkastarter is that users can exchange assets without being stuck with any standard like ERC-20 or BEP-2. In addition, the cross-chain swaps take advantage of faster processing times for transactions.

Polkastarter Pros & Cons

As with any new project there are of course benefits and advantages in using the technology. That’s true for Polkastarter as well. As an introduction to the project here are the pros and cons:

- Interoperability with different blockchain protocols.

- Permissionless listing of tokens.

- Cross-chain swaps between tokens.

- Price volatility is high in its native token.

Use Cases & Major Features

Polkastarter is expanding the fundraising space for cryptocurrency projects by allowing crowdfunding to take place. This benefits the companies using the ecosystem, but can also allow buyers to benefit from discounts in the auction process. Users also get access to full KYC integration and in the future there will be governance provided by a fully working DAO.

Polkastarter has some features not found in other DEX projects. Image via Polkastarter.com

Polkastarter has some features not found in other DEX projects. Image via Polkastarter.comThe Polkastarter network is superior to similar projects in the space as it promises all the following features:

- Functionality – Polkastarter uses sharding technology to allow for switching easily between various blockchain protocols. This enables the interoperability across blockchains so that users can swap any tokens from any network.

- Transaction speed – Transaction speed has been an issue with many blockchains as their user base grows, but Polkastarter uses the Polkadot Network, which means Polkastarter can easily process 160,000 transactions persecond, with the ability to reach as high as 1 million transactions persecond if needed.

- Governance – Because the native POLS token is used for governance any user that holds the token is able to participate in the network ecosystem by voting on the different auction types, token utility, and changes/additions/deletions to product features.

- Data sharing – Cross-chain transactions aren’t all that’s made possible on Polkastarter. It also facilitates data sharing between the protocols of different blockchain networks.

- Interoperable Token Pools – Polkastarter brings cheap transactions, secure ultra-fast swaps, user-friendly design and the possibility to buy and move assets between blockchains all in a user-friendly design.

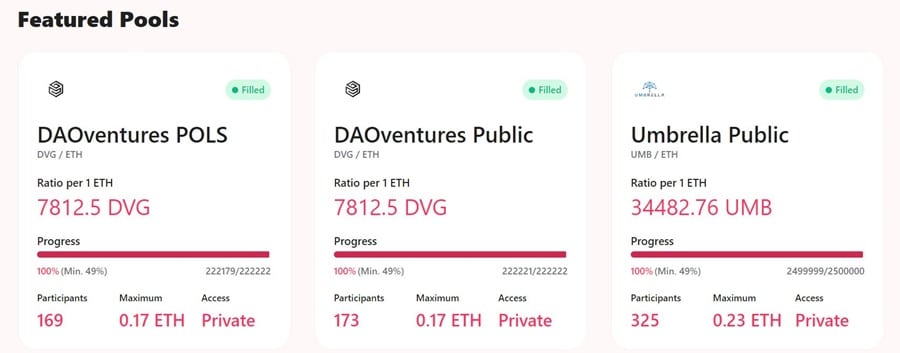

How Polkastarter Handles Fixed Swaps

The fixed swap pool on Polkastarter are the most notable components of the network. The team decided to use this architecture for their DEX because these fixed swap pools are able to counteract the price volatility that’s often seen in automated market making. Fixed swaps are also preferable for crowdfunding and fundraising in general as they provide users with a far greater level of transparency.

Polkastarter pools are created with less price volatility. Image via Polkastarter.com

Polkastarter pools are created with less price volatility. Image via Polkastarter.com So, Polkastarter is using fixed swap pools rather than the automated market making employed by the majority of decentralized exchanges. This approach has helped Polkastarter overcome many of the challenges faced by exchanges. Most notably it counteracts the artificial inflation of prices by private investors who then dump their tokens. This helps to stabilize prices for new token offerings.

Another benefit of the fixed swap pools is that it ensures tokens are distributed more fairly while also eliminating the risk of rug pulls in the liquidity pools.

Where automated market making uses a bonding curve approach to determining prices, Polkastarter has taken an approach that uses fixed prices when swapping between tokens.

This allows for the additional parameters being added to the system, such as setting a maximum on how much an individual can contribute to a project. Plus it is easier for developers to set additional parameters that ensure fairness and transparency for new token holders.

Three Fixed Swap Advantages

- The number of tokens sold and the amount raised can be calculated easily.

- Investors are distributed more evenly both demographically and geographically.

- Token holders can more easily acquire tokens at a standard price.

Why Polkadot?

When Polkastarter was still on the drawing board the founders were aware that it would need a mix of interoperability, scalability, speed, governance, and upgradeability. Various options were explored, but ultimately the founders chose Polkadot based on a presentation given by Gavin Wood on Substrate, which allows for the creation of custom blockchains within a simple framework.

Polkadot also had all the features that were envisioned to be needed by Polkastarter. It has a combination of scalability and speed that popular blockchains such as Bitcoin and Ethereum can only hope to achieve. It also has far lower fees when compared with these other blockchains.

Scalability on Polkadot is achieved through:

- Horizontal scalability in the form of Parachains

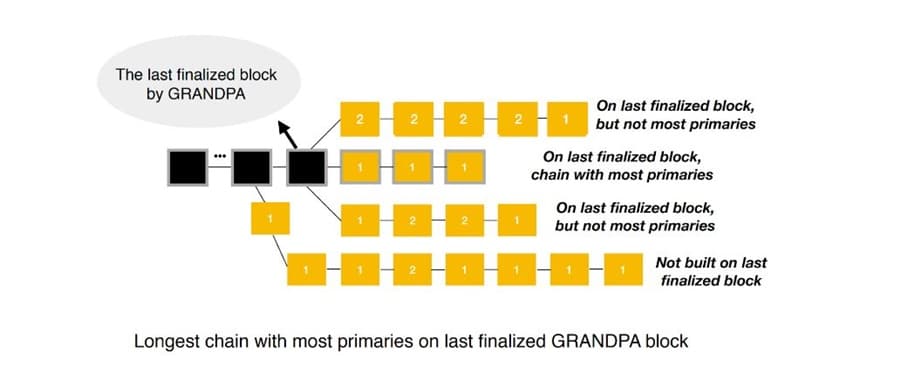

- Vertical scalability via it's GRANDPA consensus mechanism. GRANDPA enables parallel pipelined processing of blocks (also known as asynchronous block formation)

GRANDPA enables asynchronous block formation. Image via Polkastarter Docs.

GRANDPA enables asynchronous block formation. Image via Polkastarter Docs. Polkadot also provides Polkastarter with the ability to feature cross-chain swaps via EVM compatibility combined with Web Assembly. It also allows for cross-chain value transfers via its Asset Bridges, which was crucial for Polkastarter.

With Substrate Polkadot provides the framework to build the Polkastarter blockchain efficiently. And the platform has the ability to interact with external blockchains through Polkadot’s bridges, which allow parachains to communicate both internally and externally.

With the sophisticated governance mechanism included in Polkadot there’s no need to worry about the governance issues and upgradability problems that are faced by other blockchains. Polkastarter will be able to use this governance mechanism to evolve over time based on the needs and desires of the blockchain stakeholders.

In short, the founders of Polkastarter are fully convinced that Polkadot is the ideal blockchain for building the Polkastarter vision.

The POLS Token

The native token used in the Polkastarter ecosystem is the POLS token. It has a total supply of 100 million tokens and a circulating supply of 56.5 million tokens.

The POLS token is a utility token for staking, governance, and liquidity mining. Image via Polkastarter blog.

The POLS token is a utility token for staking, governance, and liquidity mining. Image via Polkastarter blog. POLS Token Utility

POLS is used on the Polkastarter ecosystem as a utility token. Among its major uses are governance, staking, and liquidity mining.

Governance - As a governance token, its holders can vote on crucial matters such as protocol features and tokens to be displayed on the network. They are also able to vote on the fee structure of the network; transactions on the platform are paid using the native POLS currency. Eventually the network will moved to a fully automated DAO governance structure.

Staking – The token can be staked to earn staking rewards on various fronts. For example, it can be staked to receive pool rewards or for pool access. Note that staking POLS for pool access is not a given, but is solely decided upon by each individual pool creator. That said, the choice to allow staking for pool access is ideal for giving top liquidity providers private access to high-end pools.

Liquidity mining – Additionally, Polkastarter’s native currency can be staked to participate in liquidity mining. Rewards are distributed to entities providing liquidity on the secondary markets, among other subsections.

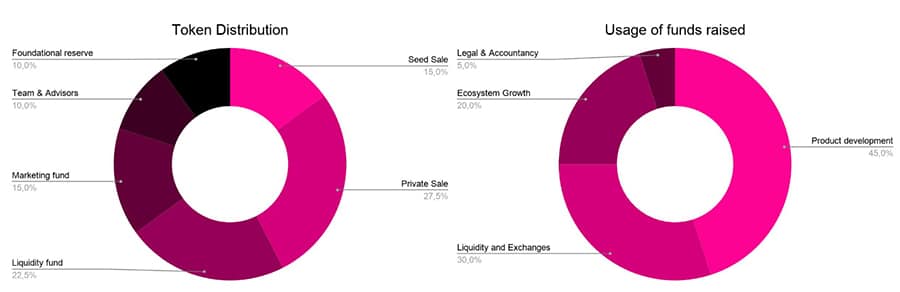

POLS Distribution

POLS tokens are set for distribution as follows:

- 15% for Seed sale

- 5% for Private sale

- 5% for Liquidity fund which will supply liquidity to Uniswap and other exchanges

- 15% for Ecosystem growth which includes marketing, awareness, partnerships and exchange listings

- 10% to the Team and Advisors

- 10% to the Foundational Reserve

Polkastarter POLS token utility and distribution. Image via Polkastarter Docs.

Polkastarter POLS token utility and distribution. Image via Polkastarter Docs. Funds Usage

Polkastarter has had several private funding rounds with the funds being distributed as follows:

- 45% to the developer team

- 20% to marketing actions including partnerships, awareness, and go-to-market strategy

- 5% to legal and accounting

- 30% to supply liquidity to exchanges

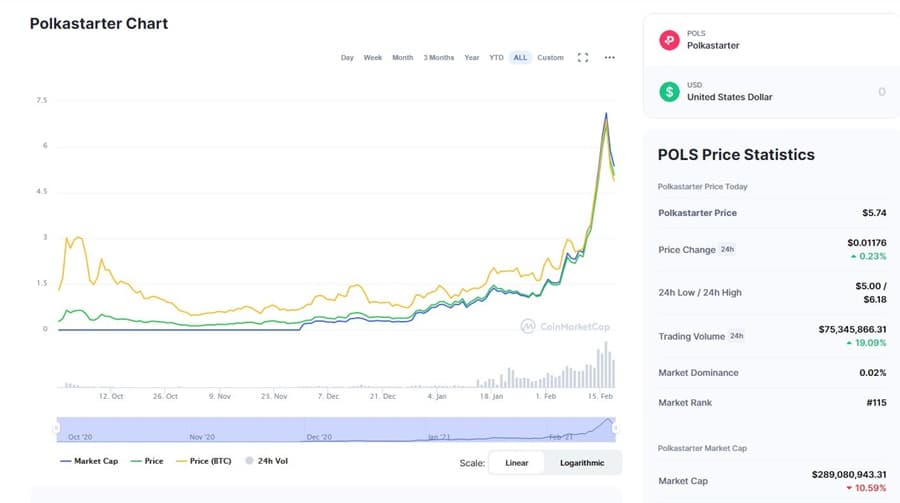

POLS Token Price History

After listing in late September2020 the POLS token immediately took off higher, reaching levels near $0.65 by early October and giving the early private investors who bought tokens at $0.015 or $0.025 some massive returns.

The POLS token has been headed to the moon recently. Image via Coinmarketcap.com

The POLS token has been headed to the moon recently. Image via Coinmarketcap.com Within a month price was trading near $0.13 and by October 29, 2020 the token was at an all-time low of $0.09986. Since then the token has been on fire however. It began rising at the start of December 2020, and was trading at $2.40 by early February 2021.

While those gains were impressive, from February 10 to February 16 the token more than tripled to reach an all-time high of $7.51. Since then it has pulled back to the $5.57 level, but the potential for more massive gains still exists.

Polkastarter Project Fundamentals

Polkastarter has seen a great deal of success in its early days as it provides an excellent way to integrate and interact between various blockchain protocols that hasn’t been realized in many other projects.

With decentralized finance continuing to gain massively in popularity there have been a number of new projects building on various blockchains to provide for a multitude of use cases. For example, lending, saving, borrowing, and stable coin use cases are all extremely popular in the space.

Polkastarter has many different use cases beyond a simple DEX.

Polkastarter has many different use cases beyond a simple DEX. With Polkastarter one user can interact with multiple different protocols even though they’ve been developed on different blockchains. It’s a single platform that enables interoperability between blockchains.

This gives users the ability to make cross-chain token swaps easily, converting from one token to another irrespective of what blockchain the token exists on. It’s also quick and inexpensive thanks to the speed and low transaction fees imposed by the Polkadot network.

Initial DEX Offerings

Since it came online Polkastarter has been one of the hottest platforms for initial DEX offerings. While there are a growing number of places where projects can launch their tokens, Polkastarter is developing an amazing track record for successful DEX offerings. It’s been truly incredible to see the successful projects launching on Polkastarter in the past few months.

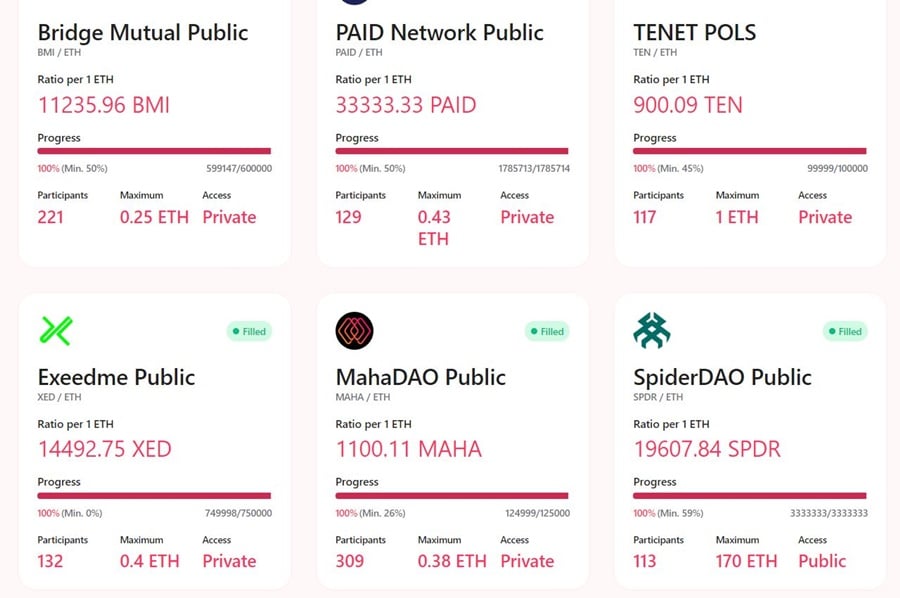

Some of the most successful projects include Maha DAO, Fire Protocol, and Exeed Me. In addition, the PAID Network was birthed from Polkastarter and is now operating as another successful crypto launchpad.

Some of the successful Polkastarter projects. Image via Polkastarter.com

Some of the successful Polkastarter projects. Image via Polkastarter.com Polkastarter has even seen some of its token sale events selling out in a matter of seconds, and many of the token launches are heavily oversubscribed by users. In general the Polkastarter launches are giving investors some of the best early returns in the industry. It’s somewhat similar to the early days of Binance Launchpad, where new projects were inevitably oversubscribed and exceedingly successful.

Note that the returns from project to project do vary, and the early success seen by Polkastarter IDOs has no guarantee of continuing, but as of mid-February 2021 it remains one of the top platforms for initial launches.

Two very interesting projects that are coming soon to Polkastarter include SuperFarm and Unido.

- SuperFarm – This is a cross-chain DeFi protocol that has non-fungible token capabilities. It is set to launch on February 22 and could be quite successful if the developers are able to deliver on their promises.

- Unido - Unido is an enterprise platform for decentralized capital markets. Unido enables enterprises to seamlessly manage their crypto assets through an enterprise-grade platform with a suite of DeFi and crypto banking management tools.

The Polkastarter Team

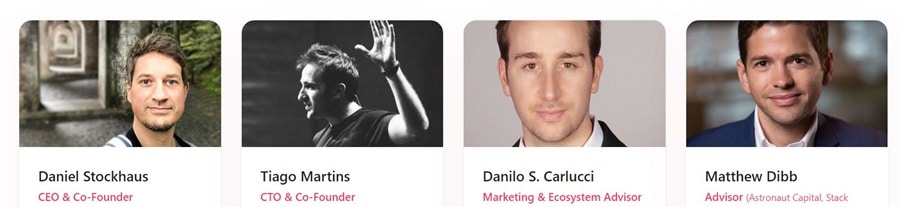

One of the troubling aspects of the project is the lack of information on the team behind Polkastarter. Blockchain proponents love transparency, so learning more about the team behind Polkastarter would be nice.

That aside, the two founders of the project are clearly listed on the website, and they do both have LinkedIn profiles that provide additional information about the background of these two.

Daniel Stockhaus is the CEO of the project, and he brings two decades of entrepreneurial experience to the project. While he does have extensive experience in marketing and digital online presence, he is notably lacking in blockchain experience.

Tiago Martins is the CTO of Polkastarter and he is an experienced software developer with a number of successful projects and startups under his belt.

Polkastarters co-founders and advisors. Image via Polkastarter.com

Polkastarters co-founders and advisors. Image via Polkastarter.com There are also two advisors listed on the Polkastarter website. One is Danilo Carlucci, who was formerly the Head of Community (U.S. and U.K.) for Youtube. He’s now an angel investor and is listed as the marketing and ecosystem advisor for Polkastarter.

The other is Matthew Dibb, who is also the COO at Stack Funds, a Singapore-based platform seeking to bridge digital assets to traditional financial investors. By working with best-in-class partners, Stack provides a streamlined, secure and simple way to gain exposure to cryptocurrencies and digital assets.

Key Polkastarter Partnerships

There are many outstanding partnerships that have been formed between Polkastarter and other blockchain projects, but there are two that stand out in particular. We can imagine there will almost certainly be more in the future.

Polkastarter and Covalent

Covalent provides a unified API to bring full transparency and visibility to assets across all blockchain networks. One of the use cases is to fetch intricate details regarding a crypto wallet.

This functionality allows Polkastarter users to check on how trustworthy a token contract is. Covalent gives users access to transaction volume, verifications, and the token contract age among other details.

Polkastarter partners with Covalent to provide anti-scam measures on token sales. Image via Covalenthq.com.

Polkastarter partners with Covalent to provide anti-scam measures on token sales. Image via Covalenthq.com. Polkastarter and DIA

The partnership with DIA (Decentralized Information Asset) provides distributed oracles to the Polkastarter platform. These trustworthy, accurate oracles help Polkastarter provide warnings of potential large price slippage.

Other notable partnerships between Polkastarter and other projects include Moonbeam for cross-chain interoperability, Shyft for its whitelisting solution, and Orion Protocol for its automated liquidity provision.

Polkastarter Roadmap

Polkastarter provides a roadmap that stretches through the end of 2021 and includes the launch of Polkastarter 2.0 and the launch of a fully functional DAO.

In the final quarter of 2020 the team was able to implement permissionless listing, liquidity mining, fixed token swaps, anti-scam features, and high slippage alerts. many of these were accomplished thanks to the above-mentioned partnerships with other blockchain projects.

The Polkastarter roadmap through the end of 2021. Image via Polkastarter.com

The Polkastarter roadmap through the end of 2021. Image via Polkastarter.com In the first quarter of 2021 the team was looking to complete all of the following features:

- Migration to Polkadot

- Multi-chain swaps

- Full KYC integration

- Whitelist features

They've been successful and are already moving on to the features that are expected in the second quarter of 2021.

Potential Polkastarter Risks

Similar to any of the other projects in the very new landscape of the DeFi ecosystem there are certainly some challenges and risks that come along with Polkastarter. One of those risks is the potential for some hacker to come along and exploit the smart contract code that powers the protocol.

If a hacker can find some way to manipulate the smart contract code of Polkastarter they might be able to introduce some exploit that allows them to withdraw funds from the system. Hacks against DeFi projects have becoming increasingly common, and in 2020 the amount of capital affected rose to $200 million.

Hacks on DeFi projects are an increasing risk. Image via NodeFactory.io

Hacks on DeFi projects are an increasing risk. Image via NodeFactory.io Obviously any hack of the Polkastarter code would have a negative impact on the project and could result in some projects leaving the platform. It would most likely also result in the defection of users. If Polkastarter were to engage a proper security audit of its code it could go a long way in reassuring potential users.

That said, there is nothing to indicate that there are currently any issues with the project, either externally or internally. While we don’t know about the project team outside the two founders there is a solid roadmap and it appears the project is the result of careful research and development. Plus it offers users some unique features within the DEX industry that could be helpful in future implementations across the board.

Conclusion

Polkastarter has set a higher bar for DEX projects through its use of fixed swaps rather than automated market making. And the transparency and fairness that’s been added to the DEX and funding aspects of DeFi are a welcome change for the better.

Polkastarter has made good decisions in creating partnerships that ensure that users are able to immediately notice when a project is suspicious. It’s also refreshing to have a DEX that’s free from price slippage.

The native POLS token is already useful thanks to the staking and liquidity mining features, and it will only become more useful in the future as the project moves to a fully automated DAO structure.

That said, it would be good to see more information regarding the team that’s working on the protocol. That could provide some reassurance to users and potential investors as the two co-founders have a decided lack of experience in the blockchain space. It would be nice to know that the technical side of the project is in capable hands.

Polkastarter has gotten off to an excellent start itself, and continues delivering on its promises. The first initial DEX offerings on the platform have been extremely popular and successful, which is also a good sign for the longevity of the project. If we can get details regarding the team in the coming months it would be appreciated. It would also be good to have a third-party security audit of the smart contracts.

Overall though, the project is quite solid from the outside looking in. All it needs at this point is some reassurances.