With over 24,500 cryptocurrencies listed on CoinMarketCap, what makes one stand out more than others? If you're new to cryptocurrencies, you may feel baffled about choosing which coins to invest in or trade. The crypto space can seem like a minefield of conflicting ideas because everyone has their favourite coins and projects.

We believe that providing unbiased information is important in this space and are here to help you become familiar with Litecoin (LTC). After that, you can decide if it's the next best thing for you or know you'd prefer something different.

You're probably familiar with Bitcoin (BTC) and Ethereum (ETH) because they're in the crypto news daily, but how about Litecoin (LTC)? Is it an established project, and what does it do?

OK, enough of the questions now. Let's discover everything you want to know and more about the project in our Ultimate Guide to Understanding Litecoin.

A Brief History of Litecoin

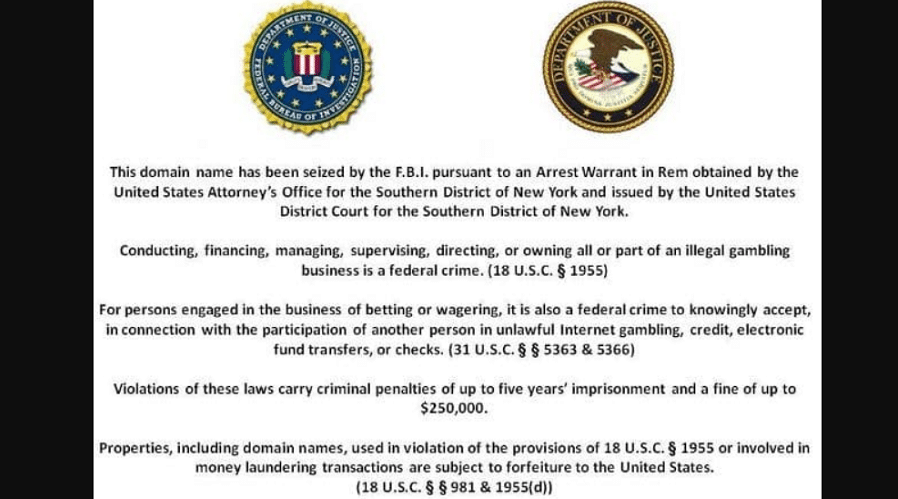

Litecoin was created by Charlie Lee. Charlie has a master’s degree in computer science from MIT and worked as a software engineer for Google for almost 6 years. An avid poker player, he was one of thousands affected by the Black Friday crackdown on online poker by US authorities in 2011. Seeing how regulators choked out online poker sites by barring payment providers from working with them is what made him “realize the importance of the freedom of money”. This drove Charlie to Bitcoin.

A website notice from US authorities on numerous popular online poker sites on Poker’s Black Friday. Image via Upswing Poker

A website notice from US authorities on numerous popular online poker sites on Poker’s Black Friday. Image via Upswing Poker On October 7th 2011, Charlie created Litecoin. The name comes from his vision of making “a lighter version of Bitcoin” which would be more convenient to use on a day-to-day basis. Oddly enough, Charlie considers Bitcoin to be the undisputed king of the cryptocurrency space and even advises people to invest in Bitcoin before anything else, including Litecoin. He also considers Litecoin to be the ‘digital silver’ which compliments Bitcoin, which is ‘digital gold’.

Charlie Lee, creator of Litecoin. Image via Bitcoinist

Charlie Lee, creator of Litecoin. Image via Bitcoinist Although there were not many other cryptocurrencies around the time Litecoin was created, Charlie highlights that even back then many of them were intended to do nothing more than profit their creators. As such, Litecoin had no pre-mine – Charlie did not keep any Litecoin for himself but did buy and mine some like many others at the start. Charlie left Google in 2013 to work at Coinbase. He was one of the five employees there and was the director of engineering when he left in 2017.

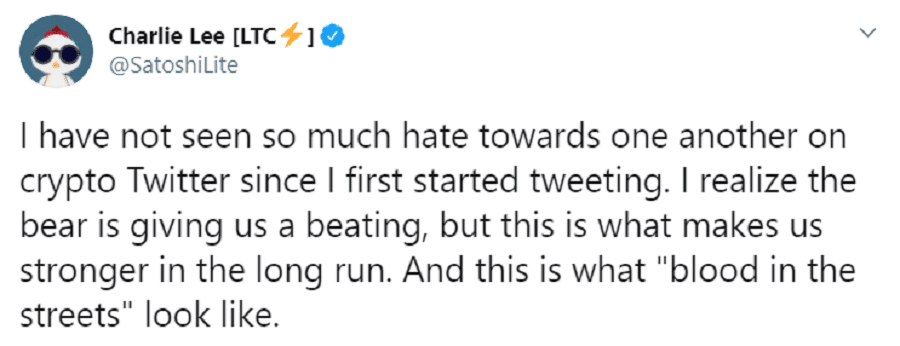

Image via Twitter

Image via Twitter That same year, Charlie sold his Litecoin, a move which angered many in the cryptocurrency community who were left wondering if the coin had any value if its creator had sold it off. This, in addition to comments he frequently made that upset Litecoin holders (such as calling Litecoin “boring”) led some to label him as the “most hated person in cryptocurrency” in 2017-2018.

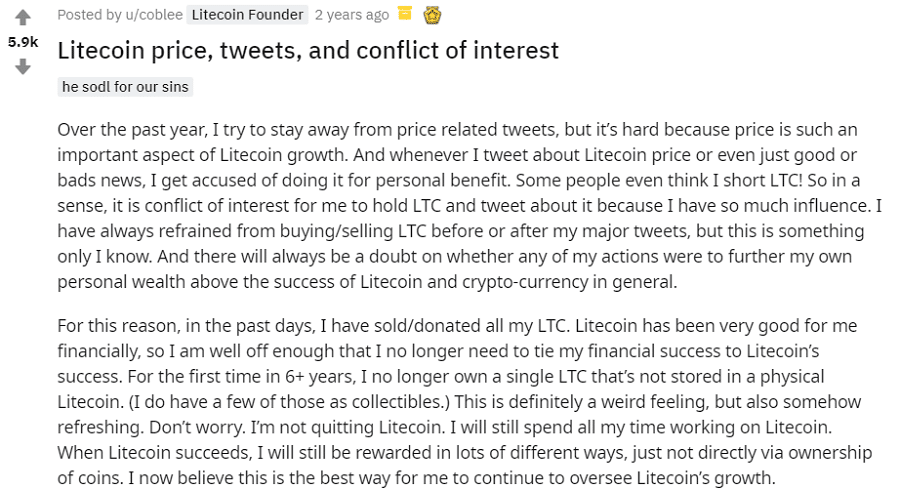

Charlie Lee’s announcement that he sold/donated his Litecoin. Image via Reddit

Charlie Lee’s announcement that he sold/donated his Litecoin. Image via Reddit Charlie has explained many times that his decision to sell his Litecoin was due to his incredible influence on its price. With over a million followers on Twitter, Charlie could see he was able move the Litecoin market with his tweets and decided that the best move for the long-term success of the project would be to sell his Litecoin and focus entirely on development. Charlie has stated that he plans on continuing development on Litecoin well into the future and will never retire from the crypto space.

Litecoin is open source and anyone can submit a Litecoin Improvement Proposal (LIP) on the Litecoin Project Github. These proposals are discussed by the Litecoin community and then accepted or rejected by the Litecoin Core development team which maintains and upgrades Litecoin.

The Litecoin Core team is supported by the Litecoin Foundation, a non-profit organization based in Singapore focused on the adoption and awareness of Litecoin. It is funded entirely by donations and merch sales. Litecoin creator Charlie Lee is the Managing Director of the Litecoin Foundation as well as the lead developer of the Lightcoin Core team.

What is Litecoin (LTC), And How Does It Work?

Litecoin (LTC) began in October 2011 via an open-source client on GitHub. Officially, the Litecoin Network went live on October 13th (Source: Wikipedia ).

Litecoin is one of the earliest cryptocurrencies ever made and was built using Bitcoin's core code. Its aim is to leverage blockchain technology with fast, low-cost and secure payments. It was named Litecoin with the intention for it to become a "lite" version of Bitcoin (BTC).

Litecoin is a "peer-to-peer Internet currency", capable of supporting almost zero-cost and fast payments worldwide. It is an open-source and fully decentralised global network with excellent trading volume and liquidity.

In the crypto world, investors refer to Bitcoin (BTC) as "digital gold" and Litecoin (LTC) as digital "silver."

Litecoin (LTC) is based on the Bitcoin protocol but differs in many ways, such as the hashing algorithm, low transaction fees, block transaction times and hard cap.

Notably, Bitcoin transactions have an average block time of 10 minutes compared to Litecoin (LTC), with 2.5 minutes (Source: Bitinfocharts).

These benefits have made Litecoin (LTC) popular with millions of global merchants because it is suitable for micro-transactions and point-of-sale payments.

Litecoin is Popular With Millions of Global Merchants: Image Source: Litecoin Twitter

Litecoin is Popular With Millions of Global Merchants: Image Source: Litecoin TwitterThere are also tens of thousands of Litecoin (LTC) ATMs globally, with over 13,000 in South Korea alone (2020) (Source: CoinTelegraph)

Litecoin has proven beneficial to Bitcoin. It was a testbed for many features later added to Bitcoin, such as Segwit and the Lightning Network.

"Litecoin is a powerful, political and economical tool which anyone, anywhere, can use without permission to transact with anyone else in the world and partake in a genuinely global economy." (Source: Litecoin)

How Does Litecoin Work?

Litecoin works similarly to Bitcoin, with a few minor differences. Like Bitcoin, Litecoin uses a proof-of-work consensus (PoW) mechanism to validate transactions and generate new blocks on its blockchain.

However, instead of using the SHA256 mining algorithm used in Bitcoin, Litecoin uses the Scrypt Mining Algorithm because, initially, it meant that anyone with a "regular" computer could mine Litecoin (LTC), unlike Bitcoin mining which requires significant computational power to solve the hash problem.

Unfortunately, that situation changed with the development of specialised Scrypt ASIC miners. It was no longer affordable for the average person to mine Litecoin (LTC). Today, most Litecoin (LTC) mining is via Litecoin mining farms and Litecoin mining pools.

A new Litecoin block generates around every 2.5 minutes, 4x faster than Bitcoin's 10-minute block generation time. Like Bitcoin, when first created, the block rewards were 50 Litecoin (LTC) per block. The block rewards halve roughly every four years (840,000 blocks).

The last Litecoin halving occurred in August 2023, and the block reward structure was reduced by half to 6.25 LTC from 12.5 LTC. LTC saw an 8% crash immediately after the successful halving.

The final halving will be in 2042.

In addition to miners, Litecoin features other network participants called nodes. Simply put, these are computers (AKA full nodes) or mobile devices (AKA light nodes or light clients) which further secure the network by storing and double-checking transaction data on the Litecoin network.

Unlike miners, Litecoin nodes are not paid for their network participation (unless you count good karma as payment).

"Litecoin for Individuals: Litecoin is stored in your digital wallet, specialist hardware device or online crypto bank. You can manage, store and send fractions of a coin to anyone else who has a wallet, no matter where they are or what time it is, as Litecoin’s network never sleeps." (Source: Litecoin)

What Makes Litecoin Unique?

As well as fast transaction times, block creation and low fees, Litecoin has several unique features that together create a unique proposition within the crypto space: -

- Litecoin SegWit

- The Lightning Network

- Litecoin Atomic Swap

- Litecoin Mimblewimble

- Omnilite for Litecoin

What is Litecoin SegWit?

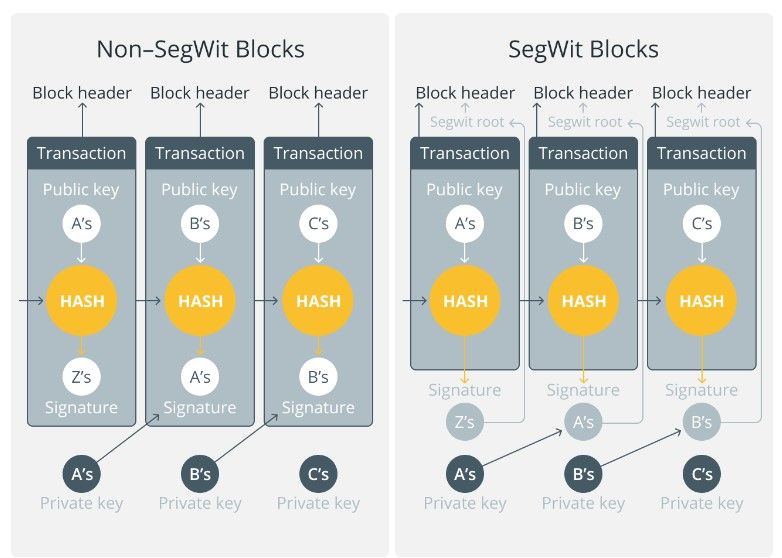

Litecoin implemented SegWit in 2017, and Bitcoin eventually followed suit. SegWit is a technology which prevents excess data from being written into new blocks. This process frees up space for blocks to store more transaction data, increasing the number of transactions per second (TPS).

SegWit doubled Bitcoin's TPS (transactions per second) from around 3 to 7 and Litecoin's TPS from roughly 28 to 56.

"Segregated Witness, or SegWit, is the name used for an implemented soft fork change in the transaction format of Bitcoin." (Source: Wikipedia)

SegWit Increases Transaction Speeds Per Second (TPS) Image Source: CoinTelegraph

SegWit Increases Transaction Speeds Per Second (TPS) Image Source: CoinTelegraphThe Lightning Network

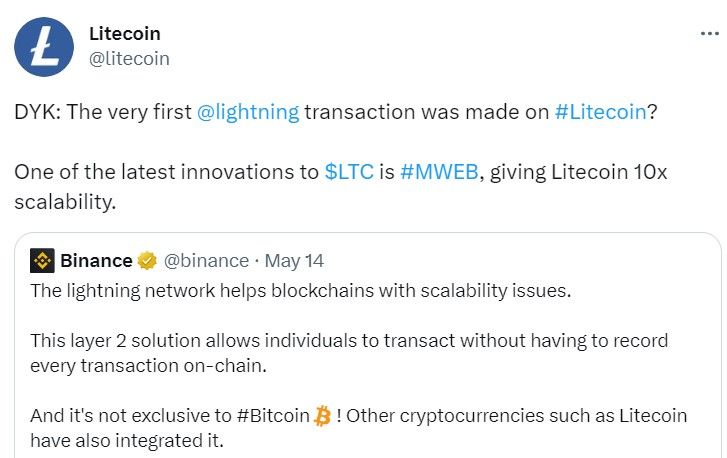

Litecoin also supports the Lightning Network, an off-chain scaling solution that increases TPS (transactions per second). It does this by opening a payment channel between two parties wherein multiple transactions can occur, with only the final balances being written to the blockchain by network nodes once the payment channel is closed.

The first Lightning Network transaction occurred in early May 2023, causing a 7% Litecoin (LTC) price spike. This layer-2 solution should help Litecoin Network scale as much as 10x.

The Lightning Network Is An Off-Chain Scaling Solution: Image Source: Litecoin Twitter

The Lightning Network Is An Off-Chain Scaling Solution: Image Source: Litecoin TwitterLitecoin Atomic Swap

Litecoin executed some of the first-ever atomic swaps with Decred, Vertcoin, and Bitcoin in late 2017. Atomic swaps allow you to exchange different types of cryptocurrency peer-to-peer without using a centralised service like an exchange.

"An atomic swap is an exchange of cryptocurrencies from separate blockchains. The swap is conducted between two entities without a third party's involvement. The idea is to remove centralized intermediaries like regulated exchanges and give token owners total control." (Source: Wikipedia)

The process uses automated contracts which release the desired cryptocurrency to a user's wallet when certain conditions are met. Atomic swaps have since become commonplace and are available on many cryptocurrency wallets.

Litecoin Mimblewimble

In May 2022, Litecoin implemented Mimblewimble, a privacy technology used by the Grin Privacy Coin (also built from Bitcoin's code). Mimblewimble is highly complex but makes wallet addresses viewable only by the parties engaged in a transaction. Mimblewimble is also used in Epic Cash, a decentralized, privacy-enhanced cryptocurrency that aims to fulfil Satoshi's true vision of a decentralized peer-to-peer payment system.

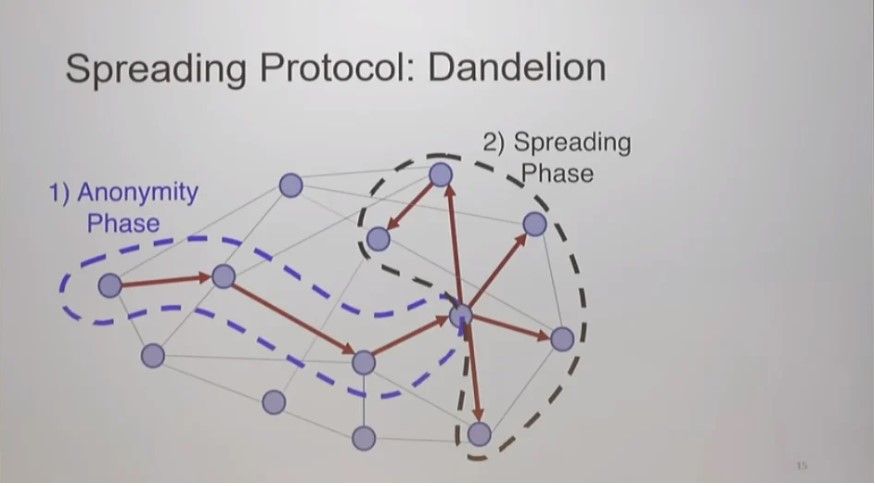

As a result of Mimblewimble, the only thing visible on the blockchain is the total amount transacted, which appears as a single transaction. Mimblewimble also uses Dandelion technology, which hides any IP address data in a transaction.

Dandelion Technology Increases Privacy For Litecoin Users: Image Source: Bitcoin Magazine

Dandelion Technology Increases Privacy For Litecoin Users: Image Source: Bitcoin MagazineMimblewimble got its name from the “Tongue-Tying Curse” from Harry Potter, preventing the cursed person from speaking coherently. An anonymous developer using the pseudonym "Tom Elvis Jedusor" proposed Mimblewimble in 2018 as the French translation of the famous Harry Potter anagram "I am Lord Voldemort."

For further reading, I recommend checking out our article: What is MimbleWimble, and Why Should You Care? It's quite a revolutionary technology that some believe may someday find its way into Bitcoin.

Omnilite for Litecoin

Litecoin launched Omnilite in September 2021. The Omnilite technology has created a range of possibilities, including the following: -

- Create Custom Currencies: Create tokens representing custom assets or currencies to transact via the Litecoin blockchain.

- Blockchain-Based Crowdfunding: "Crowdsale participants can send Litecoins or tokens directly to an issuer address." The Omni layer delivers the crowdfunded tokens automatically to the sender (without an intermediary).

- Issue NFTs: You can issue NFTs with Omni without leaving the Litecoin platform. You can create and manage NFT tokens and more. (This is a work in progress, 2023)

"Endless possibilities: Omni extends what you can do with a traditional cryptocurrency. The possibilities are endless." (Source: Omnilite)

Litecoin (LTC) Price Performance.

Although Litecoin has been around since 2011, launching at $0.00, the 'official' history of Litecoin prices began in early 2013 when CoinMarketCap went live.

In late 2013, during the first crypto bull run, Litecoin (LTC) spiked from around $3 to $40. After the bull market crashed, the price dropped back to the $3 to $4 range, but later, during the 2017/2018 bull run, the LTC price hit an all-time high of almost $400.

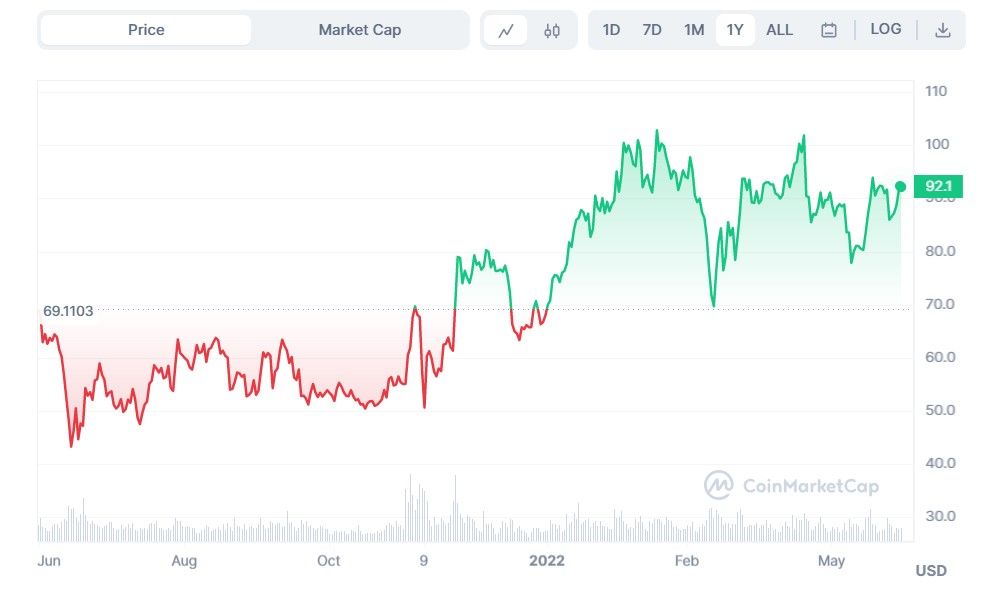

A One Year Chart for Litecoin (LTC) Image Source: CoinMarketCap

A One Year Chart for Litecoin (LTC) Image Source: CoinMarketCap The entire crypto market was static for most of 2021/2022, and Litecoin (LTC) was no different. However, in 2022, after a long period of consolidation, Litecoin (LTC) gradually began inching upward, and the Litecoin forecast looks positive.

The Litecoin price spiked in November 2022 to around $80, then dropped back to the previous low. That's not unusual. In all financial markets, the price often retests the last price before changing direction.

In March 2023, the Litecoin price retested the same low but then reached a new high of $100. Since then, the Litecoin (LTC) price retested $69.1103 (see the dotted line on the chart) and appears to be consolidating but gradually creeping upwards.

If you are new to crypto trading, or any form of trading, you may not know that prices rarely move in a straight line. It depends on so many factors, such as: -

- Market Sentiment: What is the overall feeling of investors and traders towards Litecoin (LTC)?

- Institutional Influence: If an institution buys or sells a significant amount of Litecoin (LTC), it shifts the market price.

- Achievement of Roadmaps: For instance, when a halving occurs, implementing a new technology, or a notable partnership, it can affect the price.

- Media Coverage: It only takes a tweet from Elon Musk or some other public figure to cause fear or greed reactions in the crypto market with Litecoin news.

- The State of the Crypto Market: When Bitcoin's (BTC) price changes, so does the rest of the crypto market. It follows in a wave behind the leading cryptocurrency.

If you are looking to start actively trading or perfect your trading skills, I recommend checking out our Coin Bureau Trading YouTube channel, where Dan, our professional and funded trader teaches the craft of trading financial markets.

Cryptocurrencies have been stuck in a bear market for a long time, with a few rallies. Not every chart looks the same, but the general opinion of the market follows the moves of Bitcoin.

"Litecoin for Businesses: Litecoin powers billions of dollars worth of trade all over the world daily. Decentralised commerce empowers customers and businesses at all levels to transact without intermediaries, resulting in lower fees and quicker transfer times, all whilst being secured by Litecoin’s multi-billion dollar network." (Source: Litecoin)

Is Litecoin Truly Decentralised?

As you know from Guy's video on the most decentralized crypto projects, there are different layers to “decentralization.” A network may be decentralized when it comes to the network and nodes but could suffer from mining centralization. On the same line of thought, a network may be decentralized, but the development of said network may be controlled by a “foundation” or centralized group.

From a technological perspective, Litecoin is a 100% decentralised network. Users have complete control over their money and the decisions they make. Litecoin is a decentralized, open-source global payment network not controlled by any central authority. Every node operator maintains a copy of the blockchain, verifying transaction consistency. While creator Charlie Lee aspires to make Litecoin a fully decentralized cryptocurrency, some believe it's not entirely decentralized due to a more centralized development team and the Litecoin Foundation, resulting in it being less decentralized than Bitcoin.

Litecoin vs Bitcoin: What's The Difference?

There are many similarities between Litecoin (LTC) and Bitcoin (BTC). However, the main differences are transaction speeds, fees and total supply.

See the table below for a comparison.

| Litecoin | Bitcoin | |

| Founder | Charlie Lee | Satoshi Nakamoto |

| Release Date | October 2011 | January 2008 |

| Release Method | Genesis Block Mined | Genesis Block Mined |

| Total Coin Supply | 84 million | 21 million |

| Blockchain Protocol | Proof-of-Work (PoW) | Proof-of-Work (PoW) |

| Usage | Digital Money “Silver” | Digital Money “Gold” |

| Privacy | Yes | Yes |

| Trackable | Yes | Yes |

| Cryptocurrency Used | Litoshi | Satoshi |

| Cryptocurrency Symbol | LTC | BTC |

| Transaction Fee | 0.001 LTC (average) | Variable: Based on blockchain load |

| Algorithm | Scrypt | SHA-256 |

| Block Time | 2.5 Minutes | 10+ Minutes |

Where to Buy Litecoin

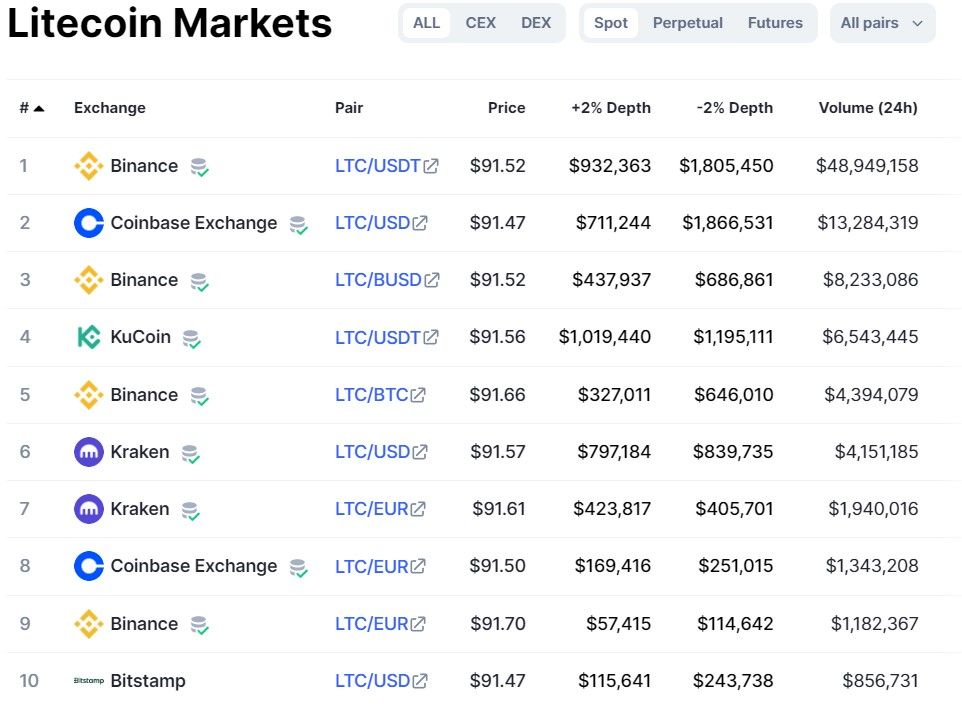

Litecoin is available on virtually every cryptocurrency exchange in existence. There are hundreds of trading pairs for Litecoin, and its 24-hour trading volume is in the tens of millions of dollars on many reputable platforms, including the leading crypto exchanges such as: -

Most top cryptocurrency exchanges have Android and iOS mobile apps for investing or trading on the go. Buying Litecoin (LTC) is straightforward, even for beginners.

Litecoin (LTC) Has Many Trading Pairs Available On Most Crypto Exchanges: Image Source: CoinMarketCap

Litecoin (LTC) Has Many Trading Pairs Available On Most Crypto Exchanges: Image Source: CoinMarketCapWherever you can buy Bitcoin (BTC), you can purchase Litecoin (LTC). You are not limited to crypto exchanges, but be aware if you choose to buy Litecoin with popular financial apps like Revolut or Uphold, you will likely pay more.

What Are The Best Litecoin Wallets?

Most available wallets support Litecoin (LTC), such as the cold storage wallets Trezor and Ledger (watch the below video about the Ledger wallet). Alternatively, you can use a hot wallet, software wallet or download the Litecoin wallet for Android and iOS.

"Download the official Litecoin wallet powered by the Foundation. Litewallet integrates seamlessly with Unstoppable Domains and VISA!" (Source: Litecoin)

Is There A Litecoin Roadmap?

There is no official roadmap for the Litecoin blockchain. While researching this article, it was surprising how little information was in the public domain. What details we found for backend information were fragmented, outdated or unclear.

The closest document to a roadmap is on The Lite School, an educational website by the Litecoin Foundation. It is not dated and provides no expected dates on when the noted improvements and additions will be implemented (if at all).

The last blog date on this site was June 2020. The downloadable eBook goes to a "page not found", and overall, the website isn't doing Litecoin any favours. An improvement in these areas could help boost Litecoin price predictions.

Litecoin Privacy: Does it Matter?

As noted previously, the Litecoin blockchain launched Mimblewimble in 2022, which created a side-chain – a parallel Litecoin chain with Mimblewimble implemented. The technology enables you to interact from the main chain on an optional basis. In other words, you could send your Litecoin (LTC) to the Mimblewimble chain if you want your Litecoin transactions to be 100% private.

Charlie Lee, Litecoin director, announced a push for privacy on Litecoin on Twitter at the beginning of 2019. Lee describes privacy as the "next battleground" in cryptocurrency, and privacy has been his focus in almost every interview since.

With the ever-evolving big brother centralised and collapsing economy, we are sure Mimblewimble is welcomed by many. Indeed, everyone wants to have control of their data and finances without interference from nosy, controlling and often bullying intermediaries. It's our right, don't you think?

Conclusion

Litecoin is a timeless classic and has truly withstood the test of time. If you have been in the crypto space for a few years, you will remember when holding Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) was an unspoken rule in the crypto community.

While Litecoin (LTC) may not be the cryptocurrency on everyone's mind, it is one of the most critical assets in the crypto space due to its role as a testbed for new Bitcoin upgrades and additions. Experts predict a Litecoin price prediction that may break through the $100 last high.

Litecoin continues building solid partnerships, including one with Metalpha Technology (NASDAQ: MATH) in February 2023. Metalpha is a "wealth management company for digital assets."

According to the Litecoin website, the plan is to work together to "develop the Litecoin ecosystem to hedge risk and lower carbon emissions." The partnership will jointly support research institutions to develop hedging solutions and sustainable mining for the Litecoin ecosystem. (Source: Litecoin).

The partnership should also increase awareness and attract the adoption of Litecoin. Focusing on lowering energy demands could also help increase Litecoin's price.

The only critique we’d make about Litecoin (LTC) is the absence of critical information such as clear directives, project roadmaps and ambitions. Most cryptocurrency projects prioritise community engagement and communication to help keep the project in the spotlight, encourage adoption, education, and not least, encourage support from institutional investors.

The information available, whilst important, such as the next halving date, isn’t massively helpful to anyone new to cryptocurrencies and wants to learn more about the project.

We hope you now better understand Litecoin (LTC) and what it does. We're all curious at Coin Bureau to see where Litecoin goes in the future, and we look forward to watching things unfold.