Luno is a cryptocurrency exchange that has carved a niche for itself in numerous developing markets.

Even though Luno is a relatively small exchange, they have been growing steadily in a number of countries around the world. They have expanded beyond their African roots and have begun to offer trading in Europe as well.

However, one of the most important questions is whether it is safe and can be trusted?

In this comprehensive Luno review we will cover everything that you need to know about the exchange. We will dig into their security features, support as well as broader community reputation.

Overview

Luno is a cryptocurrency exchange that had its roots in South Africa. It used to be called BitX and was founded in 2013. Currently the company has moved their global headquarters to London.

According to the company's about us page, Luno is a crypto exchange comprised of "40 technology and finance experts, operating across several countries and continents"

The team’s professed goal? To help billions of users the world over buy, sell, and store cryptos like ether and bitcoin.

They also seem to have expanded quite a bit over the past year on the back of some Venture Capital funding. They have offices in London, Singapore and Cape Town.

From this information, it seems as if the exchange is quite open and transparent. It is helpful to know that there is a local presence as it gives a certain level of comfort.

Is Luno Safe?

Luno’s never suffered a devastating hack that we know of, so there’s that.

They also go through some of their security procedures at an exchange level. These include storing the majority of their funds in "deep freeze" cold storage wallets. These are essentially multisignature wallets that are stored off line in bank vaults which no one person at Luno has access to.

They also store their "hot wallets" in multsignature wallets that are shared with BitGo. By splitting the keys between two different companies, Luno is ensuring an extra layer of security from any potential hacker or attacker.

As for individual users, though, the basic security options are available like two-factor identification and email confirmations. This is pretty plain vanilla when it comes to user side safety.

As a side note, we would like to stress that no matter how safe an exchange is, you do not leave large amounts of cryptocurrency on it. There is always a risk when it comes to determined hackers.

Crypto Pairs

Luno caters to customers that many other exchanges don't cater to. This dynamic is clearly present in the trading pairs it offers, which are as follows:

- BTC/IDR (Indonesian Rupiah)

- BTC/MYR (Malaysian Ringgit)

- BTC/NGN (Nigerian Naira)

- BTC/ZAR (South African Rand)

- BTC (EUR)

- ETH/BTC

So, beyond its unique fiat pairs, which obviously show Luno’s focus on presently underserved African and Southeast Asian cryptocurrency clientele, the only crypto-to-crypto possibility for Luno users is between ether and bitcoin.

Luno is also trying to expand into traditional markets in the developed world. For example, they have recently started accepting deposits and traders in Euros from countries in the EU.

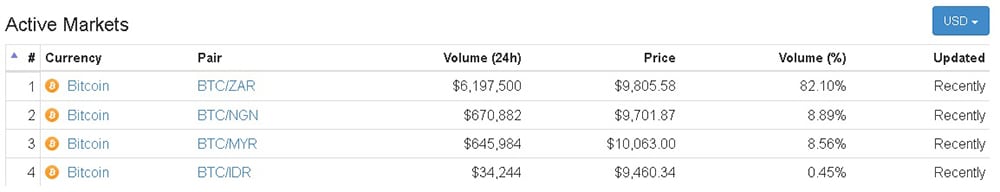

While the Euro order book is still quite limited when compared to that of their emerging market order books. For example, below are the most active markets on the Luno exchange.

Image source: coinmarketcap.com

Image source: coinmarketcap.comAs you can see, the South African rand is still their largest markets with 82% of the volume. It also seems as if there was no crypto to crypto trading volume over the past 24 hours.

There are ETH/BTC order books on Luno with volume of about 1,700 ETH so it is not being tracked appropriately by Coin Market Cap. There is also no other ZAR Crypto pair that is being traded on the exchange.

Withdraws And Deposits

Like Coinbase users in America and Europe, Luno users can purchase bitcoins with their fiat trading pair of choice by linking their bank account to their online exchange account. For those users who have debit and credit cards, they also accept payments via Upay and Everypay.

Luno’s worked hard to make the whole process as convenient as possible. Fiat withdrawals typically take no more than 48 hours to hit your bank account, while deposits show up in your exchange account between 24 and 48 hours. Take that, Coinbase!

In Europe, they bank with the same one as Coinbase. They accept wire transfers into your account in the form of SEPA payments. These should take no more than 1 to 2 days. They are also trying to find a solution for instant bank payments from a number of European banks.

When withdrawing Euros from your account, funds are also sent out via SEPA. These should take about the same time as the initial funding.

Luno Fees

Luno adheres to a fee system that’s based on monthly use of the exchange, not singular trades. And within this monthly system, the exchange also relies on a “maker / taker” dynamic.

Accordingly, the fees you end up paying are based on the trade volume you throughput on the exchange in a given month. But, with that said, it doesn’t appear that percentage-wise fees ever top out over 1 percent on Luno.

In terms of withdrawal fees, Luno says that they charge a small "admin Fee" based on the country that you are in. For example, the EFT withdrawal fee is R8.50 for a South African withdrawal. In Europe, a 0.3 Euro fee is charged.

In terms of deposits, most options are free. The only exceptions are if you are buying cryptocurrencies with cards or whether you are making a cash transaction into their bank account.

If you wanted exact clarity on the fees that you may be paying at Luno, you can read more here.

Verification Process

The sign up process is straightforward and merely needs and email address. Once on the exchange, there are 4 basic levels of verifications at Luno each with different withdrawal / funding limits. For example, below are the limits on funding in South Africa.

Assuming that you want to have full trading functionality, you would want to get verified to the third level. Luno prides itself on having some of the fastest verification processes in the industry. We decided to test this out in order to confirm their claims.

You’ll confirm your mobile number and input relevant personal details. You’ll then be asked to upload “identity documents.” Examples of proof include things like bill statements, bank statements, and tax invoices.

After completing these basic tasks, we sat and waited. In exactly 24 hours, we were fully verified and had all withdrawal limits lifted. We were really surprised how quickly Luno was able to on board its clients. This is no doubt a reflection of the increased support staff that they currently have available.

Regulation and Financing

Luno has recently made the news on the back of a successful VC financing raise from London based investors. In September last year the company was able to raise $9m series B financing raise that was run by Balderton Capital.

Apart from the impact that the additional funds could have on the growth prospects of Luno Exchange, the deal also sees Balderton Partner Tim Bunting join the Luno’s board. There is no doubt that they will use this as a launching pad for their European expansion.

On the other side of the world, Luno is facing some regulatory push-back in countries such as Malaysia. Here, the Tax authorities have demanded that Luno hand over user information and have frozen their bank accounts until they comply. This is something we have also seen with the IRS and Coinbase.

Luno says that they are co-operating with the Malaysian authorities but will not breach customer confidentiality data. This is no doubt a good sign in the trust that traders could have in Luno Exchange.

Customer Support

When it comes to getting help from Luno, you've got two options.

Have a basic problem? The exchange's help center might be all you need.

Something bigger going on? Try filling out a help ticket to contact support.

Luno Exchange has currently been growing their support function as they have been on a hiring spree on the back of the fresh VC Funding.

For example, the number of employees has ballooned since last year from under 20 to over 80. This is no doubt one of the contributing factors in the increased speed of their verifications and support.

Luno Trading Platform

One of the most important features of any exchange is the speed and efficiency of the trading platform. Moreover, the platform has to be relatively intuitive such that your average user can find navigate it.

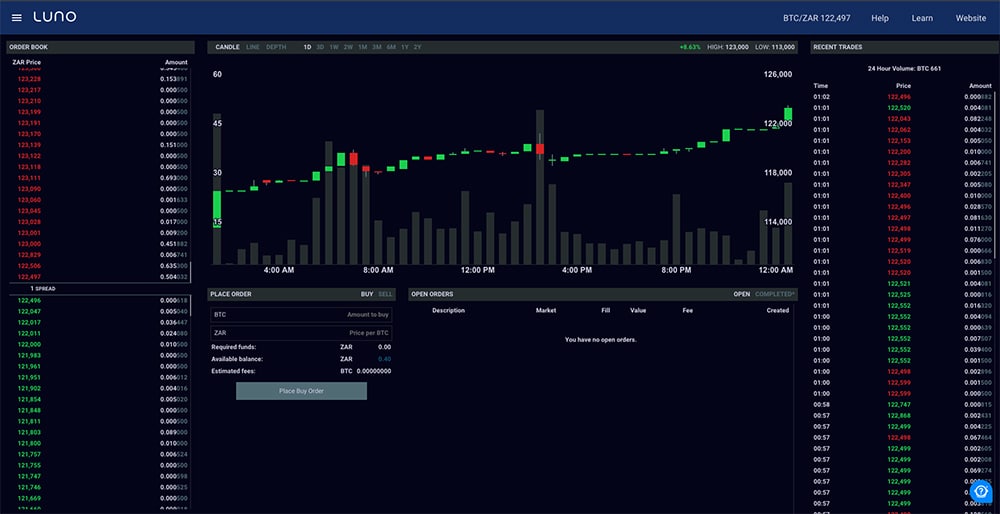

Taking a look at the ZAR/BTC order book, the exchange looks relatively plain vanilla. You have your order forms below the charts with the order book to the left. You can also alternate between a bar chart / line chart or market depth.

In terms of the trading features, the Luno platform is rather on the low side. There is no charting functionality or more advanced order book analysis that is usually on display with some of the larger exchanges such as Kraken and Poloniex.

There is also no option to change the platform to a lighter "day version". This means that traders will have to make do with the black background and darker colours. We have spoken to traders before who find it harder to read light fonts on dark backgrounds.

In terms of trading functionality itself, the Bitcoin order book seems to be relatively healthy for BTC / ZAR. This means that larger transactions can be filled without taking too much of a cut in the price. This may not be the case for the other pairs such as IDR or MYR.

Order placement is quite quick though which means that your orders will be placed on the books almost instantaneously. You can then monitor your order getting worked into the market below the charts.

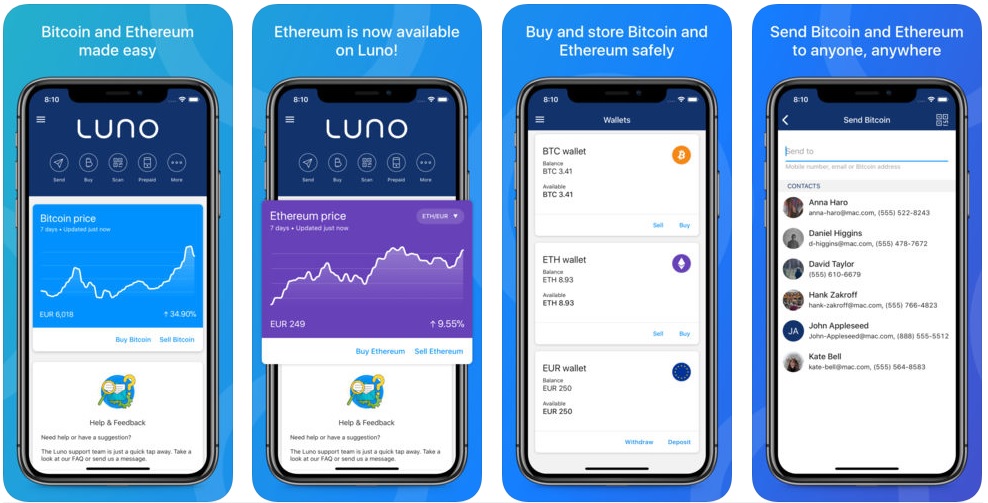

For those users who like to trade on the go, the Luno mobile app will come in handy. This seems to have most of the trading functionality that is embedded in the main exchange apart from the charting and previous orders.

Source: Apple iTunes Store

Source: Apple iTunes StoreWhat is handy though is the option to operate the mobile app as a sort of Bitcoin wallet. This will allow you to send funds to saved contacts in the app.

Luno vs. Coinbase

There is no doubt that Luno is in for some tough competition from the larger cryptocurrency exchanges. One such exchange is Coinbase. This large Fiat / crypto exchange is based in the USA and has expanded globally.

Coinbase has also just rebranded their GDAX exchange as Coinbase pro. This advanced exchange has a range of trading options and can be used for large amounts of volume by institutional investors.

So with such competition, how does Luno stack up?

| Luno | Coinbase | |

| Established | 2013 | 2012 |

| Jurisdiction | South Africa, Europe, Malaysia, Indonesia | Global |

| Buy / Deposit Methods | Wire Transfer | Credit Card, Debit Card, Wire Transfer |

| Sell / Withdrawal Methods | Wire Transfer, Cryptocurrencies | PayPal, Wire Transfer, Cryptocurrency |

| Available Crypto Pairs | BTC, ETH | BTC, BCH, ETH, ETC, LTC |

| Fiat Currencies Accepted | ZAR, EUR, MYR, IDR, NGN | USD, EUR, GBP |

| Trading Platform | Basic | Advanced (Coinbase Pro) |

| Customer Support | Email, Contact Form | Email, Contact Form, Support Number |

| Trading Fee | 1.0% | 1.49% |

| Security | Standard | Advanced |

Hence, Coinbase seems like it is an attractive alternative if you want to buy more coins than on Luno. When you are trading on the Coinbase pro trading platform you have much more functionality and charting options. This is ideal for those crypto traders that use technical analysis.

However, when it comes to trading fees is seems that Coinbase is a bit higher than Luno. You also have to know that Coinbase only accepts USD, EUR and GBP via wires. Hence, if you are going to buy on Coinbase in a currency other than that with a debit / credit card then the fee will actually be 3.9%.

So while Coinbase is a more advanced platform for traders based in the USA, Europe and the UK, it may be a less cost effective option for buyers in the Emerging Markets that Luno covers.

Conclusion

For its targeted customer base, Luno is an amazing exchange. But its customer base is very targeted at present, so Luno is really only practical for citizens in South Africa, Nigeria, Malaysia, and Indonesia. At least for now.

They also seem to follow the right procedures when it comes to exchange and personal security. They, can however, improve on the user interface of the main exchange

We did like the great customer service and fast withdrawal and verification times though. All things considered, for South African traders, we give the exchange a thumbs up.