For all the hodlers out there, content to sit on their sats and wait for the hoped-for moonshot, there are others keen to do more with their crypto. Luckily for them, this is becoming easier.

An increasing number of companies and platforms are releasing cards that allow their users to make purchases with their crypto in much the same way as we all spend fiat currencies on a daily basis.

The Status Quo of Card Payments

The Status Quo of Card Payments We’re all familiar with the big names in the world of cashless payments, most notably Visa and Mastercard. These two behemoths account between them for a whopping 90% of the credit and debit card market and sit in the upper reaches of the S&P 500.

Visa currently enjoys a market value of $449 billion and Mastercard $324 billion: it’s their systems that we almost always make use of when we flex the plastic. As such, all the big crypto cards are partnered up with one of these providers, making it possible for customers to spend their crypto right across the globe.

So, the systems are in place for you to be able to spend that crypto by using one of the many cards available. If you’re interested in getting your hands on one of these cards, then we covered some of the best crypto debit cards out there a couple of months ago. One of the most exciting cards on our list is that provided by Monolith, an up-and-coming name in the DeFi sector that’s built on the Ethereum network.

Monolith Card Making Waves

Monolith Card Making Waves Today we’re going to take a more in-depth look at the Monolith card: its features, how it works and the fees it charges. We’ll also look at the wider Monolith ecosystem and give you some essential background to the platform itself. All this should help give you a clear idea of whether or not the Monolith card is something you should consider adding to your wallet.

The Company

Monolith is the trading name of Token Group Limited, which was incorporated back in 2017. It was founded by Mel Gelderman and David Hoggard, who still serve as CEO and strategy director respectively.

Gelderman is an entrepreneur with a background in the cryptocurrency and biofuels sectors, while Hoggard studied mathematics at Newcastle University in the UK. Monolith was formerly known as TokenCard until a rebrand back in 2019.

The name Monolith is inspired by the mysterious column that appears in Stanley Kubrick’s film ‘2001: A Space Odyssey’. So if you’re wondering why some of the Monolith staff on the company's 'Team' page are pictured posing with a copy of the Arthur C Clarke novel that the film is based on well, there’s your answer.

The Monolith Logo

The Monolith Logo (Why some of them have dinosaur heads is less clear.) The company has explained the adoption of the name thus: ‘To us, Ethereum is the real-life analogy to the Monolith and it alludes to transcendence in the world economy through the introduction of Decentralised Finance (DeFi).’

The Monolith platform and app essentially consist of a non-custodial wallet that supports ETH and any ERC-20 token and the Monolith Visa debit card. There’s also a native token (TKN) which is used to incentivise the use of the Monolith card and reward members of the community through the Community Chest feature (more on this later).

The Wallet

To use the wallet you’ll need to download the Monolith app from either the App Store or Google Play. Being non-custodial, the wallet’s private keys will be held by you and not by Monolith. This is great for security purposes and also protects you in the event of Monolith itself going bust. It also means that the company can’t access or interfere with your funds in any way. Needless to say, be sure to make a note of your private keys and keep it somewhere safe.

Once set up and registered you can then deposit ETH or any other ERC-20 token into it. That’s a whole lot of tokens, although of course, it does rule out a lot of the more mainstream cryptos out there: so no BTC, XRP, ADA, etc.

The principal benefit of the Monolith wallet is that it gives you a foothold in the DeFi space, while being able to take advantage of Visa’s vast payment network through the card. You also get a European IBAN code, along with a sort code and account number: all useful for moving funds around when you need to.

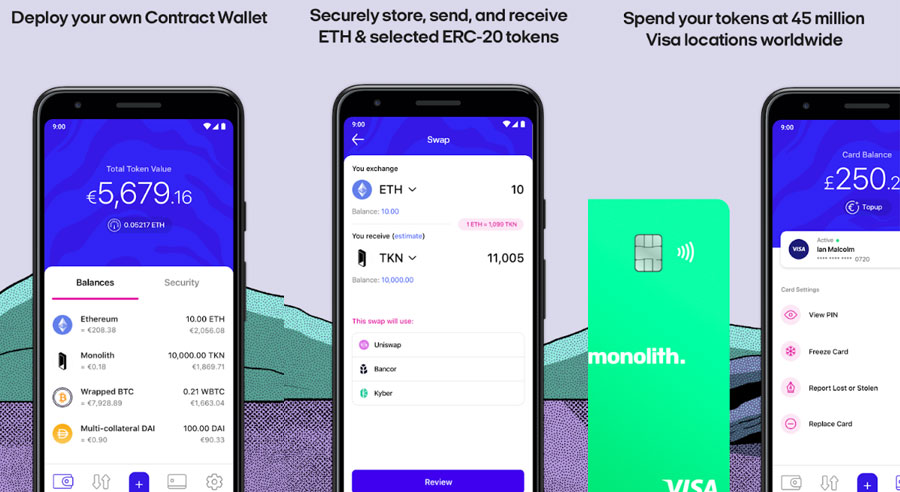

Monolith App Screenshots. Image via Google Play Store

Monolith App Screenshots. Image via Google Play Store Monolith is essentially providing a bridge between the worlds of crypto and mainstream finance. As well as benefiting users, this is also an encouraging step along the road towards mass adoption.

As of June this year, the Monolith wallet also offers swap functionality. This allows users to purchase any ERC-20 tokens through the wallet’s decentralised exchange (DEX) aggregator, which ensures that they get the best possible price for the token they’re buying.

This service is provided by Paraswap. The only costs incurred are those of the token being bought and Ethereum network fees. If you’re interested in finding out more about this functionality, then Monolith has published a Medium post on the subject which goes into more detail.

Lastly, the Monolith code is entirely open-source, so anyone curious can verify it for themselves or read their external security audits via their Github.

The Card

And so to the meat of this review: the Monolith card itself. One thing that needs to be made clear is that this is not a credit card, but instead, a debit card which you pre-load before you go out and spend. Most crypto cards function in this way, though there are a few - such as Nexo - which offer a credit card-style service.

Monolith Rebranding

Monolith Rebranding While the wallet itself supports ETH and a whole load of ERC-20 tokens, you can only top the card up with the following:

- Ethereum (ETH)

- Monolith (TKN)

- Dai (DAI)

- DigixDAO (DGD)

- Digix Gold Token (DGX)

- Maker (MKR)

- Single Collateral Dai (SAI)

- Tether (USDT)

Once you’ve uploaded your crypto into the Monolith wallet, you then exchange it for fiat through the app and add it to your card. You’re now all set to go out and spend. This being a Visa-backed card, there’s no shortage of places across the world where you can do this - around 45 million according to Monolith’s website.

One of the most useful features to emerge onto the personal banking scene in the last few years is the ability to track your spending in real time and be able to easily keep tabs on your balance through banking apps.

This comes as standard through challenger banks such as Monzo and Revolut and is now being slowly adopted by more mainstream banks. For a new platform such as Monolith it’s de rigueur, so you won’t be surprised to learn that the card will keep you in the loop in regards to your spending and balance.

Revolut & Monzo pose a challenge

Revolut & Monzo pose a challenge The card is issued by Contis Financial Services Ltd, who also issue Wirex’s crypto card. It can be used across the European Economic Area (EEA) and a handful of territories with ties to European countries.

This throws up the rather obvious drawback that the card can’t be used in the USA or Asia: two of the biggest markets for crypto. The wallet can be used across the world however, so it’s perhaps safe to imagine that the Monolith team have their sights set on offering the card to these - and other - markets at some point in the future.

Fees on Monolith

And so on to the thorny issue of card fees. These vary depending on which crypto card you decide to go for and are a big factor in the decision-making process. Nobody likes to get lumped with extortionate fees for using their card and in some cases, these fees make particular cards barely worth bothering with.

The good news for those considering the Monolith card is that there are no monthly fees, no card shipping fees and no purchase fees if you’re using the card in the country where it’s registered. There’s also no crypto/fiat exchange fee, which Monolith proudly touts as the best rate going.

There is a daily spend limit of £7,500 (€8,113) and a daily cash withdrawal limit of £350 (€378), so all but the biggest spenders should find themselves catered for here. This is also a useful way of minimising losses in the event of a breach, or if the card is stolen.

All that being said, there are some fees to watch out for. If you make a purchase outside of the card’s native currency, then you’ll be hit with a 1.75% fee. Then there’s the card top-up fee: this is 1%, however, if you top up using DAI then you can avoid having to pay this charge.

Then there’s something called the ‘community contribution’ which is also incurred with every top-up. This is also set at 1% and the proceeds from this are added to the Community Chest mentioned earlier, though if you top up the card using TKN then you avoid this fee altogether.

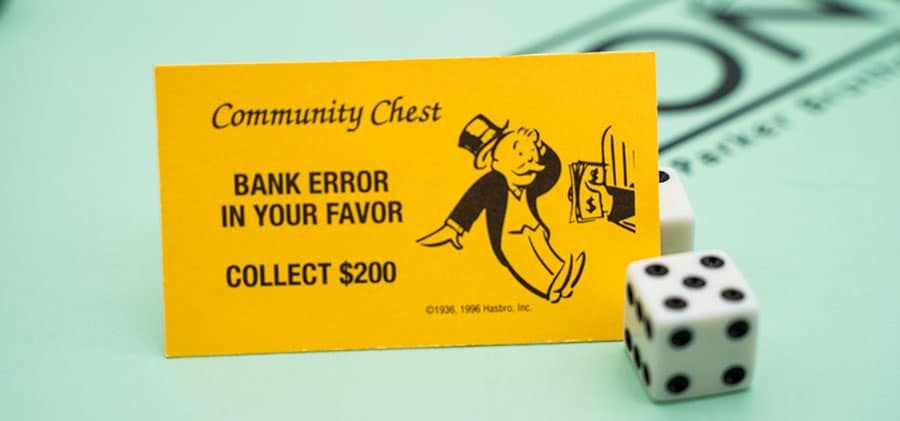

The Community Chest Helps TKN holders

The Community Chest Helps TKN holders The Community Chest is a smart contract fund designed to benefit holders of Monolith’s native TKN token. TKN holders are rewarded with funds from the Community Chest every time they burn TKN. The size of the reward is determined relative to the amount of TKN the holder has undertaken to burn. This feature is available to TKN holders through the ‘Cash and Burn’ feature.

These fees don’t seem too bad, though if you aren’t willing or able to use DAI and/or TKN then you’re going to be liable for a fee of up to 2% every time you top up your card.

This may not be too bad for those dealing with relatively small balances and levels of spending, but for anyone looking to use their card regularly and for big purchases, these fees could start to hurt. That said, there are plenty of crypto cards out there with much higher fees and, if you want to avoid paying Monolith’s, then you do at least have that option.

Rewards

If there’s one area in which the Monolith card falls down it’s that of the rewards on offer if you use the card - or rather, the total lack of any. There are plenty of crypto cards out there offering goodies such as cashback on purchases, or subscriptions to the likes of Spotify and Netflix. The range of cards from crypto.com is especially strong in this regard, while the likes of Nexo and Wirex also offer some decent rewards to their users.

Credit Card Perks have become Expected

Credit Card Perks have become Expected Monolith, on the other hand, seems to have decided against offering anything in this regard for now. This doesn’t make it unique among crypto card providers, but you have to wonder whether it’s something we’re likely to see in the future as the sector becomes more crowded and competitive.

Safety

We’ve seen that the non-custodial, decentralised nature of the Monolith setup means that your crypto is well protected, with only you knowing the private keys and thus having access. The card itself is also regulated here in the UK by the Financial Conduct Authority (FCA) which should give added peace of mind.

It is not, however, covered by the Financial Services Compensation Scheme (FSCS) which covers losses of up to £85,000 per platform. That said, if Monolith was to go under, its creditors still wouldn’t be able to access your funds without those private keys.

Conclusion - Monolith Worth it?

Monolith is something exceptional in the crypto card sphere. No-one else is offering a platform that allows you to spend Ethereum and other ERC-20 tokens, so if those are big parts of your portfolio then it’s definitely something you should consider. The fact that the Monolith wallet is non-custodial, yet also able to make use of Visa’s worldwide reach is another big plus.

Is Monolith the King of the Crypto Cards?

Is Monolith the King of the Crypto Cards? Monolith itself is an exciting company and a well-established player in the emerging DeFi field. Its app and crypto card are great starting points for those dabbling in DeFi for the first time and there’s plenty of room for the platform to expand and grow over the coming years.

Some might gripe about the card fees, though they are nowhere near as hefty as those charged by some other cards out there. Those who like to be rewarded for their spending will also be disappointed at the lack of cashback and other incentives. There is room for improvement here and let’s hope Monolith takes notice.

If you’re a believer in Ethereum and all its potential, or if you’ve gone long on ERC-20 tokens and want to put them to work, then Monolith could well be the card for you.