Nano is probably one of the most promising "payment" cryptocurrencies in the altcoin space today.

The coin makes use of some really advanced technologies including doing away with the notion of a public blockchain. This means that they are able to overcome a number of the scaling concerns that are plaguing some of the more established networks such as Bitcoin and Ethereum.

Despite these benefits, adoption has been rather slow and the price of NANO has followed the rest of the cryptocurrency market. Does this mean that Nano could be a good buying opportunity?

In this Nano review, we will give you everything you need to know about the coin. I will also take a look at the long term adoption and price potential of Nano.

What is Nano?

Nano is a new name, but far from a new project. It was formerly known as Raiblocks, but was rebranded to make the name less technical and more easily understood by the masses.

Benefits of Nano cryptocurrency

Benefits of Nano cryptocurrencyNano is a trustless cryptocurrency with low latency, and rather than being based on a blockchain it uses directed acyclic graph (DAG) technology and block-lattice architecture. This also allows each account to have its own blockchain, which is a very unique feature of Nano.

The consensus mechanism used by Nano is Delegated Proof-of-Stake (DPoS). One benefit to using DAG technology is unlimited scalability along with instantaneous transactions and no fees. The lack of resource intensive mining to secure the blockchain is what enables Nano to operate without fees.

One fairly recent development for Nano is its rebrand from RaiBlocks at the start of 2018. The rebrand was done because there was some confusion over how to pronounce the name “RaiBlocks”, and to make the name less technical-sounding as well to help foster increased adoption.

Much of the push for the rebrand came from the user community, and it’s quite encouraging to see the developers listening so closely to their user community. With nearly two years as Nano, the rebrand can be said to be a success as the project has pushed forward, and adoption is increasing.

Nano's Technology

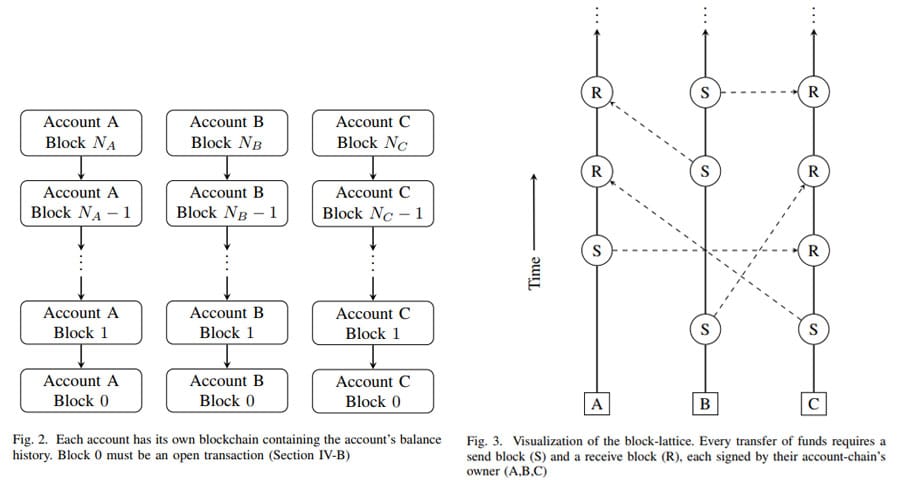

As mentioned above, Nano is built on Directed Acyclic Graph (DAG) technology and utilizes a block-lattice architecture that has each account or address possessing its own blockchain. Unlike blockchain’s that track transaction amounts, Nano records account balances, and this allows for a far smaller storage requirement.

Each individual blockchain can only be updated by its owner, and it reflects that individuals balance history, sharing it with the network. One unique feature is that this architecture allows each blockchain to be updated asynchronously to the rest of the network. Each transaction is processed by the individuals blockchain and there’s no need for a consensus protocol for distributed agreement.

Nano account blockchains and block lattice architecture. Source: Nano whitepaper

Nano account blockchains and block lattice architecture. Source: Nano whitepaperThis network is completely decentralized, and Nano is setup as the perfect way to transfer funds instantaneously and without any fees. It also theoretically has infinite scalability, and if the developers make this aspect a reality Nano could change the entire cryptocurrency ecosystem for years, if not decades.

A transfer on Nano’s network creates two separate transactions. One is a send transaction that deducts the amount from the sender’s ledger, and the second is a receive transaction that adds the amount to the receiver’s ledger. Each send attempt reference the previous block on the sender’s blockchain.

A double spend would occur if the same previous block is being referenced by two different send transactions. If this occurs, the network nodes vote for which transaction to retain, and the other is discarded.

Nano Representative Nodes

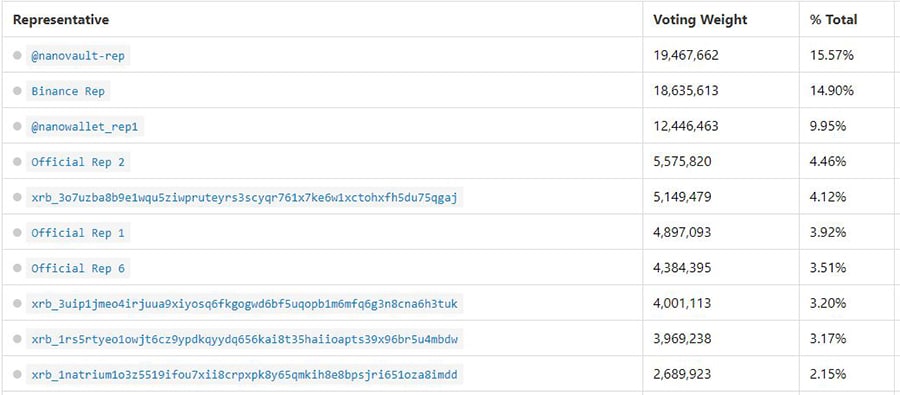

Because there is no mining the network doesn’t require transaction fees. Instead, the ledger is secured with a Delegated Proof-of-Stake (dPoS) protocol, where users can choose the node they wish to represent their votes.

List of top 10 representative Nano Nodes

List of top 10 representative Nano NodesRepresentative nodes take on tasks such as verifying block signatures and voting for valid transactions in the event of a conflict. Voting is weight balanced, with each node having a vote weight equal to the amount of Nano linked to the node.

You can find a current list of representatives on NanoLooker.

Nano Proof-of-Work

An interesting part of the architecture is the use of Proof-of-Work, but not as an agreement protocol. Instead it is used as an anti-spam measure to avoid attacks. The lack of fees means an attacker could spam the network indefinitely, but with the PoW implementation Nano has a small amount of work associated with each block. This work takes 5 seconds to generate and 1 microsecond to validate.

Because of this an attacker would need to dedicate a significant amount of computing power to carry out an attack, while normal users need only use a small amount of computing power. The network even has methods for pruning spam transactions, which limits the amount of storage that can be used by an attacker.

One criticism of this setup is that there is no incentive to run a Nano node. The developers have addressed this by stating the incentive for running a node is the usage of the coin. Running a node increases the security of the network, and it also ensures instantaneous transactions and no fees.

Running one or several nodes makes complete sense for a business or merchant using Nano, especially since it’s estimated that setting up a node only costs roughly $3 per month. The number of nodes is also increased because each wallet acts as a node.

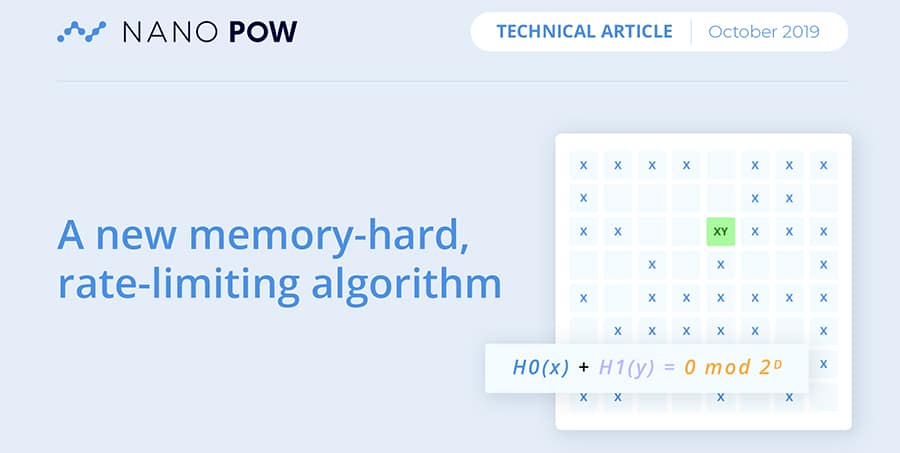

The Nano team is in the midst of creating a new PoW algorithm, which they are calling “Nano PoW”. The Nano PoW algorithm is an authentication-free rate-limiting algorithm.

Announcement of New Nano PoW Algorithm

Announcement of New Nano PoW AlgorithmOriginally scheduled for release in v20 of the protocol, it has been put on hold temporarily as the team works on a new implementation that addresses the problem of using no memory for the algorithm. The design features of Nano PoW are as follows:

- Authentication-free: A proof must be able to be constructed in the absence of authentication.

- Minimize proof size: Proof should be as small as possible: 8–16 bytes, in order to minimize space overhead when presenting the proof.

- Minimize proof verification resources: Verification should take minimal computing time and resources.

- Simple specification: Simpler solutions are easier to analyze and implement.

- Maximize generation time-area-product: The algorithm should require a certain amount of time and hardware resources to be present in order to be efficiently solved.

- Minimize power consumption: The method of proving should use as little power as possible.

How Nano Improves Crypto Usage

Nano is a nearly ideal cryptocurrency from a users perspective as it is free of fees, transactions are instantaneous, and it can scale infinitely.

The instantaneous transaction time is a dramatic improvement over the most popular cryptocurrency, Bitcoin. With Bitcoin users experience a minimum of 10 minutes for a transaction to process, but that can increase to hours, and if network traffic is extreme there have been cases where a Bitcoin transaction took days to validate.

Personal Blockchains and Representative Nodes

Personal Blockchains and Representative NodesThis is because each block only has room for so many transactions, and it takes 10 minutes for each block to be mined. Nano gets around this by making every transaction its own block and by having blocks instantly processed.

Nano also improves on security with the delegated Proof-of-Stake protocol. An attacker would need to control 50% of the Nano tokens to make a successful network attack. That would require a huge financial investment that’s beyond nearly everyone.

And of course the dPoS system avoids the huge energy consumption and expensive mining hardware required by Proof-of-Work cryptocurrencies.

Nano Consensus Method

The delegated Proof-of-Stake protocol allows for voting based on the account balance, with larger account balances having greater voting weight. The development team felt this made logical sense since those with more assets in the system have a greater incentive to keep the system honest to protect their wealth.

This differs from how other cryptocurrencies handle consensus. For example, IOTA determines consensus by stacking transactions via Proof of Work. This calls for a maximum continuous hash rate, which is paid for by miner’s electricity costs. Nano doesn’t require PoW for consensus or security, lowering operating costs significantly.

Nano Use-Cases

While Nano itself is ground-breaking that’s to its technology and features, it’s use cases aren’t. The project is attempting to solve some of the basic problems that many cryptocurrencies are also tackling. The advantage of Nano versus others is its infinite scalabilty, fee-less transactions, and its speed. Here are the basic use cases that Nano addresses:

Micro Payments - Use Nano to pay small amounts for digital asset rights, content subscriptions and more.

Cross Border Payments - Enabling friction-less cross-border payments, Nano empowers people across the globe through access to a fair, secure, and usable economy.

Business to Customer - Seamless checkouts are right around the corner with Nano, whether in store or online.

Ideal Trading Pair - Nano's ultrafast and fee-less transactions make it ideal for cryptocurrency traders.

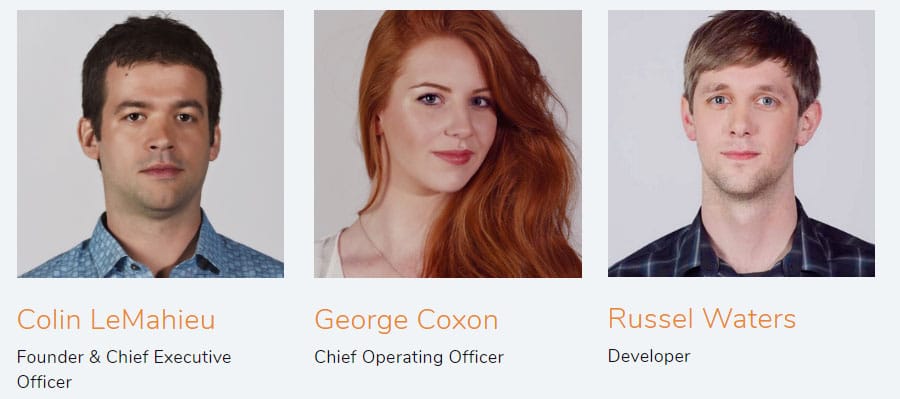

The Nano Team

The creator of Nano is Colin LeMahieu and he’s been working on the project since 2014, coding seemingly endlessly for nearly 5 years. Given the huge market cap of Nano, it is a small team working on the project, consisting of just 9 individuals, including LeMahieu himself.

The founder and CEO of the project is Colin LeMahieu, who began Nano as a side-project before becoming increasingly passionate about blockchain and its promise for the future, and transitioned into a full-time project. Prior to creating Nano he obtained a degree in Computer Science, and worked as a software developer for firms such as Dell, AMD and Qualcomm.

Some Members of the Nano Core Team. Image via Nano

Some Members of the Nano Core Team. Image via NanoThe Chief Operating Officer at Nano is George Coxon, who has had a diverse background in asset trading and finance, having interned at Saxo Bank while pursuing a degree in evolutionary anthropology at the University of Liverpool.

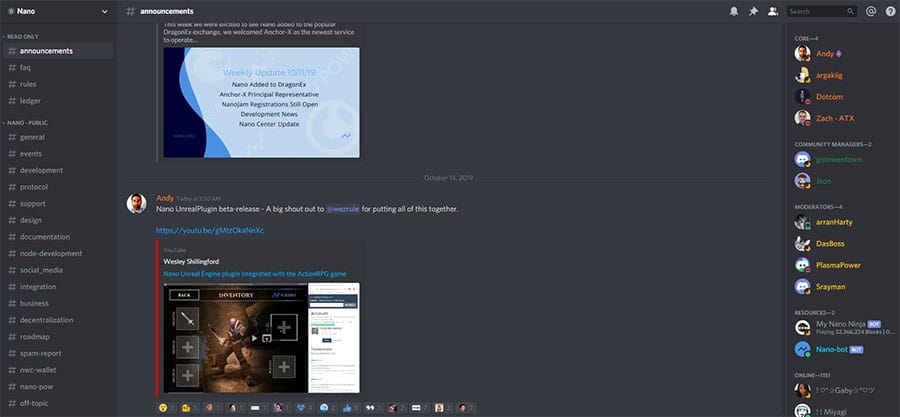

Nano Community

As mentioned above, the Nano project is extremely communicative and active on social media. One of the primary methods of communicating is through the project’s Medium blog, where weekly updates are posted as well as deep dives into specific features and improvements in the protocol.

The project has an extremely large and active following on Reddit, where the number of followers on the sub-Reddit for Nano is approaching 50,000. There are multiple posts per day and multiple comments on each post.

The project team also extends their weekly updates by providing a Daily General Discussions thread for those who might not be interested in using Discord.

Numerous Threads and Convos Popping off in Discord

Numerous Threads and Convos Popping off in DiscordSpeaking of Discord, there are over 30,000 members of the Nano Discord server, and when I connected on a Sunday morning there were nearly 1,500 active online users.

Twitter is another important outlet for the project, and it has nearly 100,000 followers. The account tweets at least once a day, and is active retweeting related content as well.

While the Nano founder and developers used to be quite active on Twitter, they have stepped away from the platform, and much of what they tweet these days is similar to what you would find on the main Nano Twitter feed.

Nano Coins (NANO)

When it was first released as RaiBlocks the token symbol was XRB and some exchanges still use that symbol, but the real symbol for Nano tokens is NANO. It has a circulating and total supply of 133,248,297 NANO. This is the maximum supply and no additional NANO will be created.

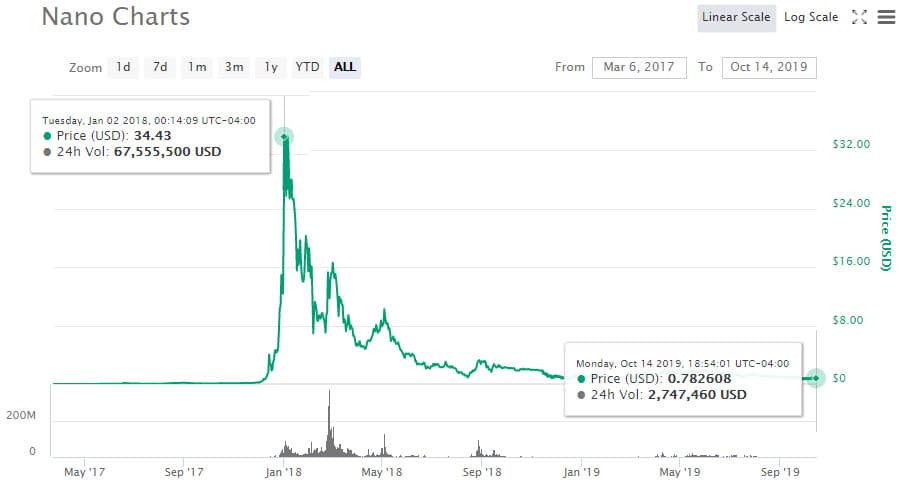

Nano is currently (as of October 13, 2019) the 50th largest cryptocurrency by market cap, with its market cap being just shy of $105 million. It has a long history, stretching back to March 2017, when it first transitioned from Raiblocks (XRB) to Nano (NANO).

At that time it was trading for less than $0.10, but as of this writing one NANO is worth $0.785141 for a return of nearly 700%. Over the 31 months in between the currency has seen its ups and downs.

NANO Price Performance. Image via CMC

NANO Price Performance. Image via CMCThe ups include an all-time high of $37.62 reached on January 2, 2018, and the downs include an all-time low of $0.006658 on March 10, 2017, just after NANO was released.

Initially, the supply of NANO was released via faucet, but that faucet ran dry back in November 2017. Hence, if you are looking to get your hands on some NANO you will have to head over to one of the exchanges that support the token.

Buying & Storing Nano

Nano is listed on a number of exchanges including Mercatox, Binance, CoinEx and Huobi amoung others. There are also pretty decent levels of volume across these exchanges and the distribution is well spread out.

Although Mercatox does the most volume, it is not our preferred exchange. Your best bet for Trading Nano is most likely Binance. On this exchange the order books are relatively liquid and turnover is strong. This means that it is relatively easy to execute large orders with little slippage.

Register at Binance and Buy NANO Tokens

Register at Binance and Buy NANO TokensOnce you have got your Nano you are going to want to take it off of the exchange and store it in an offline wallet. This is especially the case given the history of Raiblocks and an exchange hack (covered below).

There are Nano wallets available for Windows, iOS, and Linux and for Desktop, mobile or online. All the wallets are available for download from the Nano website. That includes both full node wallets and lite wallets that don’t require you to download the entire ledger.

Choices include the Ledger hardware wallet, Nanowallet.io, the Canoe wallet, the Natrium wallet, the Nano Wallet Company wallet, and the Nanollet wallet. We have actually taken an in-depth look at the best Nano wallets if you want more information.

Nano Development & Roadmap

One of the best ways to determine how much work is being done on an open source project is to look into their GitHub repository.

By observing the code commits and other activity, one is able to get a pretty good idea of what the developers are working on and how quickly they are doing it.

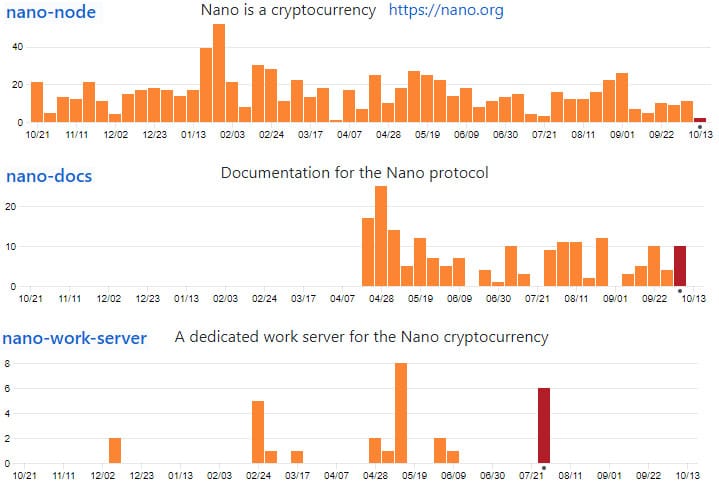

So, I decided to dive into the Nano GitHub and see what was going on. Below are the code commits to three of the most active repos over the past year.

Code Commits in Past 12 Months. Image via Nano GitHub

Code Commits in Past 12 Months. Image via Nano GitHubAs you can see, there have been pretty regular commits to these repos. There are a further 15 other repositories although these do not have that many commits.

This is about in line with the development activity that we have seen on other projects. Indeed, if you were to rank Nano according to its core protocol commits over the past year, it comes in at number 52.

In order to put this development into context we have to look at their broader roadmap with both past milestones and upcoming ones.

Roadmap

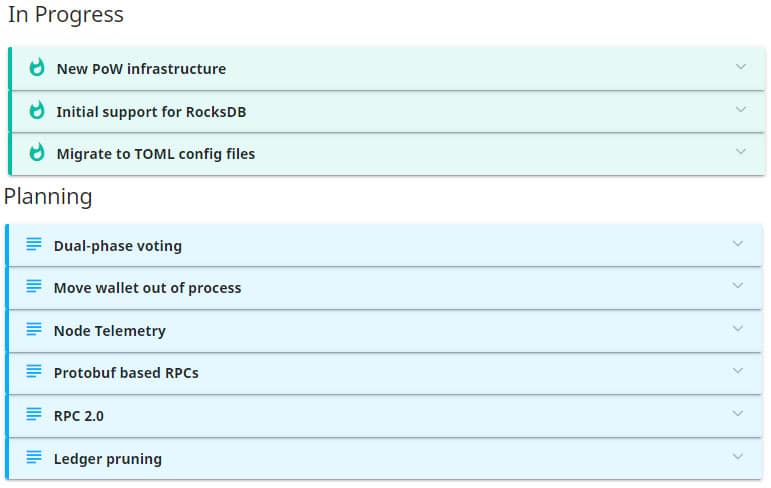

Nano has recently released an updated roadmap outlining their goals and progress in the coming year. The roadmap includes such things as integrating fiat currency exchange, increased participation in global markets, increased merchant adoption and an alpha release of a point of sale system.

The most important upcoming feature in the eyes of the development team is the transition to the Nano PoW infrastructure. Initially planned for the release of v20, it has been postponed while the team tests implementations that use no memory. The benefits of the Nano PoW infrastructure are increased security, faster PoW algorithm updates in future release and better resource management options.

Some of the most important updates to Look Forward to

Some of the most important updates to Look Forward toRegarding the protocol itself, the team is looking to implement ledger pruning to reduce the size of the database. This was thought to be dependent on the implementation of universal blocks. Universal block support was included with Nano v11 and the code review is ongoing since February 2018.

Universal blocks will incorporate the current four block types: send, receive, change and open, into one block type. This will improve internal bookkeeping and will open the door to many new improvements. The current expectations are for ledger pruning to be implemented with v23 of the protocol.

There are several other notable features being worked on by the development team, and they can be explored further at the project’s Upcoming Features page.

Bitgrail Hack

In February 2018 a hacker or group of hackers stole roughly $150 million worth of XRB tokens from Italian cryptocurrency exchange Bitgrail. At the time it was the largest XRB exchange.

The aftermath was particularly ugly, with Bitgrail blaming the developers and code base of XRB, while the Nano/RaiBlocks developers blamed the lack of security at Bitgrail. There were even some accusations against the founder of Bitgrail as being involved in the hack and theft.

There remains an outstanding lawsuit against Nano over funds lost during the hack. The lawsuit is being brought against Nano because investors say they knew Bitgrail had problems, yet failed to distance themselves from the exchange. Those who had funds stolen want Nano to hard fork, so they can recover their lost tokens.

It’s definitely a gray legal area, and the result of the lawsuit is likely to set several precedents for future hacking cases. In January 2019 the saga came to an end when an Italian court ordered the former CEO of Bitgrail to repay the funds reportedly stolen from BitGrail.

Conclusion

Nano has an interesting history, and an even more interesting use case. There’s nothing complex about what they’re trying to do. It’s a simple use case, which includes frictionless cross-border payments, micropayments, transactional consumer-to-business uses, and as an ideal trading asset. Considering that they’ve conquered the scalability and speed issues Nano could end up being the cryptocurrency that finally gains mainstream adoption.

At this point, they need a better marketing plan and a way to spread their usage far and wide. Previously I thought the Smart cards being planned by Nano could be one part of this puzzle, as it would allow users to spend and receive Nano without needing to understand anything about private and public keys, wallets or cryptocurrency security.

However we haven’t heard anything about Smart Card development in a year-and-a-half, and it’s no longer a part of the roadmap, so it appears this feature has been abandoned, or at least indefinitely postponed.

It will be interesting to see how the project develops going forward. It’s always been an active group of developers, so the technical side of the project development shouldn’t be an issue. If they can add a solid marketing plan that spreads usage to both merchants and end users it could be an exciting future for Nano holders.

Disclaimer: These are the writer's opinions and should not be considered investment advice. Readers should do their own research.