OAX is an interesting project that is trying to combine the best parts of centralised and decentralised exchanges into one platform.

This is an interesting concept that has not really been considered by other projects. Most other Decentralised Exchange (DEX) protocols that have been developed are focusing on complete decentralisation, discarding any of the benefits that may come from a centralised exchange.

However, are traders really interested in a hybrid solution?

In this review of OAX, I will attempt to answer that question by taking an in-depth look at the project. I will also analyse the use cases and adoption potential of OAX tokens.

What is OAX?

OAX (previously OpenANX) is a crypto exchange platform that is being developed by ANX International.

The company in question is one of the largest blockchain development groups in the world, started in 2013 and based in Hong Kong, the OAX platform is their decentralized market exchange, meant to combine all the best features of the traditional centralized exchange and the positive aspects of decentralization such as transparency.

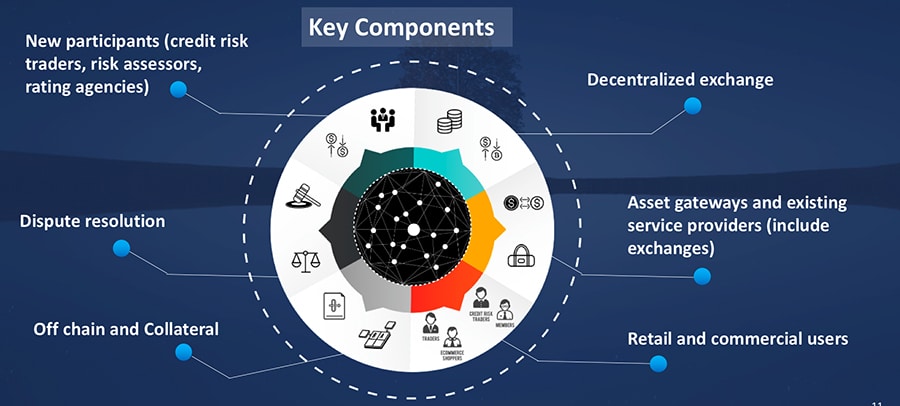

Overview of the OAX Ecosystem. Image via OAX Blog

Overview of the OAX Ecosystem. Image via OAX BlogThe company plans on achieving this synergy by connecting existing exchange platforms to the OAX platform and having users perform a risk assessment in the collateralized system. The platform will also offer off-chain consumer protections and dispute resolution.

The platform code base is all open source, giving complete transparency to the project. The platform will also avoid a centralized governance model, and will instead hand over governance to the community through voting and involvement in the project itself.

OAX Technology

OAX is taking a hybrid approach to their decentralized exchange since they’ve come to realize that not everything in an exchange can be decentralized. They acknowledge that decentralization is beneficial at the transaction level as it provides transparency. Other functions that benefit from decentralization are price discovery and trade transactions, which can both be implemented through smart contracts.

Decentralization also helps improve the processes behind dispute resolution, credit risk assessments, and security. OAX seeks to enhance these benefits and also provide some of the positive features of centralized exchanges.

One difference between the centralized exchange and OAX is the “Asset Gateway” feature of OAX, which ensures that the platform never holds both asset keys associated with any transaction. Instead, it was designed to hold just one of the two at any time, thus dramatically reducing platform risk.

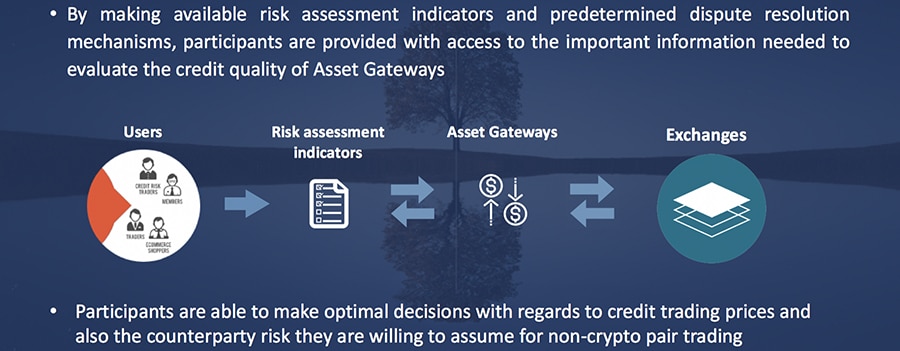

Role of the new participants on OAX Platform. Image via OAX Blog

Role of the new participants on OAX Platform. Image via OAX BlogThese Asset Gateways will accept fiat currencies into custody and mint an equivalent amount of ERC-20 tokens. These tokens are not generic in nature but are specific to the exchange. For example, the OAX Exchange would issue OAX/USD tokens in exchange for USD.

The exchange does implement Know Your Customer standards, and before the Asset Gateway can receive funds or issue tokens it will request a KYC service on the user, using a KYC smart contract. Only after the KYC requirements have been satisfied can the gateway release tokens to the user.

One major upgrade for the OAX platform will be the ability for users to actually trade “Credit Risk” or support the credit risk from other platforms order books. This will allow platform tokens to be traded against each other, thus forming the basis of a credit risk trade in crypto markets. For example, the OAX/USD coin could be traded against the BNB/USD coin.

OAX Membership

The OAX platform will work on a tiered membership basis. In this way, users can choose to have basic access to the platform, upgrade to access voting rights and upgrade even further to unlock the commercial solicitation of services. The number of OAX tokens required for each service level has not been set yet.

Users will apply for membership tiers and submit their tokens along with their membership applications. Upon approval of the application, the OAX tokens will be burned. In this way the OAX token pool will slowly diminish over time, providing a deflationary aspect for the token.

Membership levels are as follows:

- Participant Member: This is the most basic membership level and it is comprised of users looking to place retail or wholesale transactions on the OAX platform

- Voting Member: This is the next tier of membership where users will have the right to vote on any decisions regarding the OAX platform.

- Founding Member: Founding members not only get voting rights, but they will also be allowed to make suggestions for topics of discussion.

- Third Party Service Provider Member: These members will be able to provide services within the OAX ecosystem such as KYC validation, smart contract services, legal services, and other services not yet defined.

- Asset Gateway Member: These members will have all the privileges of a third party service provider and will also be permitted to offer exchange services.

Why OAX is Different

OAX isn’t the first blockchain project attempting to build a decentralized cryptocurrency exchange. Where it differs is that it is the first development team to understand that not every feature of a cryptocurrency exchange is best when decentralized. Instead, it is attempting to blend the best features of centralized exchanges with the benefits of decentralization.

The OAX platform is also somewhat unique in the open-source nature of its code base and the governance system. It is designed so that anyone is able to contribute to the codebase, and by using tiered membership levels the platform should be successful in separating political motivations from economic motivations.

The OAX Team

The website shows a total of 15 team members, which includes the four co-founders, four project advisors, and the management team. We can imagine there are also developers on the team that aren’t listed on the website, so it’s uncertain how large the team actually is.

The CEO of ANX International and co-founder of OAX is Ken Lo, a veteran in the business world with over 20 years experience in business strategy with companies such as Accenture and Verizon. He also has more than 6 years of experience in the blockchain niche.

OAX Founders. From Left: Ken Lo, Hugh Madden, Dave Chapman, David Tee

OAX Founders. From Left: Ken Lo, Hugh Madden, Dave Chapman, David TeeAnother co-founder of the project is Hugh Madden, who is considered to be the man behind the vision of OAX. He is a cybersecurity specialist and started his first security services business when he was just 16. He went on to work for financial services companies AXA and HSBC before co-founding ANX International.

Dave Chapman is the third co-founder behind OAX, and he also serves as the COO of ANX International. He has extensive financial services experience, having worked for Barclay’s, ABN AMRO and HSBC.

Rounding out the founding members is the fourth and final co-founder David Tee. He brings over 25 years experience in corporate finance, with knowledge of mergers and acquisitions, equity and debt financing, private placements and restructurings.

OAX Token Performance

The OAX platform uses the OAX token as a means to enable membership tiers, and the ICO for OAX tokens was held from June 22, 2017, through July 21, 2017, and raised $18,756,937 by selling 30 million of the total 100 million OAX tokens. There was a second token sale planned for 2018, but instead, the team chose to airdrop 5 million tokens to holders of OAX. The airdrop was from July 17, 2018, through January 16, 2019.

OAX tokens were sold at $0.45 in the crowdsale, and opened trading slightly below that level, although by mid-August they had rallied higher by more than 50%. Prices continued rallying, reaching $2.88 by August 20, 2017. The price quickly retreated from that high and by September was back under the ICO price. To say OAX was volatile is an understatement.

OAX Price Performance Since Listing. Image via CoinCodex

OAX Price Performance Since Listing. Image via CoinCodexThe price rallied again in December 2017 and January 2018 along with the broader market, with OAX hitting an all-time high of $2.92 on January 7, 2018. That price was cut in half by the end of January and once February hit the price sank under $1.

It continued lower, bouncing in April, but finally trading below the ICO price again in June 2018. The price continued a slow retreat throughout 2018, reaching an all-time low of $0.071241 on December 15, 2018.

Since then the price has been recovering and as of June 11, 2019, OAX is back to $0.236287. While this is roughly half the ICO price, it is also more than 200% above the price 6 months ago. The OAX platform is still running on its testnet, so price should get a boost when the platform goes live in production on its mainnet.

Buying & Storing OAX

If you think OAX tokens represent a value at current prices you can buy them at a few exchanges including Binance, Latoken and Gate.io. However, the Binance Exchange controls over 70% of the volume for OAX.

There are healthy levels of volume on Binance which implies that there are reasonable levels of liquidity for execution of large orders with limited slippage. However, this reliance on Binance could be a concern as it opens them up to key exchange risk.

Register at Binance and Buy OAX Tokens

Register at Binance and Buy OAX TokensOnce you have your OAX tokens you will probably want to move them off the exchange. This is because of the inherent threats that are posed from centralised exchange hacks (the whole impetus behind OAX).

OAX is an ERC-20 token, which means you can store it in any compatible wallet. This includes MyEtherWallet and MetaMask as well as many popular desktop wallets such as Exodus and Jaxx. You can also store OAX tokens in hardware wallets such as the Ledger Nano S and Trezor.

OAX Development & Community

Finding out exactly how much work is being done on a project can be quite tricky. There are a number of aspects to consider when looking at large projects. Although, one of the quickest ways to get a sense is through their public code commits.

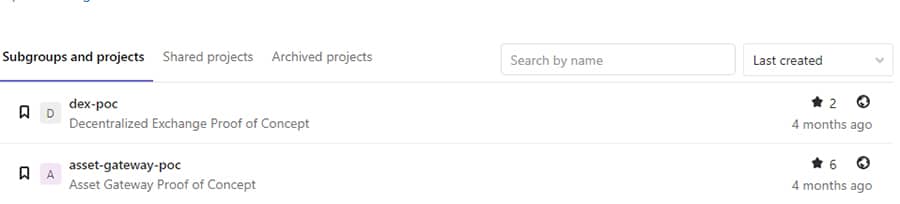

Currently, the only code that OAX has made available is their Proof-of-Concept repositories on GitLab. There are two of these available for users to test their decentralised exchange protocol.

The Proof-of-Concept repositories in the OAX GitLab

The Proof-of-Concept repositories in the OAX GitLabThere has not been that much activity in these repositories and the last commits that were pushed by the developers were 8 months ago. Of course, they may be working the protocol in private repositories but this leaves much for the community to guess.

Having said that though, the OAX team has been trying to be more open the project's development with the community. For example, they maintain an active official blog that holds regular "community updates".

They are also pretty active through their social media platforms. They have a Twitter account with over 12k followers. There is also a Telegram channel with over 4,000 followers inside it.

I jumped into the channel and the team was being pretty helpful to the followers. The conversation was also quite interesting and lacked the general "moon-boy" banter that is present in so many other Telegram channels.

Conclusion

While the drop in the price of OAX could have been a reason to stay away, the past few months have seen a solid recovery. While the coin remains one of the lower market caps the potential of the OAX project can’t be ignored. Once OAX releases its mainnet there’s a very good chance of a strong rally in the OAX token.

The idea of a DEX has been compelling, but there aren’t any that have gained significant traction. OAX can change this with its focus on combining the best features of centralized and decentralized exchanges.

The team behind the project seems to be very experienced and capable, encouraging optimism that they can make this a successful project. And the fact that the code is open-source allows for development to be an active process as the community is able to chip in.

Taken all together OAX is an interesting project that bears watching at the least, or possibly a small investment before a mainnet release leads to rising prices for the OAX token.