Auto trading and crypto trading bots have become very popular in the crypto space with major exchanges like KuCoin, Gate.io, Pionex, OKX and others offering a platform where users can take advantage of bot and auto trading.

OKX has become a go-to platform for traders interested in bot trading, providing a good selection of different trading bot strategies that traders can choose from or create their own.

This OKX Trading Bot review covers the bots available on the platform and why the OKX exchange is one of the best platforms to utilize bot trading.

But first, some background:

Disclaimer: I have personally used OKX for part of my personal crypto trading/investment strategy

Note: Users located in the US and UK are not supported.

What is OKX?

OKX is a crypto exchange that is one of the leaders in Web3 innovation. This exchange has become an oasis for crypto traders due to its huge offering of Spot, Margin, and Derivatives tradable instruments, low fees, and comprehensive features beyond just trading such as providing a platform for Polkadot Slot Auctions, an NFT marketplace, a web3 wallet, OKX Earn, crypto loans, and of course, bot trading.

A Bold Claim. Image via OKX

A Bold Claim. Image via OKXOKX is a pioneer in Web3, DeFi and DApp innovation and integration development, setting itself on a mission to be the ultimate “one-stop-shop” for crypto traders from all walks of life. OKX also has one of the highest-rated and comprehensive crypto mobile apps and users can access the OKX Web3 wallet capable of connecting to the world of DApps and Defi, enabling users to track and manage all their blockchain-related activities from one platform.

Image via OKX

Image via OKXYou can learn more about this leading crypto platform in our in-depth OKX review.

In addition, we also have articles that dive into other aspects of the OKX Exchange:

- OKX Wallet: Ultimate Web3 and DeFi Crypto Wallet

- OKX Earn: Earn interest while Hodling at OKX

- OKX Mobile App: Mobile Trading on the Go

- OKX Wallet: The Portal to Web3

- OKX Security: Is OKX Safe?

- How to Sign-Up on OKX

What are Trading Bots?

Trading bots come in many different forms, but to put it simply, trading bots are algorithms programmed to follow certain crypto trading rules and strategies.

No, There's Not Really A Robot Sitting Behind a Computer Placing Trades. Image via Shutterstock

No, There's Not Really A Robot Sitting Behind a Computer Placing Trades. Image via ShutterstockSome bots can be used for very simple automated trading strategies with rules being as simple as something like “buy 1 Bitcoin if the price hits $40,000”.

Then there are considerably more complex bots that can follow a series of “if/then/or/and” rules that can pull data from indicators and follow predefined rules to search for different patterns and signals and then execute trades or fire off a notification if all the criteria are met.

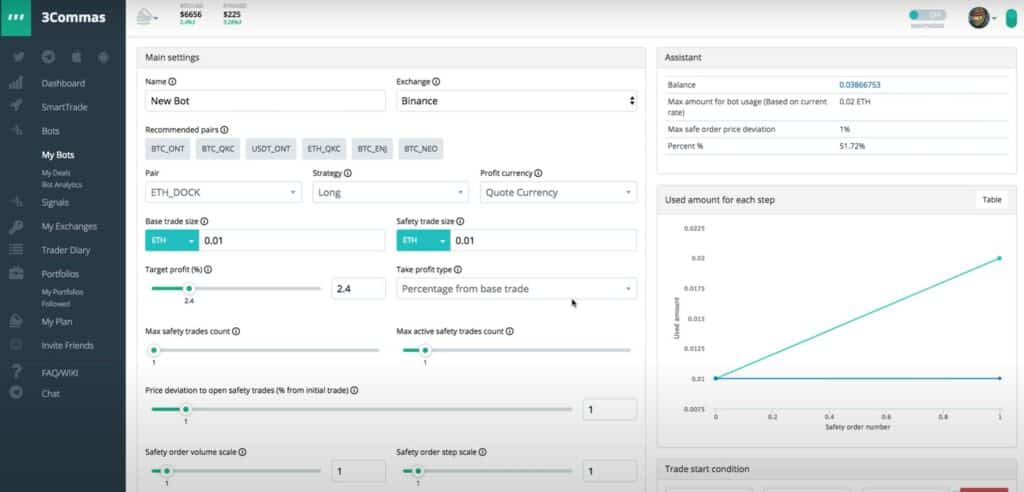

Bots can be coded by programmers from scratch, or platforms like 3Commas or TradeSanta provide “plug and play” interfaces that allow traders to program their own bots using a simple interface with no coding required:

A Look at the Bot Creation Screen on 3Commas. Image via 3Commas

A Look at the Bot Creation Screen on 3Commas. Image via 3CommasTraders rely on trading bots to execute trades on their behalf or notify them of certain market conditions. These bots can be accessed directly on platforms like OKX, or traders can venture outside and find or create their own trading bots and connect them to their exchange via API keys. Be careful if you choose to find a third-party bot coded by an unknown person as you don’t want a trading bot to withdraw all your funds due to a malicious code hidden within the bot.

The trading bots offered on major exchanges are trustworthy, or you can use a reputable crypto bot service like 3Commas or TradeSanta to find or code a bot and have it integrate into your OKX account. For extra peace of mind, you can also put API restrictions if choosing to use an outside bot to limit things like withdrawal functionality and IP whitelisting to ensure nobody can control the bot remotely.

Here are some popular use cases for trading bots:

- Automatically follow simple DCA or Grid trading strategies

- Provide signals, alerting traders to potential setups and risks

- Trade 24/7, increasing potential profitability for traders

- Monitor more charts and pairs than what is possible for one trader

- Act as a trading assistant, not by placing trades but by monitoring open positions and closing trades at appropriate times or managing stop losses/risk management

- Portfolio rebalancing

- Automatic arbitrage trading

Though I feel like I would not be a very good crypto educator if I didn’t highlight the dark but important truth about crypto bots and auto trading.

Trading bots are often promoted/sold as an easy “auto-pilot” money-making tool that traders with no experience can use to make free and easy money, but sadly, that is not the case.

Warning ⚠️: Over 90% of inexperienced traders who use automated trading bots lose money. It is important to understand that no automated trading strategy can be successfully deployed in all market conditions. Trading bots are static and rule-based, while markets are dynamic, volatile and unpredictable. Professional traders have different strategies to deploy for different market conditions, and no one strategy, like the one followed by a trading bot, can be consistently profitable in all market conditions.

Similar to using leverage, trading bots are tools best used by experienced traders who know the appropriate market conditions in which to run a bot and have already developed profitable trading strategies. Be sure to check out our article on Automated Trading Bots to learn more.

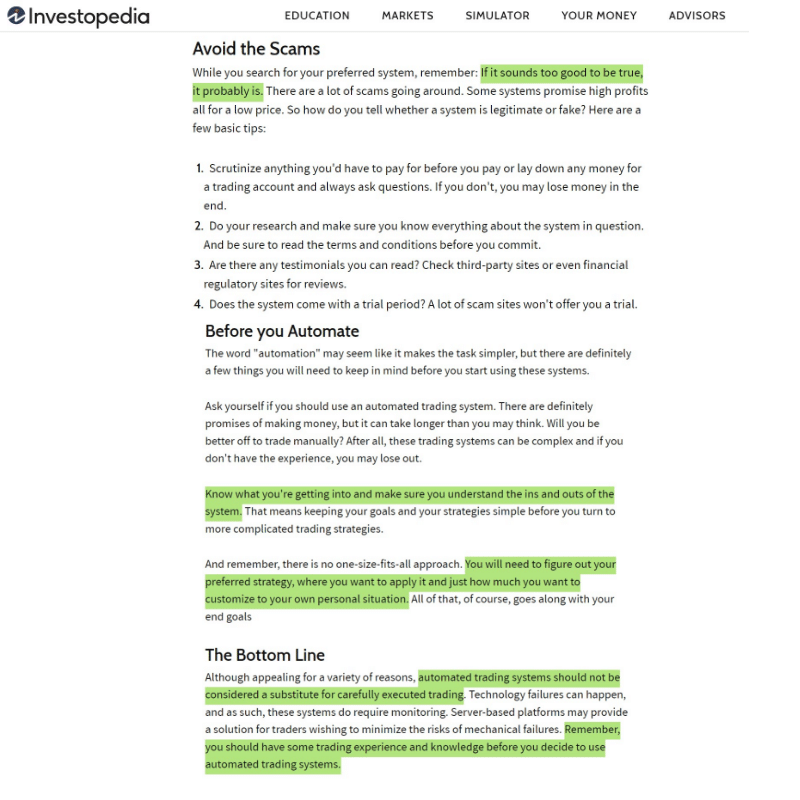

In fact, you don’t even need to heed my warning, here is what Investopedia has to say on the subject:

Words of Wisdom Brought to you by Investopedia

Words of Wisdom Brought to you by InvestopediaOkay, now with that dose of reality out of the way, let’s get into Bot trading on OKX.

Bots Available on OKX

OKX has attracted an astonishing 940,000+ crypto bot traders, making it one of the largest crypto bot platforms in the world. Traders have earned a collective 31+ million in earnings from bot use with the different bots available.

Image via OKX

Image via OKXUsers who have a strategy can create their own bots or can use the bot marketplace to select a bot in one of the following categories:

- Grid bot

- DCA bot

- Recurring buy bot

- Arbitrage bots

- Smart Portfolio rebalancing bot

- Slicing bots

We will cover each of those strategies in a moment but first, let’s take a look at the bot marketplace.

OKX Bot Marketplace

Traders who do not want to create their own bots can select a pre-created bot from the bot marketplace:

Image via OKX

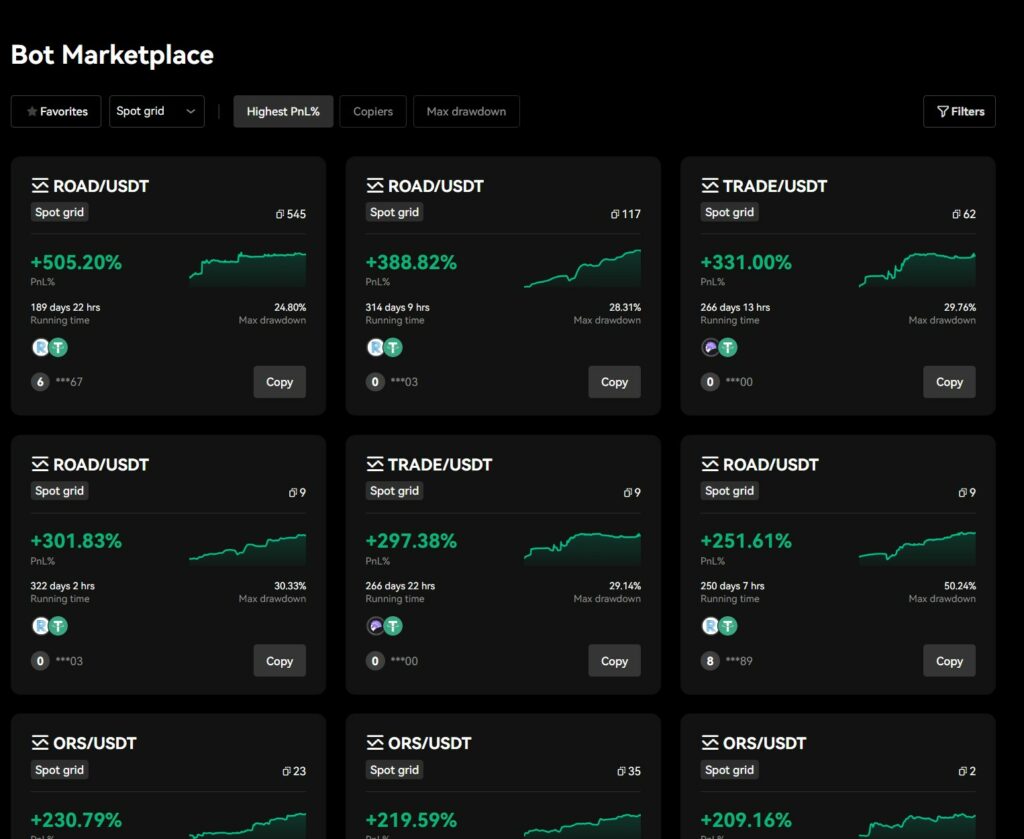

Image via OKXThe marketplace is a great way to sort through bots and traders can see the bot's performance in terms of profit and loss, running time, and max drawdown. Here is a look at the Bot marketplace selection screen:

A Look at Some of the Bots Available in the OKX Marketplace

A Look at Some of the Bots Available in the OKX MarketplaceAt the time of writing, there are over 800 pages of trading bots to choose from, so chances are you will find one that fits your trading style and risk appetite.

Pro Tip: Don’t just blindly choose the bot with the highest profit as most of the bots with the highest returns are taking on absurd unsustainable levels of risks.

Prior to my time at the Coin Bureau, I worked for a company that designed, created, and tested hundreds of trading bots. It isn’t hard to create a bot that can return hundreds of percentage per week, the hard part is designing one that can survive for a sustained period of time and earn a decent return without taking on excessive risk.

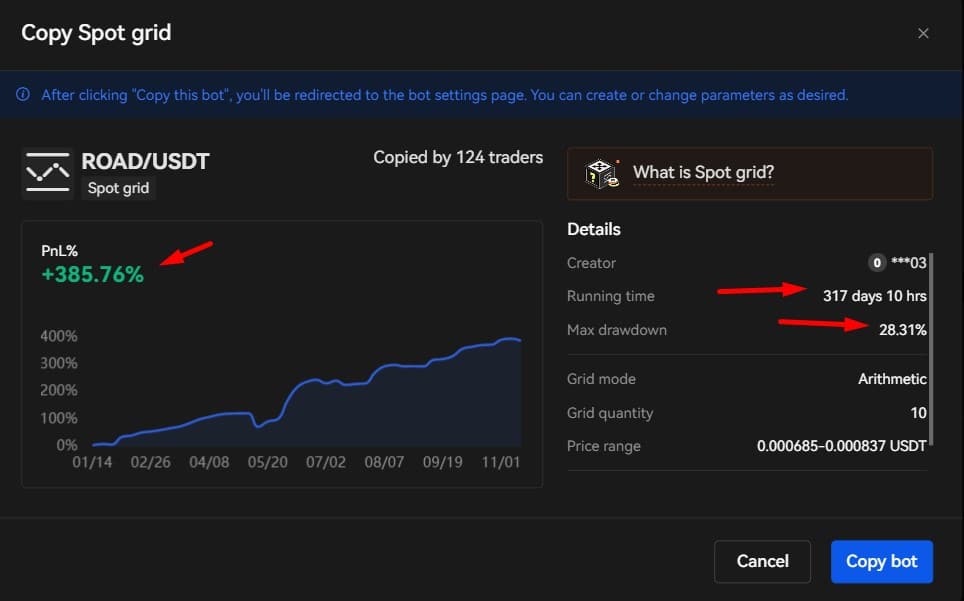

Most bots that are earning unrealistically high returns are like a ticking time bomb and will blow eventually, resulting in a loss of trader funds. Try and find a bot with a long-sustained track record that has survived multiple types of market conditions, and pay attention to the “max drawdown” metric as these are more important than ROI. You can find this information by selecting the bot of interest and looking at the performance metrics:

A Look at a Bot’s Performance Screen From the OKX Marketplace.

A Look at a Bot’s Performance Screen From the OKX Marketplace.For another perspective, here’s Guy’s take on crypto trading bots if you’re interested:

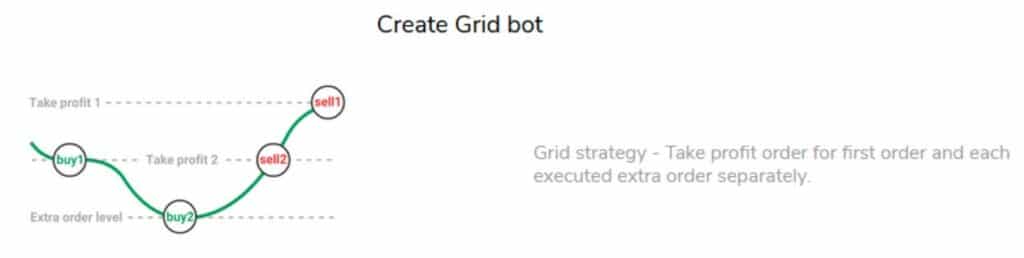

What is a Grid Bot?

Grid bots are one of the popular bots available on OKX. The principle of grid bots is simple: Buy low, sell high.

Example of how a Grid Bot Trades Image via TradeSanta

Example of how a Grid Bot Trades Image via TradeSantaThis strategy attempts to capitalize on normal price volatility in the markets by placing buy and sell orders at regular intervals above and below current price ranges. Grid trading strategies work best in stable markets when price is consolidating. You can learn more about Grid trading strategies and the pros and cons in this great grid trading article from tradingbot.info

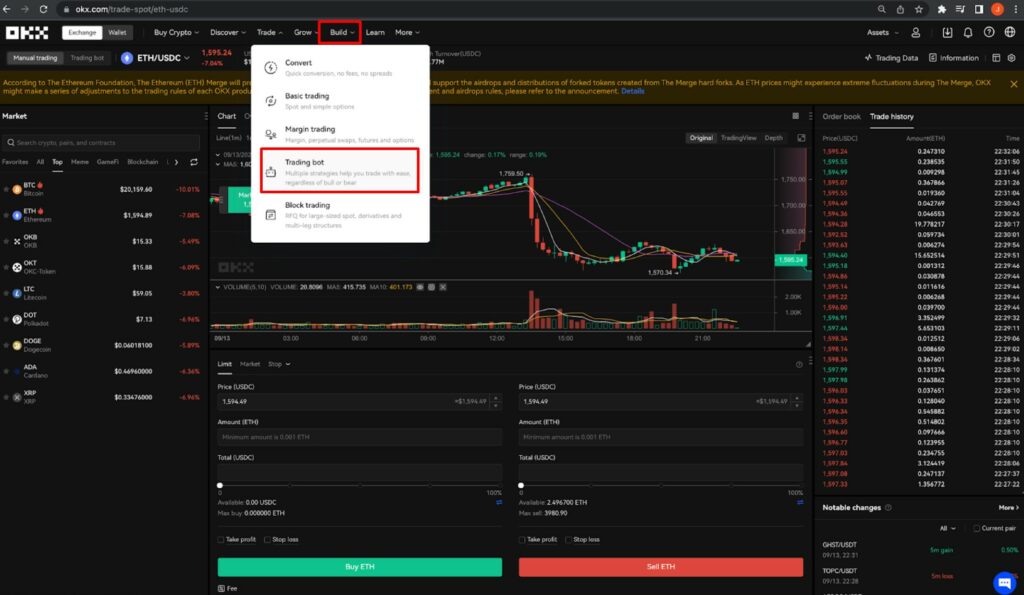

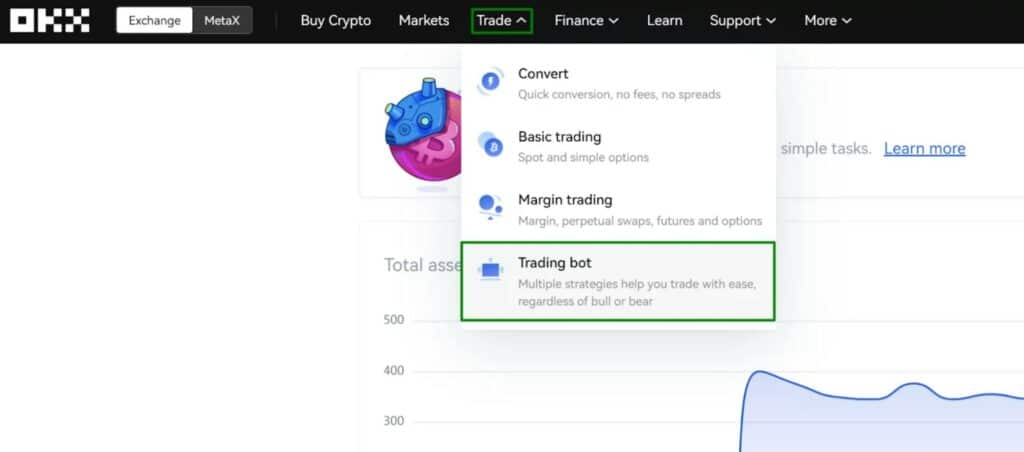

Bots can be found in OKX by navigating to the top Build tab and selecting Trading Bots:

Or alternatively, from the home screen you can head to the Trade tab and select Trading Bots

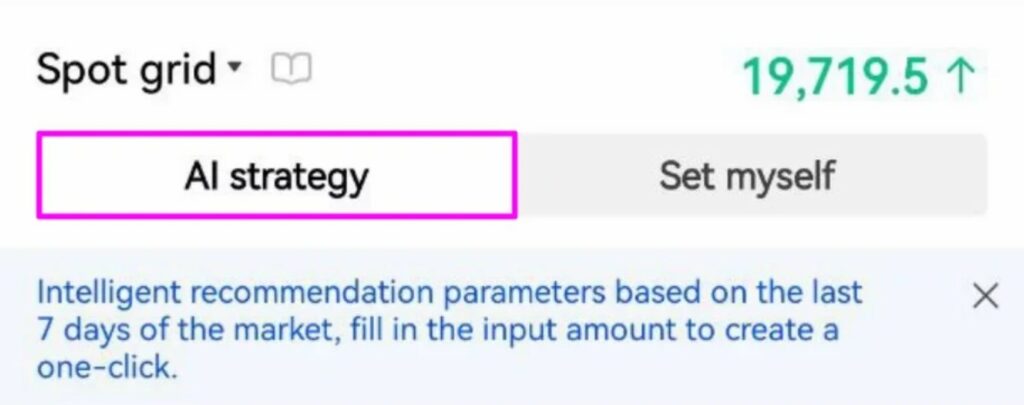

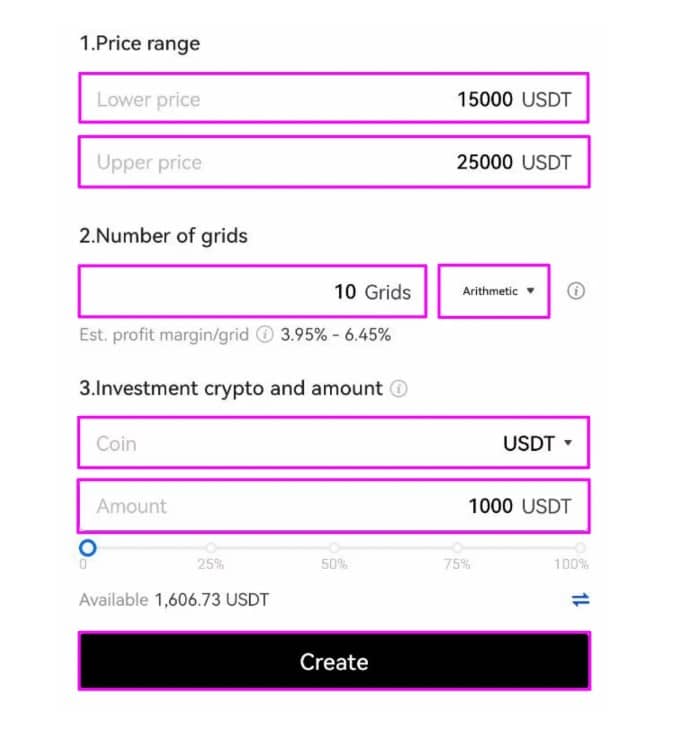

On OKX, Grid bots can be deployed on Spot or Futures trading pairs and traders can set their own parameters or use an AI strategy which is an intelligent recommendation from OKX that sets the parameters based on the last 7 days of market volatility.

Image via OKX

Image via OKXHere is a look at what the screen looks like for traders who want to set their own grid parameters:

Image via OKX

Image via OKXThen users will also determine their take profit and stop loss price levels and activate the bot on the chart of choice.

What is a DCA Bot?

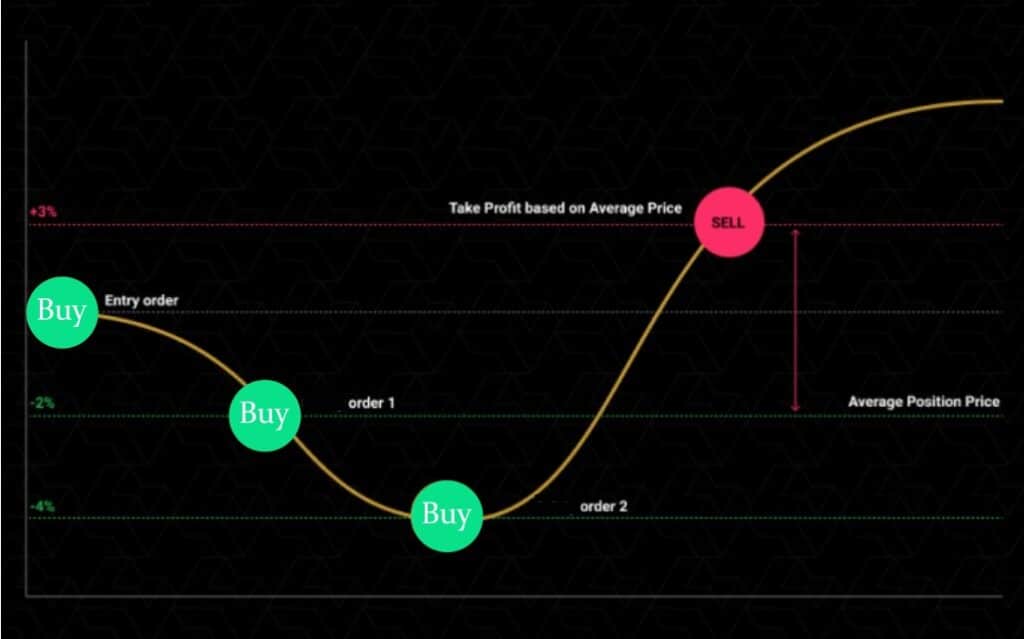

Dollar-cost Average (DCA) is a simple strategy that helps traders build or unwind positions in the market while minimizing risk by buying at the top and selling at the bottom. The strategy spreads out orders at regular time intervals so that entry positions are less affected by market timing.

Image via OKX

Image via OKXDCA bots are great for volatile markets where price swings up and down multiple times throughout the day or week, remaining within a fairly stable range. This trading style is ideal for traders who want to ensure their position is fully exited once a profit target is reached. The weakness is that dollar cost average strategies can result in heavy losses when price is in a strong trend against the trader’s open position.

If there are no retracements in price, the basket of trades is unable to close out in profit and due to the extra open positions, larger losses will be incurred. During ideal trading conditions, the DCA strategy has the potential to substantially increase a trader’s win rate.

An Example of How DCA Bots Trade

An Example of How DCA Bots TradeTraders can select multiple assets to purchase at certain price or time intervals and have the trades executed automatically in order to split their allocation up at different levels. If the market goes against their first entry, this strategy can help average out their entry for a better initial overall entry price, lowering the price that the asset needs to reach in order to place the trader in profit.

There is a lot of confusion between DCA as a trading strategy and DCA as an investment. The terms “recurring buy” and “DCA” are often incorrectly used interchangeably, here are the differences:

- Recurring buys or dollar-cost averaging as a long-term investor involves investing a fixed amount in an asset at fixed intervals (daily, weekly or monthly), regardless of market movements. This can provide traders with a better overall entry price on average over time.

- DCA as a trading strategy controls the buying price. Since buying orders can be triggered when the price drops by a fixed percentage, if price continues to go against the initial open position, additional positions can be opened, lowering the entry price and resulting in price not having to travel as far for the basket of trades to be in profit.

OKX Arbitrage Bots

Arbitrage bots buy and sell the same or different assets to profit from the changes in the asset’s price. This strategy exploits the variations in the price of similar instruments or markets on different platforms.

A new take on an old way to make money. Image via 3commasTutorials.com

A new take on an old way to make money. Image via 3commasTutorials.comOKX crypto trading bots seek to create what are known as “delta neutral” positions, meaning that if one position loses money, the other portion of the trade will make the same amount, resulting in no loss or gain. Profits arise from price differences between the instruments or funding rate payments made by perpetual swap traders holding positions in profit.

The Arbitrage bots have two modes:

- Funding Rate Arbitrage Mode- A long or short position is opened in the spot market. Simultaneously, the bot opens the opposite position in the same asset with a perpetual swap. The two positions should be delta neutral, resulting in any funding rate payment received from the trader on the other side of the perpetual swap resulting in a profit.

- Spread Arbitrage Mode- Presents opportunities to profit from the price differences between futures contracts with different settlement dates, or futures and spot prices. When the bot opens a delta-neutral position with the same asset using two differently priced instruments, the difference in price becomes profit for the trader upon settlement time.

Note that Arbitrage trading is quite complex and is not recommended for new users. Feel free to learn about arbitrage trading on the OKX dedicated guide.

Smart Portfolio

Smart Portfolio is one of the trading bot features available on OKX. When using this strategy, traders specify how much of their chosen crypto assets should make up their portfolio and as price volatility causes assets to represent more than the intended allocation, the bot will automatically sell the asset to buy underperforming ones.

Image via OKX

Image via OKXThis is a fantastic feature and use case as it ensures that a trader’s portfolio is always balanced and remains in line with their investor thesis, risk appetite, and how much exposure they want to each crypto asset.

The Smart Portfolio bot has two rebalancing triggers:

- Scheduled- The bot checks the proportion of each asset at regular time intervals specified by the user. If there is a deviation from the desired allocations, the bot will sell the asset that has increased in total portfolio share and uses the profits to buy the other assets in the portfolio.

- Proportional- This mode will have the bot only rebalance the portfolio when it has become imbalanced by a percentage determined by the user. This leaves some wiggle room for traders who are not so strict with their allocations and can cut down on trading fees as rebalancing doesn’t need to happen so frequently.

Recurring Buy

This bot is quite straightforward, it is OKX’s automated dollar-cost averaging feature. Traders can use this to buy into up to 20 different crypto assets at regular intervals to average out their cost basis.

Image via Twitter/OKX

Image via Twitter/OKXThis bot accesses a trader’s USDT balance to buy crypto at chosen intervals, or traders can also choose to set up recurring buys with their credit or debit cards via the “buy crypto” section.

Note that selecting the card option will come with considerably higher fees that will eat into profit, funding your account with lump sums via bank transfer and holding USDT will be the fee-friendlier option.

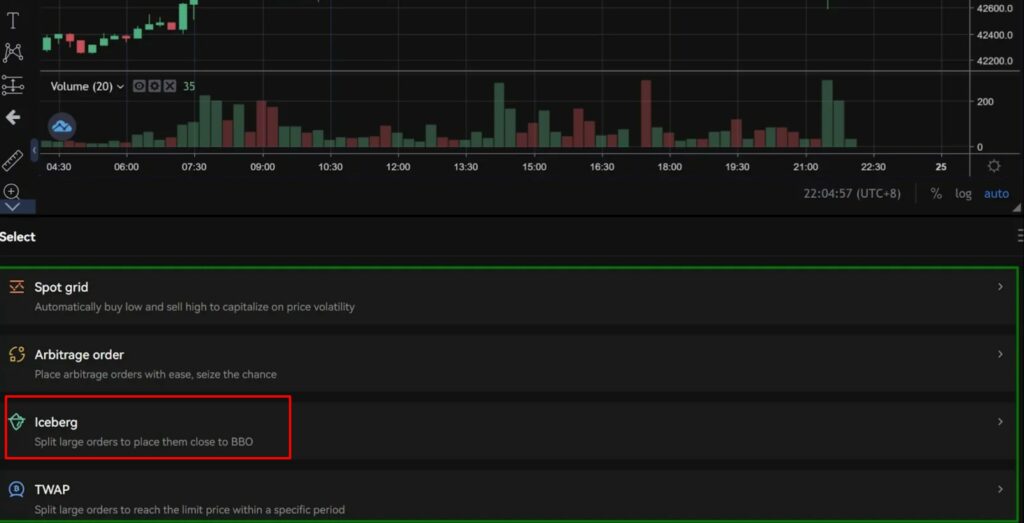

Slicing Bots

Slicing bots help traders with large orders lower their trading costs by reducing slippage and volatility. The strategy divides large orders into multiple small orders through adjustable settings.

Breaking up large orders is important, especially in illiquid markets as one large order can result in significant market movements and increased levels of slippage.

This can be done by selecting two different types of orders:

Iceberg Orders

Traders can select Iceberg orders for their bots to utilize, which are large buys or sells broken down into smaller orders.

Image via OKX

Image via OKXIceberg orders are useful when making a large trade relative to the size of the market, especially on smaller and more illiquid markets, to ensure that orders are not causing excessive volatility. Iceberg orders attempt to mask large orders and limit the impacts of price slippage.

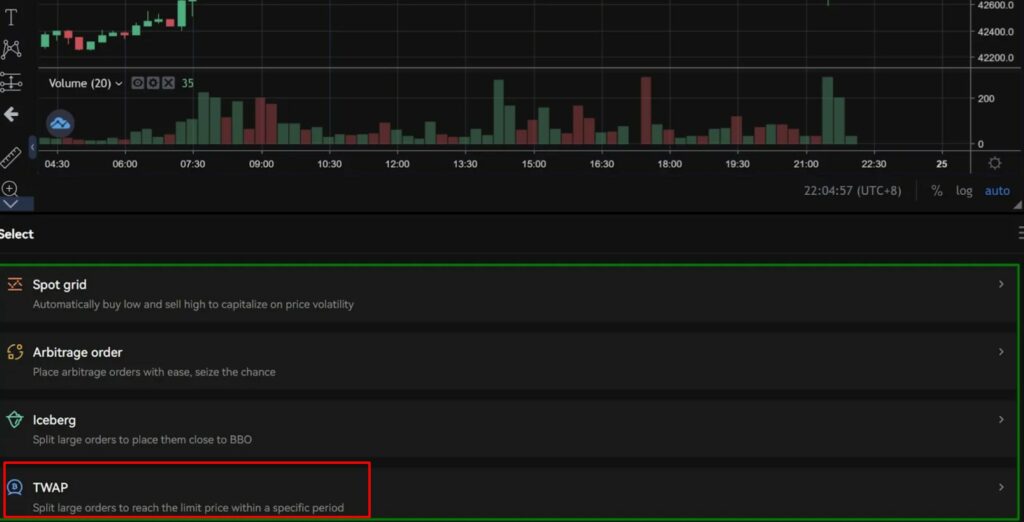

TWAP Orders

TWAP is short for “time-weighted average price” and it seeks to execute a large trade over a specified period of time determined by the trader.

Image via OKX

Image via OKXSimilar to Iceberg orders, it attempts to mask large buys, entering or exiting the markets without significantly impacting the asset’s price or causing excess slippage.

OKX Fees for Trading Bots

Fortunately, OKX does not charge anything to access trading bots, anyone with an OKX account can access the bot feature, however, standard trading fees still apply. OKX is one of the lowest-cost exchanges in the space, making it a fee-friendly place to utilize trading bots.

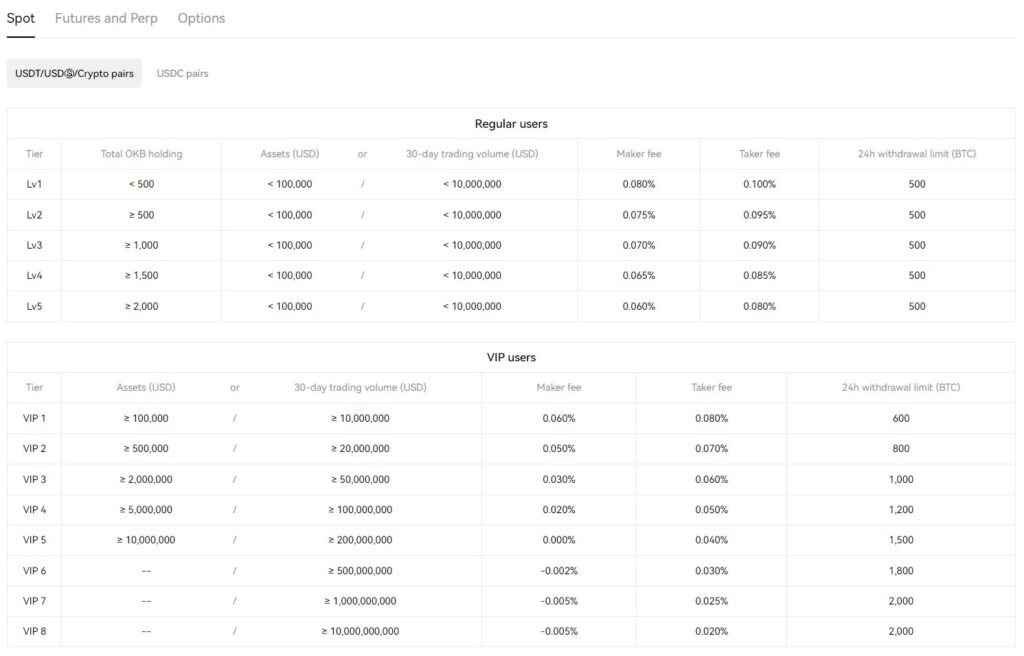

OKX uses a tiered fee structure based on total OKB token holdings, value of assets held, or 30-day trading volume. Here are the fees for spot trading:

Image via OKX

Image via OKXYou can find the fees for the various Futures and Perp contracts as well as Options by navigating to the OKX fees page.

OKX Trading Bots: Closing Thoughts

OKX provides a fantastic platform for crypto bots thanks to their low fees and great selection of different automated trading bots to suit traders with different needs.

👉 Sign up to OKX to receive a 40% trading fee discount for life!

The OKX interface is very intuitive and user-friendly, making bot creation and deployment easy, and thanks to API integration support, users have many options to either create their own automated strategies, select pre-built bots, or use a bot creation service like 3Commas and synchronize the bot to their OKX trading account.