It’s tradition here at the Coin Bureau to keep our readers up to date with regular exchange reviews and on the menu today is OKX vs SwissBorg. We’ve had plenty of great articles comparing OKX against giants such as Coinbase, Kraken and Binance but how will it fare against the lesser-known smaller exchange SwissBorg? Let’s find out.

Note: Users located in the US and UK are not supported.

SwissBorg vs OKX

SwissBorg exchange is very different to OKX as it’s aimed at beginners and offers a much simpler and basic approach to buying and selling cryptocurrencies. SwissBorg specialises in keeping things simple on their website by directing users to their beginner-friendly smartphone app. Users can download the app, complete KYC and then perform basic trading functions such as buying and selling. SwissBorg eliminates any confusion and stops beginners from having to worry about more complicated functions that larger exchanges offer such as limit orders, spot buys or margin and derivatives trading.

SwissBorg prides itself on being the most comprehensive digital wealth management platform in the industry, focusing more on wealth management than the active trading side of things. You. can learn more about it and the products and features in our dedicated SwissBorg Review.

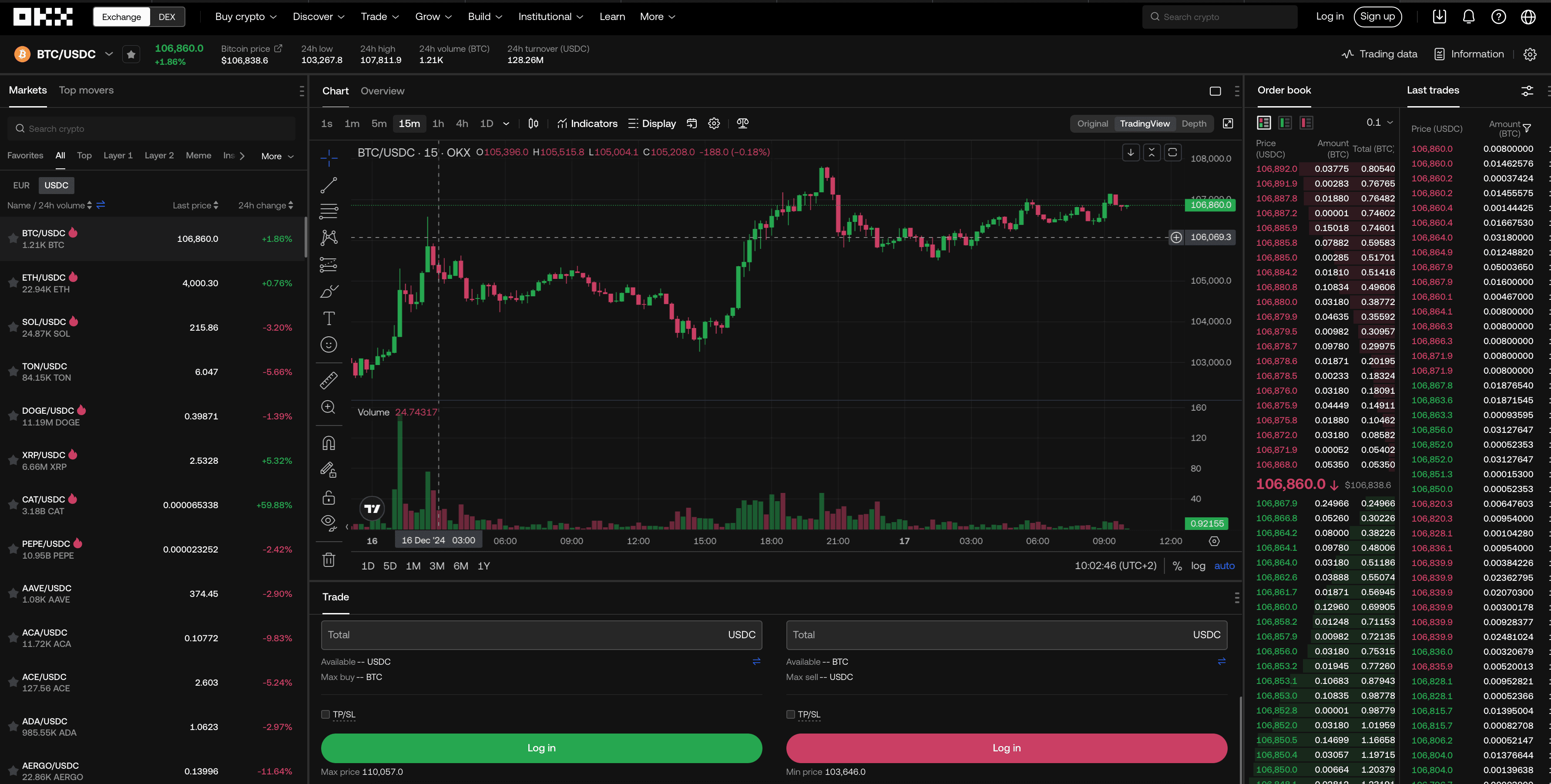

OKX is designed for much more advanced traders with a large and information-rich user interface that's much more interactive and has a large range of trading options available. Users can view candlestick and line charts, orderbooks, real-time price feeds and trade derivatives. They even offer a section for managing trading bots and margin trading. You can learn more about OKX and why they are a leader in Web3 innovation in our dedicated OKX Review.

OKX and SwissBorg are very different in their approach as exchanges with OKX being designed for experienced users who need more technical plus advanced tools and SwissBorg, which was designed with the intention of providing the easiest and most seamless way to buy and sell assets, as well as offer innovative crypto investment products that are perfect for the passive crypto investor.

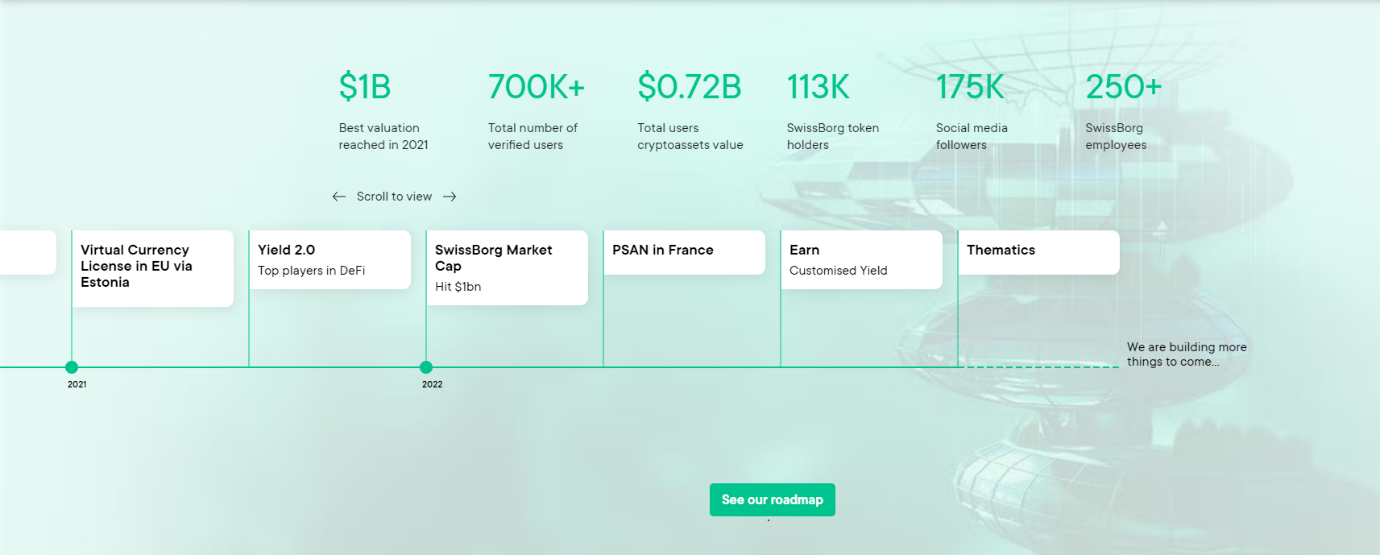

Image via Swissborg

Image via SwissborgA unique beginner-friendly service that SwissBorg offers is a fantastic investment product called ‘Thematics’ which allows users to invest in bundles of cryptocurrencies with a simple push of a button.

Similar to an index fund that you would find in the traditional stock market, Thematics allows users to gain exposure to a wide range of cryptocurrencies without the hassle of individually researching and buying separate cryptos. The Thematic bundles are curated according to a specific theme, such as Web 3.0, Gaming, and Layer 1's, and there is currently a Bitcoin + Gold bundle, which offers varying weightings for each cryptocurrency in the bundle and rebalances automatically as the market changes.

Taking a look at their ‘Best Blockchains’ Thematic, the bundle offers exposure to the top layer 0s, layer 1s, 2s, and sidechains including assets like: Cosmos, Ethereum, Polkadot, Polygon, Stacks, Optimism, Arbitrum, SwissBorg, Avalanche, Solana and others.

In their own words:

"The Best Blockchains Thematic groups the strongest & most promising blockchains of the moment. As the market evolves, so does your Thematic, ensuring you're always invested in the top players. (Source)

Both exchanges offer native tokens but they perform very different functions. The SwissBorg token BORG (previously CHSB) has a much simpler use case and is designed to be used in reducing trading fees and providing voting power along with accessing higher benefit tiers. Users who choose to use BORG to pay for their fees will receive a discount and a percentage of the revenue earned from exchange fees is used to buy back BORG tokens. BORG holders get to vote on how the tokens will be used and can vote between options such as burning tokens, increasing yield, placing funds in an insurance pool, etc.

In comparison, the OKX exchange uses a native token called OKB, which can be used for:

- Reduced trading fees on the OKX exchange

- The token buyback and burn program, where a portion of the trading fees collected on the platform are used to buy back and burn OKB tokens, reducing the total supply and increasing scarcity

- Accessing certain features and benefits such as VIP services and token sales

- Voting in governance decisions that could impact the exchange

- Staking their OKB holdings to earn yield

OKB token had a one-off issuance of 300 million OKB which was completed in 2018, and there’s no further issuance in the future. On top of its buy-back & burn scheme, the issuance plan of a total of 700 million OKB is terminated. Thus, OKB has now become the world’s first fully circulated platform token and will enter deflation.

OKX exchange also launched the OKT token which is the native token for OKChain (OTKChain). These are separate tokens with different use cases and aren’t to be confused with one another.

OKX vs SwissBorg: Products Offered

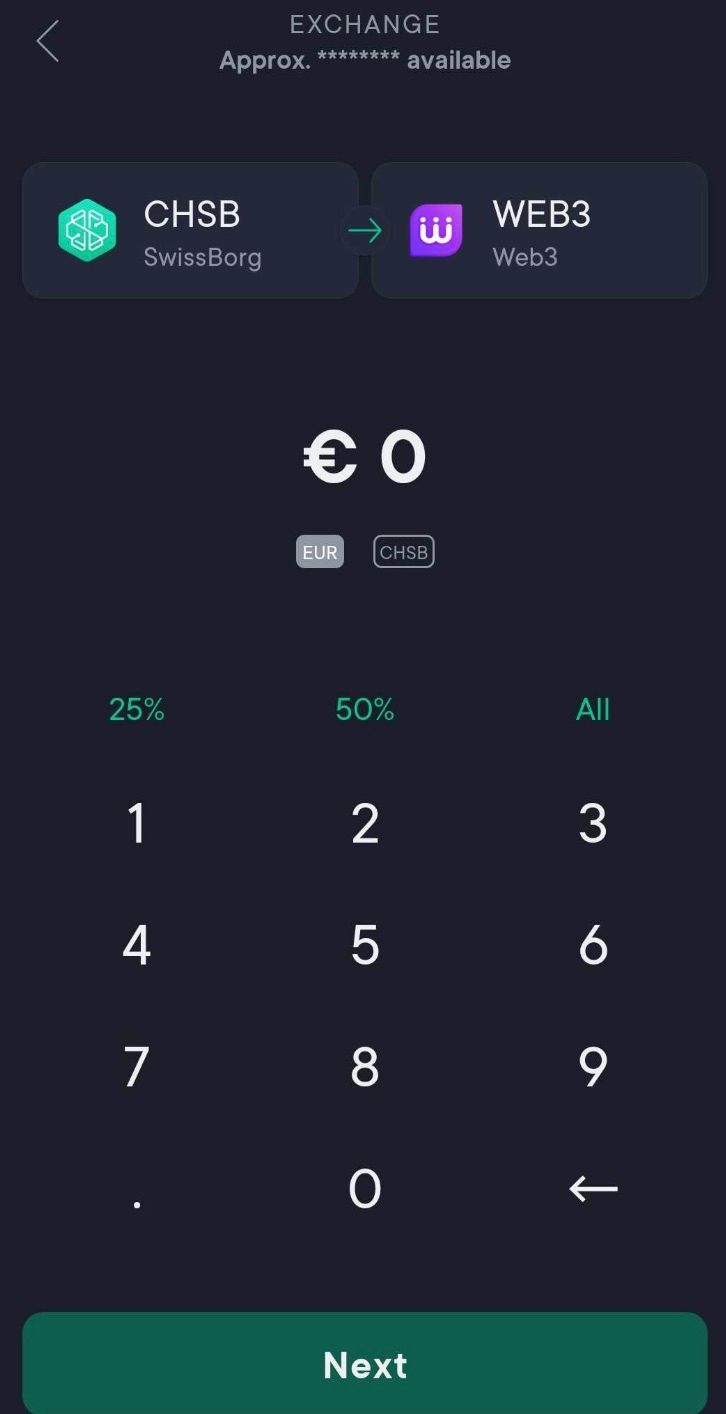

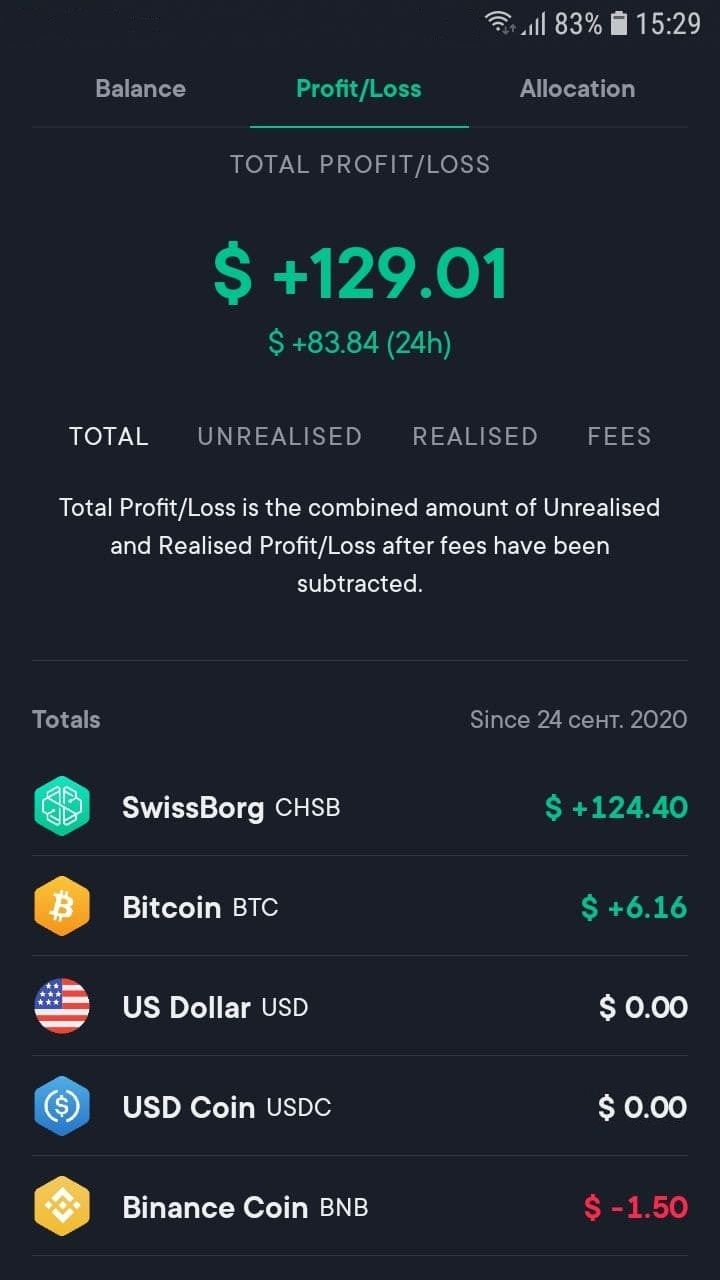

OKX and SwissBorg are worlds apart when comparing what services they offer and this is by design. As mentioned earlier, SwissBorg is designed for ease of use and investing over trading, which is emphasized by their focus on an app vs website design choice. SwissBorg doesn’t offer a website with a trading terminal for trading as trading is done by aggregating the lowest prices from multiple exchanges and presenting the user with a simple “One-Click" trade feature, as you can see below:

A Look At SwissBorg's Exchange Feature. Image via SwissBorg.

A Look At SwissBorg's Exchange Feature. Image via SwissBorg.Conversely, OKX has everything but the kitchen sink and has opted for the whole package with a wide range of tools available for all types of advanced trading, namely a full trading terminal and even a section for trading bots with API links.

Below is a list of all the different features that OKX provide:

- A variety of trading options such as spot, perpetual swaps, futures, margin, options, and trading bots.

- Ways to earn and grow your holdings with Savings, Shark Fin, ETH2.0 staking, Fixed Income, and staking for other assets.

- Loans

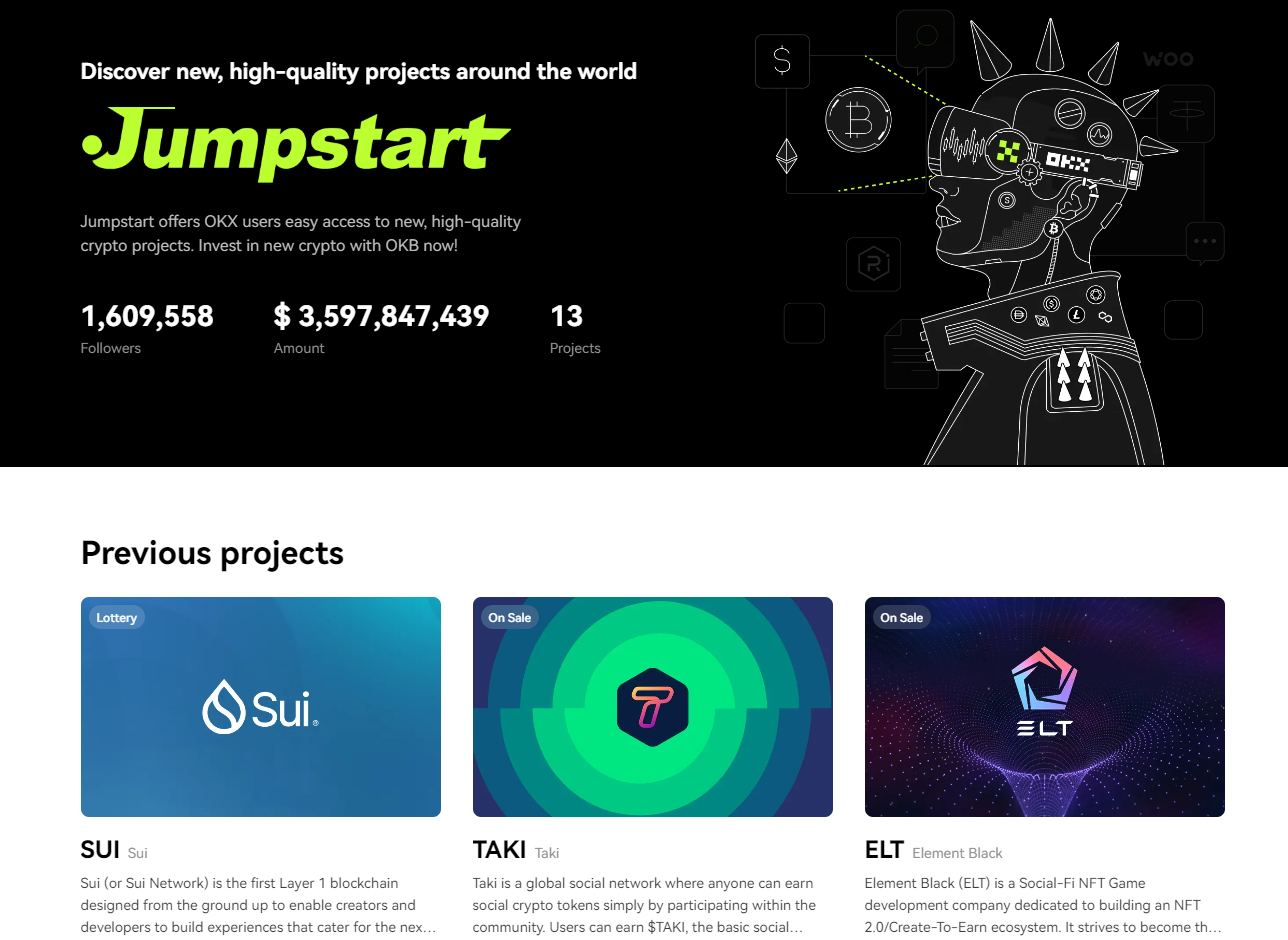

- Jumpstart – OKX's platform showcasing new, cutting-edge projects.

- Demo Trading – great for beginners new to the trading game. Advanced traders are also free to use it to test out new strategies.

- Access crypto via 90 fiat currencies

- Easily swap between different crypto pairs with the "Convert" feature

- Go to the "Explore" section to give DeFi and Web3 dApps a try

- NFT marketplace to some NFT trades

- Copy trading - the latest feature for OK clients

To give you an idea as to how trading on OKX contrasts to trading on SwissBorg in the image shown above, here is the trading terminal on OKX:

A Look at the OKX Trading Terminal

A Look at the OKX Trading TerminalWith all that on offer, you might be thinking that the more beginner-friendly and simpler SwissBorg exchange might struggle to compete, but SwissBorg has a few tricks up its sleeve to match up to these behemoths and offer a few unique products that cannot be found elsewhere.

Here’s a list of their services offered for a direct comparison:

- Multi-assets launchpad to invest in unique early-stage investment opportunities

- SwissBorg Academy to learn and become a better investor

- Cyborg Artificial intelligence predictor that forecasts an asset's movement by combining historical price movements along with technical and sentimental analysis.

- historicalWeb 3.0 Thematic to invest in 13 different cryptos with varying ratios in one swift purchase

- Auto-invest to automate your crypto investments

- SwissBorg Earn to generate passive income 24/7. Degrees of risk are on offer, core, brave and adventurous with lower to higher yields available respectively.

OKX vs SwissBorg: User Friendliness

The obvious answer to the question of ‘who is more user-friendly’ is evidently SwissBorg. SwissBorg has taken all the hassle out of trading by offering simple buy and sell functions. There’s no need to worry about setting a stop loss, posting more collateral, funding rates or covering your shorts. In fact, for many of you reading this, I should imagine some of that terminology went right over your head. If that's the case, SwissBorg is a great place to go to simplify your trading needs.

Strictly speaking, SwissBorg is a broker, not an exchange as the app uses Smart Engine technology to automatically detect the best cryptocurrency prices on major exchanges whenever you want to place a trade. The app then routes your order to that exchange and deposits your crypto in your SwissBorg account, smart stuff.

A Look at SwissBorg's Smart Engine. Image via SwissBorg

A Look at SwissBorg's Smart Engine. Image via SwissBorgWith a push of a few buttons, you can buy individual crypto or use their Thematic investment products to gain exposure to a basket of cryptocurrencies with different weightings. After all, why go through the stress of deciding which cryptocurrencies to invest in and how much to put in each one, all of which is time-consuming. With Thematic, you can let the experts with the help of artificial intelligence to decide for you and then later sit back track your investments using SwissBorg's portfolio tracker.

Image via Swissborg

Image via SwissborgAnother impressive feature SwissBorg offers is the ability to create your own exclusive crypto-fiat pairs on its Wealth App.

Users simply pick a fiat currency and then merge it with a cryptocurrency of their choice.

The app supports 14 different fiat pairs, including CHF, EUR, GBP, USD, BGN, SEK, RON, CZK, NOK, ILS, HKD, HUF, PLN, and DKK.

The supported crypto pairs include Bitcoin, Ethereum, USD Coin, PAX Gold, KNC, LEND, Enjin, DAI, Ren, Compound, Aave (LEND), Kyber Network (KNC), Binance Coin, and BORG

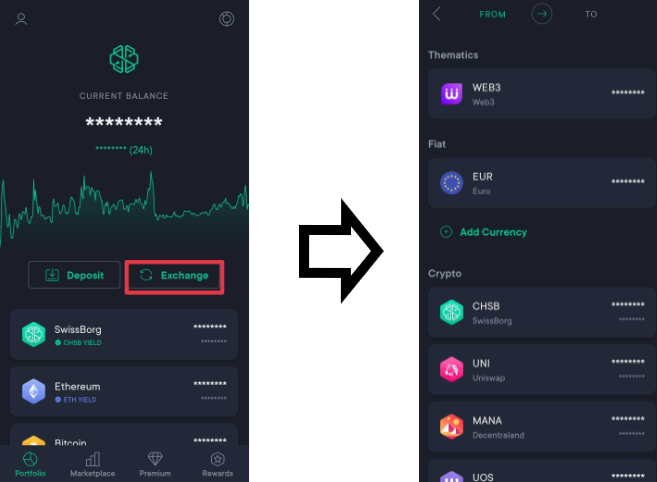

The steps required to successfully execute an order on the SwissBorg Wealth App are quite straightforward, easy to understand, and follow.

Users just need to navigate to the Portfolio tab on the Wealth App home screen and click on Exchange.

From there, just follow these steps:

- Select the icon of the Crypto/Fiat you want to exchange from and then click on the asset you would like to exchange to

Step 1: Choose the asset to exchange

Step 1: Choose the asset to exchange- Type or select the amount you wish to exchange

- Place your order by clicking Next.

- The SwissBorg Smart Engine will carry out a quick search for the best rate and SwissBorg price to execute your order once you click the Next button.

- The available rate and trading fees will be displayed on the next page with the option to Confirm the exchange.

Steps 2 - 4: Amounts, Rates and Confirmation

Steps 2 - 4: Amounts, Rates and ConfirmationBefore tapping on "Confirm", please make sure that all details are correct! After tapping on "Confirm", the exchange is executed and you'll see a confirmation screen that it was successful.

OKX vs SwissBorg Fees

Let’s take a look at fees and compare the differences between OKX and SwissBorg. Starting with trading fees it’s easy to see how each exchange differs as SwissBorg is a broker, which means it’s doing a lot more work to help you find great prices from different exchanges. As such, the exchange fees on SwissBorg are slightly higher than on OKX and are considered more of a ‘service fee’ in return for them helping facilitate your purchase.

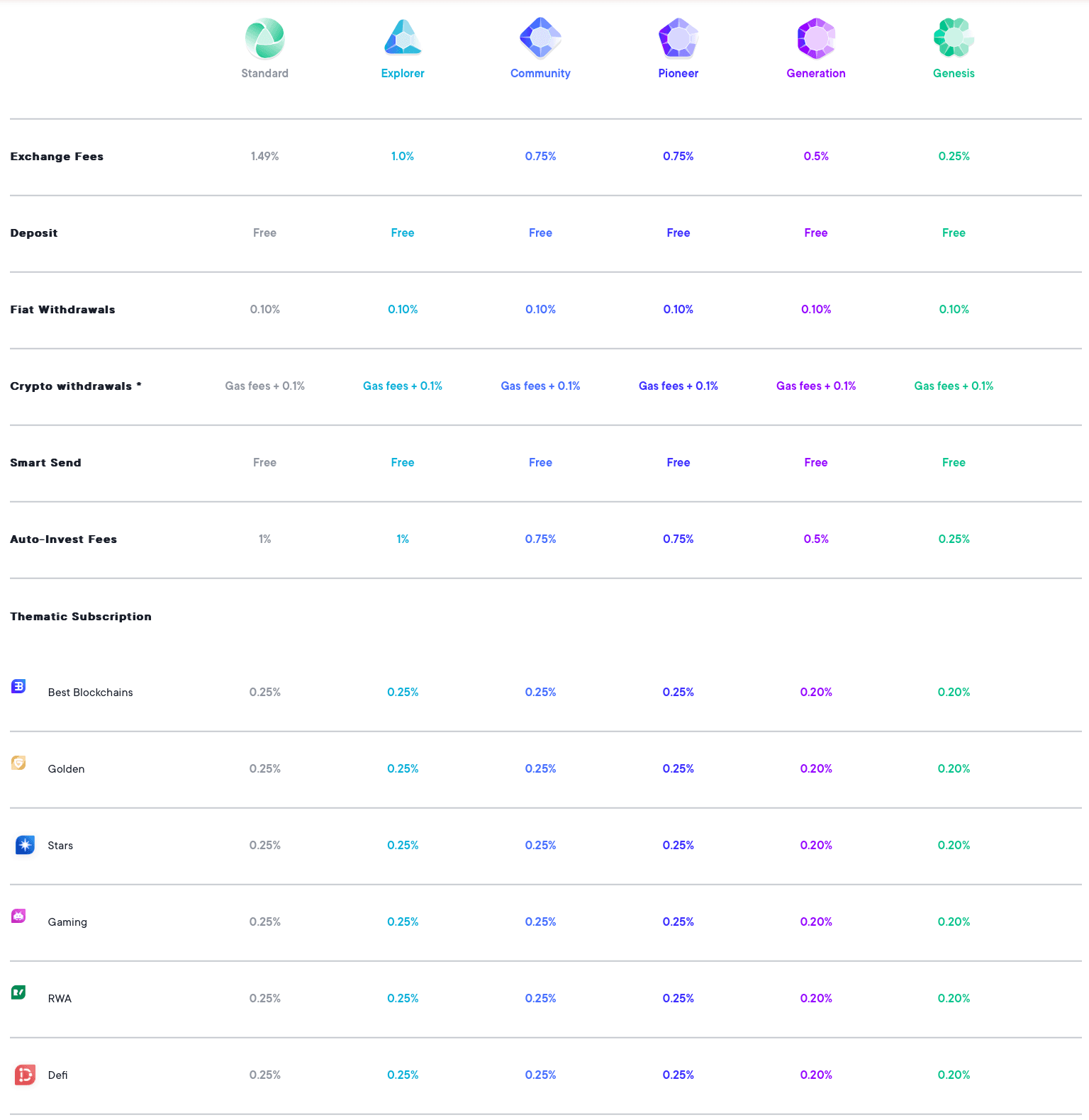

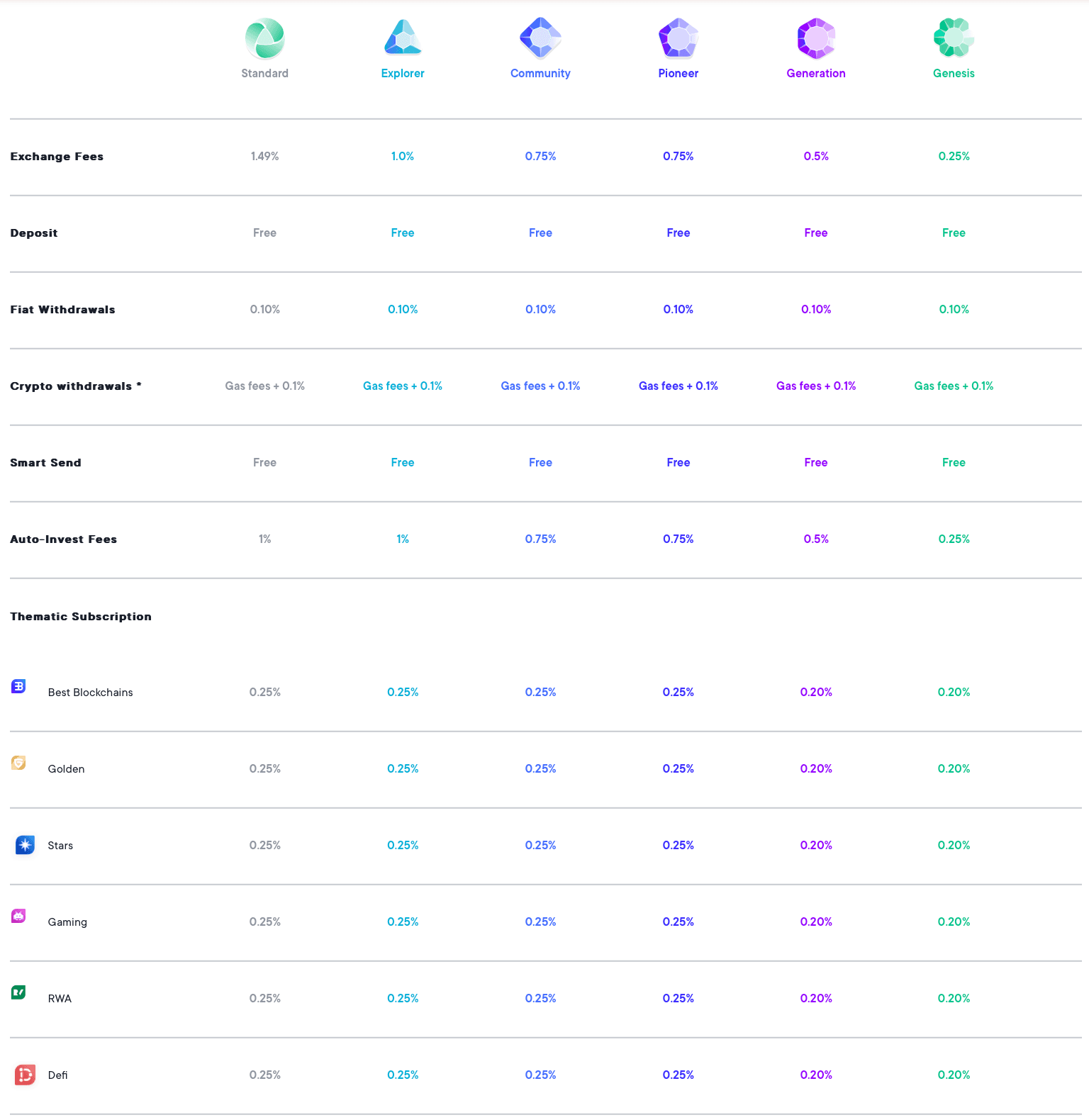

Below is a table showing the different fees for using SwissBorg.

SwissBorg Fees. Image via Swissborg

SwissBorg Fees. Image via SwissborgOKX’s fees are cheaper as it’s you who is doing all of the hard work as it’s designed for more advanced traders who want more customisation when executing trades. If your size IS size, then OKX is a much better place to be trading otherwise the standard fees on SwissBorg will really start to add up.

Trading size? OKX has you covered. Image via Twitter

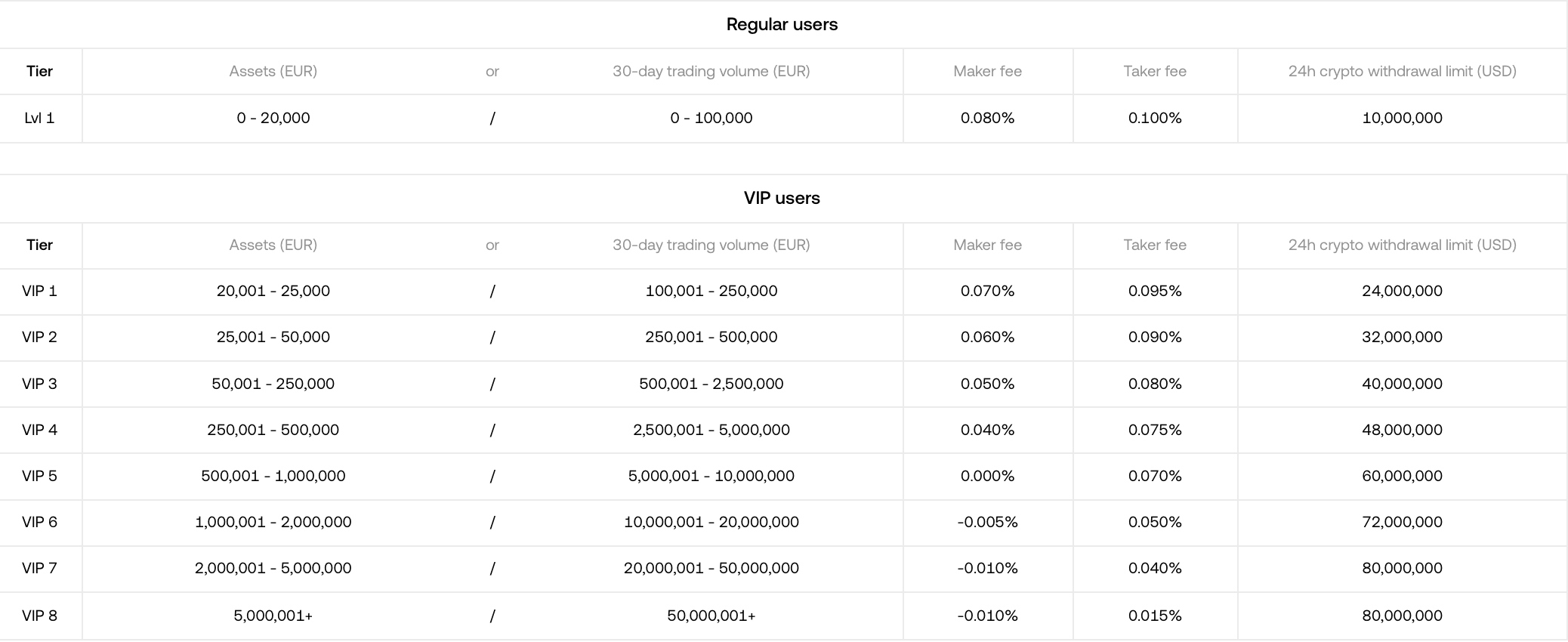

Trading size? OKX has you covered. Image via TwitterOKX fees follow a tiered system and also distinguish between regular and VIP traders. To get to that level, you'd need to be trading at a minimum of USD100k to qualify for a 0.06% maker fee and 0.08% for taker fees as shown below.

OKX trading fees. Image via OKX

OKX trading fees. Image via OKXOKX is one of the cost leaders in the space when it comes to rock-bottom fees, making it a great exchange for those looking to save every sat.

That’s trading fees covered, but what about deposits and withdrawals? We’ll start with deposits and compare both exchanges.

On SwissBorg, with the exception of card deposit fees, there are no other fees associated with the deposit of fiat currencies, stablecoins or crypto assets. You may be charged a fee by your bank or platform from where you are sending the funds.

OKX does not charge any fees for deposits of cryptocurrency. However, you will of course incur network fees when transferring your cryptocurrency from your own wallet to your OKX account.

If you’re a beginner and thinking of using SwissBorg, for deposits or withdrawals, please take the time to understand depositing and withdrawing different coins onto different networks. Crypto is not the most beginner-friendly user experience and it’s easy to lose coins.

What About Withdrawals?

OKX withdrawals are entirely based on on-chain fees which of course, are decided by what cryptocurrency you are withdrawing and to which blockchain you are withdrawing it to.

The system will calculate the fee automatically. The actual amount that will be credited to your account on the withdrawal page and is calculated with this formula:

The actual amount in your account = Withdrawal amount – Withdrawal fee

The fee amount is based on the transaction (A more complex transaction means that more computational resources will be consumed), hence a higher fee will be charged.

The system will calculate the fee automatically before you submit the withdrawal request. Alternatively, you can also adjust your fee within the limit.

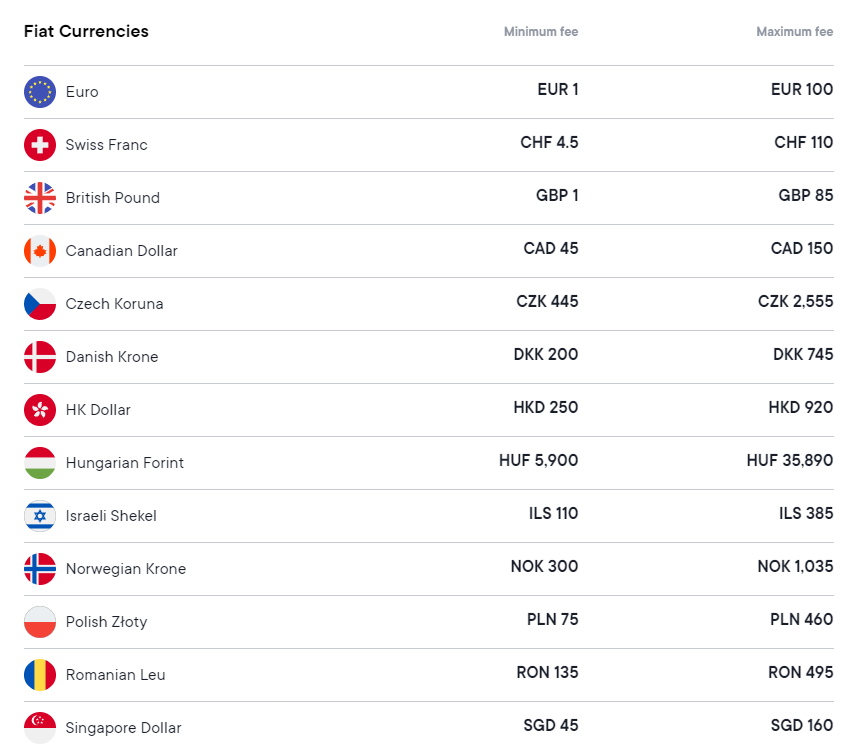

As for SwissBorg, fiat currency withdrawals are subject to an execution fee of 0.10%, with a minimum fee per currency (see table below). You may be charged an additional fee by the receiving bank or platform.

Fiat currency fees on Swissborg. Image via Swissborg

Fiat currency fees on Swissborg. Image via SwissborgCryptocurrency withdrawal fees are blockchain specific, much the same as OKX. Some blockchain fees are cheaper than others and it’s commonplace for exchanges to add a small amount of their own fees on top to cover their expenses.

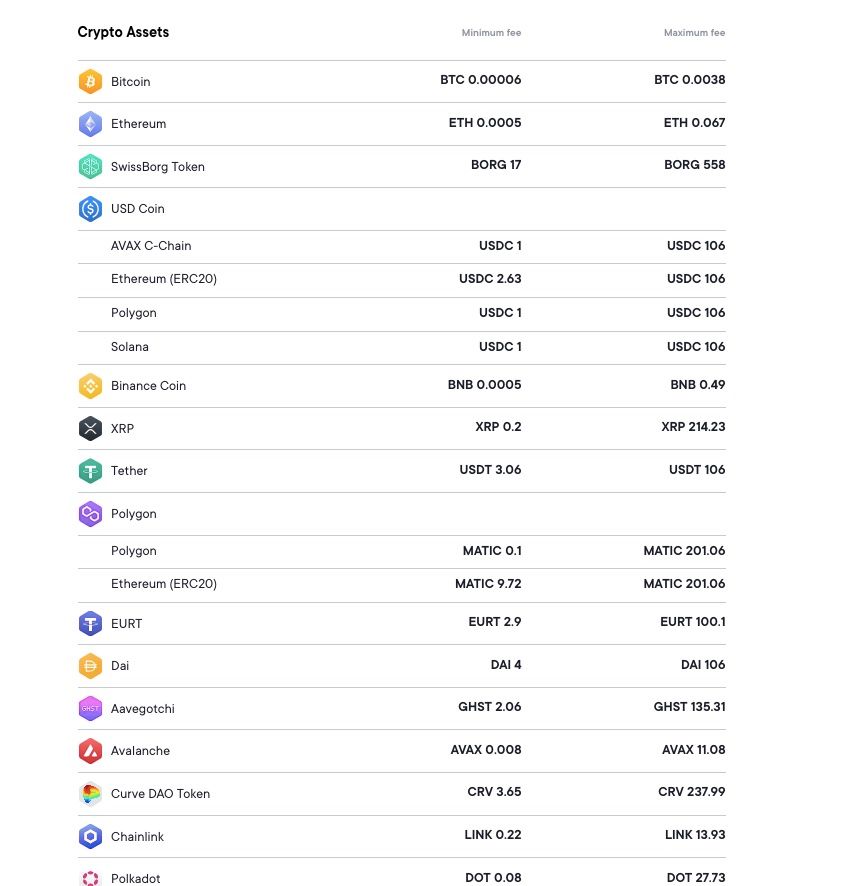

Below is a list of the cryptocurrency withdrawal fees for some of the cryptocurrencies by SwissBorg.

Image via SwissBorg

Image via SwissBorgOKX vs SwissBorg: Security

Security is probably one of the most noticeable talking points in crypto in recent years after consistently bad news in 2022 surrounding the bankruptcy and collapse of platforms like Celsius, BlockFi, Voyager, and exchanges like FTX, then the hacks that hit the likes of HTX and Poloniex in 2023.

Given all of the devastating news that has hit the headlines in the crypto space, it’s important we take a look at the security of each exchange so we don’t repeat these mistakes all over again.

SwissBorg uses Fireblocks to secure digital assets in storage and in transit as it’s a flexible platform that uses world-class multiparty computation technology. Fireblocks is a digital asset security platform that helps financial institutions protect digital assets from theft or hackers by using breakthrough MPC & patent-pending chip isolation technology to secure private keys and API credentials and eliminate the need for deposit addresses. Fireblocks offers financial institutions an all-in-one platform to run a digital asset business, providing them with infrastructure to store, transfer and issue digital assets.

Secure Exchanges Keep These Guys Out. Image via Shutterstock

Secure Exchanges Keep These Guys Out. Image via ShutterstockAt the heart of SwissBorg’s security measures is MPC Technology. Multi-party computation (MPC) provides the ability for multiple parties to jointly perform mathematical computations without one party ever revealing its secret to others. Fireblocks combines MPC-CMP with hardware isolation to create a multi-layer security technology. This eliminates a single point of failure and insulates digital assets from cyber-attacks, internal collusion, and human error.

At SwissBorg, all of your funds will be stored on your account. With SwissBorg, there are no safekeeping fees, all your assets will be stored free of charge and your funds are segregated from the company's assets. In case of bankruptcy, your funds will remain, and you will not suffer any losses. The policy of segregation will guarantee the safety of your funds, which is a pretty big deal considering the problems that many people are facing with the FTX Chapter 11 bankruptcy proceedings.

OKX platform diligently follows industry best practices by storing most of their crypto in cold storage. OKX uses both online and offline storage and multiple backups with location-separated QR codes for key personnel. Multi-sig authorisation for any movement of funds is a must for both platforms, thereby preventing the "one bad apple" scenario that allows them to become compromised.

Other security measures taken by OKX include:

- A limit of 1000 BTC for each cold wallet, used once only.

- The encryption of private keys are stored in an offline computer using AES technology. Only the offline ones are accessible via QR codes, in paper form, and are stored in bank vaults around the world, all requiring physical access.

Even if an unfortunate incident were to occur, OKX has the ability to reimburse users from a special risk reserve fund set aside precisely for this purpose. This would surely go a long way to reassure OKX customers that they can safely trade on their platform.

Customers can also do the following to secure their own account:

- Login Password

- Email Verification

- 2FA for login

- Google Authenticator

- Mobile Verification

- Secondary password for withdrawals

- Anti-phishing code

OKX employs a security approach that is among the strongest across the exchanges we've assessed here at the Coin Bureau. We cover their robust security measures in our detailed Analysis of OKX Security, and you can see for yourself the impressive lengths OXK takes to secure customer funds in their OKX Risk Shield site.

SwissBorg Overview

SwissBorg sets itself apart from other exchanges with its simplicity and innovative digital asset management solutions. SwissBorg doesn’t offer a myriad of trading functions that advanced traders need and want, instead, SwissBorg is actually more focused on the beginner retail investor who simply wants to gain exposure to crypto by buying in a safe and simple way.

In this manner, SwissBorg is very different to other exchanges that we’ve covered at the Coin Bureau as it’s more of a brokerage service that does the work for you. To simplify your trading, SwissBorg provides a broker service via its app that uses Smart Engine technology to automatically detect the best cryptocurrency prices on major exchanges whenever you want to place a trade. The app then routes your order to that exchange and deposits your crypto in your SwissBorg account. This allows the average user to bypass all the confusing trading terminals and focus on just buying or selling in real-time.

SwissBorg started their journey with a team of 9 and a successful ICO in 2018. They are now a team of more than 200 committed to creating the bank of the future with a clear roadmap.

Image via SwissBorg

Image via SwissBorgIn their own words, they are:

Empowered by our diversity and passion, we will keep going for years to come. Let our numbers speak for itself. - (Source: SwissBorg)

They are headquartered in Switzerland with additional locations in Estonia and Portugal and are licensed and regulated by:

- Switzerland’s Supervisory Body for Financial Intermediaries & Trustees, Estonia

- France’s Financial Markets Authority

- Estonia’s Financial Intelligence Unit

SwissBorg Products

Let’s take a step back and have a look at the wide range of products that SwissBorg has available. Take a look at this list of products provided:

- SwissBorg makes trading easy by facilitating the exchange of currencies instantly at the best price

- SwissBorg Earn allows users to earn passive income 24/7

- Thematics investment products let users instantly buy a basket of currencies with different ratios. Their first Thematic, Web 3.0, offers exposure to 13 different cryptocurrencies

- Fiat deposits via credit or debit card payments

- More than 50 curated crypto assets available to trade

- Asset analysis, with live asset analysis powered by AI using CyBorg Predictor which combines historical data and technical indicators - more than a human could ever compute!

- Portfolio analytics for live portfolio monitoring

- Auto-invest function to automate your Crypto Investments

- SwissBorg launchpad where users can participate in early-stage investment opportunities

Types of Accounts and SwissBorg Fees

SwissBorg takes all the stress out of investing and as such operates as a brokerage. With that will come fees, more so than a traditional exchange where the user does all the work.

That being said, if you’re willing to invest in the SwissBorg token (BORG) and lock up your funds for 12 months you can significantly reduce your trading fees by upgrading your membership level.

Memberships come on a sliding scale with 6 different tier levels. At the lowest end, you have standard with 0 lockup and 1% exchange fees. At the top end of the membership range with 50,000 BORG locked up the exchange fees drop to 0-0.25%

See below for a more detailed layout of the types of accounts available

Memberships Available and Fees for Swissborg. Image via Swissborg

Memberships Available and Fees for Swissborg. Image via SwissborgSwissBorg Security

Security is everything in the world of finance. Keeping assets secure is what occupies most people’s minds when it comes to saving or investing. Whether a bolted safe or a smart wallet, people have always needed to know that their assets are secure to be able to sleep soundly at night.

SwissBorg takes a unique approach to security and are true to their namesake embracing the Swiss levels of craftsmanship and expertise.

After all, what comes to your mind when you hear about “Swiss Quality”? Precision, craftsmanship and expertise - that’s what lies deep in the foundation of the Swiss culture and its work ethic. Switzerland’s financial sector is incredibly safe and stable, thanks to centuries of expertise. The SwissBorg app is a fantastic reflection of this.

Swiss Products and Innovation are World Renound and Recognized. Image via Shutterstock

Swiss Products and Innovation are World Renound and Recognized. Image via ShutterstockSwissBorg maintains full transparency and always communicates openly and honestly with the community. They are fully compliant with all legal rules and regulations and have all the required licences. You can learn more about that on their Terms and Conditions page.

A critical difference in how SwissBorg operates in regard to security is how user funds are stored. User funds are segregated from SwissBorg funds, and all users' funds will be stored in their accounts. User funds are segregated from the company's assets, so in case of bankruptcy, users' funds will remain intact, and users will not suffer any losses. The policy of segregation will guarantee the safety of customers' funds.

SwissBorg uses the MPC Wallet which stands for Multi-Party-Computation and it is one of the most secure systems in use in the SwissBorg app. With MPC, the security key is divided into multiple parts, that have to be engaged in a certain order during the transaction. Systems like these are very difficult to hack. Additionally, there is no private key that could accidentally be shared with a third party, either intentionally or unintentionally.

OKX Review

OKX is one of the most respected exchanges in the cryptocurrency industry. The exchange, which has its headquarters in Seychelles, is a part OK Group and was founded by Xingming Xu, starting as an OKCoin subsidiary in 2017.

The platform's target market includes both traders and non-traders. Its product mix and approachable UI/UX design demonstrate this. The user-friendly interface and diversity of trading choices, including spot, derivatives, margin, futures, perpetual swaps, and options markets, are sought after by advanced traders. Users can use the wide range of Earn products while exploring the Metaverse, NFTs, DeFi, and GameFi dApps using the OKX Wallet if they are interested in earning yield on their token assets. OKX has removed the option for US clients to take part in their Earn programme due to the regulatory circumstances around cryptocurrency in the US.

For traders who are new to the game, there are two versions of the trading interface: a basic version and an advanced version. Depending on your trading experience, there is also a great tool called Demo Trading that can be utilised as a sandbox or a testing ground.

In addition, OKX provides a ‘Learn’ section where users may learn more about fundamental crypto concepts and trading strategies. The ‘Learn’ section also includes a few entries on industry analysis to help you gain a general sense of what's going on in the market.

Fiat and Cryptocurrencies Available on OKX

On OKX, you can buy fiat currency in more than 90 different countries. Through the spot, margin, and derivatives markets, these fiat currencies can be exchanged for 350+ crypto assets using 500 trading pairs.

OKX Products

What is mentioned is only a small glimpse of what is offered since this is simply an overview of what OKX provides. Check out our specific OKX review to learn more about each of the products.

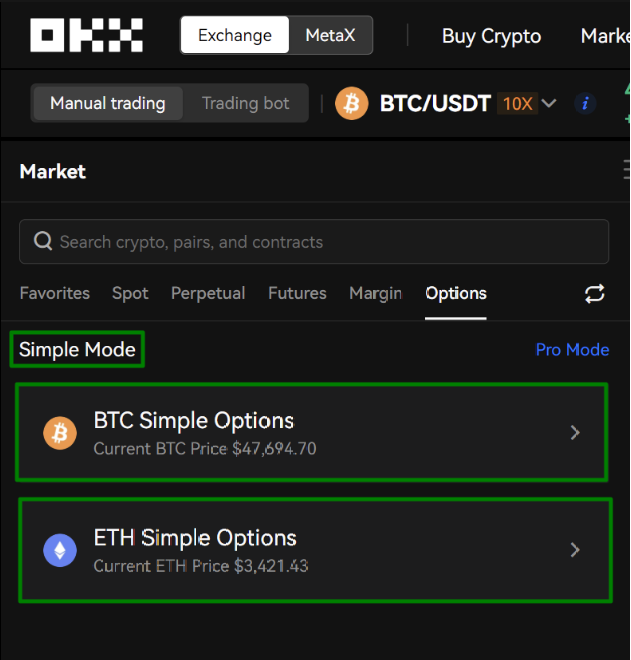

OKX Trading Platform

The OKX exchange's trading platform is divided into three parts:

The Spot market and a condensed form of Options are available in basic trading. There are many other time frames available on the trading platform, with the longest one lasting up to three months for individuals who prefer to look at the big picture when trading options. If you're interested in trying it out there are three simple steps required: choose your course, select your options, and buy your options.

Image via OKX.com

Image via OKX.comFor perpetual Swaps, Margins and Futures trading you’ll need to navigate to the Derivative and Margin trading section which also includes a more advanced version of options trading. Each of them has its own trading interface which is largely the same interface and easy to navigate.

- Order types such as Stop, Trailing Stop, Trigger, and Advanced Limit can be executed on Perpetual Swaps and Futures.

- You can execute Stop, Trailing Stop, and Trigger orders with Margin Trading.

The normal Limit and Market orders are also available for all trading options.

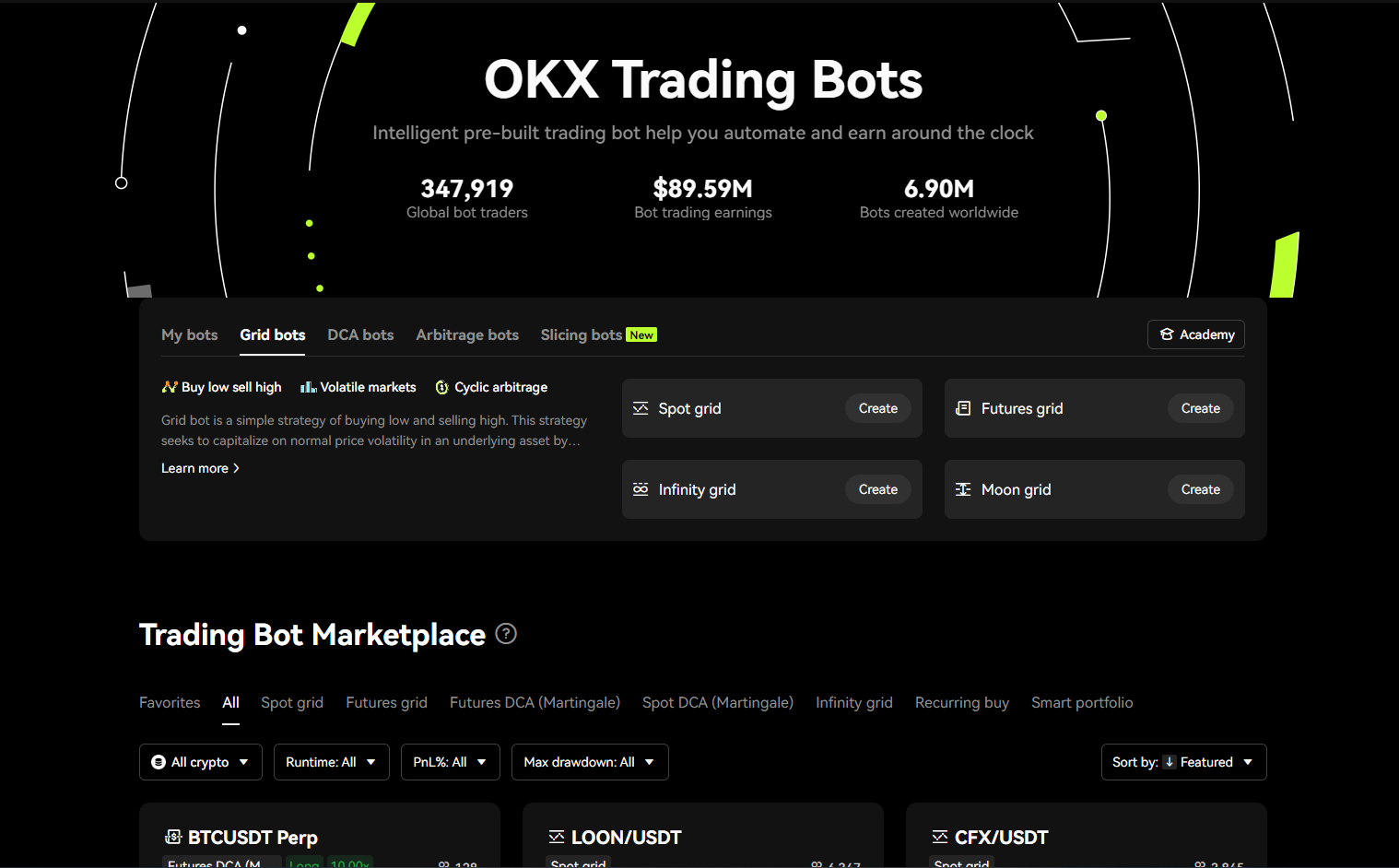

Trading Bots are another popular feature on OKX. More than 900,000 traders already use its auto-trading features, and plug-and-play tools allow them to build their own bots. Before choosing a strategy, traders can review the metrics and trading history of the platform's standard bots before making a decision.

Here are the bots to choose from:

- DCA bot

- Arbitrage bot

- Grid bot

- Recurring buy bot

- Slicing bots

- Smart Portfolio rebalancing bot

Please read our post on OKX trading bots to learn more about how these trading bots work.

Image via OKX

Image via OKXIf staring at cryptic charts all day doesn't sound like your cup of tea, OKX does have a convert function which allows you to swap between crypto and stablecoins with ease, providing users with simple access to a “one-click” swapping feature.

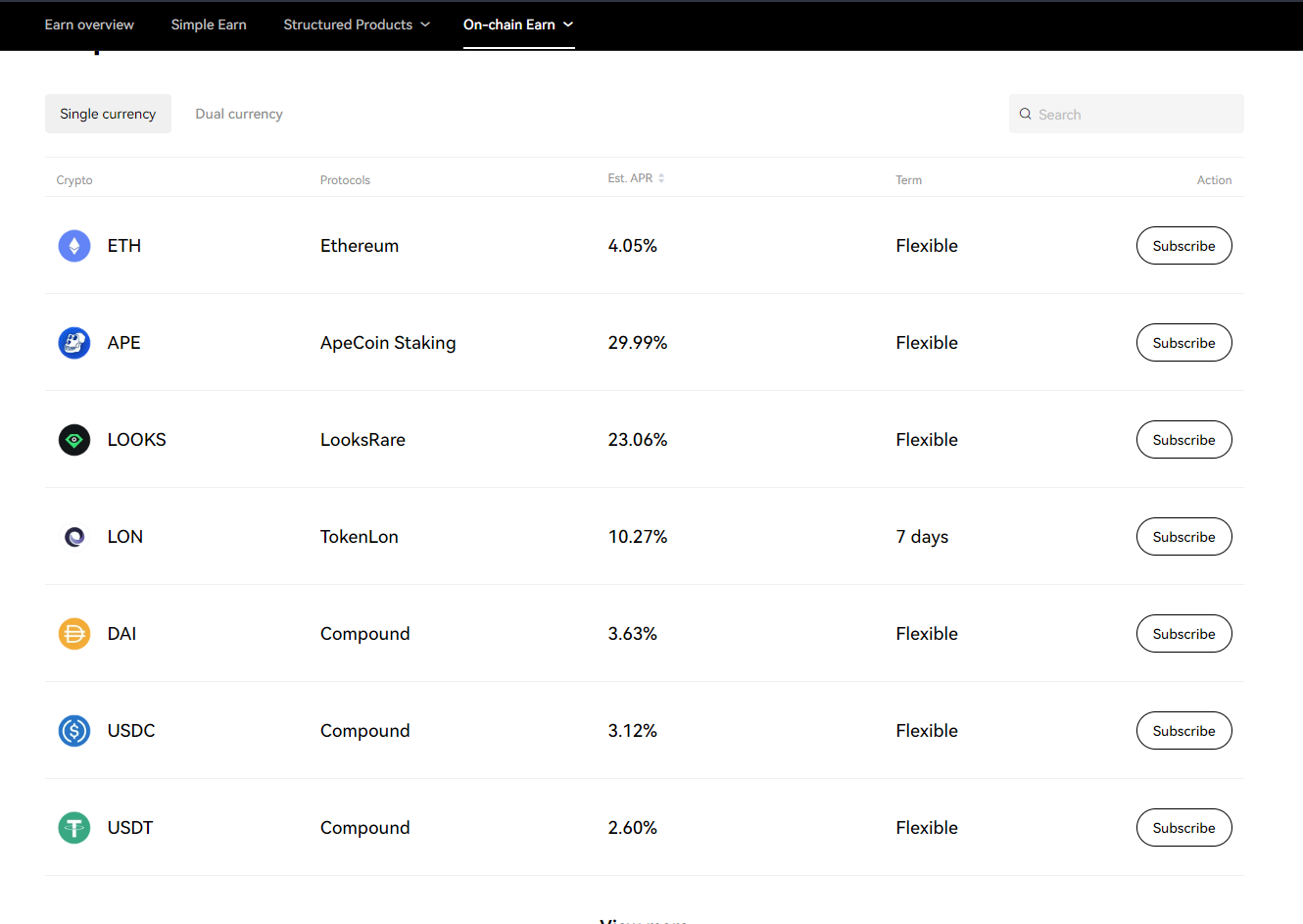

OKX Earn

For those who aren’t interested in regular trading and would like to earn some yield on your tokens, OKX Earn might be the place for you. OKX Earn allows you to stake or lend your tokens to others and get rewards for them. For more information about OKX Earn, check out our OKX Earn article where we cover the ins and outs.

The basics of OKX Earn are:

- Savings: Similar to a savings scheme in a bank with any-time withdrawals.

- Fixed Income: Higher interest than savings section but restricted to just USDT, BTC, ETH and OKB with fixed durations.

- Dual Investment: BTC, ETH and USDT only with a lock up period but there is a possibility of losing what you put in with high market volatility

- Shark Fin: Bet on the price of an asset at the end of a 7-day period. The more accurate your bet, the more yield you can receive.

- Staking: Staking pools are available with caps on how much can be staked and differing time lock durations.

- Flash Deals: The wild card, huge APY’s for low market cap coins – big risk, big reward.

DeFi - It's apparent that this section was created with new DeFi users in mind. Self-custodial wallets and several networks are typically required for any kind of interaction with a dApp, which can be a major hassle. By applying the same UI and feel as other OKX products to the dApps, OKX was able to incorporate them into their platform. It looks just like an OKX product to the uninitiated, drastically lowering the entry barrier and satisfying the curious.

The categories for the dApps on the OKX platform are Yield, Lending Pools, Decentralised Exchange with Sushiswap, and Staking.

DeFi on OKX Earn. Image via OKX

DeFi on OKX Earn. Image via OKXOKX Jumpstart

New projects are hand-selected by the OKX team to be displayed in this section and are waiting to be discovered (to become the next 100x token). Joining the party involves staking the platform's OKB token in order to receive the new project's token, pro-rated to their staked amount, similar to how other platforms of a similar nature operate on Binance and KuCoin. The most successful blockchain featured on OKX to date is Raydium on the Solana network.

Jumpstart. Image via OKX

Jumpstart. Image via OKXOKX vs SwissBorg : Conclusion

As previously said, this comparison is not quite apples to apples because these two platforms cater to traders with different interests. For people who are more interested in the crypto world and have a good knowledge of Web3, DeFi, and advanced trading strategies, OKX is a fantastic choice. SwissBorg is designed for ease of use, perfect for beginners and anyone interested in taking a more investing and portfolio management approach with their digital assets. If you're new to crypto and just want some simple buy and sell functions with basic portfolio tracking, SwissBorg is probably the better option for you. Feel free to select the one that best suits your needs based on where your starting point is.