As crypto users and traders ourselves here at the Coin Bureau, we know what a difficult and time-consuming task it can be to spend hours scouring through the hundreds of exchanges, looking for the perfect one to match our needs.

Let’s face it, not all crypto exchanges are created equal, and different crypto trading platforms have strengths and weaknesses in different areas.

One of the ways that we aim to help our community is by doing the research and testing of dozens of different exchanges to streamline the process to help fellow crypto enthusiasts find which exchange is best to suit their individual needs.

As you are on a journey to find the perfect crypto exchange, you may find this article useful:

Best Cryptocurrency Exchanges 2024

We also have in-depth dedicated reviews for both of the exchanges in this article if you want to learn more about them:

For our US-based readers, I recommend checking out our Kraken Review.

In today’s article, we will be doing a head-to-head comparison between SwissBorg, one of the most well-respected and innovative crypto investment platforms, vs. Bybit, one of the top crypto exchanges for active trading.

Today’s article is an interesting one as these two exchanges could not be more different to one another, both being quite dominant in their respective specialities. This SwissBorg vs. Bybit review will help you determine if you should sign up for Bybit and find out what makes this a popular trading hub for serious traders, or SwissBorg, and see for yourself what makes them the king of crypto wealth management solutions.

Note: Users located in the US and UK are not supported.

SwissBorg vs Bybit:

Further in this article, we will take a closer look at each exchange individually, but first, we want to give you an overview of our findings by comparing SwissBorg vs. Bybit.

To start, one notable major difference between these two is the regulatory and licensing framework. SwissBorg is licensed and regulated in multiple respectable jurisdictions, providing users with an additional level of safety and protection. SwissBorg is highly respected within the industry for its trustworthiness, transparency, and the contributions its leadership team makes to the crypto industry.

Bybit holds licenses and regulations in Cyprus and Dubai, with a fantastic reputation among serious crypto traders and is also highly trusted within the crypto industry. Bybit is one of the most solid and dependable crypto exchanges offering advanced trading features, trading contests, and a good selection of crypto-centric products.

SwissBorg vs Bybit: Products Offered

As I mentioned in the intro, these two platforms offer substantially different products and cater to very different user bases. To save you some time and sum up the key differences between these two, Bybit will be the obvious choice for anyone who is seeking to actively day trade crypto assets.

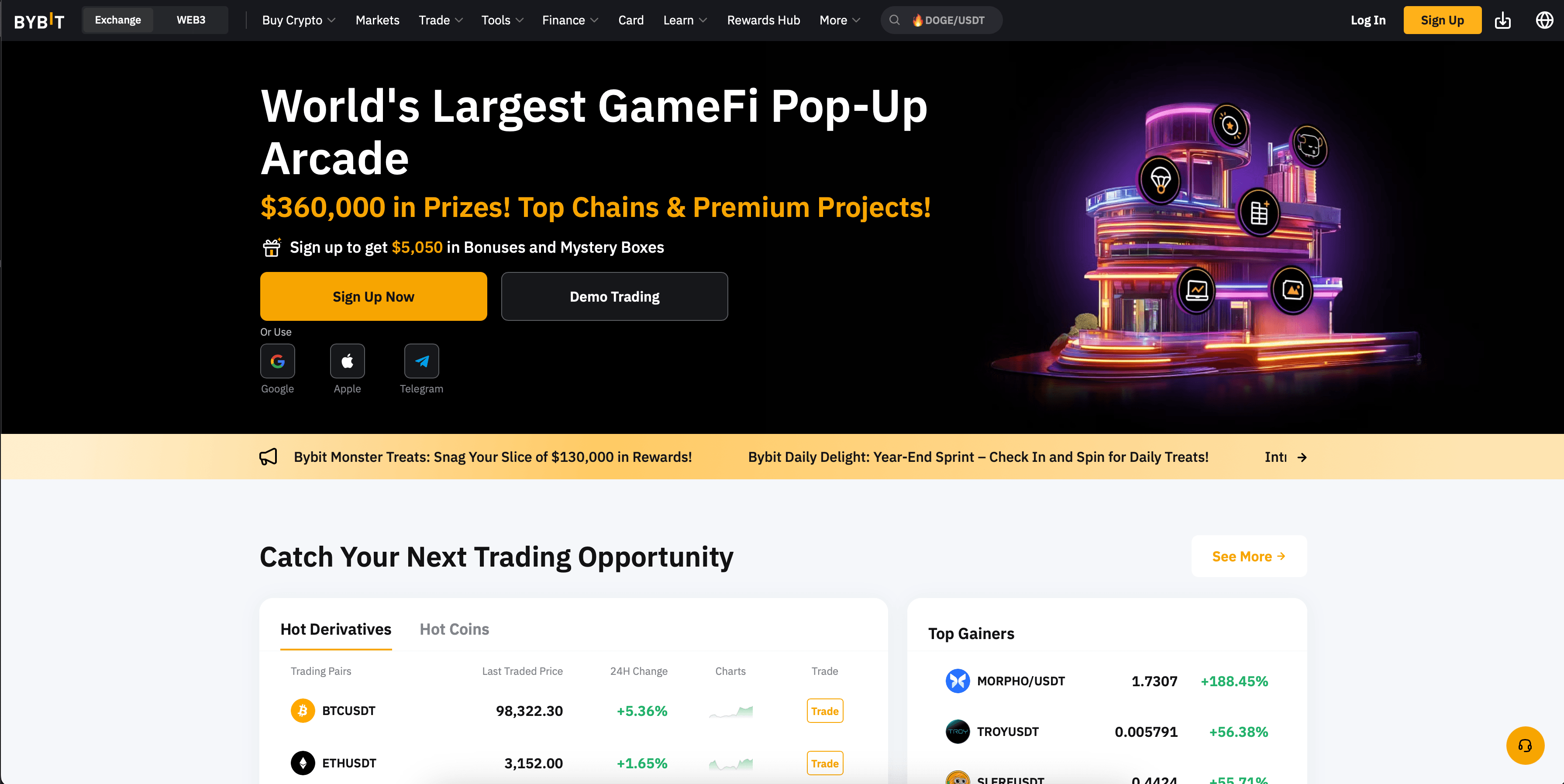

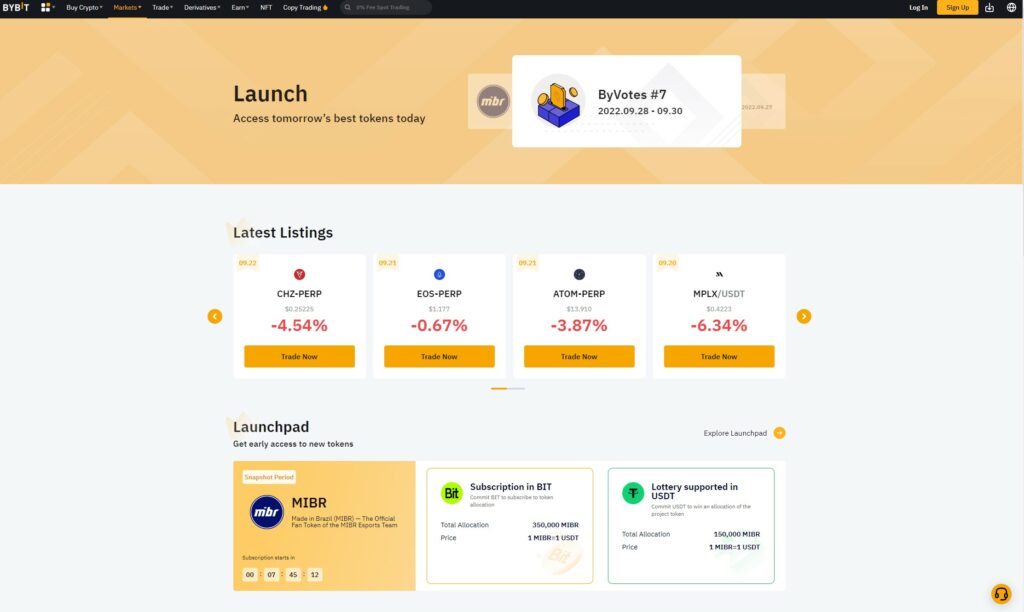

Bybit is one of the top 5 crypto trading exchanges in the world for derivatives trading and offers a professional-grade trading platform with an extensive selection of tradeable spot and derivatives products and margin. Bybit also features a launchpad, NFT marketplace, some of the best trading competitions around, and has become one of the leading platforms for copy trading and trading competitions.

A Look at the Bybit Homepage

A Look at the Bybit Homepage Changing focus now, SwissBorg has an excellent reputation as one of the most secure crypto wealth management platforms in the world and should be a top consideration for any crypto investors looking to hodl and do more than just trade.

SwissBorg offers unique and powerful crypto wealth management products that cannot be found anywhere else and has become one of the best places to earn attractive APYs on crypto. SwissBorg also has one of the highest-rated, award-winning mobile apps and is often praised for being incredibly user-friendly with a best-in-class UI/UX.

A Look at the SwissBorg Homepage

A Look at the SwissBorg Homepage It is common for users to have an account on both platforms, and use an exchange like Bybit or Binance to buy crypto, perform their trading, and access the site features, then also have an account at SwissBorg to take advantage of their leading wealth management and earn products.

👉 Sign up to Bybit and receive up to $50k in bonuses!

Both platforms can be used for trading, with Bybit providing a considerably more powerful and advanced trading interface for serious and professional traders, while SwissBorg focused more on being user-friendly, and is, in fact, one of the easiest platforms to trade crypto with the click of a button.

👉 Sign up to SwissBorg and get up to €100 Free!

Here is a look at what Bybit offers its traders:

- Up to 100x leverage

- VIP, broker, and Affiliate programs

- Ability to buy crypto via card or bank transfer

- DAO participation

- Leveraged tokens

- Trading bots

- Launchpad

- Spot + Derivatives trading

- Fiat on and off-ramp services

- Advanced analytics and educational section

- Copy trading

- Earn

- Rewards hub and trading contests

- NFT marketplace

Here is what SwissBorg brings to the table:

- Buy crypto with over 15 fiat currencies

- Cash-out with fiat withdrawals

- Very beginner/user-friendly interface

- Award-winning crypto app

- Some of the highest APYs in the industry

- Suitable investment products for varying levels of risk tolerance

- Easy access to DeFi protocols without the complexities of DeFi navigation

- Smart Yield Accounts

- Thematics- Crypto portfolio bundles

- SwissBorg Earn

- Smart Engine aggregator for low-fee and efficient token swaps

- SwissBorg Rewards Program

- AI portfolio analytics

- Safety + Security with comprehensive licensing and regulatory compliance

After using both platforms myself and being a fan of SwissBorg for years, I can confidently say that both platforms are operating at a top level, both providing an enjoyable user experience.

Both SwissBorg and Bybit traders enjoy flawless, lightning-fast trade execution and low fees. The trading interface on Bybit is suitable for the most demanding traders while the investment products on SwissBorg are suitable for beginner and sophisticated investors.

Alright, and that covers the key features at a glance. Now we will get into the other ways these two stack up.

Bybit vs SwissBorg: User Friendliness

In case the above section didn’t already give it away, SwissBorg is one of the most user and beginner-friendly crypto exchanges around and is a clear winner in this category.

Though that is not to say that there is anything wrong with the Bybit platform as they chose to cater to more advanced and experienced crypto traders who know their way around a crypto platform, they simply targeted a different demographic of crypto user.

SwissBorg will be well suited to beginners and those looking for a simple crypto platform. The app really is so clean and easy to use, I feel like I could nearly navigate it with my eyes closed, though advanced crypto traders needing more robust order types and charting capabilities will find SwissBorg lacking.

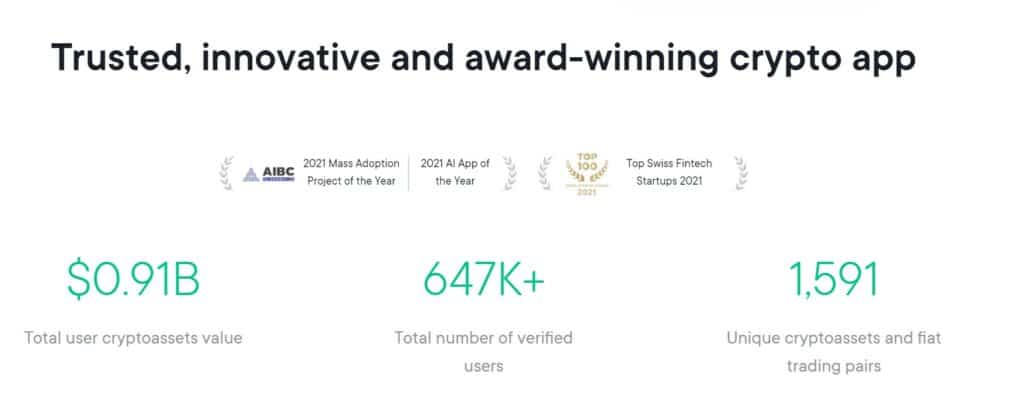

SwissBorg adopted a mobile app first approach, with the time, energy, and effort they put into the design of the app clear as it is a community favourite and won SwissBorg the Top Swiss Fintech Startup award and the Mass Adoption Project of the year award in 2021.

Some Impressive Accolades. Image via SwissBorg

Some Impressive Accolades. Image via SwissBorgThe SwissBorg team did a great job designing the app with different areas that users can navigate to, ensuring the interface is always uncluttered and each section of the app serves its purpose. It has become common for many crypto apps to try and feature a massive selection of products and features on one screen, resulting in a cluttered and less streamlined experience.

A Look at SwissBorg's Sleek Interface. Image via SwissBorg

A Look at SwissBorg's Sleek Interface. Image via SwissBorg After using SwissBorg for over a year myself, I cannot really come up with anything negative to say about the platform at all. It always works exactly as intended, trading is easy, accessing all the distinct features is straightforward and I really enjoy the extra insights and analytics that can be utilised when looking at crypto projects. It is a seriously powerful little app.

Turning our attention to Bybit, while new users may stumble a bit understanding the concepts and navigation of the platform, the Bybit team did a good job making a feature-packed, advanced platform as user-friendly as possible.

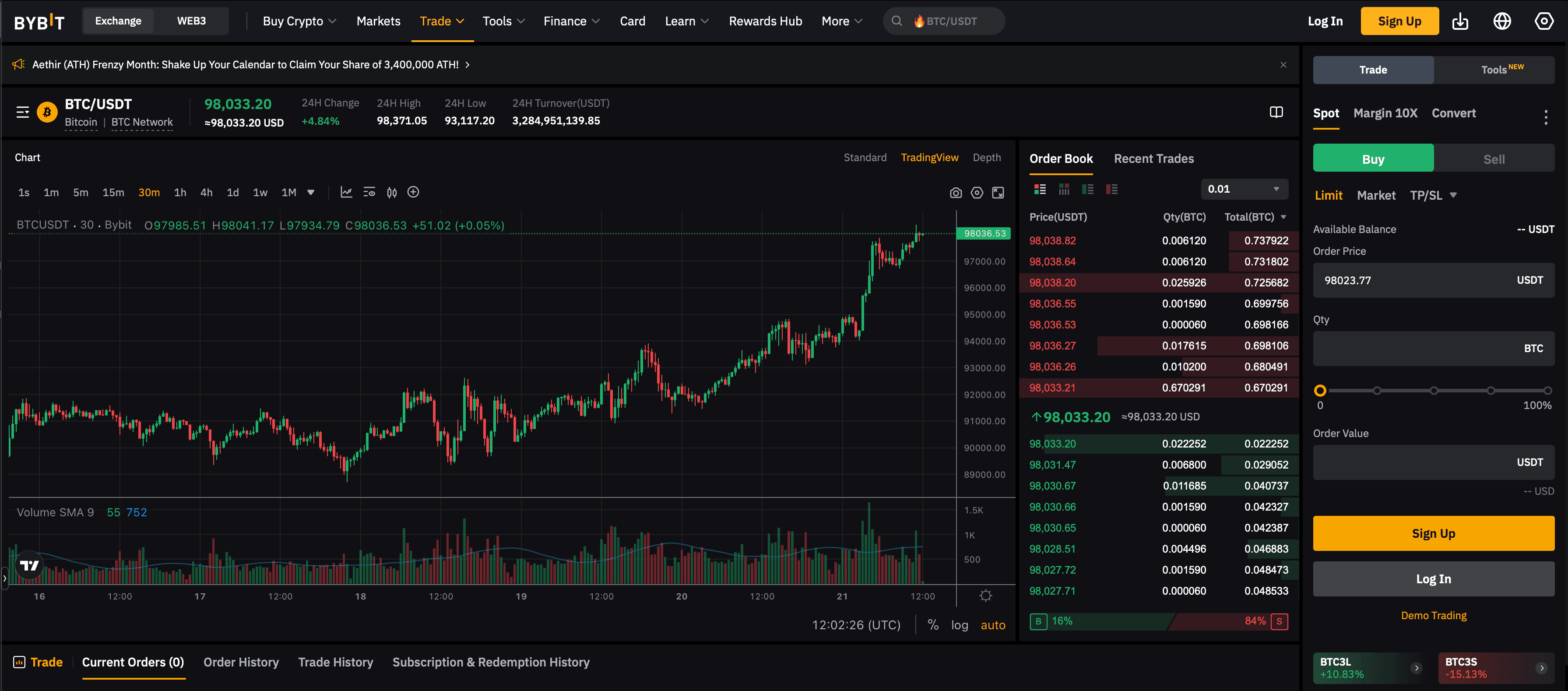

Bybit prides itself on having a best-in-class trading interface and uses sophisticated technology to fuel its powerful matching and trading engine to ensure a flawless trading experience.

The high-performance trading experience on Bybit has attracted over 10 million users to the platform, including professional and institutional traders, and their fantastic educational section and demo practice accounts make it an excellent platform for those looking to learn how to trade.

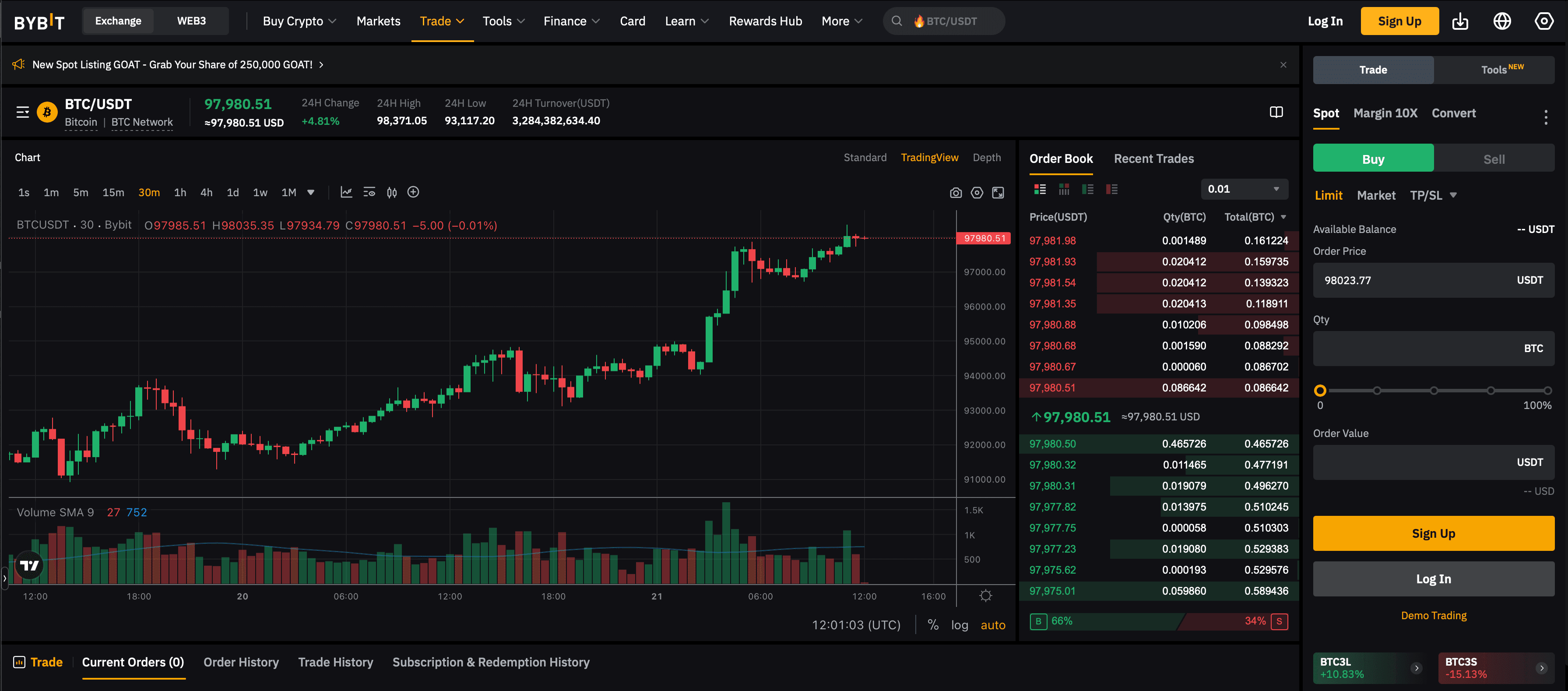

Here is a look at the Bybit trading interface:

A Look at Bybit’s trading screen

A Look at Bybit’s trading screen Bybit uses TradingView for its charting capabilities, leading to it being suitable for the most hardcore technical analysis traders while also being able to accommodate those with simpler trading needs.

Users who have no interest in charting can also access Bybit’s “Once-Click Buy” feature:

The Easiest Way to Buy Crypto on Bybit

The Easiest Way to Buy Crypto on Bybit Though be careful with these “one-click” buy, swap, and convert features that are convenient and common on most crypto exchanges, as they can often come with significantly higher fees than using the trading interface.

Learning how to navigate crypto platforms and use the trading interface will be a tremendous benefit to you as you may save a substantial amount on fees over time. Even at the most basic level and simply hitting the “buy” and “sell” buttons on the trading interfaces will not only save you money on fees, but can also help you get in and out of the markets at better prices by using things like limit orders.

If you want to learn the basics of trading, Guy put together this great three-part trading series, I will link the first part below:

To sum up this section, if you are looking to actively trade, it is tough to beat Bybit. It really provides one of the best places for serious traders and has one of the best copy-trading platforms I’ve come across. You can learn more about Copy Trading in our Bybit Copy Trading Review.

Crypto users who are interested in the easiest way to trade and who want to access the most cutting-edge and innovative crypto investment products will definitely want to check out SwissBorg. There are no platforms out there that I know of providing the same level of service and quality products.

SwissBorg vs Bybit: Fees

Fees have become very competitive in the crypto exchange industry, with exchanges like Binance, OKX, and KuCoin being the leaders in the space offering the lowest fees.

Though neither Bybit nor SwissBorg take the gold in having the lowest fees in the industry, their fees certainly aren’t high by any stretch of the imagination.

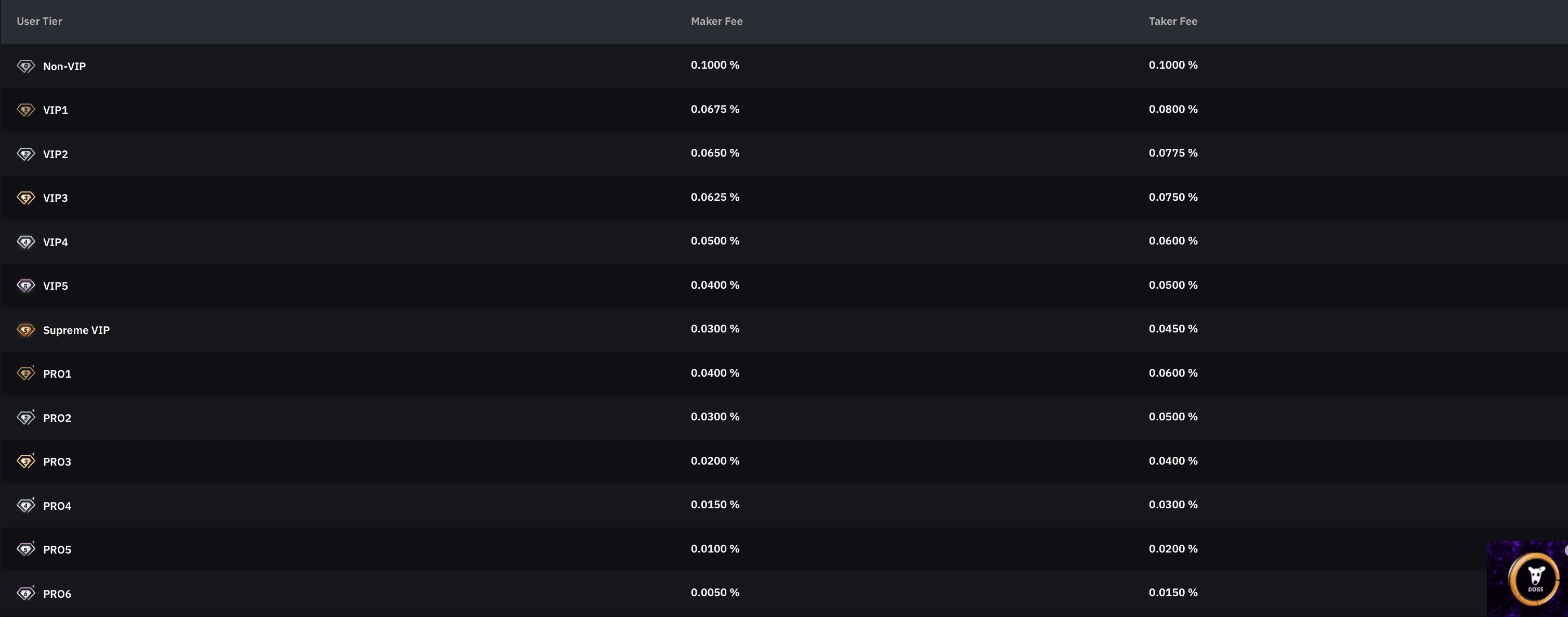

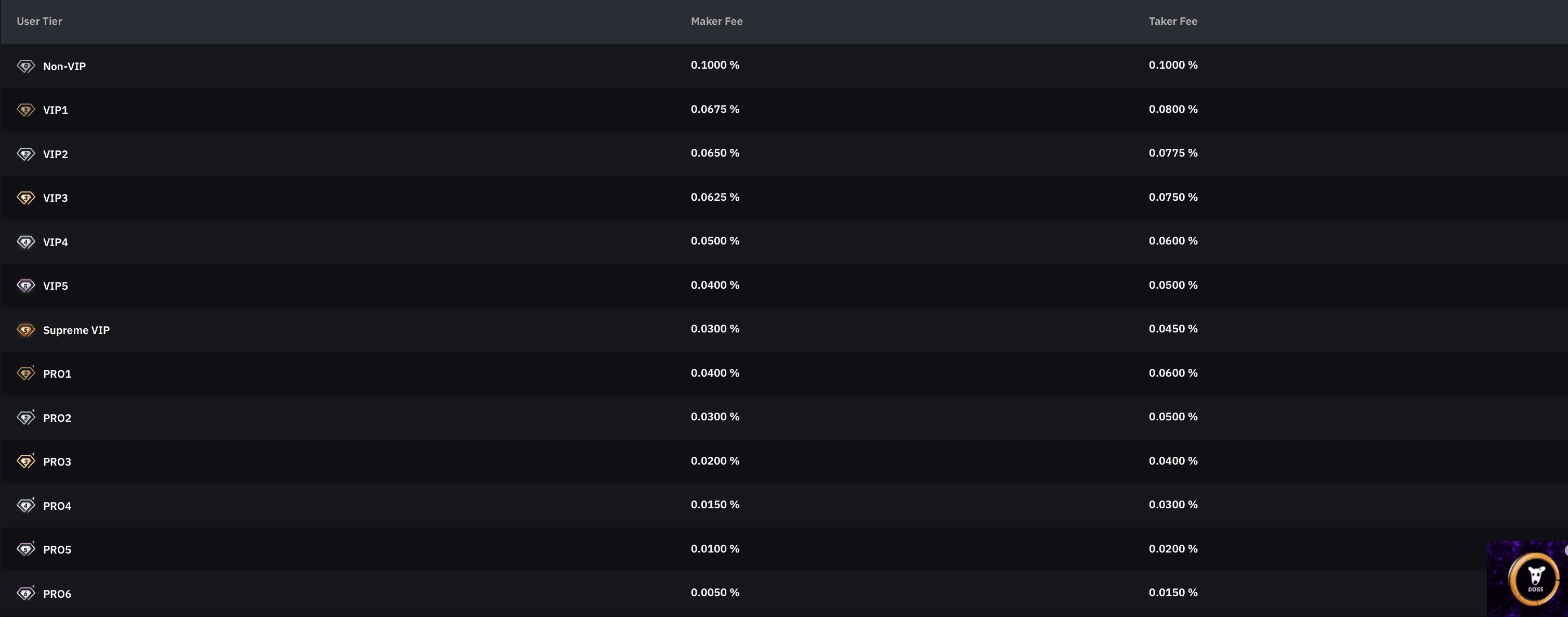

Here are the trading fees users can expect to pay on Bybit:

- Spot trading fees:

Spot Trading Fees on Bybit. Image via Bybit

Spot Trading Fees on Bybit. Image via Bybit

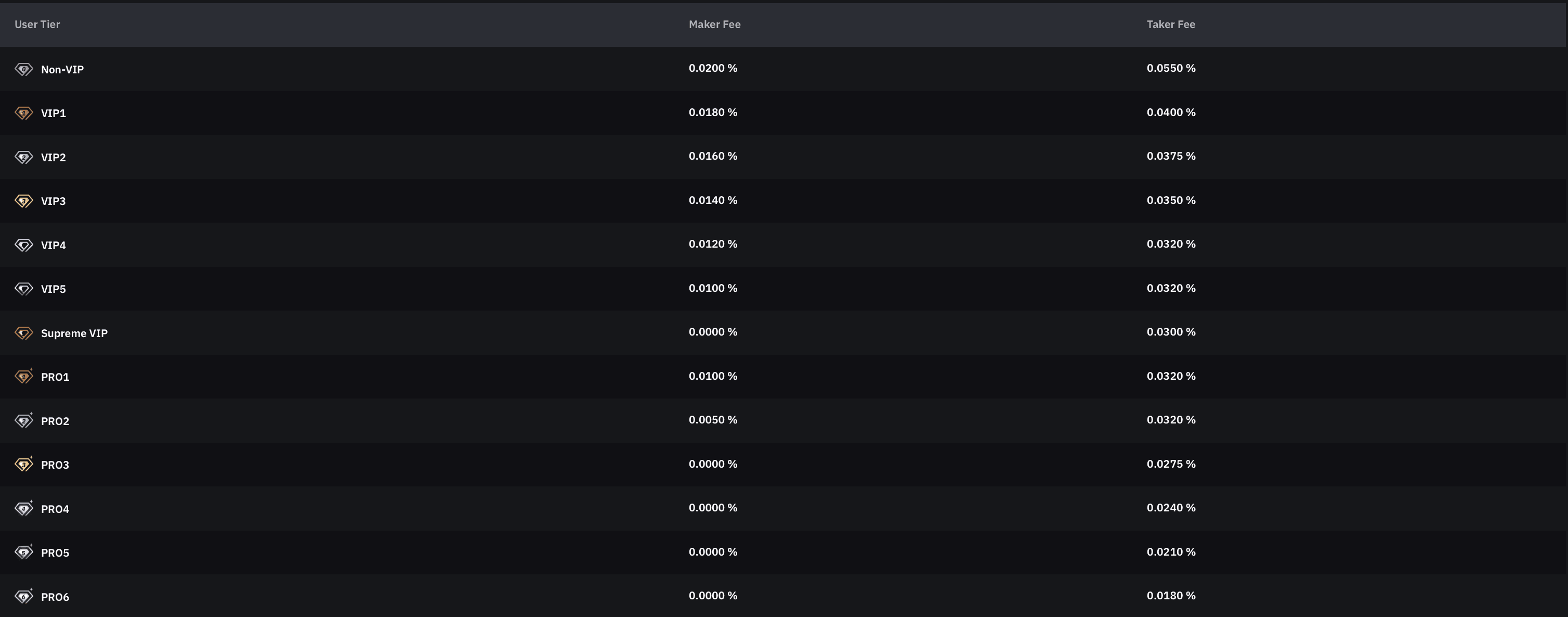

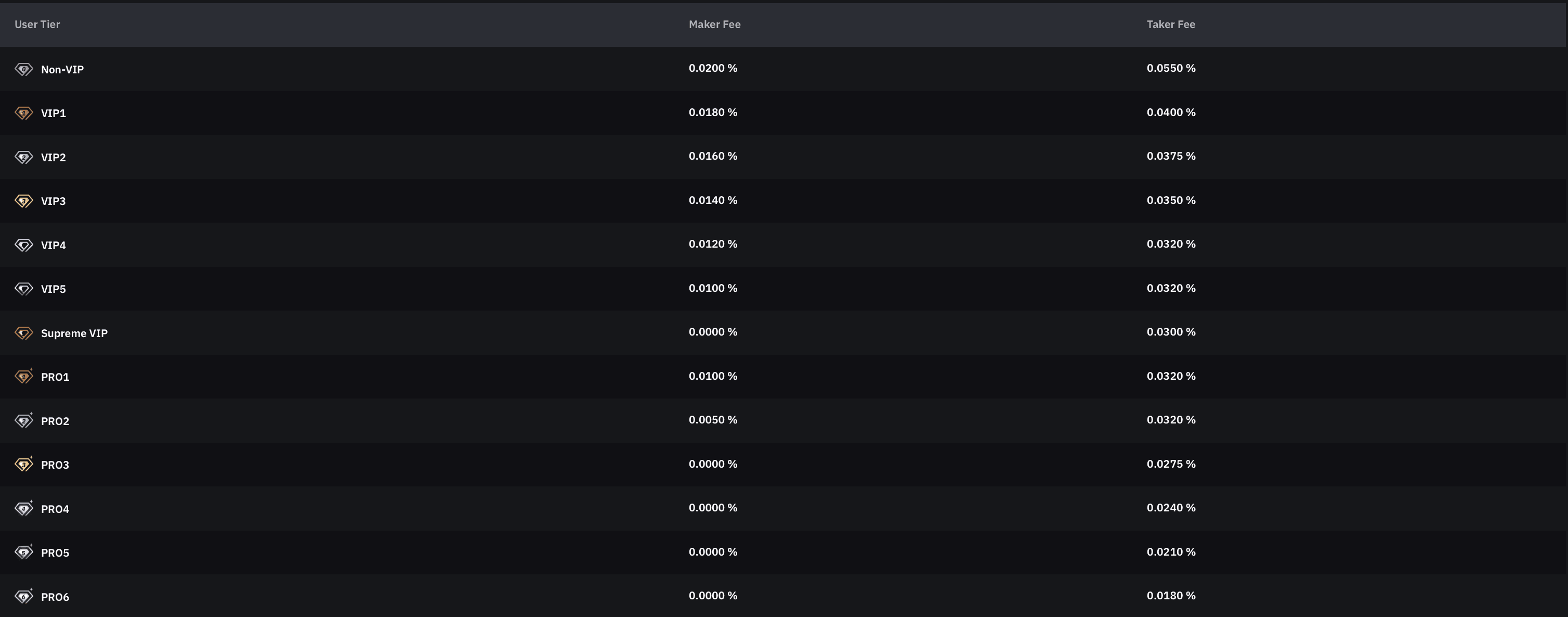

- Perpetual & futures trading fees:

Perpetual & Futures Trading Fees. Image via Bybit

Perpetual & Futures Trading Fees. Image via BybitLike most exchanges, Bybit uses the standard Maker/Taker fee model with fees depending on a 30-day rolling trading volume.

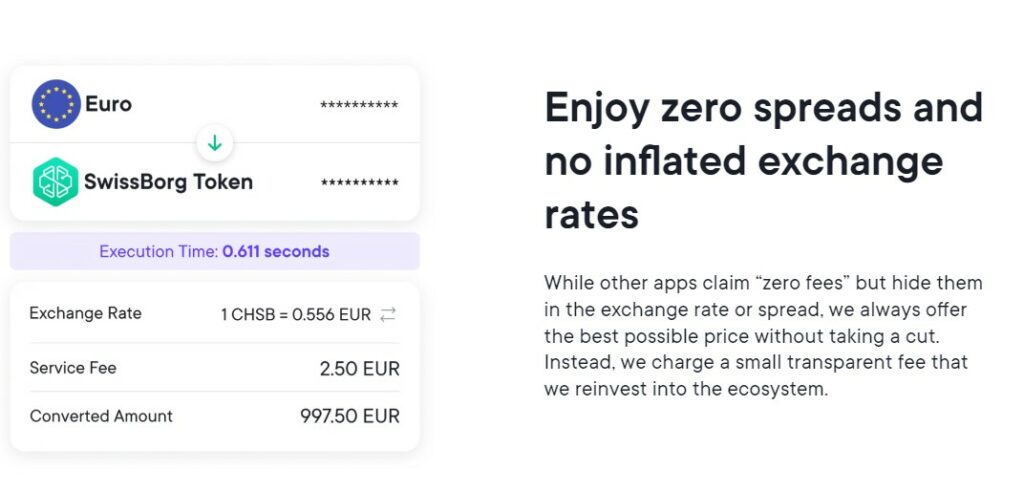

SwissBorg prides itself on transparency and not hitting users with hidden fees and marked-up spreads after they agree on an exchange rate, which is a common complaint from users of many other platforms.

SwissBorg users enjoy zero spreads and through a handy aggregator that pulls exchange rates from many of the top exchanges, traders on SwissBorg can be confident that they are always getting the lowest exchange rate.

Image via SwissBorg

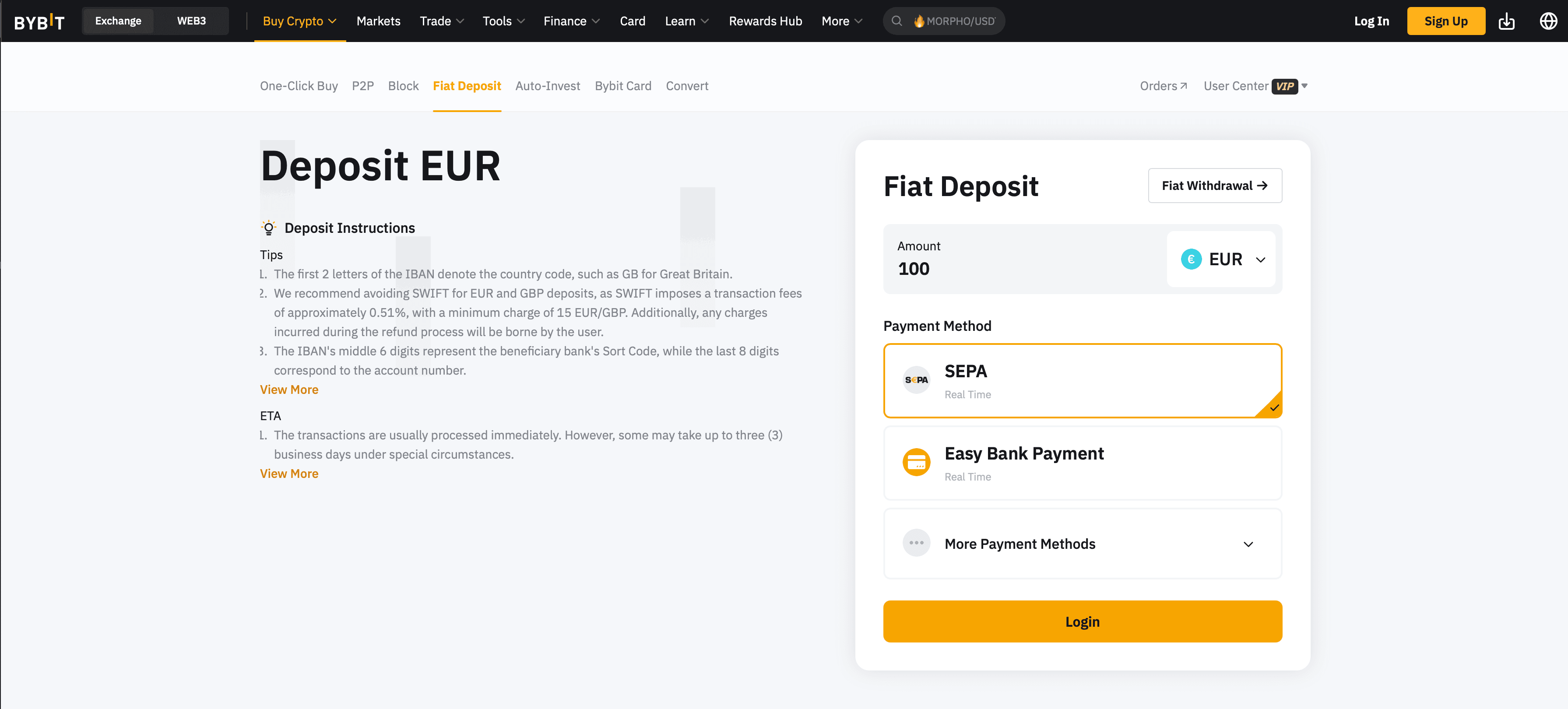

Image via SwissBorgUsers can deposit crypto on SwissBorg and Bybit without fees, and withdrawals are subject to industry-standard network fees.

Fiat withdrawals on SwissBorg also vary depending on the currency and method being used, and then SwissBorg charges an additional 0.1% execution fee on withdrawals. You can find a detailed breakdown on the SwissBorg Fees Page.

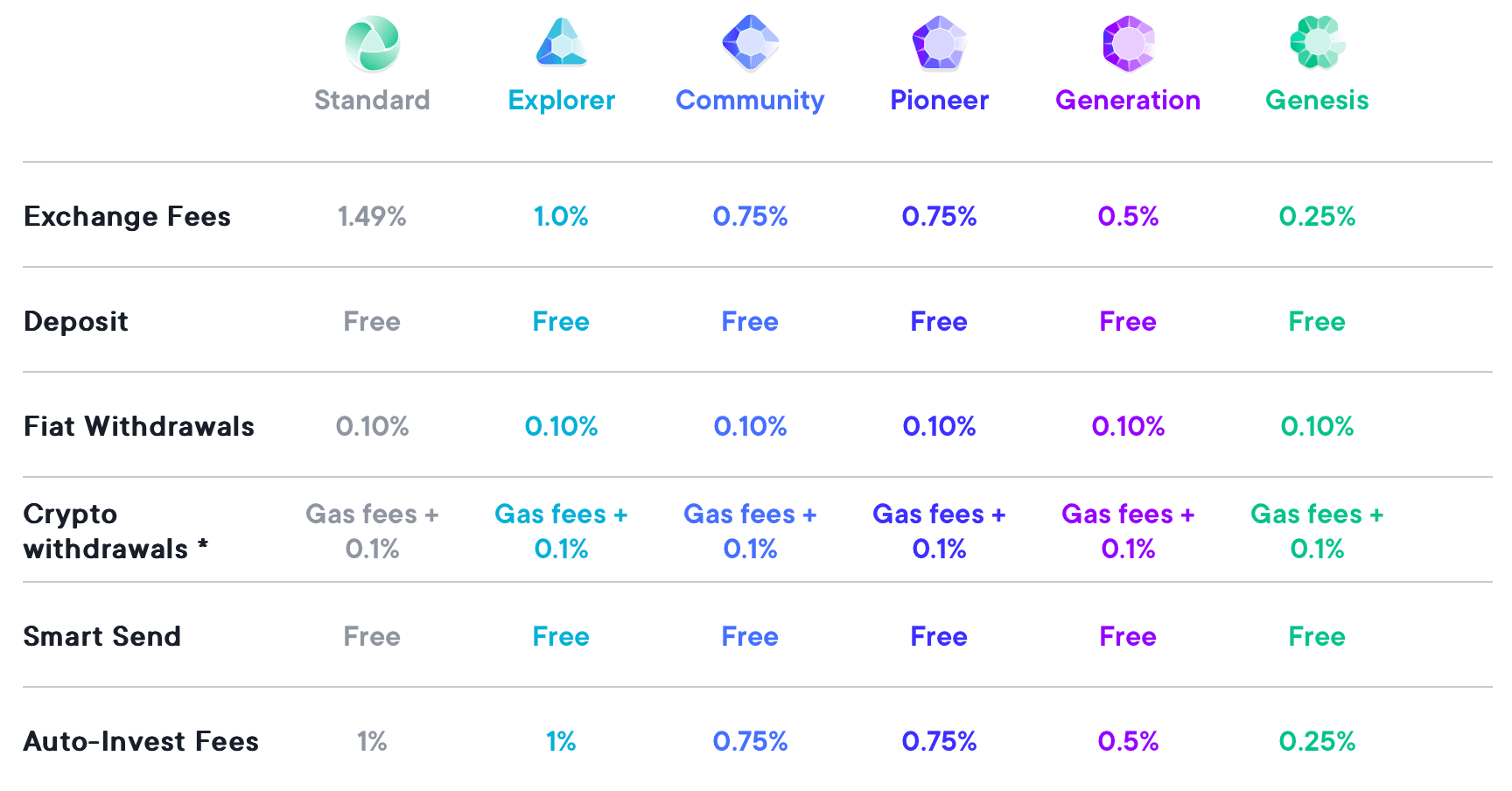

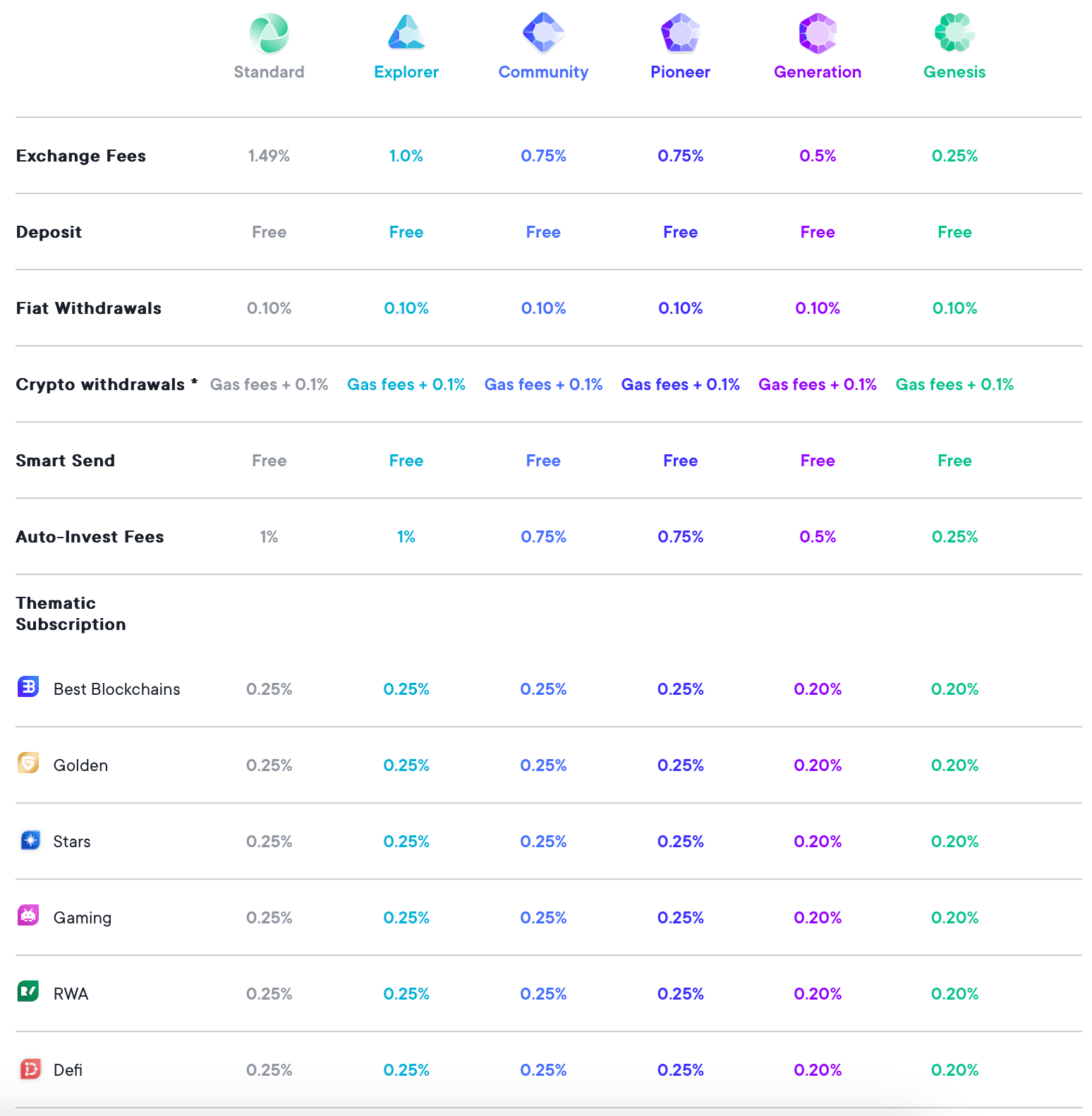

As for exchange fees on SwissBorg, users will fall under a certain loyalty tier depending on how many SwissBorg Tokens they hold, you can see the various levels and benefits below:

Image via SwissBorg

Image via SwissBorgTo summarise this section, SwissBorg does not have the lowest trading fees. Active traders will want to stick to an exchange that specialises in trading like Bybit, OKX, KuCoin, or Binance to save the most on trading and exchange fees.

Buying crypto is cheaper on SwissBorg on average as they support fiat bank deposits. Bybit has recently announced fee-free SEPA bank transfers, which is great if you can take advantage of that, but in most cases, SwissBorg is the better platform for buying crypto out of these two.

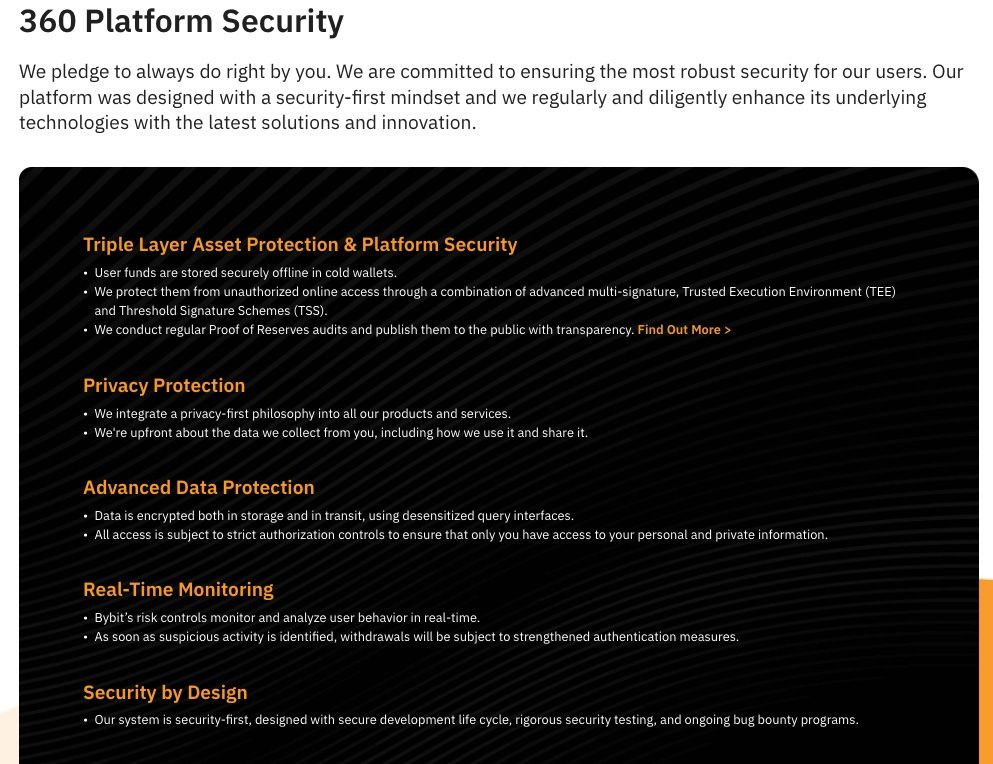

Bybit vs SwissBorg: Security

Now onto the ever-important topic of security. This is an important consideration because it doesn’t matter if you are using the best exchange in the world, if the exchange gets hacked and all your funds get stolen…Well, nothing else about the exchange really pertains to you once you’ve got no crypto left to use it.

Crypto exchange security is something I place a strong emphasis on when conducting these reviews, and while I try to remain as neutral as possible, I can't tiptoe around the fact that SwissBorg takes the win in this category. Thanks to their use of MPC technology and their approach to safety and regulatory adherence, SwissBorg is among the most trustworthy exchanges in the industry.

That doesn’t mean that Bybit lacks security, in fact, independent audit company Certified ranks Bybit as a top ten secure exchange with a triple-A security rating. Quite impressive. Bybit takes the #1 most important step in crypto security, and that is that they keep the majority of funds in cold storage wallets and out of the reach of hackers.

Image via Bybit

Image via BybitBybit also implements multi-signature authorisation requirements for withdrawals and the movement of funds on the platform to prevent internal bad actors from making off with funds.

From a customer point of view, Bybit offers its users the following security features:

- 2FA

- Real-time platform security monitoring

- Encrypted Data transmissions

- Security notifications

- Biometric login for mobile app

Investigating SwissBorg’s security, not only are they licensed and regulated in multiple jurisdictions including Switzerland, but they have also gone beyond industry best practices, elevating their security to the next level.

While I did mention that SwissBorg is a bit high when it comes to fees, I should point out that they reinvest a considerable amount of their profits back into their security; a good use of profits anyone would argue. I am happy paying a bit more in fees if it means I can rest easy knowing my funds are safe.

SwissBorg Has Been Found to Be Highly Secure During Third-Party Penetration Tests. Image via SwissBorg Blog

SwissBorg Has Been Found to Be Highly Secure During Third-Party Penetration Tests. Image via SwissBorg BlogSwissBorg utilises Multi-Party Computation (MPC) keyless technology and performs periodic stress tests, even creating advanced security software to ensure the safety of the platform and user funds.

MPC technology is often considered a secure alternative to traditional private keys as it does not require keys to be created that the user can lose or forget, and there is no single point of failure should the private key become compromised. Users who prefer that method can also create private keys if they choose.

Furthermore, SwissBorg has formed a partnership with Fireblocks, a crypto-security firm that is widely respected within the industry for their security solutions. Fireblocks handles the security for many crypto platforms and uses multi-party computation technology to secure digital assets. SwissBorg has never experienced a known security breach and has insurance in place for users in the higher-tiered memberships in the unlikely event of a successful hack.

Great, now that we have covered a bit of head-to-head, let’s dive into each one a little more in detail.

Bybit Overview

What is Bybit?

Bybit is a cryptocurrency spot and derivatives trading exchange that offers numerous products and features outside of simple trading, such as Earn, Launchpad, Copy Trading, and more. The professional-grade trading platform along with an impressive selection of features and products has turned Bybit into a popular crypto hub. This highly rated crypto exchange recently celebrated hitting the 10 million traders milestone and has been one of the fastest-growing crypto exchanges since its launch in 2018.

This crypto exchange has had a very impressive growth trajectory thanks to its incredibly powerful and seamless trading and matching engine and effective marketing campaigns. Bybit also offers some of the best trading competitions and sign-up bonuses, which have been attracting new users in droves to the platform.

Bybit has become a trading oasis for traders from all walks of life from amateur to professional, and even institutions have jumped on the Bybit ship as it offers a second-to-none trading platform every bit as effective as the top-rated exchanges like OKX and Binance.

Currently looking to become a top ten exchange in terms of spot trading volume, Bybit is quickly moving up in the ranks and is on the doorstep of breaking into the highly competitive world of the top 10 exchanges, an impressive feat that is a testament to what a top-notch crypto trading exchange it is. Bybit has already secured itself as one of the top 5 crypto exchanges for derivatives trading.

Bybit is highly respected and has a fantastic reputation within the crypto community thanks to their continuous and selfless efforts to advance and benefit the entire industry with their Bybit educational academy Bybit Learn, which is a fantastic resource for anyone looking to up their crypto knowledge.

Bybit also goes to great lengths to progress the entire crypto community by releasing fantastic reports regularly on the state of crypto and highlighting important developments in the industry. There are many comprehensive analytic reports and tools accessible to anyone on the Bybit platform.

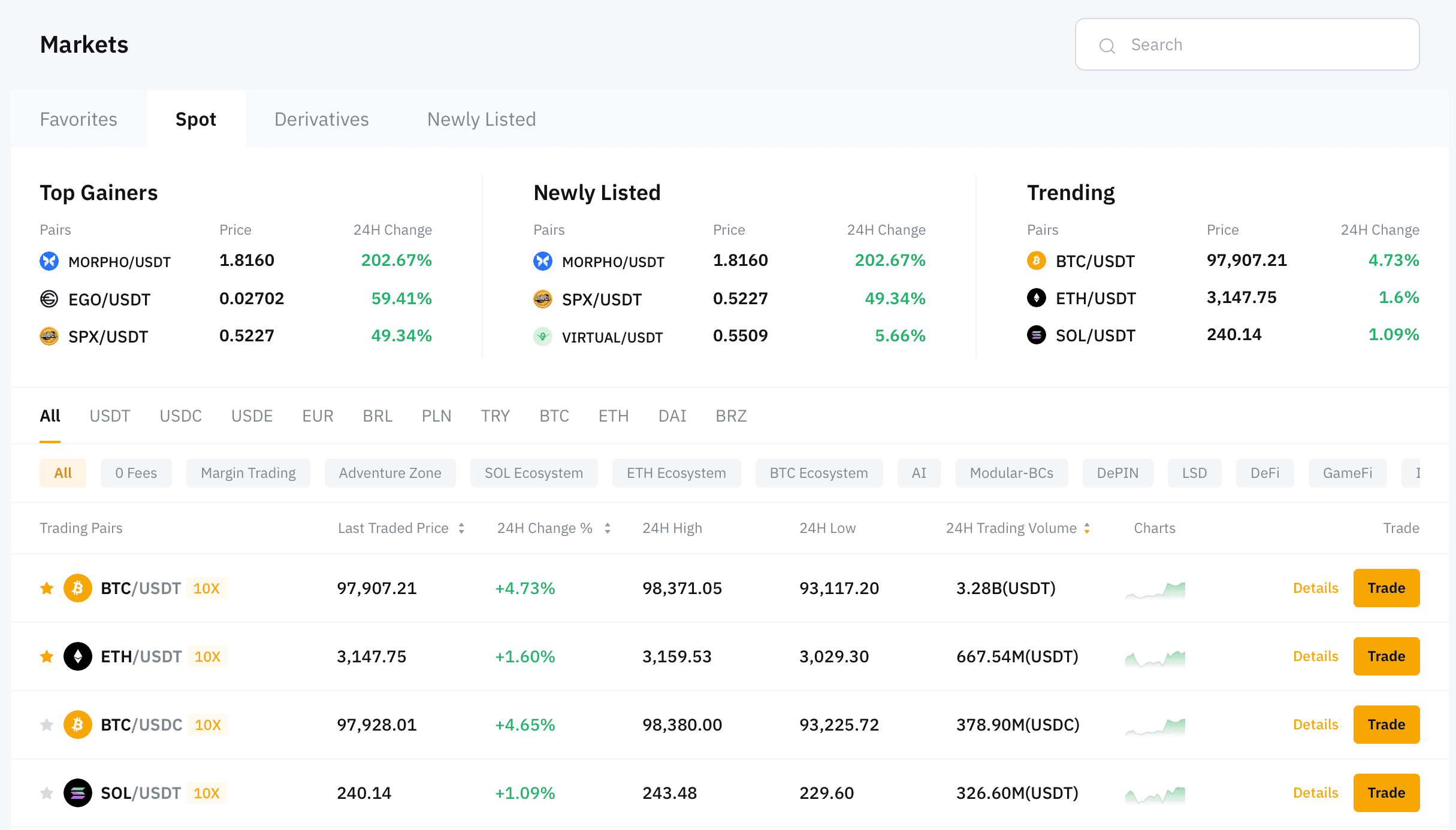

Cryptocurrencies Offered

Bybit has a respectable selection of over 600 crypto assets to trade on the spot market and nearly 300 derivatives products, one of the better selections among the crypto exchanges falling behind only to the likes of Binance, KuCoin and Gate.io.

A Look at Some of the Assets Available for Trading at Bybit

A Look at Some of the Assets Available for Trading at BybitBybit is also known for listing new project tokens earlier than much of the competition, benefitting Bybit users with first dibs on many early project tokens.

On Bybit, traders can access the most popular cryptocurrencies like Bitcoin and Ethereum, along with many of the smaller tokens like Tezos, Cardano, Polkadot and more.

Bybit Products

We cover Bybit’s products in more detail in our Bybit review, but here is a high-level overview of the most prominent features.

Trading Platform

As mentioned, the trading interface, matching and trading engine on Bybit are all the highest grade and quality, which is one reason Bybit has become such a powerhouse in professional trading circles. Bybit claims it can handle 100,000 transactions per second and takes lengthy measures to ensure there is no server downtime.

Bybit has proven over the years to provide a seamless trading experience, boasting a record of over 99% uptime. It is a great place to trade for traders looking for both simple and advanced order functionality and order types. Thanks to the Bybit academy and demo accounts, this is also a great platform for those looking to learn how to trade.

Spot trading interface on Bybit

Spot trading interface on BybitWith the TradingView integration, the charting functionality on Bybit can meet the needs of any style of trader, even the most hardcore technical analysis traders who like to use multiple indicators and charting setups. The trading interface also provides users with the ability to swap to a standard depth chart and customise their charting layouts.

Bybit is praised for providing a flawless trading experience. There isn’t anything negative to be pointed out here as I have encountered no issues with the platform myself, nor have read or heard of any glaring issues regarding trading functionality.

Bybit Leveraged Tokens

Similar to the leveraged products found on Binance and KuCoin, Bybit also offers leveraged tokens for trading.

Leveraged tokens provide traders with responsible access to leverage, up to 5x, all without liquidation or margin risks. Leveraged tokens are a popular product that have become widely adopted among traders as they can be traded while avoiding the complexities of margin trading.

Bybit Launch

With many of the major exchanges featuring launchpads, Bybit was not about to miss out and also released Bybit Launch.

A Look at the Bybit Launchpad

A Look at the Bybit LaunchpadWhile Binance and KuCoin remain the leaders in the launchpad space, featuring the highest quality new projects, I was surprised to find that the Bybit launchpad is also quite active and popular, attracting deep-pocketed investors and high-quality projects. The future for Bybit looks bright and their launchpad is only getting better, attracting users and new projects alike.

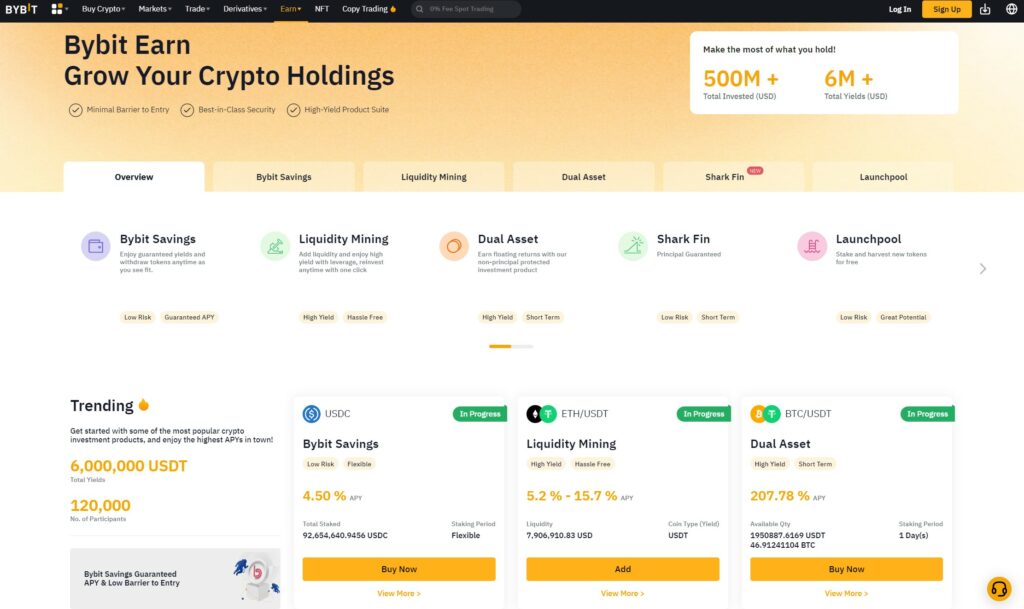

Bybit Earn

Bybit has one of the better Earn platforms outside of the top 5 exchanges, providing traders with multiple opportunities for passive income on their crypto holdings.

A Look at Bybit Earn

A Look at Bybit EarnThere are earn features available for flexible and fixed terms, along with high and low-risk Earn products suitable for crypto holders with different goals and risk appetites.

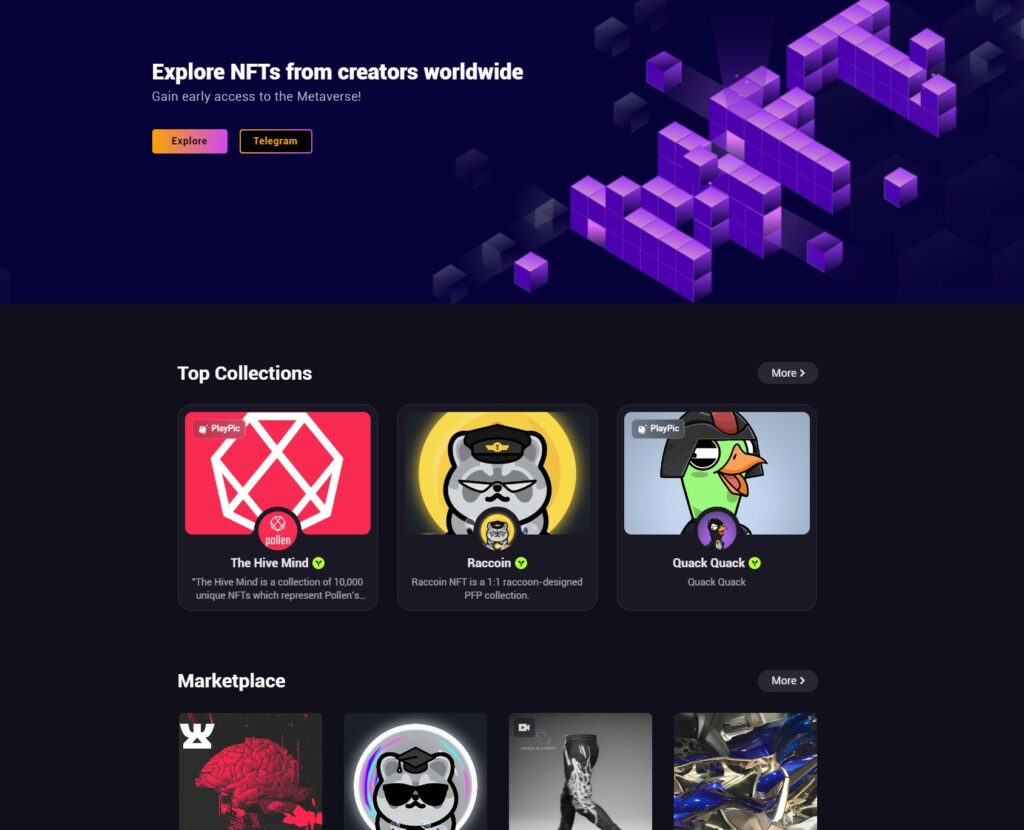

Bybit NFT Marketplace

Like many of the top exchanges, Bybit also offers a well-designed and easy-to-use NFT marketplace for users to buy and sell NFTs

The Bybit NFT Marketplace

The Bybit NFT MarketplaceThe NFT marketplace on Bybit is pretty good, one of the better ones I’ve seen outside of the top handful of exchanges. Users on Bybit can buy and sell NFTs with zero fees in the digital art, collectable, GameFi and Metaverse niches.

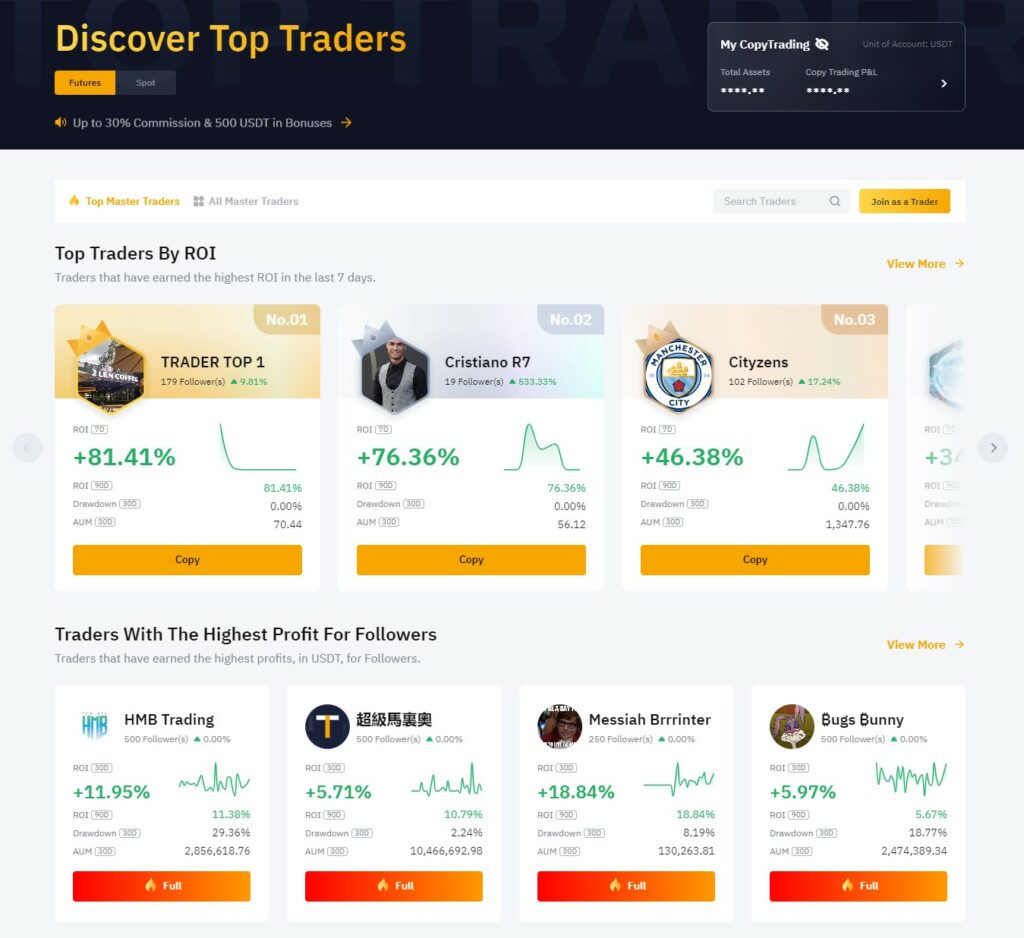

Bybit Copy Trading

Copy trading is one category where Bybit has become a powerful player in the industry. Copy trading became an instant success on Bybit and has attracted thousands of users to the platform, with the copy trading platform already seeing nearly 300k users

Image via Bybit

Image via BybitBecause Bybit is known for attracting professional and highly skilled traders, there is a great selection of traders for those looking to copy trades to choose from.

Traders on Bybit who allow their trades to be copied by the community get to enjoy 10% of the profits earned by each of their followers which can lead to highly lucrative trading activities. If you are interested in earning extra income by allowing others to copy your trades, or just looking for passive income opportunities by following other traders, Bybit is definitely a platform worth checking out.

Types of Accounts and Bybit Fees

Bybit offers only one main account type with a tiered fee structure similar to most other exchanges.

Alongside the main account, traders can open sub-accounts and there are also custodial trading sub-accounts for users who want to entrust their funds to a team of professional traders.

As far as fees go, Bybit fees follow the standard Maker/Taker model, meaning that they charge traders different fees for either adding liquidity to the books or taking it off the books.

Bybit’s tiered structure has the following fees:

Spot trading fees:

Spot Trading Fees on Bybit. Image via Bybit

Spot Trading Fees on Bybit. Image via BybitPerpetual & futures trading fees:

Perpetual & Futures Trading Fees. Image via Bybit

Perpetual & Futures Trading Fees. Image via BybitThe fees on Bybit are quite reasonable in terms of being easy on the bank account, but exchanges like KuCoin, Binance, and OKX still edge them out with slightly lower fees.

Bybit Security

Bybit utilizes cold storage solutions to protect customer funds via offline cold wallets that are secured in an air-gapped environment to reduce the likelihood of successful hack attempts. Funds also require multiple signatures from key staff members before they can be moved so one bad actor cannot run off with customers’ crypto.

A Look at Bybit's 360-Degree Security Approach. Image via Bybit

A Look at Bybit's 360-Degree Security Approach. Image via BybitThe website is also SSL encrypted and users can take advantage of 2FA and biometric login for the mobile app for added layers of security.

Great, that covers Bybit, now let’s crack into SwissBorg

SwissBorg Review

What is SwissBorg?

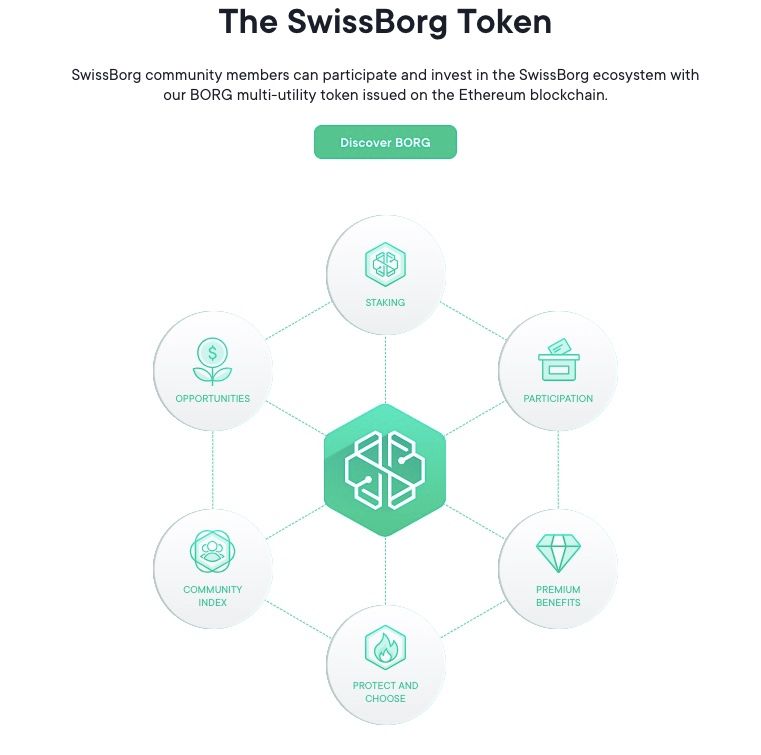

SwissBorg has made our list of the Top 5 Regulated Exchanges for crypto trading and investing. Founded in 2017 by Anthony Lesoismer and Cyrus Fazel in Switzerland, SwissBorg became one of the top European crypto exchanges in 2021 after raising an impressive $53 million to fund the project.

After their meteoric rise in popularity in 2021, SwissBorg achieved the coveted “Unicorn Status,” reaching the $1 Billion market cap milestone for their BORG token.

A Look at the BORG Token and SwissBorg Ecosystem

A Look at the BORG Token and SwissBorg EcosystemWith the headquarters still firmly planted in Switzerland, SwissBorg is one of the most widely used exchanges for European traders looking for a safe and reputable crypto exchange, thanks to its comprehensive regulatory and licensing framework.

Users from all over the world enjoy SwissBorg as more than just a crypto exchange, it is a blockchain-based wealth management platform for digital assets, offering unique investment products and ways to earn that cannot be found anywhere else.

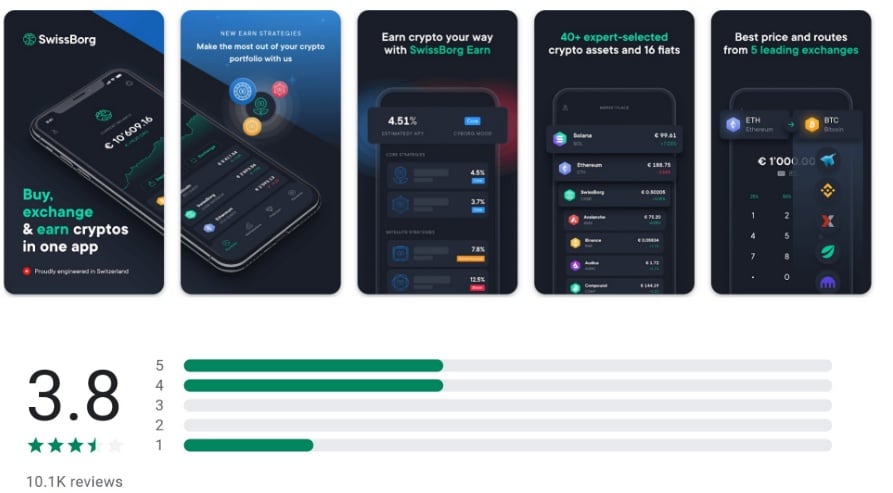

SwissBorg has won multiple awards both for their innovative app and revolutionary crypto-centric products. The SwissBorg app is available on both IOS and Android and has good ratings and reviews from the community.

Image via Google Playstore

Image via Google PlaystoreIn our SwissBorg review, I mention how using the app feels like having access to a portfolio manager and a financial advisor for crypto in the palm of your hand all without the need for meetings in stuffy bank rooms with stuffier bank advisors.

The SwissBorg team aims to simplify the process of investing in digital assets while removing some uncertainties by providing plenty of useful educational content, metrics, and indicators that help users understand and navigate the world of crypto.

This great platform is available in over 115 countries, with a notable exclusion being the United States. You can find which countries are supported by visiting the Swissborg Supported Countries page.

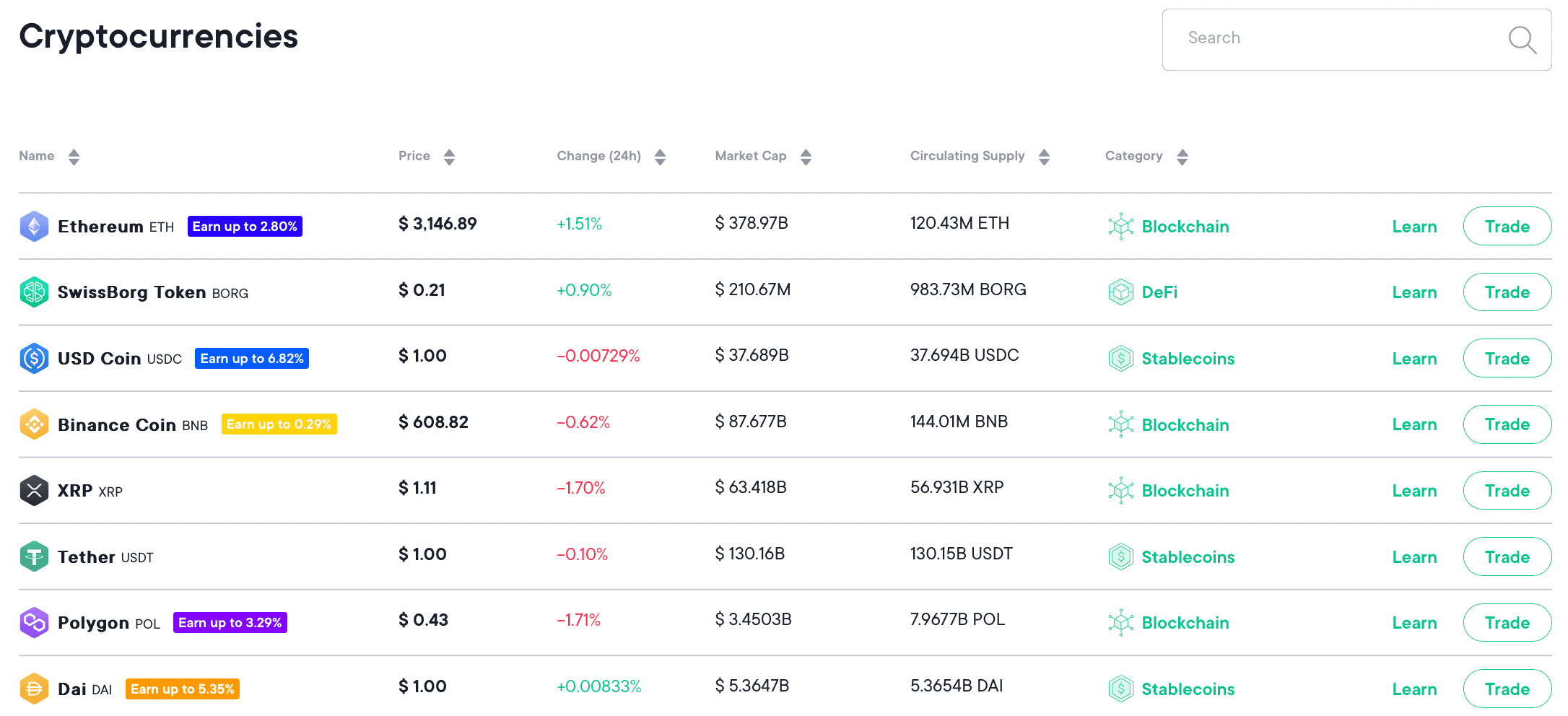

Cryptocurrencies Available on SwissBorg

SwissBorg supports 43 different cryptocurrencies, with the majors like Bitcoin and Ethereum being covered, along with some altcoins like Avalance, XRP, Polygon and many others.

A Look at Some of the Assets Available on SwissBorg

A Look at Some of the Assets Available on SwissBorgWhile it would be nice to see SwissBorg support more assets, they do have a great selection of Stablecoins pegged to different currencies and support 16 fiat currencies.

SwissBorg Products

We cover the products available in more detail in our SwissBorg Review, but here are the highlights.

Cryptocurrency Trading

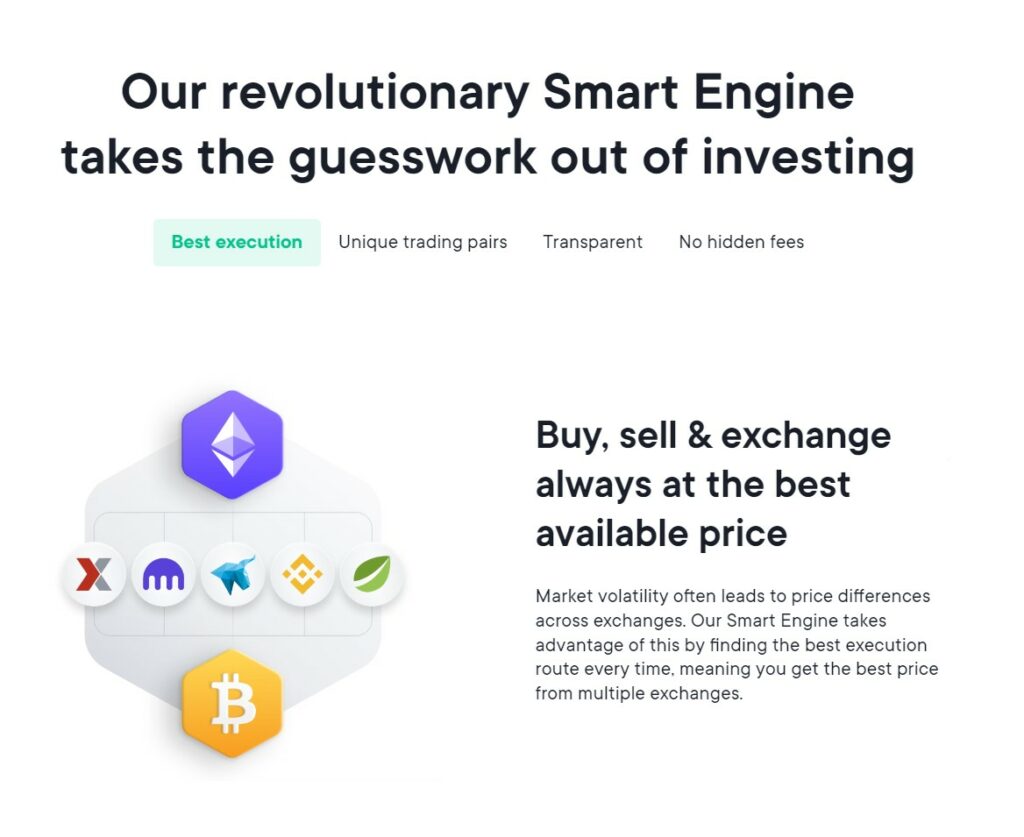

Of all the platforms I’ve used to trade crypto, SwissBorg is definitely one of the easiest and handles the process quite differently than most exchanges out there.

The trading function acts as an aggregator, sourcing the best exchange rates from multiple different exchanges like Binance, Kraken, and others, so SwissBorg users always know they are getting one of the best rates available.

Image via SwissBorg

Image via SwissBorgTrading is done by what SwissBorg refers to as their “Smart Engine,” which searches around the industry, finding the lowest prices and best liquidity in fractions of a second. One of the main reasons I always recommend SwissBorg to new users or anyone looking for the easiest way to trade crypto is that SwissBorg offers the lowest “one-click” trading fees I’ve come across.

Convenient “one-click” swap and convert features are now offered on many of the most popular exchanges, but that convenience often comes at a cost in the form of high exchange fees; SwissBorg is a superb choice for anyone who wants hassle-free trading without paying extortionate fees.

Image via SwissBorg

Image via SwissBorgSwissBorg traders benefit from a best-in-class trade execution system, being able to access over 2,000 unique crypto-to-fiat pairs, zero spreads and no inflated exchange rates. The fee you see on your loyalty tier and shown to you at the time of a swap is the fee you pay, that’s it.

SwissBorg Earn

Among the many benefits available on the platform, SwissBorg Earn products have become the most beloved feature by many users.

For anyone who loves DeFi, but hates the complexity involved and poor UI/UX that comes with most DeFi protocols, SwissBorg has got you covered.

SwissBorg connects to a full range of DeFi protocols that users can access from the award-winning SwissBorg interface, with all the clunky “DeFi stuff” happening on the back end.

Image via SwissBorg

Image via SwissBorgI believe DeFi will change the world and is the best invention since whoever first combined peanut butter and jelly, but let’s not sugarcoat the fact that we are years away from DeFi hitting the mainstream as most of the protocols are quite nuanced and alien for new users to learn and navigate.

SwissBorg makes DeFi access a breeze and familiar to anyone who can figure out a simple smartphone app, which is pretty much everyone these days. Platforms such as Compound Finance, Curve, Aave, Uniswap, and others can be accessed directly within the SwissBorg app. Sweet 😎

Additionally, the platform has a full suite of investment products where users can earn yields, with solutions available for all terms, risk appetites, and goals.

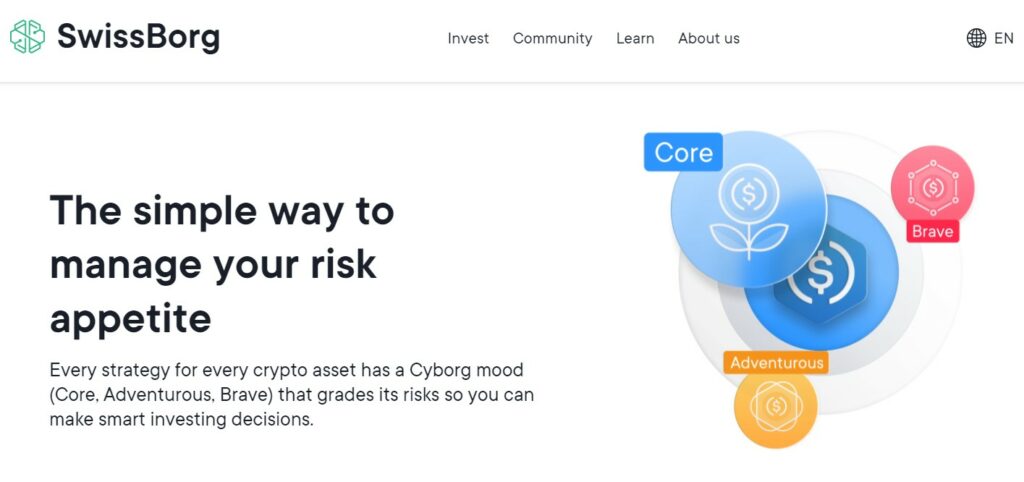

Manage Your Risk With a Variation of Earn Products. Image via SwissBorg

Manage Your Risk With a Variation of Earn Products. Image via SwissBorgInvestments can be filtered by terms, returns, risk, and users can even specify their investment strategies to filter by different industries.

Portfolio Analytics

The Analytics features of SwissBorg provide excellent insight into our portfolios and offer some pretty in-depth statistics and metrics regarding projects, allowing users to make better investment decisions.

Gain Valuable Market Insights and Analysis With SwissBorg

Gain Valuable Market Insights and Analysis With SwissBorgWith Portfolio Analytics, users can gain insight into:

- Token Balance– Shown in both fiat and token denominations

- Diversification– What percentage of your funds are allocated to what assets

- Profit/Loss– Track the performance of your assets and investments

- Fees– Find out how much you are spending on fees.

Users can gain analytical insight into any asset on SwissBorg, updated hourly, by leveraging products offered by SwissBorg that use machine learning to provide trend predictions and display the information in easy-to-understand, appealing graphics. This feature is completely free and includes:

- CyBorg Predictor– Machine learning algorithm that forecasts an asset’s movement over the next 24 hours.

- SwissBorg Indicator– Combines the most popular technical indicators so users can understand market trends at a glance.

- Community Sentiment– A gauge that shows the volume of transactions in the app over the past 24 hours, revealing the balance between buying and selling pressure.

- Support/Resistance– Levels of support and resistance are shown to help traders see key levels of price.

SwissBorg Thematics

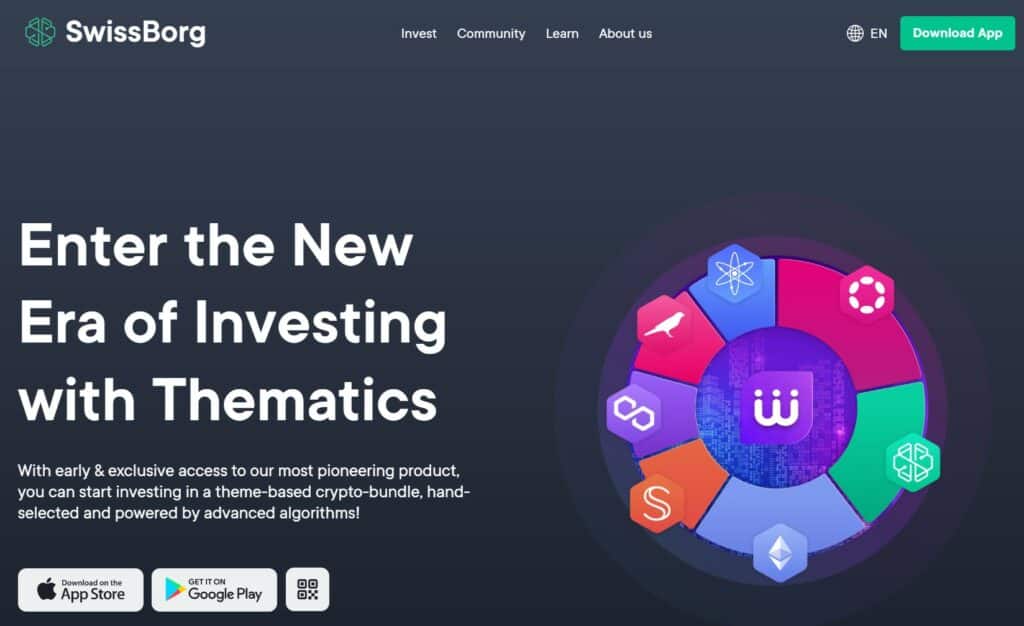

Thematics is a recent addition to SwissBorg and is an innovative product not offered anywhere else. I have been excited about this product since it was first announced months ago as this could be a serious game changer in the industry.

Image via SwissBorg

Image via SwissBorgThematics is a bundled crypto-centric product, similar to an index ETF in traditional finance, that provides diversified crypto investments in one portfolio, in one place. As crypto investors, the number of hours we spend scouring through projects and shopping around for tokens can be a nightmare, Thematics does all the heavy lifting for you.

Thematics provides investors with theme-based diversified crypto bundles, selected by experts and advanced AI algorithms, which rebalance to provide diversified, risk/reward balanced exposure to web3 projects in different niches.

Some of the Benefits of Thematics. Image via SwissBorg

Some of the Benefits of Thematics. Image via SwissBorgSwissBorg’s Thematics products aim to make crypto investing as hassle-free as possible, without reducing due diligence or encouraging irresponsible investing practices.

At the moment there are only two Thematics available. The Best Blockchain Thematic provides exposure to the most promising Layer 0s, 1s, and 2s, while the Golden Thematic provides exposure to Bitcoin and Tokenized gold. I recommend checking out our dedicated Thematics Review to learn more about this innovative product.

Types of Accounts and SwissBorg Fees

SwissBorg has one type of account that will fall under a certain tier level depending on the number of BORG tokens held by the user. Fees depend on the loyalty tier level as you can see below:

A Look at SwissBorg Benefit Tiers

A Look at SwissBorg Benefit TiersExchange fees range from 0%-1%, there are no deposit fees and crypto withdraw fees vary depending on the network, along with an additional 0.1% charged by SwissBorg.

Fiat withdrawals also vary depending on what currency and method is being used, you can find the full fee breakdown on the SwissBorg Fees page.

SwissBorg Security

SwissBorg has cemented itself as one of the most secure exchanges in the industry and is highly respected for its transparency and approach to user safety.

The app taps into the security capabilities already built into modern smartphones such as password and biometric authentication to protect against unauthorised access and uses Multi-Party Computation Keyless technology to keep the app safe from malicious viruses or malware which may be present on the device and to safeguard against single point of failure risk.

Image via SwissBorg Blog

Image via SwissBorg BlogSwissBorg users can enable recovery phrases for account recovery and enable pin protection for device access and withdrawals.

The Fireblocks partnership further helps protect the platform against hackers and bugs. In March 2021, SwissBorg hired SCRT, one of the most reputable security providers in Switzerland to run penetration tests on the SwissBorg app. The app was found to be highly secure. Here are the results: SCRT Penetration Test.

SwissBorg vs Bybit: Conclusion

And that about wraps this article up, I hope that we helped give you an idea of which platform is better suited to your needs as a crypto enthusiast.

For serious traders looking to perform in-depth technical analysis and access derivatives products, leveraged tokens, a launchpad, NFT marketplace, and more, Bybit will be the better choice.

👉 Sign up to Bybit and receive up to $30k in welcome rewards!

For long-term crypto holders who are ready to get serious about investing, or for those looking for an easy and secure place to exchange crypto, SwissBorg is tough to beat.

👉 Get serious about crypto investing and get up to €100 free by using our Swissborg Sign-up Link.