Cryptocurrency exchanges are the backbone of the digital asset ecosystem. Whether you're buying Bitcoin for the first time or managing a multi-strategy trading portfolio, you need a reliable platform to facilitate those transactions.

These exchanges fall into two categories: centralized (CEXs) and decentralized (DEXs). CEXs, like Binance or Coinbase, offer deep liquidity, fiat on-ramps, and customer support, but they also require custody of user funds. DEXs, on the other hand, champion self-custody and transparency but often struggle with fragmented liquidity and steep learning curves.

In this landscape, most users find themselves looking for a sweet spot: an exchange that offers the performance and features of a centralized platform with the security and autonomy ethos of decentralization. That’s where hybrid platforms like Phemex come into the picture.

In this review, we’ll take a closer look at Phemex’s features, fees, token utility, security practices, and recent developments. We’ll explore whether Phemex has matured into a reliable all-in-one crypto platform or if there are still gaps that users should be aware of.

Key Takeaways

- Phemex has evolved from a derivatives-only exchange into a hybrid crypto platform offering spot trading, copy trading, DeFi tools, and governance via PhemexDAO.

- Its competitive fee structure is enhanced by PT token discounts and VIP tiers, making it appealing for high-frequency and cost-sensitive traders.

- Security practices include cold-wallet architecture and Proof-of-Reserves, though a major hot wallet breach in January 2025 raised concerns.

- Features like sub-accounts, trading bots, mock trading, and Launchpool access position Phemex as a versatile option for both beginners and pros.

- While it offers solid performance and deep derivatives markets, users should weigh the platform’s past incidents and evolving regulatory stance before fully committing.

What is Phemex?

Phemex is a global cryptocurrency exchange that has grown into a multi-faceted trading platform offering both traditional and next-gen crypto services. Founded in 2019 by a group of former Morgan Stanley executives, the platform was built with a mission to combine Wall Street-grade efficiency with crypto-native flexibility. Headquartered in Singapore, Phemex is officially registered as Phemex Ltd in the British Virgin Islands.

Initially launched as a derivatives-focused exchange, Phemex has since broadened its scope to support a wide range of services including spot trading, copy trading, passive income products, and trading contests. It aims to serve both retail and institutional audiences by offering robust trading infrastructure alongside beginner-friendly tools.

Phemex operates as a registered Money Services Business (MSB) with FinCEN in the U.S., and has increasingly aligned itself with global regulatory frameworks such as Singapore’s DTSP licensing and the EU’s MiCA regime, as per the impression in its tweets at least. While not licensed in every jurisdiction, it follows strict KYC/AML protocols to ensure compliance across key markets. January 2025, however, wasn't a really comfortable time for Phemex owing to a major hack.

In a strategic pivot towards decentralization, Phemex has also introduced the concept of PhemexDAO, a governance experiment designed to give users more say in platform development. This initiative reflects the exchange’s broader ambition to evolve into a hybrid CEX-DEX model that blends the reliability of centralized platforms with the ethos of decentralized finance.

Key Features of Phemex

Phemex delivers a robust suite of trading tools designed to cater to both seasoned crypto pros and newcomers. Beyond basic spot trading, the platform offers high-leverage derivatives, yield strategies, automated tools, gamified contests, and Web3 integrations like on-chain lending and DAO governance.

Phemex has also Introduced the Concept of PhemexDAO. Image via Phemex

Phemex has also Introduced the Concept of PhemexDAO. Image via PhemexHere's a breakdown of its flagship features:

Derivatives Trading

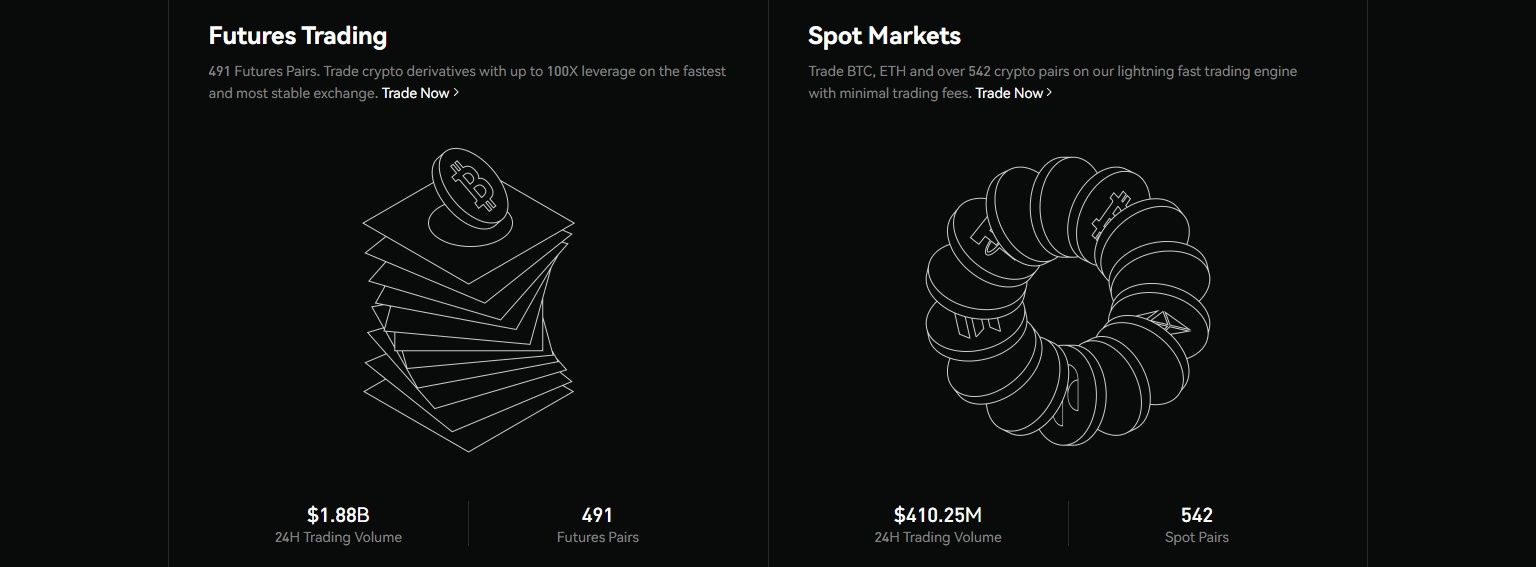

Phemex started life as a derivatives-first exchange, and this remains a core strength. It offers both USD-margined and Coin-margined perpetual futures with up to 100× leverage on popular assets. The matching engine is renowned for its low latency and deep liquidity, enabling tight spreads and efficient execution. Strategically placed, advanced order types and charting tools (powered by TradingView) allow pro traders to deploy complex strategies smoothly.

Launchpool & Phemex Earn

Phemex’s Earn portal provides multiple passive-income vehicles:

- Fixed and Flexible Savings cater to different risk-tolerance levels, offering rates on major assets like BTC, ETH, and USDT.

- Launchpool lets users stake tokens to earn rewards in newly launched projects, earning hourly yields with liquidity flexibility.

Copy Trading

The copy-trading feature enables novices to mirror pro traders’ strategies without manual execution. The interface displays key metrics like ROI, drawdown, total followers, and risk-adjusted performance. Users can allocate funds to a trader and auto-replicate trades under customizable risk settings, which is a helpful learning tool and a way for beginners to participate in derivatives play.

Mobile App

Available on iOS and Android, the Phemex mobile app maintains full parity with the desktop version, offering spot and futures trading, bots, Earn, copy trading, and contests. Current App Store and Google Play reviews rate it at 4.6 and 4.,3 respectively, praising its usability and performance. A few users have reported occasional sync delays, but the overall feedback underscores a high-quality mobile experience.

Other Features

Phemex gives Traders a Powerful, all-in-one Platform Ideal for both Learning and Advanced Trading. Image via Phemex

Phemex gives Traders a Powerful, all-in-one Platform Ideal for both Learning and Advanced Trading. Image via PhemexSub‑Accounts

Phemex supports up to 20 sub-accounts, enabling traders to separate strategies, manage risk pools, or allocate different portfolios easily under one main account.

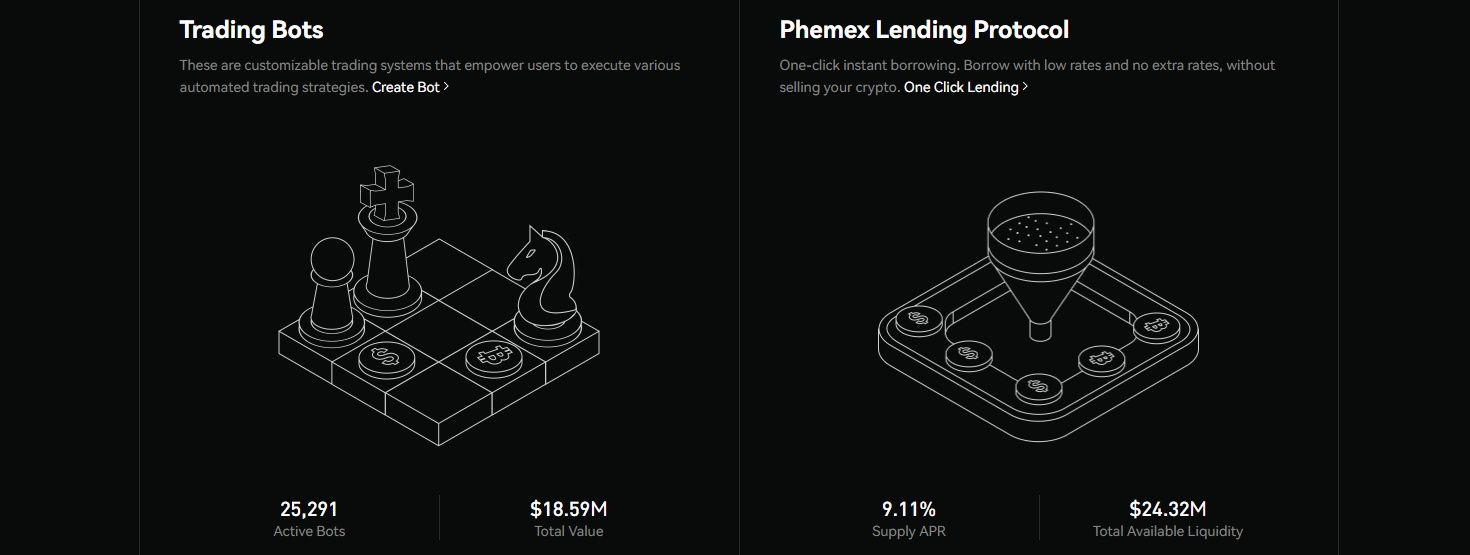

Trading Bots

Phemex offers free built-in bots like Grid, Martingale, and Signal bots to automate spot and futures strategies. These bots operate on predefined parameters like price range, intervals, and threshold triggers. A helpful Marketplace allows users to copy popular bot configurations with a few clicks.

Mock Trading

The demo trading environment lets users simulate ETH/USDT futures (and others) with virtual funds, making it an excellent playground for learning derivatives or testing strategies risk-free.

Launchpad

Select token launches are accessible through the Launchpad feature, allowing users to secure new project tokens at designated sale prices before full public release.

On‑Chain Integrations & Lending Protocol

Newer to the platform are on-chain features like wallet connect, on-ramp/off-ramp support, and a built-in Web3 lending protocol for borrowing/lending on-chain assets. This marks a pivot toward DeFi integration alongside its CEX roots.

Referral Program

Phemex offers a tiered referral program, rewarding both referrers and referees with bonuses in USDT or other tokens for meeting trading volume thresholds. The dashboard tracks referrals and rewards in real-time.

Trading Contests

Adding a competitive edge, Phemex hosts solo and team-based trading contests with real cryptocurrency prize pools. Participants typically trade specified pairs during the contest and are ranked by ROI or volume, earning leaderboard spots and prizes. These events generally run weekly or monthly and help gamify trading for growth and exposure.

Summary

Phemex has evolved from a derivatives powerhouse into a full-featured crypto ecosystem. It blends professional-grade tools like high-leverage futures and automated bots, with youthful innovations including earning products, on-chain lending, and gamified features. While its yield offerings sit within industry norms, its emphasis on automation and product breadth gives traders a powerful, all-in-one platform ideal for both learning and executing advanced strategies.

Phemex Token (PT)

Phemex Token (PT) is the native ERC-20 utility token of the Phemex platform, with a total supply capped at 1 billion PT. It serves multiple functions aimed at enhancing the user experience and aligning user interests with platform growth.

Phemex has Evolved from a Derivatives Powerhouse into a Full-Featured Crypto Ecosystem. Image via Phemex

Phemex has Evolved from a Derivatives Powerhouse into a Full-Featured Crypto Ecosystem. Image via PhemexUtility & Benefits

- Fee discounts & VIP perks: Staking PT grants users trading fee reductions and unlocks VIP-level privileges.

- Staking to vePT & Governance: Locking PT yields vePT (vote-escrowed PT), enabling participation in PhemexDAO voting, proposals, and protocol direction.

- Rewards & access: Stakers are eligible for staking yields, trading bounties, cashback on fiat purchases, and early access to new token offerings and Launchpool projects.

Staking Mechanics

PT staking occurs on the Optimism network and enables flexible lock-up periods (1 month to 2 years), with vePT rewards decaying linearly over time. Phemex also conducts daily buybacks of PT to support staking yields.

Tokenomics

| Allocation | Percentage | Tokens | Schedule |

|---|---|---|---|

| xPT Pre-mining | 10% | 100,000,000 | 25% unlock at TGE, remaining 75% distributed weekly for 3 weeks. Unclaimed supply added to DAO Treasury. |

| Collaborator Program | 5% | 50,000,000 | 50% unlock at TGE, 6-month vesting for remainder. Unclaimed supply added to DAO Treasury after TGE. |

| Strategic Investors | 20% | 200,000,000 | 2 years cliff, then 5-year quarterly vesting. |

| Ecosystem Fund (DAO Treasury) | 15% | 150,000,000 | Reserved for DAO Treasury. |

| Trading Rewards (DAO Treasury) | 12.5% | 125,000,000 | 5-year linear distribution after TGE. |

| Liquidity Provider Rewards (DAO Treasury) | 12.5% | 125,000,000 | 5M unlock at TGE for insurance pool. Remaining 120M distributed linearly over 5 years. |

| Operations & Marketing | 10% | 100,000,000 | 20% unlock at TGE, 5-year monthly vesting thereafter. |

| Core Builders | 15% | 150,000,000 | 1 year cliff, then 4-year monthly vesting. |

Phemex Security

Security forms the backbone of Phemex’s platform design, combining enterprise-grade infrastructure with transparent protection mechanisms to safeguard users’ assets.

Suspicious Transactions are Flagged for Manual Verification. Image via Shutterstock

Suspicious Transactions are Flagged for Manual Verification. Image via ShutterstockCold-Wallet Architecture & Proof-of-Reserves

Phemex implements a custom Hierarchical Deterministic (HD) cold wallet system, assigning each user a unique deposit address while storing the majority of funds in offline multisig wallets. The company asserts that its platform holds user assets 1:1, backed by regular Merkle-Tree Proof-of-Reserves for public verification.

Security Infrastructure & User Protections

The exchange runs its operations on AWS, protected by segmented firewalls and whitelisted system zones, with internal risk management overseeing withdrawal requests. Suspicious transactions are flagged for manual verification. Users are encouraged to reinforce accounts with 2FA, anti-phishing codes, and withdrawal address whitelisting. Phemex may suspend accounts flagged for compromise or policy violation as a preventative measure.

Breach Incident Response & Transparency

In January 2025, Phemex temporarily halted deposits and withdrawals after a breach in its hot wallet system, impacting approximately $69 million (the number across networks varies a bit). They promptly launched emergency protocols, enlisted third-party security audits, law enforcement, issued Proof-of-Reserves, and restored services over the following days. The firm has since reinforced its hot-wallet infrastructure and introduced a compensation plan for affected users.

Phemex blends institutional-grade security; cold storage, segmented systems, Proof-of-Reserves, with responsive incident management. Despite the major hot-wallet breach, their swift, transparent response and cold-storage model reinforce asset integrity. Users should still enable all available security options to maximize protection.

In fact, you should check out our detailed guide on how to stay safe when trading crypto.

Phemex Fees

Understanding Phemex’s fee structure is key to evaluating its value for both casual and high-frequency traders. Here's a breakdown of the main fee elements:

Users can Reduce Trading Costs Further By Using PT to Pay Fees. Image via Shutterstock

Users can Reduce Trading Costs Further By Using PT to Pay Fees. Image via ShutterstockSpot & Derivatives Trading Fees

| Category | Details |

|---|---|

| Spot Trading Fees (VIP 0) | 0.1% maker / 0.1% taker across all pairs |

| Futures & Perpetuals (VIP 0) | 0.01% maker / 0.06% taker |

| Highest VIP Tier (Star VIP) | 0% maker / 0.03% taker on futures contracts |

| VIP Program Reductions | Based on 30-day trading volume or vePT balance |

| Fee Discounts with PT Token | 20% off spot trading fees, 10% off USDT-margined contract fees; stackable with VIP discounts |

Phemex charges a flat 0.1% maker and taker fee for spot trades across all pairs at its base tier (VIP 0). For perpetual and futures contracts, the starting rates are 0.01% for makers and 0.06% for takers. These fees reduce significantly under Phemex’s VIP program, which is based on either 30-day trading volume or vePT token balance. The highest tier, Star VIP, offers 0% maker and 0.03% taker fees on futures contracts.

Additionally, users can reduce trading costs further by using Phemex Token (PT) to pay fees. PT holders receive a 20% discount on spot trading fees and 10% off USDT-margined contract fees, and these discounts can be combined with VIP fee reductions.

Deposits & Withdrawals

Crypto deposits are free and typically processed after one blockchain confirmation. Each token has a unique address, and wallet generation is guided within the UI.

Withdrawal fees vary by token and are adjusted dynamically based on network conditions. For example, BTC withdrawals generally cost around 0.00005 BTC in miner fees. Phemex supports security tools like 2FA and withdrawal whitelisting, and most transactions are completed within minutes.

When buying crypto using fiat through providers like MoonPay or Banxa, users may encounter fees ranging from 5% to 8%, depending on the region, payment method, and current exchange rate markup. These are third-party service charges and are not set by Phemex.

Supported Cryptocurrencies

Phemex offers a broad and diverse asset selection across its spot and derivatives platforms, with recent figures sourced from CoinGecko:

Spot Markets: According to CoinGecko, Phemex lists 522 coins and 532 trading pairs on its spot platform, spanning large-cap staples like BTC, ETH, and USDC to smaller altcoins and memecoins.

Derivatives Markets: The exchange provides 518 perpetual contract pairs, combining both USD‑margined and Coin‑margined options with up to 100× leverage.

Asset Additions are Frequent: Major stablecoins (USDT, USDC, BUSD) are supported, and newer assets such as OP, SOL, and Arbitrum are consistently added to both spot and perpetual listings. Users benefit from a categorized market interface, enabling easy navigation by asset type, margin mode, or leverage level.

Phemex also supports a variety of emerging tokens through its Launchpad and Launchpool programs, often listing project tokens early. While it doesn’t host traditional spot CFD markets, it does offer leveraged Coin‑margined futures or perpetuals where actual tokens (e.g., BTC, ETH) back the contracts, unlike USD‑margined ones.

Overall, Phemex’s current asset depth makes it competitive among top-tier exchanges, offering both breadth and depth for spot traders and derivatives users alike.

Closing Thoughts: Is Phemex Right for You?

Phemex has made notable strides since its launch, transitioning from a derivatives-centric platform into a more complete crypto ecosystem. It now offers a wide array of tools, from spot and futures trading to staking, copy trading, bots, and even DeFi-like lending. The platform also shows ambition in moving toward decentralization with initiatives like PhemexDAO and on-chain integrations.

On the technical side, Phemex’s performance remains solid, with a responsive interface and features powered by TradingView. Its fee structure is competitive, especially for high-volume traders, and PT token incentives add another layer of cost-efficiency. That said, user feedback remains mixed, particularly when it comes to customer support responsiveness and recent concerns following the early 2025 hot wallet breach. While the company took swift action and introduced compensation plans, such events underscore the need for transparency and continuous improvement.

Whether Phemex is the right exchange for you will depend on your trading style, risk tolerance, and need for support services. Some users may value its deep derivatives tools and automation options, while others might prefer platforms with more fiat capabilities or stronger regulatory licensing.