QASH is another high profile example of a cryptocurrency that is powering a global exchange.

This token that was released to the public in an ICO last year is starting to gain traction. This is because the QASH token is trying to solve a problem that most crypto investors have run up against: lack of liquidity.

In this QASH review, we will delve into the underlying technology, use case, roadmap and future prospects. We will also take a look at the most important barriers that have to be overcome if the token is to reach new highs.

Let's dive into some crypto liquidity.

What is QASH?

You might not have heard about QASH if you don’t trade on one of the Quoine owned exchanges, but it’s a cryptocurrency that was created by Quoine to help provide liquidity in their exchanges and to pay for exchange services.

The goal of Quoine is to unite all the cryptocurrency exchanges and create one, single world order book. In essence QASH works with Quoine in the same way XRP works with Ripple, but it has far more utility and is designed to work better than XRP. The main fiat / crypto exchange of Quoine is Quoinex, and it has support for an impressive number of trading pairs.

Benefits of the QASH Token

Benefits of the QASH TokenQuoinex also supports margin trading, futures, lending and trading algorithms. All these features make it one of the most advanced cryptocurrency trading platforms. It was also one of the first exchanges regulated by the Japan Financial Services Agency. In addition to Quoinex, there is a crypto-only exchange called Qryptos which supports nearly 100 different cryptocurrencies and has recently added an ICO market as well.

Finally there is the Liquid Platform, which hasn’t been released yet, but will be the next generation platform and the beginning of the world order book being created by Quoine.

What Problem is QASH Solving?

There’s no problem being solved directly by QASH yet, but eventually it will be used by exchanges to solve the liquidity problem that is becoming an increasing burden in crypto markets. Each exchange carries its own order book, which not only causes pricing discrepancies, it also means that there may be someone looking to buy your coin at your ask price, but if that order is on a different exchange you’re out of luck.

It will also give liquidity to the small or new coins that have little trading volume. And for those trading exclusively in cryptocurrencies the Qryptos exchange gives investors advanced security features, as well as liquidity for ICOs.

How Will QASH Solve Liquidity Problems

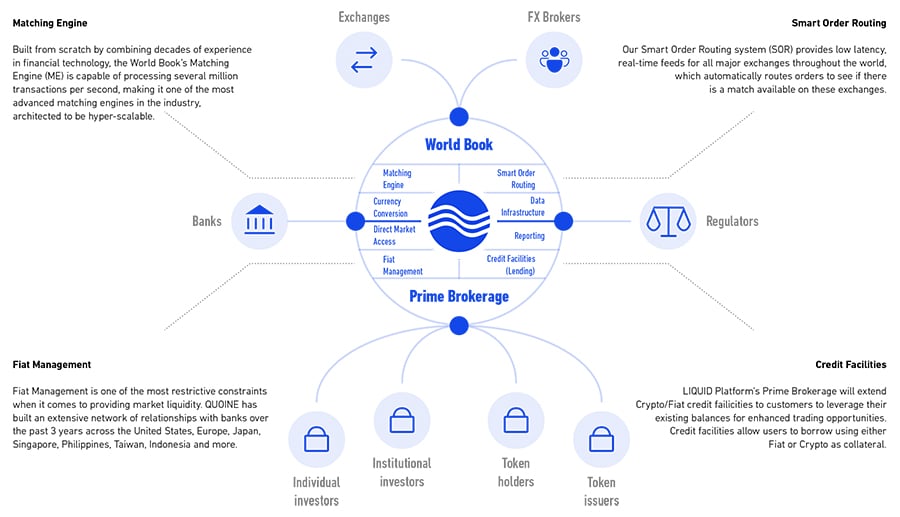

Much in the way some decentralized exchanges are trying to tackle the issue of liquidity, Quoine is planning on resolving liquidity problems by creating a platform that connects to all the world’s cryptocurrency exchanges, and they’re calling this the World Book. The World Book will do away with the inability to match orders simply because they aren’t listed on the exchange you prefer. It will also combine orders from across the globe, giving greater liquidity to all coins.

The World Book will be a part of the planned Liquid Platform, as will the Prime Brokerage, which will provide users with an advance selection of trading tools. The World Book works with a technology called the Matching Engine, which was built from scratch specifically for the Liquid Platform.

Overview of the Liquid Platform

Overview of the Liquid PlatformThe Matching Engine is based on decades of financial services knowledge and will be designed to process millions of transactions per second. This will give the Liquid Platform immense scalability and will make it the most advanced cryptocurrency platform on the planet.

One of the primary constraints to liquidity is fiat currency management, and Quoine has an answer for this as well. They have created relationships with banks around the world, and will use these relationships to create a network that solves the restrictions often caused by fiat management in cryptocurrency platforms. This network will include banks from across all of Asia, throughout Europe and from the U.S.

The Matching Engine includes a smart order routing system that will provide price feeds from all the major global exchanges. The goal of the system is to find the best match for any orders coming into the system. The smart order routing system will even be capable of making matches across pairs. This means you might see a BTCSGD order filled against an ETHJPY order by combining it with an ETHBTC and SGDJPY transaction in the background.

Finally, there’s the Prime Brokerage, which will be providing credit facilities to clients, giving them the ability to trade on margin or participate in the exchange lending program. Clients will have the ability to use either cryptocurrencies or fiat as collateral.

How will the Liquid Platform be Superior

There are other platforms trying to create a global order book or increase liquidity in other ways, but none are looking as successful or advanced as Liquid. Most haven’t been able to create an aggregated order book, and are also missing real-time currency conversions and market making.

The most glaring omission from many platforms is fiat management, primarily because most of the platforms trying to solve this liquidity problem are being created as decentralized platforms, and are thus finding it difficult to build relationships with banks. Liquid is also the only platform with a functional matching engine and order routing system.

What Does QASH Do?

QASH was created as a utility token for all the exchanges under the Quoine umbrella. It will provide users with a discounted payment method for any services in the network of exchanges. Even though the discount is currently set to just 5%, it is expected that the sheer volume of transactions will increase the value of QASH. As the adoption of the exchanges grows, so too will the value of QASH.

Quoine is viewing QASH as a future preferred payment method for a wide range of financial services. Increasing adoption of the Quoine network services by fintech companies, financial institutions and other partners will give QASH greater utility.

It will be available for trade on all the major exchanges, and in addition to being used as a payment method on the Quoine platforms, it is also planned to be used as a payment token at a broad range of financial institutions.

QASH Centralization

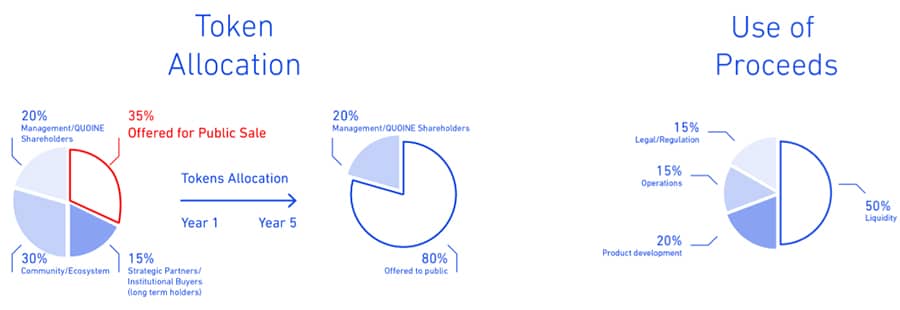

The Quoine platforms are not meant to be decentralized, so it shouldn’t come as a surprise to learn that the QASH token is currently quite centralized. One address holds nearly 65% of all the tokens, and the top four addresses hold over 80% of the available tokens.

QASH Planned Token Allocation from Crowd Sale

QASH Planned Token Allocation from Crowd SaleThat is planned to change, and in fact it is changing because six months ago one address held nearly 80% of the coin supply. Quoine is being somewhat cautious as they rollout the tokens, which is understandable considering that the coin is expected to be widely used within the financial services industry.

Quoine Partnerships

Qryptos is unique in the cryptocurrency world as the only exchange using Deloitte as an external auditor. There was an interview conducted with Quoine CTO Andrew Pemmelar some months ago, and while he didn’t mention specific names he did say partnerships had been formed with South Korea’s largest exchange (Bithumb), and 4 of the top 5 U.S. exchanges.

We can guess that this would mean Bittrex, Gemini, Kraken, Bitstamp, and maybe even Coinbase Pro. More recently partnerships have been announced with Bitfinex, Binance, CEX.io and many others.

The Quoine Team

It’s always encouraging when you see a project whose team has significant experience in the fintech realm. That’s certainly true for Quoine. The CEO and co-founder Mike Kayamori was formerly a senior vice president at Softbank, while the other co-founder and CTO Mario Gomez-Lozada was previously the Japan CIO and head of Fixed Income IT Asia at Credit Suisse.

Mike Kayamori (Left) and Mario Gomez-Lozada on the Right

Mike Kayamori (Left) and Mario Gomez-Lozada on the RightIt isn’t just the founders who have such deep fintech experience though. The Quoine team has a combined 250 years of fintech experience. The board directors and investors are equally impressive. Boasting executives from a who’s who of companies including JAFCO (200B market cap), PWC, Softbank, Yahoo, Singapore Telecom Group (60 B), Credit Suisse, Goldman Sachs, Morgan Stanley, Paypal and the list goes on and on. No reasons to doubt QASH because of the team.

QASH Price Analysis

QASH has fallen throughout much of 2018 and is currently quite inexpensive at roughly $0.25 (July 27, 2018). That quite a drop from its all-time high of $2.33 hit in mid-January of 2018. Back in January QASH was ranked #60 in terms of market capitalization, but as of late July it has fallen to #103.

That’s considerably below comparable coin Ripple, which ranks #3 in market cap. QASH has similar capabilities to XRP, but has generated far more partnerships. The real test will be once the Liquid Platform launches.

If the Quoine team really delivers on the Liquid Platform then QASH could become widely adopted very rapidly. It’s unsure if that will happen however, as the Liquid Platform was initially scheduled to be released in the first quarter of 2018, but here we are still waiting in the third quarter.

Conclusion

The Quoine platform certainly sounds like a winner, but until there’s a functioning Liquid Platform that does what Quoine is claiming it will do there’s no way to know. If the platform does work as advertised QASH could explode in value. The vast number of partnerships show there’s great backing for the coin from within the industry too.

While I would personally prefer to see one of the decentralized solutions to the liquidity problem surface as a winner in this race, the reality is that the only way to get the financial services industry on board is with a centralized exchange. It’s what they’re familiar with, and it’s what they trust.

The massive amounts of capital that existing financial services companies would bring to the table could easily see QASH overtake XRP.