Decentralized finance was the huge movement in the crypto and blockchain ecosystem in 2020, but in 2021 it looks as if it will be overtaken by a new sector – NFT.

NFT stands for non-fungible token and these are digital representations of unique items, typically something considered highly collectible.

And along with these highly collectible NFTs we also have a new development of marketplaces where they can be bought and sold. Rarible is one of these and it extends its functionality by giving users the ability to mint their own NFTs without the need for coding skills.

In the following review of Rarible we’ll have a look at the marketplace and see how it works. In addition to that we’ll also have a look at the fundamentals of the project, and at the utility of its native token – RARI.

What is Rarible?

The Rarible platform was launched in early 2020 as an open-source marketplace for the minting, buying, and selling of non-fungible token collectibles. The marketplace is not restricted and can be accessed by anyone who wishes to use it. Art pieces can easily be created without any coding knowledge and users are also able to purchase the digital art pieces they like.

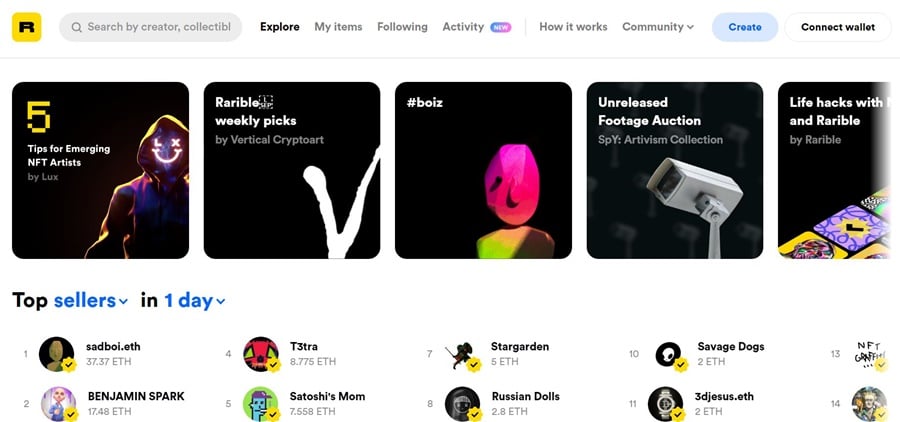

The homepage of Rarible shows some impressive sales. Image via Rarible.com

The homepage of Rarible shows some impressive sales. Image via Rarible.com Rarible is a non-custodial marketplace where you keep full control over your tokens. At no time does the platform hold your tokens. Creators can also get Intellectual Property (IP) rights to their artwork through a Proof of Provenance granted by Rarible. Transactions for the collectible NFTs can be completed quickly and easily with little cost other than the price of the NFT itself.

Pros and Cons of Rarible

- Open-source codebase

- Non-custodial marketplace

- Create and mint digital tokens without coding knowledge

- Peer-to-peer trading NFTs with low costs

- Wash trading can allow bad actors to unfairly access RARI tokens

- There is no whitepaper or roadmap indicating the future direction of the project

- Only supports tokens of Ethereum blockchain network

Using the Rarible NFT Marketplace

Users at Rarible can use the platform to create their own unique NFTs, or they can simply browse the marketplace to collect the creations of others. Created NFTs can be listed for sale, but that isn’t a requirement. Users are free to keep the NFTs they create, or gift them to others. They can even list the NFTs on the OpenSea platform.

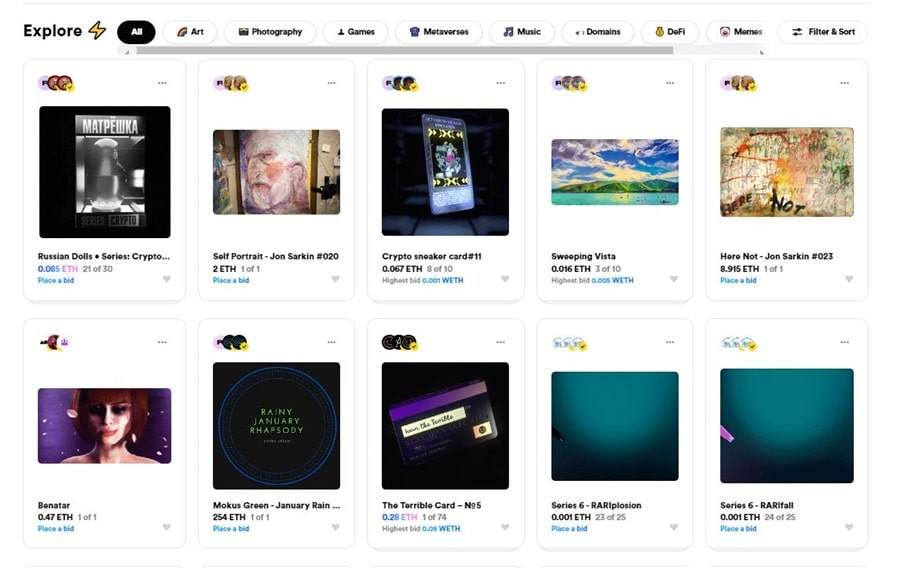

Create your own NFTs or explore the creations of others. Image via Rarible.com

Create your own NFTs or explore the creations of others. Image via Rarible.com Using Rarible requires ETH tokens and users are required to connect an Ethereum compatible wallet to interact on Rarible. Suitable wallets include Metamask, Fortmatic, Coinbase Wallet, MyEtherWallet or WalletConnect.

One of the excellent features of Rarible is that anyone can create their own unique digital art. There is no coding knowledge or experience needed at all.

As an open marketplace anyone can access the platform to create an NFT, to sell their creations, or to purchase NFTs created by others. While transactions are done using ETH, the native token of Rarible is RARI.

NFT Minting Platform

Minting NFTs on Rarible is one of the coolest aspects of the platform. Anyone can create NFT artwork on the platform by paying just the necessary gas fees. That makes Rarible quite unique and lets it stand out from other platforms like Makers Place and SuperRare that curate digital artists, but don’t allow just anyone to create NFTs. As you might imagine this has created a surge of interest from young, aspiring artists with loads of talent.

Unfortunately, since the platform is open to anyone, it has also opened the doors to scammers as well. Rarible is fighting against these scammers however, and has created a verification process to vet artists and help ensure its users aren’t dealing with some fake project.

The project is also becoming popular among celebrities, and in February the platform welcomed billionaire Marc Cuban, rappers Soulja Boy and Mike Shinoda of Linkin Park, and actress Linsey Lohan. So far Lohan seems to be the most successful of the bunch, with her piece entitled “Bitcoin Lightning”, which is an NFT of her tweet “Bitcoin to the moon” complete with a rocket emoji, selling for 33 ETH worth $59,000 at the time.

Here’s how to create your own NFT on Rarible

- Go to Rarible.com and connect your Ethereum-compatible wallet (i.e. Metamask).

- Click the blue “CREATE” button at the top right of the page.

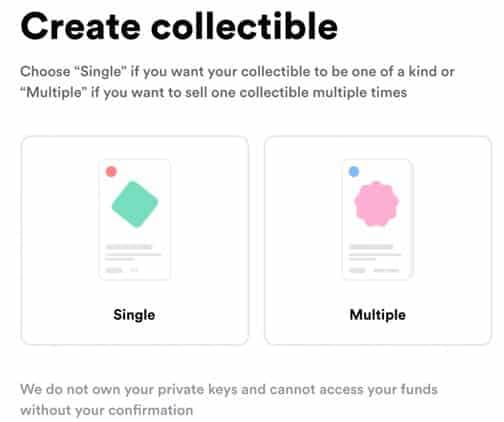

- Select minting a Single NFT or an NFT with multiple editions.

- Upload your image, video, or music file.

- Specify a price, name, description, royalties, and any other relevant info.

- Click create item.

- Your wallet will ask you to sign and pay for gas fees. Because gas fees can be high at times it’s worth it to watch the Ethereum gas fees and pick the right moment to mint your NFT.

Create a single NFT or a collection. Image via Rarible.com

Create a single NFT or a collection. Image via Rarible.com Through the creation of NFT digital art anyone can be the creator of a completely unique piece of art. It has the added bonus of also serving as a store of value. And each NFT is wholly and provably owned with the ability to sell, gift, or leverage the value of the asset.

Rarible Governance

The primary use-case for the RARI token is to provide governance for the Rarible platform. The developers desired to give the power over the future of the platform to the community, allowing them to curate and moderate the NFTs created on the platform, and to vote on the addition of new features, or the removal of outdated features.

The first NFT governance token. Image via Rarible blog.

The first NFT governance token. Image via Rarible blog. Eventually the Rarible team intends for the platform to evolve into a decentralized autonomous organization (DAO), giving all of the governance decisions over to the users. On Rarible the community will have the first and last say over what needs to change.

In order to direct the community into the right direction from the start the development team has released a set of governance principles that they hope to see the community abide by as it grows.

Rarible Governance Principles

Radical Inclusion

The inclusion of every RARI holder is intended to ensure complete community inclusion. Creators and collectors all have the opportunity to propose changes and new features, vote on platform upgrades and use their power to make the platform a place for the public good. No idea is too radical to share and suggest for inclusion.

Self Expression

Self expression is encouraged on Rarible in any form or matter. That can be to suggest a new feature, to express a concern, to support a project, or even to disagree with other members. Every form of self expression is highly encouraged and every opinion will be heard and counted.

Positivity

Every proposal should be made with the goal of improving the platform. Rather than simply flooding the community with proposals each one should be carefully considered for its impact on the Rarible platform and community before being delivered.

Responsibility

Along with the need to examine any proposal or idea to ensure it is for the good of the community and the platform, each idea or proposal that’s brought to the group should be clearly articulated. It should offer solid arguments in its favor, and should come with practical steps that can be used to implement the proposal rather than simply expressing a wish or vague desire.

Transparency

Until such time as an actual DAO is in place it is encouraged for anyone submitting or commenting on any proposal be fully transparent. That includes mentioning their name and the amount of RARI tokens held.

Rarible Project Fundamentals

Evaluating the fundamentals of Rarible isn’t as straightforward as you might think, considering the project is among the first in an emergent NFT ecosystem. We aren’t certain yet what the space will evolve into, or what the needs of its users will be. That aside, Raribles does provide creators with the opportunity to design unique digital creations, while also allowing them to connect with buyers and collectors interested in their creations.

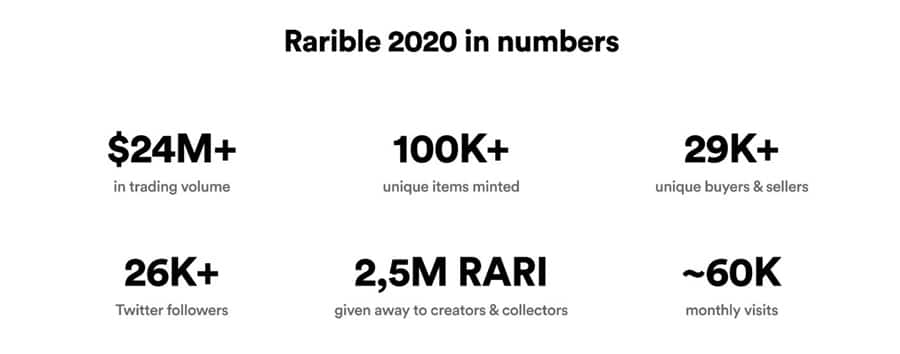

Rarible made a lot of progress in 2020. Image via Rarible blog.

Rarible made a lot of progress in 2020. Image via Rarible blog. The platform understands that art and technology aren’t always combined, and the platform was designed to cater to those with artistic leanings, but no technical expertise. This enables a completely inclusive community, where anyone can participate in the creation of NFTs and the marketplace for displaying and selling them.

The fact that Rarible is aiming to become a DAO eventually is also one of its strengths. It has allowed the project to be among the first NFT-based project to release its own native token, and promises community governance for RARI holders. This type of community participation should also be positive for the growth of the community, and also of the marketplace.

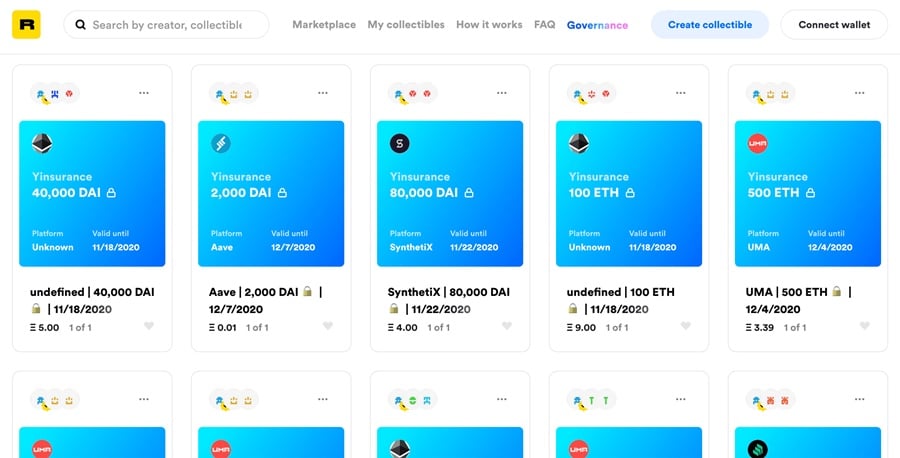

Another strength of Rarible is its merger with the DeFi ecosystem. By connecting with the yInsure project at Yearn Finance Rarible is encouraging the issuance of insurance in the form of tokens. This also creates a connection between the DeFi and NFT communities, encouraging cross-over growth between the two groups.

yInsure and Rarible

Just as Rarible has become extremely popular and grown rapidly, there’s a project in the DeFi space that generated massive buzz. yEarn is arguably the best known and most popular projects in the DeFi space. It is a yield aggregator project that was created by Andre Cronje as a way to pull together the variety of Ethereum based money projects. It does so in some very imaginative ways.

Are Rarible and DeFi a perfect match? Image via Dapp.com

Are Rarible and DeFi a perfect match? Image via Dapp.com yEarn also releases new projects at a frantic pace, and the community was not too surprised when it released the yInsure product. With yInsure users are able to tokenize insurance coverage on a number of DeFi activities.

The really cool part is that the insurance policies created with yInsure are NFTs. That means they can be traded easily on platforms such as Rarible. And unsurprisingly that’s exactly what users are doing.

In fact, users began listing the yInsure NFTs on Rarible almost immediately, leading to the development team optimizing support for the assets literally within hours. In addition to having a marketplace for selling these NFTs users also benefit from the Marketplace Liquidity Mining that releases RARI rewards to them as sellers on the platform. It’s another situation where users are able to stack incremental yields on top of each other in the DeFi space.

It’s this yield stacking that’s helped create a synergy between the yEarn and Rarible communities. The bridge between the two projects has brought new users to Rarible, and new users to yEarn.

The yInsure NFTs may have been the very first melding of DeFi and NFTs, but now that users are informed on the possibilities you can be sure it won’t be the last. Users will certainly be paying attention to ways in which they can meld the two ecosystems to create even greater value.

The Team

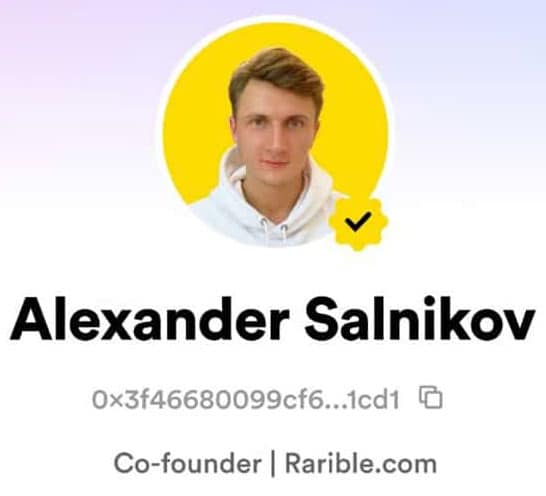

The Rarible website won’t give you much information about the founders of the project or the development team working on growing and improving the platform. However with a little bit of digging it’s possible to discover that Rarible was the brain-child of Alexei Falin and Alexander Salnikov.

Alexander Salnikov is listed as the Head of Product for Rarible, which includes the whole spectrum of product-related activities. Prior to the creation of Rarible Alexander was connected with several other crypto projects and startups, including Humaniq.

One of the two founders of Rarible. Image via Rarible blog.

One of the two founders of Rarible. Image via Rarible blog. Alexei Falin has very little information available other than that he attended the University of Southern California, and that prior to co-founding Rarible he was the co-founder of Sticker.place, which is a marketplace for iOS 10 sticker packs.

There is a listing of 21 Rarible employees on LinkedIn, with the majority holding positions in PR, communications, and community development. That indicates the platform is most interested in marketing and outreach currently.

The RARI Token

Another interesting feature of Rarible is that it is the first NFT project to roll its own native token. The RARI token is the very first governance token released in the NFT ecosystem. As announced by the Raribles team:

Welcome RARI: the governance token of Rarible. RARI enables the most active creators and collectors on Rarible to vote for any platform upgrades and participate in curation and moderation.

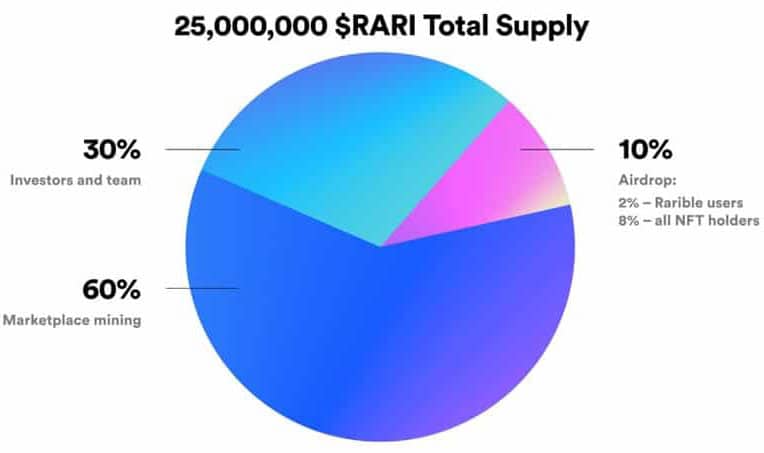

RARI was created with a total supply of 25,000,000 and is being distributed as follows:

60% of RARI tokens will be used as rewards for buyers and sellers. Image via Rarible blog.

60% of RARI tokens will be used as rewards for buyers and sellers. Image via Rarible blog. - 10% tokens were airdropped in July 2020. Out of which, 2% were allocated to Rarible users and 8% were allocated to all NFT holders.

- 60% of tokens are allocated to marketplace liquidity mining. Each week, 75,000 RARI tokens are released that are disbursed to the buyers and sellers.

- 30% of RARI tokens are allocated to the investors and the team.

RARI Token Utility

RARI is a utility token and confers the following uses in the Rarible marketplace:

- Governance –This is the primary function of the RARI token. It is the governance token of the ecosystem, allowing the creators and collectors on Rarible to vote on system updates and other variables of the Rarible ecosystem. This includes trading fees, platform development efforts, and new features to be added to the platform.

- Curators –The marketplace is attempting to establish community-driven curation through the holders of RARI tokens.

- Featured artworks - RARI token holders are able to vote on the pieces they believe should be featured in the marketplace.

How to Acquire RARI

RARI tokens cannot be purchased from the Rarible marketplace, although they can be purchased on a number of exchanges, including Poloniex, SushiSwap, and the 1inch Exchange.

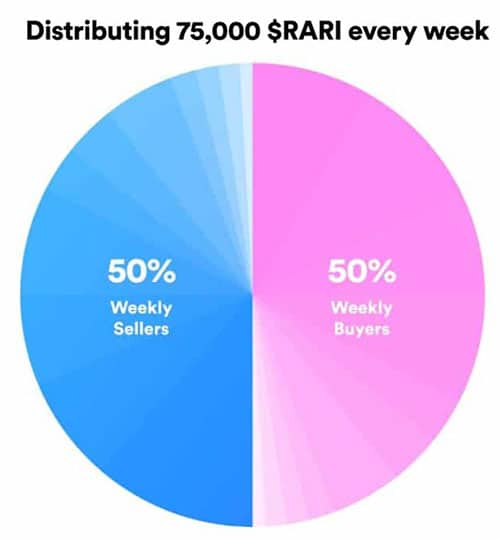

Perhaps the best way to acquire RARI though is through Marketplace Liquidity Mining. This is the process used to distribute the 60% of the total supply that wasn’t allocated to the team and investors or air dropped. In Marketplace Liquidity Mining 75,000 RARI tokens are distributed each week on Sunday.

Half of the tokens go to marketplace buyers, and the other half go to marketplace sellers. This Marketplace Liquidity Mining serves to encourage activity on the Rarible marketplace since the more you buy or sell the greater your weekly distribution of RARI tokens.

Buyers and sellers split RARI tokens each week. Image via Rarible blog.

Buyers and sellers split RARI tokens each week. Image via Rarible blog. Of course, this is just another form of asset or yield farming, but it does seem to be working well to encourage usage and participation at Rarible, making it a mainstay in the top three marketplaces on DappRadar.

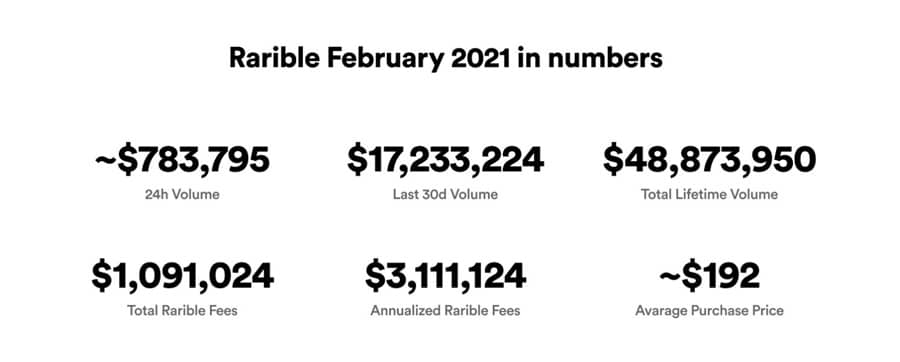

Certainly the RARI token is doing well in 2021 for investors. It began the year right around the $2 mark, and as of late March 2021 is trading around $23.50 after hitting an all-time high of $42.05 on March 14, 2021.

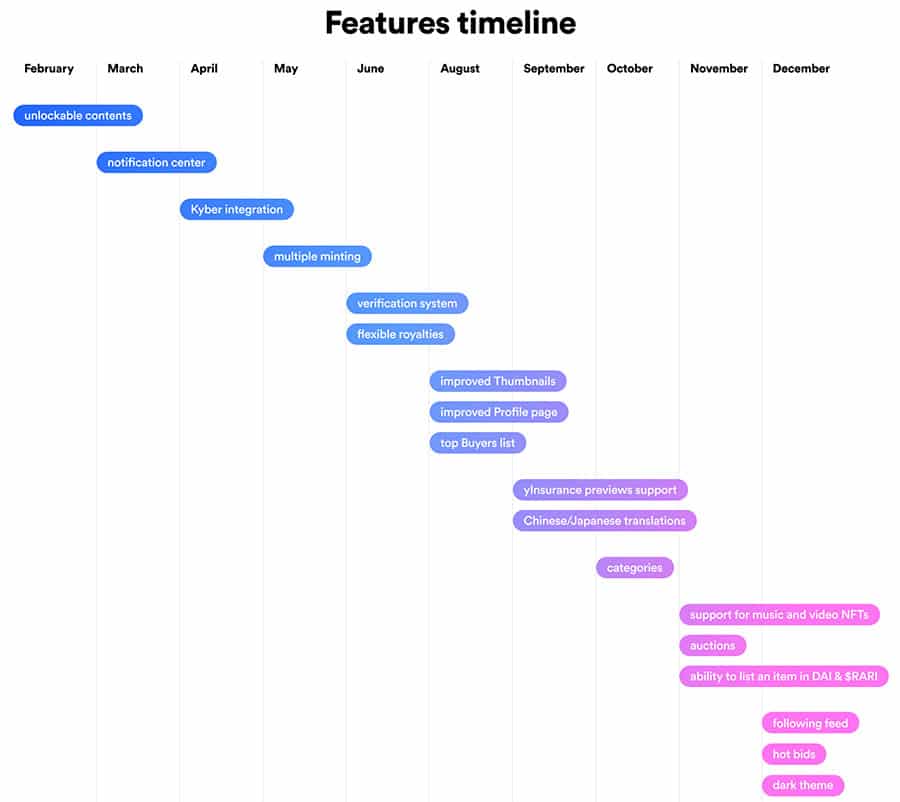

Rarible Roadmap

Unfortunately there is no official roadmap for Rarible, and in some cases it seems that the team behind the project is very reactive to events as they unfold, indicating a certain lack of planning. Yet the project has continued to develop rapidly, which is promising for the future development, even lacking a roadmap.

There is also no whitepaper for the project, which further highlights a potential lack of planning. The most information about the project can be gleaned from their blog posts, some of which mention features that the Rarible team is investigating. These include a price discovery mechanism, more DeFi NFT’s, a mobile app, social features, an NFT market index, and fractional ownership of products.

Progress made by the Rarible team in 2020. Image via Rarible blog.

Progress made by the Rarible team in 2020. Image via Rarible blog. Can Rarible be Trusted?

Absolutely. It is a real marketplace and has thousands of users already. Users can safely create their own NFTs and sell them on the marketplace. These NFTs even include those that bridge to DeFi use cases. It has provided users with an easy way to create unique digital assets, and to match buyers and sellers.

It’s possible that the trustworthiness of the platform might not come into question if it was more upfront regarding its founders and development team. It is interesting that one of the governance principles of the project is Transparency, yet the team developing the marketplace lack this very characteristic themselves.

Rarible is seeing increasing growth, users, and transactions. Image via Rarible blog.

Rarible is seeing increasing growth, users, and transactions. Image via Rarible blog. It would also be beneficial if the project had a whitepaper and a roadmap. These would make it easier to find out the details behind the product, and have an understanding of where it is headed.

Rarible Risks

While it can be trusted, Rarible is not without some issues that will need to be fixed before the platform is able to hit the mainstream. Chief among these is the ability for users to abuse the system through wash trading. This is a situation where a user has multiple accounts and purchases art from themselves in order to acquire RARI tokens. If this type of manipulation becomes too widespread it will devalue the entire project.

Indeed, the NFT economy analytics site Nonfungible.com delisted Rarible in July 2020 over the increasing wash trading occurring on the platform and as of March 2021 they have not been relisted.

Wash trading has not helped Rarible. Image via Twitter.com

Wash trading has not helped Rarible. Image via Twitter.com In the meantime Rarible is taking steps to minimize wash trading. It has increased efforts to locate and blacklist wash traders on the platform, but as you can imagine this can be quite hit or miss. The efforts to find these bad actors will need to continue, but it is important that the team discover some more reliable automated method for finding, punishing, and banning wash trading.

Conclusion

Rarible has certainly managed to create a buzz around its marketplace, which has led to rapid growth. It is one of the most watched projects in the NFT space, and with its bridge to DeFi it is known in that space as well. The combination could make it one of the top projects in 2021 or 2022, if the team is able to address some of the concerns around the project.

Those concerns include the wash trading that continues to plague the platform, and the lack of a whitepaper and roadmap. In the first case the trust in the project is definitely being undermined, and in the second concerns over a lack of transparency and planning could keep some users or investors away from the project.

Even with the current issues Rarible is a project to keep an eye on, and if you’re a creator it might be worth giving it a go and seeing if you can become an important part of the Rarible ecosystem.