Ravencoin is a project that has exploded onto the scene. Demand for RVN reached unprecedented levels as it was listed on a number of exchanges.

This Bitcoin fork is one of the few coins that you can still mine with a GPU. In fact, the Ravencoin developers have specifically designed the blockchain to be resistant to the threat that is posed by ASIC mining rigs and miner centralization.

However, is it really worth considering?

In this complete Ravencoin review, I will attempt to answer that. I will also take a look at the adoption potential and long term use cases / price potential of RVN.

What is Ravencoin?

Ravencoin was created in 2017 as a fork of the open-source Bitcoin code as a way to hold assets digitally and transfer them easily between parties. That was the specific use case Ravencoin was designed for in contrast with the original Bitcoin, which is meant as a way to transfer value between individuals.

After the debut of Ravencoin on October 31, 2017 the first coins were mined on January 3, 2018. The date is significant as the ninth anniversary of Bitcoin’s launch. There was no pre-mine of Ravencoin.

Ravencoin was created with a phased development schedule in place. Work continues on the blockchain and so far the developers have created the blockchain and mining capabilities, as well as the ability to create unique assets. They have also developed a unique algorithm called x16r, which allows for Proof-of-Work mining while also maintaining ASIC resistance.

Future updates to the blockchain are expected to include the ability to issue rewards to RVN holders, a messaging system, voting capabilities, a compatibility mode that allows newly created assets to appear exactly like RVN, LTC, or Bitcoin for easy integration into exchanges, wallets, explorers, etc.

Why Ravencoin is Unique

One of the most obvious changes made in the creation of Ravencoin is the use of the newly developed x16rv2 algorithm. It was developed specifically to allow for PoW mining but get away from the centralization caused by ASIC mining.

What makes the x16rv2 algorithm unique is that it using 16 different hashing algorithms and randomly chooses one to use. This randomization makes it extremely difficult to develop an ASIC that can take advantage of the x16rv2, and allows anyone the ability to mine Ravencoin without competing with the powerful ASIC rigs.

Image via Shutterstock

Image via ShutterstockThe Ravencoin team has also stated they will change the algorithms used in x16rv2 if an ASIC rig with the capability to mine the Raven network is ever developed. That's just what they did in October 2019 when they upgraded from x16r to x16rv2 simply on the suspicion of ASIC rigs mining the network.

The other changes from Bitcoin that were made when creating Ravencoin include the following:

- Total coin supply of 21 billion rather than 21 million;

- Block time reduced from 10 minutes to 1 minute;

- Initial block reward of 5,000 RVN rather than 50 BTC;

- Plans for the future addition of voting, messaging, and staking rewards;

- The addition of the ability to issue and transfer assets, and create unique assets.

Ravencoin Objectives

According to the Ravencoin whitepaper Ravencoin was created for:

“The secure and free movement of various assets utilizing open-source code that will be improved upon continuously.”

The whitepaper goes on to say that once blockchains begin to influence the global economies it will also change how capital markets work. Eventually, they say geographic borders and government jurisdictions will become increasingly less relevant as trading across borders becomes increasingly frictionless.

Once it’s seen that individuals can move significant wealth using Bitcoin or other cryptocurrencies people from all across the globe will demand to have the same ability with other assets such as equities, real estate or physical commodities like gold and oil.

What can be Transferred?

The creators of Ravencoin made a list of potential use-cases within the white paper, but they emphasized their list was only suggestions, and that virtually anything could be sent with the Raven network since that’s precisely what it was created for.

Assets that Can be Transferred. Image via Ravencoin

Assets that Can be Transferred. Image via RavencoinA few of the suggestions made in the white paper include gold bars or coins, physical fiat currency, rare artwork, real estate deeds, gift cards, in-game assets, electronic tickets, and many other things.

Any of these assets can be represented by a non-minable token on the Raven network, with such tokens being freely created by users on the Ravencoin platform.

Security

With so many different assets being stored on the blockchain one of the stated primary goals of Ravencoin is security. The blockchain itself functions in much the same way as Bitcoin, and it shares the same level of security that Bitcoin offers.

Ravencoin functions with a strong mining community and wide distribution. Privacy is included as one aspect, with Ravencoin fully taking advantage of the inherent separation between a user’s identity and their wallet address.

The developers have also committed to continual improvement of the raven network, and have said that any new technology that improves on the security of the system or the privacy of users will be implemented in Ravencoin whenever possible.

Ravencoin Mining

The Ravencoin website says it avoided using a pre-mine so all users will have an equal opportunity to accumulate RVN coins. Proof-of-Work was chosen as the consensus algorithm so Ravencoin could take advantage of building an ever-larger wall of protection against future attempts at censorship and tampering.

Moreover, given the use of the unique consensus algorithm, Ravencoin has been able to stave off the threat that has been posed by ASIC mining chips on other blockchains. This means that Ravencoin is still relatively easy to mine with your home GPU.

Mining Pools 🐳: If you are looking to combine your hashing power with a number of other miners then you can join a mining pool. We have looked at a few of the best Ravencoin mining pools

Mining Ravencoin has been popular and remains so in 2019. If you’re interested in mining some RVN yourself you can have a look at our previous guide to mining Ravencoin that will walk you through the process of mining RVN.

Ravencoin Use Cases

Aside from being able to tokenize and send pretty much anything using the Raven network, the developers also gave several concrete examples of Ravencoin in action.

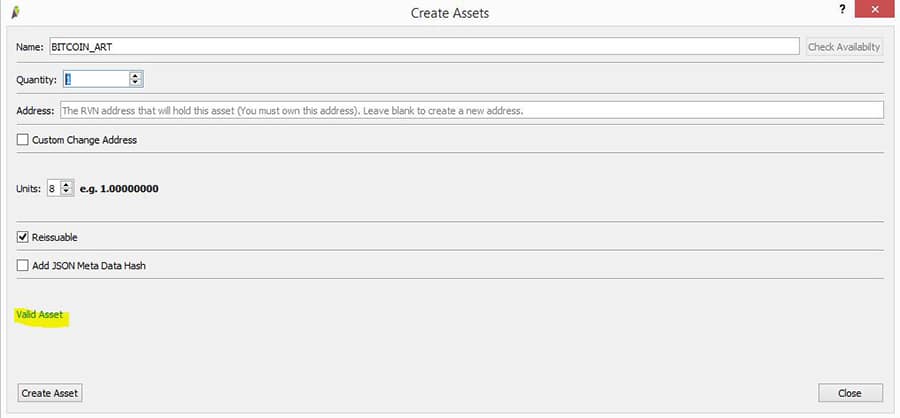

One such example is that of an art dealer who wishes to transfer the ownership of a valuable painting or other physical work of art to a customer. Each piece of art can have a unique token created on the Raven network, and each token has a unique serial number and name associated with it.

These tokens can’t be destroyed, they can’t be duplicated, and they can’t be modified. They will serve as a stand-in for the physical piece of art and will also act as the proof of authenticity since each token is unique and tied to a single piece of art.

Creating Art on Ravencoin Network. Image via Medium Post

Creating Art on Ravencoin Network. Image via Medium PostOnce voting is added to the blockchain the developers have envisioned a use-case that would simplify voting for the holders of shares of public companies. They point out that currently, any listed company needs to pay a quasi-monopoly company to get the mailing addresses of their own shareholders.

Then they need to conduct a physical mailing of the proxy voting form and instructions for voting. Shareholders need to fill in the form and return it to the company, and then the forms all need to be collected and tallied, presumably in a secure manner.

Ravencoin can eliminate the need for this system through its messaging and voting capabilities. Tokens can be created which are linked to shareholders equities, and then the Raven network can be used to notify every token holder when a vote is scheduled.

The network can then issue new voting tokens in a 1:1 ration with the original tokens. That will allow the actual vote to be mostly automated since users can send their voting tokens back to specific addresses for counting purposes.

Ravencoin Team

The Ravencoin team isn’t listed on the website, but we do know that the white paper was signed by blockchain advisor Bruce Fenton, and software developer Tron Black.

Bruce Fenton has been an advisor to the Bill and Melinda Gates Foundation and is also the founder of the Dubai Bitcoin Conference. Tron Black was most recently the principal software developer for Medici Ventures.

Bruce Fenton & Tron Black. Images via Twitter

Bruce Fenton & Tron Black. Images via TwitterThe white paper also gives credit for the development of Ravencoin to more than 430 unnamed Bitcoin developers. Of course, not all of them worked directly on the project, but this broad acknowledgment of developers shows the open-source and decentralization philosophies at their best.

In the case of Ravencoin open-source technology was leveraged to build the best possible product by taking advantage of products and services created by and for the many.

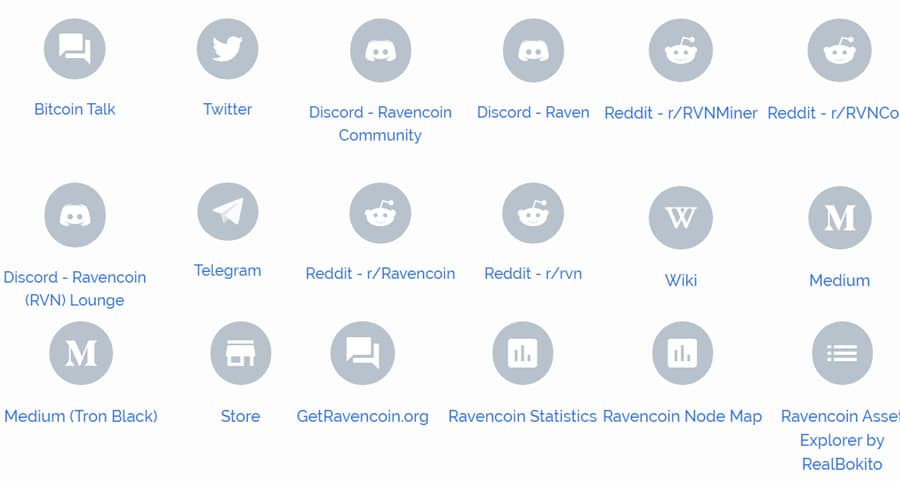

Ravencoin Community

Ravencoin makes it extremely easy to find a community that suits you, with an entire page dedicated to all the different Ravencoin communities being built across a variety of social media and messaging platforms.

That said, I have seen much larger communities. The main sub-Reddit for Ravencoin has just over 7,000 followers. It is active though, with daily posts and comments on most posts as well. Twitter is also a medium-sized following, with just under 30,000 followers, but like Reddit a good deal of activity within the modestly sized group.

List of Ravencoin Communities. Image via Ravencoin

List of Ravencoin Communities. Image via RavencoinThe largest and most active following is on the messaging platforms. The Ravencoin Discord has over 17,000 members, and the Telegram channel has more than 11,000 users.

The team is also active in communicating with the community, and founder Tron Black continues blogging about his thoughts regarding the future of Ravencoin on his Medium blog.

The RVN Coin

The RVN coin began trading on March 10, 2018 at $0.026499 and by the end of the month it had nearly tripled in value, but that was short-lived.

It dropped back and remained around 75-100% higher over the next couple of months, but by June was back at its starting level and was headed lower. It did manage to pop higher several times throughout 2018, which was encouraging given the bear market that wiped 90% or more from most cryptocurrencies.

RVN Price Performance. Image via CMC

RVN Price Performance. Image via CMCBy February 9, 2019 RVN reached its all-time low of $0.009506. Again, that’s not too bad of a loss when compared with the broader cryptocurrency markets. It made good gains in the first half of 2019, and hit its all-time high of $0.080258 on June 3, 2019.

Since then it has been sliding steadily lower in sympathy with the broader market. As of October 30, 2019 it has a value of $0.028717, meaning it is basically where it started in March 2018.

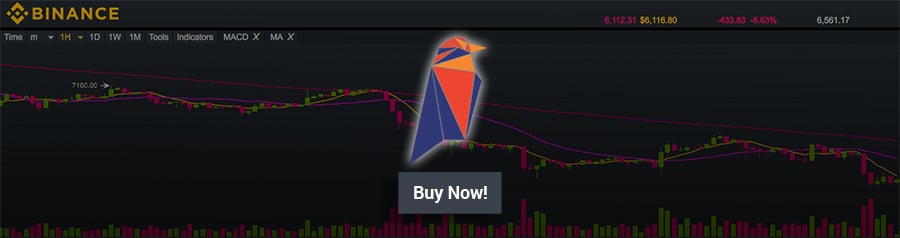

Buying & Storing RVN

You have a fairly broad choice of exchanges if you’re looking to buy or sell RVN. The largest trading volume is on CoinEx, but you’ll also find decent volumes at DigiFinex, BitForex, and Binance.

There’s also another half dozen or more exchanges where volume is enough to get a good trade. You can even buy RVN with the U.S. dollar at the Binance U.S. exchange.

The trading volume is relatively well spread out across these exchanges which means that liquidity is not too highly concentrated in any one place. On the individual order books, you also have a reasonable bid ask spread with strong turnover. This can be confirmed by looking at Binance's RVN / USDT order book.

Register at Binance and Buy RVN

Register at Binance and Buy RVNRavencoin has its own native desktop and mobile wallets available for download from its website. There are versions for Windows, Mac OS and Linux for the desktop versions, and for Android and iOS for the mobile versions.

There are also a good number of third-party wallets with support for RVN, including the Exodus wallet, Cobo wallet, and Atomic wallet. And for those who prefer security, there is also a paper wallet available from the Ravencoin website, or you can store your RVN in the Trezor hardware wallet.

We have actually completed a list of the best Ravencoin wallets if you want more information on how to safely store your RVN.

Ravencoin Development

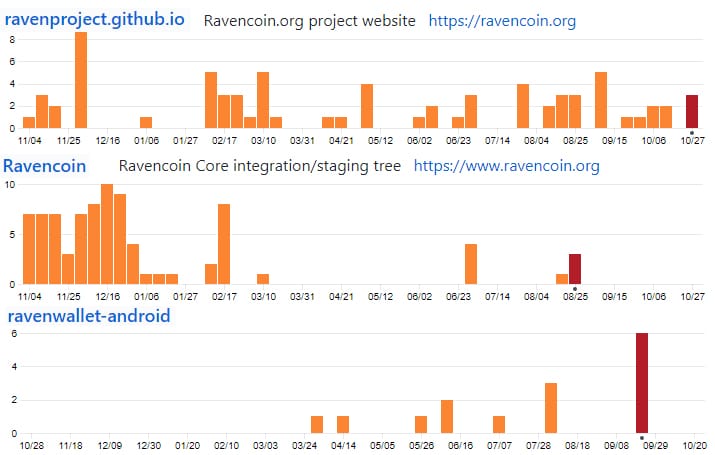

So this all seems well and good but how much work is being done on the Ravencoin protocol? Well, one of the best ways to determine this is to take a look at the coding output.

Therefore, I sometimes like to look into a project's GitHub and take a look at the number of commits that have been pushed. It is a great proxy for raw output.

I jumped into the Ravencoin GitHub to get a peek at what is going on under the hood. Below you have the total commits to the top three most active repositories over the past 12 months.

Code Commits to Select repos in past year

Code Commits to Select repos in past yearThe most active appears to be work on the website and updates to the core code have been less frequent of late. So, this means that the project is still being worked on but less than we have seen for other projects.

In fact, if we were to take a look at where Ravencoin comes when compared to other projects in the space, they are ranked at 145 in terms of total commits to their core repo.

Of course, there may be other factors at play here. Ravencoin was forked from Bitcoin which means that it has not had to develop its own protocol. This is unlike many of the other newer projects.

However, if you would like to keep up do date with the latest on the latest to come from the project then you can follow their Telegram group.

Conclusion

The restraint of Ravencoin’s developers is to be applauded. So many blockchain projects try to pretend they can solve every problem, or try to offer a use-case for every scenario. Ravencoin is different because it’s focused on doing one thing right – tokenized asset transfers. That’s bound to help the project become successful.

But Ravencoin does remain a young project, and the crypto-landscape changes very rapidly. It’s impossible to predict how well they will remain ahead of the competition, but the active community and partnerships should certainly help.

We’re also seeing a definite trend towards tokenizing assets too, but it’s not certain yet if Ravencoin can lead that change, or if some other project will find greater success.