The Solana blockchain has been notorious for frequent outages over the past three months. This has caused recent sentiment around Solana to turn sour, but there is no denying that it has one of the best teams backing and building on it.

This is why I think Solana might still be around in the top 10 during the next bull run. One of the reasons Solana still deserves credit despite its outages is its incredible transaction throughput and what it can do for DeFi.

Solana’s DeFi ecosystem, in my blasphemous opinion, is in some ways superior to what Ethereum currently provides. And no, I’m not talking about the low gas costs. I’m referring to Solana’s incredible Serum DEX and its network of decentralised exchanges building on top of it. Serum allows DEXs built on top of it to leverage its central on-chain order book, leading to cross-exchange liquidity, which benefits users!

But that’s not all. There are a ton of applications building on top of Solana that deserve individual attention due to their innovative models. For example, last month, we took a look at Mango Markets and what it has done for on-chain derivatives trading.

This time, we’re exploring another diamond from the Solana ecosystem that provides the best liquidity and spot trading features for the ecosystem- Raydium.

Raydium utilises Serum’s on-chain central order book for trading, allowing users to access trading features similar to those found at centralised exchanges. At the same time, Raydium can access and supply liquidity from its pools to other DeFi protocols within the ecosystem.

In this Raydium review, we take deep-dive into what Raydium is, who is behind it, and whether it’s the right exchange for you. If you have a question, we’ve probably answered it here. Read on!

Raydium Summary

| HEADQUARTERS: | Decentralized |

| YEAR ESTABLISHED: | 2021 |

| REGULATION: | Unregulated |

| CRYPTOCURRENCIES SUPPORTED: | Any SPL Token (Solana’s Token Standard) |

| NATIVE TOKEN: | Raydium Token (RAY) |

| MAKER/TAKER FEES: | 0.25%/0.25% |

| SECURITY: | Audit in progress |

| BEGINNER-FRIENDLY: | Recommended for those with experience using DApps and self-custody wallets |

| KYC/AML VERIFICATION: | None |

| FIAT CURRENCY SUPPORT: | None |

| DEPOSIT/WITHDRAW METHODS: | On-chain & non-custodial |

What is Raydium

Raydium is an automated market-maker built on the Solana blockchain that allows its users to trade, swap and earn a yield on digital assets. Being built on Solana, Raydium enables users to execute trades at instant speed and near-zero network costs.

Like most decentralized exchanges, Raydium employs a liquidity pool system for users to swap assets. However, Raydium does this by leveraging the Serum DEX built on Solana. The Serum DEX integration allows users to gain access to an ecosystem-wide central limit-order book system that provides unparalleled liquidity compared to other platforms.

Raydium also has its own token, 'RAY', which provides holders various benefits such as a share in protocol earnings, and access to the platform's native launch pad 'AcceleRaytor'. In the future, RAY is expected to also act as a governance token granting holders potential governance rights. According to DeFi Llama, 'Raydium' currently occupies 4th place in overall TVL within the Solana ecosystem, with over $317 million in assets locked on its platform.

Raydium Team & History

Raydium's development began in the summer of 2020 and was founded by pseudonymous developer AlphaRay and their team. At the time, DeFi was just starting to pick wind and AlphaRay, a seasoned trader tired of Ethereum's high gas costs, was looking for a solution to fix this. So he reached out to the FTX team and told them about his vision. In turn, FTX introduced AlphaRay to two projects they had been closely involved with and worked on- the Solana blockchain and the Serum protocol.

Image via Medium

Image via MediumAlphaRay, along with other team members, saw the potential of Serum DEX and began building Raydium, which launched in Feb 2021. Raydium's team has over two decades of experience in market making, arbitrage, and high-frequency trading in cryptocurrency and traditional markets.

AlphaRay is in charge of Raydium's overall strategy, operations, product direction, and business development. He has a background in commodity algorithmic trading, but in 2017 he shifted to cryptocurrency market making and liquidity provision.

Other notable team members include GammaRay and XRay. GammaRay is the marketing and communications director. He is in charge of product development and strategy. His crypto speciality before joining Raydium was discretionary marketing and technical analysis.

XRay is the Chief of Technology and the leader of the Development team. He has around eight years of experience in crypto and regular markets trading and systems architecture. X is also the architect of Raydium's infrastructure and systems.

Raydium Exchange Key Features

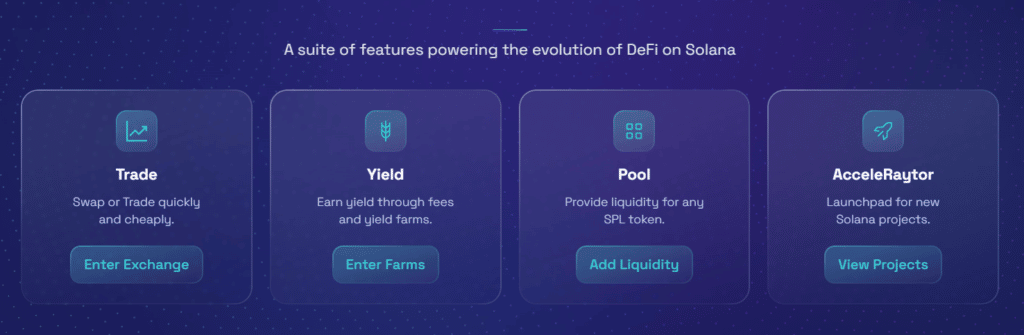

Raydium primarily offers four key features to its users:

- Trading

- Farming

- Staking

- Launchpad

Raydium Features via Raydium Website

Raydium Features via Raydium WebsiteTrading

The trading experience on Raydium is similar to DEXs on Ethereum, but with two key differences- unparalleled liquidity and the ability to place limit orders on select tokens. Both these features are possible due to Raydium’s integration with Serum DEX.

If you’ve never heard of Serum before, Serum is a base protocol layer for decentralised exchanges that allows developers to build their own DEXs on top of it. This allows exchanges leveraging Serum to access and share liquidity through its on-chain central limit order book system.

Raydium also offers users a choice between two different trading experiences within its platform- Limit-Order Book and Swaps via liquidity pools.

Limit Order Book

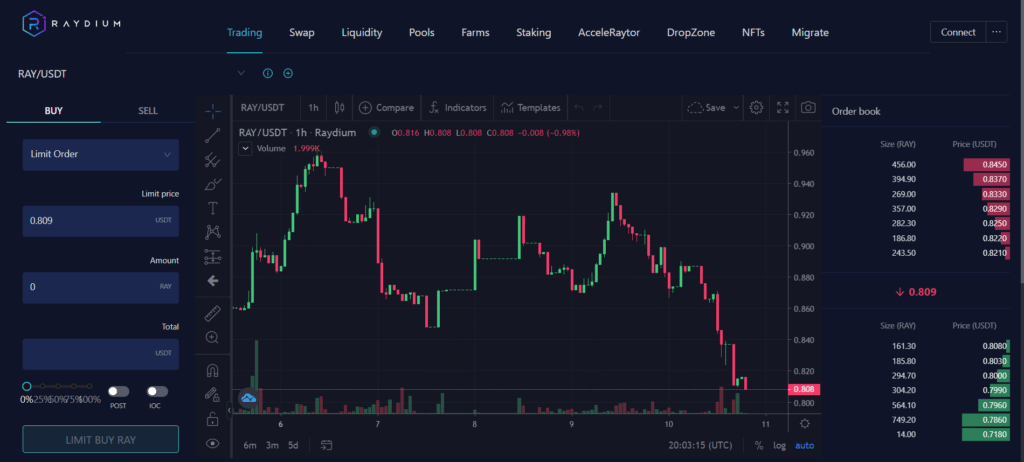

Raydium’s Limit Order Book interface provides users with an experience similar to centralised exchanges, where the user can watch the price chart of the desired token pair and the top buy or sell bids placed by users of the exchange.

Raydium Limit Order via Raydium Website

Raydium Limit Order via Raydium WebsiteAs the name suggests, it allows users to place limit orders on selected tokens featured on its trading interface. Limit orders allow users to specify the price at which they would like their trade to execute. This allows users to experience a relatively stress-free trading experience compared to most other DeFi exchanges.

Currently, Raydium actively supports around 260+ market pairs on its user interface. However, users can access and add any new market pair not listed on the interface as long as it has an existing market on Serum.

To add an existing market pair on Serum to Raydium, users need to create a custom market on the interface by clicking the ‘+’ symbol above the trading chart on the interface and adding the market id of the desired pair. Be careful, though; certain custom market pairs might be deprecated, do not trade on them.

Swaps via liquidity pools

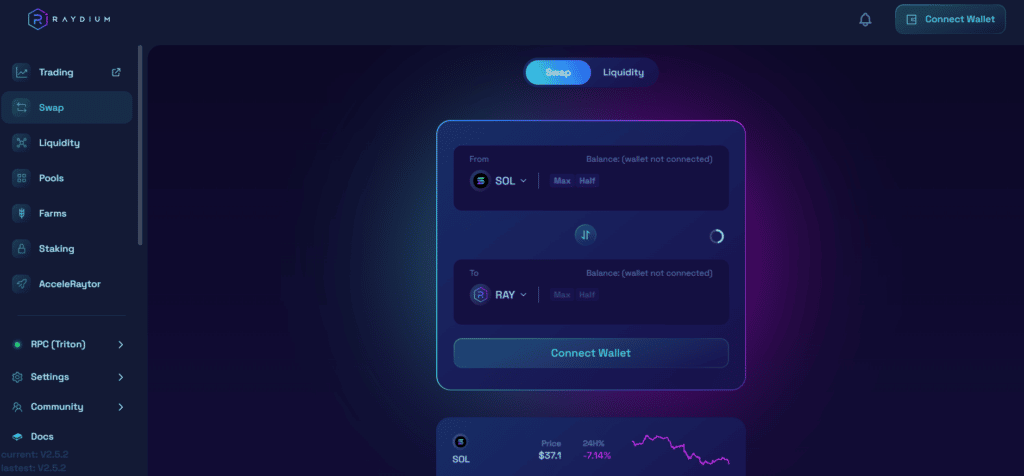

Raydium also has a swap interface that enables the swapping of assets in a liquidity pool by using a constant function market-maker to determine prices. This interface might be familiar to those using decentralized exchanges on the Ethereum ecosystem for a while.

Raydium Swap Interface via Raydium Website

Raydium Swap Interface via Raydium WebsiteHowever, unlike its Ethereum counterparts, Raydium's AMM interacts with Serum's central limit order book, which means that pools have access to all order flow and liquidity on Serum, and vice versa. This allows Raydium to offer users the best price possible for their swaps.

Raydium does this by analyzing and determining whether swapping within a liquidity pool or through the Serum order book will provide the best price for the user and executes accordingly. Users can execute trades for any SPL token (SPL or Solana Program Library is Solana's Token Standard) as long as it has an existing liquidity provider or market on Serum.

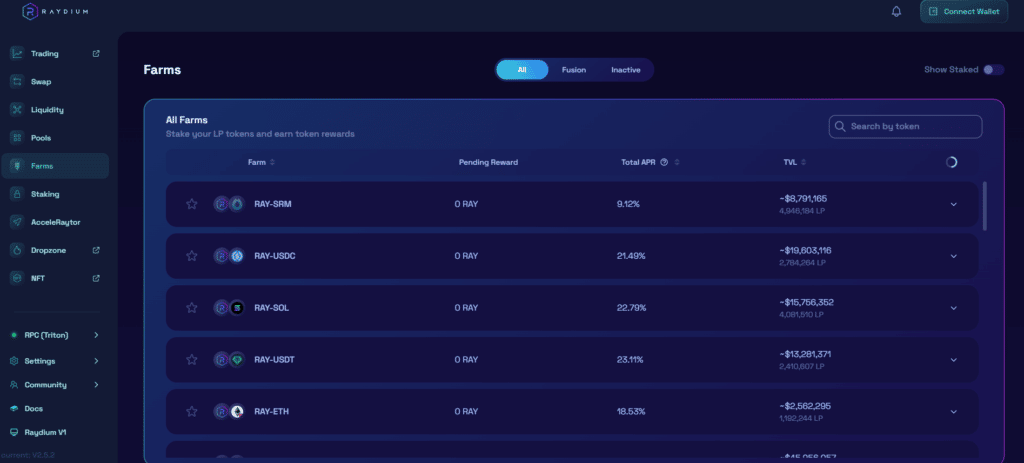

Farming

Users can farm rewards in the form of RAY tokens by providing liquidity to the Liquidity Pools on Raydium. In addition, the exchange's 'permissionless pool' system allows anyone to create a liquidity pool for any SPL token pair on the platform. This eliminates any whitelisting process for liquidity pools on the platform.

Raydium Farms via Raydium Website

Raydium Farms via Raydium WebsiteLiquidity providers on Raydium earn a share in the total transaction fees earned by the platform by staking their LP tokens in ‘farms’. Around 88% of the fees collected are re-routed to the liquidity pool and earmarked as rewards for liquidity providers. The remaining 12% rewards RAY tokens for the staking pool.

Staking

Raydium allows holders of its native token ‘RAY’ to earn additional RAY tokens by staking on the platform and earning interest. Currently, the RAY staking pool offers a 10.29% interest rate on staked RAY.

Raydium LaunchPad- AcceleRaytor

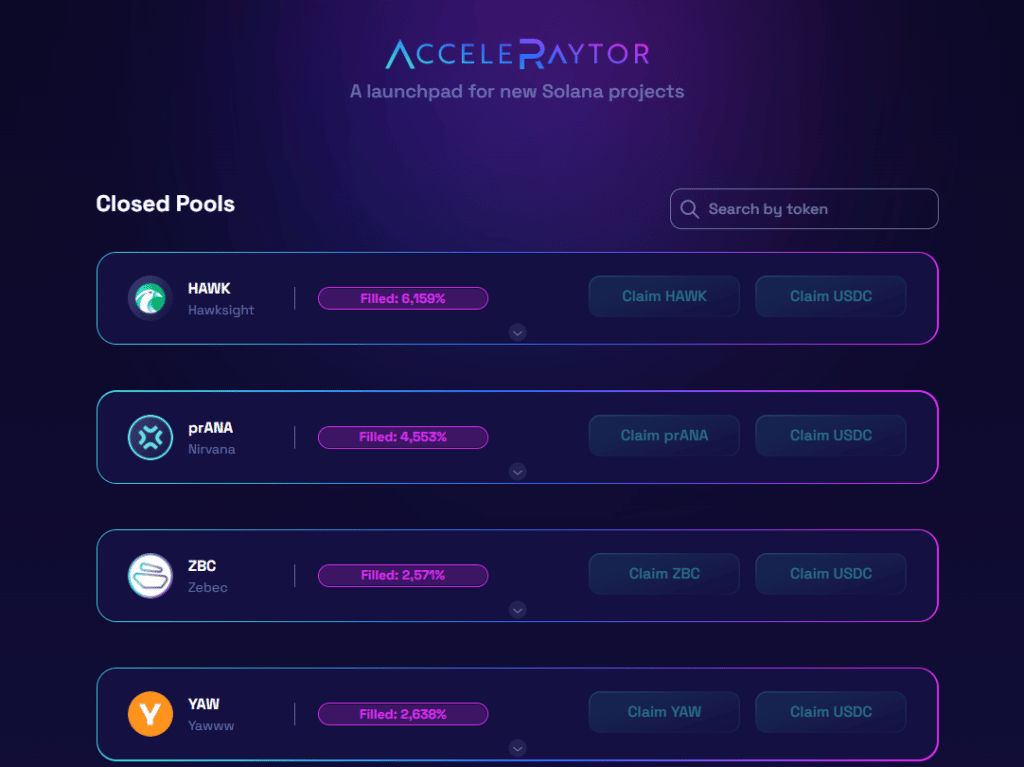

AcceleRaytor is Raydium’s native launchpad that helps projects raise capital and drive initial liquidity in a decentralized manner. It is a part of Raydium’s efforts to spearhead and promote development in the Solana ecosystem. This is generally achieved through launching an initial token offering on the Raydium platform. The Raydium team curates and vets projects to determine if they are a good fit for the platform's vision before listing their tokens on the launchpad.

Raydium Launchpad via Raydium Website

Raydium Launchpad via Raydium WebsiteParticipation in token offerings on AcceleRaytor is decided by a lottery system. Eligible users must enter tickets into the lottery and win a chance to invest. The more tickets you have, the higher your chance of winning an allotment in the IDO. To gain access to tickets, users must generally stake at least 100 RAY tokens for a minimum period of 7 days before the snapshot date. The longer you stake, the more tickets you win.

Raydium Fees

Raydium charges a 0.25% fee for both maker and taker orders when executing a swap in its liquidity pools. This 0.25% fee is split and distributed as follows-

- 22% (88% of the fee) is redeposited into the liquidity pool and acts as a reward for liquidity providers.

- 03% (12% of the fee) is used to buy RAY and distribute it to the staking pool as rewards for RAY stakers.

For orders fulfilled via the Serum DEX, the transaction fee is paid to Serum and is determined by the number of SRM tokens staked. Generally, Serum charges an average of 0.22%, which decreases based on the amount of SRM held.

Apart from the fees charged by Raydium for the use of its platform, users must also be mindful of network fees. Solana transactions typically cost between 0.0001 — 0.001 SOL.

Raydium KYC and Account Verification

Raydium is a decentralized exchange and does not follow any KYC or account verification process. All you need to use the platform is access to a self-custody Solana wallet and some SOL tokens to pay for network fees.

Moreover, unlike most IDO Launchpads, Raydium’s AcceleRaytor does not require any KYC to participate in its IDO launches. With regulation around the world increasing, it is unclear how much longer this would be possible. Though, enforcement of regulation on decentralized applications remains nearly impossible.

Raydium Security

Raydium received an initial audit in 2021 by Kudelski Security and has since undergone numerous changes. Therefore, while a full re-audit is currently underway, the team has received extensive reviews from members of the Neodyme team via a bug bounty agreement.

Raydium Initial Audit via docs

Raydium Initial Audit via docsAcceleRaytor, DropZone and stable-curve AMM programs have not yet been audited. However, an additional full audit that will review all upgrades and more recent programs is planned for Q2 of 2022.

Moreover, Raydium's AMM uses the constant function pricing curve k=x*y to determine price according to the ratio of tokens in a liquidity pool. This means that Raydium does not rely on an outside oracle at this time for pricing feeds, eliminating the risk of Oracle manipulation in flash-loan attacks. Similarly, Solana's low latency and high throughput reduce the risk of front-running transactions.

Wallets and Cryptocurrencies Supported on Raydium

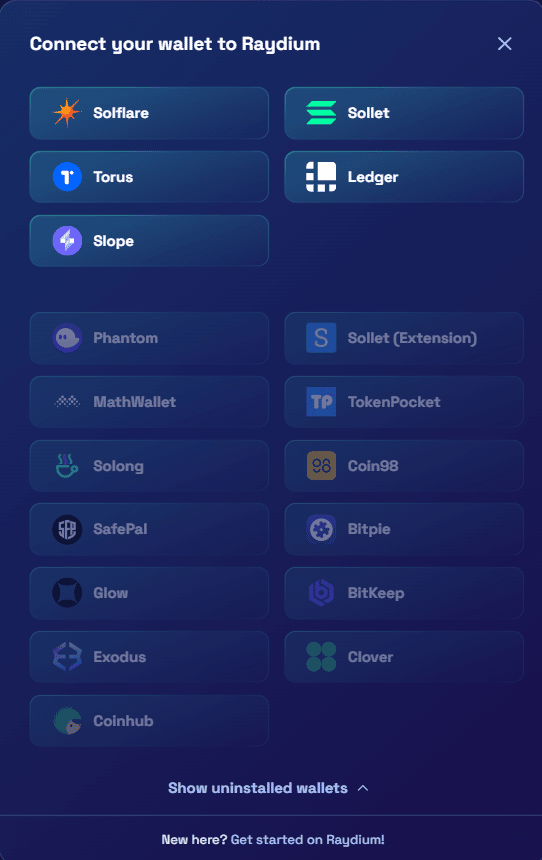

Currently, Raydium supports over 20 wallets, including Solflare, Sollet, TokenPocket, Phantom, Ledger, and Bitkeep, to name a few.

Raydium Supported Wallets

Raydium Supported WalletsOn the matter of supported cryptocurrencies, there is no bottom in sight as Raydium supports the trade of all SPL tokens on its exchange, as long as a liquidity pool or Serum market exists for the desired token pair. Furthermore, Raydium also supports wrapped versions of other tokens from different blockchains, such as wrapped BTC or wrapped ETH.

Raydium Exchange Platform Design and Usability

The Raydium Platform is easy to use and navigate from a design perspective due to its simple layout and clean UI. All the website features are functional, and the text is easy to read. The darker colour scheme is easier on the eyes in low-light surroundings. The platform is also compatible with mobile devices and can be accessed via the mobile browser. The team is currently working on a cleaner, more optimized version of the platform for mobile devices.

My only gripe with the platform is its limit order book interface. Some text seems to be squished together in certain areas of the site. However, this does not seem to affect its functionality. Just a visual eyesore. Moreover, the team seems to be actively addressing and resolving issues with the platform at the earliest opportunity.

Deposits and Withdrawals at Raydium

Raydium is a non-custodial exchange. This means that users do not deposit assets onto the platform to execute trades; rather, the platform facilitates seamless peer-to-peer trading via smart contracts in on-chain order books or swapping of assets in liquidity pools.

Raydium Token (RAY): Uses and Performance

Utility

The Raydium token (RAY) is an SPL token that runs on the Solana blockchain. The RAY token is intended to be a governance token for the protocol in the long run.

Currently, it grants holders a claim on a portion of trading fees collected by the exchange. Each trade or swap on Raydium incurs a 0.25% fee, where 0.22% goes to LPs (liquidity providers), and 0.03% goes to a staking pool that rewards users staking their RAY tokens on the protocol. Also, users wishing to gain access to the AcceleRaytor launchpad must stake RAY for a certain duration.

Token Distribution

RAY has a max supply of 555 million tokens minted at launch. More than 60% of the token supply is split between Mining Reserve (34%) and the Ecosystem and Partnership fund (30%). These tokens will be used to develop the ecosystem and reward early community members who have staked RAY.

The team has a 20% allotment of the token supply with a three-year vesting period. The remaining tokens are split between the liquidity for AMM at Launch (8%), the community pool (6%) and advisors (2%). The community pool and advisor tokens are subject to a vesting period of 1 and 3 years, respectively.

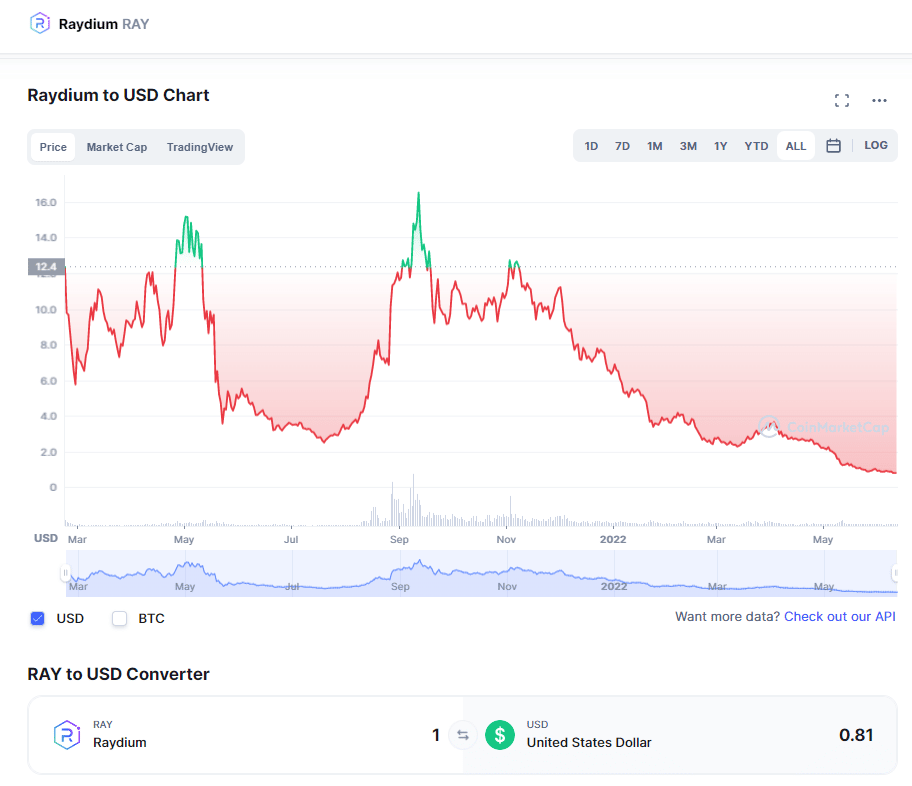

Price History

Raydium Price History via CoinMarketCap

Raydium Price History via CoinMarketCapAccording to CoinMarketCap, RAY seems to be currently trading at $0.80, its all-time-low, with a market cap of $91 million. The token reached an all-time high of $16.93 during the peak of Solana’s rally from $30 to $200 in September 2021. The current price of RAY is likely a result of Solana’s dwindling DeFi TVL caused by its recent serial outages and, of course, the current bear market.

Where to buy RAY?

RAY can currently be bought on both centralized and decentralized exchanges. The available markets are listed below

Centralized Exchanges- Binance, Gate.io

Decentralized Exchanges- Raydium and Serum DEX

Can I stake RAY?

Yes, RAY can be staked at raydium.io to earn staking rewards. The current rate of interest is 10.29% APR.

Raydium Customer Support

Raydium has responsive customer support with multiple channels for customers to get their issues addressed. Users can contact the Raydium team and raise support tickets via Discord, or Telegram. I personally found the discord channel to be more responsive with at least one moderator present in the group at all times.

Raydium Top Benefits Reviewed

Raydium is an excellent platform for trading tokens on the Solana ecosystem due to the following reasons-

- Liquidity- Raydium has a lot of liquidity due to its integration with the Serum DEX. This makes order execution seamless and creates a lesser gap between buy and sell bids.

- Price Execution- Raydium consistently executes orders at the best available price across the Solana ecosystem.

- Community and Development- The Raydium team and community seem to be a loyal bunch, this comes in handy when facing issues with the platform. There is always somebody to help or answer questions in the discord.

- Lack of KYC- Not sure if this is a good thing or a bad thing. But, for those concerned about privacy, Raydium does not require KYC for any of its services.

What can be Improved

In terms of improvement, the first thing to address would be an expansion of the current range of products. While liquidity might be shared due to being integrated with Serum, Solana’s DeFi ecosystem is fragmented, with users hopping between different decentralized exchanges to gain access to different products, i.e. margin trading, derivatives trading, etc.

I’d like to see an exchange that offers many products similar to centralized exchanges. Of course, I understand the difference in the size of operational teams between the two might make this wishful thinking. But a man can hope.

Trading Charts on Raydium

Trading Charts on RaydiumAs for more realistic areas of improvement, Raydium’s trading chart feature on its limit order book interface is something that most traders appreciate. It allows users to mark and draw trading patterns. However, it remains limited to the trading pairs whitelisted by Raydium unless you’re willing to manually add a custom market and spend some SOL on network fees in the process. In my opinion, Raydium could improve on this by increasing the number of trading pairs on the limit order interface or by launching a dedicated trading chart interface for all assets on Solana.

Closing Thoughts

Raydium is undoubtedly one of the top DeFi projects to launch on Solana providing incredible liquidity for users. Their launchpad is also a force to reckon with, having launched many quality products in the Solana ecosystem, such as Star Atlas, Genopets, etc.

Raydium is an excellent choice if you’re thinking about exploring DeFi on Solana for the first time. Its user interface resembles most DEXs on Ethereum while also showing users Solana’s promise of low latency trading and on-chain order books.