More than 10 years after the creation of Bitcoin and blockchain protocols networks still struggle with the scaling dilemma that keeps them from growing to global levels while also being able to achieve stable purchasing power and value. Enter the Reserve Protocol and its team, who are looking to change all that by creating an accessible and trusted stablecoin that can scale to global usage.

It’s interesting to see that in just a decade cryptocurrency went from a mailing list discussion among a bunch of technical geeks, slowly grew into a decentralized movement, brought in masses of speculation, and most recently has split off into thousands of mostly useless projects and protocols.

Reserve Rights Transforming Reserve Money

Reserve Rights Transforming Reserve MoneyAccording to the creators of the Reserve Protocol eventually cryptocurrencies and blockchains will consolidate. There will be a power struggle to determine which blockchains are most useful and most usable, and eventually we will see a small number of cryptocurrencies emerge with global domination.

Until this happens disruption in the financial world, and the possibility of a looming catastrophe as central bankers print mountains of money remain on the table. Once cryptocurrencies consolidate and go global a golden period of prosperity is likely to follow, and here’s why.

Traditional fiat money that’s printed and controlled by governments is broken in parts of the world, and is becoming increasingly broken as increasingly corrupt politicians and governments seek power and wealth, which is creating an issue in the maintenance of stable values in fiat currencies.

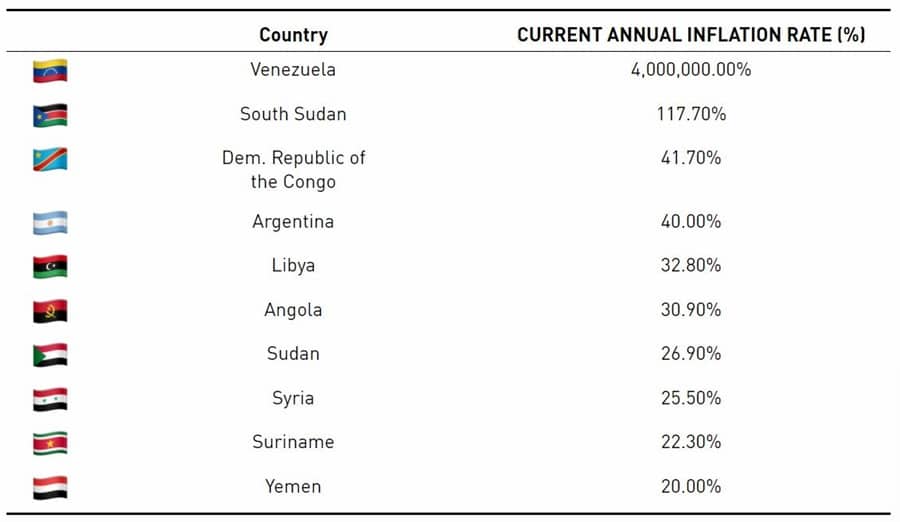

High inflation countries and currencies. Image via Reserve Protocol.

High inflation countries and currencies. Image via Reserve Protocol. This problem can be solved through the use of cryptocurrency, specifically stablecoins. There are a number of projects that currently have centralized stablecoins pegged to the U.S. dollar or to some other fiat currency, but the most promising future of cryptocurrencies is more likely to be in a decentralized stablecoin that’s not dependent on any one fiat currency or asset. Once this type of asset emerges many nations of the world will see an improvement in the livelihood of the common man.

Introducing the Reserve Protocol

The team at the Reserve Protocol seeks to build a stablecoin that is completely decentralized, with a network of fiat on/off ramps, and a complete inability to be shut down once launched.

The goal is to have a stablecoin that makes money secure for not just the banked in developed countries, but also for the billions of unbanked around the world who have no safe place to stare their money. The Reserve Protocol seeks to circumvent corrupt bankers and governments, allowing anyone in the world to have a secure store of currency that can’t be stolen by banks or inflated away by governments.

The Reserve Protocol will make this a reality by creating a fully decentralized stablecoin backed by a diverse set of assets. This stablecoin will make low-friction cross-border transactions possible all around the world. And it will ensure that governments can’t abuse the currency since it will be out of their control and also impossible to shut down.

A fully decentralized , stable, global currency is coming. Image via Reserve Protocol.

A fully decentralized , stable, global currency is coming. Image via Reserve Protocol. The initial development of the Reserve tokens is being done in Ethereum, but there are plans to eventually create a bridge that will introduce complete interoperability that will help to fully decentralize the network.

Not only does the stablecoin being created by the Reserve Protocol team need to be decentralized, it also needs to be trusted while also being strong economically and able to withstand attacks. It’s a lot to ask for, but if achieved the Reserve token could become the safe haven currency of the world, assuming the team can also achieve adoption for the tokens.

The plan for the Reserve Protocol was to decentralize the network operation in three distinct phases.

The first phase was meant to take place in 2019 and have the RSV token centralized and backed by U.S. dollars held in trust by a third-party, similar to the way in which Tether is collateralized. Instead, the team skipped over this first stage and went to the second stage.

The second stage is a decentralized stage where RSV tokens are backed by a basket of other blockchain assets. This is the current stage as of October 2020.

Finally the project will enter the independent phase in which RSV is backed by a diverse set of assets. The token at this point will have its own strong economy and purchasing power and will no longer require a peg with the U.S. dollar. At this point the RSV will be able to serve its global userbase on its own regardless of the fluctuations in the U.S. dollar or other fiat currencies.

Reserve Protocol Tokens

Currently there are two different ERC-20 tokens that work together in the Reserve protocol. These are the Reserve Stablecoin (RSV) and the Reserve Rights Token (RSR).

The Reserve Stablecoin (RSV)

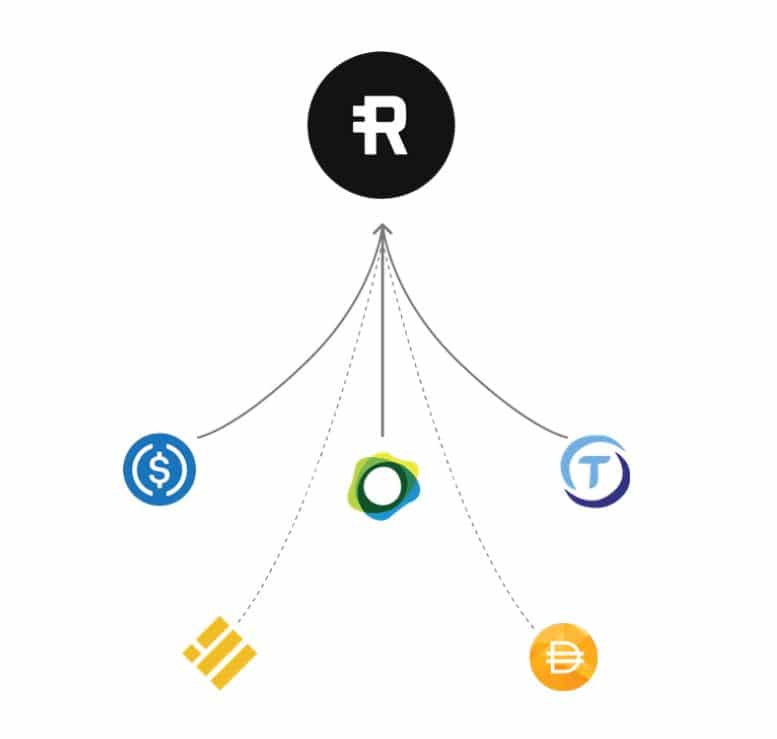

The Reserve Stablecoin (RSV) was launched in 2019 and is backed by a basket of tokenized assets. At launch these were the USD Coin (USDC), TrueUSD (TUSD), and Paxos Standard (PAX). Over time more assets, including securities, other currencies, and commodities are planned to be added to the basket to increase the diversity of the backing.

There are three primary functions of the RSV token:

- Preserve savings against hyperinflation

- Facilitate cheap remittance between countries

- Enable a more reliable and robust merchant ecosystem in developing countries.

The team envisions a vault of 100 different low-volatility assets eventually backing RSV. As of October 2020 they haven’t announced which assets might be included.

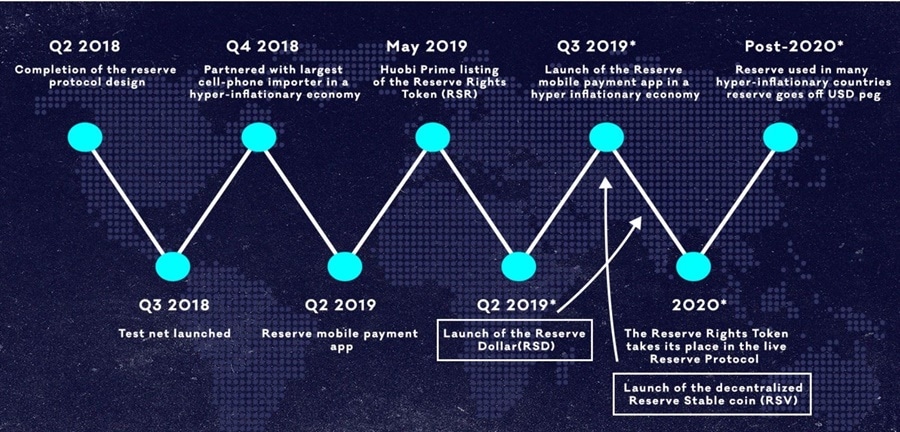

The launch of the RSV token. Image via Reserve Protocol blog.

The launch of the RSV token. Image via Reserve Protocol blog. The RSV is meant to maintain parity with the U.S. dollar for the time being, but will eventually maintain a static value determined by the token itself. It is already included in the Reserve Protocol app that is being used in Venezuela, Columbia, and Argentina.

The RSV is designed to be fully-collateral backed, with the collateral being held in the Reserve Vault. The Vault is a smart contract used to pool and hold the assets that collateralize the RSV token. There are two ways in which the Vault will be funded:

- There is a 1% fee on all RSV transactions and that fee goes to the Vault.

- Any capital gains of the assets held in the Vault will help fund the Vault.

How the Reserve Token is Stabilized

One key to the Reserve token is how well it maintains stability. If demand for the token drops it would logically follow that the price will also drop. How will a stable peg be held in the face of changing demand?

For the sake of argument let’s imagine that the redemption price of 1 RSV is $1. If the price on the open market drops to $0.98 there will be an incentive to buy RSV on the open market and redeem it to the smart contract for $1 worth of collateral tokens. That will continue until the open market value returns to $1 at which time it will no longer be profitable to buy and redeem the RSV tokens.

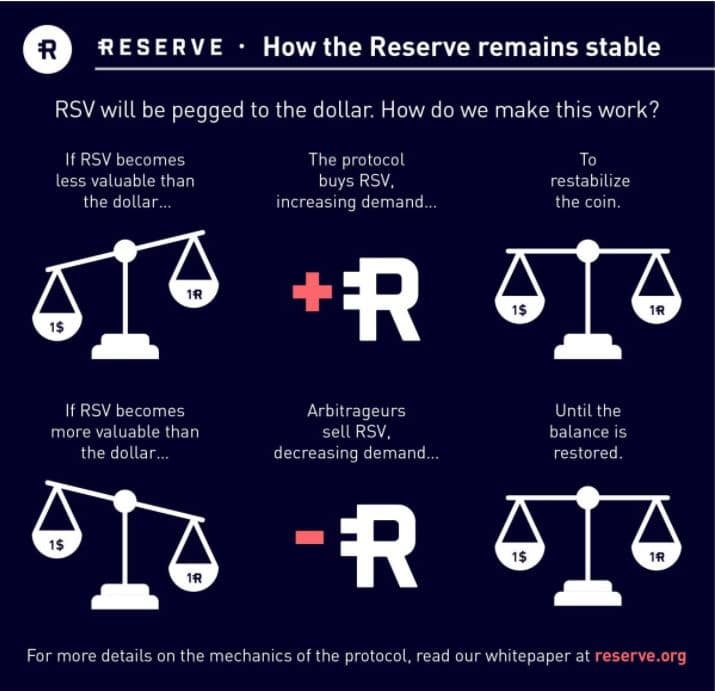

Simple explanation of how the RSV token maintains a stable value. Image via Reserve Protocol blog.

Simple explanation of how the RSV token maintains a stable value. Image via Reserve Protocol blog. If demand increases and the price of RSV rises the same mechanism will return the price to its stable peg. For example, if increased demand causes RSV on the open market to be priced at $1.02 arbitrageurs will step in and purchase the newly minted RSV for $1 and then sell them on the open market for a profit. This will continue until the price on the open market is driven down to $1 by all the RSV selling.

The Reserve Rights Token (RSR)

The second token in the ecosystem is the Reserve Rights Token (RSR). This token has two primary functions in the Reserve Protocol:

- It is a utility token, allowing holders to vote on governance proposals.

- It will help keep the RSV value at its target price of $1.

Unlike the stablecoin RSV the RSR token is volatile. They have been offered to investors and the proceeds fund the Reserve Protocol project. While the RSR is volatile it is also used to guarantee the collateralization rate and peg of the RSV.

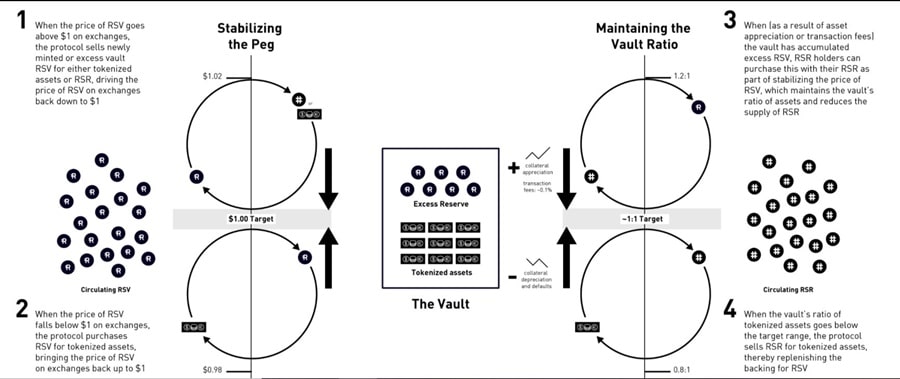

Flow chart showing how to stabilize the Reserve token. Image via Reserve Protocol website.

Flow chart showing how to stabilize the Reserve token. Image via Reserve Protocol website. RSR is also used to recapitalize the network if at any time the assets held in the Reserve’s Vault depreciate and can no longer fully collateralize the RSV in existence. As a result, whenever there is an increase in the total supply of RSV the number of RSR tokens circulating will decrease. This is because the arbitrage opportunity presented can only be exploited by RSR holders who then settle by selling RSR.

The Reserve Dollar (RSD)

The third token type is the Reserve Dollar (RSD). This token was not mentioned in the whitepaper, however the team has mentioned it. The RSD was meant to be centralized and backed 1:1 by the U.S. dollar, with a 1:1 peg to the U.S. dollar. It was supposed to be the first token issued, however the team jumped over it and issued the RSV first. At the time they said they will still be issuing the RSD, but there has been little mention of it since July 2019.

The Current State of the Reserve Protocol

The Reserve Protocol has already released its mobile app in several South American countries, and they say the typical users in October 2020 are the business owners and common people of Venezuela who benefit from the low-friction transactions enabled by the Reserve Protocol. They also benefit from the ability to save and transact in a currency other than the intensely inflationary Venezuelan Peso.

Using the Reserve Protocol gives them the ability to cash in and out using bank transfers if they wish, or by using Paypal or Zelle. The process is quite simple. A user cashes into the ecosystem by requesting to buy RSV in the app. They make a transfer in whatever way they prefer and the transfer goes to one of the Reserve Protocol network traders who fulfill the request by sending RSV. The user can then spend the RSV as they like and if they wish to cash out later they simply use the same process in reverse.

Some assets that could be used for collateralization. Image via Reserve Protocol website.

Some assets that could be used for collateralization. Image via Reserve Protocol website. The project already has a growing user-base, but it is just the beginning of what the Reserve Protocol team is envisioning. The plan is to extend the network to countries all around the globe. Additionally there are plans to add other functionality, such as handling card payment processing, automated currency exchange, handling payrolls, and more.

Of course everything that’s planned has been built before, but not all together and not on the blockchain. Plus there are many places in the word cut off from access to these basic financial services.

It hasn’t been proven yet, but the Reserve Protocol team believes entire economies can be run using cryptocurrencies. And that by using a per-to-peer approach they will remove the oversight and regulation that often comes with financial systems. These P2P transactions cannot be tracked by any third-party agency, they are anonymous, and it is nearly impossible for governments to control the flow of capital in these P2P transactions.

Competitive Advantage

It’s well known that cryptocurrencies and digital assets as they exist today are extremely volatile in their nature. Because of this there are already numerous stablecoins that have been developed in order to provide cryptocurrency traders and holders with more reliable long-term prices.

Some of the largest stablecoin projects include Tether (USDT), True USD (TUSD), Paxos Standard (PAX), USD Coin (USDC), and Binance Coin (BUSD). All of these are collateralizing their stablecoins with the U.S. dollar. In addition there are a number of projects that are not using the U.S. dollar as a collateralization method. These include DAI from MakerDAO and of course RSV the Reserve stablecoin from the Reserve Protocol.

Some uses for Stablecoins. Image via Changelly blog.

Some uses for Stablecoins. Image via Changelly blog.Top Competitor Valuations (Oct 2020):

- Tether - valued $16.5B

- USD Coin - valued $2.9B

- Maker DAO/DAI - valued $940M

- Binance USD - $710M

- HUSD - $272M

- True USD - valued $250M

- Paxos Standard - valued $245M

It’s impossible to say how RSV compares against rivals since there is no circulating supply data available and so no market capitalization listed on Coinmarketcap.com. That said, the Reserve Protocol team has been clear in declaring their desire to become the stablecoin for the world. In addition they are also interested in expanding the ecosystem to include a range of cryptocurrencies, including some that can be held for the long-term as a store of value. In addition there could be currencies to help support the growing dApp economy.

By launching in high inflation countries such as Venezuela and Argentine, and by targeting emerging market economies, the team believes they will be able to gain a competitive advantage. That’s certainly true for those countries, but it remains to be seen if it will be true on a global scale.

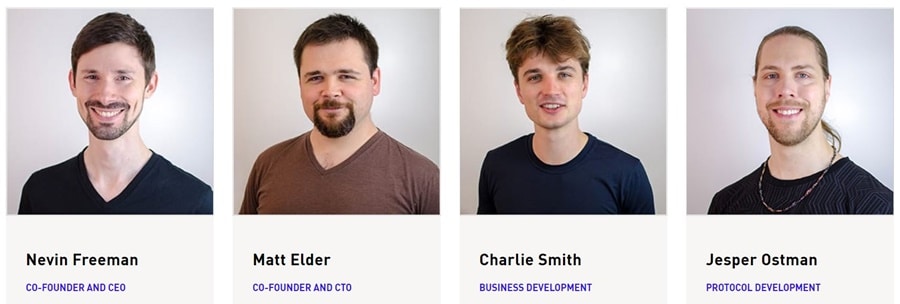

The Reserve Protocol Team

One of the most impressive things about the Reserve Protocol is the team. They have an incredible skill set, and very impressive credentials. After being founded in 2018 by a group of three co-founders the team has grown to 10 known members.

Those 18 individuals have working experience at Alphabet, Impossible Foods, Tesla, IBM, OpenAI, Hashgraph, the Jane Goodall Institute, and MIRI. Besides these 10 who are listed on the Reserve Protocol website there are a number of anonymous members who are not listed because of their location or because they don’t wish their identities to be known.

Some of the Reserve Protocol team members. Image via Reserve Protocol website.

Some of the Reserve Protocol team members. Image via Reserve Protocol website. - Nevin Freeman (Co-Founder & CEO): Nevin is the primary founder of the Reserve Protocol and acts as the CEO of the project, overseeing the strategy, legal, and team coordination at Reserve. Prior to founding Reserve Protocol Nevin was a serial entrepreneur and was the co-founder of Paradigm Academy, Metamed, and RIABiz. He is driven to find ways to solve problems that keep the human race from achieving its full potential. He is particularly concerned with the long-term risks posed by technology, especially the problems that come with the development of artificial intelligence.

- Matt Elder (Co-Founder & CTO): Matt is the chief technology officer at the Reserve Protocol and he designs, analyses, and oversees the Protocol as well as being the architect of the Reserve protocol implementation. Before co-founding the Reserve Protocol he was an engineer at Alphabet, IBM, and Quixey.

- Miguel Morel (Co-Founder): Miguel was previously in charge of operational strategies at Reserve Protocol and while his LinkedIn profile shows him still with the project, he is no longer listed on the Reserve Protocol team page. It seems he has moved on to found a new start-up, but nothing is known about it as it is a “stealth startup’.

Other team members include Charlie Smith in Business Development, Jesper Ostman and Taylor Brent in Protocol Development, Cathleen Kilgallen as CFO, Mark Lee in Legal, and Erika Campbell in Onsite Operations.

Conclusion

Blockchain technology is evolving, and the economy associated with cryptocurrencies is growing and maturing, which makes it increasingly difficult for one project to stand out from all the others. The Reserve Protocol is competing against a large group of stablecoins, and seeking to become the dominate stablecoin globally. It faces many challenges in that respect, but does feature an incredibly strong and talented team that is committed to the challenge of creating a decentralized, global, digital stable currency.

The team comes from an impressive number of major tech companies, and the team is extremely passionate about making the project a reality. The team also includes some advisors with impressive credentials, including monetary economist Garett Jones, and former SEC Commissioner Paul Atkins. The team has been able to secure the backing of some well-known investors that include the co-founder of Paypal, Peter Thiel, the Coinbase Ventures venture fund, and YCombinator founder Sam Altman.

Image via Reserve Rights Blog

Image via Reserve Rights Blog In addition to the solid funding received from direct investors, the project operates in the financial services and payments sector, which remains a high growth area and has immense potential when you include the billions of unbanked and under-banked all across the globe.

The team is facing a significant challenge in coming to market by directly targeting high inflation countries and emerging market economies. It’s quite a large task to develop a global network of merchants and users who commit to using the RSV tokens. The team is working ahead of schedule, but gaining global traction is a huge undertaking and could slow down the progress of the project in the coming months and years.

All of that means the project is extremely speculative, and the team is likely to learn new things and pivot in new directions as the project grows. We’ve already seen this when the team decided to skip centralized collateralization with the U.S. dollar and moved right to collateralization with a basket of other collateralized assets. No doubt the complexities of the project itself, combined with the difficulties that come with working in economically inefficient countries will create unforeseen issues that will need to be addressed.

Reserve has made significant progress already, but it is a project with a very long time horizon. There’s no saying when the project might begin to move into full independence and decentralization, but for those who agree with the philosophical leanings of the project and what they are trying to accomplish support can be given by purchasing and holding the RSR governance tokens. If the project accomplishes its goals this could be a very profitable long-term investment, however it should be considered a long-shot in the current state of development.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.