Stablecoins are arguably the most successful real-world use case of blockchain technology. They’re foundational to value exchange in DeFi, often used as collateral, settlement currency, and trading pair across every major crypto platform. As a result, they’re among the most widely owned and liquid assets in the space.

But not all stablecoins are built the same. The most popular variants—like USDT and USDC—are fiat-backed and rely on traditional financial infrastructure to maintain their peg. For users who prefer a more trustless, blockchain-native design, crypto-backed stablecoins like USDS offer an alternative. These require over-collateralization to maintain stability, which limits capital efficiency.

That trade-off between decentralization and efficiency has long defined stablecoin design. But a new architecture has emerged in recent years: stablecoins backed by delta-neutral crypto portfolios. Instead of holding excess reserves, these stablecoins use a combination of spot and derivative positions to maintain price stability with far less capital locked up. Ethena was the first major protocol to implement this strategy.

This article explores Resolv Protocol, another delta-neutral stablecoin project that introduces a new twist. It pursues greater decentralization and creates distinct yield opportunities through a dual-token structure. The result is a stablecoin system that’s more transparent, more crypto-native, and arguably more adaptable to market conditions.

Key Takeaways

- Resolv Protocol is a stablecoin system that issues USR—a crypto-backed, delta-neutral stablecoin collateralized by ETH and BTC—while maintaining price stability without relying on fiat.

- Resolv introduces RLP (Resolv Liquidity Pool), a decentralized insurance layer that absorbs protocol risks like liquidation losses and negative funding rates to protect USR holders.

- RLP offers high yield to users who opt in to underwrite the protocol’s risk in exchange for bearing market and counterparty exposure.

- The protocol mitigates systemic risks using collateral buffers, smart contract safeguards, and real-time incentive adjustments based on risk exposure.

- RESOLV is the protocol’s upcoming governance token; it has not yet launched but will play a central role in protocol control and community incentives.

What is Resolv Protocol?

Resolv is the protocol behind $USR, a delta-neutral stablecoin natively backed by Ether and Bitcoin. Like other delta-neutral stablecoins, Resolv uses a mix of long spot positions and short perpetual futures to construct a portfolio that holds its value regardless of market direction. This approach allows it to issue a stablecoin—USR—that tracks the dollar without relying on fiat reserves or over-collateralization.

But Resolv’s standout feature is its Resolv Liquidity Pool (RLP). This is a dedicated pool that absorbs the volatility and risks associated with the USR stablecoin, such as sudden price swings, funding rate imbalances, or exchange-related risks. RLP ensures that USR can always be redeemed for $1 worth of crypto assets, even during periods of market stress. This separation of risk—between the stablecoin layer and the protection layer—makes Resolv’s design particularly crypto-native.

At a high level, Resolv performs three core functions:

- Issuing and redeeming USR, allowing users to mint stablecoins backed by ETH-based assets and unwind positions when desired.

- Maintaining an on-chain pool of ETH and BTC positions—balanced through delta-neutral hedging—to collateralize USR.

- Operating the Resolv Liquidity Pool (RLP), which acts as an insurance fund and incentivized buffer to protect USR peg stability.

Resolv is a Delta-Neutral Stablecoin | Image via Medium

Resolv is a Delta-Neutral Stablecoin | Image via MediumKey Components of the Resolv Protocol

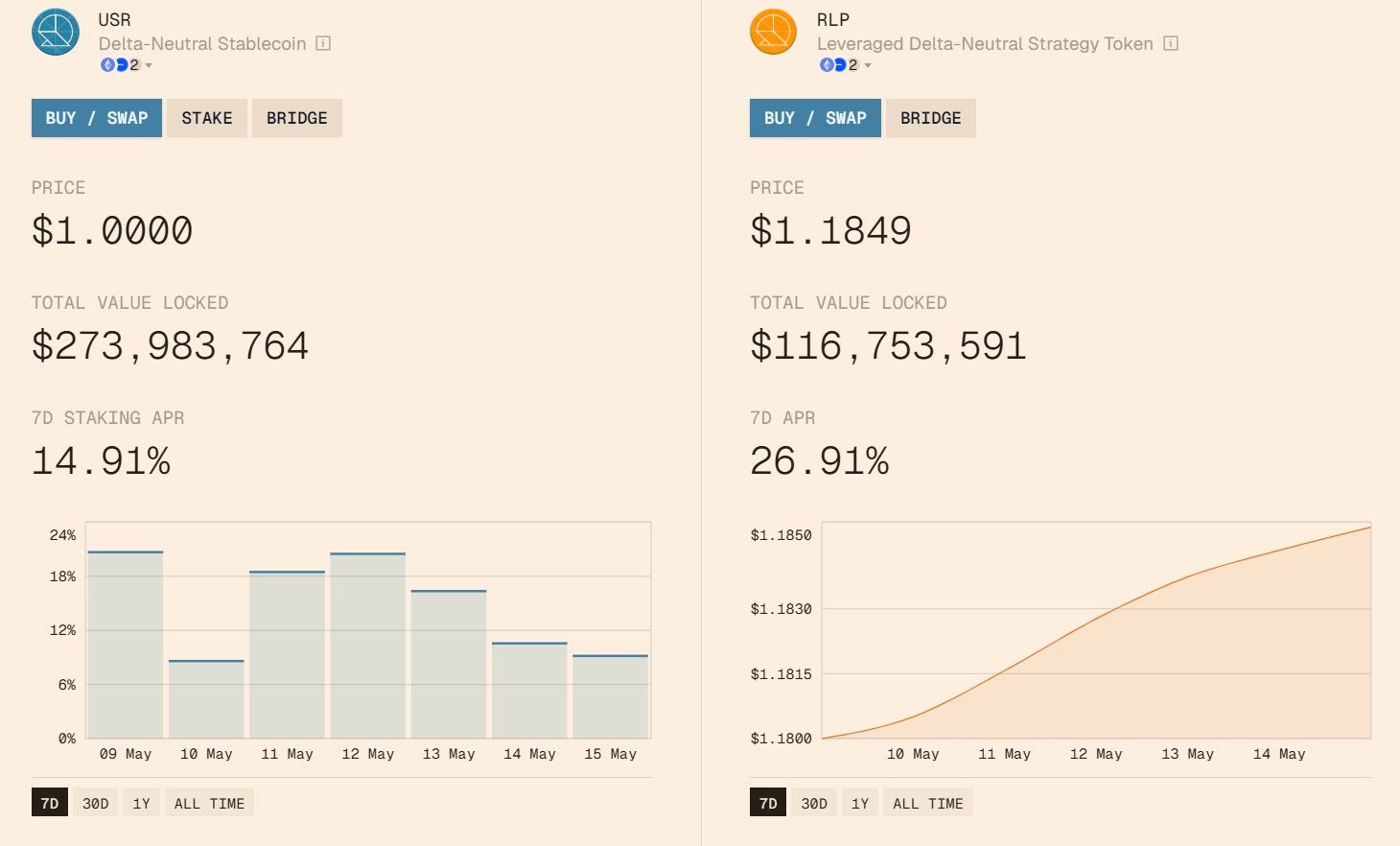

- USR: The stablecoin issued by Resolv. Each unit of USR is backed by a delta-neutral portfolio of ETH and BTC, and is designed to remain fully redeemable at all times.

- Resolv Liquidity Pool (RLP): The insurance pool that absorbs USR’s risk exposures—such as liquidation losses or negative funding rates. The pool is tokenized into RLP tokens, which users can purchase to earn high yields in exchange for underwriting protocol risk.

- stUSR: A liquid staked version of USR that allows holders to earn a share of protocol revenue. Like other liquid staking tokens, stUSR remains transferable while accruing yield.

Resolv’s dual-token design introduces a meaningful shift in risk management. While projects like Ethena centralize risk controls and rely on in-house insurance funds, Resolv delegates this responsibility to the open market through its RLP pool, offering a more decentralized and transparent model for stablecoin protection.

Delta-Hedging Explained

A delta-neutral portfolio is an investment strategy designed to maintain a stable total value regardless of market movement. It achieves this by holding a combination of positions that offset each other’s price risk.

In essence, the portfolio is constructed so that losses in one asset neutralize gains in another. For example, if one part of the portfolio gains $1 million due to a market move, another part is designed to lose an equivalent amount, keeping the overall value unchanged. This balancing act allows the portfolio to stay “market-neutral” even when prices are volatile.

Delta Hedging is s Common Practice in Financial Management | Image via Investopedia

Delta Hedging is s Common Practice in Financial Management | Image via InvestopediaThis concept is instrumental in the context of stable assets. A stablecoin, for instance, needs to be backed by assets that don’t fluctuate in value. While fiat-backed stablecoins solve this by holding inherently stable assets like U.S. dollars, crypto-backed models must find other ways to ensure price stability, often requiring significant over-collateralization to absorb volatility.

Delta-neutral portfolios offer an alternative: they can deliver price stability without the need for excess reserves. By carefully constructing a portfolio that cancels out directional risk, it’s possible to maintain a relatively constant value using otherwise volatile crypto assets. This makes them appealing for capital-efficient stablecoin designs.

Understanding Delta and Futures Contracts

The term “delta” comes from options and derivatives trading, and refers to how much the price of a derivative (like a futures contract) changes in response to a $1 move in the underlying asset.

- A delta of +1 means the derivative moves dollar-for-dollar with the underlying asset.

- A delta of –1 means it moves in the opposite direction.

By combining assets with opposite delta values—typically long spot positions (positive delta) and short futures contracts (negative delta)—you can build a portfolio where the overall delta is close to zero. This is the foundation of delta-neutrality.

Such a portfolio doesn’t bet on price going up or down. Instead, it’s designed to neutralize exposure to market movements altogether. This opens the door to financial applications that require stability—without requiring off-chain assets or trust in traditional financial systems.

How Does Resolv Protocol Work?

To maintain its price stability, Resolv constructs a delta-neutral portfolio involving a combination of long spot positions and short futures perpetuals, specifically involving Ether (ETH) and Bitcoin (BTC).

Here’s how it works in practice:

When a user deposits ETH or another accepted asset to mint USR, the protocol uses the funds to acquire spot ETH and BTC. At the same time, it opens leveraged short positions in ETH and BTC perpetual futures markets. These opposing positions offset each other’s market exposure, allowing the protocol to maintain a stable portfolio in dollar terms, regardless of crypto price swings.

Once the position is established, the user receives $USR tokens equivalent to the dollar value of their deposit. Because the underlying portfolio is hedged, the value of the collateral doesn’t fluctuate wildly—allowing the stablecoin to maintain its peg with greater capital efficiency than traditional overcollateralized models.

That said, delta-neutral does not mean zero risk. Resolv maintains a marginally overcollateralized buffer, targeting a 30% margin ratio, with a minimum threshold of 20% to safeguard against slippage, sudden market moves, or delays in rebalancing.

USR is an ERC-20 token. While minting is only available on the Ethereum mainnet, the token itself is bridged and available across multiple chains, including Base, Berachain, and BNB Chain, allowing users to access liquidity and utility across ecosystems.

Resolv Protocol Revenue Streams and Staking

The delta-neutral setup at the core of Resolv enables price stability and opens up two distinct sources of protocol revenue. These earnings sustain staking rewards and incentivize participation across the ecosystem.

1. Staking Yields

A portion of the assets deposited into Resolv is allocated to liquid staking protocols like Lido Finance. These staked ETH holdings generate passive income through Ethereum’s proof-of-stake rewards. By tapping into staking yields, Resolv creates a baseline revenue stream that is relatively stable, though subject to fluctuations in network activity and validator rewards over time.

| Protocol/Provider | Target Allocation |

|---|---|

| Lido wstETH | 70% |

| Binance wdETH | 15% |

| Dinero apxETH | 15% |

2. Perpetual Futures Funding Rates

In addition to staking, Resolv’s short futures positions expose it to the funding rate mechanism in perpetual futures markets. This mechanism is designed to keep the price of perpetual contracts in line with the underlying spot asset.

- When the perp price is higher than the spot, long position holders pay short sellers a fee (the funding rate).

- Short sellers pay the funding rate to longs when the perp price is lower than the spot.

Since Resolv holds short positions, it earns yield when perp markets trade at a premium—and incurs cost when they trade at a discount. This revenue stream is dynamic, fluctuating with market sentiment, leverage demand, and volatility conditions. In bull markets with strong long demand, funding rates tend to stay positive, making this a valuable and protocol-aligned source of yield.

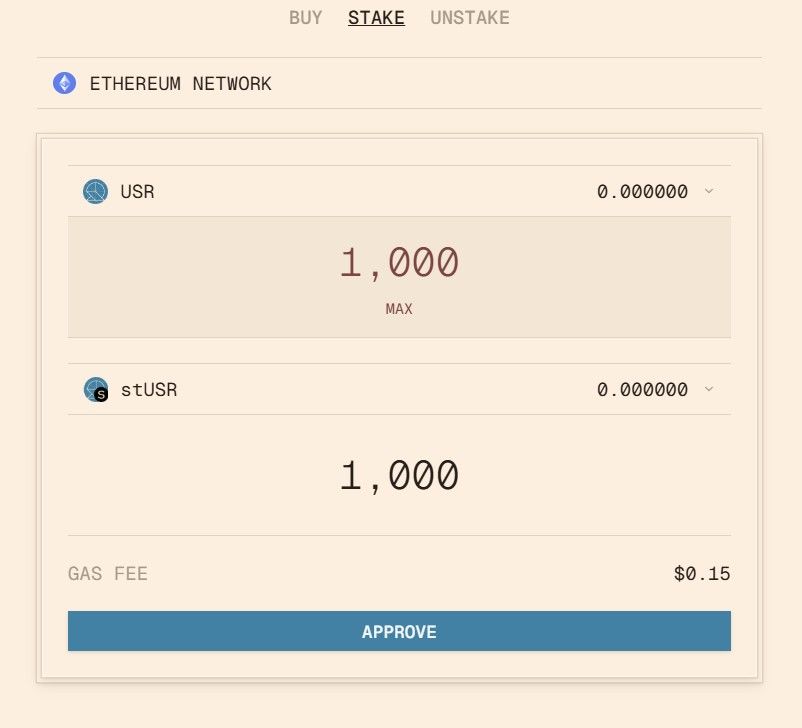

USR Staking: Minting stUSR

USR holders can stake their tokens in the protocol to mint stUSR, a liquid staking version of USR. stUSR represents a claim on both the underlying stablecoin and a share of the protocol’s yield from staking and funding rate income.

stUSR is a Rebasing Liquid Staking Token | Image via Resolv App

stUSR is a Rebasing Liquid Staking Token | Image via Resolv AppWhile USR remains price-stable and fully redeemable, stUSR carries no guaranteed yield. Earnings are distributed based on protocol performance, and returns may fluctuate depending on prevailing funding rates, ETH staking conditions, and market-wide risk appetite.

This separation between stablecoin utility and staking yield gives users flexibility: they can either hold USR for price stability and liquidity, or stake it for stUSR to access variable yield tied to Resolv’s core revenue streams.

Risks of Delta-Neutral Strategy

While delta-neutral portfolios are designed to hold steady through market swings, they still carry structural risks—especially when deployed using spot and futures markets. Resolv mitigates these risks through a combination of safeguards, with the most critical backstop being the Resolv Liquidity Pool (RLP), which acts as USR’s insurance fund. Here’s a breakdown of the key risk categories involved:

Counterparty Credit Risk

This is the risk of loss if a trading venue becomes insolvent. Two specific asset categories are exposed:

- Margin held on the exchange to support futures positions

- Unrealized gains from open futures trades

To reduce exposure:

- Margin collateral is held via third-party custodians outside of exchanges

- Trading venues are diversified to avoid concentration risk

- RLP covers the unrealized gains in the event of exchange default

Market Risk

Market risk primarily refers to negative funding rates in the futures market. Since Resolv holds short positions, it normally benefits from positive funding—but if the market flips and short positions start paying funding, the protocol incurs ongoing costs.

To mitigate:

- Positions are allocated to high-liquidity exchanges, where pricing mismatches (between spot and futures) are less likely

- RLP absorbs these funding losses, ensuring the protocol doesn’t pass the risk to USR holders

Liquidity Risk

A sudden outflow of capital—especially from RLP—can impair the protocol’s ability to maintain stability. If too much capital exits the system too quickly, the backing for USR could weaken.

To manage this:

- The protocol enforces a minimum collateralization threshold—specifically, RLP redemptions are suspended if the overall collateral ratio (CR) drops below 110%

- This mechanism helps preserve the solvency of USR even during volatile market conditions

| Risk Category | Description | Resolv’s Mitigation Measures |

|---|---|---|

| Counterparty Credit Risk | Risk of loss due to failure or insolvency of a trading venue. Exposed assets include margin and unrealized gains. | - Margin held via third-party custodians (not directly on exchanges) - Diversified venue exposure - Losses covered by RLP |

| Market Risk | Risk of loss due to negative funding rates in futures markets. | - Allocation to highly liquid venues to minimize price mismatches - Funding losses absorbed by RLP |

| Liquidity Risk | Risk of protocol destabilization due to large capital outflows, especially from the RLP pool. | - RLP redemptions suspended if Collateral Ratio falls below 110% - Safeguards prevent draining core reserves |

| Price Volatility / Liquidation Risk | Risk of rapid ETH/BTC price movements triggering forced liquidation of futures positions. | - Protocol maintains 30% target margin buffer (20% minimum) - Collateral actively rebalanced to prevent margin breaches |

| Funding Rate Dependency | USR yield partially relies on positive funding; in bearish conditions, rates may turn negative. | - Funding risk offloaded to RLP, shielding USR holders - Protocol adjusts incentives to rebalance system during stress |

These risks are actively managed through protocol design, collateral buffers, and smart contract limits. But the key concept is that USR holders are shielded from these risks—the protocol routes this exposure to its dedicated insurance layer: the Resolv Liquidity Pool (RLP). The next section will explain how that pool works and how it’s incentivized.

Understanding RLP: Resolv’s Risk Absorption Layer

At the core of Resolv’s design is a simple question:

How do you build a decentralized stablecoin without exposing users to hidden systemic risks?

Resolv’s answer is the Resolv Liquidity Pool (RLP) — a dedicated capital buffer that absorbs all volatility and risk tied to the stablecoin’s delta-neutral strategy. RLP is what makes USR actually delta-neutral from a user’s perspective.

While USR remains price-stable and redeemable, RLP is the layer that handles the turbulence.

What Is RLP?

RLP is Resolv’s risk-bearing insurance pool. It comprises ETH and other assets deposited by users who opt in to underwrite the protocol’s risk in exchange for yield. The pool is tokenized into RLP tokens, representing claims on this risk capital and its earnings.

In return for taking on exposure to liquidation losses, negative funding rates, and counterparty risks, RLP token holders earn a much higher yield than USR stakers. These elevated yields aren’t arbitrary—they reflect real risk exposure absorbed by the RLP layer.

What Risks Does RLP Absorb?

RLP acts as a buffer for three main categories of protocol risk:

- Negative funding rates: If futures markets flip and short positions become costly, RLP covers the deficit.

- Liquidation risk: If ETH or BTC prices spike suddenly and margin buffers aren’t topped up fast enough, RLP absorbs the resulting losses.

- Counterparty credit risk: If a trading venue fails or locks user funds, RLP covers unrealized gains and margin exposure.

By isolating this risk in a tokenized, market-driven layer, Resolv ensures USR remains stable and fully redeemable—regardless of backend volatility.

stUSR and RLP Yields in May 2025 | Image via Resolv App

stUSR and RLP Yields in May 2025 | Image via Resolv AppHow RLP Incentives Work

The most crucial feature of RLP is its self-balancing incentive structure. The pool’s APY dynamically adjusts based on how much capital is available in the protection layer.

- When the capital adequacy ratio (CAR) is high (e.g., 170%), yields may drop as risk per dollar is lower.

- When CAR falls (e.g., near 110–120%), yields rise to attract more capital.

This elasticity encourages rational behavior: RLP offers higher returns when the system needs capital most, and moderates incentives when the buffer is already robust.

This is crucial during periods of stress. For example, in late 2024, Resolv’s CAR dropped from 170% to ~120%. Instead of triggering a protocol failure, RLP incentives spiked, drawing new capital and rebalancing the system—all without impacting USR redemption or peg stability.

Withdrawal Limits and System Safeguards

To prevent a sudden drain of insurance capital, the protocol applies protective limits:

- If the collateralization ratio drops below 110%, redemptions of RLP are temporarily suspended.

- However, RLP remains tradable on secondary markets, so holders can exit exposure if needed without straining protocol reserves.

These safeguards ensure protocol solvency takes priority over short-term exits, preserving USR’s redeemability under adverse conditions.

A Market-Driven Alternative to Centralized Insurance Funds

What makes RLP particularly notable is how it contrasts with other designs.

Where protocols like Ethena use centralized insurance reserves, managed behind closed doors, Resolv lets the open market price and supply protection. The result is:

- Greater transparency

- Higher alignment between risk and reward

- Permissionless participation—no whitelist, no KYC

RLP is not just an insurance layer—it’s an economic experiment in decentralized risk pooling.

Why RLP Matters

RLP is the mechanism that allows Resolv to offer a stablecoin (USR) without centralized custody, fiat exposure, or opaque risk management. By letting the market underwrite volatility through tokenized incentives, Resolv aligns risk capital with protocol health in real-time. The system adjusts to stress, incentivizes participation when needed, and isolates complexity from end users.

In a space filled with opaque stablecoin mechanics, RLP is one of the clearest examples of decentralized financial engineering done right.

RESOLV Tokenomics

$RESOLV is the native utility token of the Resolv protocol, designed to support long-term alignment between users, contributors, and governance participants. While the token’s exact utility features are yet to be fully disclosed, it is expected to play a central role in protocol governance and community-driven decision-making.

The Token Generation Event (TGE) has not yet taken place, and as such, the token is not live at the time of writing. However, Resolv is actively running airdrop campaigns to bootstrap community participation and reward early adopters. The protocol is currently in its second season of airdrop farming, with various opportunities across platforms like Pendle Finance and native USR staking.

Token Supply Overview

- Ticker: RESOLV

- Total Supply: 1,000,000,000 tokens

Allocation Breakdown

- Airdrop Season 1 – 10%: Unlocked at TGE, with short-term vesting for top wallets.

- Ecosystem & Community – 40.9%: Up to 10% unlocked at TGE, remainder vests over 24 months.

- Team & Contributors – 26.7%: 1-year cliff, followed by 30-month linear vesting.

- Investors – 22.4%: 1-year cliff, followed by 24-month linear vesting.

The token distribution emphasizes long-term incentives, with significant allocations reserved for ecosystem growth and contributor alignment. More details about the token’s economic role within the protocol, beyond governance, are expected to be released closer to the TGE.

Final Thoughts

With USR, Resolv Labs has struck a rare balance between decentralization and capital efficiency—two goals that often pull in opposite directions in stablecoin design. Their architecture doesn’t rely on fiat reserves or centralized governance structures. Instead, it introduces a tokenized reinsurance layer (RLP) that lets open markets, not institutions, manage risk.

What makes Resolv stand out is its inclusivity. There’s no gatekeeping, no whitelisted access to mint or stabilize the system. Anyone can mint USR or participate in its risk management through RLP, making it one of the more transparent and permissionless stablecoin systems currently in development.

While adoption is still early, momentum is building. Resolv already has multichain presence and has already established meaningful traction on DeFi-native platforms like Pendle Finance, where both USR and RLP tokens are being actively farmed and traded.

Whether Resolv can scale while maintaining its risk buffers and yield incentives remains to be seen. But the foundation is solid, and the design is arguably one of the most crypto-native approaches to stablecoin issuance we’ve seen so far.