DeFi saw tremendous growth in 2021, with the total value locked (TVL) in DeFi products and protocols peaking at $250 billion in December 2021. While most of this TVL was concentrated in the Ethereum ecosystem, we have now begun to see Ethereum losing its dominance as projects and TVL are migrating to other chains such as BNB, Solana, and Avalanche, etc.

Among these chains, Solana is leading the charge in DeFi due to its low transaction costs and incredible speed. In particular, the Serum protocol has been a significant player in simplifying the process for DeFi projects to onboard and share liquidity in Solana.

Serum has helped a number of projects such as Mango Markets, Raydium, Bonfida, Jupiter, etc., build amazing DeFi products while leveraging Serum’s central limit order book and matching engine to enable frictionless trading.

In this article, we take a closer look at the Serum protocol to find out who is behind it, what makes it promising and whether it will survive in the long run.

Serum Summary

| HEADQUARTERS: | Decentralized |

| YEAR ESTABLISHED: | 2020 |

| REGULATION: | Unregulated |

| SPOT CRYPTOCURRENCIES LISTED: | Any SPL Token (Solana’s Token Standard) |

| NATIVE TOKEN: | Serum Token (SRM) and MegaSerum Token (MSRM) |

| MAKER/TAKER FEES: | Nil/3bps- 4bps |

| SECURITY: | Public Audit for Serum Core in progress |

| BEGINNER-FRIENDLY: | Recommended for users with prior experience using Dapps. |

| KYC/AML VERIFICATION: | None |

| FIAT CURRENCY SUPPORT: | None |

| DEPOSIT/WITHDRAW METHODS: | Non-custodial |

What is Serum

Serum is a permissionless base protocol layer for decentralized exchanges built on the Solana blockchain that allows developers to create their own DEX user interface on top of it. On the protocol level, Serum features a fully on-chain, non-custodial order book mechanism that allows users of DeFi projects leveraging Serum to place on-chain ‘bid’ or ‘ask’ orders with specific prices.

The central order book of Serum also allows DeFi projects using it to benefit from true composability and access to ecosystem-wide liquidity. Being built on Solana, Serum enables users to execute trades with low latency and incredible speed at affordable and cheap network fees.

Serum also has its own tokens called ‘SRM’ and ‘MSRM’ that unlock trading fee discounts for holders based on the number of tokens held. According to Defi Llama, Serum currently occupies 3rd place in overall TVL within the Solana ecosystem, with over $222 million in assets locked on its platform.

Serum Team and History

The Serum Project was built by the Serum Foundation, and was backed by several heavy-weights in the industry, such as the Solana Foundation, and now disgraced FTX ex-CEO Sam Bankman-Fried and the teams Alameda Research. Serum officially launched on 31st August 2020 and was one of the first major open-source projects to build on Solana.

Serum was built as a solution to the problems faced by DeFi users on Ethereum in the summer of 2020. Defi platforms were extremely limited in functionality at the time, and users had to pay high gas costs to transact on them.

To solve this and provide a better experience for DeFi users, the Serum Foundation decided to build Serum on the Solana blockchain, which processes transactions at 65,000 transactions per second.

The team also decided to provide users with an on-chain order book, unlike other DEXs that typically use a liquidity pool, to give them an experience similar to centralized exchanges. The Serum DEX took about three months to develop, with the whitepaper being released in July of 2020.

When it first launched, Serum featured its own basic trading interface that developers could fork and build upon to integrate with the Serum protocol. However, once enough projects had started to develop their Graphical User Interfaces (GUI) on Serum, the protocol removed the trading interface so that all trading activity comes via several GUIs built on top of it.

Serum Exchange Key Features

While Serum does not host its own trading user interface anymore, its current model allows it to host one of the most vibrant and liquid Defi ecosystems. Developers and projects are incentivized to build on top of Serum to gain access to its massive liquidity via the central limit order book system.

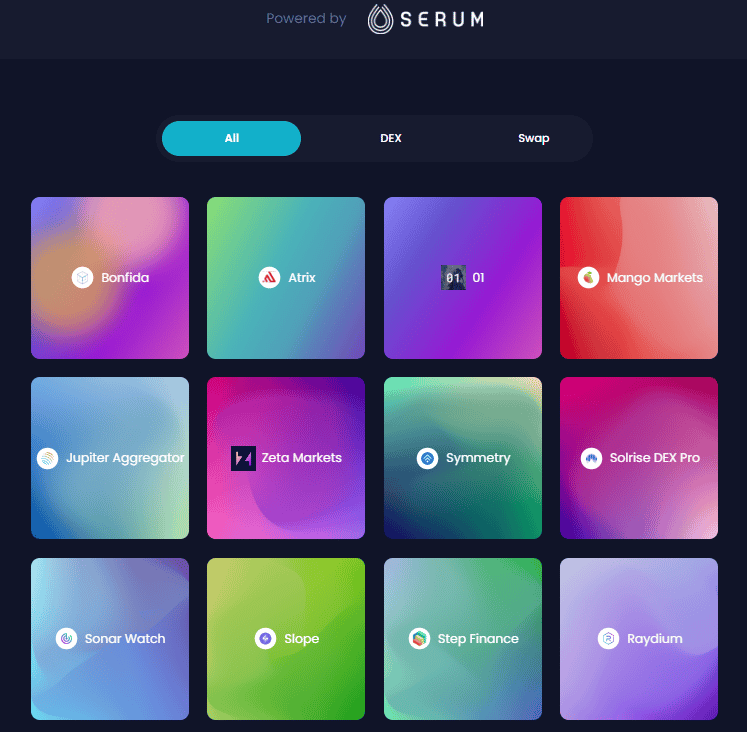

A few exchanges built on Serum

A few exchanges built on SerumThe liquidity and ease of creation allow developers to focus more on creating an efficient suite of Defi products hosted on an attractive and easy-to-use GUI. This has led to Serum becoming one of the most popular protocols on Solana for Defi projects to build on.

To put it simply, its success is due to four key features:

- Central limit order book and efficient matching engine

- Serum’s developer ecosystem and services

- True composability

- Serum DAO

Central Limit Order Book and Matching Engine

Decentralized exchanges (DEXs) like Sushiswap, Uniswap and 1inch employ an automated market maker (AMM) that utilizes a liquidity pool to swap assets instantly and determine a price based on the ratio of assets present in it. In contrast, centralized exchanges like Binance or Kucoin use an order book mechanism to facilitate the trade of assets.

AMM vs Order Books

AMM vs Order BooksOrder books allow users to set limit orders and stop-loss orders. These orders enable the user to specify the price at which the order must be executed. AMMs, on the other hand, do not allow the user to specify the price at which they want to buy/sell the asset. Instead, the user is shown a live price based on the ratio of assets in the pool, at which they can buy/sell the asset.

If you're thinking, 'Order books sound pretty convenient. Why don't DEXs offer them?'

Here's why. Most DEXs are built on Ethereum, a network whose relatively long latency makes an on-chain matching engine inefficient. This means that on-chain order books are not practically possible.

However, Serum can use an on-chain central limit order book mechanism because it is built on Solana. The Solana network produces blocks every 400–600ms, that's more than 10x faster than Ethereum's 14-second block time (on average). This makes Serum's on-chain central order book and matching engine quite efficient.

Serum's Developer Ecosystem and Services

Serum allows developers and projects to build more efficient DEXs by allowing them to access a central limit order book and matching engine that shares liquidity with other projects and DEXs building on top of it. In addition, the Serum protocol works in the back-end allowing developers to focus on creating efficient and attractive GUIs and financial products.

Thus far, 30 GUIs have been listed on the official Serum portal page. Each of these GUIs offers various decentralized finance products. For example, Mango Markets offers margin trading and perpetual futures, Raydium offers spot and limit order trading, and Jupiter Aggregator offers swap price aggregation services.

True Composability

DeFi in the Ethereum ecosystem is fragmented, with liquidity in one protocol unable to be accessed by another. Serum solves this by allowing a diverse range of applications and participants to share middleware in one place. This makes Serum's architecture more suited to modularity. As a result, serum-based programs will offer more flexibility while adhering to some basic design principles and composability.

Serum DAO

The Serum DAO handles the governance of the protocol. Serum's SRM token acts as the governance token used to vote for or against proposals. The Serum DAO has a forum page where community members can discuss various issues and eventually create a governance proposal for key issues on the official governance page.

Serum DAO

Serum DAOUsers must hold a minimum of 25,000 SRM tokens to create a governance proposal. To vote on a governance proposal, users must connect their wallet to the official governance page and deposit all their tokens. Then, they can choose to vote in favour of or against a particular proposal. While the vote is in effect and the voting period is ongoing, the tokens will be temporarily locked up. After the proposal is closed, the tokens are returned and can be withdrawn from the governance page.

Serum Core

Serum Core is an 'asset agnostic order book' system built by Bonfida that is yet to be released.

If you're wondering what an 'asset agnostic order book' is, here's the ELI5 version. Basically, the Serum protocol, a fully on-chain order book protocol, executes trade on-chain by calling a smart contract and transferring the SLP tokens after the matching engine matches two orders together. This means that the matching engine requires the transfer of SLP tokens under the basic Serum protocol.

This becomes a problem for projects that want to introduce products such as perpetual futures trading under Serum, as they would have to tokenize users' positions to do so. However, tokenizing positions becomes tricky because it requires encoding information such as collateral, position size, entry price etc.

To solve this, Serum Core was built. Serum Core allows the on-chain order book to store 'state' information and match positions without tokenizing them. Under Serum Core, the order book itself is a matching engine. When a match occurs on Serum Core, the matching engine triggers the creation of a position owned by the taker and held with the maker. Serum Core also allows projects to create their own order book or work with other existing order books.

Serum Fees

Order book exchanges generally have two fees: a maker fee and a taker fee.

A maker fee is charged to a user who makes an order or supplies liquidity to an order book. A taker fee is charged to a user who accepts an order or removes liquidity from an order book.

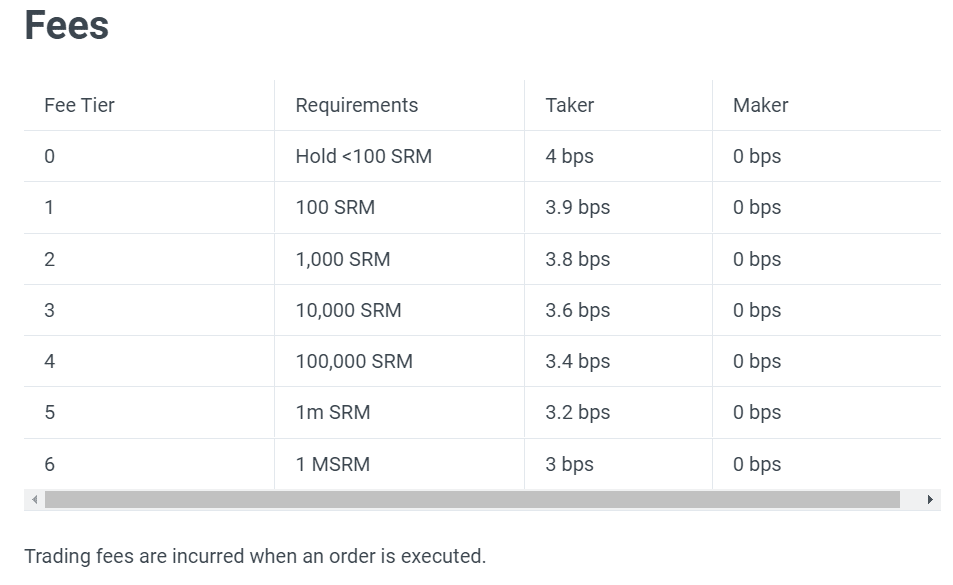

The Serum protocol only charges users a fee for taker orders. This means that maker orders are not subject to a fee as they provide liquidity. Since Serum's matching engine fulfils these orders, it charges taker orders a fee ranging between 3 basis points (bps) to 4 basis points (bps).

The fee levied depends on the amount of SRM tokens you hold. The collected protocol fees are split into two- 80% of the fee goes towards the buyback and burn of SRM, and 20% of the fee goes towards the project or GUI hosting the activity.

Serum Fees Discounts

Serum Fees DiscountsYou can find the different fee discounts and the corresponding SRM holding in the picture above.

Apart from these fees, the different GUIs building on top of Serum might also charge their own fee. The Solana network will also charge a minimal transaction fee, and in certain situations, it might also charge something known as an 'open order account rent fee'.

The 'open order account rent fee' is 0.02 SOL per market pair. It is charged when trading a market pair for the first time and is used to create the intermediary "open order account" that interacts with the DEX. This fee can later be recovered if you're not planning to use that pair again.

Serum KYC and Account Verification

Serum is a decentralized protocol and does not follow any KYC or account verification process. Moreover, the different GUIs built on top of Serum might have their own KYC or AML process. But generally, most GUIs do not have any KYC or AML due to their decentralized nature. All you need to use the platform is a self-custody Solana wallet and some SOL tokens to pay for network fees.

Serum Security

Serum has been privately audited. A public audit for the next version of Serum, called Serum V4 or Serum Core, is currently underway.

Cryptocurrencies Supported on Serum

Serum supports trading any SPL token as long as there is a market and liquidity for it. Moreover, the anticipated release of Serum Core will enable the trading of defi products such as Perpetual Futures without needing to tokenize them on the network.

Serum Exchange Platform Design and Usability

Serum does not host its own trading interface. Instead, it relies on the different DeFi projects building on top of it to do so. Many of these GUIs on top of Serum are very user-friendly and efficient.

These GUIs provide users with a customized and unique trading experience, making Serum's ecosystem quite diverse. You can find all sorts of defi products, such as a derivatives exchange, swap aggregator, crypto index, lending platform, etc., built on top of Serum.

Primarily, Serum was designed to be a base protocol for the different Defi projects in the Solana ecosystem. It seems to have been able to stay true to this vision so far.

Deposits and Withdrawals at Serum

Serum is a non-custodial protocol. It enables peer-to-peer trading between the different wallets in the Solana blockchain. As such, there are no deposit or withdrawal charges on Serum directly. However, remember that the different GUIs on top of Serum might have their own custodial features, such as collateralization account for derivatives or margin trading.

Serum Tokenomics (SRM & MSRM)

The Serum Project has two tokens in its ecosystem- SRM and MSRM. Both tokens exist as SPL tokens on the Solana blockchain.

Utility

The SRM token is Serum’s utility and governance token. SRM token holders can vote on governance proposals in the Serum DAO and also avail of trading fee discounts based on the number of tokens they hold.

MSRM token is a special token with a limited supply of 1000 MSRM. MSRM tokens are created by locking up 1,000,000 SRM tokens in a contract. They offer holders additional benefits and rights such as increased discounts and the ability to run a node.

Token Supply and Emissions

SRM has a maximum supply of 10,161,000,000 SRM tokens, and MSRM has a maximum supply of 1000 MSRM or 10% of SRM supply. Serum began with 10% of its token supply unlocked, with the other 90% slowly trickling into circulation in the form of validator and staking rewards over the next 6 years, beginning on the 11th of August 2021, at approximately 1/2190 per day.

Price History

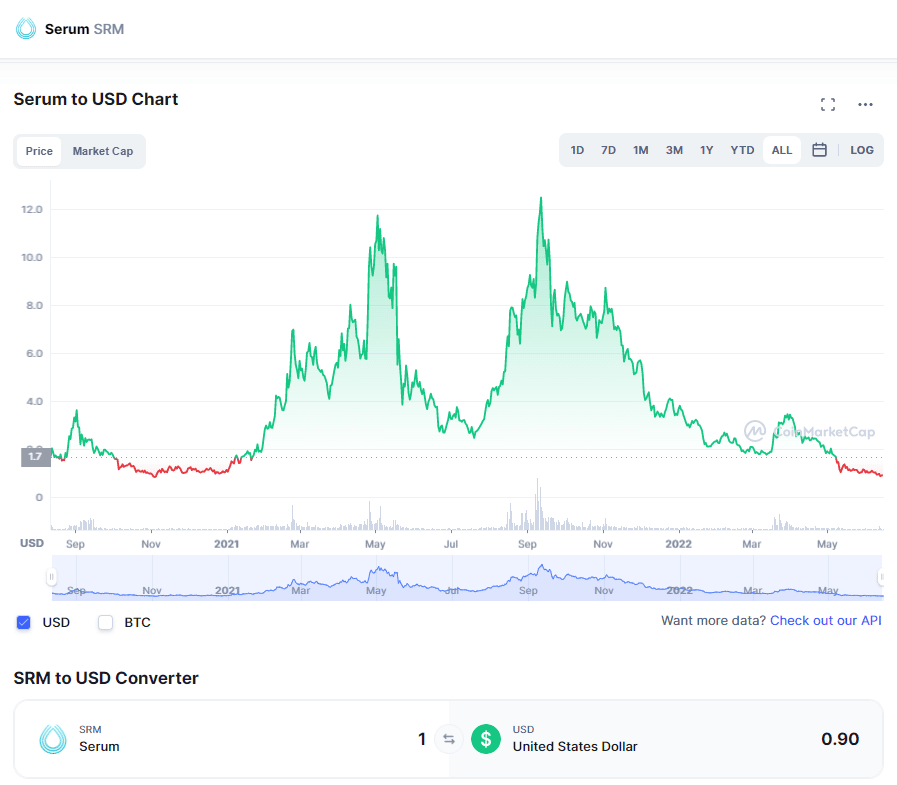

SRM Price History via CoinMarketCap

SRM Price History via CoinMarketCapThe SRM token first began trading in August 2020. The token reached an all-time high of $13.72 in September of 2021 and an all-time low of $0.11 during its IEO in 2020. According to CoinMarketCap, the token is currently trading at $0.90 with a market cap of $236 million. The current price is due to a declining interest in Defi amid the current bear market conditions.

Where to buy SRM?

SRM can currently be bought on both centralized and decentralized exchanges. The available markets are listed below

Centralized Exchanges- Binance, Gate.io

Decentralized Exchanges- Raydium and Serum DEX

Can I stake SRM?

Yes, SRM can be staked to earn rewards and participate in governance. SRM can also be staked to run a validator node, earning you additional rewards. To run a validator node, you will need 10 million SRM tokens, with 1 million of them in the form of 1 MSRM token.

Validators in the Serum project have two primary duties: to support cross-chain cryptocurrency swaps and “turn the crank”. The second function refers to the fact that orders on the Serum DEX are not fulfilled automatically due to the nature of the Solana blockchain – they must be manually activated by a third party, in this case, a validator node.

Serum Customer Support

Serum is a decentralized project run by the Serum DAO. It has an active developer base with the Serum DAO granting funds to projects developing on Serum. While there may not be any customer support in the traditional sense, users can get their doubts or queries addressed in the project’s Discord or Telegram channels.

However, in my experience, the project’s Discord channel is not as active or responsive as most other crypto discord servers. So you might have to wait a while or ask a question repeatedly before being able to secure an answer.

Serum Top Benefits Reviewed

Serum is an excellent protocol for DeFi projects and developers on the Solana ecosystem to build on due to the following reasons-

Shared Liquidity- All projects building on top of Serum share the liquidity and central order book. This makes the trading experience through consistent price feeds and larger trading volumes.

Ecosystem- The more projects built on top of Serum, the bigger its network and role in the Solana ecosystem.

Permissionless- Users of Serum can create market pairs on Serum without permission or authorization. It is a permissionless decentralized protocol that allows users and projects to leverage Serum in any way possible.

Composability- Projects built on Serum are truly composable with each other. With the upcoming release of Serum Core, the composability of projects on Serum will only get better.

What can be Improved

Serum is a great protocol with incredible promise for the Solana ecosystem. However, it can be challenging for beginners to learn or understand the project due to its not-so-optimized documentation practices. This is one area that Serum must definitely work on.

While researching for this article, I found that the protocol has gone through many changes in the past two years, but the documentation of these changes was not so easy to find. Their official documentation can also do with more details on their security audit status or how the DAO governance works in better detail.

Apart from the problems with documentation, Serum also seems to be suffering from a lack of support for newcomers in their official Discord channels. I noticed that researchers and beginners have left many questions unanswered by the moderators or team. This does not bode well when building a strong, engaging community.

Closing Thoughts

Serum is a truly promising project that has achieved many of its goals since its launch. It also has backing from some of the best minds and teams in crypto. The Serum Core is an anticipated upgrade to the current order book of Serum that will help bring to life many more projects on the Serum DEX.