Anyone who is involved in the cryptocurrency space knows well the HODL strategy where one simply sits and holds their assets, with very little crypto portfolio management needing to be done. But what about those who appreciate a more hands-on approach, or who want to trade crypto? Well, then you've done well to find your way to this Shrimpy Crypto review.

Shrimpy allows users to monitor and manage their entire crypto portfolio across all supported exchanges. It will even automatically adjust your portfolio based on your own instructions, keeping your risk profile in check no matter how the market is behaving.

In the following Shrimpy review, we’ll take an in-depth look at the features of this unique trading tool, such as its ability to automatically rebalance your portfolio, and the social trading aspect of Shrimpy. You might be favourably impressed when you see how Shrimpy makes it possible to more easily manage your crypto portfolio and reach your investment goals.

Warning ⚡️: Trading Bots do NOT guarantee profit. Always exercise risk management

Shrimpy Crypto Review TL;DR

- Test and automate trading strategies.

- Simple crypto portfolio management.

- Build new apps with cryptocurrency APIs.

- Copy other traders’ portfolios with the social trading program.

- Get paid for each Follower.

- Assess crypto portfolio’s profitability.

- Gather existing or live market data from major exchanges.

- Long-term trading strategy automation using Shrimpy trading bot.

- Offers crypto index funds for multiple crypto exchange accounts.

- Keeps API keys secure.

Shrimpy Review: Summary

| Headquarters: | California |

| Year Established: | 2018 |

| Regulation: | N/A |

| Security: | High |

| Beginner-Friendly? | Yes |

| KYC/AML Verification: | None |

| What Trading Pairs Can be Automated? | trading tools can be used on any chart and pair supported by the crypto exchange |

| Supported Exchanges/Platforms | Binance, KuCoin, Coinbase, Huobi, Gemini, Kraken, Bittrex, Gate.io. See Shrimpy Supported Exchanges for a full list. |

What Is Shrimpy?

Shrimpy was created in 2018 in San Francisco, CA by Michael McCarty and Matthew Wesly and was originally registered as Bethos Lab Inc. The platform was created in an effort to make investing in cryptocurrencies and asset management less laborious, while also reducing investing risk.

It automates crypto trading and also assists in the creation and deployment of automated trading strategies, making portfolio management easier with features like index fund development and portfolio rebalancing. Thanks to its unique features the platform has gained great popularity in the three years of its existence.

Start managing your crypto portfolio the smart way. Image via Shrimpy.io

Start managing your crypto portfolio the smart way. Image via Shrimpy.io While portfolio automation is considered the primary feature of the platform, users can also take advantage of a number of other features. These include the ability to create a custom portfolio strategy, utilize copy trading, and easily track performance over time. Plus, users can also create their own custom indices across all the supported platforms.

In addition to its automation features, Shrimpy is also a social trading platform that allows traders to follow the trades of other users. This can be extremely useful in creating a hands-off approach to cryptocurrency investing. We have seen how popular this has become with sites like eToro copy trading and the copy trading platform on Bybit also exploding in popularity.

Shrimpy can really save you time since its use of APIs means you no longer need to log into all of your exchange accounts separately to execute your trading strategies. Instead, you log into Shrimpy and tell the platform what percentage you want to allocate to each cryptocurrency in your portfolio, and Shrimpy then automatically rebalances your crypto portfolio to match those percentages. Of course, you can also manually trade at any time as well.

Automated portfolio management for decentralized finance. Image via Shrimpy blog

Automated portfolio management for decentralized finance. Image via Shrimpy blog Shrimpy is web-based, so there’s no application download to mess with and no additional Shrimpy app needed. You can access the platform from the Shrimpy.io platform and then begin using it by integrating the exchange APIs associated with your accounts at the supported exchanges. Currently Shrimpy supports 16 crypto exchanges, with more on the horizon.

Shrimpy Features

Shrimpy has a number of excellent features which are categorized as Portfolio Management, Trading Automation, and Social Trading. Below I go into greater depth regarding each of these features and the sub-features that are related.

Shrimpy Crypto Portfolio Management

Crypto used to be all about trading, but portfolio management has become increasingly important for crypto traders as they look to become long-term investors. Shrimpy is an excellent portfolio management platform that gives users increased risk management as well. The addition of automation and the ability to interact with other Shrimpy users is an added bonus.

Manage multiple portfolios and much more! Image via Shrimpy.io

Manage multiple portfolios and much more! Image via Shrimpy.io Shrimpy is also unique as a portfolio management tool as it doesn’t use any trading signals or indicators, and it doesn’t directly manage users’ portfolios. Rather it uses automation and the basic risk management strategies of rebalancing and dollar-cost-averaging to keep portfolio risk in check. It also includes performance tracking to make sure your investments continue growing as you like.

With Shrimpy, traders are able to develop their very own crypto index using the parameters included in the built-in smart indexing tool. This gives traders the power of performance tracking and index funds.

For those who don’t want to be bothered with the creation of their own index, Shrimpy offers a social copy trading feature that helps manage a portfolio by following the trades and strategy of another trader on the platform. This feature is as easy to use as a single click within the platform, after which Shrimpy will automate every trade made by the trading leader.

Index Funds

As mentioned above, Shrimpy includes its very own built-in indexing tool which allows each user to create their very own index, thus helping to ensure their portfolio remains diversified. Shrimpy’s indexing tool includes a number of parameters that make it the most powerful indexing tool available in crypto portfolio tools. Not only can users create an index, but they can also weigh the index appropriately.

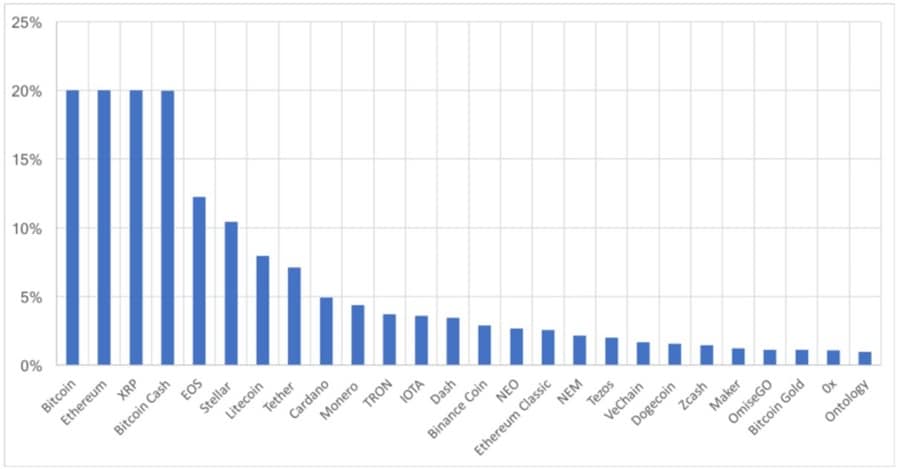

This is an index of 26 cryptocurrencies, weighted by market cap. The maximum allocation for any asset is capped at 20%. Image via Shrimpy blog.

This is an index of 26 cryptocurrencies, weighted by market cap. The maximum allocation for any asset is capped at 20%. Image via Shrimpy blog. With Shrimpy, it’s possible to construct an index manually, or you can automate the process based on market-cap-weighted, equal-weighted, and dynamic indexes. Then users select a rebalance period for their newly created cryptocurrency index portfolio.

Performance Tracking

If you have multiple exchange accounts you know what a hassle it can be to track your performance. However, with Shrimpy’s intuitive and user-friendly dashboard, it’s a breeze to track your portfolio’s performance across all the supported exchanges. Without this type of tracking, you’re simply guessing at your profitability. That’s why top traders use Shrimpy to help them make crucial trading decisions.

Shrimpy Portfolio Automation

Automating your trades using Shrimpy’s built-in trade algorithm makes it a simple task to automate and rebalance your portfolio. Unlike other automated portfolio solutions in the crypto space that use complex signals, indicators, and statistics to automate, Shrimpy keeps things simple and elegant. It uses such long-term strategies as dollar-cost averaging and portfolio rebalancing to ensure risk remains in control and your portfolio remains evenly balanced.

Portfolio Rebalancing

The core automation feature of Shrimpy is portfolio rebalancing. This is how the tool helps to reduce risk and enhance your profit margins. And because it’s automated it is even more effective in creating a good environment to profit from market movements.

Sometimes even the best portfolios need some rebalancing.

Sometimes even the best portfolios need some rebalancing. Portfolio rebalancing is nothing new. It’s been used by equity investors for decades. However, as the cryptocurrency markets mature traders are also finding it useful for managing crypto portfolios. Portfolio rebalancing simply works by buying and selling assets to ensure that a set target allocation is matched at all times. Shrimpy automatically makes these trades to keep the portfolio at the percentages specified by the user.

Users can take advantage of two rebalancing strategies:

- Threshold rebalancing – This strategy involves rebalancing the portfolio any time one of the assets strays from the specified allocation by a specified amount. This type of rebalancing can incur higher trading fees as it typically triggers more trading events.

- Periodic rebalancing – This is a simple method that looks at your portfolio at a regular time interval (monthly, weekly, daily, etc.) and rebalances it to meet the specified asset percentages. When set to rebalance on a weekly or greater timeframe, periodic rebalancing can keep trading fees in check, however, it does increase market risk.

One very handy feature included in Shrimpy is the backtesting tool that helps to determine whether a strategy or index fund would have performed well in the past. You can look at the past five years of data to determine what the performance of any custom-generated strategy, index, or portfolio would have been. This aids in developing a potentially profitable trading strategy with Shrimpy.

Shrimpy Social Trading

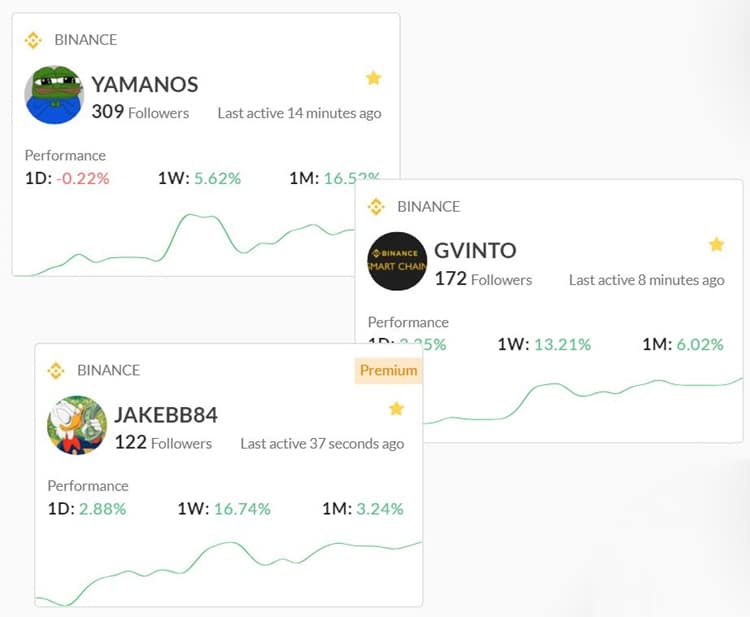

A second very distinctive feature of the Shrimpy platform is its social trading feature. With this, any user is able to copy the trades of “lead traders” and hopefully profit as a result. And unlike other copy trading platforms that work by sharing signals and indicators, Shrimpy is focused on the community of traders using the platform. Traders are permitted to become leaders and create groups of like-minded traders, or they can simply follow whichever traders they prefer.

Follow successful traders or become a leader yourself. Image via Shrimpy.io

Follow successful traders or become a leader yourself. Image via Shrimpy.io In this way, a new trader can still grow a portfolio by following the trades of more experienced traders. They can even automate the whole process, allowing their portfolios to update whenever the portfolio of the trader they are following changes. Shrimpy makes it a snap to follow the trading strategies of successful traders.

And for those creating the groups, the “lead traders”, there’s a reward of $4/mo for every other user who implements the trading strategy. So, have 10 followers using your strategy and make $40/mo. Have 100 followers and make $400/mo. There’s no limit to the rewards for successful traders.

The social trading feature implemented at Shrimpy is perfect for those who are new to trading cryptocurrencies. They can have a better shot at profitability, and can also learn from the trades of the successful traders they are following. If you are interested in copy and social trading, I would also recommend checking out our Bybit and Gate.io review, as those platforms have a large social trading community.

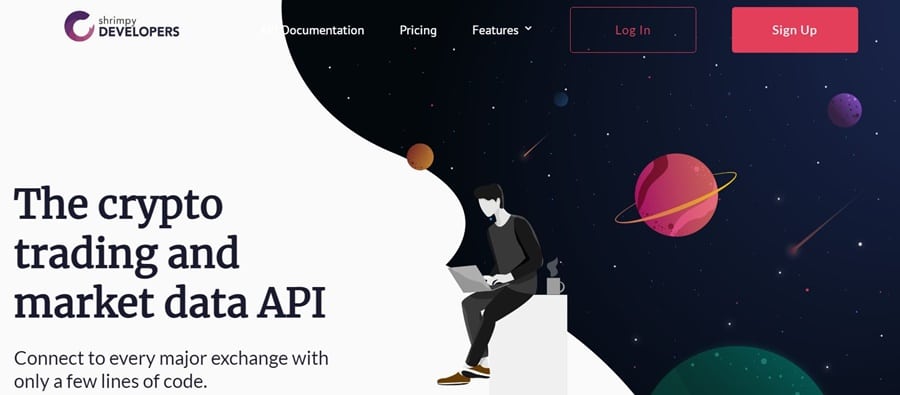

Shrimpy for Developers

There’s actually more available at Shrimpy than just the portfolio automation and social trading features. The platform also has powerful market data APIs that allow developers to get involved with Shrimpy. This API allows for the creation of algorithmic trading bots, tracking applications, portfolio management tools, market signals, and more.

The developers portal. Image via Developers.Shrimpy.io

The developers portal. Image via Developers.Shrimpy.io The Shrimpy APIs are perfect for crypto trading apps, with historical exchange data going back to 2013. They can also be used for real-time data collection or for efficient account management of all exchange accounts. With just one API a developer can integrate all the major exchanges supported by Shrimpy into their platforms, without needing to write a custom code for each individual exchange. This provides developers with the opportunity to quickly create and launch crypto trading platforms and much more.

The Shrimpy APIs for crypto trading include:

Trading API– The trading API allows developers to integrate trade execution from all 16 of Shrimpy’s supported exchanges. The API allows for the creation of market orders, limit orders, and supports smart order routing.

Live Data API– The live data API is the heart of any trading platform. After all, it’s impossible to trade without having a live price feed. With the Shrimpy live data API developers can integrate live data into their trading platforms, signals, and other trading tools. Shrimpy makes it possible to access live data via REST API endpoints or via WebSocket feeds. Having both available is quite useful since the REST API endpoints work well in mobile apps that don’t need to be updated as frequently, while WebSockets are ideal for high-frequency trading.

Historical Data API– Shrimpy has data going all the way back to 2013, and the historical data API is the means to access all that lovely data. Historical data is presented in candlesticks, 1-minute interval order book snapshots, and tick-by-tick trade data.

Shrimpy Supported Exchanges

Shrimpy currently supports 16 exchanges and 13 wallets:

Choose your favorite exchange. Image via Shrimpy.io

Choose your favorite exchange. Image via Shrimpy.io All 16 of these exchanges are compatible with all of Shrimpy’s features, including the developer APIs.

Shrimpy Fees

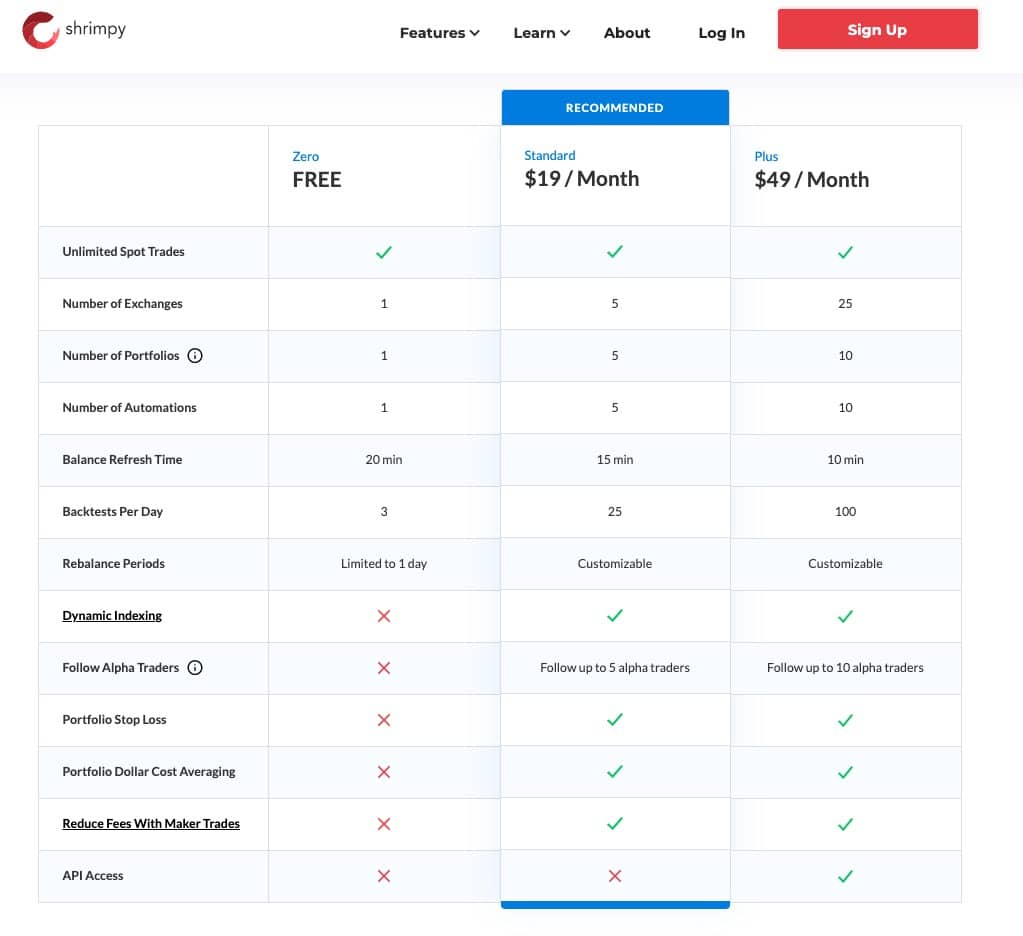

Shrimpy fees are based on three different packages that offer various features and functionality:

Free ($0/mo)

- Spot trading

- No. of Exchanges: 1

- No. of Portfolios: 1

- No. of Automations: 1

- Balance refresh time: 20 min

- Backtests per day: 3

- Rebalance period: 1 per day

Standard ($19/mo)

- Unlimited spot trading

- No. of Exchanges: 5

- No. of Portfolios: 5

- No. of Automations: 5

- Balance Refresh Time: 15 min

- Backtests per day: 25

- Customizable Rebalance Periods

- Follow up to 5 Alpha Traders

- Portfolio stop loss and dollar-cost average features.

- Reduced fees

- IP whitelisting

Plus ($49/mo)

- Unlimited spot trading

- No. of Exchanges: 25

- No. of Portfolios: 10

- No. of Automations: 10

- Balance Refresh Time: 10 min

- Backtests per day: 100

- Customizable rebalance periods

- Follow up to 10 Alpha Traders

- Portfolio stop loss and dollar-cost average features.

- Reduced fees

- IP whitelisting

- API access

Shrimpy Fees. Image via Shrimy.io

Shrimpy Fees. Image via Shrimy.io The plan you choose will obviously depend on which features you require. Many people will be able to run their crypto portfolio strategy with the standard account, while more experienced traders will want to move up to the Plus account.

For those who would like to take the platform for a test drive, Shrimpy also provides a demo platform where you can dig into the functionality of the platform on your own.

Shrimpy Team

Shrimpy runs a lean operation, with a small team of developers and business professionals. That said, the platform's popularity led to Shrimpy doubling its staff in the first quarter of 2021. The primary team members leading the growth of the platform are:

Michael McCarty – Co-founder and CEO. Before founding Shrimpy Michael was a software engineer at Samsung and Boeing. After achieving a Bachelor’s degree in Bioengineering he started his career at NASA, where he was an Associate Research Scientist.

Matthew Wesly – Co-founder and CTO. Matthew and Michael met while at the University of Illinois at Urbana-Champaign, where Matthew received a Bachelor’s degree in Biomedical and Electrical Engineering. Following that he went into software engineering, first with KMC Systems and later with MedAcuity Software.

Nishant Nayudu – Head of Infrastructure. Nishant is the member of the team who actually studied Computer Science in university. Before joining Shrimpy, he held a number of positions, including that of software engineer at Amazon. Like McCarty and Wesly, he’s also an alumnus of the University of Illinois at Urbana-Champaign.

Sumaya Mehzabin – UI/UX Designer. Sumaya is the creative side of the team, and prior to joining Shrimpy she held a number of positions as a graphic designer, handling responsibilities like wire-framing, screen mock-ups, and visual design. If you enjoy the intuitive design of the Shrimpy platform you can thank Sumaya.

Is Shrimpy Safe to Use?

Based on its fairly long history within the crypto community and the positive reviews of users it appears that Shrimpy is both trustworthy and reliable as a portfolio management tool for automating trading within many major cryptocurrency exchanges. The APIs used are fully encrypted and secure, and there have been no breaches or other security issues in the history of Shrimpy.

The design of the platform and APIs means that Shrimpy only has access to trade on your behalf at the exchanges. There is no time at which the platform has access to your private keys and no way for Shrimpy to make a withdrawal and steal your coins. According to the Shrimpy knowledge base:

Safety is hands down the largest concern in the cryptocurrency space for everyone involved. Due to this, it's necessary to be skeptical of everything, and we here at Shrimpy both understand and appreciate that...

Shrimpy does not, under any circumstances, want or need "Withdrawal" permissions. The permissions we require on API keys are Data and Trading permissions. These will allow us to receive data from the exchange regarding the balances held in your exchange account, as well as place trades using the funds held in your exchange account.

Because we do not have withdrawal permissions, we are not able to remove any of the funds held within your exchange account - even to another exchange that you have linked to Shrimpy.

Shrimpy Customer Support

The primary support is provided through an extensive knowledge base, where Shrimpy has provided answers to all the most common questions and issues pertaining to the usage of the service. In the event you have a question that’s not addressed by the knowledge base Shrimpy has a dedicated support email ([email protected]) where you can contact the support team.

The team can also be reached via various social media accounts (Twitter, Youtube, Facebook, Telegram, Discord, and Reddit). And there’s an online chat feature on the Shrimpy website that allows users and potential users to connect with the Shrimpy team at any time.

Shrimpy Review: Conclusion

As you’ve likely seen from our review, Shrimpy is a robust automated crypto portfolio management tool that can save time and help to preserve and even increase profit margins within a crypto portfolio. The powerful set of APIs included in the platform makes Shrimpy one of the leading crypto portfolio automation tools on the market.

The platform also includes an excellent social trading aspect that allows traders to copy the trades of those who are more successful. This can be both a timesaver and a way for new traders to learn how to properly craft a winning crypto portfolio strategy.

With features like automated dollar-cost averaging, portfolio rebalancing, backtesting, and social trading, Shrimpy is a tool that any crypto trader will find to be both useful and valuable. And thanks to the powerful APIs, developers can also benefit from Shrimpy through the creation of new tools, signals, and even trading terminals.

The Shrimpy platform has a user-friendly interface that makes it easy to get started but is still powerful and rich in features. And most importantly, the platform is secure and safe to use, with no concerns over the safety of your coins and keys.

You can get started today with Shrimpy at a 20% discount from their usual fees by using our special Shrimpy Sign-up Link. Start taking advantage of trading and portfolio automation with Shrimpy.